Chime first proposed an IPO in 2021, but market conditions delayed the plan, pushing it to 2025. Chime is pursuing an IPO to access capital markets for expansion, diversify its revenue beyond interchange fees, and capitalize on its growing user base, which reached 22.3 million in 2023. The neobank has generated significant interest due to its disruptive model, offering fee-free banking and targeting underserved, lower-income consumers. With a 2021 peak valuation of $25 billion, Chime has attracted prominent investors, including Sequoia and SoftBank, despite a valuation decline to $6.5 billion in 2024.

Source: investopedia.com

I. What is Chime

Chime is a leading neobank in the fintech sector, founded in 2014 by Chris Britt (CEO) and Ryan King (CTO). Headquartered in San Francisco, California, Chime operates as a private company offering online banking services through partnerships with small banks, specifically The Bancorp Bank and Stride Bank, to provide financial services without the formal regulatory requirements of a traditional bank. As a neobank, it primarily serves consumers through mobile-based financial products, targeting middle-income millennials, many of whom live paycheck-to-paycheck.

Source: chime.com

Chime's core services revolve around no-fee checking and savings accounts, a Chime-branded Visa debit card, and early direct deposit, which allows users to access their wages up to two days early. The absence of monthly, low-balance, or overdraft fees is a significant draw for its customer base, which had grown to 7 million by May 2024. Chime also offers a "Credit Builder" prepaid card that helps users improve their credit scores by reporting their transactions to credit bureaus.

Source: sacra.com

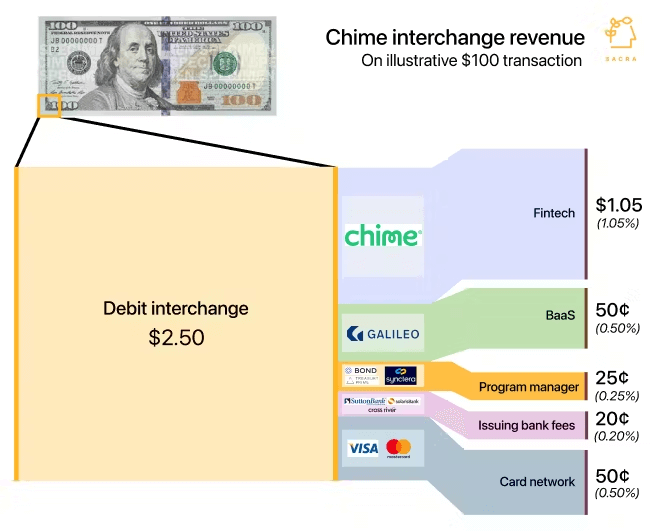

The company's business model relies heavily on interchange fees. Chime earns roughly 50 cents for every $100 spent on its Visa-branded debit cards, made possible by a provision in the 2010 Dodd-Frank Act that allows smaller banks to charge higher interchange fees. This fee structure represents around 80% of Chime's revenue, while the remaining 20% comes from service charges, such as out-of-network ATM fees. Chime's low-cost acquisition strategy, with a customer acquisition cost (CAC) of around $100, contrasts sharply with traditional banks, whose CAC ranges from $650 to $700.

Source: chime.com

Chime's rapid growth, particularly during the pandemic, was driven by its ability to offer financial relief, such as early access to stimulus payments. The neobank's investors include prominent venture capital firms like Sequoia Capital, Tiger Global Management, and SoftBank, reflecting strong market confidence in its business model and potential. In 2024, Chime began expanding its product suite by offering short-term loans, further positioning itself as a disruptive force in consumer finance.

