I. Recent AMAT Stock Performance

AMAT Received DOJ Subpoena

Applied Materials recently disclosed that the U.S. Department of Justice issued a subpoena requesting information about its grant applications under the U.S. Chips and Science Act. The company's application for federal funding was ultimately denied.

This denial marks a significant setback for Applied Materials, which had planned to build a $4 billion research facility in Sunnyvale, California.

The company has been under increased scrutiny, particularly regarding its product shipments to China. Earlier this year, Applied Materials also received inquiries from the Securities and Exchange Commission and the U.S. Attorney's Office for the District of Massachusetts, further highlighting its regulatory challenges.

AMAT Share Exchange Update

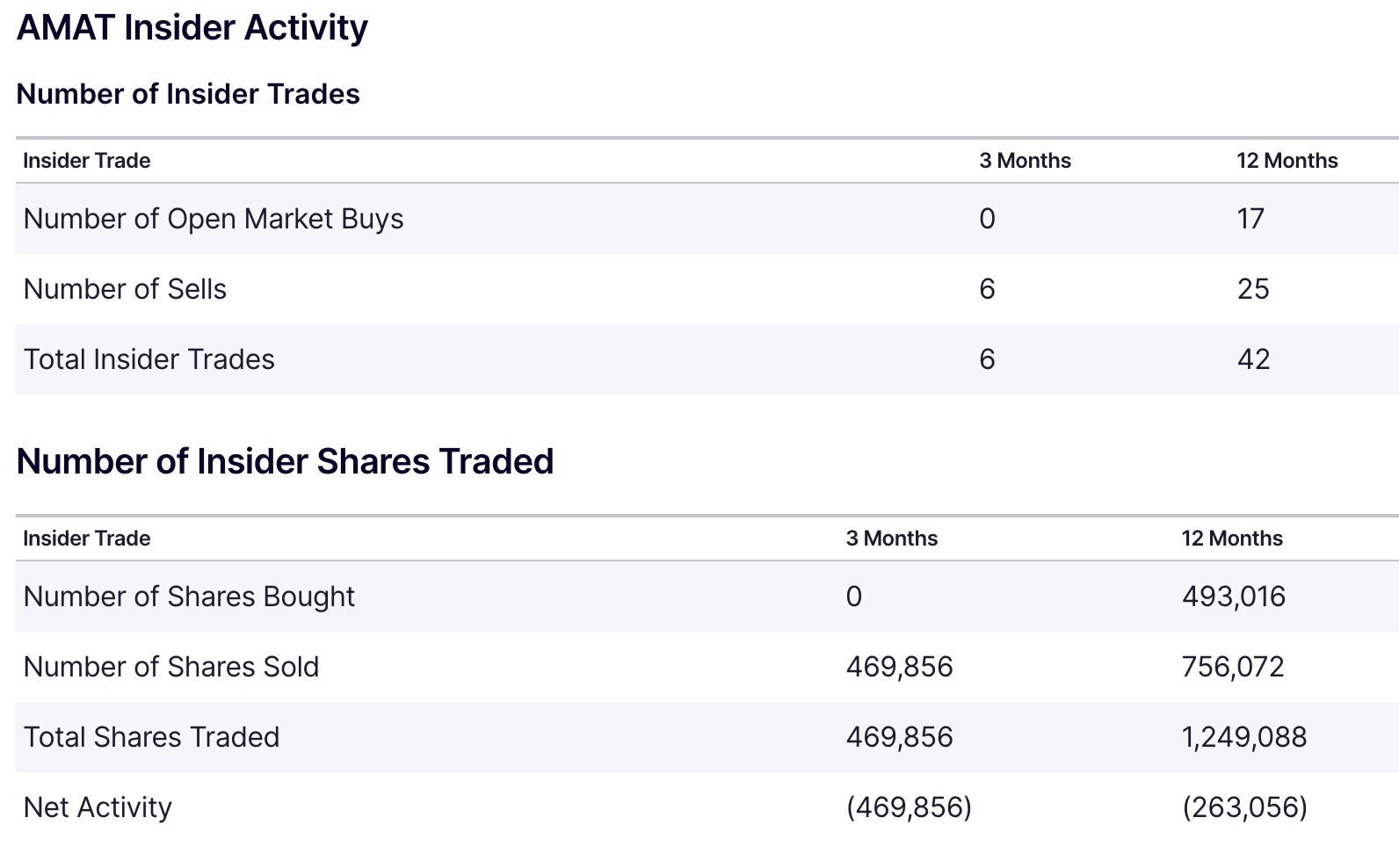

According to a recent SEC filing, Bailard Inc. trimmed its holdings in Applied Materials, Inc. (NASDAQ: AMAT), reducing its position by 6.6% during the second quarter. The institutional investor sold 1,869 shares, leaving it with 26,262 shares of the semiconductor equipment manufacturer, valued at approximately $6.2 million.

This adjustment in Bailard's portfolio mirrors similar moves by other institutional investors. For instance, Redmont Wealth Advisors LLC and Atlantic Edge Private Wealth Management LLC initiated new positions in Applied Materials, valued at $26,000 and $27,000, respectively.

Mark Sheptoff Financial Planning LLC acquired a stake worth $35,000 in the first quarter. These strategic shifts reflect a broader trend of investors recalibrating their exposure to Applied Materials amid a complex semiconductor industry landscape.

AMAT Lawsuit Threat

Bronstein, Gewirtz & Grossman, LLC has launched an investigation on behalf of investors who purchased securities of Applied Materials, Inc. (NASDAQ: AMAT). This inquiry follows reports that the U.S. Justice Department is conducting a criminal investigation into Applied Materials, alleging that the company violated export restrictions involving China's leading chipmaker, SMIC.

The revelation of this probe led to significant declines in Applied Materials' stock price in November 2023 and February 2024.

