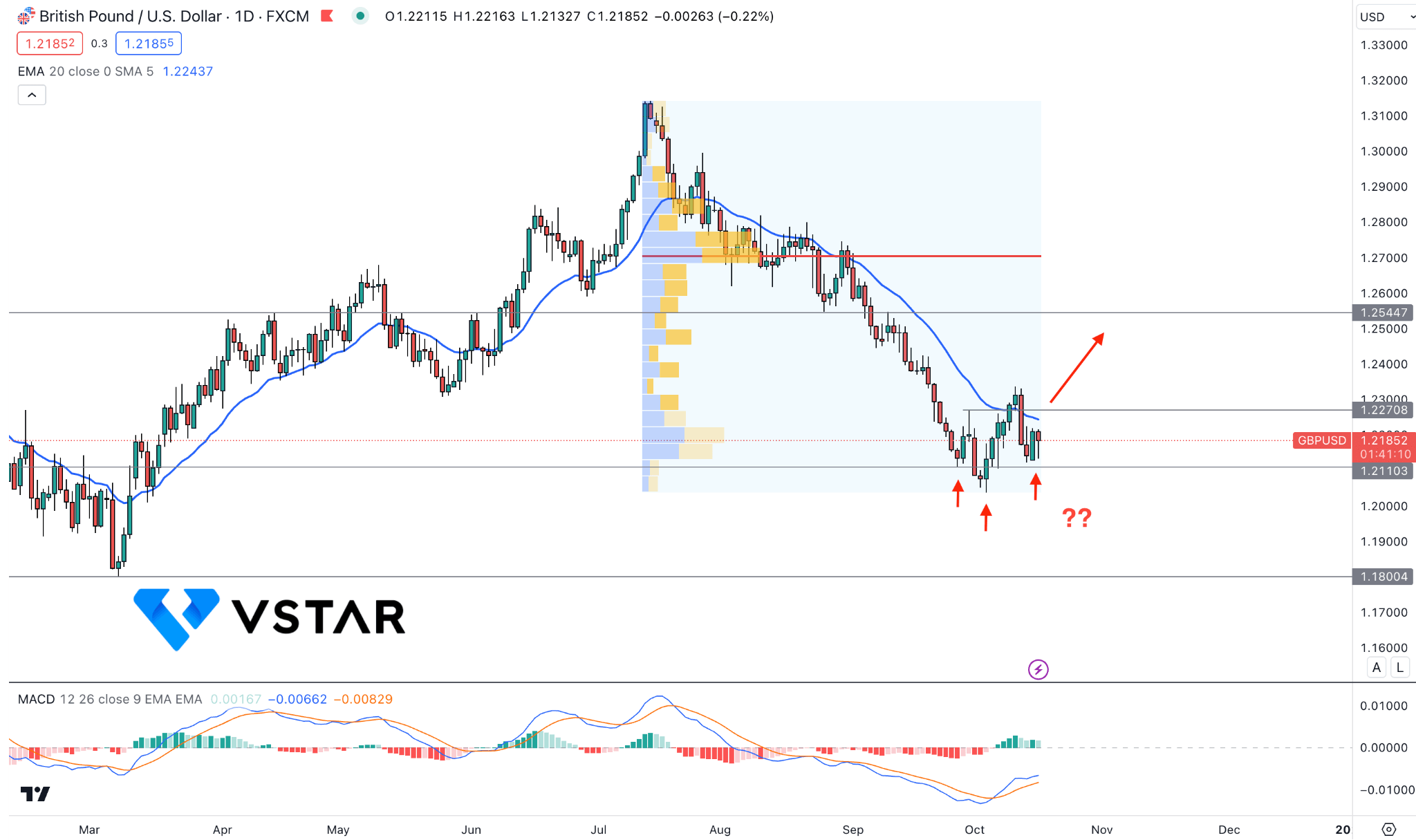

GBPUSD Bulls Look Feeble From the Death Cross Formation

The GBP/USD exchange rate rose for the third day, reaching near the 1.2500 psychological level.

GBPUSD Sellers Might Continue Below the 200 Day SMA Line

Since the beginning of the week, the GBPUSD pair fluctuates in a small trading range beyond the mid-1.2500s.

GBPUSD Might Find A Stable Trend From The BoE Rate Decision

As traders anticipated the Bank of England's (BoE) announcement today, the GBPUSD surged beyond 1.2700 on a relatively calm Wednesday.

Is GBPUSD A Buy As It Tapped To The 1.2600 Level?

The British Pound (GBP) maintained its upward trend against the US Dollar (USD) over the week, surpassing the 1.2600 level for the first time since mid-April.

GBPUSD Looks Vulnerable Above The 1.2517 Key Support Level

GBPUSD bulls continue to be under pressure near the 1.2517 support level, suggesting a possible bearish breakout.

Can GBPUSD Bulls Hold The Gain Above The 1.2600 Level?

The GBPUSD pair shows a neutral momentum from the technical perspective, while the broader market remains bullish.

GBPUSD Tumbled From Upbeat US Data

Tuesday's trading session produced a mixed fundamental structure for GBPUSD as investors closely watched the week's forthcoming pivotal events.

Should You Short GBPUSD Ahead of The UK CPI?

Before the UK CPI release, GBPUSD lost its bullish momentum on Tuesday following the US Retail sales.

Trading GBPUSD Like the Pros: Learn From Real Trade Setups and Examples

Forex analysis for the GBPUSD currency pair, learn from GBP USD real trade setups and examples.

Mastering GBPUSD Technical Analysis: An Extensive Guide for CFD Traders

GBPUSD Technical Analysis Guide for GBP USD currency pair CFD Traders.

Fundamental Analysis of the GBP/USD Currency Pair

The GBP/USD currency pair is among the most popular and actively traded currency pairs in the foreign exchange market. The GBP is the British pound, the currency of the United Kingdom, while the USD is the United States dollar, the currency of the United States. Fundamental analysis is an essential tool for traders who want to understand the underlying factors that influence the value of a currency pair.