Cerebras Systems first proposed its IPO plans in August 2023, filing confidentially as it prepared to challenge industry leader Nvidia. The decision to go public stems from the company's unique position in the booming AI hardware sector. With AI demand surging, Cerebras' advanced chip technology, notably its Wafer-Scale Engine (WSE), is vital for large-scale AI workloads. This has generated significant interest, as the AI hardware market is projected to reach $250 billion by 2030. Major investors like the Abu Dhabi Growth Fund and Coatue Management backed the company, adding to its allure for potential investors.

Source: reuters.com

I. What is Cerebras

Cerebras Systems is a cutting-edge company in the artificial intelligence (AI) hardware industry, founded in 2016 by Andrew Feldman, Gary Lauterbach, Jean-Philippe Fricker, Michael James, and Sean Lie. The company, headquartered in Sunnyvale, California, is renowned for its Wafer-Scale Engine (WSE) technology, which powers its advanced AI computing systems like the CS-3. Feldman, the CEO, and Lauterbach, the CTO, had previously founded SeaMicro, acquired by AMD in 2012, adding a strong technical foundation to Cerebras.

Cerebras operates through multiple revenue streams, with its primary focus on hardware sales. Its flagship products, such as the CS-3 system, are priced in the millions and cater to high-performance computing (HPC) and AI workloads. The company also offers professional services, contributing to 25-33% of new customer deals. Additionally, cloud-based access to its systems and potential subscription models provide recurring revenue streams. These offerings allow Cerebras to maintain a competitive edge in the growing AI hardware market.

Source: cerebras.ai

The company's innovative technology has attracted notable customers across industries. For instance, the Mayo Clinic partnered with Cerebras to develop AI models for healthcare, while pharmaceutical giant AstraZeneca uses Cerebras systems to expedite research, cutting model training times from weeks to days. GlaxoSmithKline (GSK) and TotalEnergies have also leveraged Cerebras systems for drug discovery and seismic modeling, respectively. Government institutions like Argonne National Laboratory and the U.S. Department of Energy's National Energy Technology Laboratory use Cerebras for groundbreaking scientific research.

Source: cerebras.ai

Cerebras is supported by major investors such as Abu Dhabi Growth Fund, Altimeter Capital Management, Alpha Wave Ventures, and Moore Strategic Ventures. These investments enable it to continue its rapid growth and innovation in the AI chip industry, positioning the company as a potential competitor to giants like Nvidia.

II. Cerebras Financials

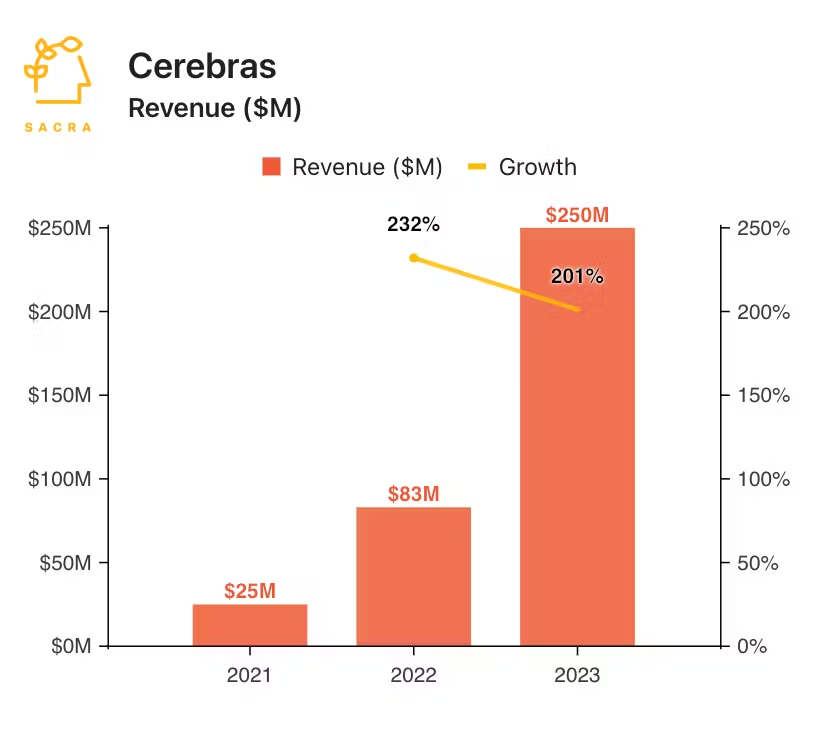

Cerebras Systems has shown impressive financial growth, with 2023 sales estimated at $250 million, representing a remarkable 201% year-over-year increase from $83 million in 2022. This rapid revenue expansion reflects the company's success in the AI hardware market, and with customer commitments approaching $1 billion, it is positioned for further growth in 2024. This trajectory makes Cerebras the largest revenue-generating AI chip startup, surpassing many competitors in the space.

