I. Recent TSMC Stock Performance

Recent TSM stock price performance and changes

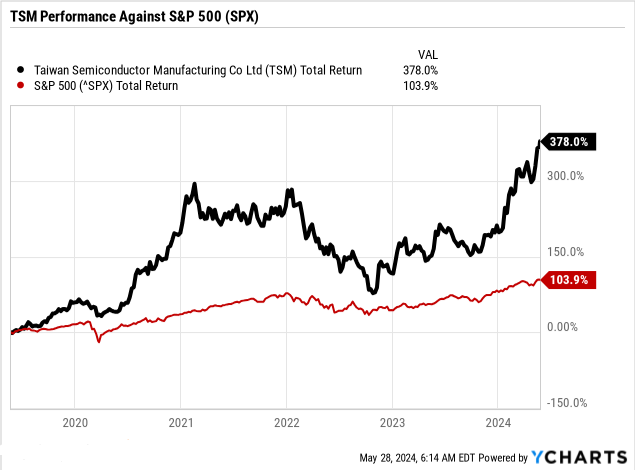

TSMC (NYSE:TSM) has shown significant stock performance over various timeframes, reflecting strong investor confidence and growth prospects. In the week (as of 28 may 2024) , TSMC stock price rose by 5.49%, markedly outperforming the S&P 500's 0.03% increase, indicating robust short-term momentum. Over the past month, TSMC stock appreciated by 20.33%, compared to the S&P 500's 4.60%, highlighting TSMC's superior performance likely driven by favorable quarterly TSM earnings and market sentiment towards semiconductor stocks.

The six-month price performance is particularly impressive, with TSMC stock surging by 63.55%, while the S&P 500 increased by 16.35%. This substantial growth can be attributed to heightened demand for semiconductor components and TSMC's strategic advancements in chip manufacturing technology. Year-to-date, TSMC stock has gained 53.85%, significantly outpacing the S&P 500's 11.21% rise, underscoring TSMC's pivotal role in the global semiconductor supply chain.

Over the past year, TSMC stock returned 77.52%, reflecting strong operational performance and market expansion, compared to the S&P 500's 28.90%. In longer-term performance, TSMC's 5-year and 10-year returns stand at 318.85% and 674.44%, respectively, dramatically surpassing the S&P 500's 87.71% and 179.12%, showcasing TSMC's consistent growth trajectory and its critical position in the tech industry.

Source: Ycharts.com

TSM Performance Against S&P 500 (SPX)

Source: seekingalpha.com

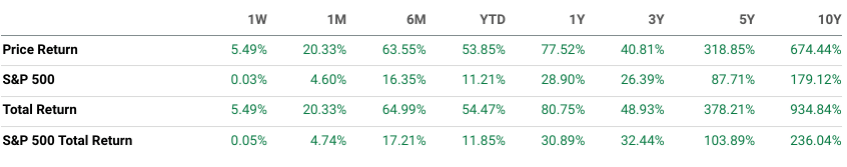

Main Influencing Factors

TSMC's recent financial results for Q1 2024 indicate robust year-over-year growth with a 16.5% increase in revenue and an 8.9% rise in net income and EPS. However, sequential declines from Q4 2023, with revenue down 5.3% and net income down 5.5%, reflect seasonal impacts and changing demand dynamics. The company's strong gross margin of 53.1% and significant contributions from advanced technologies (65% of wafer revenue) showcase its operational efficiency and technological leadership.

Additionally, the demand for TSMC's 3-nanometer and 5-nanometer technologies remains strong, driven by high-performance computing (HPC) and AI applications. These advanced nodes account for a significant portion of revenue, with 3nm at 9% and 5nm at 37%. However, smartphone seasonality has negatively impacted revenues, demonstrating the cyclical nature of certain segments of TSMC's business.

Source: Q1 2024 Earnings

Moreover, the April 3 earthquake in Taiwan posed operational challenges, leading to some production losses. However, TSMC's swift recovery, with minimal impact on Q2 2024 revenue, underscores its resilience. Additionally, rising electricity costs in Taiwan have pressured margins, expected to dilute gross margins by 70-80 basis points in Q2 2024 and continue affecting costs in the second half of the year.

Finally, TSMC's significant capital expenditures, projected between $28 billion and $32 billion for 2024, are focused on advanced process technologies and global manufacturing expansion. This includes new fabs in the U.S., Japan, and Europe, aiming to support customer growth and enhance geographic flexibility despite higher associated costs.

