CoreWeave is one of the prominent players in the GPU-based cloud computing sector and has progressed rapidly due to the recent demand surge in several computer-based applications such as machine learning, artificial intelligence, and visual effects rendering. The company's foundation was established in 2017 by three commodity traders. It started as a startup platform for mining Bitcoin and transformed into an AI infrastructure provider. GPU-powered cloud services from Corewave outperform traditional public cloud providers in terms of cost efficiency and process speed.

CoreWeave has a robust infrastructure designed to support training and AI interface phases, delivering significantly faster processing and notable cost reduction. So, it supports various types of industries ranging from metaverse to life science, strengthening faster networking and efficient resource utilization. Strategic partnerships with tech giants like Microsoft give CoreWeave a positive edge to expand more such as doubling data centers.

Recently the company drew investors' attention due to the IPO possibility, which was sparked by the AI revolution and impressive revenue growth.

I. What is CoreWeave

CoreWeave is a prominent player in the GPU-powered cloud computing solutions company that offers services to both developers and merchants. The company was founded back in 2017 and the founders are three former commodity traders Michael Intrator, Brian Venturo, and Max Beaulieu. The company started as a crypto-mining platform that has transformed into a powerhouse of GPU-based cloud computing solutions, headquartered in Roseland, New Jersey. When they started the company was named Atlantic Crypto, which was renamed to CoreWeave in 2019. As of writing the company has fifteen data centers, thirteen across the United States and two in the United Kingdom.

The company focuses on providing enhanced cloud-based solutions for visual effects rendering, AI training and inference, and other intensive workloads. These solutions enable thirty-five times faster processing than traditional while providing cost efficiency, decreasing processing costs by up to 80%. The company has partnerships with prominent players in the industry, such as NVIDIA and Microsoft, which enables the company to offer GPU-based cloud services, making CoreWeave a well-known player in the industry.

Business Model

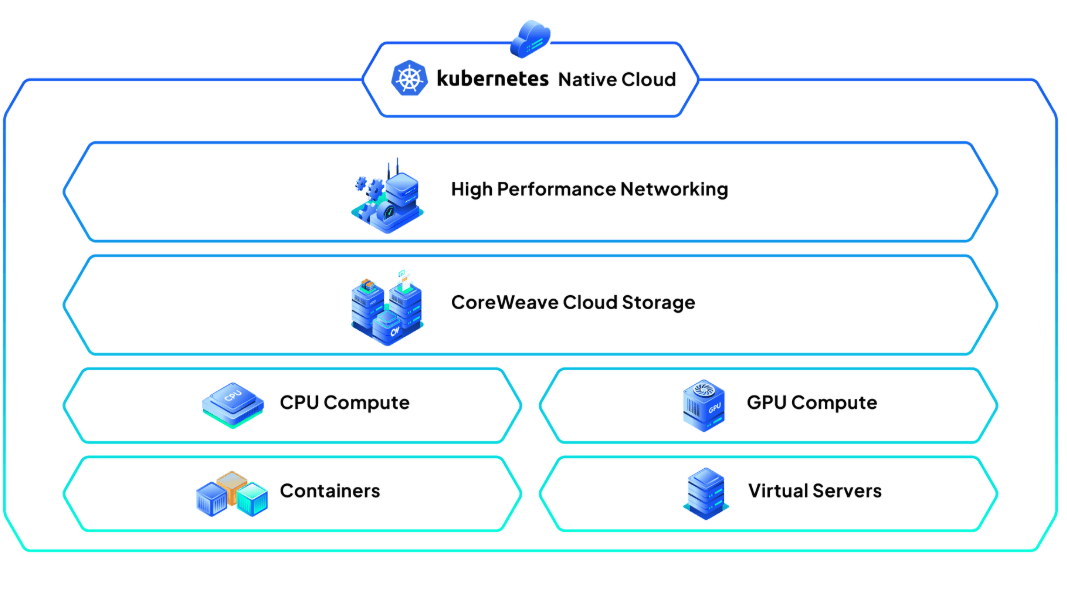

CoreWeave has a robust business model focused on providing flexible and scalable cloud computing solutions for AI developers and enterprises. The company has a vision to provide infrastructure-as-a-service (IaaS) and high-performance computing (HPC) solutions optimized for computational workloads, machine learning (ML), artificial intelligence (AI), and visual effects rendering. CoreWeave is popular for its cost-efficient and faster solutions, which leverage GPUs to provide robust processing power.

