SoFi Technologies' stock price has been volatile. Despite strong financial results (revenue growth, profitability), the stock underperformed the market. Analysts have mixed forecasts for 2024, with a range of $5.75 to $10.25. The long-term outlook is bullish, with predictions for 2030 ranging from $15.50 to $50.00. Factors influencing the forecast include SoFi financial performance, economic conditions, and company strategy.

I. Recent SOFI Stock Performance

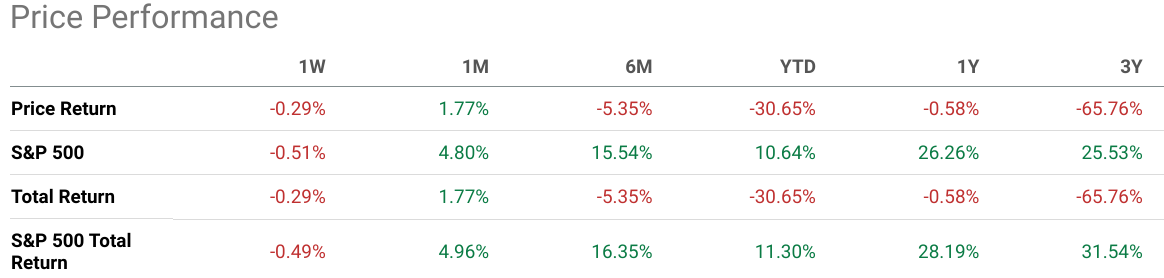

SoFi Technologies (NASDAQ: SOFI) has experienced notable fluctuations in its stock price over the past year. Within a 52-week range of $6.41 to $11.70, the stock's performance highlights several key trends. Over the past month, SOFI achieved a 1.77% price increase, which, although positive, significantly lagged behind the S&P 500's robust 4.80% growth, reflecting investor hesitation despite broader market optimism. The last six months have been challenging for SOFI, with a -5.35% return. In contrast, the S&P 500 saw a 15.54% gain. This divergence underscores specific investor concerns or sectoral issues affecting SOFI.

Year-to-date, SOFI has suffered a substantial -30.65% loss, vastly underperforming the S&P 500's 10.64% gain. Over the last year, SOFI's -0.58% return starkly contrasts with the S&P 500's 26.26% increase. This significant underperformance highlights potential fundamental or operational challenges within SoFi. Over three years, SOFI's price return plummeted by -65.76%, whereas the S&P 500 achieved a 25.53% return. This long-term underperformance suggests persistent issues affecting investor confidence and SOFI's market positioning.

Source: Ycharts.com

Source: seekingalpha.com

Main influencing factors

Strong Financial Results:

- Revenue Growth: SoFi reported significant growth in Q1 2024, with net revenue of $645 million, up 37% from the previous year. This growth was primarily driven by a 54% increase in the Tech Platform and Financial Services segments, which collectively accounted for 42% of total adjusted net revenue .

- Profitability: The company achieved its second consecutive quarter of GAAP profitability, with a net income of $88 million. This is a marked improvement from the loss of $34.4 million in Q1 2023.

Diversification and Member Growth:

- Product and Member Expansion: SoFi's strategy to diversify its product offerings has led to a 35% growth in total members and a 38% increase in total products year-over-year. The company now has over 8.1 million members and 11.8 million products.

Source: Q1 2024 Investor Presentation

- Financial Services Growth: The Financial Services segment saw a 42% increase in products, driven by significant growth in SoFi Money, SoFi Relay, and SoFi Invest accounts.

Operational Efficiency:

- EBITDA Margin Improvement: SoFi reported an adjusted EBITDA of $144 million with a 25% margin, reflecting a 91% year-over-year increase. This improvement is attributed to better operating leverage and a decline in sales and marketing expenses as a percentage of adjusted net revenue.

Balance Sheet Strengthening:

- Convertible Notes Transactions: SoFi reduced its overall financing costs by issuing $862.5 million in convertible notes due in 2029 and exchanging $600 million of convertible notes due in 2026 for common stock. These actions enhanced the company's balance sheet and capital ratios .

- Deposit Growth: The company's total deposits grew by $3 billion, reaching $21.6 billion. This growth in low-cost deposits is advantageous for funding loans and optimizing returns, especially in uncertain macroeconomic conditions.

Macro and Regulatory Environment:

- Interest Rates and Economic Conditions: The company's conservative approach to lending amidst macroeconomic uncertainty has helped maintain strong margins and net interest income. The net interest margin expanded to 5.91%, driven by efficient management of funding sources and interest-bearing liabilities .

- Regulatory Compliance: SoFi's total capital ratio improved to 17.3%, well above the regulatory minimum of 10.5%, ensuring robust compliance and operational stability.