Source: sacra.com

The company has strategically secured partnerships and high-profile clients across various industries, contributing significantly to its revenue growth. The partnership with G42, an Abu Dhabi-based AI firm, to build supercomputers further enhances Cerebras' financial and technological standing.

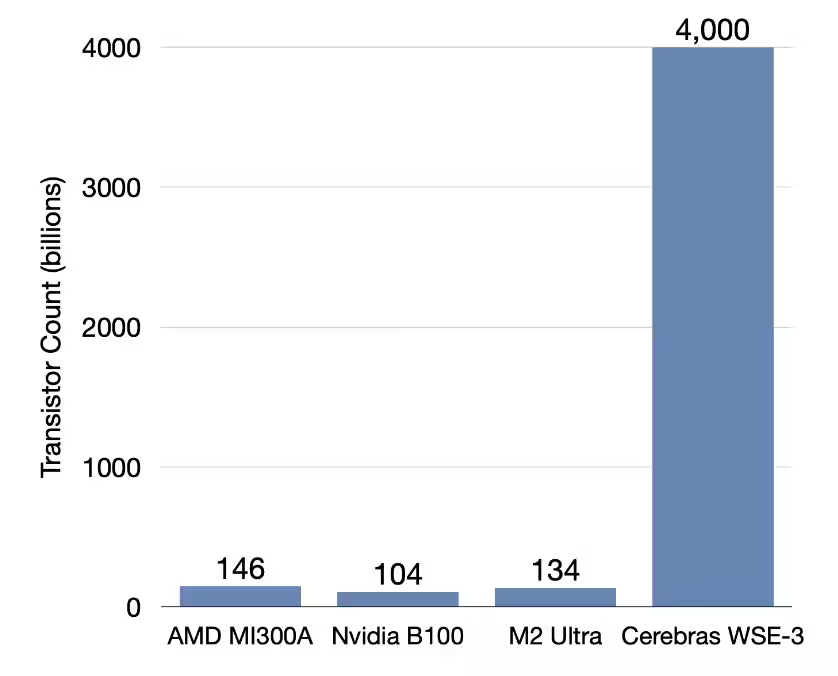

Cerebras' flagship product, the CS-3 system, powered by the Wafer Scale Engine 3 (WSE-3), offers significant advantages over traditional AI chips from competitors like NVIDIA. The WSE-3, measuring 46,000 square millimeters and featuring 900,000 cores, allows for faster processing and lower power consumption due to its unique data locality and vast on-chip memory. These advantages reduce the need for complex distributed systems, making Cerebras' systems ideal for large-scale AI workloads.

In terms of market share, Cerebras is growing its presence in both the AI hardware and semiconductor sectors, particularly in high-performance computing (HPC) and AI model training. The company's ability to simplify large AI model training, such as reducing code for a 175-billion parameter model from 20,000 lines to 565, positions it uniquely in the market.

Source: sacra.com

Cerebras is a loss-making company, and its burn rate is significant. If the company's losses continue or accelerate, its stock valuation might be impacted. Cerebras' expansion into subscription-based models and cloud services, along with its growing client base in sectors like pharmaceuticals, energy, and government research, suggests a strong potential for sustained revenue growth and improved margins.

