I. Introduction

A. Recent Apple Stock Performance

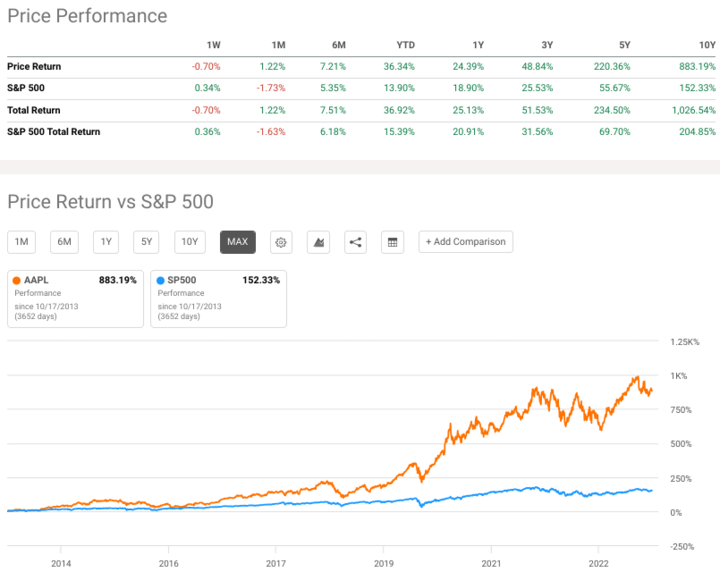

Apple Inc. (NASDAQ:AAPL) has exhibited a remarkable performance in recent times. Over the past year, AAPL shares delivered a solid return of 25.13%, surpassing the S&P 500's return of 20.91%. However, in the short term, there was a minor setback with a 0.70% decrease in the last week. Still, over the long term, Apple has exhibited remarkable resilience with an impressive 10-year return of 1,026.54%, indicating sustained growth.

Source: seekingalpha.com

B. AAPL Stock Trends and Influencing Factors

Apple's stock performance can be attributed to several key factors. Firstly, Apple boasts a diverse product portfolio, including best-selling products like iPhones, Macs, iPads, and lucrative services such as Apple Music, the App Store, and iCloud. This diversification ensures a steady stream of revenue. Additionally, Apple's unwavering brand loyalty and strong brand equity continue to bolster its performance.

The company's expansion into new markets has further contributed to its success. Wearables, notably the Apple Watch, have become increasingly popular, while services like Apple TV+ and Apple Arcade have diversified its revenue streams. These factors position Apple as a well-rounded and adaptable tech giant, capable of navigating changing market conditions.

It is essential to acknowledge that Apple's stock performance is also intricately linked to global economic conditions and consumer spending trends. A robust global economy typically benefits Apple, as consumers tend to spend more on premium tech products when they feel financially secure. Conversely, economic downturns or unfavorable global conditions may impact Apple's performance.

C. Expert Insights on AAPL Stock Forecast

Should I buy Apple stock? According to 37 analysts (CNN), the 12-month price forecast for Apple is promising. The median target price stands at $200.00, with a high estimate of $240.00 and a low estimate of $125.00. This indicates a potential increase of 12.91% from the current stock price of $177.14, offering investors an optimistic outlook.

Notably, the consensus among 45 polled investment analysts remains firmly in favor of buying Apple Inc. stock. This consensus rating has remained unchanged since October, emphasizing a consistent and strong buy recommendation. This stability in expert opinions underscores the high degree of confidence in Apple's future growth prospects.

Source: money.cnn.com

II. Apple Stock Forecast 2023

A. Recent Developments and News

Key Financials and Financial Forecast: Apple Inc.'s upcoming quarter's earnings, to be announced on 10/25/2023 (Estimated), are eagerly awaited by investors. The EPS estimate is $1.39, with a revenue estimate of $89.31 billion. Looking forward, the consensus EPS estimates for FQ4 2023 (ending September 2023) are $1.39, reflecting a YoY growth of 7.72%. FQ1 2024 (ending December 2023) is estimated to have an EPS of $2.08, with an anticipated YoY growth of 10.82%. These forecasts indicate a positive trajectory, suggesting confidence in Apple's earnings performance.

Source: seekingalpha.com

Recent news highlights the availability of Apple's iPhone 15 models. Bank of America reports increased availability, especially for the Pro and Pro Max models, across various geographies. Europe is the exception with a 7% availability rate, while the US, Canada, China, and Asia (excluding China) have seen improvements, ranging from 20% to 30% availability. This reflects a more balanced supply-demand environment, with new product launches compensating for somewhat weaker consumer demand trends. Notably, Chinese availability of the iPhone 15/15 Plus models has surged to 97%. However, market reports indicate that the iPhone 15 faces competition in China, particularly from Huawei's Mate 60 Pro, which has gained market share.