Expert Insights on SOFI Stock Forecast for 2024, 2025, 2030 and Beyond

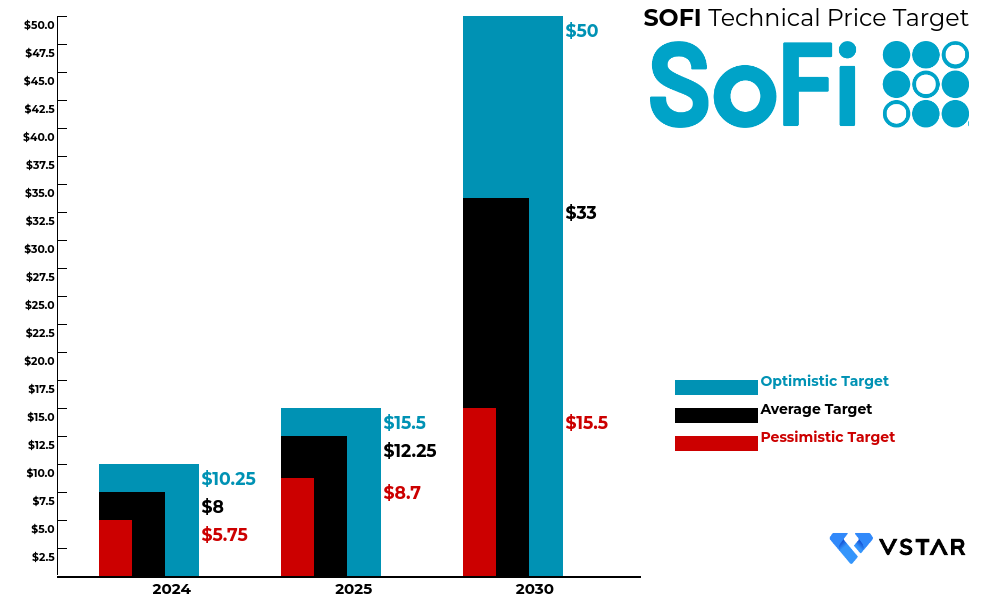

Historically, SoFi stock performance has shown significant volatility. Looking forward, technical forecasts for SOFI stock suggest varied outcomes. For 2024, targets range from a pessimistic $5.75 to an optimistic $10.25, reflecting cautious market sentiment. By 2025, projections improve, with estimates between $8.70 and $15.50, indicating expected growth. The long-term forecast for 2030 is notably bullish, with targets spanning $15.5 to $50, suggesting potential substantial gains. These predictions highlight uncertainty but also significant upside potential.