Expert Insights on AMAT Stock Forecast for 2024, 2025, 2030 and Beyond

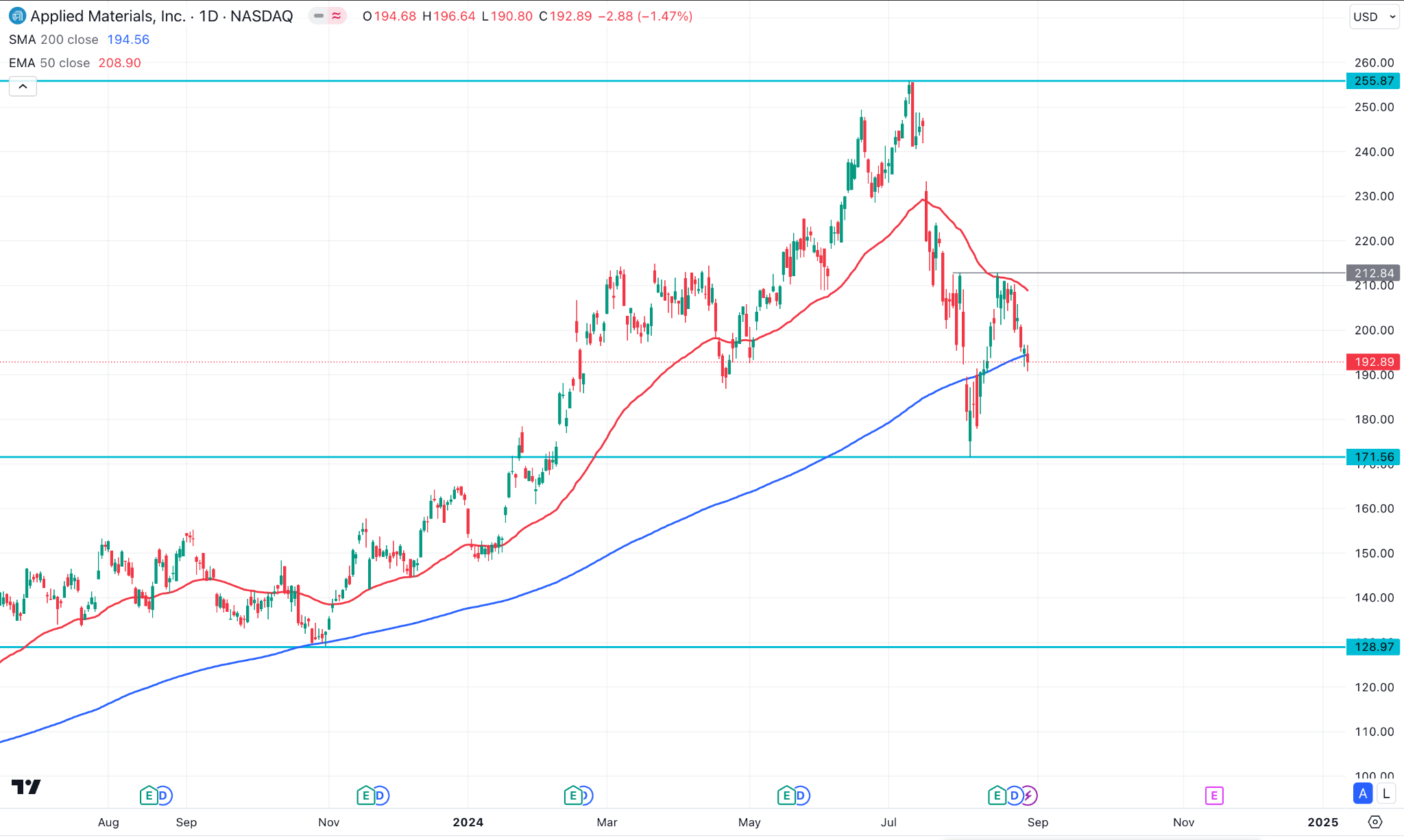

The AMAT stock price reached a high near 167.06 at the beginning of 2022 and started declining. It then made a low near 71.12 by October 2022. Since then, the price has been on an uptrend until July 2025, hitting the ATH of 255.89 and starting to decline.

As of writing, the price of the AMAT stock is floating at 196.23 after bouncing back from the low of 171.61. Before checking further details, let's see what experts anticipate about AMAT stock price by the end of 2024, 2025, 2030, and Beyond.

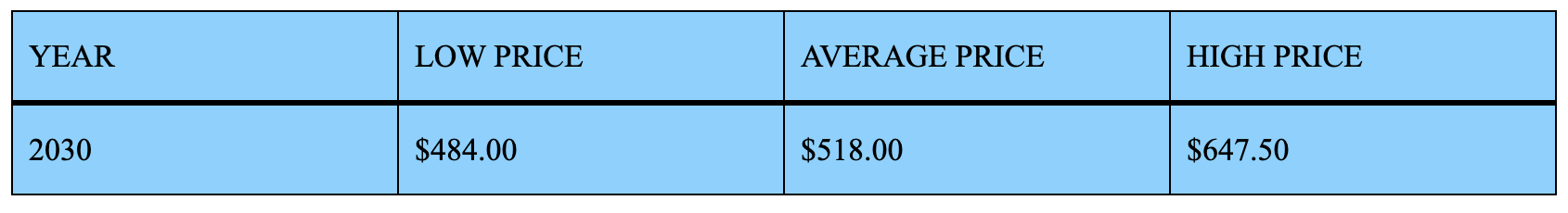

|

Providers |

2024 |

2025 |

2030 and beyond |

|

StockScan |

$274.90 |

$381.66 |

$553.03 |

|

Markettalks |

$282.00 |

$337.50 |

$647.50 |

|

Coincodex |

$215.56 |

$258.17 |

$1,019.63 |

II. AMAT Stock Forecast 2024

The AMAT stock price is trading within a minor bearish pressure, which may soon regain the previous resistance of 231.90 and gradually create a new ATH near 280.00 by the end of 2024.

In the daily chart of AMAT, the broader market direction remains bullish, where the most recent price struggles to aim higher at the double-top pattern.