III. Cerebras IPO: Opportunities & Risks

A. Profitability Potential & Growth Prospects

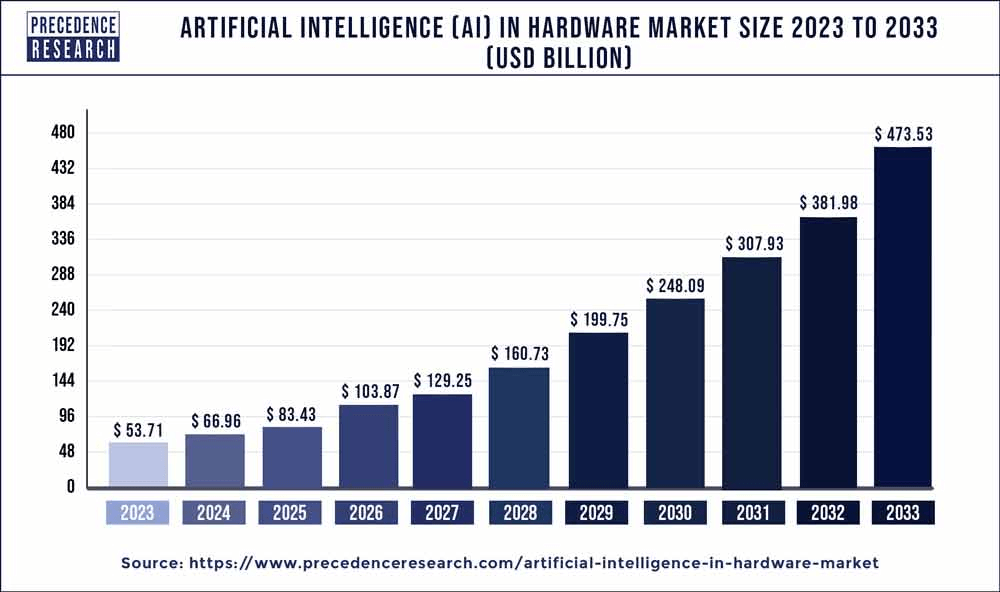

Cerebras operates in the rapidly expanding AI hardware industry, with market potential driven by the rise of AI and machine learning, especially generative AI. As per sacra.com, the AI hardware market is projected to reach nearly $250 billion by 2030, with companies investing heavily in AI infrastructure. Cerebras' revenue growth has been impressive, with sales reaching $250 million in 2023, a 201% increase from $83 million in 2022. Customer commitments are nearing $1 billion, further signaling its growth potential. As per precedenceresearch.com, global AI in hardware market revenue was $54 billion in 2023 and may hit ~ $475 billion by 2033 at a CAGR of 24.3% (2024 to 2033).