II. Chime Financials

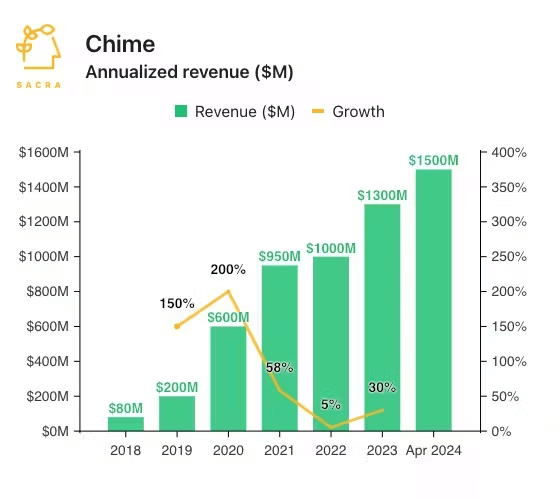

In 2023, Chime reported $1.3 billion in revenue, reflecting a 30% growth from the previous year. By April 2024, Chime's revenue annualized to $1.5 billion, with projections aiming for $1.9 billion by the end of 2024, a robust 46% year-over-year growth. This rapid growth underscores Chime's successful business model and aggressive user expansion, particularly through its primary revenue sources: interchange fees and out-of-network ATM fees. Approximately 80% of Chime's revenue comes from interchange fees, where it earns a portion of the 1%-2% charged by Visa, while 20% comes from ATM service fees.

Source: sacra.com

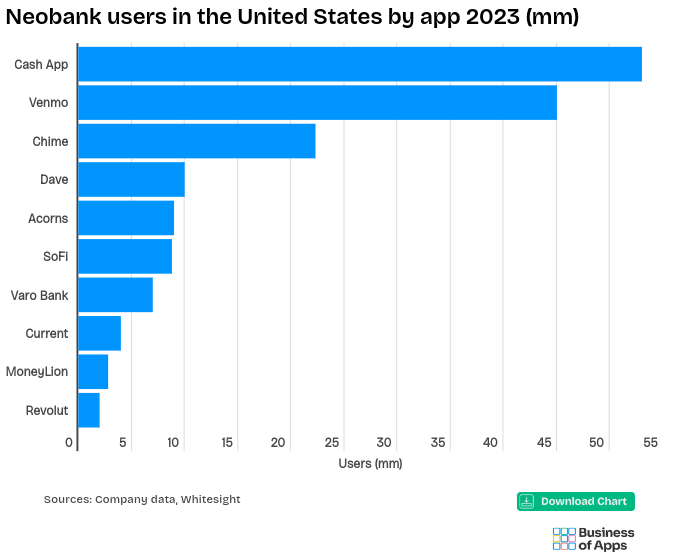

Chime's active user base also demonstrates significant growth, rising from 14.5 million users in 2022 to 22.3 million in 2023. Approximately half of these users consider Chime their primary bank, signifying a strong customer retention rate. In comparison to competitors, Chime holds a competitive market share, boasting more customers than neobanks like SoFi, Varo, and Dave combined. With 7 million customers signed up for direct deposit, Chime's ARPU (average revenue per user) reached $214 in 2024, outpacing Cash App's ARPU of $204 but trailing Chase's $731 ARPU.