The company provides services for a wide range of customers including AI research, financial modeling, media and entertainment, and healthcare, serving clients who desire highly efficient computing resources. It is anticipated that CoreWeave might expand data center numbers to expand operations by nearly double to twenty-eight, which is nearly double compared to the current number by the end of this year in different regions.

Core Services

CoreWeave core services center on optimizing performance for GPU-intensive applications across various industries, such as:

- High-Performance Computing (HPC): CoreWeave supports large-scale data simulation and research in various fields, including weather modeling, genomics, and physics simulations.

- Machine Learning and AI: CoreWeave supports complex data analytics optimization besides training and deployment of artificial intelligence.

- Cloud Infrastructure: The cloud solution infrastructure of CoreWeave is designed to provide both computing capabilities and storage, dissolving workloads.

- Visual Effects Rendering: The company has notable capabilities to provide scalable GPU services to fill up the increasing demand in animation and special effects rendering to, especially to production houses and studios enabling cost-efficient and faster project completion.

- Media Streaming: The company platform supports real-time video transcoding and distribution, enabling efficient delivery for media companies and content providers.

Ownership Of CoreWeave

CoreWeave has been a privately owned company since the beginning. So, no wonder the founders Michael Intrator, Brian Venturo, and Max Beaulieu possess a significant portion of the company ownership.

The company is backed by notable financial institutes such as The Carlyle Group and Magnetar Capital to support its growth and infrastructure expansion.

II. CoreWeave Financials

CoreWeave Revenue Growth

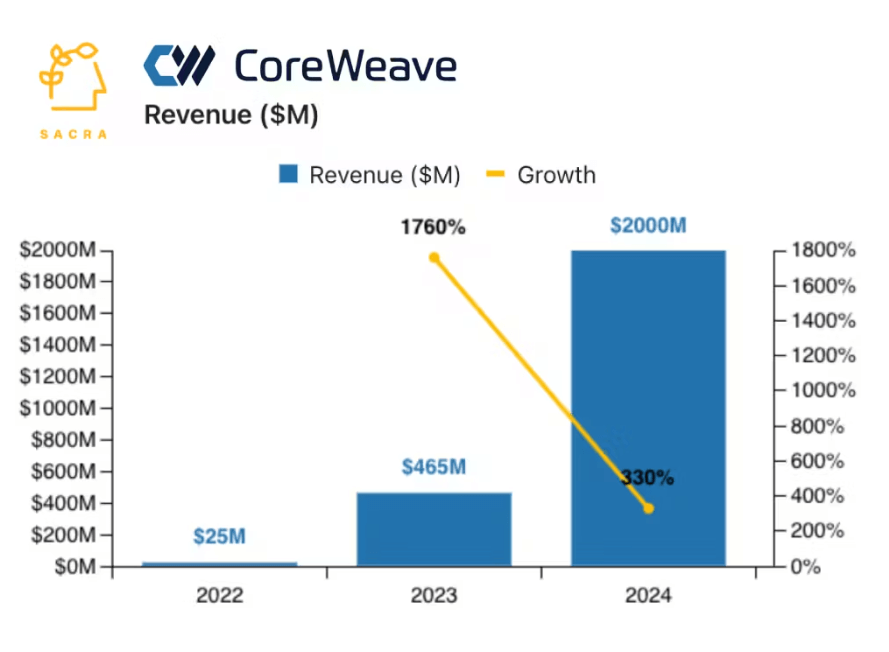

CoreWeave, the prominent player in the cloud computing infrastructure provider has shown notable strategic and growth positions in the Blockchain, AI, and gaming sectors.

Experts anticipate CoreWeave revenue for 2024 could hit $2B, a 330% increase compared to 2023, when it was $465. The rapid demand surge in GPU-based cloud computing and AI services completely boosts this significant increase.

Moreover, the revenue could hit $8B by 2025 due to notable expansion and increasing demand in cloud computing. CoreWeave booked contracts of $10B out of $17B from Microsoft, as the company has a multi-year partnership with Microsoft to supply GPU computing amid rapidly increasing demand in Azure cloud customers that Microsoft cannot meet.

Profitability and Margins

Like most other cloud-computing providers, CoreWeave makes money from operating a model that enables renting computing resources to developers and businesses. The company leverages efficient, scalable, and faster computing while maintaining cost efficiency.