Apple CEO Tim Cook's recent visit to China underscores the company's focus on this critical market. He expressed enthusiasm for Tencent's "Honor of Kings", highlighting its global success on the App Store. Furthermore, Cook's visit to a Sichuan farmer using iPads for business transformation and interaction with students using iPads for various educational purposes reflect Apple's ongoing commitment to innovation and market penetration.

While Apple is making inroads in other markets, China remains crucial, generating substantial revenue. However, research firms have debated the strength of the iPhone 15 in China, with Jefferies analysts noting a drop in sales compared to the iPhone 14 Pro due to Huawei's new Mate 60 Pro. This raises concerns about Apple's competition in the Chinese market.

To prepare for the upcoming fiscal fourth-quarter results to be reported, Apple faces potential supply shortages and the impact of a stronger U.S. dollar, which could affect guidance. Despite potential challenges, solid margins and services growth are anticipated for the quarter, though analysts have lowered their price targets due to a slightly lower revenue base.

B. Analyst Price Targets and Ratings

Apple currently maintains a unanimous "Strong Buy" consensus (NASDAQ) among 31 analysts from various firms, including Goldman Sachs, JPMorgan Securities, and Morgan Stanley. This collective sentiment underscores a positive outlook for the tech giant.

The average 12-month Apple price target stands at $207.51, with a high estimate of $240 and a low estimate of $167. These price targets indicate an optimistic trajectory for the stock. However, investors should be aware of the range of price targets, reflecting diverse analyst opinions.

While the "Strong Buy" rating and the impressive price targets are encouraging, the stock market can be influenced by numerous internal and external factors. Market dynamics, consumer demand, and competition in the tech industry could impact AAPL's journey to achieve or surpass these targets.

Source: NASDAQ

C. Apple Stock Forecast for 2023

Is Apple stock a good buy? The outlook for Apple in 2023 is moderately bullish, with a year-end target price of $186 per share, representing a potential increase of around 5% from the current price of $177.15. Furthermore, the forecast for the first half of 2024 indicates an increase to $188 per share, with a more substantial boost in the second half, reaching $215 per share, reflecting an impressive 21% growth from the present level.

Apple's Analyst Ratings reflect a variety of opinions from different financial analysts. Morgan Stanley maintains a "Buy" rating with a target price of $215, indicating their optimistic outlook on Apple's stock. Barclays reiterates their "Hold" rating, suggesting a more cautious stance, and sets a target of $167.

Similarly, Bernstein also reiterated a "Hold" rating, but with a slightly more positive Apple stock price target of $195. Evercore ISI Group maintains a "Buy" rating with a target of $210, aligning with a bullish perspective on Apple's potential. UBS reiterates their "Hold" rating while increasing the target to $190, implying modest optimism.

Finally, Bank of America Securities also reiterated a "Hold" rating and set a target of $208, indicating a balanced outlook.

Key Factors to Watch for Apple stock forecast 2023

Apple Stock Price Prediction - Bullish Factors

New Product Launches: Apple's product launches are a significant driver of its stock performance. In 2023, the company unveiled the iPhone 15, iPhone 15 Pro, and iPhone 15 Pro Max. These new offerings, featuring advanced technology, thinner bezels, and improved camera systems, are expected to bolster sales and strengthen the Apple ecosystem. Additionally, Apple could introduce next-generation Macs with the M3 chip, further expanding its product line and appealing to a broader customer base.

Growth in Services Business: Apple's services segment continues to be a pivotal part of its revenue stream. Services such as Apple TV+ and Apple Music have gained traction, providing a reliable source of income. This diversification helps reduce the company's reliance on hardware sales and contributes to consistent revenue growth.

Apple Stock Projections - Bearish Factors

Slowing iPhone Sales Growth: Despite new iPhone releases, the smartphone market is reaching maturity, particularly in developed regions. This saturation may lead to challenges in maintaining robust growth in iPhone sales. In highly competitive markets like China, Apple faces intense competition from local manufacturers, potentially impacting its market share and sales growth.

Supply Chain Issues: The persisting supply chain issues affecting numerous industries can disrupt Apple's product manufacturing and distribution. Component shortages, production delays, and rising costs can impact the company's ability to meet consumer demand and maintain profit margins.

