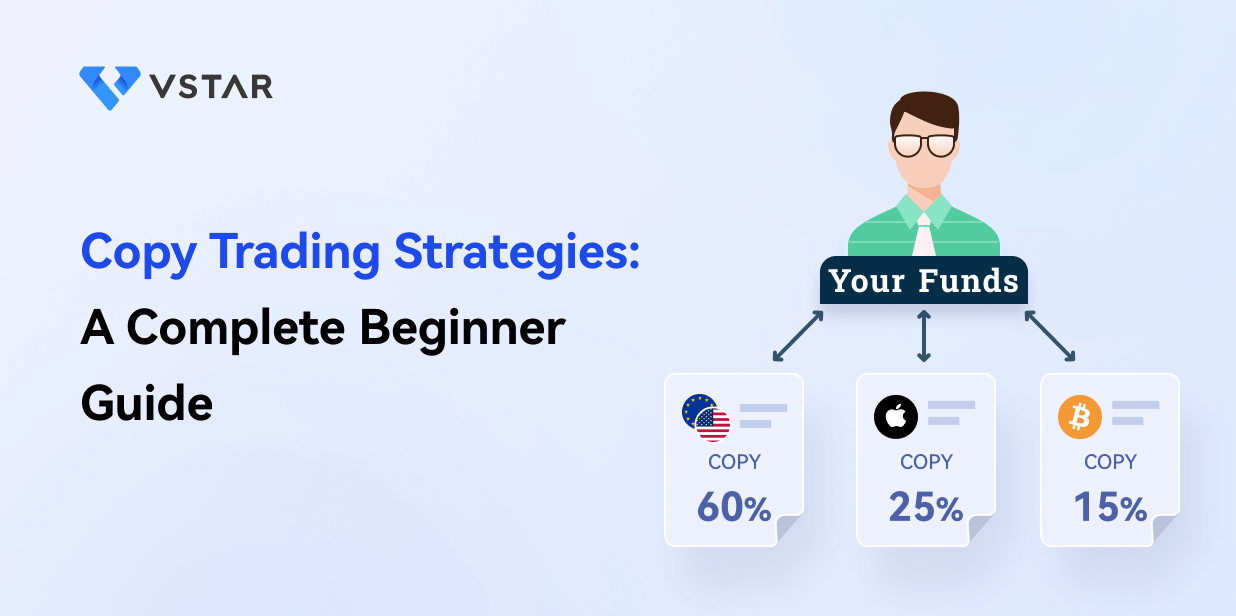

Copy Trading Strategies: A Complete Beginner Guide

Successful copy trading relies on three essential factors: effective risk management, thorough research, and a diverse copy trading portfolio. These strategies are crucial for a secure and rewarding investment journey.

The Ultimate Guide to Copy Trading

The ultimate guide to copy trading including definition, key players, who to copy trade, how to copy trade, potential risks and tips for successful copy trading.

Comprehensive Guide on Day trading for Beginners

Comprehensive Guide on Day trading for Beginners including what is day trading, how to start day trading, and day trading strategies.

Stop Out Level: What is it and why should you pay attention to the stop level of your broker?

Learn what is stop out level, manage risk with stop losses, leverage, and margin to avoid stop out and protect your investments.

MACD Trading Guide: Ultimate MACD Strategy For Beginners

The MACD indicator helps traders gauge momentum and identify potential trend changes in the financial markets. Learn how to read and interpret this popular momentum oscillator.

Bollinger Band Strategies for Trading Ranges, Breakouts, and More

Bollinger Bands aims to provide traders with a visual representation of price volatility and potential trading opportunities. They can identify overbought or oversold conditions, detect trading ranges, and spot potential breakouts.

Bullish vs Bearish - Understanding the Differences

Bulls expect prices to rise, while bears expect prices to fall. Understanding bullish vs bearish trends helps traders make informed decisions.

A Comprehensive Guide to Choosing a Reliable Broker

Your broker choice is one of the most important decisions of your trading career. It can make or break your dreams of becoming successful.

A Comprehensive Guide To Stop Out and Margin Call Levels in Trading

Almost everyone is excited about controlling massive funds, which can multiply trading profits. However, there are several risks in taking the opportunity because it can also amplify your losses. Some of them include stop outs and margin calls.

Learning from Experience: The Power of Analyzing Past Trades to Improve Your Trading Skills

New traders must take several actions and decisions to become successful. You may know about enrolling in suitable courses, creating a trading plan, and testing your skills on demo accounts. Sadly, not everyone pays enough attention to past trade analyses.

Understanding Return on Investment (ROI): A Key Measure of Investment Efficiency

Want to learn more about ROI? Learn about it in the VSTAR guide.

Understanding Market News and Why It Matters For Trading

Market news is arguably the most important for informed trading decisions. It refers to updates impacting financial markets, such as currencies, bonds, and stocks. Market news can include breaking announcements, financial analyses, or commentary on market conditions.

Unlock Profit Potential with Advanced Price Action Trading Strategies

Price action trading is a popular and effective trading strategy that traders across the world widely use. It is a trading methodology that involves analyzing and interpreting the market based on price movement alone, without using any indicators or other technical analysis tools.

Master the Market with the Ultimate Guide to the Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a technical analysis indicator used to measure the strength of price movements of a financial instrument. RSI is a momentum oscillator that compares the magnitude of recent gains to recent losses, indicating overbought or oversold conditions.

Understanding the Consumer Price Index: A Guide for Traders and Investors

The Consumer Price Index (CPI) is an economic report almost every trader or investor looks forward to.

The Importance of Trading Psychology in Successful Trading

Trading psychology studies the thought process behind every trader's actions in the market. It involves understanding how your mindset (whether positive or negative) can influence your performance.