Source: precedenceresearch.com

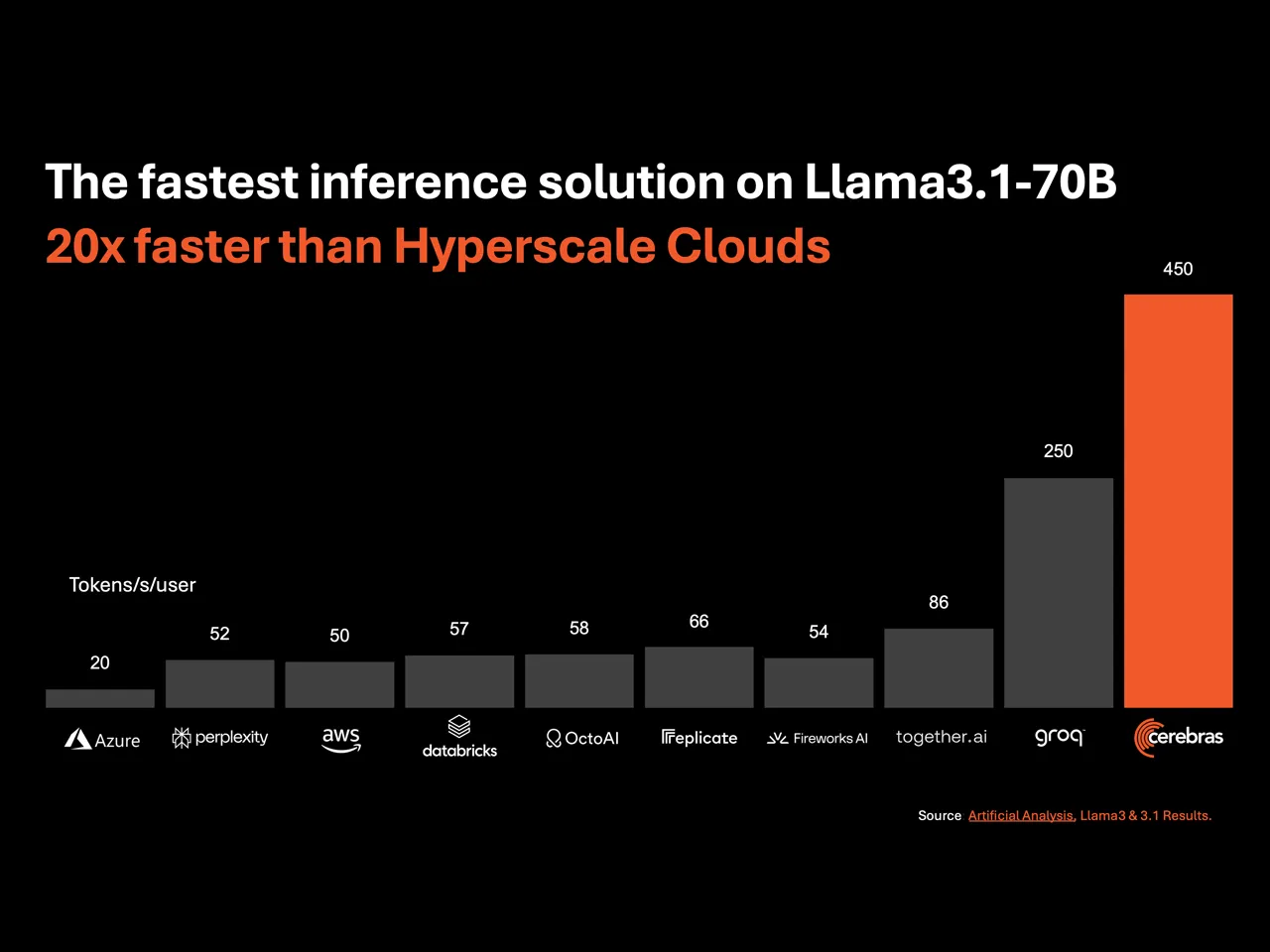

Cerebras distinguishes itself from competitors like Nvidia, AMD, and Intel with its Wafer Scale Engine (WSE-3), the world's largest AI chip. While Nvidia dominates 85% of the AI hardware market with its GPU-based architecture, Cerebras' WSE-3 simplifies scaling by eliminating complex software and hardware requirements. This allows for faster and more efficient AI training, appealing to sectors with high compute needs, such as pharmaceuticals (e.g., GlaxoSmithKline), healthcare (Mayo Clinic), and energy (TotalEnergies).

Cerebras has opportunities to expand into new verticals such as healthcare, financial services, and national security. For example, its work with Mayo Clinic demonstrates its potential in healthcare AI, while partnerships with government institutions highlight opportunities in national security and climate modeling. Additionally, Cerebras is expanding from AI training into AI inference, where its chip architecture could enhance real-time AI applications like robotics and autonomous systems.

Strategic partnerships, such as with Qualcomm for AI inference, offer Cerebras a chance to capture a more extensive portion of the AI workflow, from model training to deployment. The company's collaborations with cloud providers also help reduce barriers to adoption by making its systems available without on-premises hardware investment.

B. Weaknesses & Risks

Cerebras faces risks related to software compatibility, as Nvidia's CUDA platform has become the industry standard. Cerebras' bespoke software stack may struggle to gain widespread adoption. Additionally, its focus on high-end, expensive AI systems limits its market to a niche of hyperscalers and enterprises with massive compute needs, which could hinder growth if demand shifts towards more efficient, smaller-scale AI solutions.

Source: cerebras.ai

Cerebras stock valuation is likely to be influenced by the overall market sentiment and the valuation multiples of comparable companies. If the market becomes more cautious or if comparable companies experience a decline in valuation multiples, Cerebras' stock valuation might be impacted. Cerebras' stock valuation is heavily dependent on its revenue growth expectations. If the company fails to meet or exceed these expectations, its stock valuation might decline.

IV. Cerebras Systems IPO Details

A. Cerebras IPO Date

Cerebras Systems is expected to go public in the second half of 2024, though market conditions may delay this timeline. Chipmakers, including Cerebras, face headwinds due to volatility in the sector. The ongoing downturn in chip stocks, such as Nvidia's recent 8% drop, is discouraging Cerebras from launching its IPO in the current market environment. Although the company has hired Citigroup as its lead underwriter, the listing could be postponed if market volatility continues, making it less likely for Cerebras to achieve its desired valuation.