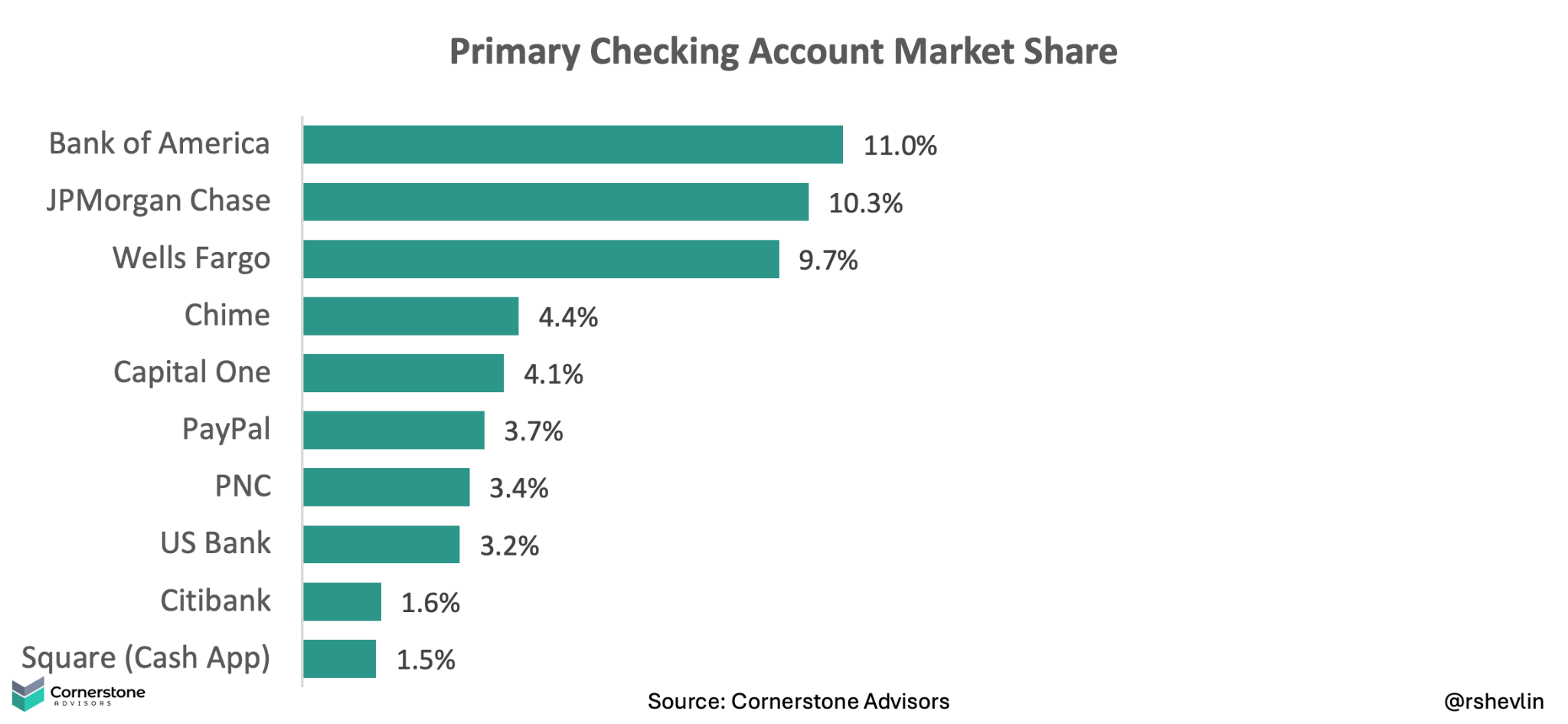

Chime's profitability, while improving, is constrained by its reliance on low-margin revenue streams. Its interchange-based model limits profitability, as larger banks like Chase generate higher margins through diversified financial services like lending. However, Chime's continuous expansion of product offerings, including loans up to $1,000 in 2024, marks its efforts to diversify revenue streams. In the highly competitive digital banking sector, Chime controls approximately 10% of the digital market for checking account services, ranking just behind megabanks like Wells Fargo, Chase, and Bank of America. With Gen Z and Millennials comprising a majority of its customers, Chime has carved out a strong foothold in the U.S. fintech landscape.

