I. Recent Block Inc Stock Performance

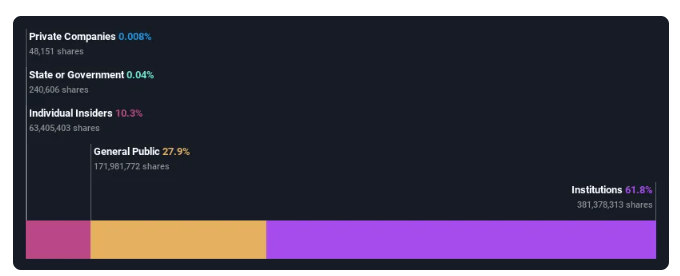

Block Inc Insider Holding

Block, Inc. (NYSE) has a market cap of $40.68 billion and operates a global commerce and financial services ecosystem.

The company generates approximately $15.93 billion in revenue from Cash App and $7.38 billion from Square. Its projected annual growth is 32.6%, which remarkably outpaces the 15% of the US market average. Although the recent insider selling was a matter of concern, the company remained profitable and is currently trading only below 12.6% of the fair value estimation. It posted a solid earring in Q2, with a net income of $195.27 million and a revenue growth of $6.16 billion, reflecting efficient operational improvement and robust profitability, significantly recovering from the previous year's loss.

SQ Business Model

Block Inc., formerly known as Square, has become a leading company in the technology and financial service sector. Initially, the company focused on enabling small businesses to accept card payments, but it has now reached far beyond that.

The Square segment, which caters to merchants, now offers more than just point-of-sale hardware. It provides various financial services and software solutions, including invoicing, marketing tools, and loans. Square generated a profit of $3.1 billion in 2023, which is 42% of the total profit that the company made.

On the consumer side, the Cash App, which enables individuals to manage banking services, was launched in 2013. This platform has 57 million active users and generated notable profit growths that outpaced Square in 2023 and Q1 this year.

However, Block isn't just focusing on managing these two ecosystems. The company's leading authority is now focusing on integrating Cash App and Square to create a more unified business. The acquisition of Afterpay, a buy-now-pay-later company, in 2022 was a crucial step in this direction.

Expert Insights on SQ Stock Forecast for 2024, 2025, 2030 and Beyond

The company was formed in 2009 and went public after six years. The SQ stock price hit a high near 289.23 back in 2021, then declined and has been sideways since then. Before checking on details on the SQ stock price Forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about SQ stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Exlaresources |