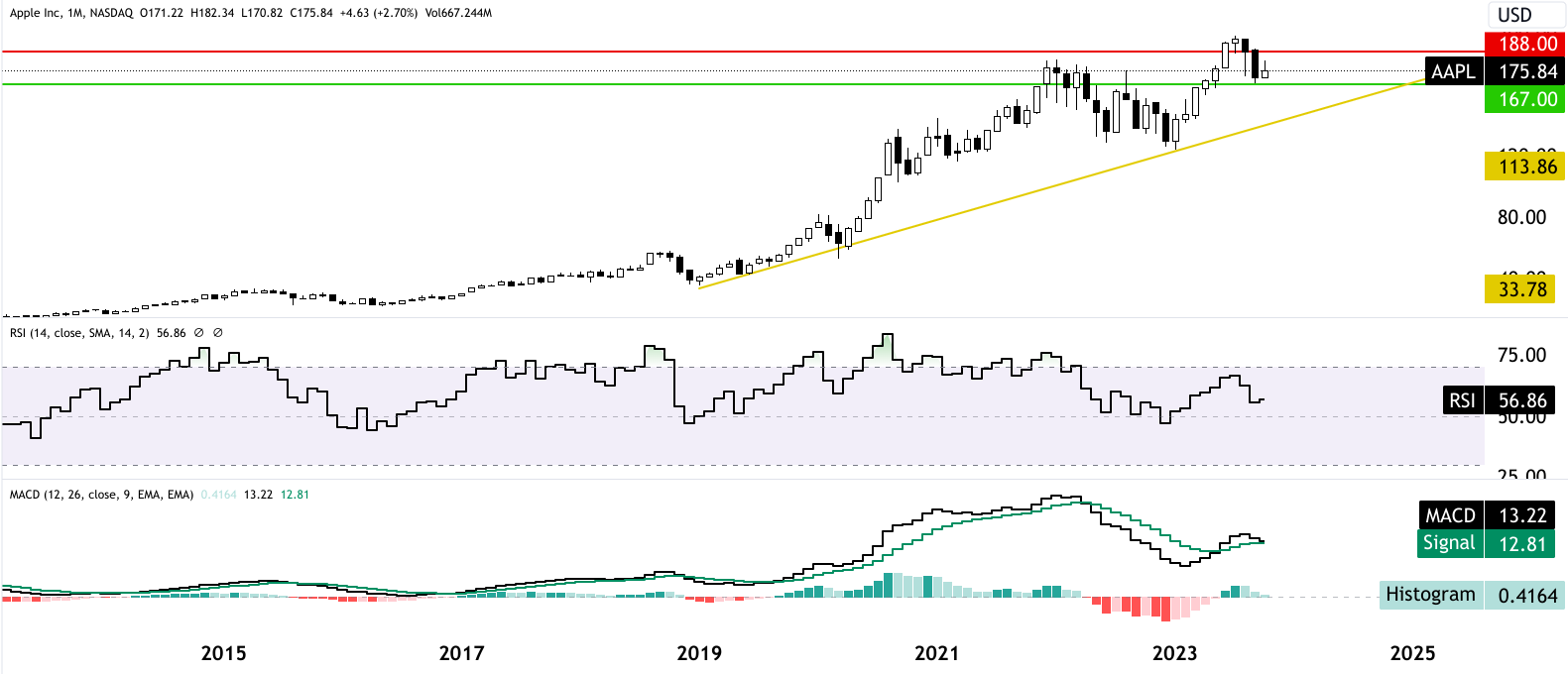

Technical Analysis for AAPL Stock Forecast 2023

Moving Averages (MA): Moving averages are commonly used technical indicators to assess the trend and potential support or resistance levels. Apple's moving averages indicate a favorable outlook:

- The Exponential Moving Average (EMA) and Simple Moving Average (SMA) are both in "Buy" territory across multiple timeframes, suggesting a positive trend in the stock's performance.

- The EMA and SMA for shorter timeframes, such as 10 and 20 days, show more robust buy signals, indicating short-term positive momentum.

MACD (Moving Average Convergence Divergence): The MACD is a momentum indicator that helps assess the strength and direction of a stock's price trend:

- The MACD level shows a "Buy" signal, suggesting favorable momentum in AAPL. This indicates that the stock's recent price increases are consistent and may continue.

Relative Strength Index (RSI): The RSI is a popular oscillator that measures the speed and change of price movements. It can help identify overbought or oversold conditions:

- The RSI stands at 57, indicating a "Neutral" market sentiment. This suggests that buying and selling pressures are relatively balanced, and the stock is not currently overbought or oversold.

Source: tradingview.com

Bollinger Bands: Bollinger Bands are used to gauge the stock's volatility and potential price breakout:

- The Bollinger Bands suggest price stability. The bands have not expanded significantly, indicating that the stock is currently experiencing a period of relative price stability. However, this could change, leading to potential price volatility in the future.

