Weekly Market Overview and Forecast 1218 - 1224

Weekly Market Overview and Forecast for the week of 18 December - 24 December, analyzing Gold, Oil, Forex, Indices, Crypto, and Stocks markets.

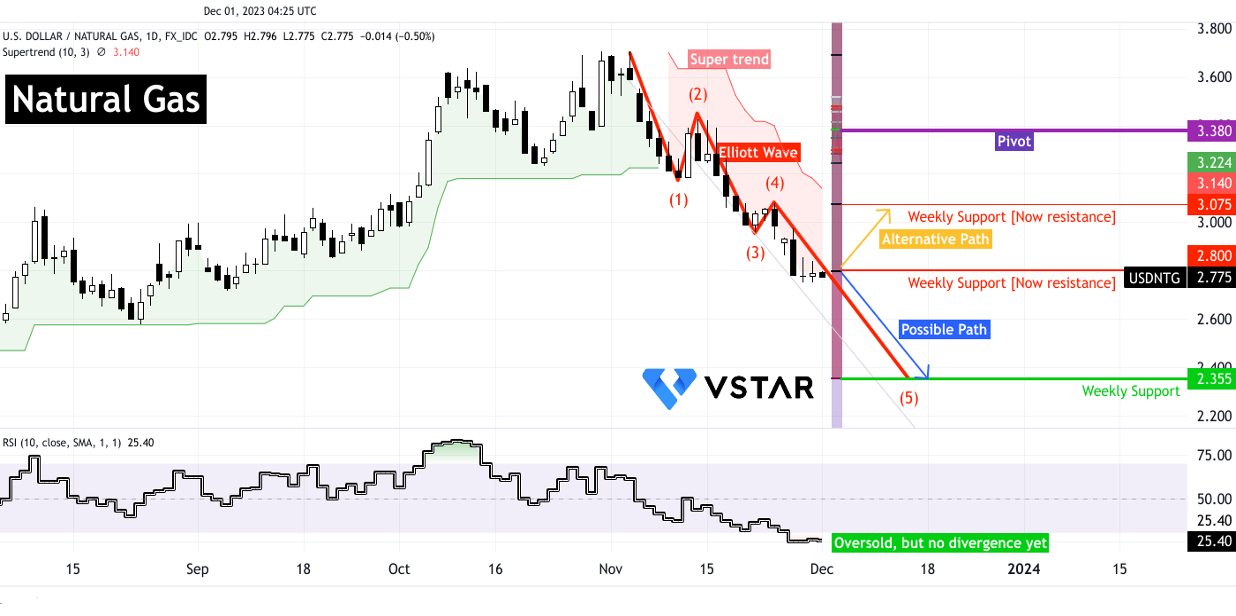

Price Volatility Looms for Natural Gas CFDs

Exploring natural gas’ regional price disparities, supply-demand shifts, global trends, and future projections.

Tracking Potential Pathways of Natural Gas

Analyzing surplus storage, pricing trends, global impacts, and demand surges: insights into the complexities influencing Contracts for Difference on Natural Gas.