Source: Analyst's compilation

II. SOFI Stock Forecast 2024

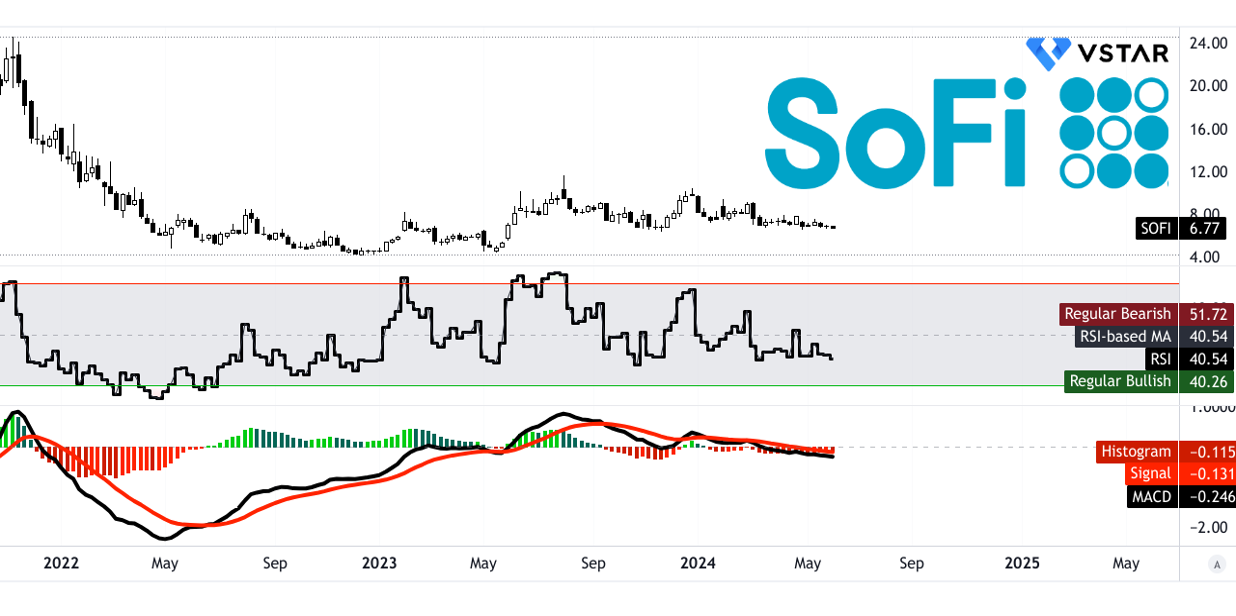

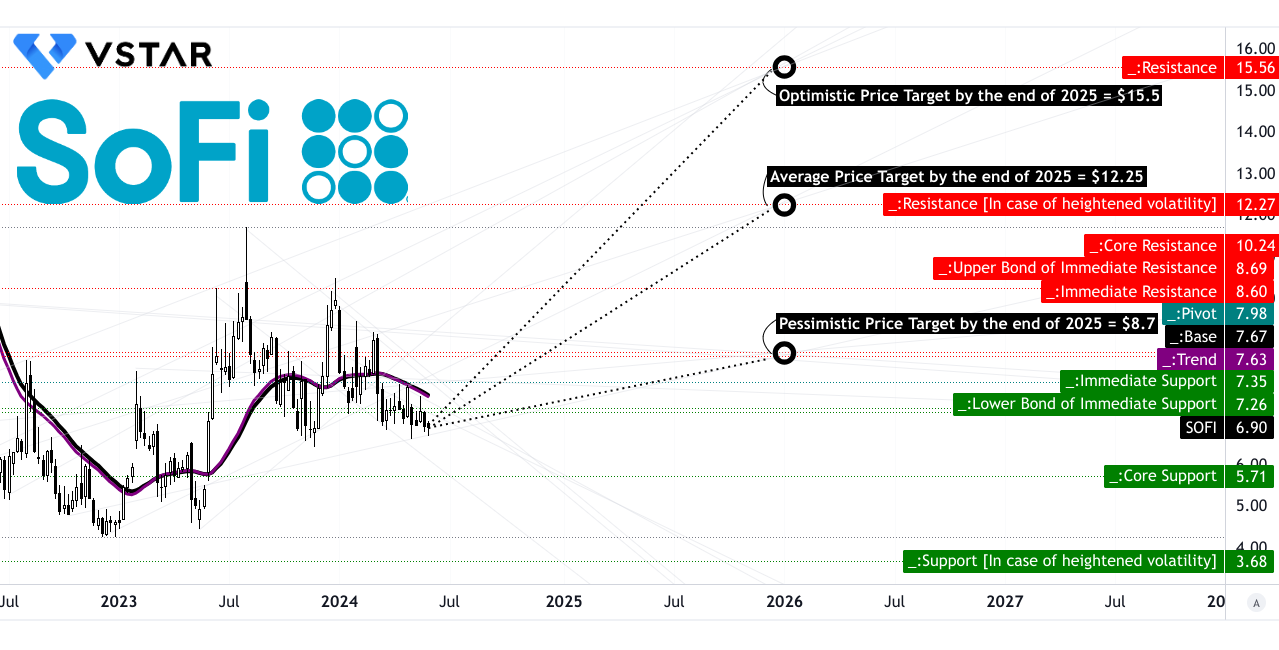

Technicals have mixed predictions for SOFI by the end of 2024. The average Sofi target price sits at $8, reflecting a possible shift in momentum. An optimistic scenario suggests a climb to $10.25 if the current upward swing holds. On the flip side, a continued downtrend could push SOFI as low as $5.75. SoFi stock (SOFI) is at a crossroads. Currently priced at $6.90, it's trending downwards. However, there are signs of potential support around $7.63 based on technical indicators like modified moving averages.

Resistance levels act as potential roadblocks for price increases. The current channel sits at $7.26, with other hurdles at $7.98 and $8.69. A core resistance zone exists at $10.24. Conversely, support levels indicate areas where the stock might find buyers. The core support sits at $5.71, with a possible drop to $3.68 in extreme volatility.