Source: businessofapps.com

III. Chime IPO: Opportunities & Risks

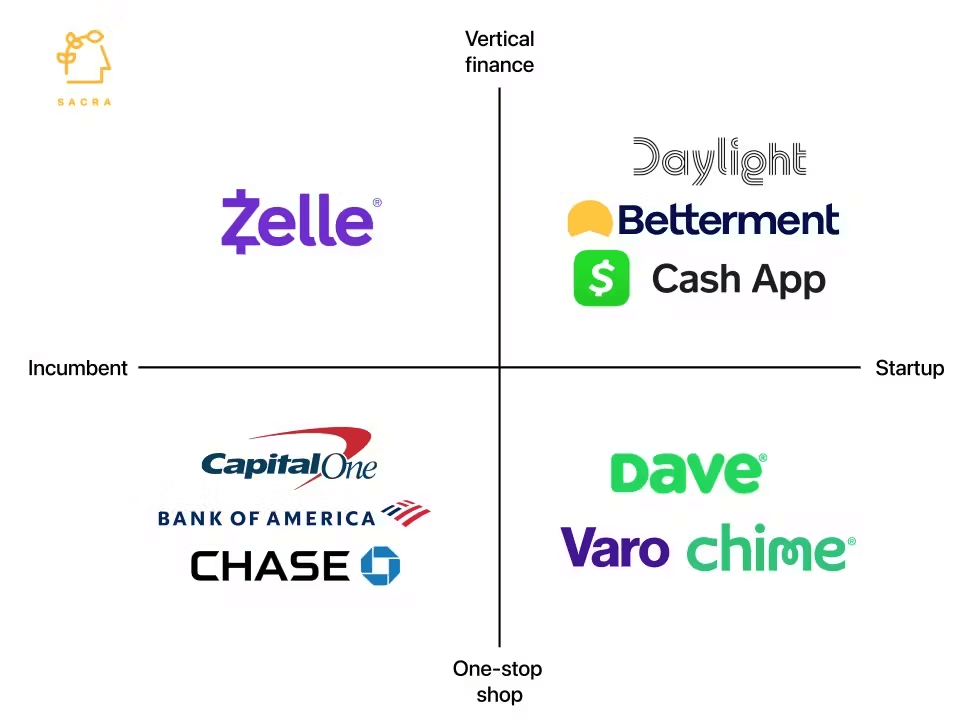

Chime's IPO presents significant growth opportunities within the competitive neobank and fintech landscape. As the largest private neobank globally, Chime boasted a strong user base of 22.3 million in 2023, half of whom use it as their primary bank. The digital banking industry is increasingly competitive, with Chime positioned against fintech players like Robinhood, Cash App, and PayPal's Venmo, as well as traditional banks such as Chase and Capital One. Chime's app was downloaded 6.7 million times in H1 2022, closely competing with major banks—Capital One at 7.7 million and Chase at 6.3 million.

Source: forbes.com

Chime's competitive advantage lies in its strong focus on user experience and low fees, attracting younger, lower-income demographics. However, its profitability potential will significantly hinge on its planned expansion into lending. In May 2024, Chime confirmed its lending rollout, acquiring licenses across multiple states. Lending could potentially double its revenue, emulating successful models like Nubank, which generated $1.6 billion from lending in 2023, or Monzo, whose lending revenue jumped 130% to £90 million in 2023.

Additionally, Chime can capture further market share by enhancing its app and expanding into investment services. The total addressable market (TAM) includes 138 million U.S. adults earning less than $65,000, offering Chime a potential ARPU of $420 based on non-housing expenses. Furthermore, strategic collaborations with fintech infrastructure providers, like Marqeta and Lithic, could enable Chime to diversify its offerings by integrating with platforms like Uber and Toast, embedding financial services into existing ecosystems.

Weaknesses & Risks

Despite its growth potential, Chime faces several risks, including exposure to consumer spending downturns. As an interchange-based model, its revenue is tied to consumer transaction volumes, which may be disproportionately affected in economic recessions. Moreover, with increasing competition, the concept of a primary bank account is declining as users spread their finances across multiple platforms, potentially weakening Chime's user retention over time.

Source: sacra.com

IV. Chime IPO Details

A. Chime IPO Date

Chime has not announced a specific IPO date, but reports suggest that it is preparing for a 2025 debut. Chime had previously targeted a 2022 IPO, but market conditions delayed those plans. With IPO markets showing signs of recovery in 2024, fintech is now positioning itself for a listing on the Nasdaq.