The price floats between the EMA 50 and SMA 200 lines, reflecting a mixed signal. The EMA 50 lines act as dynamic resistance, while the SMA 200 line acts as a dynamic support level. The price above the SMA 200 line indicates the price is still in a bullish trend for the longer term, and when it is below the EMA 50 line, it reflects short-term bearish pressure. So, the price exceeds the EMA 50 line, indicating significant bullish pressure on the asset price. In that case, it may reach the nearest resistance near 231.90, followed by the next possible ATH, as many experts predict by the end of the current year.

Meanwhile, the price reaches below the SMA 200 line. In that case, it will declare sellers' domination, and the price may retrace toward the previous support of nearly 171.60 before bouncing back to the resistance levels.

A. Other Applied Materials Stock Forecast 2024 Insights

Assessing whether Applied Materials could trade higher from current levels requires a close look at analyst forecasts. Wall Street analysts have set an average 12-month AMAT price target of $259.54, with a high of $300 and a low of $224. Among the analysts, ten have issued positive ratings, three are neutral, and none have negative ratings.

Over the past month, eight analysts have adjusted their price targets for Applied Materials, indicating ongoing reassessments of the company's potential.

While stock movements are unpredictable, with an average market return of around 10% annually, Applied Materials has already gained 27.97% year-to-date. Analysts' current average AMAT target price suggests there may still be room for the stock to appreciate further.