Expert Insights on TSM Stock Forecast for 2024, 2025, 2030 and Beyond

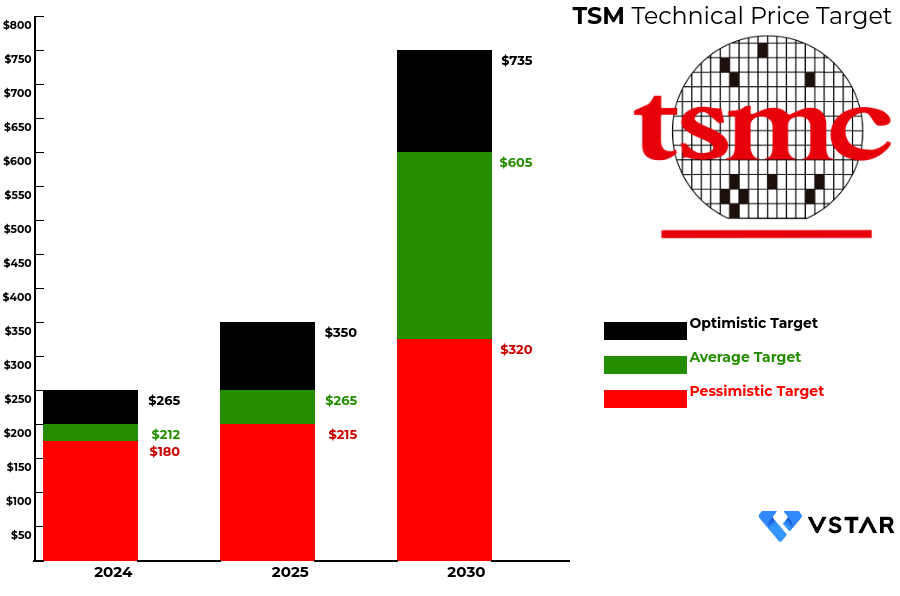

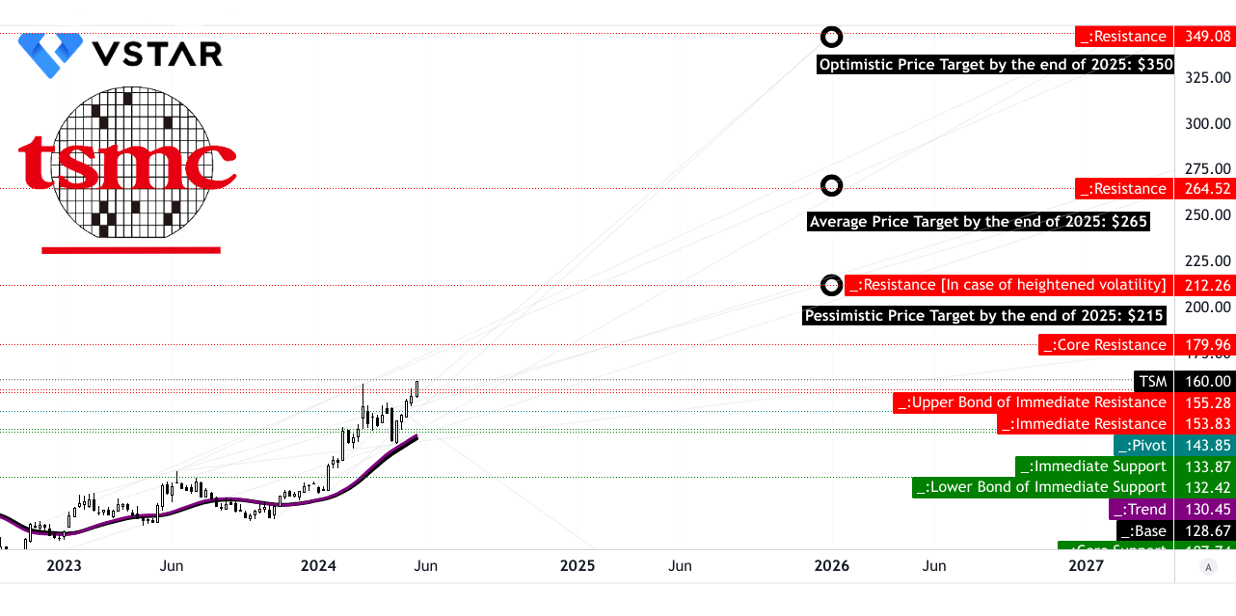

For 2024, optimistic projections suggest a target of $265, while the average and pessimistic targets are $212 and $180, respectively. This variability reflects market uncertainty and the reliance on TSMC's ability to maintain its tech lead and manage supply chain challenges.

Looking ahead to 2025, the optimistic target jumps to $350, indicating confidence in TSMC's growth potential driven by increased demand for advanced semiconductors in sectors such as AI, 5G, and automotive. The average target of $265 suggests moderate growth, while the pessimistic target of $215 underscores potential risks including geopolitical tensions and competition from other semiconductor manufacturers.