B. Chime Valuation

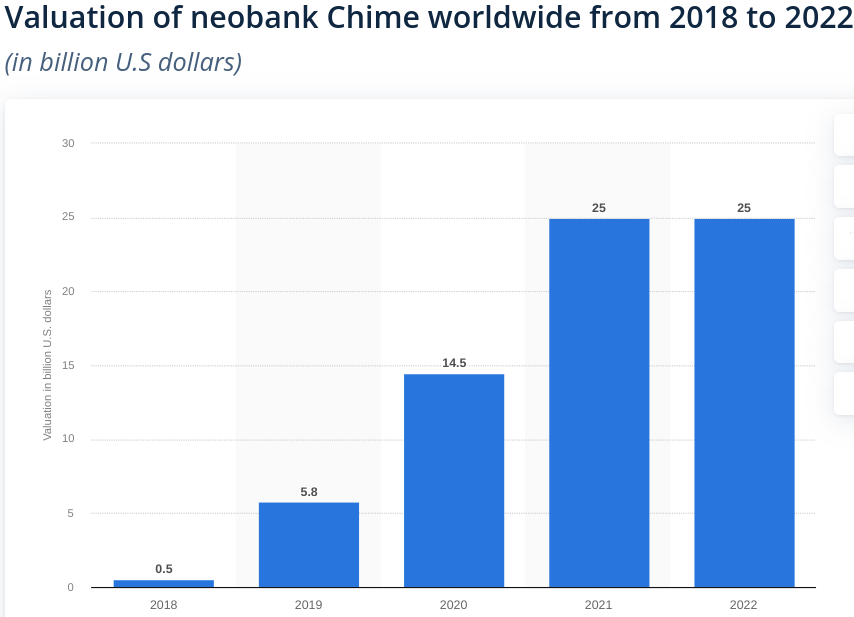

Chime was valued at $25 billion at its peak in 2021, riding the wave of investor enthusiasm in fintech. However, by early 2023, its valuation had fallen significantly due to the broader "fintech winter" and cooling investor sentiment. As of March 2024, Caplight estimates Chime's value has declined to approximately $6.5 billion, reflecting a 74% decrease from its 2021 valuation peak.

Chime has raised a total of $2.3 billion across 11 funding rounds, with its most significant being a $1.1 billion Series G round in August 2021. The company's valuation trajectory showcases the volatility in the fintech space:

- 2018:$0.5 billion

- 2019:$5.8 billion

- 2020:$14.5 billion

- 2021:$25 billion

Source: statista.com

Chime's rapid growth is largely driven by its focus on fee-free banking services and early access to direct deposits, which resonate with its predominantly younger, lower-income customer base. Despite the valuation drop, Chime remains one of the largest neobanks globally.

C. Share Structure & Analyst Opinions

Specific details on the number of shares to be offered, the share price, and the expected market capitalization are not yet available. Analysts are closely monitoring Chime's ability to maintain its customer growth and primary account status, particularly given its strong presence among younger users. However, concerns about profitability and competition from traditional banks remain significant risks.

V. How to Invest in Chime IPO & Chime Stock

Where to Buy Chime IPO Shares

To buy Chime IPO shares when they become available, you need to open a brokerage account with firms that offer IPO access, such as Robinhood, Fidelity, or TD Ameritrade. Many platforms require you to meet certain eligibility criteria, such as account balances or trading frequency, to participate in IPOs.