Source: tradingview.com

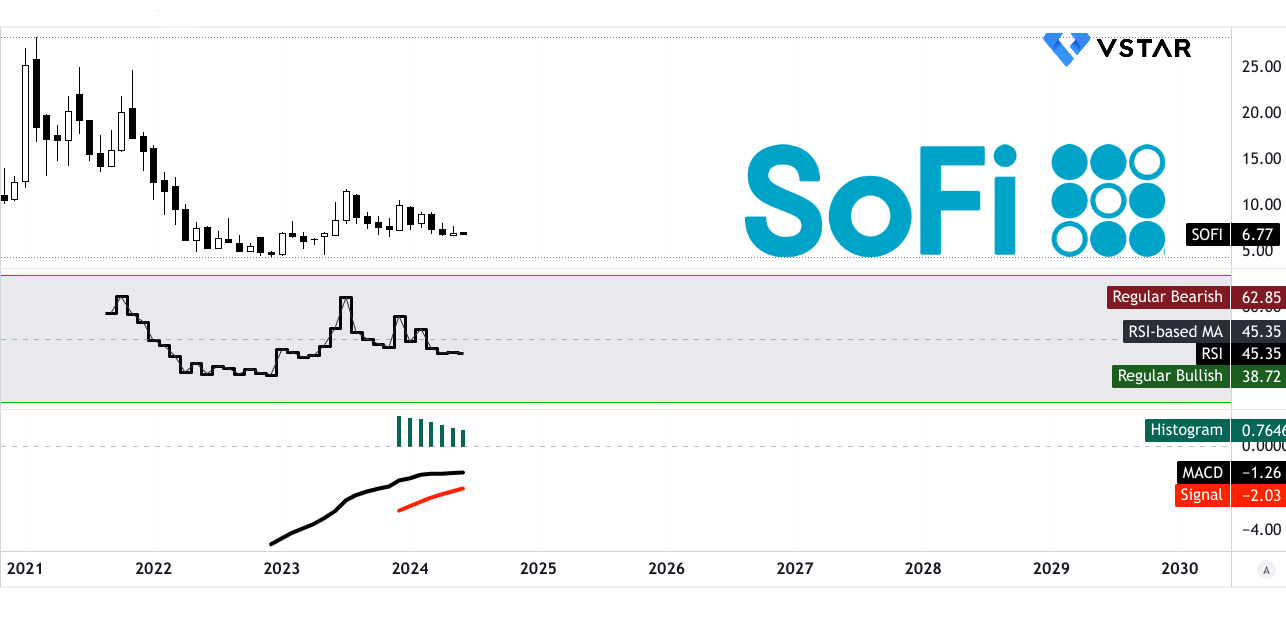

The RSI (Relative Strength Index) is currently neutral, but its downward trend suggests continued weakness. The MACD (Moving Average Convergence Divergence) indicator shows a bearish trend, but its stabilizing strength hints at a potential reversal if positive momentum builds.

Source: tradingview.com

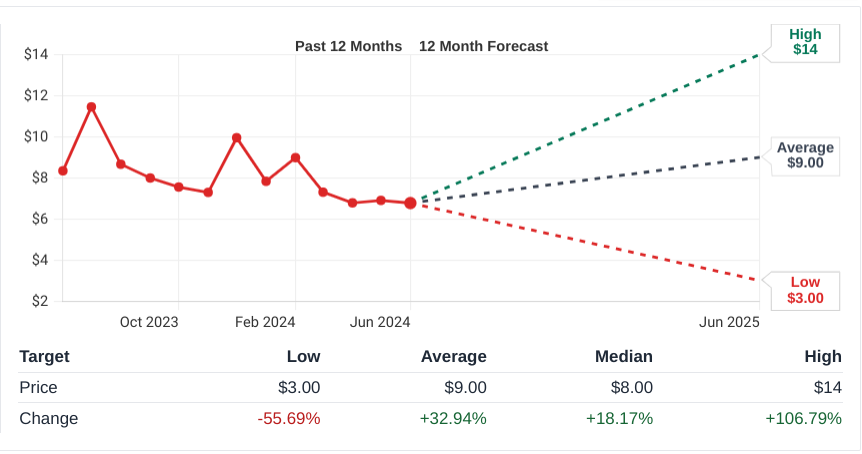

The 2024 stock forecast for SoFi Technologies (NASDAQ: SOFI) presents a mixed yet optimistic outlook. According to TipRanks, analysts predict an average SOFI price target of $8.91, with high and low estimates of $14 and $4, respectively. This suggests a potential upside of 29.13% from the current price of $6.9. Similarly, StockAnalysis provides a slightly higher average target of $9, ranging between $3 and $14, indicating a potential 30.43% increase (in the next 12 months). In contrast, CoinPriceForecast offers a more conservative projection, expecting the stock to reach $7 by mid-2024.