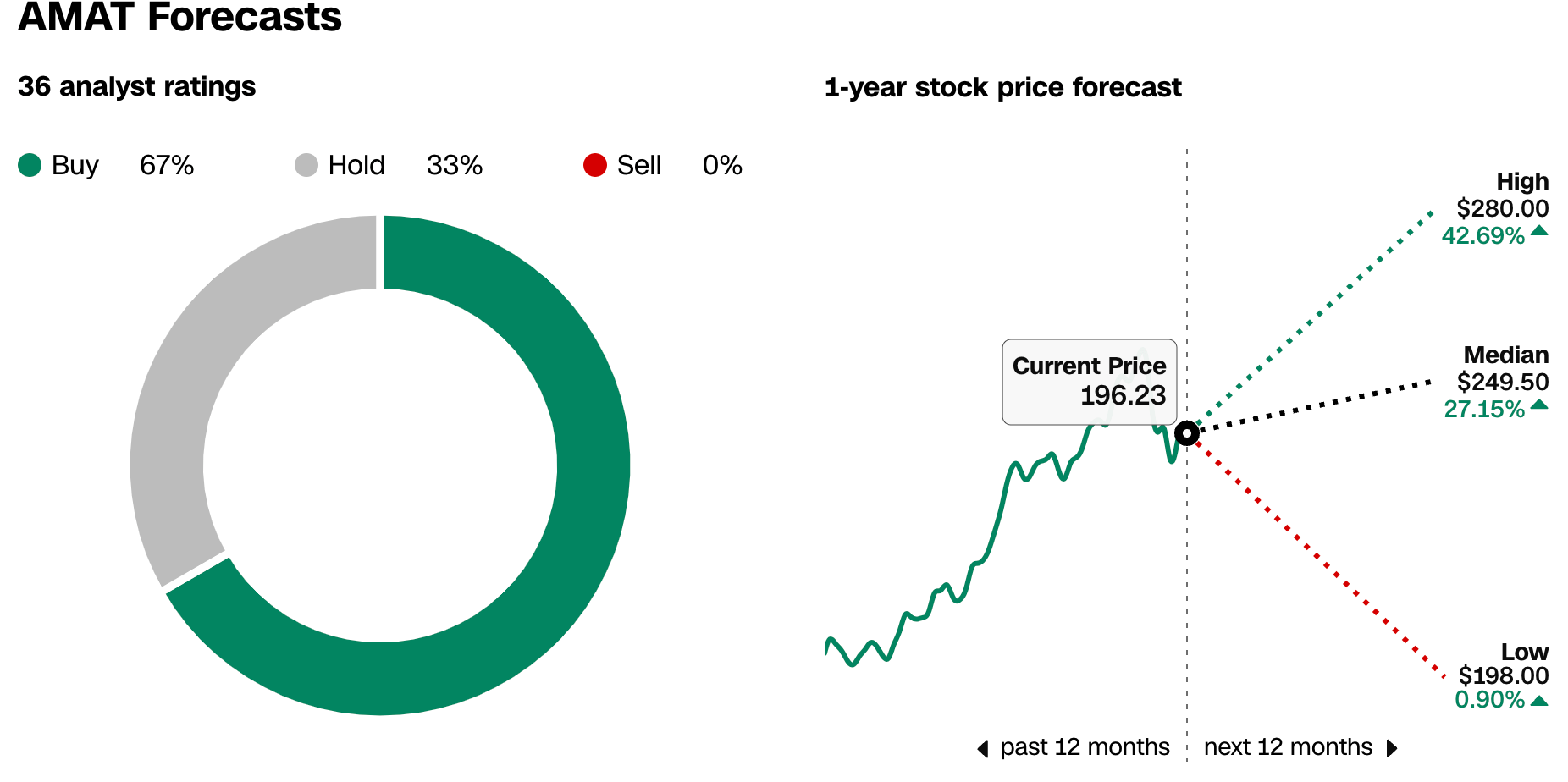

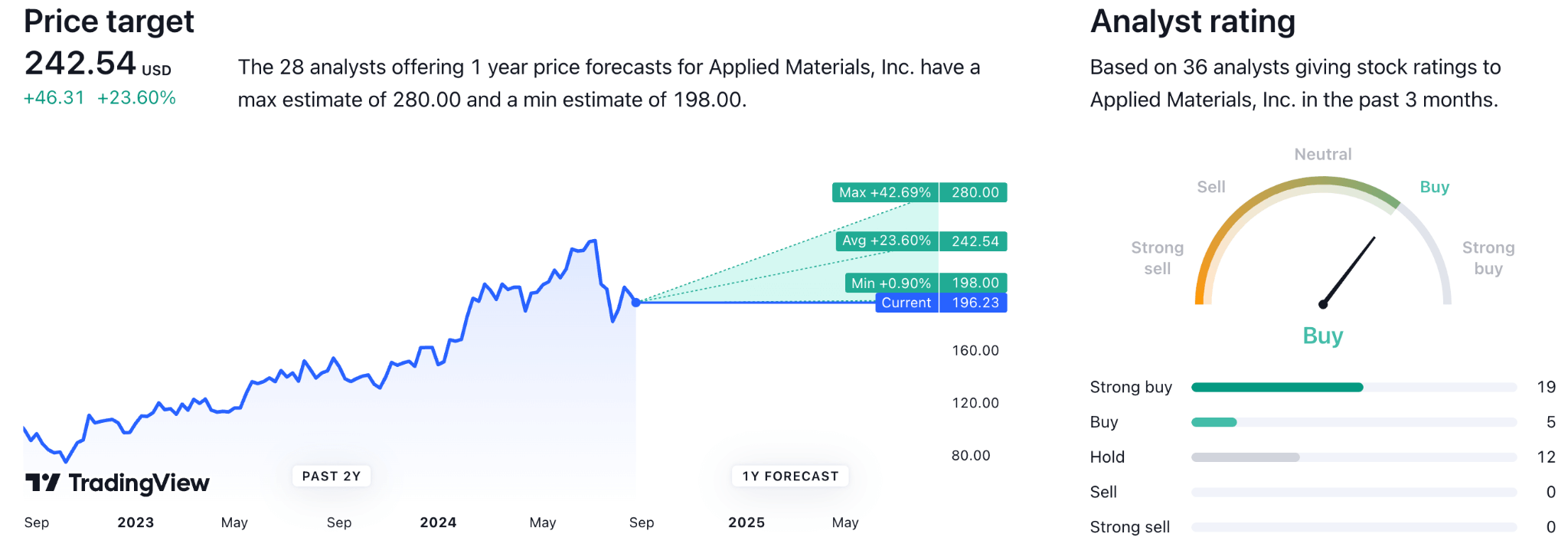

According to recent data from CNN, AMAT is a potential stock to invest in as of the August 2024 report; no analysts suggest selling.

Thirty-six analysts gave their predictions, with 67% suggesting buying and 33% suggesting holding the asset but no selling suggestions. They predicted that in the meantime, the price could reach a high near 280.00, the median price is 249.50, and the low they predicted is 198.00.

B. Key Factors to Watch for AMAT Stock Forecast 2024

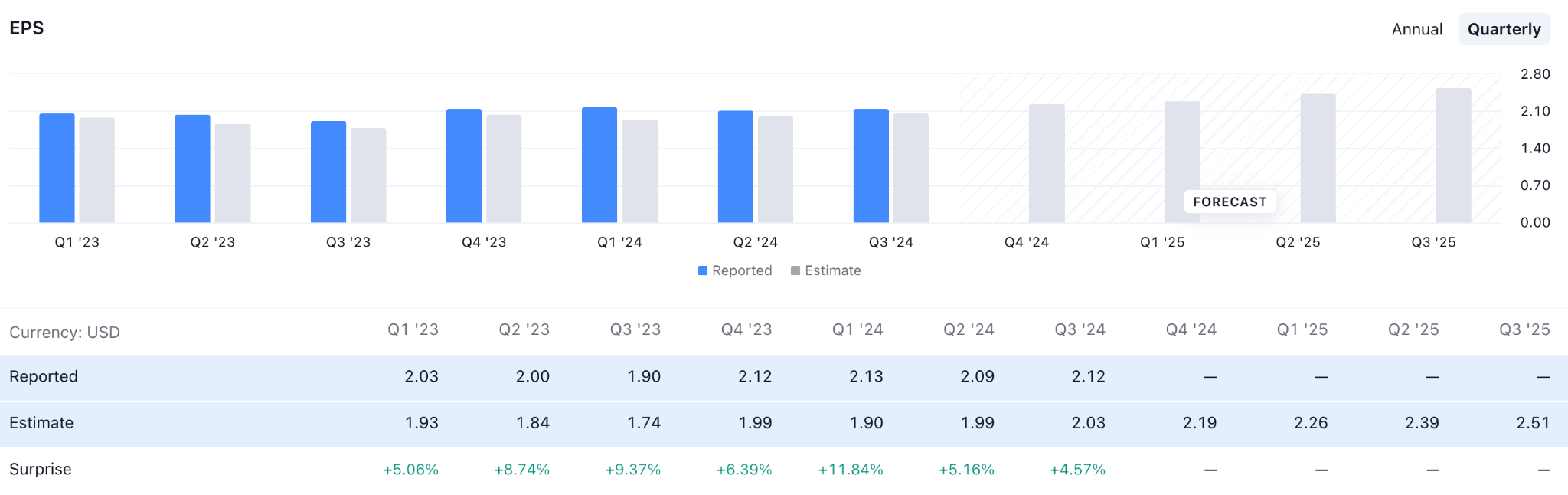

AMAT EPS Forecast For 2024

Although past performance doesn't guarantee future growth, Applied Materials Inc. has posted consecutive earnings growth for several years, making the stock a potential investment for the upcoming days. The company's operational efficiency and robust strategic investment have supported sustainable dividend payments in the past and, perhaps notably, in future progress.

AMAT Investors' Sentiment On Lawsuit

According to Reuters reports on 16 November 2023, the U.S. Justice Department had initiated a criminal investigation into Applied Materials for allegedly evading export restrictions related to China's top chipmaker, SMIC. Following this news, by 17 November 2023, Applied Materials' stock price declined by $6.19, or 4%, closing at $147.75 per share.

Later, on 27 February 2024, Reuters published that Applied Materials had received subpoenas from both the Securities and Exchange Commission (SEC) and the U.S. Attorney's Office for the District of Massachusetts. These subpoenas pertained to the company's shipments to China and included requests for information related to specific federal award applications. The news further impacted the stock by 27 February 2024, causing it to decline by $5.31, or 2.6%, closing at $197.28 per share.