$75 |

$94.72 |

$536.65 |

|

Coinpriceforecast |

$63.83 |

$72.40 |

$144.16 |

|

Stockscan |

$69.00 |

$155.91 |

$45.22 |

|

Coincodex |

$59.97 |

$85.02 |

$485.95 |

II. SQ Stock Forecast 2024

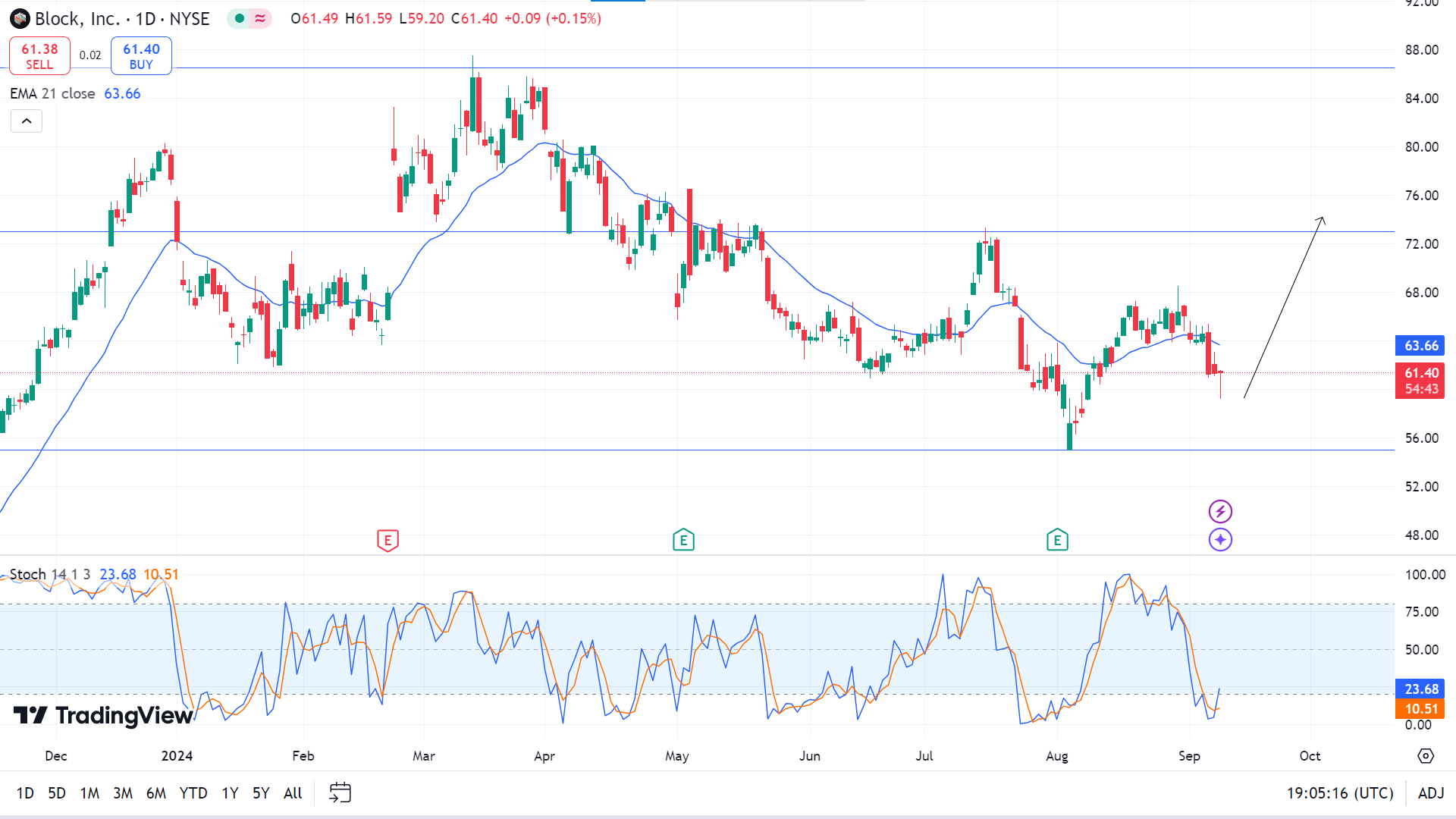

The SQ stock price is floating at 61.40 when writing, heading toward reaching the resistance levels, which can end up reaching 86.50 by the end of 2024.

The primary support level is near 55.00, which is the bounced-back level in August. Looking at the daily chart, the price is just floating below the EMA 21 line due to recent bearish pressure, whereas the Stochastic indicator window signals differently.

Based on the SQ Stock Forecast 2024, the price can reach the primary support of 55.00 level before touching the resistance levels when the next possible support is near 43.71.

On the other hand, the Stochastic indicator window shows fresh bull activity. The dynamic signal lines create a bullish crossover below the lower line of the indicator window, reflecting fresh bullish pressure on the asset price. If these signal lines continue moving upward on the indicator window and the price exceeds the EMA 21 line, it can soon hit the nearest resistance near 73.00. Any breakout can trigger the price to reach the next desired resistance of 86.50 by the end of the current year.

A. Other Square Stock Forecast 2024 Insights

The stock of Block Inc. or Square started with an initial price of $12.85 and was listed on the New York Stock Exchange back in 2015, hitting a high of $276 by 2021. The price has continuously declined since then and is currently floating near $66.08 after facing resistance at a recent peak near $85.

According to expert opinion and past performance, SQ's stock price estimation for the end of 2024 is $75.