Source: stockanalysis.com

A. Other SOFI Stock Price Prediction 2024 Insights: SoFi stock buy or sell?

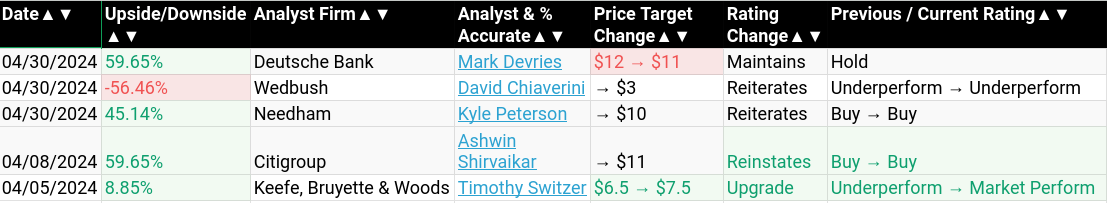

The forecast for SoFi Technologies Inc. (NASDAQ: SOFI) in 2024 presents a mixed outlook, reflecting varying degrees of optimism and caution among financial analysts. Deutsche Bank's analyst, Mark Devries, has revised the Sofi price target from $12 to $11, maintaining a Hold rating. This represents an upside of 59.65%, indicating a moderate level of confidence in SoFi's ability to grow, albeit with some reservations about its current valuation. Similarly, Citigroup's Ashwin Shirvaikar reinstated a Buy rating with an $11 price target, suggesting substantial growth potential and a comparable upside of 59.65%.

Conversely, Wedbush analyst David Chiaverini remains highly skeptical, setting a Sofi stock price target of $3 and reiterating an Underperform rating. This pessimistic view implies a downside of 56.46%, highlighting significant concerns about SoFi's financial health and competitive position. This stark contrast underscores the risks that some analysts perceive in SoFi's business model and market environment.

On a more optimistic note, Needham's Kyle Peterson has reiterated a Buy rating with a $10 price target, reflecting a 45.14% upside. Peterson's confidence in SoFi is further demonstrated by his initiation of coverage with a Buy rating earlier in the year. Meanwhile, Keefe, Bruyette & Woods' Timothy Switzer upgraded his SOFI price target from $6.5 to $7.5 and improved his rating from Underperform to Market Perform, suggesting a modest upside of 8.85%. This upgrade signals a cautious optimism about SoFi's prospects.

Source: Benzinga.com

B. Key Factors to Watch for SOFI Stock Forecast 2024

SOFI Stock Prediction 2024 - Bullish Factors

Financial Performance and Forecast:

SoFi Technologies has shown robust financial growth, highlighted by its Q1 2024 performance. The company reported an adjusted net revenue of $581 million, marking a 26% year-over-year increase, and adjusted EBITDA of $144 million, reflecting a 91% increase year-over-year. The company achieved a GAAP net income of $88 million, a significant turnaround from previous losses. For 2024, analysts expect SoFi to break even in Q2, with EPS estimates gradually increasing to $0.03 in both Q3 and Q4, indicating potential profitability sustained over the year. Revenue is forecasted to grow steadily, with Q2, Q3, and Q4 estimates of $566.16M, $607.72M, and $628.30M, respectively.

Source:Seekingalpha.com

Recent Developments:

- Diversified Revenue Streams: The increasing contribution of the Financial Services and Technology Platform segments to SoFi's revenue mix is a positive sign. These segments are expected to drive future growth, offsetting slower growth in the lending segment.

- Membership Growth: The continued expansion of SoFi's membership base and deeper product adoption by members demonstrate strong customer engagement and potential for cross-selling opportunities.

Sofi Technologies Stock Forecast 2024 - Bearish Factors

- Macroeconomic Uncertainty: Persistent concerns about high interest rate volatility, inflation, and overall US economic conditions could impact SoFi's growth, particularly in its lending business, which has shown conservative growth due to these factors.

- Revenue Revision Trends: Despite overall positive growth projections, there have been downward revisions in revenue estimates over the past six months, indicating potential concerns about the near-term revenue performance.

- High-Expense Investments: Significant investments in expanding products like Credit Card and Invest, which currently incur losses, might pressure profitability in the short term.

III. SOFI Stock Forecast 2025

Technicals predict a potential turnaround by the end of 2025. The forecasts range from an average price target of $12.25 to an optimistic Sofi stock price target 2025 of $15.50. This bullish outlook is based on the idea that the stock will experience a significant upward movement in the coming years. There's also a pessimistic target of $8.70, which suggests the downtrend could persist. This scenario is based on the current price momentum. It's important to remember that the stock price can be volatile. Monthly Beta (5-Years) of 1.76 is high for SOFI. This means the stock price could swing dramatically in either direction.

There are a few key resistance and support levels to watch. These levels can act like price barriers. If the stock price breaks above a resistance level, such as $7.35, $7.98 (pivot), or $10.24, it could signal a continued rise. Conversely, a break below a support level, particularly the core support at $5.71, could indicate a further decline.

Source: tradingview.com

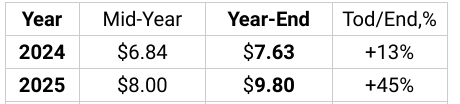

The SoFi stock forecast for 2025 varies between sources. Coincodex.com predicts a modest increase to $7.88, reflecting a 14.07% rise based on historical growth rates. Conversely, coinpriceforecast.com suggests a more optimistic outlook, forecasting a rise to $9.8 by year-end 2025, indicating a potential 45% increase.