Support & Resistance Levels: Understanding support and resistance levels can assist in assessing potential price movements:

- Key support is anticipated around $167, indicating a level at which buying interest may increase, preventing the stock from falling further.

- Resistance is expected around $188 in the first half of 2024. This suggests a price level at which selling pressure may emerge, potentially slowing down the stock's ascent.

Source: tradingview.com

III. Apple Stock Forecast 2025

A. Financial Forecast

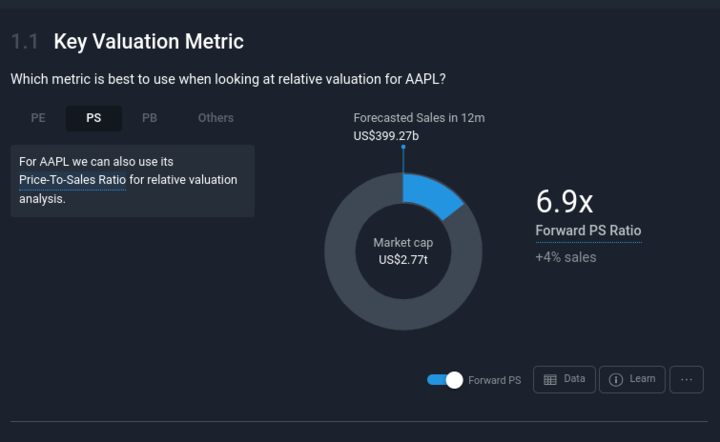

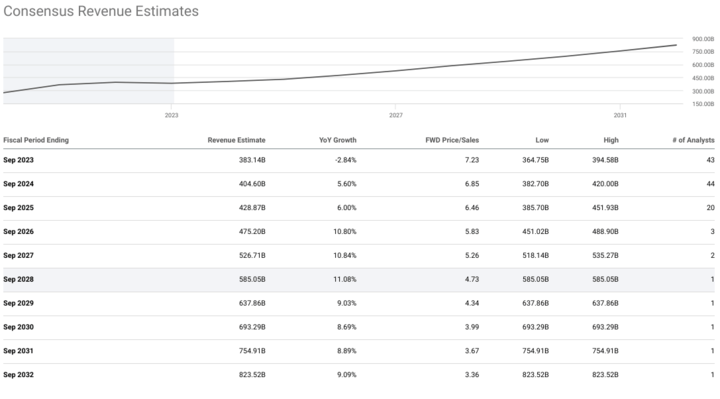

For the fiscal year ending in September 2025, analysts anticipate that Apple's earnings per share (EPS) will reach $7.10, reflecting an 8.31% year-over-year (YoY) growth. This indicates a forward price-to-earnings (PE) ratio of 24.97, reflecting investors' optimism about the company's future performance.

Source: simplywall.st

The estimated revenue for the same period stands at $428.87 billion, projecting a 6% YoY growth. With a forward price-to-sales (P/S) ratio of 6.9, Apple maintains a strong position in terms of its financial performance.

Source: simplywall.st

Several factors contribute to this optimistic financial outlook:

Product Diversification: Apple is renowned for introducing new products to cater to diverse consumer needs. The expected launch of the 14-inch and 16-inch MacBook Pro models with advanced M3 Pro/Max chips, the 24-inch iMac, and Apple Vision Pro exemplifies the company's commitment to addressing both professional and consumer markets.

Evolving Technology: Apple's rumored products, such as the foldable iPhone and Apple Car, signal the company's venture into new territories, ensuring its competitiveness in a rapidly changing tech landscape. These innovations offer significant growth potential.

Services Growth: The services category, driven by Apple TV+ and Apple Music, underlines Apple's commitment to expanding beyond hardware sales. This strategy reduces the company's reliance on iPhone sales and secures a steady revenue stream.

Competition with Android Ecosystems: As competition from Android ecosystems intensifies, Apple aims to maintain its position by offering innovative features, enhanced security, and a seamless user experience.

B. Company Strategy

To comprehend Apple's future outlook, it's crucial to assess the company's strategies:

Product Innovation: Apple's core strategy revolves around innovation, a focus on consumer experience, and creating desirable products. The potential launch of a foldable iPhone can open up a new revenue stream and help Apple retain its position as a tech leader.

Ecosystem Integration: Apple maintains a well-established ecosystem, encompassing hardware, software, and services. The seamless integration of devices, such as iPhones, Macs, and Apple Watches, fosters customer loyalty and increases the switching costs for users.

Diversification: While iPhones remain a key revenue source, Apple is actively diversifying. The launch of services like Apple TV+ and Apple Music expands the revenue base, reducing the company's dependence on a single product line.