Approx. 85% of the gross margin comes from the difference in maintenance cost of these resources including initial hardware investment, electricity cost, maintenance, cooling, and support staff costs and the company generates revenue from customers paying for these resources.

Customers pay for using these resources on an hourly basis, but the payment model is so efficient and attractive that customers only have to pay for what they use. Using premium GPUs like Nvidia's H100 gives a competitive edge providing thinner costs compared to older models for instance A40, which helps boost the operation utilization by approx. 80%.

Key competitors

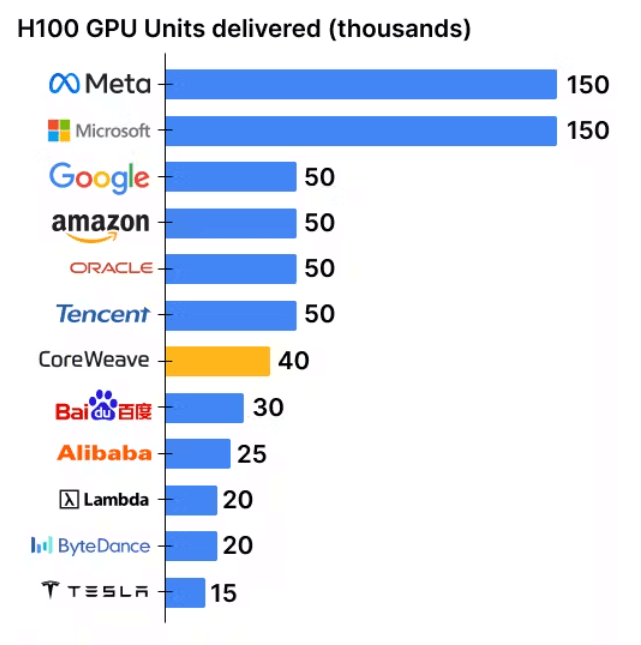

As per the above image, Meta and Microsoft remain at the top position of the competitor's list. However, Prominent companies like Alphabet. Amazon, Tencent, and Alibaba are other CoreWave competitors.

Key Financial Metrics

- Cloud Utilization Efficiency: CoreWeave focuses on delivering optimized utilization of GPU efficiently, giving the company a competitive edge in increasing demand for GPU-based cloud computing demand surge.

- Lifetime Value (LTV): The company benefits from strategic partnerships with many enterprises. Partnerships with tech giants like NVIDIA, & Microsoft could help CoreWeave to maximize LTV.

- Average Revenue Per User (ARPU): CoreWeave serves enhanced AI, ML, and rendering applications significantly boosting ARPU, As it focuses on B2B operation, the ARPU could be higher but the actual number would be available upon listing.

III. CoreWeave IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

AI-driven GPU-based cloud computing has been experiencing massive expansion due to increased adoption in artificial intelligence, gaming, machine learning (AI/ML), blockchain applications, and graphics rendering. The rapid demand in this sector positions the company as a frontline platform in the industry.

CoreWeave differentiates itself in AI-optimised cloud services and solutions by leveraging strategic partnerships with NVIDIA. This enables providing enhanced services to customers with highly efficient and cost-effective computing and gives CoreWeave a competitive edge over competitors such as Google Cloud, AWS, and Microsoft Azure, as well as smaller niche providers like Paperspace and Lambda Labs.

Future Growth Opportunities

- AI and ML Expansion: CoreWeave has a robust optimized infrastructure for the increasing ML and AI expansion sectors, where demand for GPU-based computing explodes, making the company a potential player in the industry.

- Blockchain Infrastructure: Blockchain technology adoption is increasing rapidly, so the demand for decentralized and GPU-based computing matches the CoreWeave offerings, enabling additional revenue growth for the company.

- Gaming And Graphics Rendering: The gaming and entertainment industry requires notable GPU-based computing rendering that CoreWeave focuses on providing, the media and gaming industry remains a key driver for the company.

- Remarkable Expansion: Data centers of CoreWeave are rapidly increasing, the number remains at fifteen as of writing, which can hit nearly double to twenty-eight compared to the current figure by the year-end.

B. Weaknesses & Risks

- CoreWeave depends heavily on NVIDIA for GPU supply, so any disruption in the current supply chain, a price increase, or a production decrease on NVIDIA can negatively impact the company's profitability.

- The company competes with tech giants, specifically Amazon Web Service (AWS), Google Cloud, and Microsoft Azure, which benefit from extensive worldwide networks, pricing for services and resources, and an established customer base. So it can be challenging for the company to remain a key competitor.