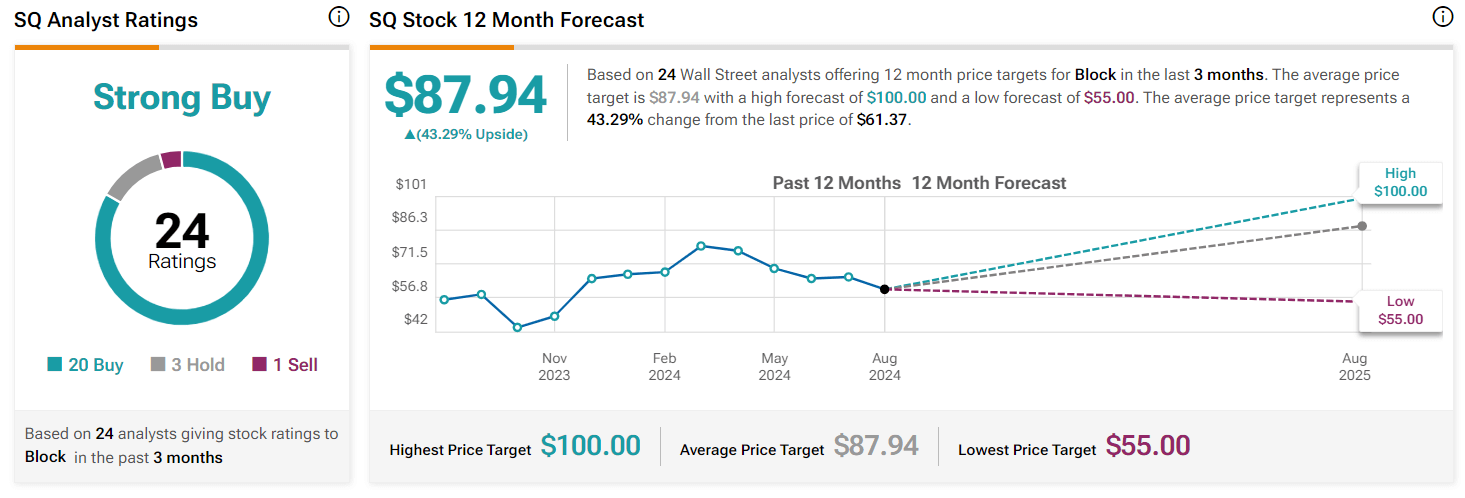

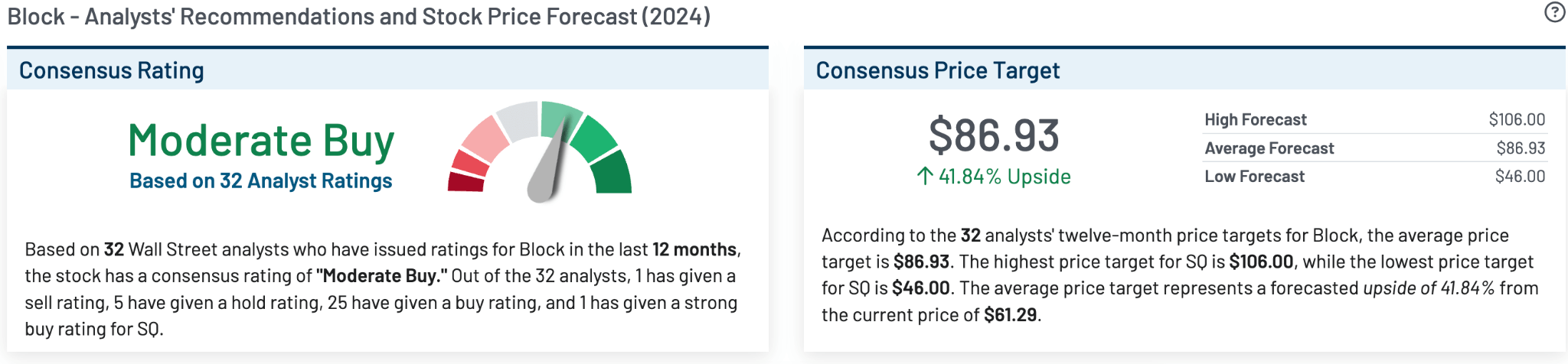

According to Tipranks' forecast, based on Wall Street analysts, the average stock price for SQ can hit $87.94 by the end of 2024. In the meantime, they predict the high will be near $100 and the low will be $55.

Twenty-four analysts gave ratings on the stock; twenty among them suggested buying, where three suggested holding, and only one selling suggestion came.

Another top analysis firm confirms, based on thirty-two Wall Street analysts, issued ratings on the SQ stock in the previous twelve months, having an average SQ price target of $86.93, with a high near $106.00 and a low of $46.00.

Among those thirty-two analysts, twenty-five gave buy ratings, five gave hold ratings, and only one projected sell ratings. The other one gave strong buy ratings.

B. Key Factors to Watch for Block Stock Forecast 2024

SQ Earnings Outlook 2024

Block Inc. posted a 20% surge in profit growth, bringing it closer to the projected 40% margin target with an adjusted 18% operating margin. For the full year, the company is projected to achieve a 35% target, up from the last guidance of 32%, supported by a gross profit of over 18% and at least an operating margin of 16%.

During Q2, Block Inc. also reported stock-based compensation of $320.4 million, which is 42% of its adjusted EBITDA. This reflects notable profitability progress, as stock-based compensation of $319.2 million accounted for 83% of its $384.3 million EBITDA before one year.

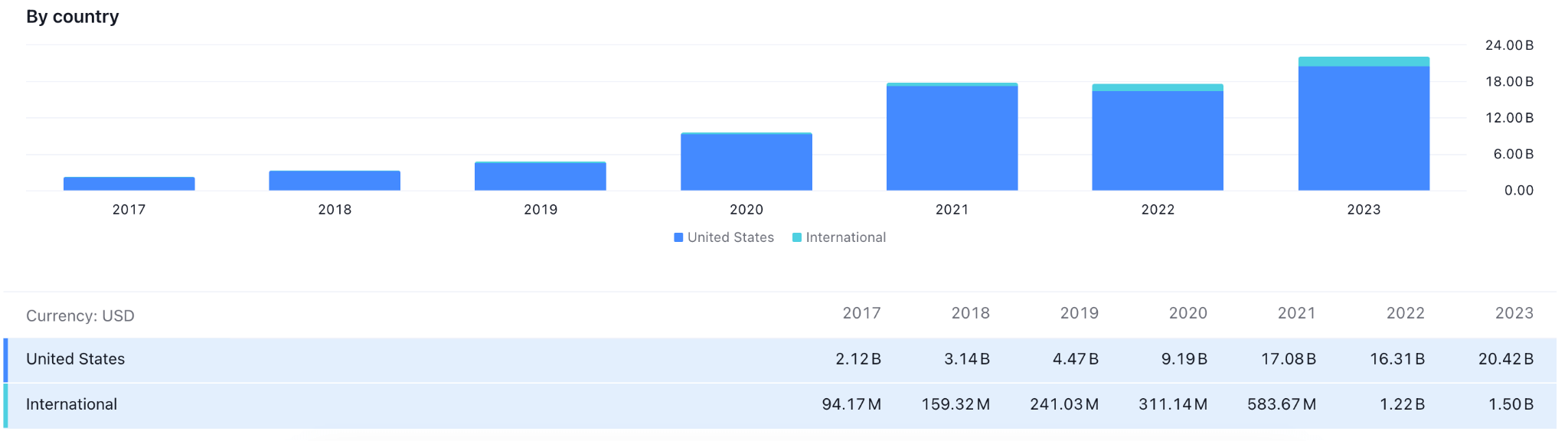

SQ By-country Revenue Outlook

Block Inc. is now focused on growing this business segment by accelerating its onboarding process and enhancing its product lineup. A crucial early market, food service, remains a top priority. Recent initiatives include enhancing its ordering system and partnering with US Food to improve order accuracy, minimise wait time, and reduce labour costs. Furthermore, the company is aiming to expand internationally to continue growth. A presence in the international market could be a potential bullish factor for this stock.

Square Stock Price Prediction 2024 - Bullish Factors

- Jack Dorsey, Block's founder and CEO, believes in Bitcoin, sees it as the future currency of the internet, and is aligning the company to leverage this vision. Cash App has supported Bitcoin trading for some time, but Block plans to deepen its involvement in cryptocurrency.

- The company continues to see double-digit gross profit growth while focusing on achieving consistent profitability. Block's offerings remain essential to users' daily needs, reinforcing its market position.

- Streamlining operations has been a critical focus, driving a 20% increase in gross profit in recent quarters. These efficiency gains have bolstered investor confidence, potentially positively impacting Block stock price.

SQ Stock Prediction 2024 - Bearish Factors

- The company's involvement in digital payments and Cryptocurrency makes Block Inc. vulnerable to regulatory challenges. Regulation adjustments, especially in Bitcoin or digital payments, could negatively impact its profitability and business operations.