Eco-Friendly Initiatives: Apple's commitment to sustainability is an integral part of its strategy. The company aims to have a net-zero climate impact by 2030, emphasizing environmental responsibility, which resonates with environmentally conscious consumers.

While these strategies have been successful in the past, Apple will need to continually adapt and innovate to remain competitive in a dynamic tech landscape.

C. Apple Stock Predictions 2025

Apple stock is set for substantial growth between 2025 and 2029, with the price expected to surge from $215 to $435, marking a remarkable 102% increase. The journey commences in 2025 at $215 and anticipates reaching $251 within the first half of the year, concluding at $281, translating to a significant 59% upswing from today's valuation.

Source: simplywall.st

These Apple ratings signify a high level of confidence in Apple's ability to continue its growth trajectory. It's essential for investors to monitor any changes in analyst ratings, as they can have a substantial influence on the stock's performance. Also, according to the Wall Street Journal (WSJ), the 2024-2025 target price for AAPL is $240.00.

Source: tradingview.com

Apple stock currently finds short-term support at its present price level, with a technical target price of 237.15 for 2025. Before reaching this target, there might be a minor resistance around $196.45. Conversely, if conditions take a downturn, the stock could pivot around $163.15 and test a critical support level at $129.95. In an adverse scenario, like a recession, the stock may be tested at $89.45. However, given the positive Apple stock outlook and the gradual market recovery, the 2025 target remains achievable.

Key Factors to Watch for AAPL stock forecast 2025

Apple Stock Forecast - Bullish Factors

Apple's ongoing commitment to innovation, exemplified by upcoming releases like a foldable iPhone and the Apple Car, promises new revenue streams and technological leadership. These innovations are poised to captivate consumers and boost sales. Also, steady expansion in services and wearables counters hardware sales volatility. Strong demand for offerings like Apple TV+ and Apple Music diversified income sources.

AAPL Stock Forecast - Bearish Factors

Rising competition from Android ecosystems necessitates continuous R&D investments to maintain premium pricing and market leadership. Market saturation and heightened rivalry may impact Apple's market share. Innovation, R&D costs, and supply chain disruptions may squeeze Apple's margins, potentially affecting profitability. Securing essential components like semiconductors remains a challenge with potential supply chain disruptions.

Apple Stock Prediction - Economic Outlook

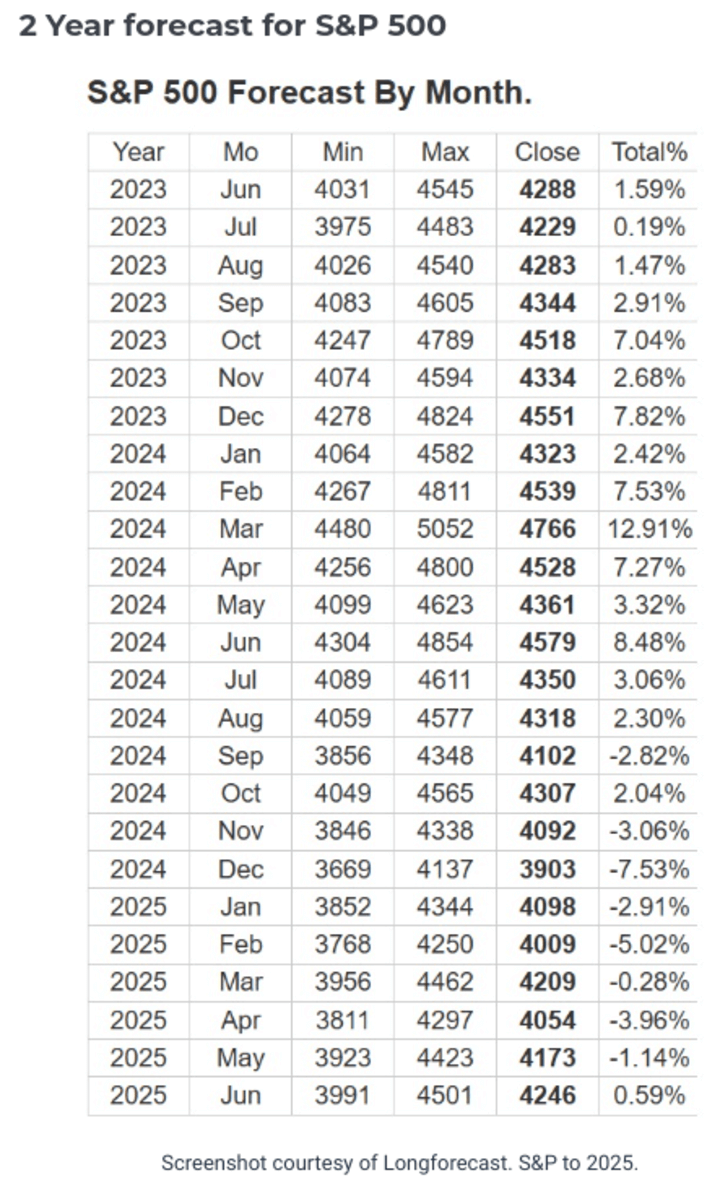

The 2025 economic forecast hinges on various key factors:

- Interest Rates: Anticipated declining interest rates are set to stimulate housing construction and consumer spending, reducing borrowing costs.

