I. Recent Snowflake Stock Performance

Snowflake Eyed On AI Demand

Snowflake CEO Sridhar Ramaswamy announced that the company would strengthen its partnership with AI chip titan Nvidia. In a CNBC interview, Ramaswamy stated that Snowflake and Nvidia have formed a partnership on numerous projects to date and intend to undertake many more. The partnership between the two companies was extended in April to offer businesses a comprehensive AI platform. This collaboration will incorporate Nvidia's full-stack accelerated platform into Snowflake's Data Cloud, which features a secure AI and trusted data foundation.

Ramaswamy stated that demand for Snowflake's Cortex AI platform and Iceberg databases is already substantial. Additionally, he disclosed that the company would deliberate on artificial intelligence and novel product introductions during its forthcoming Data Cloud Summit conference the following month. Snowflake introduced Snowflake Arctic in April; it is a large language model intended for complex enterprise workloads and can generate responses to inquiries from vast amounts of text data.

Furthermore, Snowflake disclosed its intentions to procure technology assets and recruit 35 personnel from TruEra, an AI observability platform. TruEra software assists developers in monitoring and evaluating applications using large language models and other AI tools.

In general, Snowflake exhibited strong efficacy in its fundamental operations. Despite surpassing initial revenue projections, the revised guidance for the year suggests that anticipated profit margins remain stagnant. Nevertheless, the marginal upswing in anticipated product development from 22% to 24% annually indicates that Snowflake is regaining stability after a difficult quarter.