AMAT Forecast 2024 - Bullish Factors

- Applied Materials, a global leader in semiconductor manufacturing equipment, remains strong financially despite Chinese export challenges, restrictions, and industry cycles.

- The company's Q3 results surpassed expectations, with solid performance across services, semiconductor, and display segments, particularly in Artificial Intelligence and memory technologies.

- Analysts and institutional investors are confident in Applied Materials. Most price targets suggest high institutional ownership and noteworthy upside potential, which reflects increasing investor confidence in the company's future.

AMAT Stock Price Forecast 2024 - Bearish Factors

- The cyclical semiconductor industry means a slowdown in demand for critical technologies like memory, AI, or displays could adversely impact Applied Materials' revenue and stock price in the upcoming days.

- The current valuation of AMAT is above historical averages and high growth expectations priced in; the stock is at risk of decline if the company fails to meet these raised expectations or if market conditions worsen.

III. AMAT Stock Forecast 2025

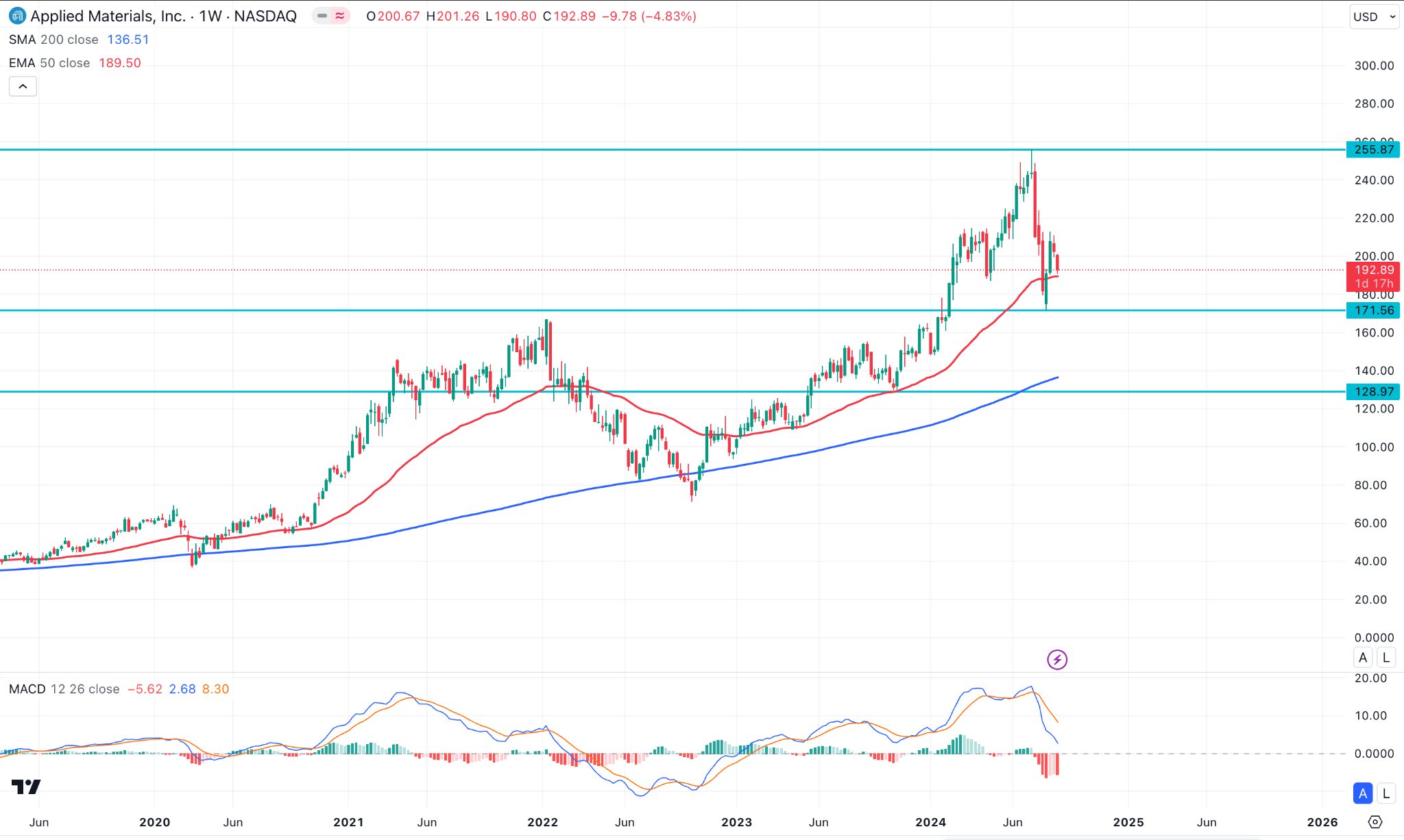

On the weekly chart, AMAT stock price retraces after reaching the ATH and bounces back to recover losses and gain, creating a new ATH of nearly 337.00 by the end of 2025, as many expert investors anticipate.

In the weekly timeframe, the current price is trading within a downside pressure after making a new all-time high level. However, the most recent price failed to make a significant low, limiting the downside possibility.

The 50-week EMA is the immediate support line from which a bullish reversal is visible. Moreover, the 200-week SMA is working as a major support. In that case, we can anticipate a bullish continuation as long as the major 200 SMA is protected.

The MACD indicator window shows recent sell pressure through the downside-sloping signal lines and red histogram bars below the midline. Moreover, the Signal line has more room to aim down before finding a barrier from the bottom.

Based on the AMAT Stock Forecast 2025, the price can again retest the recent support near 171.60 before returning to the resistance. Meanwhile, any break below this line could lower the price toward the next support near 139.72.

On the bullish side, the price is still above the EMA 50 line, which declares bull pressure is still active on the asset price, leaving optimism for buyers that the price will regain the previous resistance of 255.89. Any breakout of that level will open the door toward the next possible ATH near 337.00 by the end of 2025.