- Consumer Behavior: As normalcy returns, consumer spending on tech products and discretionary items is expected to surge.

- Small to Medium-Sized Businesses: Recovery post-pandemic is likely to drive growth in small and medium-sized businesses, contributing to economic revival.

- Commodity Prices: Soaring commodity prices might challenge both consumers and businesses, impacting production costs.

- Trade with China: Increasing trade resistance with China may prompt U.S. production shifts, potentially affecting tech companies like Apple.

- Energy Costs: Rising oil and energy costs will impact production and operating expenses.

- Tax Policy: Higher taxes to fund government spending will influence corporate profitability.

- Housing Market Boom: A pent-up housing demand is projected to trigger a construction boom and boost consumer spending.

- Changing Demographics: A growing housing stock and a decentralized economy away from urban centers.

- Transition in Energy Sources: A shift from high-cost green energy sources to more practical alternatives.

The economic landscape remains unpredictable, with unforeseen events and policy changes capable of altering the outlook for 2025.

Long-Term Economic Projections

Long-term economic projections offer diverse expectations, from moderate growth to slower growth. Factors include interest rate trends, consumer behavior, and trade resolutions with China.

Multiple variables influence the economic landscape, such as technology adoption, renewable energy investments, trade policies, and demographic shifts. These projections should be considered in conjunction with other market dynamics.

Source: gordcollins.com

IV. Apple Stock Forecast 2030 and Beyond

A. Apple Development prospects for the next five years and beyond

Financial Forecast

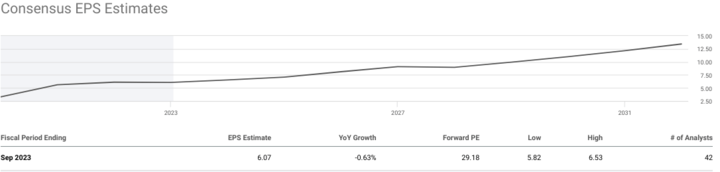

Apple's financial outlook paints an optimistic picture, extending to 2032. The company is expected to experience consistent growth in both revenue and earnings per share (EPS), which underscores its financial strength and market resilience. A closer look at the EPS figures reveals a significant uptrend, starting at $6.07 in September 2023 and gradually ascending to $13.44 by September 2032. This trajectory signifies an impressive 121% growth over the course of the decade. The upward trajectory is indicative of Apple's capacity to maintain a robust growth pattern in its bottom line.

The consensus revenue estimates for Apple are equally promising. Commencing at $383.14 billion in September 2023, these forecasts project a substantial surge, reaching $823.52 billion by September 2032. This represents to a remarkable 115% increase in revenue. These figures underscore Apple's ability to achieve substantial growth in both top and bottom lines in the coming years.

Source: seekingalpha.com

Company Strategy

Apple's strategic direction for the next decade revolves around sustainability and innovation. The company's ambitious "Apple 2030" initiative aims to make every product in its lineup carbon neutral. Apple is keen on reducing emissions significantly across its products' entire life cycle, with a strong emphasis on clean electricity usage for manufacturing and product operation, as well as the incorporation of recycled materials. It is essential to highlight that this commitment to sustainability is not merely a public relations move; it constitutes a forward-looking strategy designed to meet the expectations of a market that is increasingly environmentally conscious.

Here are some key examples of Apple's environmental initiatives:

Product Decarbonization: Apple is focused on the comprehensive reduction of greenhouse gas emissions across the life cycle of its products. This strategy prioritizes clean electricity for both manufacturing and product use, ensuring that 100% clean electricity is employed.

Use of Recycled Materials: The company is actively incorporating recycled materials, such as 100% recycled aluminum in Apple Watch Series 9 cases and recycled cobalt in batteries. This aligns with Apple's overarching goal of using 100% recycled metals in key components by 2025.

Source: apple.com

Shift Towards Renewable Energy: Apple is actively investing in renewable energy sources and partnering with suppliers to promote the use of 100% renewable electricity in manufacturing. This commitment extends to both Apple's operations and its supply chain, resulting in a significant reduction in the carbon footprint.