SNOW Quarterly Earnings Remained Steady

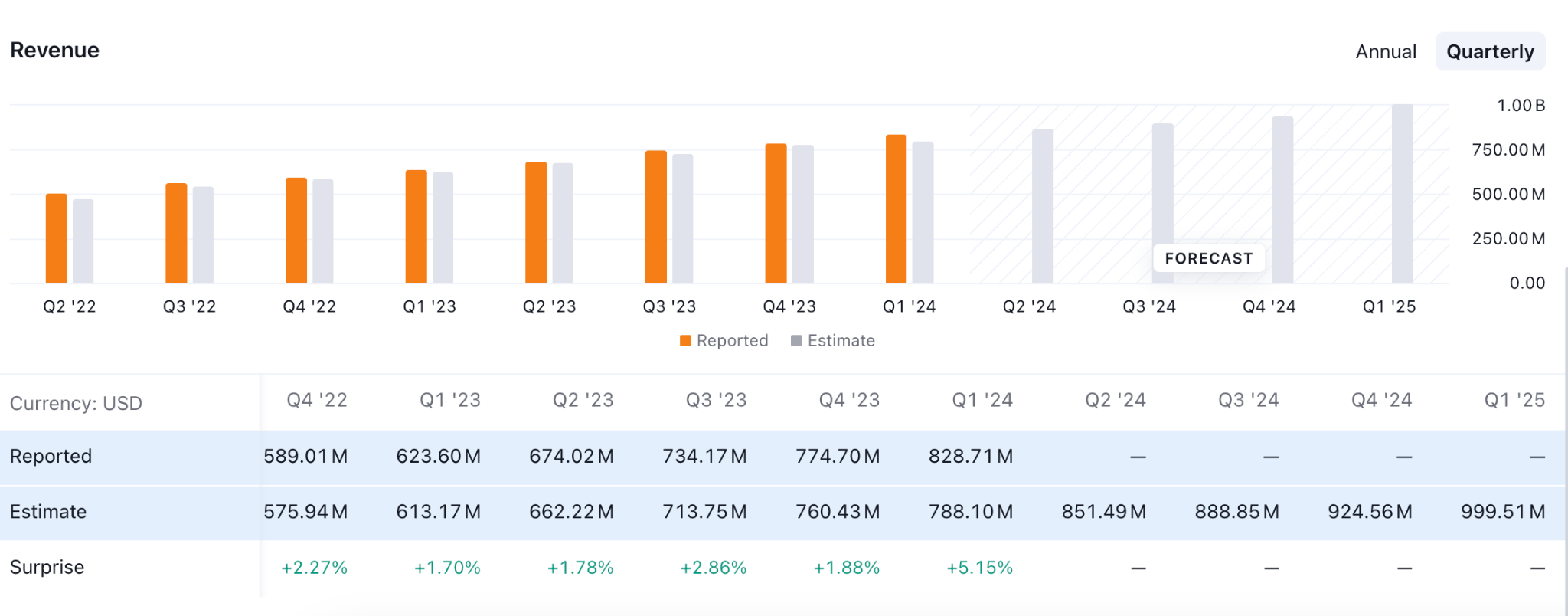

Snowflake reported 33% year-over-year revenue growth to $828.7 million and 34% product revenue growth to $789.6 million for the quarter ending April 30, exceeding Wall Street's expectations. The Snowflake revenue retention rate declined from 151% in the corresponding quarter of the previous year and 131% in January to 128%.

Adjusted earnings per share fell 6% annually to 14 cents, below the analysts' consensus estimate of 15 cents.

Wall Street received Snowflake's revised product revenue guidance for fiscal year 2025. Snowflake has revised its product revenue forecast from $3.25 billion to $3.3 billion for the fiscal year from February 1, 2024, to January 31, 2025. In contrast, the organization altered its operating income forecast for the entire year. Non-GAAP operating margins are now anticipated at 3%, a decrease from the projected 6% and the previous year's 8%.

Product revenue for the second quarter is anticipated to range from $805 million to $810 million, exceeding analysts' average forecast of $785 million.