A. Other AMAT Stock Price Prediction 2025 Insights

As per a report from TipRank, Joseph Quatrochi has reaffirmed his Buy rating on Applied Materials, which is driven by the company's solid revenue performance and a substantial backlog of orders. Despite a slight revenue dip from Samsung, one of its key customers, Applied Materials achieved year-over-year and quarter-over-quarter revenue growth. This growth reflects a diversified and expanding revenue base, mainly fueled by increased sales in leading-edge front-end logic, highlighting the company's strong market position.

Quatrochi also pointed to the stability of Applied Materials' sizable backlog in unsatisfied performance obligations, which is expected to contribute significantly to near-term revenue. This backlog underscores the ongoing robust demand for the company's products. Additionally, the stability in warranty accruals, which Quatrochi views as a proxy for healthy installed base growth, further indicates substantial service opportunities and customer satisfaction, reinforcing the company's solid financial outlook.

TipRanks reveals Quatrochi is a 5-star analyst with a success rate of 64.13% and an average return of 26.7%. He specializes in Technology, focusing on companies such as Applied Materials, ASML Holding, and KLA. In line with Quatrochi's assessment, Bank of America Securities also reiterated its Buy rating for Applied Materials in a report released on August 16, setting a AMAT stock price target of $280.00.

Based on 36 analysts' ratings on the TradingView, AMAT is a potential stock that may post a significant gain in the next 12 months or by the end of 2025. Twenty-eight analysts suggest the price may reach a maximum of 280.00, whereas the average price can be 242.54, and the minimum price by that time is 198.00.

Among the 36 analysts' ratings, 19 suggest a strong buy, 5 indicate a buy, and 12 suggest a hold. Meanwhile, there are no sell suggestions.

B. Key Factors to Watch for AMAT Stock Forecast 2025

AMAT Cash Flow Position

Applied Materials (AMAT) prioritizes shareholder returns through an aggressive share buyback strategy. In Q1, the company authorized a new $10 billion repurchase program, representing its current market cap of nearly 9%. Over the past decade, AMAT has reduced its outstanding share count by 30%, highlighting its commitment to returning cash to shareholders.

The company's financial position is strong, with $7.1 billion in cash and investments, an increase of over $1 billion from the previous year. This growth in cash reserves demonstrates AMAT's ability to generate some money, even in a somewhat challenging operating environment. AMAT's long-term debt stands at $5.5 billion, with $4.05 billion due before 2030, a manageable level given the company's free cash flow.

With solid cash reserves and a manageable debt profile, AMAT is well-positioned to continue its shareholder-focused initiatives and ensure significant returns for investors in the coming years.

AMAT Profitability Analysis

The profitability ratio of the AMAT stock is attractive; posting consecutive gains on asset returns, equity returns, investment capital returns, etc., makes the asset attractive for long-term investors.

AMAT Stock Forecast 2025 - Bullish Factors

- Analysts forecast that Applied Materials (AMAT) could achieve an average stock price of $330 by 2025, with some estimates reaching $384, driven by the company's strong financial performance and growing revenues.

- The global expansion of chip manufacturing, particularly in the U.S. and Europe, where there's an effort to reduce dependence on Asian suppliers, is expected to benefit AMAT due to its role as a critical equipment and materials provider.

- AMAT's leadership in materials engineering for semiconductor production positions it to take advantage of the growing demand for semiconductors, which is driven by expanding industries like AI, 5G, and cloud computing.

AMAT Stock Forecast 2025 - Bearish Factors

- Applied Materials (AMAT) faces intense competition in the semiconductor equipment market. If rivals introduce disruptive technologies or capture more market share, AMAT may experience pricing pressures and shrinking profit margins.

- Broader economic challenges could negatively affect AMAT's stock, including interest rate increases, inflation, and a potential global economic slowdown. These factors may lead to reduced market sentiment and lower investment in technology stocks, casting a bearish outlook for AMAT in 2025.