B. Cerebras Valuation

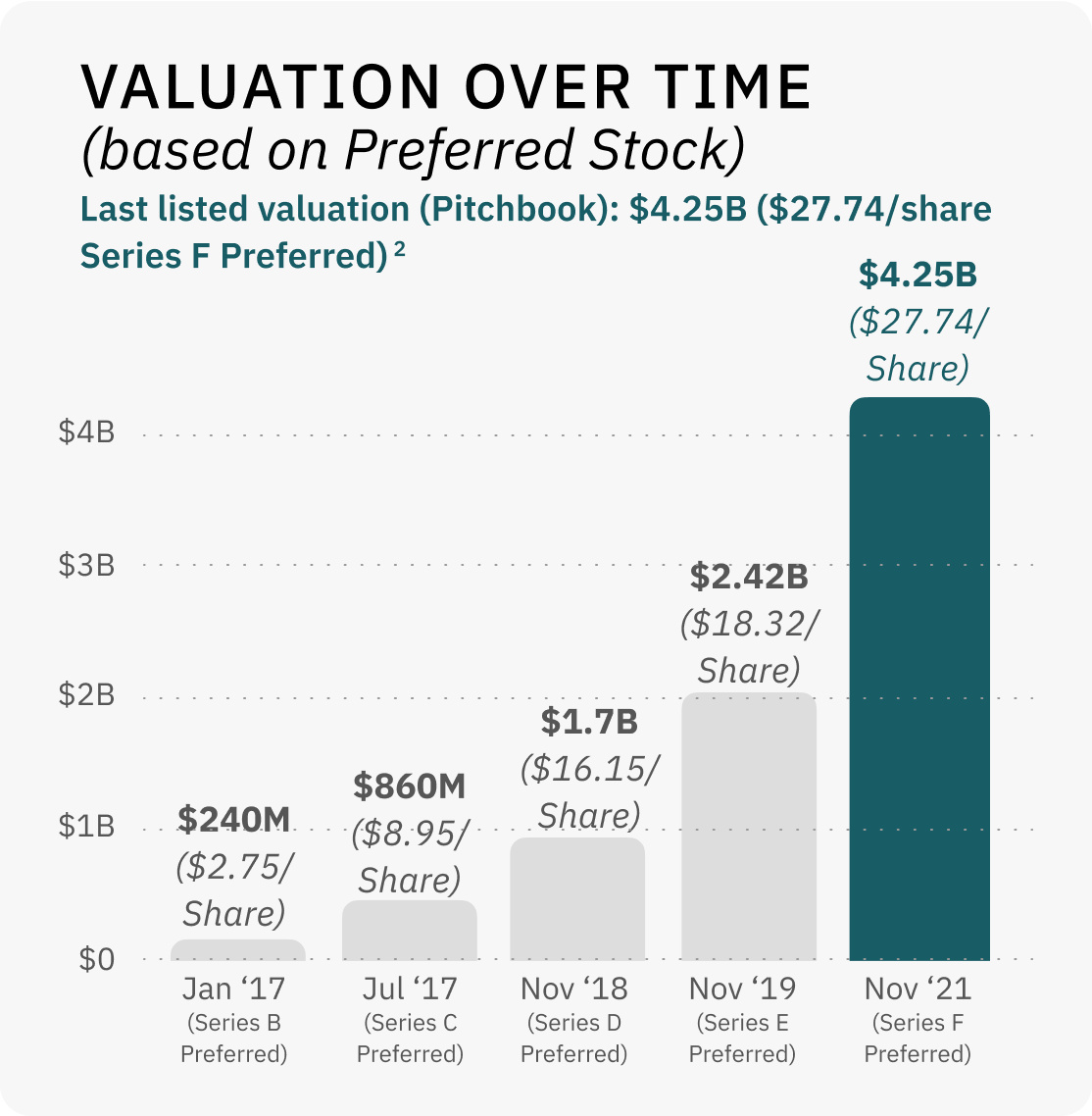

Cerebras' estimated valuation for its IPO is expected to be around $4 billion, which was its last confirmed valuation following a Series F funding round in November 2021. In this round, the company raised $250 million, bringing its total funding to over $720 million across six rounds. Notable funding milestones include a $272 million Series E in 2019 at a $2.4 billion valuation and an $81 million Series D in 2018 at a $1.7 billion valuation. Cerebras achieved unicorn status in 2018 with its Series D, and major investors include Alpha Wave Ventures, Abu Dhabi Growth Fund, G42, Altimeter Capital, and Benchmark.