Source: apple.com

Carbon Credits and Nature-Based Projects: The company employs high-quality carbon credits from nature-based projects to offset remaining emissions. Apple supports projects aimed at removing carbon from the atmosphere, such as restoring forests and grasslands.

Grid Forecast: Apple's Grid Forecast tool empowers users by providing real-time information about the carbon footprint of their energy consumption. This tool assists users in making decisions to reduce their environmental impact by encouraging the use of electricity during cleaner periods.

Apple's steadfast commitment to sustainability is in alignment with the growing global emphasis on environmental responsibility. This strategic approach is poised to resonate with a broad consumer base, fortifying the company's corporate image.

B. Apple Stock Price Prediction 2030 and Beyond

In the forthcoming years from 2030 to 2034, Apple stock price is poised for a significant upswing, ascending from $435 to $545, reflecting a robust 25% growth. The year 2030 will commence with Apple's stock at $435, experiencing an early-year boost to $444, ultimately concluding the year at $453. This progression marks a substantial increase of approximately 156% compared to the current valuation.

The Apple stock outlook for the next decade is promising. Their dedication to innovation, sustainability, and eco-friendliness positions them for sustained growth. Key factors influencing Apple's future stock performance include:

- Expanding Services: Apple's suite of services like Apple TV+ and Apple Music will boost revenue stability and reduce reliance on hardware sales.

- Ecosystem Loyalty: Seamless integration and customer focus will maintain user loyalty and increase switching costs.

- Strong Cash Flow: Apple's robust cash generation enables ongoing R&D and innovation.

- Competition: In a competitive market with Google, Amazon, and Meta, innovation is vital for market retention.

- Hardware Growth: Potential saturation in the global device market may affect Apple's hardware sales.

- Geopolitical Tensions: U.S.-China tensions could disrupt Apple's supply chain and market access.

With a strong market position, brand loyalty, and diverse products, Apple should continue to grow beyond 2030.

V. Apple Stock Price History Performance

Is Apple a good stock to buy? Apple's stock price history is marked by significant milestones and price movements. A brief analysis of key price levels and the factors influencing them:

1997 - Steve Jobs' Return: In 1997, Apple was struggling, and its stock price was below $1. Steve Jobs' return to the company marked a turning point. His leadership, innovation, and the introduction of the iMac and iBook helped Apple's stock price climb.

2007 - iPhone Launch: The iPhone's release in 2007 was a game-changer. Apple's stock price jumped from around $10 to $27 in a year, reflecting the market's recognition of its revolutionary product.

2012 - $700 Peak: Apple reached its all-time high at around $700 per share in 2012, fueled by strong iPhone sales and impressive growth. However, concerns about maintaining this pace and Jobs' passing led to a significant correction.

2013 - Stock Split: In 2014, Apple executed a 7-for-1 stock split, reducing the share price to make it more accessible to a broader range of investors.

2015 - Dividend and Buybacks: Apple started paying dividends and initiated massive stock buyback programs. This increased investor confidence, and the stock price steadily climbed.

2018 - $1 Trillion Valuation: Apple became the first publicly traded U.S. company to reach a market capitalization of $1 trillion. Strong services and wearables sales were pivotal.

2020 - COVID-19 Impact: While Apple's stock price remained resilient during the COVID-19 pandemic, it experienced turbulence due to supply chain disruptions and store closures. The subsequent work-from-home trend, boosted by Apple's products, supported the stock.

Source: tradingview.com

2021 - Regulatory Scrutiny: Apple faced regulatory challenges, particularly regarding its App Store policies. This led to concerns about potential changes impacting its business model.

VI. Apple Stock Forecasting and Trading Tips

A. AAPL Stock Forecasting and Trading Tips

- Comprehensive Research: Conduct in-depth research into Apple's financials, industry trends, and competitive positioning. This knowledge is essential for informed investment or trading decisions.

- Diversification: While Apple is an attractive investment, diversify your portfolio to spread risk. Over-reliance on a single stock can expose you to undue volatility.

- Long-Term Perspective: Consider your investment horizon. Apple's steady performance and dividend payouts make it appealing for long-term investors. However, short-term traders may also find opportunities.

- Technical Analysis and Swing Trading: Some traders use technical analysis and swing trading strategies to profit from short- to medium-term price movements in Apple stock. These traders often rely on chart patterns, technical indicators, and market sentiment.

- Fundamental Analysis: Investors and traders interested in Apple can conduct fundamental analysis, examining the company's financial health, competitive positioning, and growth prospects to make informed decisions.

- Economic Indicators and News Trading: Traders may focus on economic indicators and news releases that can impact Apple stock price, such as earnings reports, product launches, or trade developments.