Source: coinpriceforecast.com

A. Other SOFI Stock Price Prediction 2025 Insights: Is SoFi a good stock to buy?

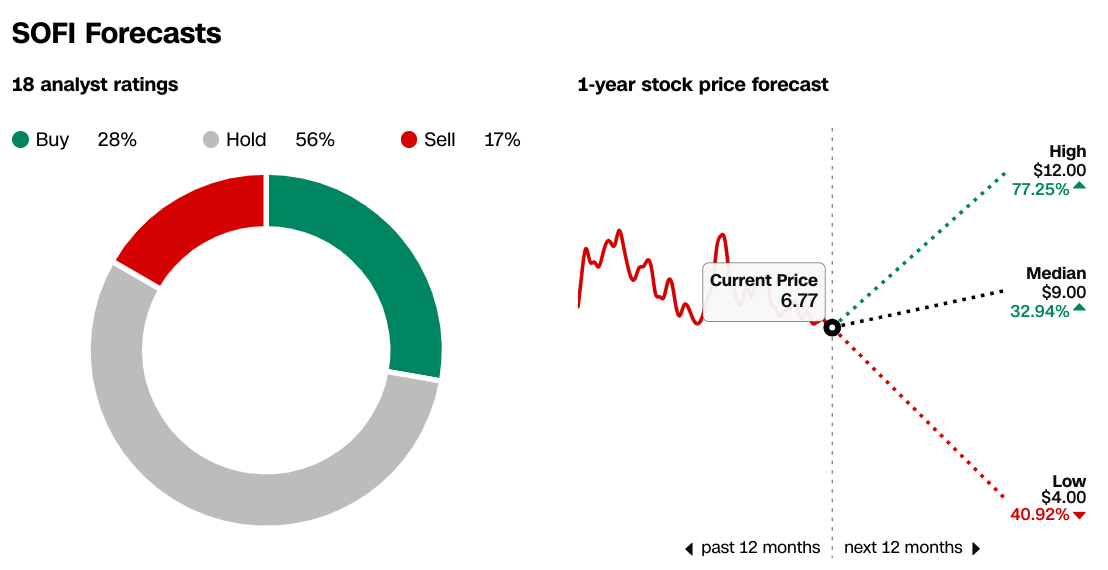

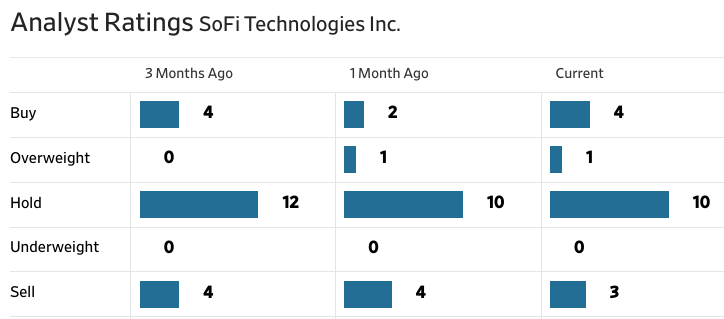

SOFI stock forecast for 2025, insights from CNN.com and WSJ.com provide a mixed outlook. CNN reports 18 SoFi analyst ratings, with 28% suggesting a buy, 56% hold, and 17% sell. The one-year forecast ranges from a high of $12.00 (73.91% increase from the current price), a median of $9.00 (30.43% increase), to a low of $4.00 (42.03% decrease).

Source: CNN.com

WSJ's data aligns with CNN's, showcasing four buy, one overweight, ten hold, and three sell ratings. The stock price targets reflect a similar range, with a high of $12.00, a median of $9.00, and a low of $4.00, averaging at $8.53.

Source: WSJ.com

B. Key Factors to Watch for SOFI Stock Forecast 2025

SOFI Price Prediction 2025 - Bullish Factors

The CBO economic outlook for 2023-2025 predicts a recovery in 2024-2025. As the economy recovers and interest rates decline, consumer spending is expected to pick up. This could benefit SoFi products as demand for its products increases. The Federal Reserve is expected to reduce interest rates in 2024-2025. This could be positive for SoFi's lending business as higher interest rates generally mean higher profits. However, it could also make it more expensive for SoFi to borrow money, potentially offsetting some of the gains.

Overall, the economic outlook presents opportunities for SoFi. The mid-term US economic recovery could lead to SoFi's growth.

Financial Forecast 2025:

SoFi's financial forecast for 2025 presents a promising outlook with significant growth anticipated in both EPS and revenue. Consensus estimates project an EPS of $0.23, reflecting a remarkable YoY growth of 175.04%. Likewise, revenue estimates foresee a substantial increase to $2.78 billion, indicating a YoY growth of 15.32%. These projections signal a bullish sentiment among analysts regarding SoFi's future performance.