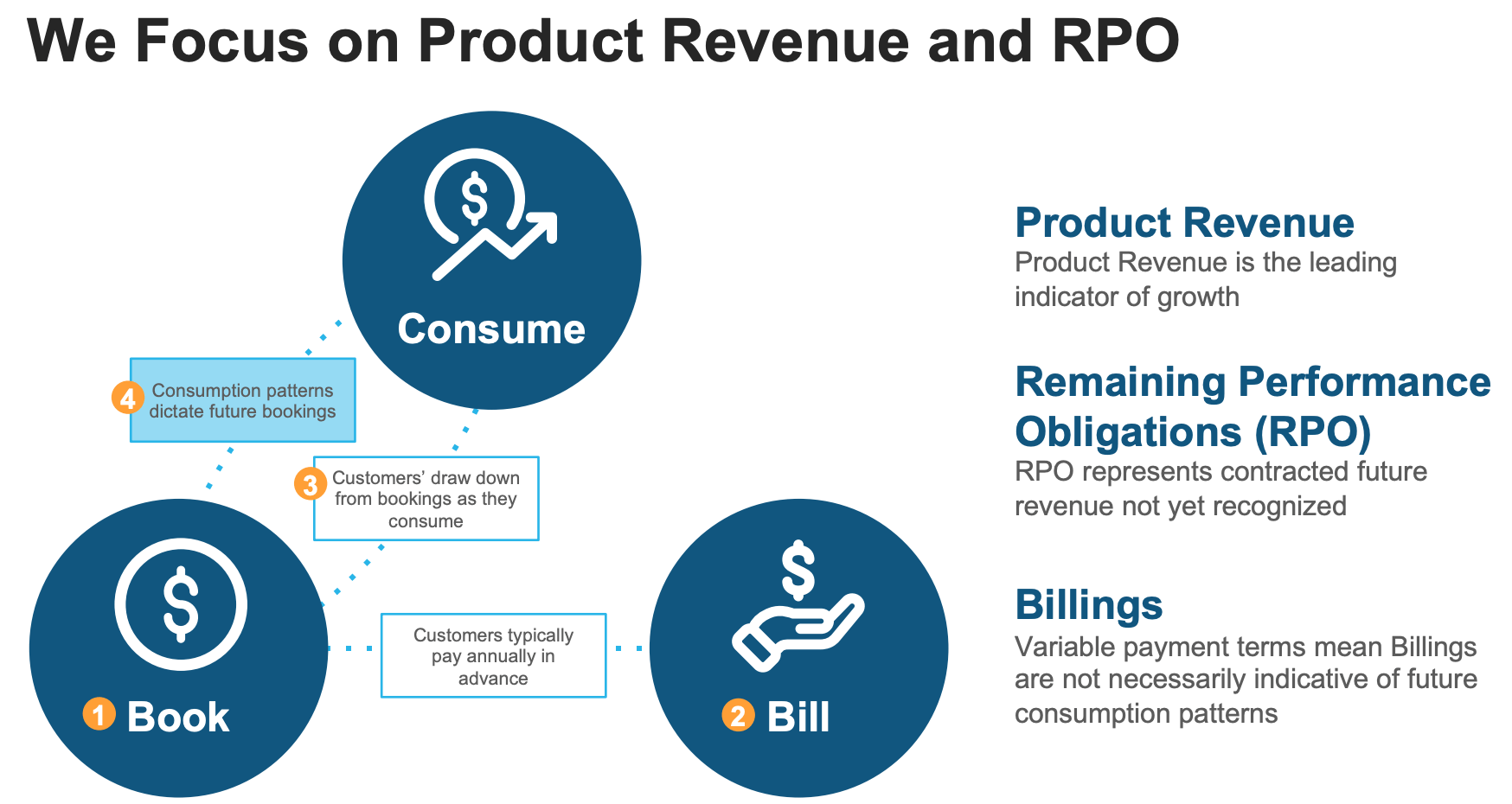

SnowFlake RPO

Snowflake and other subscription software companies include remaining performance obligations (RPO) in their financial statements. Snowflake disclosed an RPO of $5 billion for the latest quarter, indicating a marginal decline from $5.2 billion in the fiscal fourth quarter of 2024, yet a noteworthy year-on-year growth of 46%. This signifies a substantial surge in prospective business in comparison to the corresponding period of the previous year.

The primary insight is that customers, who were previously hesitant to make long-term commitments, are now swiftly increasing Snowflake's RPO, and management observes a resurgence in long-term customer commitment. The news is extraordinarily favorable for investors.

Expert Insights on SNOW Stock Forecast for 2024, 2025, 2030 and Beyond

The recent collaboration and implementation of Artificial Intelligence could be a strong buying factor for SNOW.

Before proceeding further, let's see what analysts think about SNOW Stock Forecast for 2024, 2025, 2030, and Beyond:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$174 |

$228 |

$380 |

|

Coincodex |

$196.19 |

$155.30 |

$151.22 |

|

Stockscan |

$164.13 |

$233.39 |

$22.72 |

II. SNOW Stock Forecast 2024

Snowflake stock (SNOW) remains under pressure as the current price hovers at a record low level. Considering the bullish break of structure, we may expect the SNOW share price to correct higher at the 180.00 level by the end of 2024.

The ongoing bearish pressure is potent in the weekly SNOW price as the current price hovers below the 100-week SMA line. Moreover, the near-term price action suggests a consolidation, from where a potential breakout could signal an impulsive wave.

Looking at technical indicators, the 20-week Exponential Moving Average is the near-term resistance. This average is in line with the 100 SMA line, providing an additional bearish signal.

On the other hand, there is recent buying pressure with a bullish break-of-structure above the 192.76 level. After a new high, the SNOW share price dropped and reached the near-term demand zone. In that case, investors should closely monitor how the price trades at the near-term order block from where a bullish trend trading signal might come after a valid price action.

Based on the SNOW Stock Forecast 2024, an upward pressure with a valid weekly close above the 168.38 high could be a potential bullish opportunity, targeting the 180.00 level.

On the other hand, the rising trendline support acts as a major barrier for sellers, and a sell-side liquidity sweep from the 138.00 to 120.00 zone could be another long signal.