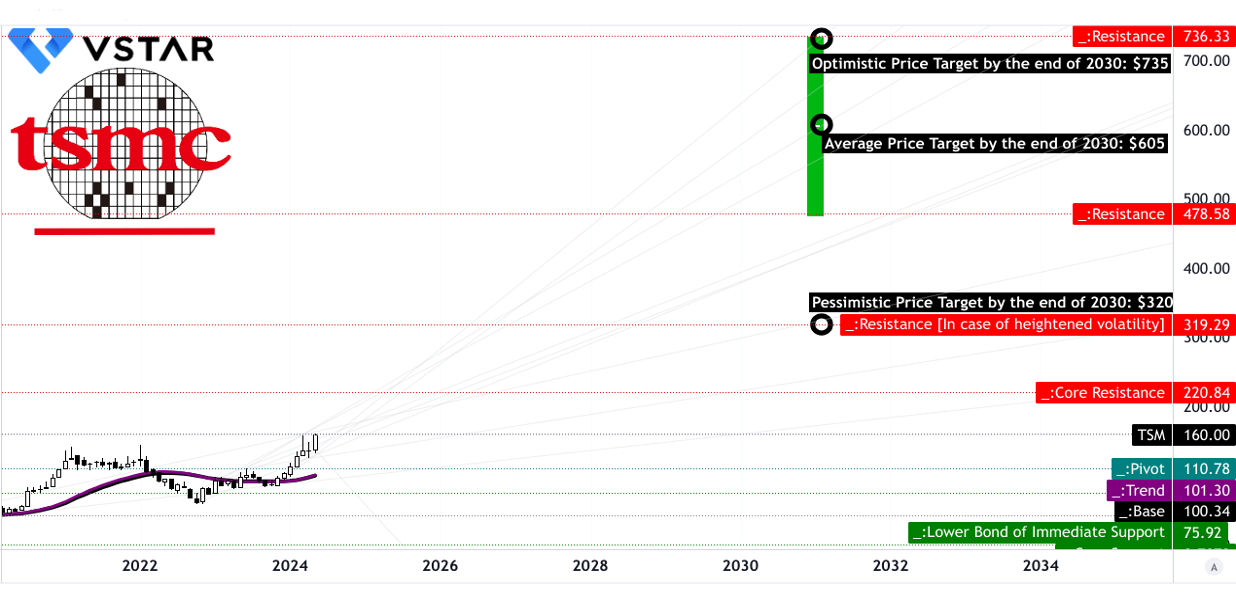

By 2030, the forecasts widen significantly. The optimistic target of $735 highlights expectations of TSMC's dominance in the semiconductor industry and successful expansion into new markets. The average target of $605 reflects a more tempered but still strong growth outlook, while the pessimistic target of $320 suggests concerns over market saturation, potential regulatory hurdles, and global economic fluctuations.

Source: Analyst's compilation

II. TSM Stock Forecast 2024

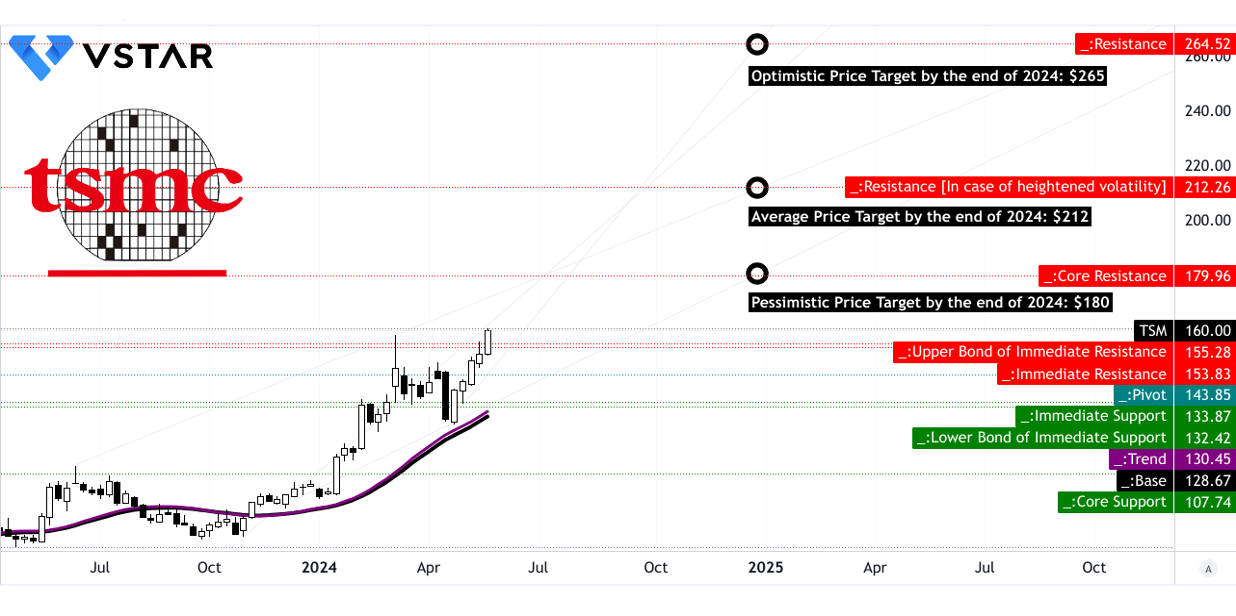

TSMC stock's positive outlook is reflected in the various price targets for the end of 2024. The average TSM price target is set at $212.00, supported by the momentum of change-in-polarity over the short term and projected through Fibonacci extension levels. This suggests that analysts anticipate continued growth based on recent performance trends. The optimistic target is even higher at $265.00, driven by the strong upward price momentum of the current swing when extended through Fibonacci levels, highlighting the potential for substantial gains. Conversely, the pessimistic target is $180.00, considering potential downward price momentum over the short term and retracement levels, which still suggests room for growth but at a more conservative rate.