- Stricter monetary policies, increasing inflation, or economic slowdown may deduct consumer spending, directly affecting Block's commerce segment. Small business and retail clients may reduce their usage of Block Inc. services due to cost cutting.

III. SQ Stock Forecast 2025

The Square stock price has been sideways, seeking to reach the anticipated 149.00 by the end of 2025.

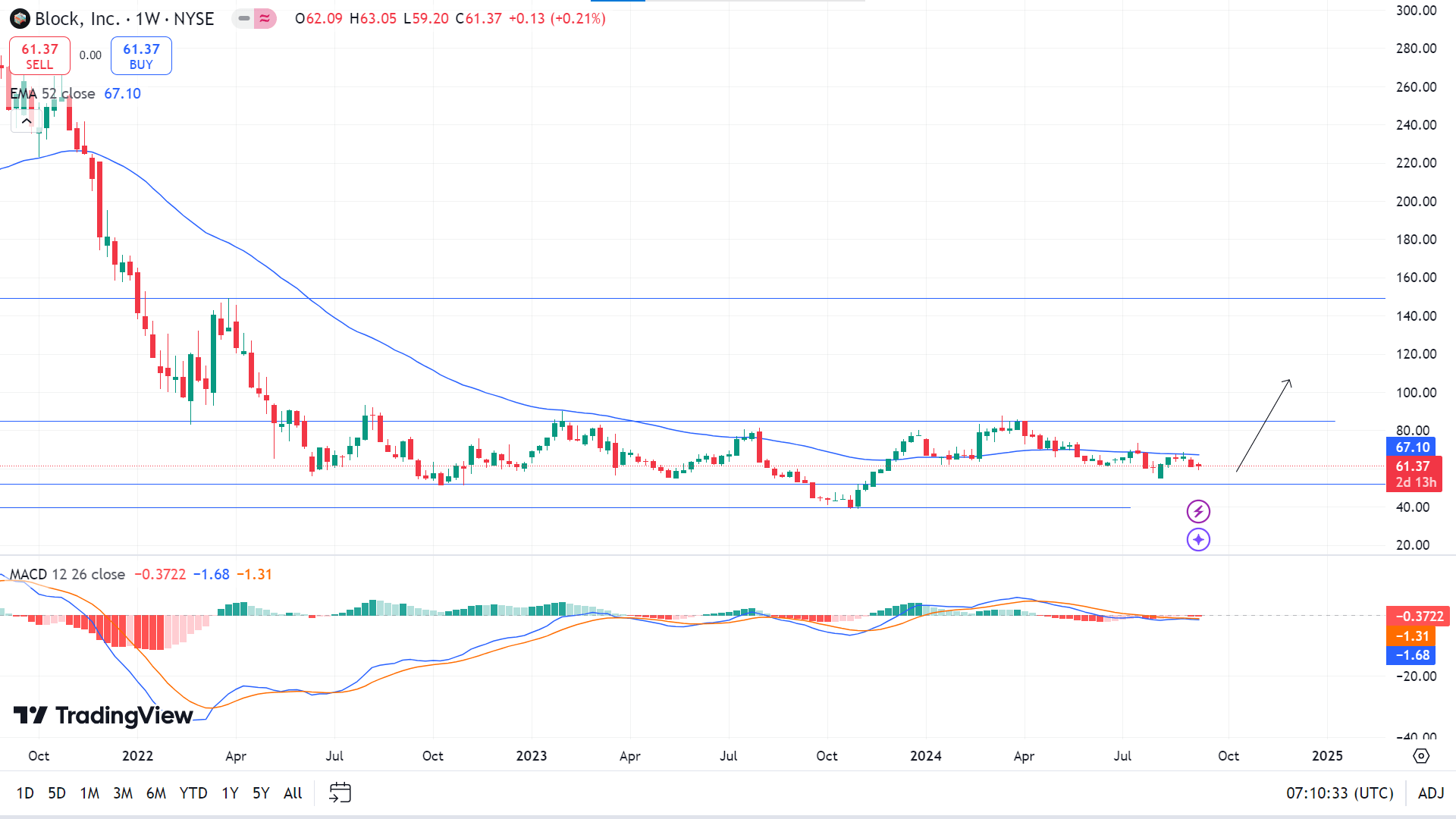

In the weekly timeframe, SQ stock price has become flat since the beginning of 2023 with no clear direction. However, the long consolidation with a bullish break from the rectangle pattern could be a potential long signal.

Consiodering the ongoing selling pressure, the price can retouch support at around 52.00 before bouncing back. The price is floating below the EMA 52 line on the weekly chart; moving closer to the line may cause significant pressure to get a specific direction for the future.

Based on the SQ Stock Forecast 2025, If the price remains below the EMA 52 line and continues sideways, the price can return to the previous support of 52.00, followed by the subsequent support near 39.50.

On the other hand, the signal line is floating closer to the mid-level, and the red histogram bars are fading, signalling sideways. Significant bullish pressure can trigger the price above the EMA 21 line, which may lead toward the primary resistance near 85.00. A breakout can lead toward the next resistance near 149.00.