Source: startengine.com

C. Share Structure & Analyst Opinions

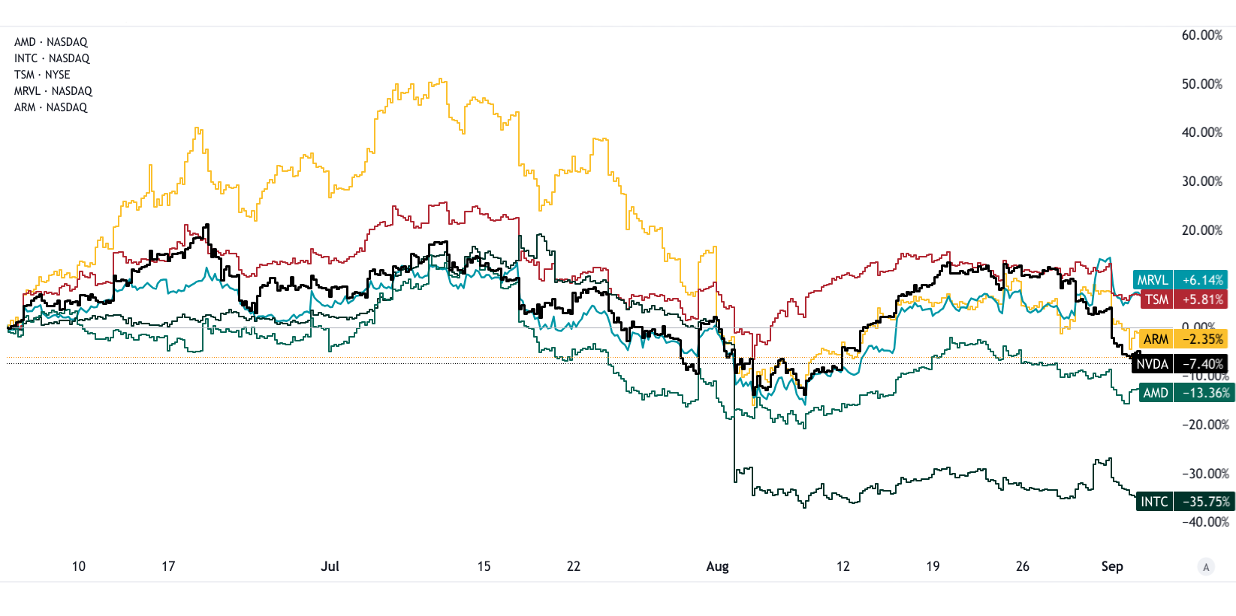

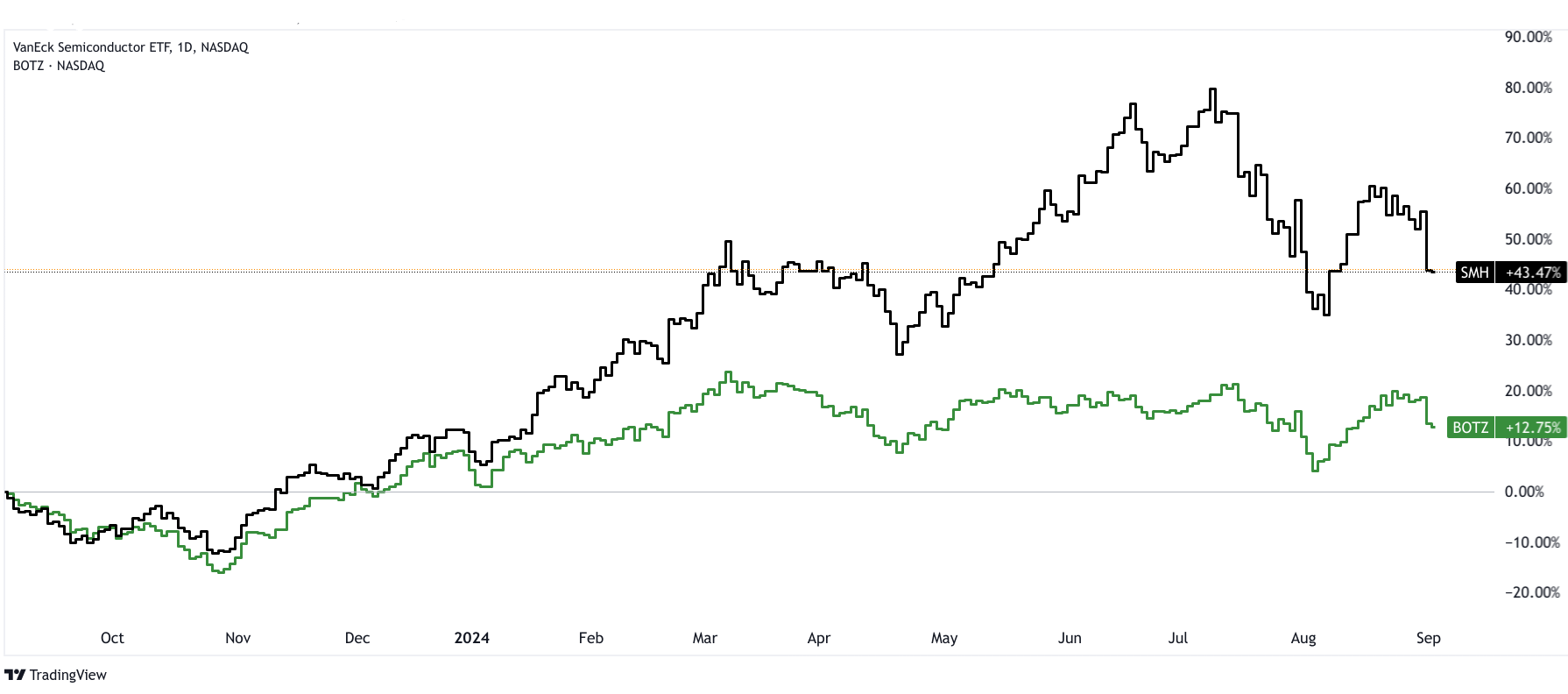

As of now, no specific details have been released regarding the number of shares or pricing for the IPO. However, analysts are cautious about Cerebras' IPO prospects due to the broader market conditions affecting the tech and semiconductor sectors. The performance of chip stocks in 2024 has been underwhelming, with key players like Nvidia, Intel, and AMD all facing significant sell-offs. This has led to speculation that Cerebras may delay its IPO until more favorable conditions arise, as a poor market debut could impact its valuation and future growth trajectory. While analyst perspectives remain generally optimistic about the company's long-term potential due to its differentiated AI hardware, the timing of its IPO is highly contingent on market recovery.

Source: cerebras.ai

Cerebras' IPO valuation in 2024 may face ongoing volatility in the semiconductor and broader technology markets. Chip stocks, including industry giants like Nvidia, have experienced significant sell-offs, with Nvidia seeing an 8% drop recently.

Source:tradingview.com

V. How to Trade Cerebras IPO & Cerebras Stock

Getting Cerebras IPO Shares

To purchase Cerebras IPO shares, retail investors typically need to open an account with a brokerage firm that offers access to IPOs, such as Fidelity, TD Ameritrade, or Charles Schwab. Investors may also need to meet certain eligibility requirements, including minimum account balances or participation in the broker's IPO program. It's important to research which brokers provide retail access to IPO allocations, as availability can vary. Alternatively, institutional investors will gain shares through their underwriters like Citigroup.