SOFI Stock Prediction 2025 - Bearish Factors

Intensifying competition within the financial services industry may exert pressure on SoFi's market position and profitability. Financial adversities in the US economy may continue to be a headwind for the company.

IV. SOFI Stock Price Prediction 2030 and Beyond

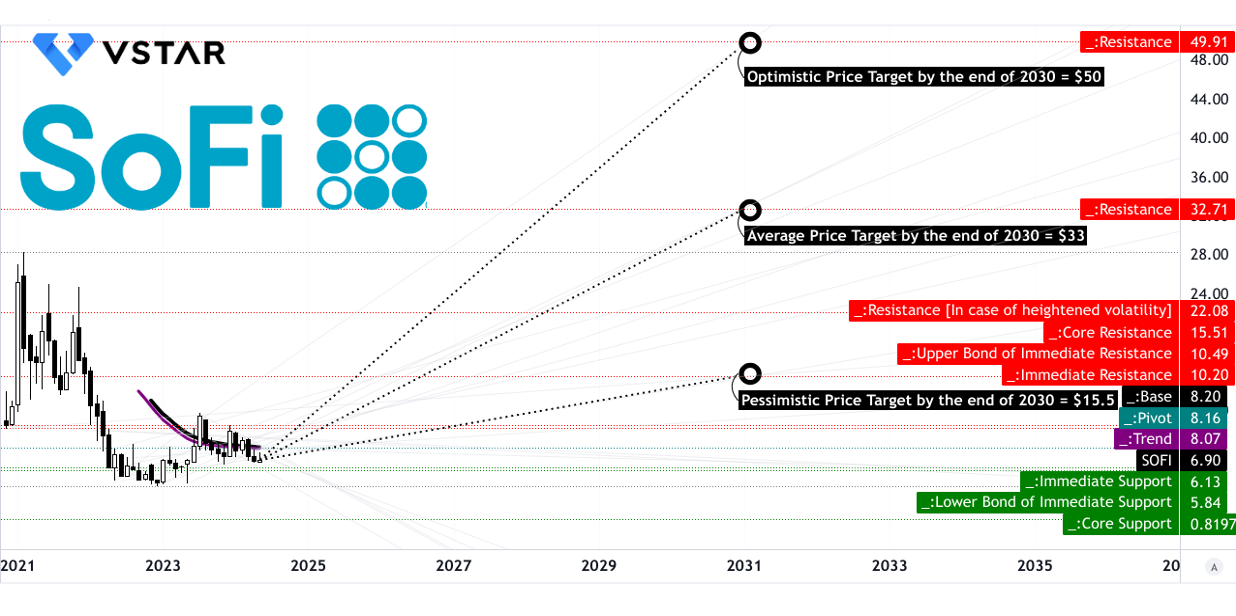

SoFi Technologies (SOFI) stock average price target is a bullish $33 by 2030. This is based on the idea that the recent change in momentum for SOFI will continue over the long term. An even more optimistic target of $50 is possible if the current upward swing keeps going. However, a decline is also a possibility, with a pessimistic target of $15.50.

There are certain price levels that could act as hurdles or buying opportunities in the future. The first one is right around the current price at $8.16. Higher resistance exists at $22.08, $15.51, and $32.71. On the flip side, support levels indicate areas where investors might be more likely to buy. Currently, there's only one identified support level at $5.84.

Source: tradingview.com

The RSI is at 45.35, indicating the stock is neither overbought nor oversold. Interestingly, there's a bullish divergence happening, where the RSI is rising even though the price isn't. This could signal a potential price increase despite the current sideways trend. The MACD indicator is also bullish, but with a caveat. While the overall trend is positive, the strength of the upward move seems to be weakening.

Source: tradingview.com

The predicted trajectory of SOFI stock varies between sources. Coincodex forecasts a steady increase, reaching $15.21 by 2030, reflecting a substantial 120.31% growth from 2029. Conversely, coinpriceforecast.com projects a more aggressive climb, hitting $17.09 by 2030 with a 153% gain.