A. Other Block Stock Forecast 2025 Insights

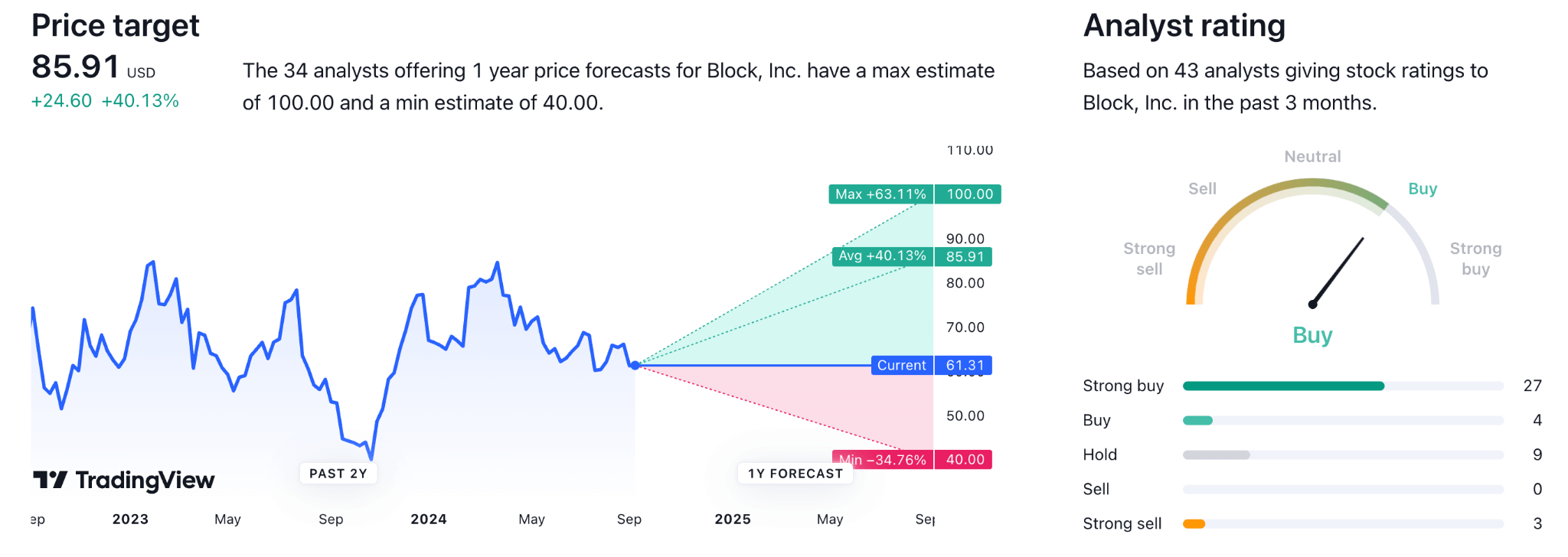

Thirty-four analysts in Tradingview offer price forecasts for the Block Inc. stock for the next year with a maximum estimation of 100 and a lower level near 40, while the average price could be 85.91 during that period.

Fourty-three analysts gave their ratings on the SQ stock, where twenty-seven among them suggested it as a “strong-buy” asset, four of them indicated it as a “buy”, nine of them suggested “hold”, and only three among them suggested it could be a “sell” asset.

Another famous firm, Capital Reports, reports on Block Inc.'s stock price. According to Wallet Investor, an algorithm-driven forecasting tool, the SQ stock can have a positive outlook depending on analysts. The platform defines SQ as "an excellent long-term (one-year) investment," with anticipation of a potential 58% surge and may hit $203.77 by the next twelve months.

The site further projected that by April 2023, SQ stock could increase to $214.07 and, by April 2024, jump further to $271.54. The forecast suggests the stock could touch as high as $329.68 by 2025.