- Acquiring high-performance GPUs and expanding data centers requires substantial capital, which can reduce financial flexibility and negatively impact revenue growth.

- High-end GPUs like Nvidia’s H100 require high usage to achieve profitability, which can be challenging in fluctuating demand environments.

IV. CoreWeave IPO Details

A. CoreWeave IPO Date

There is no specific date or official report for the CoreWeave IPO, but Bloomberg reported in November 2024, that the company has an IPO planned for 2025. The company will be listed on the NewYork stock exchange and selected Morgan Stanley, JP Morgan Chase, and Goldman Sachs to chase the initial price offering. This drew attention to the significant investor base for the robust performance, growth perspective, and service offerings.

B. CoreWeave Valuation

As of 2024, CoreWeave valuation reached $23B, following the secondary share sale with the participation of remarkable investment firms including Fidelity Management, BlackRock, and Jane Street. The revenue data reveals that the company made revenue of $2B against the valuation of $23B.

The company has raised $12B through debt and equity financing, which includes a $7.5B debt facility, enabling the company to utilize expanding and providing efficient service scaling operations. CoreWeave got attention from remarkable investors; besides a strategic partnership with NVIDIA, the company has some key investors such as Macquarie Capital, Magnetar, and Pure Storage.

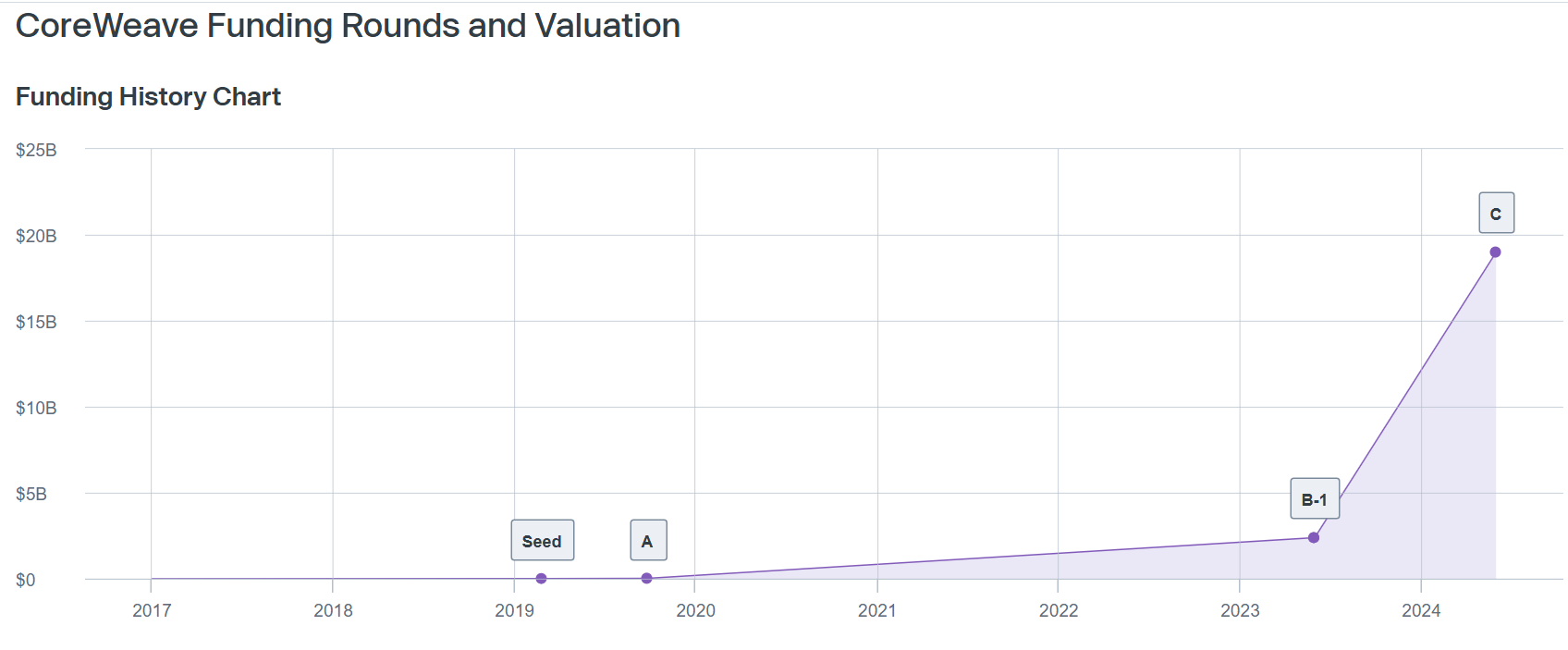

Major Funding Rounds & Total Funding

CoreWeave has raised $4.6B from funding and $1.15B from the latest funding round. Let’s check the company funding rounds in detail:

|

Funding Date |

Funding Series |

Funding Amount |

Key Investors |

|

30 May 2024 |

Series C |

$1.15B |

Altimeter Capital, Coatue, Fidelity, Lykos Global Management, Magnetar |

|

31 May 2023 |

Series B-1 |

$5.01M |

Daniel Gross, Magnetar Capital, Nat Friedman, Nvidia |

|

31 May 2023 |

Series B |

$421M |

Daniel Gross, Magnetar Capital, Nat Friedman, Nvidia |

|

25 Sep 2019 |

Series A |

$2.82M |

Undisclosed Investors |

|

25 Feb 2019 |

Series Seed |

$3M |

Undisclosed Investors |

C. Share Structure & Analyst Opinions

In the latest report, CoreWeave declares a $650 million secondary share sale to the investors, resulting in the company valuation ending at $23B. Fidelity Management, Magnetar, Jane Street, and Macquarie Capital lead the investors. The company operates privately, so all information is not publicly available. So, it is no wonder that IPO details such as share price, share numbers, etc., aren't publicly available. However, the share price will be equivalent to the valuation of the company, as many other companies went public through IPO.

As information is limited, no official analysis has been published yet, but many expert investors and analysts confirm through different sources that the CoreWeave IPO is going to be a potential investment asset following rapid revenue growth, expansion, performance, strategic involvement, increasing demand, etc.

V. How to Invest in CoreWeave IPO & CoreWeave Stock

Where to Buy CoreWeave IPO Shares

When seeking to invest in CoreWeave IPO shares, it is mandatory to observe the official announcement from the company for authenticity. In a recent report, Bloomberg states that CoreWeave plans an IPO by 2025 and primarily selects JP Morgan Chase, Goldman Sachs, and Morgan Stanley to assist with the program.

So, primarily investors who are interested in the CoreWeave IPO program must open an account with any of these supporting financial institutes or any other financial institute that enables investing in CoreWeave IPO. In most cases, validating the account is required to access the full features of the platform. So, after opening an account, validate it by providing the required documents and then deposit to invest.

Trading Strategies for CoreWeave IPO

As CoreWeave transitions into the public market, investors can leverage a variety of trading approaches tailored to their goals and risk appetite:

Momentum Trading

CoreWeave's prominence in AI-driven cloud infrastructure positions its IPO as a likely target for heightened market interest. Traders can capitalize on this initial enthusiasm by tracking early price surges and volatility, seeking quick profits during the IPO's debut days.

Short-Term Trading

Short-term strategies, such as day trading or swing trading, can take advantage of the dynamic price shifts expected in CoreWeave's early market phases. By closely monitoring trading patterns, investors can respond to rapid fluctuations as the stock stabilizes post-IPO.

Long-Term Investment

For those with a long-term outlook, CoreWeave's leadership in GPU-based cloud solutions and its integration into AI and generative computing markets offer substantial growth potential. Holding CoreWeave shares could align with broader trends in AI expansion and global cloud adoption, presenting an attractive investment for patient investors.

Alternative Approaches to Trading CoreWeave Stock

- ETFs for Diversification: Investors can gain exposure to CoreWeave through exchange-traded funds (ETFs) focused on sectors like AI, fintech, or advanced cloud computing. These funds provide diversification, spreading the risk across multiple companies within similar industries.

- Options Trading: Options are an effective tool for managing IPO volatility. By trading call options, investors can secure potential buying opportunities at set prices, while put options serve as insurance against sudden price declines.

- CFD Trading with VSTAR: Platforms like VSTAR enable Contracts for Difference (CFD) trading, allowing investors to speculate on CoreWeave stock price without actually owning shares. This approach provides leverage and flexibility, letting traders profit from both upward and downward price movements, depending on market conditions.

Choosing the right trading strategy for CoreWeave requires aligning with personal financial objectives and an informed perspective on market trends. Staying updated on CoreWeave's performance and the broader AI cloud landscape will be vital for navigating this exciting IPO opportunity.