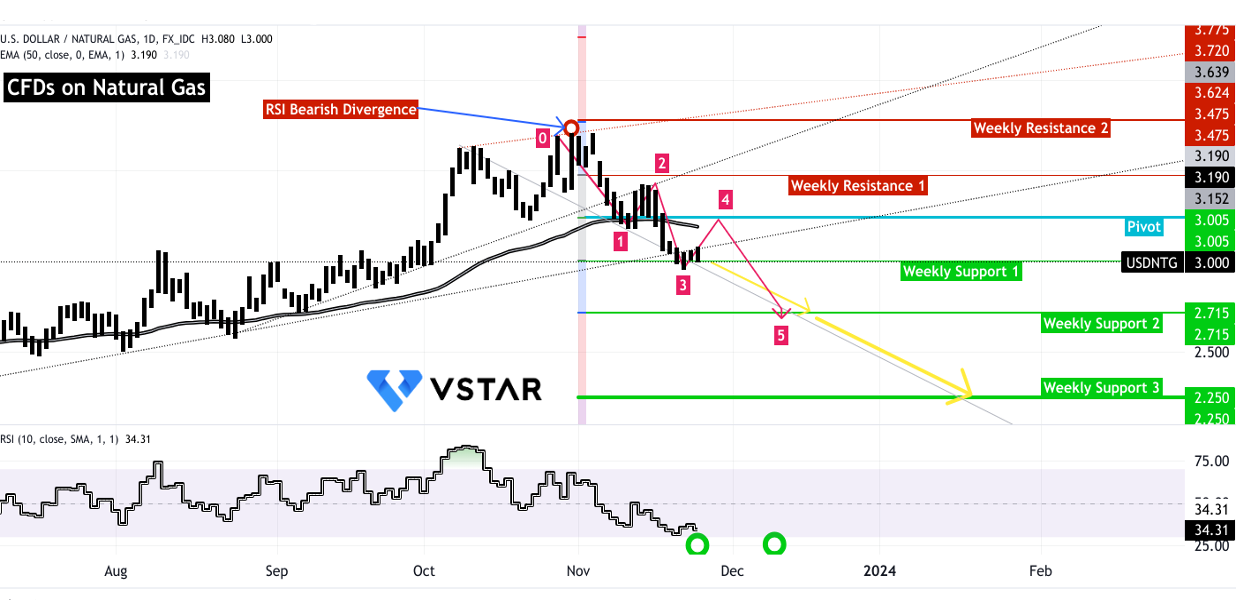

Balancing Acts in the Global Natural Gas Arena

Natural gas price direction analysis: Expanded LNG capacities, surplus storage, and the tenuous tightrope of supply disruptions, geopolitical risks, and weather extremes in the 2023–24 winter market.

Natural Gas Supply Ease or Global Uncertainty: What's Moving The Market?

Natural Gas prices continued to decline in November, influenced by the anticipation of a ceasefire in Gaza. In a worst-case scenario, Natural Gas prices were projected to drop to the near-term support level.