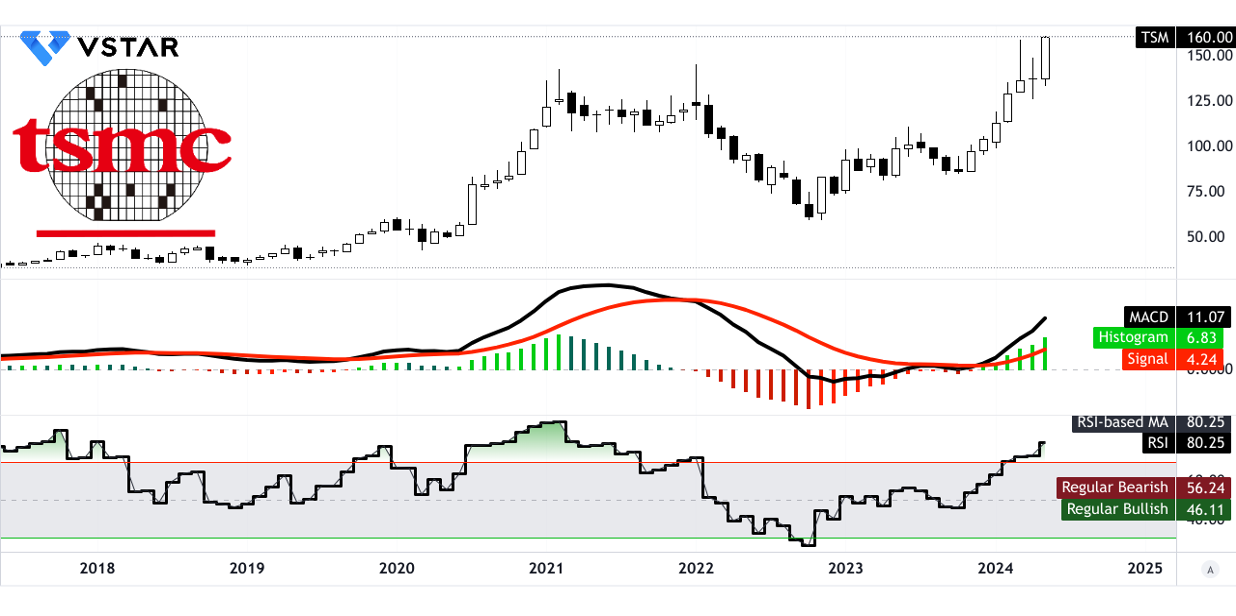

TSM stock is currently displaying a strong technical performance in the stock market. With a current price of $160.00, the stock is showing an upward trajectory. The modified exponential moving average (EMA) trendline at $130.45 and baseline at $128.67 further validate this upward momentum, indicating that the stock has sustained gains over time and is trading significantly above these averages.

Support and resistance levels play a crucial role in analyzing TSMC's stock movement. The primary support is identified at $155.28, suggesting a strong buy signal if the price approaches this level. The pivot of the current horizontal price channel is at $143.85, which serves as a critical juncture for price direction. Resistance levels are marked at various points, with core resistance at $179.96 and a higher resistance at $264.52, indicating potential price ceilings. The core support is noted at $107.74, providing a baseline for potential downward corrections, while heightened volatility could see support at $132.42.

Source: tradingview.com

The Relative Strength Index (RSI) at 72.26 indicates that TSM stock is currently in an overbought condition, though it hasn't reached the regular bullish level of 83.06, suggesting some room for further price increases before a potential correction. The absence of bullish or bearish divergence and the upward trend of the RSI line further support the stock's positive momentum.

Additionally, the Moving Average Convergence/Divergence (MACD) indicator supports the bullish outlook. With a MACD line at 11.09, a signal line at 9.41, and a histogram value of 1.68, the stock exhibits a bullish trend with increasing strength. This suggests that the recent upward price movement is robust and likely to continue.

Source: tradingview.com

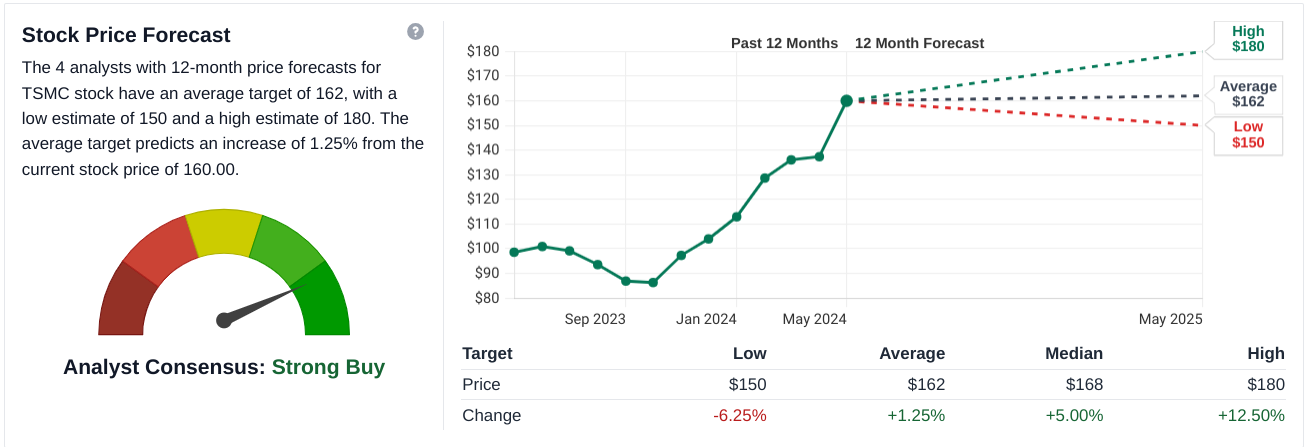

The TSMC stock forecast for 2024 shows varied predictions across different sources, reflecting both optimism and caution regarding its future performance.