IV. AMAT Stock Forecast 2030 and Beyond

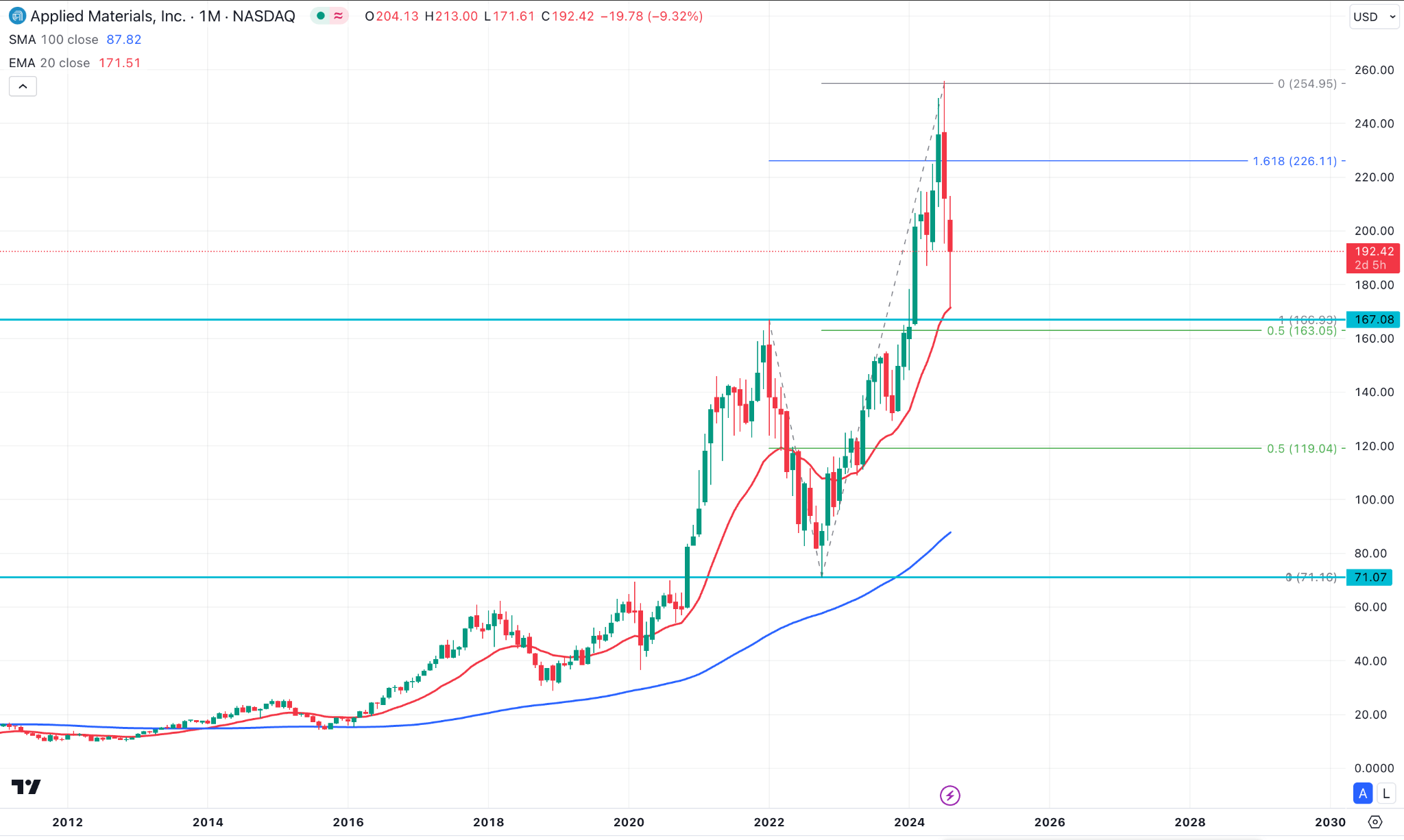

AMAT stock price showed a strong bearish reversal from the all-time high level, suggesting considerable bearish pressure. Although the major trend is bullish, the price is likely to extend higher at the 500.00 level by the end of 2030.

AMAT stock is trading above the 100-month Simple Moving Average line in the monthly time frame, suggesting a major bullish trend. However, the most recent price extended higher above the 161.8% Fibonacci Extension level, suggesting an overextended buying pressure. Although the 20-month EMA is still protected, investors might not consider it a pump-and-dump scheme.

In the main chart, the gap between the current price and the 100-month SMA has widened, suggesting a pending downside correction as a mean reversion. Also, the current price is trading at the premium zone from the 254.94 high to the 71.07 low, suggesting a higher price for bulls.

Based on the AMAT Stock Forecast 2030 and Beyond, a sufficient downside correction is pending, where the price is likely to move below the 167.08 level. On the bullish side, a valid reversal from the 160.00 to 100.00 zone would be a long opportunity, aiming for the 500.00 psychological line.

On the bearish side, a failure to hold the price above the 160.00 level could lower the price towards the 100.00 to 80.00 area.

A. Other AMAT Stock Prediction 2030 and Beyond Insights

With a price-to-earnings (P/E) ratio of 24, the shares are trading below the market average. For such a large, industry-leading company, this seems inexpensive.

However, unlike the previous five years, don't anticipate shares to increase by over 400% in the upcoming five. When Applied Materials last traded five years ago, its P/E ratio was less than ten, and the company's numerous expansions significantly increased shareholder profits. The stock may still perform well, but its dependency on China may still present challenges. Before purchasing Applied Materials capital at these prices, lower your expectations.

We predict that Applied Materials stock price will keep rising through 2030. This rise is anticipated to be driven by the growing need for sophisticated semiconductors across a number of industries, including the automotive and healthcare sectors.

The semiconductor sector anticipates higher demand in 2030 for chips utilized in cutting-edge medical equipment and autonomous vehicles. Applied Materials' growth will probably be mostly driven by the company's continued growth in equipment for making chips with extreme ultraviolet (EUV) lithography. The business's attempts to create sophisticated packaging and 3D chip stacking solutions are also expected to have a major impact on the marketplace.