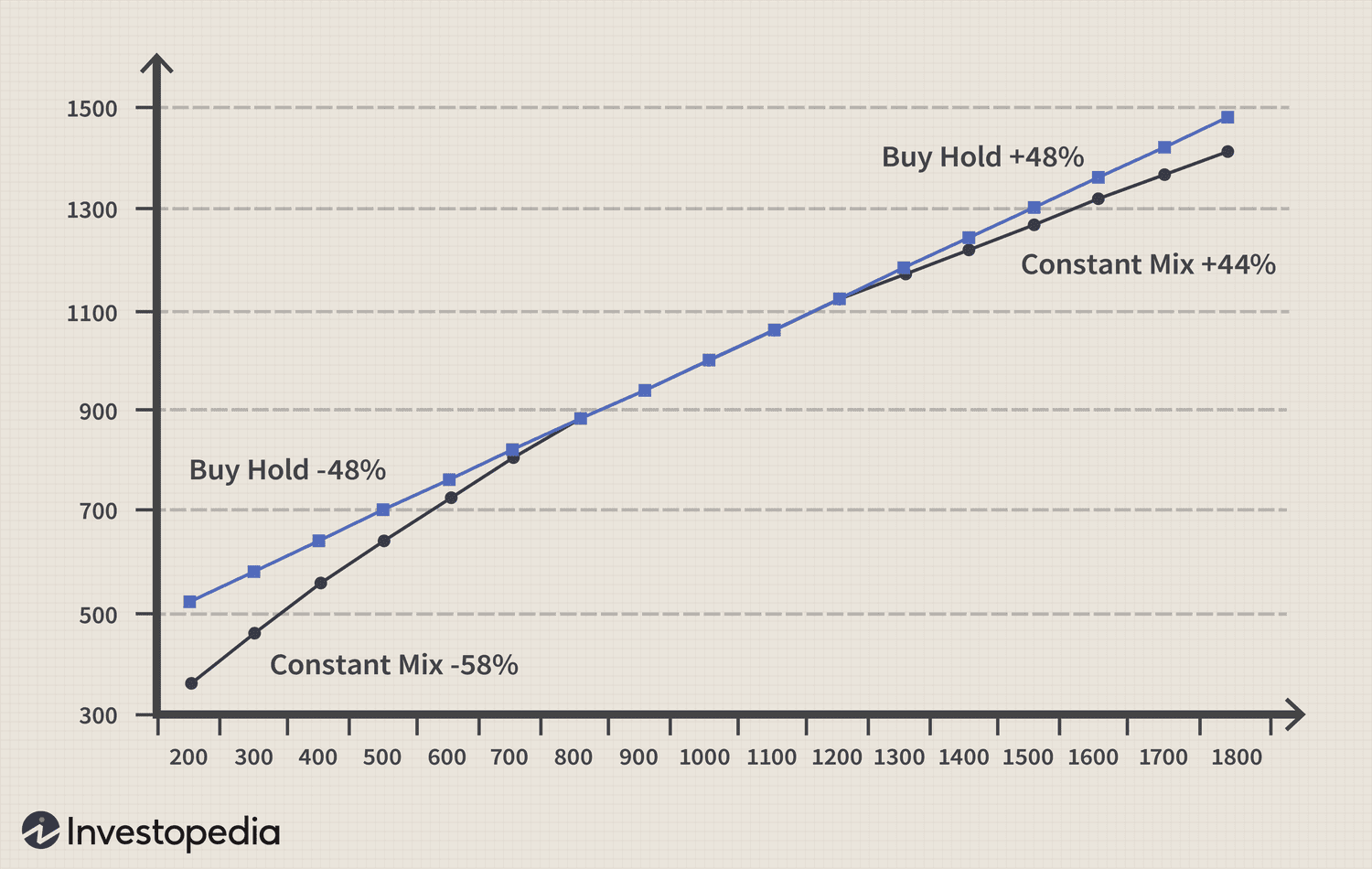

Chime IPO Trading Strategies

Once Chime begins trading, you can apply several strategies. Day trading, for instance, involves capitalizing on price volatility shortly after the IPO launch, but this approach comes with high risks due to fluctuating stock prices. Alternatively, a long-term buy-and-hold strategy may allow investors to ride out early price volatility for potentially stable returns as Chime matures.

Source: investopedia.com

Ways to Trade Chime Stock

When Chime goes public, it can be traded through individual shares or various financial instruments. For more flexibility, investors can explore exchange-traded funds (ETFs) that may hold Chime stock, such as fintech-focused ETFs like ARKF. Options contracts on Chime stock could allow for more leveraged positions, while Contracts for Difference (CFDs) through platforms like VSTAR enable trading without owning the underlying asset, providing an opportunity to speculate on Chime stock price movements.