Tipranks.com suggests an average TSM price target of $163.11, with a high of $188.00 and a low of $150.00. This average target indicates a modest 1.94% increase from the current price of $160.00. The narrow range between the high and low estimates suggests analysts expect relatively stable performance, with limited upside potential.

Stockanalysis.com provides a similar outlook with an average target of $162, a low estimate of $150, and a high of $180. This average target implies a 1.25% increase, echoing the cautious sentiment found on Tipranks.com. Both forecasts emphasize a conservative growth trajectory, likely influenced by market conditions and competition within the semiconductor industry.

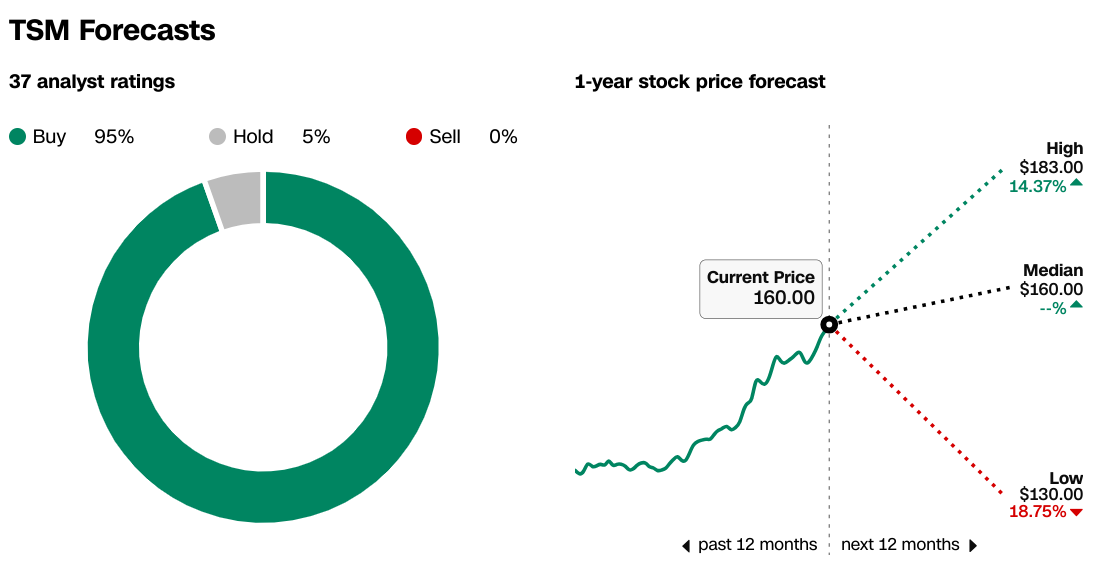

In contrast, coinpriceforecast.com projects a significantly higher year-end price of $226, representing a 41% increase. This bullish prediction assumes substantial growth potential, possibly driven by anticipated advancements in technology and increased demand for semiconductors.

Source: stockanalysis.com

A. Other TSMC Stock Forecast 2024 Insights: Is TSM a good stock to buy?

TSMC has garnered significant attention from major financial institutions and analysts regarding its stock forecast for 2024. Analysts from Needham, Barclays, and Susquehanna have provided varied insights, reflecting both confidence and caution about the company's future. Charles Shi from Needham has consistently maintained a "Buy" rating, raising his price target to $168 in April and reiterating it in May 2024.

Similarly, Simon Coles from Barclays has maintained an "Overweight" rating, adjusting his TSM stock price target from $125 to $145 and later to $150. Meanwhile, Mehdi Hosseini from Susquehanna remains optimistic with a "Positive" rating, raising his price target from $160 to $180. The consensus shows a generally positive outlook, with price targets spanning from $145 to $180, underlining TSMC's strong market position and growth potential, albeit with some recognition of potential market volatility.