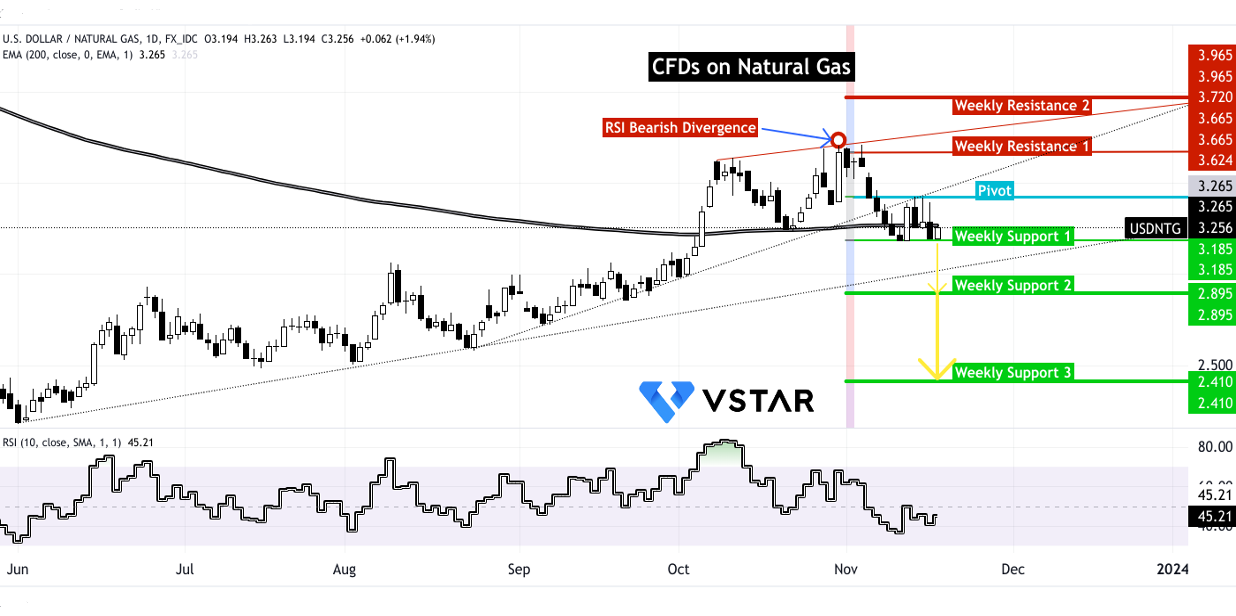

Gas Gauge: Deciphering Natural Gas CFD Price Whirlwinds

Natural gas price analysis: exploring surplus storage, demand-driven fluctuations, weather impact, and global market ripples in energy pricing.

Flaming Natural Gas Prices

Exploring market trends, regional dynamics, and global influences on the price direction of CFDs on Natural Gas.

Natural Gas Weekly Review & Outlook

Delve into the Natural Gas market for a precise understanding of current developments and their implications for trading CFDs on natural gas.

Vital Developments in Natural Gas

Analyzing the Continuing Impact on Prices of Natural Gas CFDs Amidst Current Developments.

Weekly Market Overview and Forecast 0918 - 0924

Weekly Market Overview and Forecast for the week of September 18 - September 24, analyzing Gold, Oil, Forex, Indices, Crypto, and Stocks markets.

Fighting Sticky Inflation: Why the Fed Isn't Focusing on the Money Supply

The Federal Reserve no longer regulates the money supply as its primary objective and means of influencing economic activity.

How To Trade Gas CFDs Using Technical Analysis: A Complete Trading Guide

In gas Contract for Difference (CFD) trading, technical analysis plays a crucial role in making informed trading decisions.

Gas CFD Trading Costs

By understanding the factors that affect trading costs and implementing strategies to minimize them, traders can improve their profitability in Gas CFD trading.

Gas CFD Trading and Fundamental Analysis

Gas CFD trading, which stands for Contracts for Difference, is a popular method for speculating on the price movements of natural gas without owning the underlying asset. Fundamental analysis plays a crucial role in Gas CFD trading as it helps traders make informed decisions based on the intrinsic value of the gas market.

The Risks Involved In Trading Gas CFDs And How To Mitigate Them

Gas CFD trading exposes traders to market risks, including volatility and price fluctuations, as well as supply and demand factors. Mitigating risks is crucial to protecting investments and enhancing the chances of success in gas CFD trading.

How To Manage Your Gas CFD Trading Risks With Stop-Loss Orders

Gas CFD trading involves speculating on the price movements of gas contracts without owning the physical asset. While it offers potential opportunities for profit, it also carries inherent risks that traders should be aware of.

How to Analyze Gas CFD Charts and Make Informed Trading Decisions

Gas Contract for Difference (CFD) trading is a popular method for investors to speculate on the price movements of natural gas without owning the physical commodity. To make informed trading decisions, analyzing gas CFD charts is crucial.

Gas CFD Trading and Geopolitical Events

Gas CFD (Contract for Difference) trading refers to the buying and selling of contracts that derive their value from the price movements of gas commodities without actually owning the physical gas itself.

Factors that a trader may focus on when trading gas CFDs

Gas CFDs (contracts for difference) allow traders to speculate on the price movements of natural gas without owning the underlying asset. In a CFD, traders initiate an agreement with a broker to exchange the difference in natural gas prices between the opening and closing of the contract.

Gas CFD Trading Strategies for Different Market Conditions

Gas CFD trading refers to trading contracts for difference (CFDs) that derive their value from the price movements of natural gas. Natural gas is a fossil fuel used primarily for heating and electricity generation. It is also used as a raw material in producing chemicals and other products.

Mastering Gas CFD Trading: Strategies for Harnessing Profits in the Volatile Market

Gas CFD trading can be a volatile and unpredictable market, but with the right strategies, traders can harness its potential for significant profits. The key to success lies in understanding the different trading strategies and identifying the ones that work best for current market conditions. Whether it's trend-following, breakout trading, news trading, hedging, or scalping, each strategy has its unique strengths and weaknesses.