B. Key Factors to Watch for Square Stock Price Prediction 2025

SQ Valuation Outlook

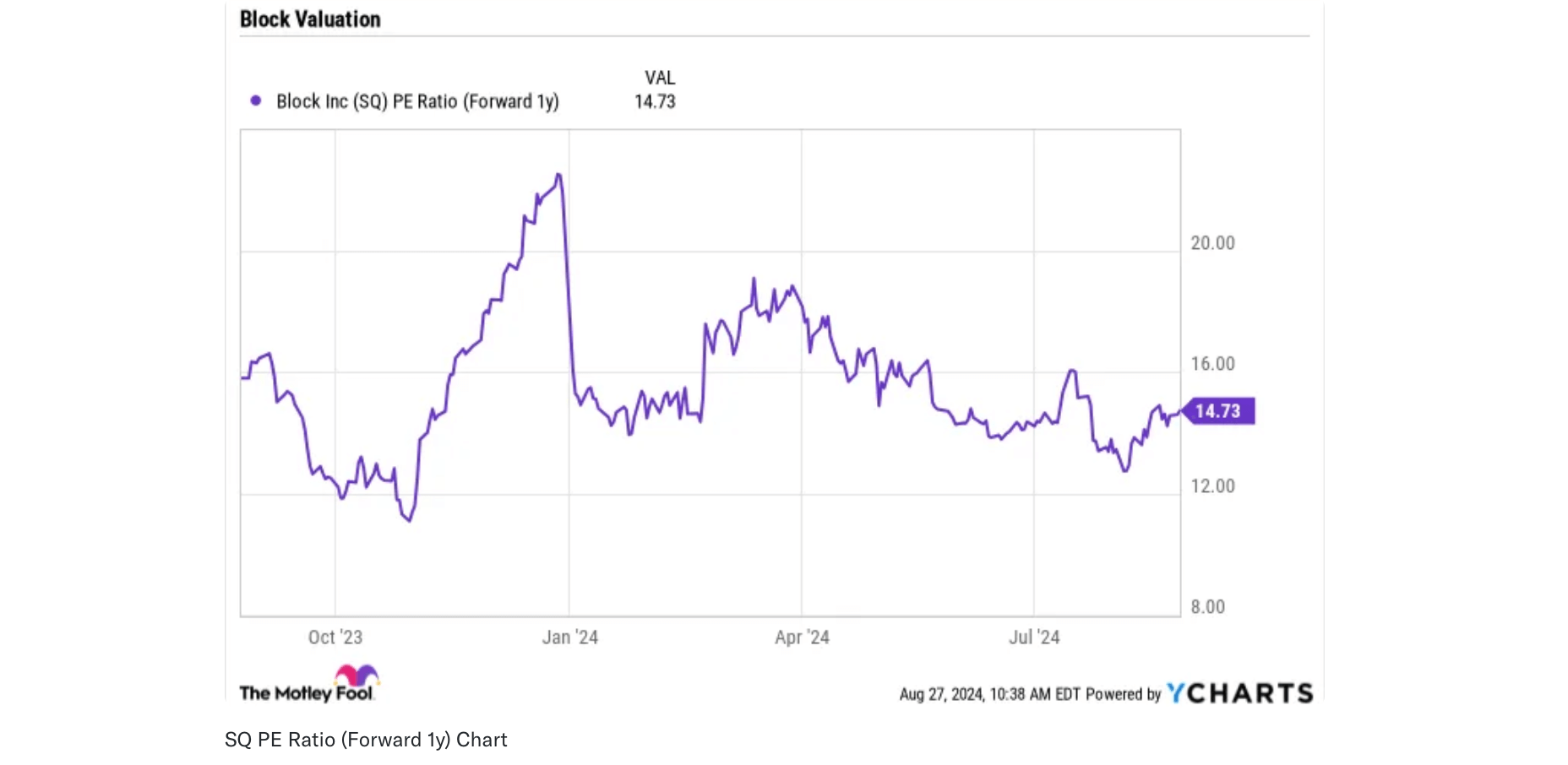

With a forward P/E ratio below 15 based on analysts' earnings estimates for the coming year, block stock seems highly attractive for a growing and increasingly profitable company. However, factoring in stock-based compensation adjustments to its adjusted EPS makes it less attractive. With these adjustments, the P/E ratio would likely be around 26.5 times forward earnings estimates. While this is still appealing, considering Block's gross profit and earnings growth, it doesn't offer the bargain valuation that the initial P/E figure might suggest.

SQ Growth Potential

Block Inc. has shifted its strategy in recent years to strengthen its revenue growth by focusing on more profitable expansion, intending to achieve the "Rule of 40" by 2026.

The Rule of 40, a standard benchmark for valuing early-stage SaaS companies, is met when the profit margin and revenue growth reach 40% or more. Since the company's revenue growth is diagonal by its Bitcoin trading activities, it instead focuses on adjusted operating margin and gross profit growth, which reflects its enhanced performance. Block's adjusted operating income excludes one-time charges, interest, taxes, and non-cash amortization expenses.

SQ Stock Forecast 2025 - Bullish Factors

- Cash App remains a crucial revenue generator for Block. It has shown significant growth, with a 15% YOY increase in cash inflows and a 21% surge in Buy Now Pay Later (BNPL) gross merchandise value, improving the position of Block in digital finance.

- Block Inc. is focusing on its banking solutions and expanding its mid-market reach, both of which are anticipated to drive future growth. The company also invests in Crypto innovations, such as developing its mining chips, which could provide long-term value.

- The company recently announced a $3 billion share repurchase program that reflects management's confidence in its current valuation. The program aims to mitigate share dilution and support an increase in stock price.

SQ Forecast 2025 - Bearish Factors

- Block Inc.'s bold ventures into blockchain technology and BTC mining may face technical and operational obstacles. If these projects do not achieve the anticipated return, it could negatively impact investors' sentiments.

- Despite its growth potential, many analysts might see the company as overvalued. According to Marketbeat, with price targets ranging between $46 to $106, failing to meet earnings expectations could lead to further stock price declines.

IV. SQ Stock Forecast 2030 and Beyond

SQ stock price can regain 175.50 or beyond by the end of 2030, while the downside risk is 39.50.