Source: Benzinga.com

B. Key Factors to Watch for TSM Stock Prediction 2024

Taiwan Semiconductor Stock Forecast 2024 - Bullish Factors

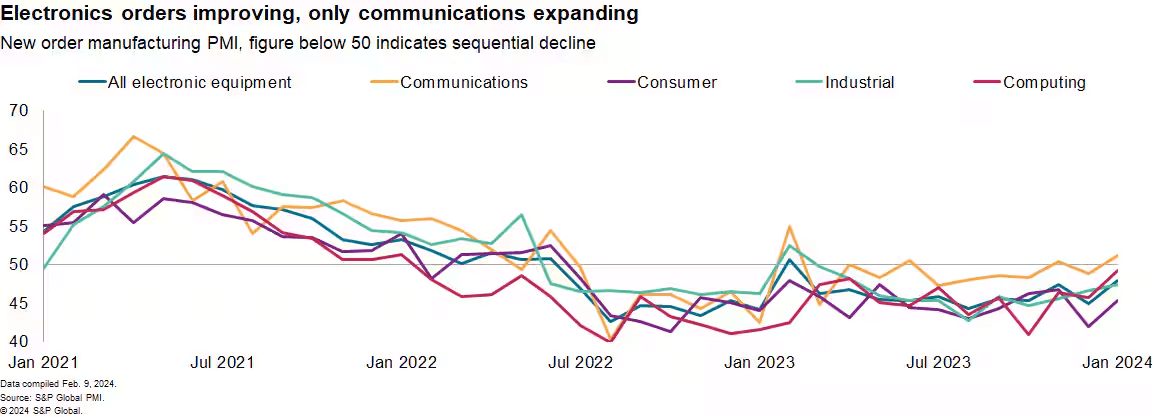

Generative AI Demand: The global semiconductor industry is projected to rebound in 2024, with a significant boost from generative AI. AI-driven chips, including those used in high-performance computing and data centers, are expected to generate over $50 billion in revenue (as per Deloitte), accounting for 8.5% of total semiconductor sales. TSMC, as a leading producer of advanced node chips, stands to benefit greatly from this surge in demand for AI-specific processors.

PC and Smartphone Market Recovery: After declines in 2023, PC and smartphone sales are expected to grow by 4% in 2024 (as per Deloitte). Given that TSMC supplies critical components for these devices, a recovery in these markets will positively impact its revenue.

Source: S&P Global Market Intelligence

Strong Revenue Growth: TSM's revenue estimates for fiscal 2024 show robust growth, with consensus estimates projecting double-digit year-over-year increases for each fiscal quarter. This growth is driven by demand for the company's industry-leading 3-nanometer and 5-nanometer technologies, particularly in segments like high-performance computing (HPC) and artificial intelligence (AI).

TSM Stock Price Prediction 2024 - Bearish Factors

Margin Pressure: TSMC faces margin pressures due to various factors, including increased electricity costs in Taiwan and the impact of natural disasters like earthquakes. The company expects its gross margin to decline in the second quarter of 2024, primarily attributed to the earthquake's aftermath and rising operational expenses. Additionally, the conversion of 5-nanometer tools to support 3-nanometer capacity is projected to further dilute gross margins in the second half of the year.

Cost Escalation: TSMC anticipates higher costs associated with its overseas fabs, necessitating strategic pricing adjustments and government support to mitigate the impact on profitability. Despite efforts to manage expenses and maintain operational efficiency, the company acknowledges the challenges posed by increased costs in a fragmented global environment.

III. TSM Stock Forecast 2025

Price targets for TSM by the end of 2025 show varied potential outcomes. The average TSM price target is $265.00, derived from the momentum of change-in-polarity over the mid-term, projected using Fibonacci extension levels. The optimistic target reaches $350.00, assuming sustained upward price momentum, while the pessimistic target is $215.00, considering a potential downward shift and using Fibonacci retracement levels.

Support and resistance levels provide critical insights into price stabilization and potential breakout points. Primary support is noted at $155.00, with significant resistance levels at $180.00 and $265.00, indicating potential barriers to upward movement. The pivot of the current horizontal price channel is $144.00, suggesting a consolidation point, while heightened volatility could push resistance to $212.00 and support to $134.00.

Source: tradingview.com

The forecast for Taiwan Semiconductor stock in 2025 shows varied predictions. Coincodex.com projects a price of $196.18, reflecting a 22.62% increase based on the average annual growth over the past decade. Contrastingly, another long-term forecast is more optimistic, predicting TSM stock will reach $250 by mid-2025 and $295 by year-end, indicating an 84% rise from current levels. These differences highlight the uncertainty and varying analyst expectations regarding TSM's future performance, influenced by factors such as market trends, technological advancements, and geopolitical considerations.

Source: coinpriceforecast.com

A. Other TSMC Stock Forecast 2025 Insights: TSM stock buy or sell?

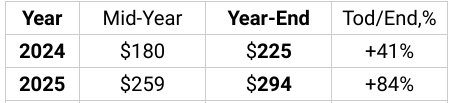

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is a cornerstone in the semiconductor industry, and its stock forecast for 2025 reflects a robust market confidence in its growth prospects. According to CNN.com, 95% of analysts rate TSM as a "Buy," with a high price target of $183, a median TSM target price of $160, and a low TSM target price of $130. Nasdaq.com reports an average 12-month TSM price target of $163.11, with estimates ranging from $150 to $188. The Wall Street Journal's latest ratings show 25 analysts recommending a "Buy," 10 rating it as "Overweight," and only 2 suggesting a "Hold." Their price targets align with CNN's, forecasting a high of $183, a median of $160, and a low of $130. These insights collectively underscore a strong optimism about TSM's future, driven by its leading position in the semiconductor market and anticipated technological advancements.

Source: CNN.com

Source: WSJ.com

Source: Nasdaq.com

B. Key Factors to Watch for TSM Stock Prediction 2025

Taiwan Semiconductor Stock Prediction 2025 - Bullish Factors

Demand Forecast 2025: TSMC's financial forecast for 2025 is shaped by its ambitious expansion plans and technological advancements. The company is expected to benefit from the increased global demand for semiconductor manufacturing equipment, which SEMI predicts will reach $124 billion in 2025, driven by advanced technologies and new fab projects. TSMC's revenue will likely see significant growth from the mass production of its 2nm process, scheduled to start in 2025. The anticipated ramp-up in production capacity to 110,000-120,000 wafers per month by 2027 further underscores its robust growth trajectory.