Cerebras Stock IPO Trading Strategies

Short-Term Strategy: Short-term traders may look to capitalize on volatility during Cerebras' initial trading days, especially given the current uncertainty in the semiconductor market. The IPO could experience rapid price fluctuations, presenting opportunities for day traders and swing traders to profit. Monitoring price movement within the first 24-48 hours of trading, when volume is highest, can yield significant short-term gains.

Long-Term Strategy: Long-term investors should focus on Cerebras' growth prospects in AI and semiconductor sectors. With projected AI hardware market expansion, Cerebras' unique wafer-scale technology positions it well to capture market share. A long-term strategy involves holding the stock to benefit from its revenue growth, partnerships with major organizations (e.g., Mayo Clinic), and potential market leadership in large-scale AI workloads.

Ways to Trade Cerebras Systems Stock

ETFs: Once Cerebras is publicly listed, it may be included in AI or semiconductor-focused ETFs like the VanEck Semiconductor ETF (SMH) or the Global X Robotics & AI ETF (BOTZ). These ETFs allow investors to gain diversified exposure to Cerebras alongside competitors like Nvidia, AMD, and Intel.

Source:tradingview.com

Options and CFDs: For more advanced traders, options trading or Contracts for Difference (CFDs) offer ways to speculate on Cerebras stock price movements without directly owning shares. CFDs, available on platforms like VSTAR, enable traders to take leveraged positions, increasing potential returns (or losses) based on price fluctuations. Similarly, options can provide strategic ways to hedge or speculate on Cerebras stock performance.