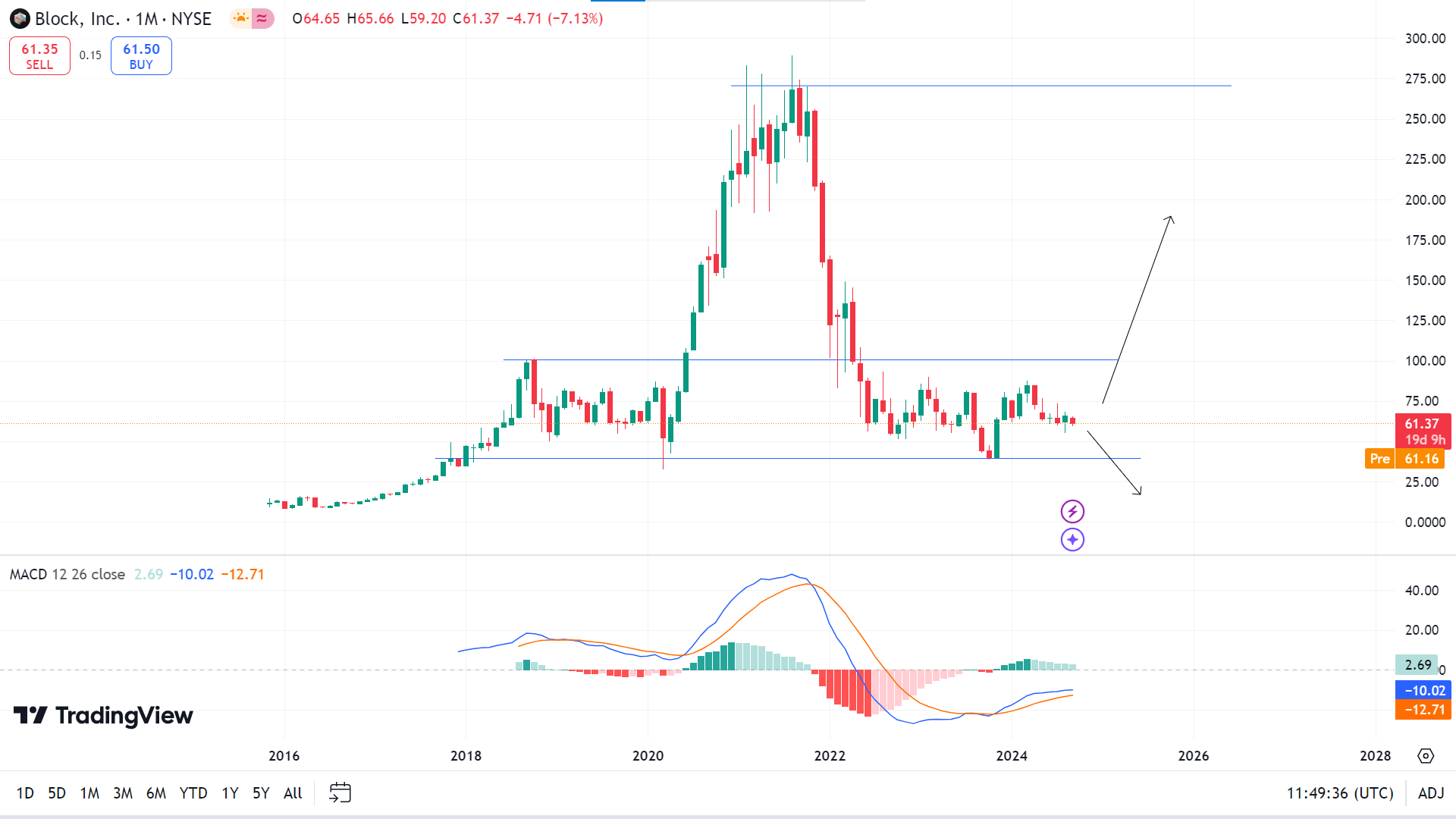

The monthly chart shows the price movement for the SQ stock since the initiation period. It reached a peak near 100.72 in October 2018, moving sideways. The low was near 32.33 during the consolidating period and hit a high of 289.23 by 2021. Since then, Block Inc.'s price has declined and remained sideways between 51.93 and 85.00, with a low near 39.50.

According to the MACD indicator readings, the price is moving on an uptrend, although the green histogram bars are fading, reflecting decreasing bullish pressure. If the bullish pressure surges, the SQ stock price can hit the nearest resistance of 100.72, whereas any breakout might drive the price toward the following resistance near 175.50 or beyond.

A. Other Square Stock Price Prediction 2030 and Beyond Insights

When considering the Block (SQ) stock evaluation, it's essential to recognize that algorithm-based price targets and analysts' anticipations are not always authentic. These estimates come from historical performance through technical and fundamental analysis, but the previous performance doesn't guarantee the future outcome.

The long-term outlook anticipates that in 2026, the SQ stock will hit $387.49. And the SQ stock price may surge to $430.32 by 2027, a significant increase from the current price level.

According to moneymystica.com, the Block stock price estimation for 2030 is that the price can increase from $278.68 to $419.13. In the meantime, the average price prediction for the SQ stock is $312.00, which is significantly higher than the current price level.

B. Key Factors to Watch for Square Stock Forecast 2030 and Beyond

Data Center Growth Forecast

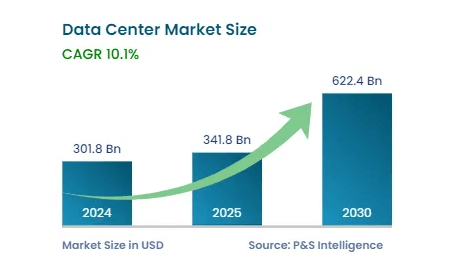

Future Market Intelligence projections for 2024 show the data centre market valuation can hit $30.4 billion, with a compound annual growth rate of 14.4%, and might reach $117.24 by 2034. Demand for data centres has increased rapidly even before the Artificial Intelligence surge, with Jefferies reporting growth rates of 10% to 20% over the past 15 years. However, in the past two years, the rise of AI has rapidly accelerated this growth to around 30%.