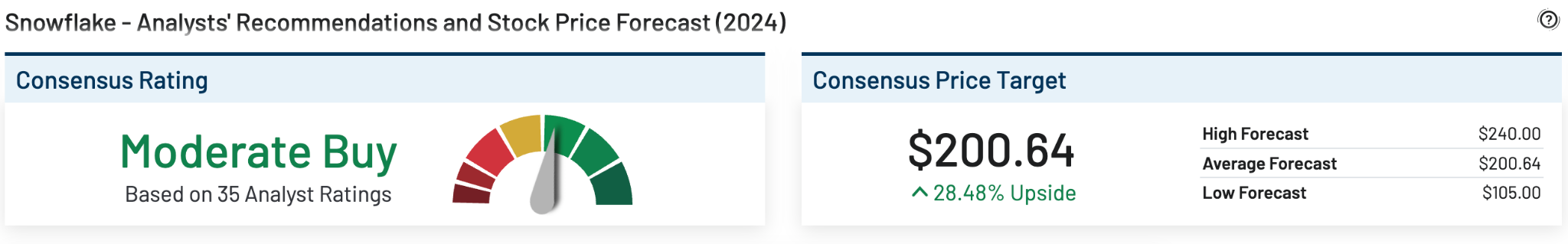

A. Other Snowflake Stock Forecast 2024 Insights: SNOW stock buy or sell?

Source: marketbeat

According to a report from marketbeat, there is a moderate buy signal in SNOW stock, as provided by 35 analysts. However, the highest target of the buying possibility is $240.00 level by the end of 2024, while the lowest forecasted Snowflake price target is $105.00.

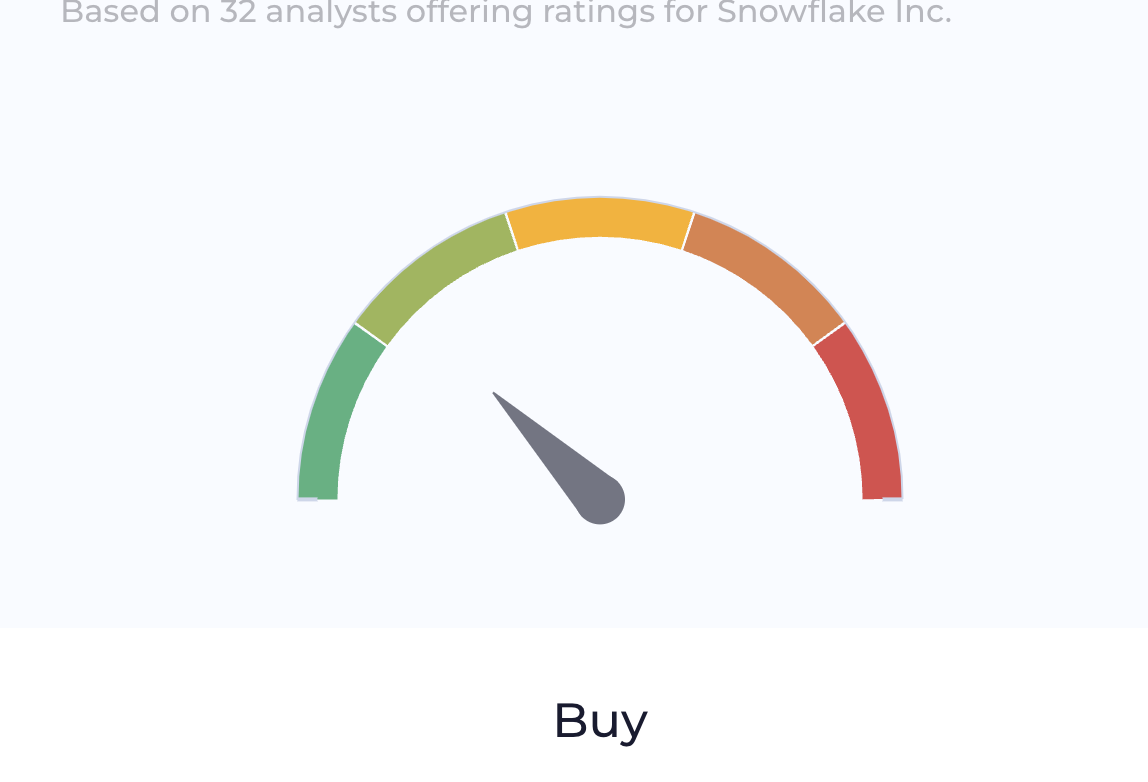

Souce: wallstreetzen

Another report from Wallstreetzen suggests another moderate buy signal, where the highest SNOW price target is $240.00 level. Among forecasts, 13 analysts showed a strong buy signal, while 10 analysts were medium buy with hold signals by 10 analysts.