Company Strategy/Development Prospects: TSMC is focusing on the development and mass production of its 2nm and 1.4nm process technologies. The 2nm fabs in Hsinchu and Kaohsiung are set to play a crucial role, with the former beginning tool-in in Q2 2024 and mass production by Q4 2025. This aggressive expansion in advanced node capacity positions TSMC to meet the high demand from major clients like Apple, Intel, AMD, NVIDIA, and MediaTek, who are all keen on adopting the 2nm technology. The company's strategic move to diversify production by establishing advanced node facilities in the U.S., particularly in Arizona, also mitigates geopolitical risks and ensures supply chain resilience.

Revenue and EPS Growth: TSMC anticipates robust revenue and EPS growth for 2025, with consensus estimates projecting a 20.52% increase in revenue and a 24.76% rise in EPS. This optimistic growth trajectory suggests sustained demand for TSMC's advanced semiconductor technologies, particularly in AI-related applications.

Diversified Revenue Streams: TSMC's revenue diversification across multiple industries, including high-performance computing (HPC), smartphones, Internet of Things (IoT), automotive, and AI processors, mitigates risks associated with fluctuations in any single sector. The increasing contribution of AI-related processors to revenue, expected to double in 2024 and grow at a 50% CAGR over the next five years, underscores the company's resilience and growth potential.

TSM Stock Forecast 2025 - Bearish Factors

Competitive Pressure: Intel's (NASDAQ:INTC) advancements in semiconductor technology, such as the introduction of backside power delivery ahead of TSMC and its use of High-NA lithography for 1.4nm production, pose significant competitive challenges. If Intel's processes prove more efficient or cost-effective, TSMC might lose market share.

Cost Pressures: TSMC faces escalating costs, particularly from higher electricity prices in Taiwan and increased expenses associated with overseas fab construction. These factors are expected to exert downward pressure on gross margins, potentially impacting profitability in the short to medium term.

IV. TSM Stock Forecast 2030 and Beyond

Source: tradingview.com

In terms of long-term projections, TSMC has an average price target of $605.00 by the end of 2030. This target is based on the momentum of change-in-polarity over the long term, projected using Fibonacci extension levels. The optimistic target reaches $735.00, while the pessimistic target is set at $320.00. The optimistic scenario assumes sustained upward price momentum, whereas the pessimistic scenario considers potential downward swings, both evaluated using Fibonacci levels.

TSM stock is currently trading at $160.00. The trendline and baseline stand at $101.30 and $100.34 respectively, indicating an upward trajectory in TSMC stock price. This upward trend aligns with the overall bullish sentiment surrounding the stock, reinforced by a current price significantly above these averages.

Support and resistance levels are crucial in technical analysis. The primary support level for TSMC is $111.00, while the pivot of the current horizontal price channel is $110.78. Core resistance stands at $220.84, with another resistance level at $478.58. In cases of heightened volatility, resistance could reach $319.29. Core support is at $75.92.

Source: tradingview.com

RSI value of 80.25 signifies an overbought condition, suggesting that the stock might be overvalued in the short term. Regular bullish and bearish levels are 46.11 and 56.24, respectively, with no divergence noted. The RSI line trend is upward, supporting the bullish outlook but also hinting at a possible correction if the overbought condition persists. MACD indicator further supports the bullish trend. The MACD line is at 11.07, with the signal line at 4.24, producing a histogram value of 6.83, indicating a strong and increasing bullish trend.

Taiwan Semiconductor (NYSE: TSM) is projected to see substantial growth through 2030, with both coincodex.com and coinpriceforecast.com offering optimistic forecasts. Coincodex.com predicts a price of $543.83 by 2030, a 239.92% increase from 2023, while coinpriceforecast.com estimates a slightly lower $484, marking a 203% rise. These projections reflect TSM's robust market position and growth potential in the semiconductor industry. However, forecasts are inherently uncertain, subject to market dynamics, geopolitical tensions, and technological advancements, which could significantly impact actual performance.

Source: coinpriceforecast.com

A. Other TSM Price Prediction 2030 and Beyond Insights: Is TSM a buy?

As per Bloomberg, TSMC focus on achieving 60% local procurement for its first chip plant in Japan by 2030 is a strategic move to enhance its supply chain resilience and foster local industry collaboration. By sourcing a significant portion of materials and components locally, TSMC can mitigate risks associated with global supply chain disruptions, which have been a prominent issue in recent years. This move is also likely to garner favorable support from the Japanese government and local industries, potentially leading to subsidies or incentives that could reduce operational costs and enhance profitability.

As per US Department of Commerce, TSMC's investment in Arizona marks a significant milestone in the company's global expansion strategy. The construction of three fabs in Arizona, with capabilities to produce 2nm nanosheet process technology and possibly more advanced nodes, underscores TSMC's technological leadership. This investment not only strengthens TSMC's position in the U.S. market but also aligns with U.S. strategic goals of increasing domestic chip production.

The planned production of tens of millions of leading-edge chips annually from the Arizona fabs will cater to high-demand sectors such as 5G/6G smartphones, autonomous vehicles, and AI datacenters. This diversification into cutting-edge technology markets ensures robust future revenue streams. Moreover, the $65 billion CapEx (largest foreign direct investment in a greenfield project in US history) for the Arizona project reflects TSMC's prolonged competitive edge in advanced manufacturing capabilities.