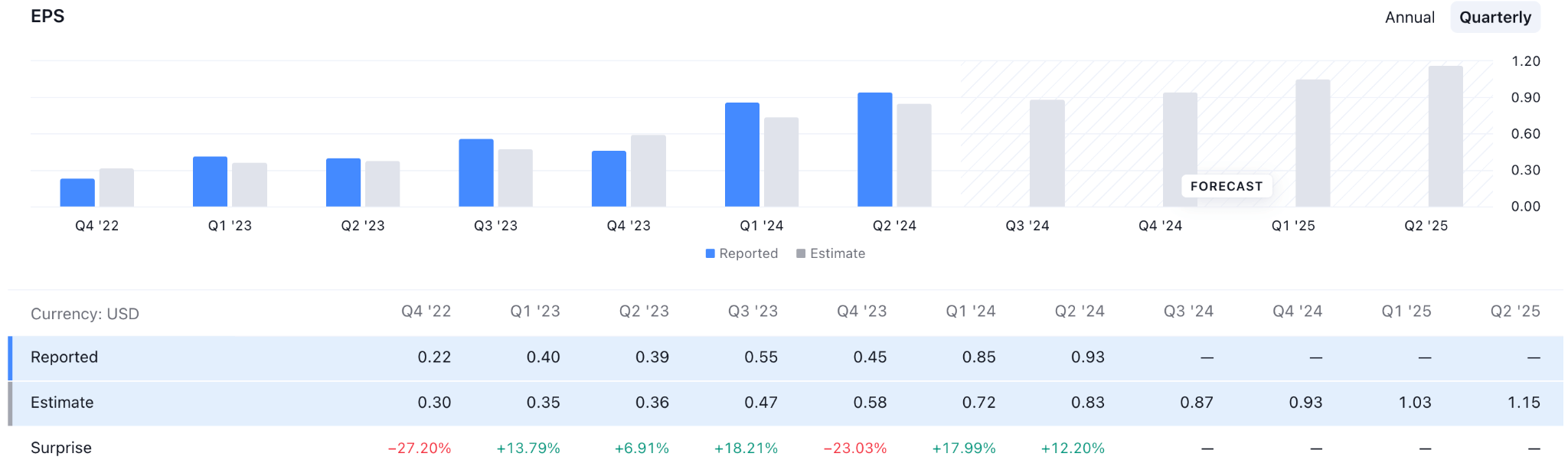

SQ Earnings Forecast 2030

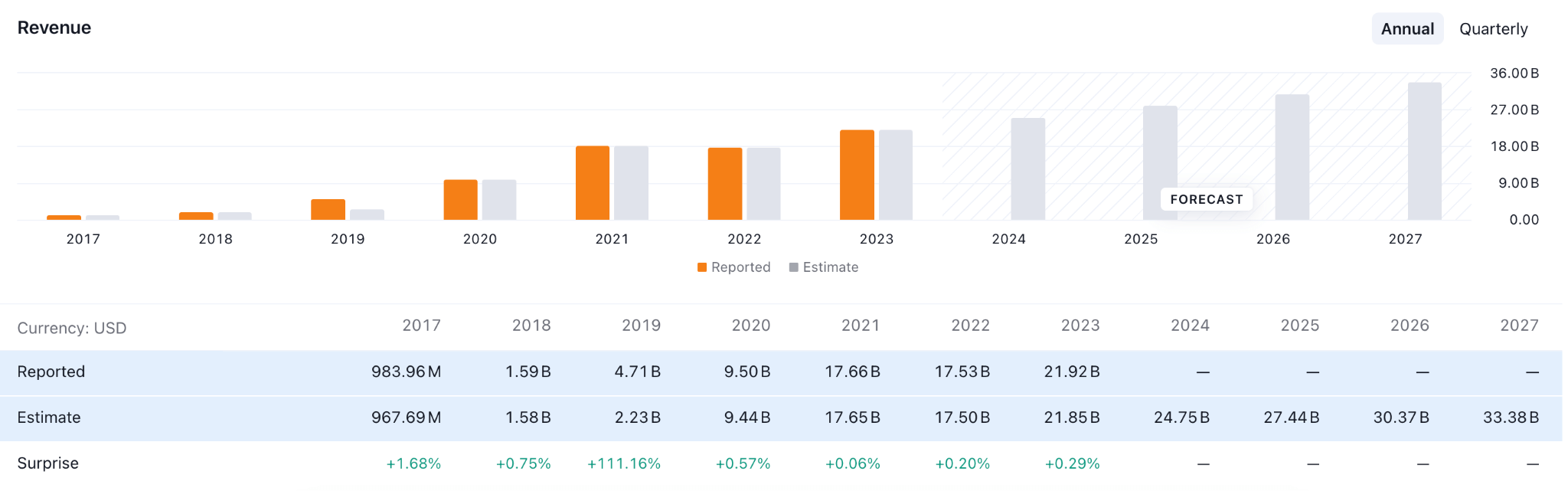

The chart above shows how SQ stock earnings have beaten estimates in previous years, making the asset attractive for long-term investment. The future earnings projection confirms the SQ stock as a potential investment asset as the figures gradually increase for the upcoming years.

SQ Stock Forecast 2030 and Beyond - Bullish Factors

- The efficiency enhancements and Cash App's expanding user base and profitability are key to its long-term success for Block Inc. They will provide a reliable revenue stream well into the 2030s.

- The company's significant investments in Bitcoin-related initiatives, such as developing proprietary mining chips, position it in the cryptocurrency market advantageously. This innovation could spur substantial growth as digital currencies see wider adoption.

- Block Inc.'s focus on increasing its market share in financial services and digital payments is crucial. Demand for Block's core services will grow as consumers and businesses shift toward digital payment solutions.

Block Stock Forecast 2030 and Beyond - Bearish Factors

- The transformative potential of AI and data centers is undeniable, but increasing energy consumption is a concern. Goldman Sachs Research reveals that data centres currently use 1%—2% of global power, which can surge to 3% to 4% within the next decade.

- Block Inc. faces criticism for its high stock-based compensation, which involves paying employees with the company stock. Many firms eliminate stock-based compensation from their adjusted earnings, and free cash flow often overlooks it, as the process is considered a non-cash expense.

V. Conclusion

A. Block Stock Outlook

Block stock is trading at a record low, from where a minor upside pressure might come in 2024. However, the long-term bull might come after having a bullish break above the 73.00 level. In that case, the price might find a path as a bullish continuation in 2025 by taking the price above the 150.00 level.

However, the long-term bullish projection might come with corrective pressure due to order building. If the price can hold the pressure above the 100.00 line, it might extend beyond the 200.00 to 400.00 level in 2030 and beyond.

B. Trade SQ Stock CFD with VSTAR

Buying a CFDs stock might offer a decent trading opportunity in any stock like SQ as investors are open to buy or sell the instrument at a time.

A platform like VSTAR would be a great option to join the SQ CFDs as it offers a top-notch trading environment with a lower cost and higher execution speed. Also, mobile portability, a higher number of available assets, strong regulation and superior customer support could make anyone's trading journey more fruitful.