Source: coinpriceforecast.com

A. Other SOFI Stock Forecast 2030 and Beyond Insights: Is SoFi a buy?

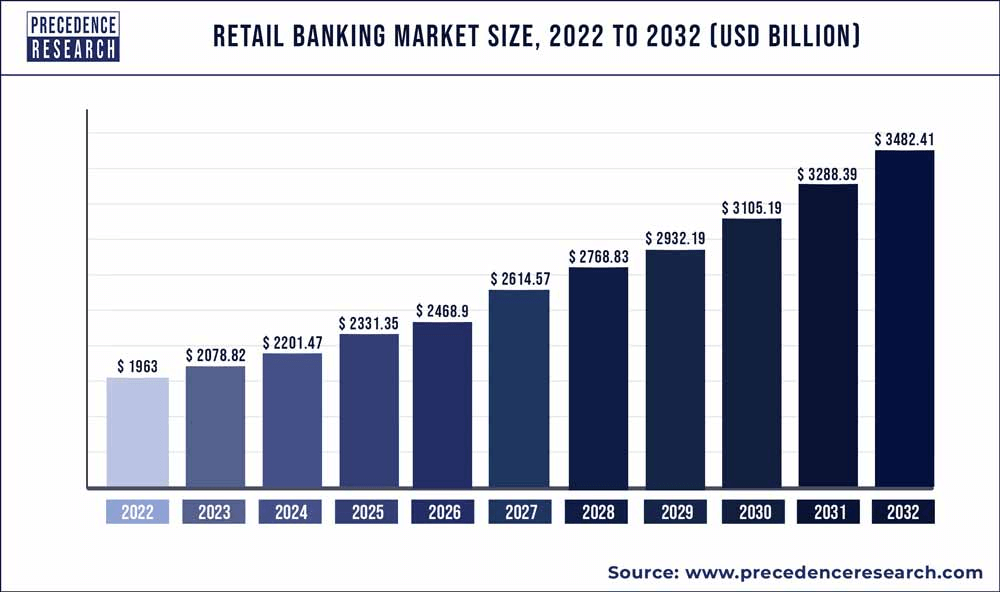

As per precedenceresearch.com, the global retail banking market may hit around $3.482.41 trillion by 2032 with a CAGR of 5.90% during 2023 to 2032. This serves as a key support to SoFi's topline growth over the long-term.

Source: precedenceresearch.com

B. Key Factors to Watch for SOFI Stock Price Prediction 2030 and Beyond

SOFI Stock Forecast 2030 and Beyond - Bullish Factors

Consistent Revenue and Earnings Growth: SoFi demonstrates strong revenue and earnings growth projections, with revenue expected to increase steadily through 2033. Consensus EPS estimates also show a positive trend, indicating the company's ability to generate profits.

Source: Seekingalpha.com

Diversification and Growth Strategy: SoFi's strategy to diversify its revenue streams beyond lending, notably through its Financial Services and Technology Platform segments, is yielding positive results. The company's focus on innovation, product development, and expanding its member base contributes to revenue diversification and long-term growth potential.

SOFI Forecast 2030 and Beyond - Bearish Factors

External Economic Factors: SoFi acknowledges external uncertainties, such as interest rate volatility, inflation, and macroeconomic conditions, which could impact its performance. Economic downturns or adverse market conditions may challenge revenue projections and profitability.

Lending Market Concerns: Despite SoFi's efforts to diversify revenue streams, lending remains a significant portion of its revenue. Slower growth in lending revenue and a conservative approach to originations suggest cautiousness in a competitive lending market, potentially limiting revenue growth compared to other segments.

Credit Performance: While SoFi maintains a focus on high-quality credit underwriting, credit performance metrics, such as delinquency rates and charge-off rates, warrant monitoring. Any deterioration in credit quality could lead to increased provisions for credit losses, impacting profitability.

V. Conclusion

A. SOFI Stock Outlook

SoFi Technologies stock price has been on a rollercoaster ride despite showing strong financial performance. 2024 predictions ranging from a low of $5.75 to a high of $10.25. Forecasts for 2025 paint a slightly more optimistic picture, ranging from $8.7 to $15.5. The long-term outlook, however, appears brighter, with forecasts for 2030 varying from a conservative $15.5 to a very optimistic $50. Several factors will influence this trajectory, including SoFi's own financial health, the broader economic climate, and the company's strategic direction. SoFi stock is a buy with systemic application of dollar cost averaging.

B. Trade SOFI Stock CFD with VSTAR

To mark an edge on the stock's volatility, it's important to remember that VSTAR, a trading platform, offers CFD trading opportunities. VSTAR provides institutional level trading experience with lowest trading fee, 0 commission, super tight spreads and deep liquidity along with super fast order execution.

FAQs

1. Will SoFi stock go up?

Analysts have mixed opinions, but there is a general positive sentiment with an average price target suggesting a potential upside.

2. What is the SoFi price target?

The average SoFi stock price target is around $9.07 to $9.32, indicating a potential increase from the current price.

3. What will SoFi stock be worth in 2025?

Estimates for SoFi stock in 2025 vary widely, with some predicting an average price of $2.94 and others predicting as much as $26.70.

4. What will SoFi stock be worth in 2030?

Predictions for 2030 also show a broad range, with average estimates around $4.82, and more optimistic forecasts suggesting a price of $52.00.