Also, a specified analysts projection is also available in the Wallstreetzen as shown below:

B. Key Factors to Watch for SNOW Stock Prediction 2024

Snowflake EPS Forecast

In the EPS forecast, SNOW showed a moderate buy signal as the upcoming reports are expected to remain flat compared to Q1 2024.

As per the latest report, the forecasted EPS was $0.18, while the actual report came at $0.14. The forecasted EPS for Q2 and Q4 of 2024 are expected to come at $0.16, where any upbeat result could be a potential long signal for Snowflake stock.

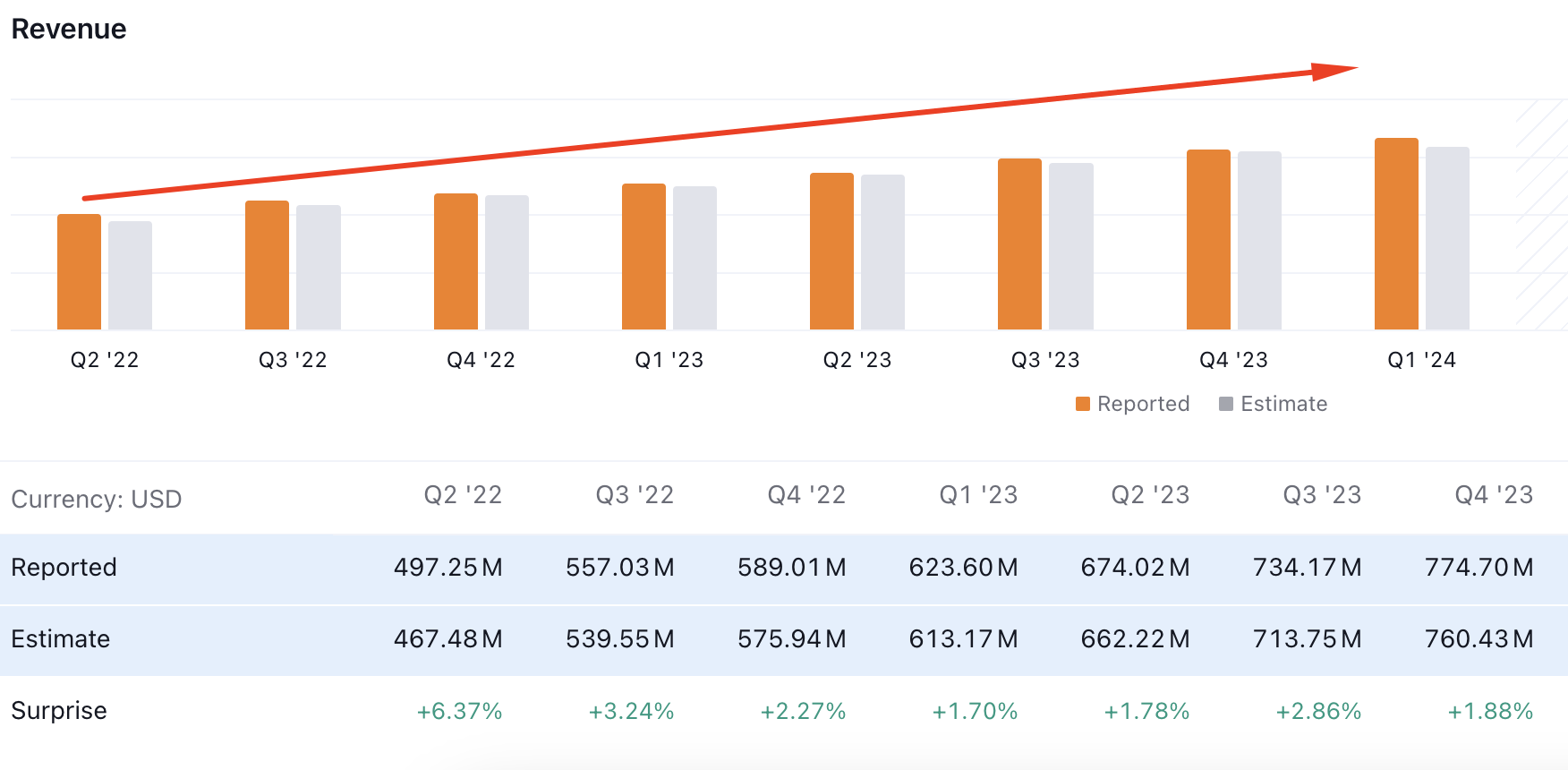

Snowflake Revenue Forecast

Despite the flat EPS forecast, SNOW is expected to maintain the growth in revenue. As per the latest report, the revenue maintained the growth, while the latest report showed a 5.15% growth, which is higher than the last 5 quarters.

If the company maintains the growth in the coming quarters, we may expect SNOW stock price to grow higher.

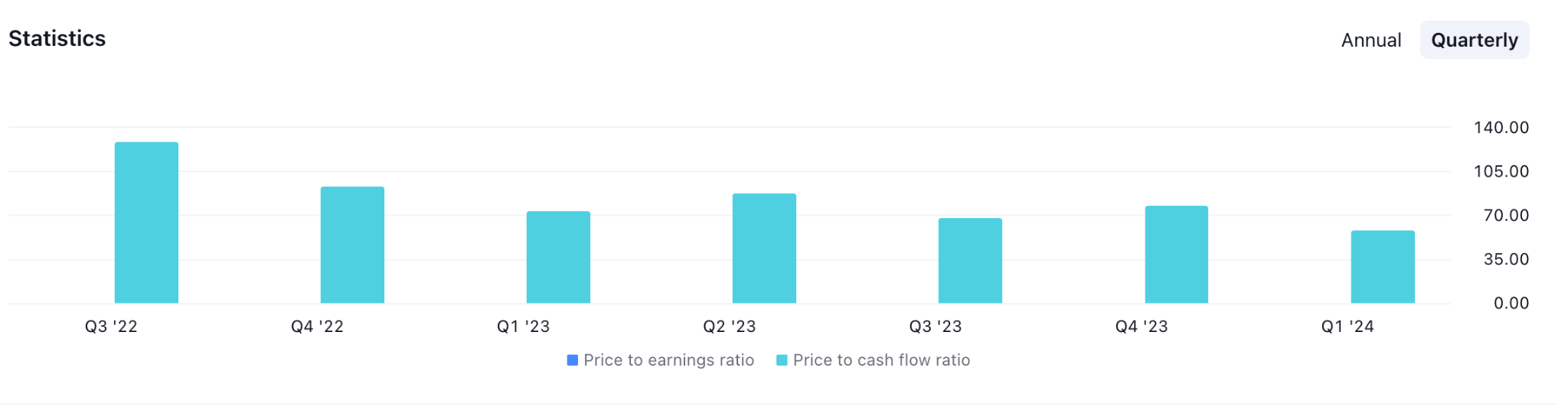

Snowflake Price To Cash Flow Ratio

The P/CF ratio suggests potential investment valuation, which could be a crucial indicator for determining a stock price. As per the current reading, SNOW maintained a stable P/CF ratio, and a surge above the 70.00 level could be a long signal.

SNOW Stock Price Prediction 2024 - Bullish Factors

The first bullish factor for Snowflake stock is the recent revenue report, where upbeat results indicate a potential business activity. However, when considering a buy, the ideal revenue growth is 20% or above, which has not been met yet. In that case, the upcoming earnings report should be monitored to find a suitable buying position.

Other bullish factors are as mentioned:

- Snowflake's growing list of high-profile customers, including Fortune 500 companies, highlights its robust market position and potential for continued revenue increases.

- Strategic acquisitions and partnerships with cloud providers like AWS, Microsoft Azure, and Google Cloud can further enhance Snowflake's offerings and market reach.

- With substantial cash reserves, Snowflake's strong balance sheet allows for continued investment in R&D, marketing, and strategic acquisitions. This financial strength supports long-term growth initiatives.