Source: commerce.gov

B. Key Factors to Watch for TSMC Stock Forecast 2030 and Beyond

TSM Stock Prediction 2030 and Beyond - Bullish Factors

Technology Roadmap: TSMC's roadmap for achieving 2nm, 1.4nm, and eventually 1nm process nodes highlights its focus on continuous innovation and technological advancement. The establishment of a research and development center in Hsinchu with 7,000 researchers dedicated to exploring novel materials and transistor structures for 1nm chips demonstrates TSMC's proactive approach to overcoming future technological and financial challenges.

The competitive landscape of semiconductor manufacturing is poised to intensify with advancements in Extreme Ultraviolet (EUV) lithography, crucial for achieving smaller nodes like 1nm. As ASML, a key supplier, targets 1nm technology by 2028, TSMC's synchronized efforts in this domain are likely to keep it at the forefront of the semiconductor market.

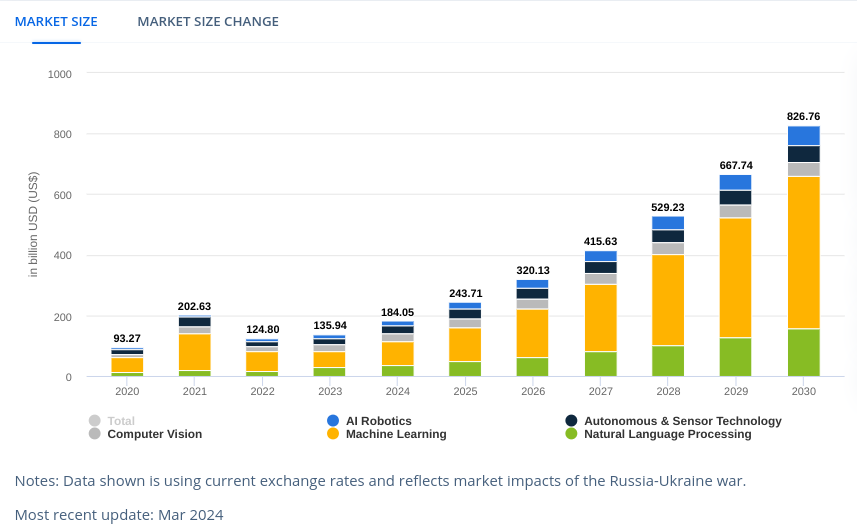

Market Trend: TSMC is poised for substantial growth through 2030 and beyond, driven by the rapid expansion of the AI market and the overall semiconductor industry. The AI market is expected to grow at a staggering CAGR of 28.46%, reaching a market volume of $826.70 billion by 2030. This explosive growth will likely increase demand for TSMC's advanced semiconductor technologies, essential for AI applications. Simultaneously, the global semiconductor market is projected to grow at a CAGR of 7.64%, from $544.78 billion in 2023 to $1,137.57 billion by 2033. TSMC, being a leader in semiconductor manufacturing, stands to benefit significantly from these trends.

Source: statista.com

TSM Forecast 2030 and Beyond - Bearish Factors

Macroeconomic and Geopolitical Uncertainty: TSMC's heavy reliance on Taiwan for its most advanced production facilities exposes it to geopolitical tensions, particularly with China. Any conflict or instability in the region could disrupt operations and negatively impact stock performance.

V. Conclusion

A. TSM Stock Outlook: Is TSMC a good stock to buy?

The outlook for TSMC (NYSE: TSM) stock remains optimistic, with substantial growth anticipated over the next several years. For 2024, the stock price forecasts range from a pessimistic $180 to an optimistic $265, with an average target around $212. By 2025, projections elevate, with estimates from $215 to $350, and an average of $265, reflecting strong expected demand for advanced semiconductors, especially in AI and 5G sectors. Looking further ahead to 2030, forecasts are even more bullish, with prices potentially reaching $735 in optimistic scenarios, averaging around $605, though conservative estimates suggest $320.

Investment recommendations for TSMC stock via Contracts for Difference (CFDs) are favorable, particularly for those looking to capitalize on short-term price movements without owning the stock outright.

B. Trade TSMC Stock CFD with VSTAR

Trading best semiconductor stocks like TSMC stock CFDs with VSTAR offers several advantages. VSTAR's platform is known for its deep liquidity, providing reliable and fast order execution which is crucial for CFD trading. It features an intuitive user interface suitable for both beginners and professional traders, along with tools like copy trading. This feature allows less experienced traders to replicate the trades of successful investors, enhancing their potential for profitability. Additionally, VSTAR's low trading costs, with zero commission and tight spreads, increase the potential for higher net gains.

FAQs

1. How high will TSM stock go?

The maximum price prediction for TSM stock in the near term is around $191 by June 2024.

2. What is the stock price prediction for TSM in 2024?

TSM stock forecast in 2024 ranges from a low of $150 to a high of $295, with a year-end forecast of about $273.

3. What is the TSM 5 year forecast?

Analysts predict that by 2029, TSMC stock could potentially reach an average price of around $334.30, with a high estimate of $442.10 and a low of $226.49.

4. What will TSM stock be worth in 2030?

For TSM stock price prediction 2030, the stock is expected to reach an average of $605, with a high forecast of $735 and a low forecast of $320.