B. Key Factors to Watch for AMAT Stock Forecast 2030 and Beyond

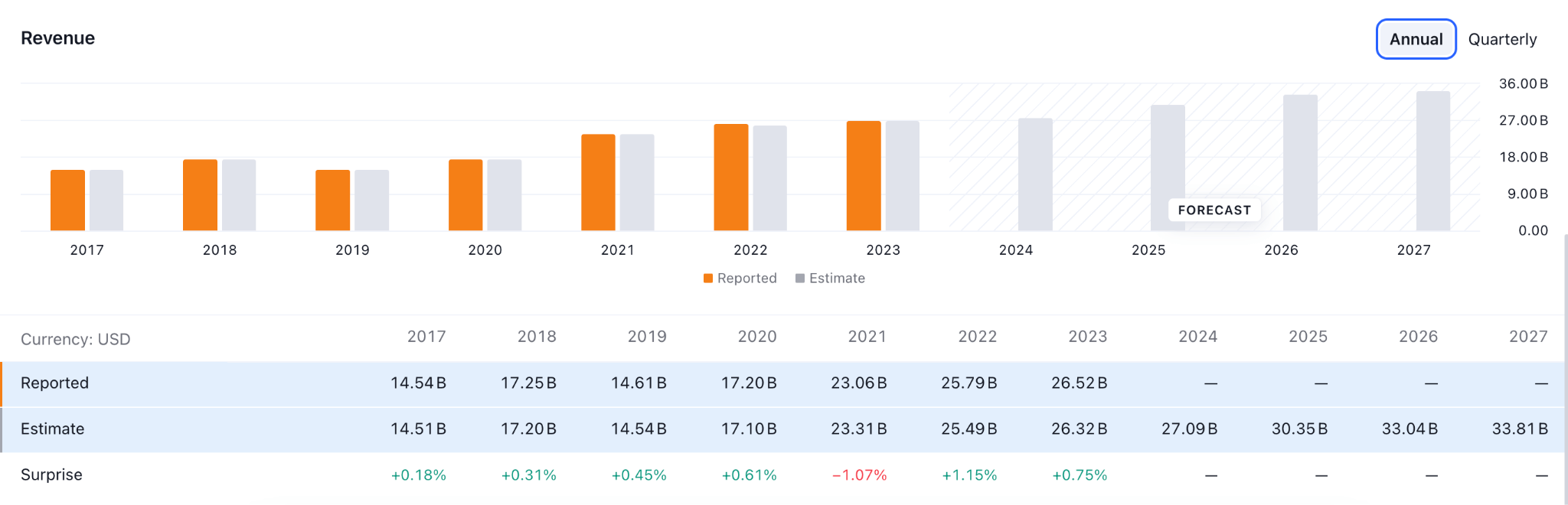

AMAT Revenue Forecast 2030 & Beyond

AMAT's yearly revenue has maintained a stable moment since 2017, suggesting a positive outcome in the coming years. As per the above image, the forecasted revenue is positive, with the highest level projected in 2027.

If the actual revenue can maintain the growth, investors might expect this stock to soar and make a new all-time high above the 500.00 psychological line.

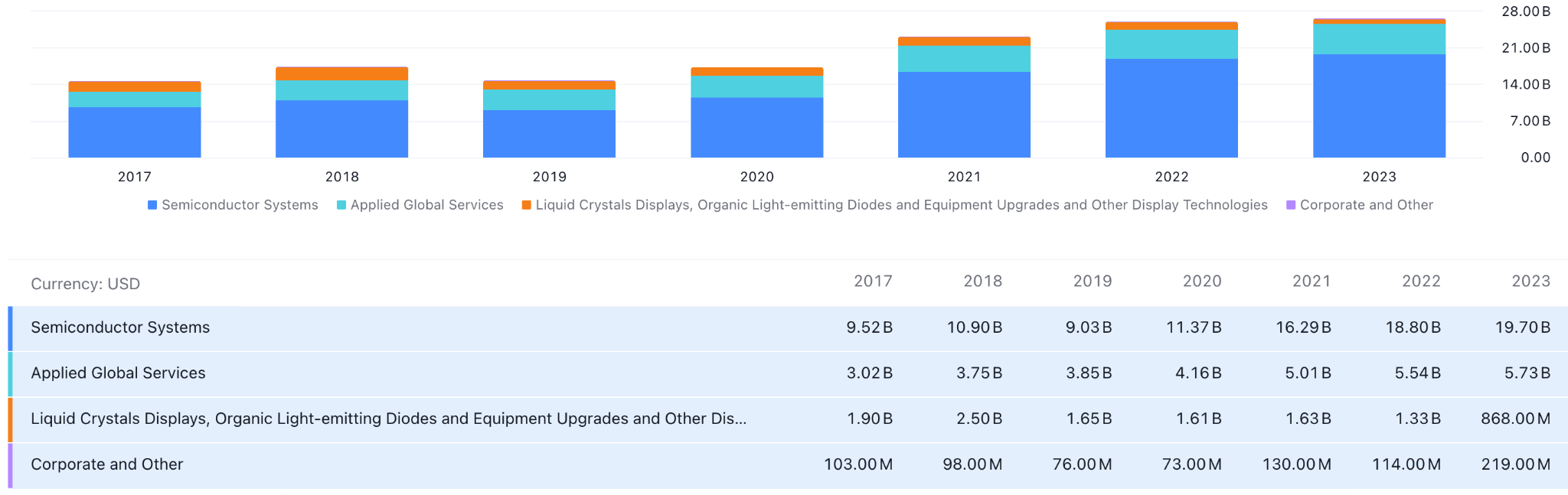

AMAT Revenue Segment Analysis

The AMAT revenue segment is a crucial indicator of future price. As the above image shows, this company's major revenue source is the semiconductor system. Clearly, the global semiconductor industry is expanding, which can be a positive factor for AMAT investors.

Applied Materials Stock Forecast 2030 and Beyond - Bullish Factors

- Smartphones and cloud computing have led to development in the semiconductor industry over the previous 15 years. The evolution in AI tools, which experts predict could reach $1 trillion in revenue by 2030, could propel the next fifteen years. The computer chip manufacturing that drives this growth in AI will require applied materials, no matter how big the market is.

- Although AMAT's starting yield is relatively low, it presents an exciting opportunity for dividend growth. Given the anticipated expansion in the semiconductor sector, AMAT's dominant market position, and its strong cash generation capabilities, I think the company should be able to maintain dividend growth at a rate higher than 15% CAGR.

AMAT Stock Forecast 2030 and Beyond - Bearish Factors

- Years of significant investment in development and research. The business invests more than $3 billion annually in research and development to maintain this competitive edge. Because the incumbents in the semiconductor device market have such a significant advantage, there aren't many competitors.

- With most semiconductor companies, it has a significant presence in China, which accounts for about 30% of its total sales on average. Due to political tensions between the US and China, the US has restricted the sale of semiconductor machinery tools to China, including the renowned advanced lithography machines made by ASML. These new limitations apply to Applied Materials tools, and it's unclear how far they will stretch.

V. Conclusion

A. Applied Materials Stock Outlook

The overall market momentum for AMAT looks potent, where the recent price is trading at a crucial discounted zone. Although a bottom is not formed, investors might expect an upward signal once a valid upward signal comes from the candlestick pattern.

The company has a strong position in the Semiconductor sector, which might face an expansion due to the implementation of Artificial Intelligence (AI) and 5G technology.

Although a geopolitical concern is uncertain, investors might expect the stock price to soar above the 500.00 level by the end of 2030. Before that, a minor correction might happen in 2025 and 2026, offering a buying possibility from the discounted zone.

B. Trade AMAT Stock CFD with VSTAR

Trading AMAT CFDs could be a potential opportunity for VSTAR as it offers trading with a superior trading environment.

The tighter spread, lower trading cost, top-notch customer support, mobile portability, and wide range of available assets could offer AMAT stock from a trustworthy environment.