Snowflake Stock Prediction 2024 - Bearish Factors

- Snowflake is currently being valued excessively in comparison to its revenue and earnings. If the market deems it overvalued, negative pressure may be exerted on Snowflake stock, particularly if growth rates decelerate or the prevailing market sentiment shifts toward risk aversion.

- Prominent cloud service providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, each providing data warehousing solutions, present formidable competition for Snowflake. These Snowflake competitors' considerable resources and customer bases may impede the expansion of Snowflake market share.

- The potential emergence of novel technologically advanced competitors may cause Snowflake to face market disruption and gradually lose its competitive edge.

III. Snowflake Stock Forecast 2025

In the weekly SNOW forecast, the ongoing downside pressure is potent, which needs to be properly validated by a stable market above the 180.00 level. Successful bullish pressure could extend the price above the 220.00 level by the end of 2025.

In the weekly price, SNOW trades within a strong downside pressure, where the recent price grabbed buy-side liquidity from the 192.76 high with a bearish counter-impulsive momentum. Moreover, the 20-week EMA is above the current price, which suggests an ongoing bearish pressure.

In the current context, the most recent price hovers above the 138.76 support level, which could be a major barrier to bulls. Moreover, the most recent selling pressure from the 227.84 high is backed by an ongoing bearish trend initiated from the 2021 high, which could result in a bearish trend continuation at any time.

Based on the Snowflake Stock Forecast 2025, a bearish weekly candle below the 138.00 level might find the 110.58 level as valid support. However, a bull market in 2025 needs a proper bottom formation from the 110.00 area.

On the bearish side, a downside continuation below the trendline support could lower the price below the 100.00 psychological line.