Source: centerpointsecurities.com

B. Ways to trade or invest in Apple Stock

How to buy Apple stock? Here are different ways to invest in or trade Apple stock:

Stock Market Investment

- Long-Term Investing: Buying Apple shares with the intention of holding them for an extended period, often years or even decades. Long-term investors typically benefit from Apple's steady growth, dividends, and capital appreciation.

- Dividend Investing: Apple offers dividends to its shareholders. Investors seeking regular income can buy Apple shares to receive periodic dividend payments. This is a more conservative approach.

- DRIP (Dividend Reinvestment Plan): Enrolling in Apple's DRIP allows you to reinvest your dividend payments to purchase additional shares, increasing your position over time.

Options Trading

- Call Options: Buying call options on Apple stock allows you to benefit from potential price appreciation without owning the stock outright. However, options trading is complex and involves time sensitivity.

- Put Options: Put options can be used to profit from a decline in Apple stock price. They can also be used for hedging an existing Apple stock position.

Stock CFD (Contract for Difference) Trading

- Contract for Difference (CFD) Definition: A CFD is a financial derivative contract between a trader and a CFD provider (broker). It allows traders to speculate on the price movement of an underlying asset (in this case, AAPL stock) without owning the actual stock.

- Price Speculation: When traders trade AAPL CFDs, they are essentially predicting the future price of AAPL shares. Traders don't buy or own the shares themselves; instead, they agree with the CFD provider.

- Buy (long) or sell (short)

Traders have two choices:

1. Buy (long): If traders believe the price of AAPL will rise, they go long. If the price increases, traders profit; if it decreases, traders incur a loss.

2. Sell (short): If traders believe the price of AAPL will fall, they go short. When the price falls, traders profit; if it rises, traders incur a loss.

- No Ownership of the Underlying Asset: Unlike traditional stock trading, where traders buy and own shares of a company, with CFDs, traders don't own the underlying AAPL stock, they are simply speculating on its price movement.

- Leverage: CFDs often offer leverage, which means traders can control a larger position with a relatively small amount of capital. This amplifies both potential profits and losses. Leverage allows traders to magnify their exposure to price movements.

- Margin: To open a CFD position, traders are typically required to deposit a fraction of the total position value as a margin. This margin acts as collateral, and it is used to cover potential losses. The use of leverage means that a trader's profit or loss is calculated based on the full size of their position, not just the margin they put up.

- Rolling Over Positions: CFDs are typically designed for short to medium term trading, and they have expiration dates. If traders want to keep their positions open beyond the expiration date, they can "roll over" the contract, which involves closing the current position and opening a new one.

- Costs and Financing: When traders hold a CFD position overnight, they may incur financing charges or receive financing payments, depending on the direction of the trader's trade (long or short). These charges are associated with the cost of borrowing or lending the underlying asset.

For traders and investors considering exposure to Apple stock, there are different methods available. Trading Apple stock CFDs with VSTAR is one such option:

- Leverage: CFD trading offers leverage, allowing you to control larger positions with a smaller capital outlay. This can enhance potential returns, but it's essential to manage leverage carefully, as it also amplifies risks.

- Lower Trading Costs: VSTAR offers $0 commission trading, which can help maximize profits. Be aware of other trading costs, such as spreads and overnight financing.

- Access to Global Markets: Trading AAPL stock CFDs provides exposure to not only the U.S. market but also global stock markets. This diversification can help manage risk.

- Swift Execution: In the fast-paced world of stock trading, quick execution is crucial. VSTAR's promise of fast execution ensures that you can enter and exit trades efficiently.

VII. Conclusion

In conclusion, Apple (AAPL) has a promising future with forecasts pointing to steady growth. For 2025, AAPL stock is expected to rise from around $215 to $281, driven by its commitment to sustainability and innovative products. Looking ahead to 2030, AAPL stock price may reach $545. The company's focus on reducing emissions and investing in clean energy will resonate with eco-conscious investors.

FAQs

1. Is Apple a Buy, Hold or Sell?

Most analysts currently rate Apple a Buy/Hold. Analysts point to Apple's strong brand, ecosystem loyalty, consistent cash flow, and pipeline of new products like augmented reality as reasons to be bullish on the stock for the long term.

2. Is Apple stock expected to rise?

Apple stock is expected to continue to rise moderately in the near term.

3. What is the 12-month forecast for Apple stock?

The consensus analyst 12-month price target for Apple stock is around $210.

4. What will Apple stock be worth in 2025?

Based on historical growth trends and analyst forecasts, Apple stock could be worth about $250 in 2025.

5. What will Apple stock be worth in 2030?

Looking further ahead, if Apple continues to innovate and grow earnings, its stock price could reach about $450 by 2030.