A. Other Snowflake Stock Price Prediction 2025 Insights: Is Snowflake a buy?

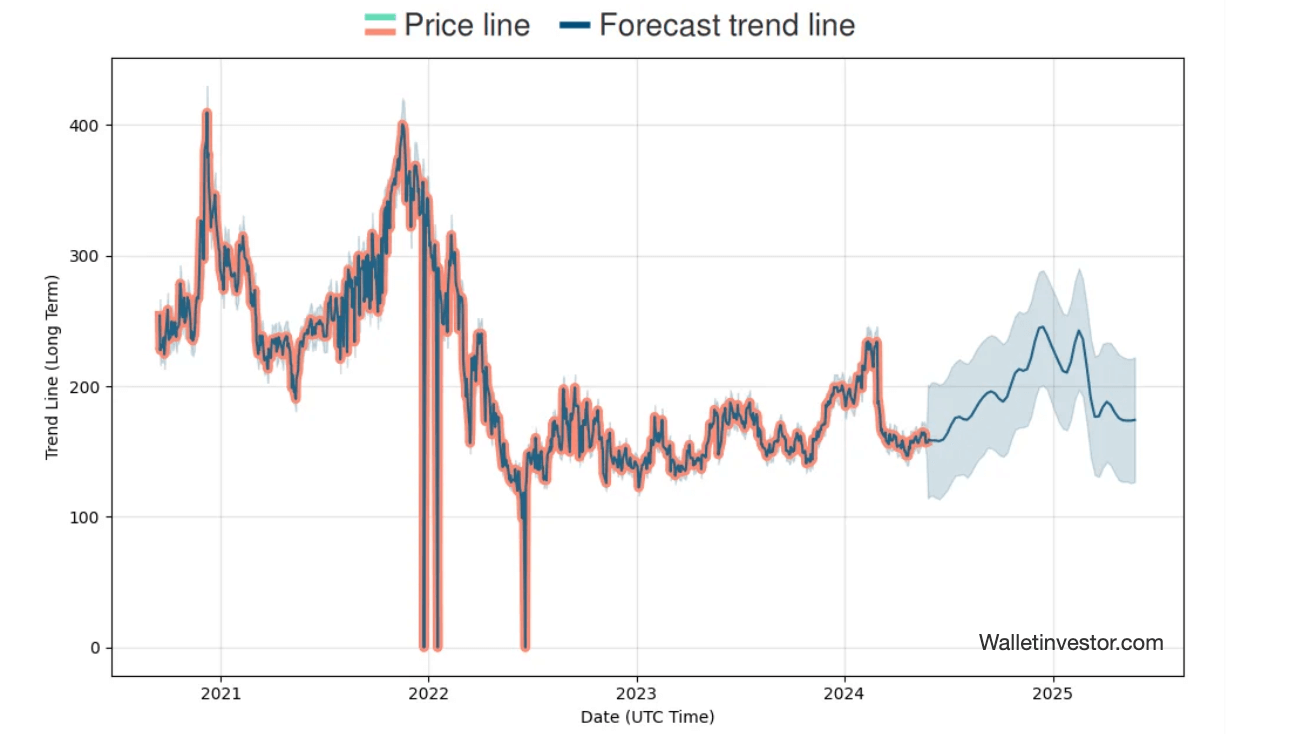

Souce: walletinvestor

According to a recent report from the Walletinvestor, Snowflake stock is forecasted to remain corrective in the coming years, where the highest forecasted level in 2025 is 220.00. After reaching the peak, SNOW stock is expected to correct lower and dip down below the 200.00 psychological line by the end of the year.

Souce: marketwatch

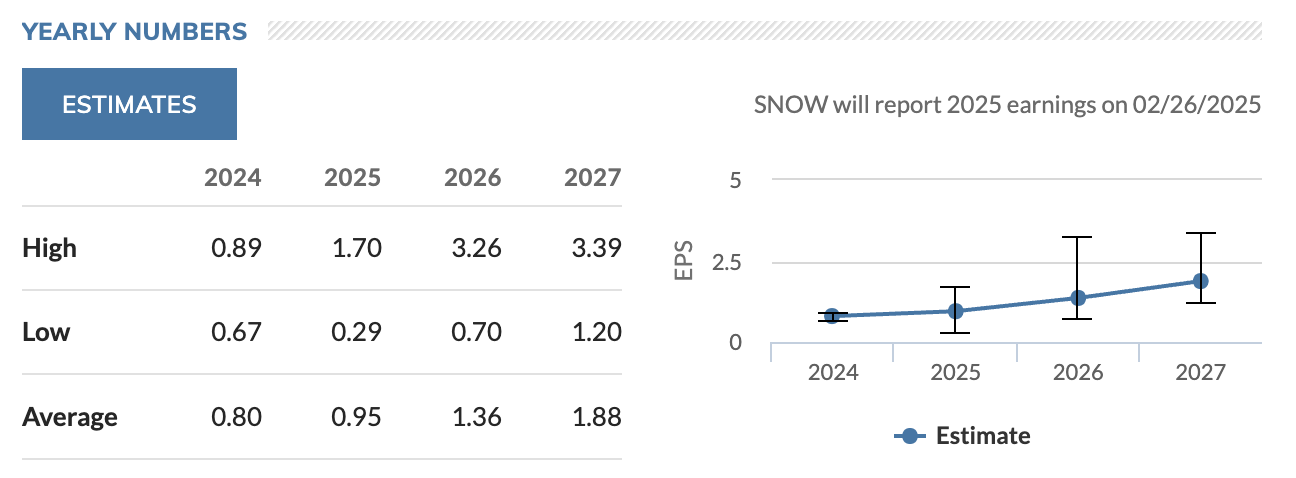

Another report from Marketwatch suggests that an upbeat SNOW earnings report in 2025 will have a positive result, with an upward curve in the earnings report. As per analysts' projections, the Earnings Per Share could reach up to $1.70 in 2025 before reaching $3.26 per year in 2026.

B. Key Factors to Watch for SNOW Stock Forecast 2025

SNOW Earnings Forecast 2025

According to the current earnings forecast for SNOW, the upcoming Snowflake earnings report might continue growing after 2025. As per the current report, the EPS forecast for 2025 is $1.00, which is higher than 2024's $0.63.

In that case, an upbeat SNOW stock earnings report in 2024 and 2025 could be a bullish factor for SNOW stock.

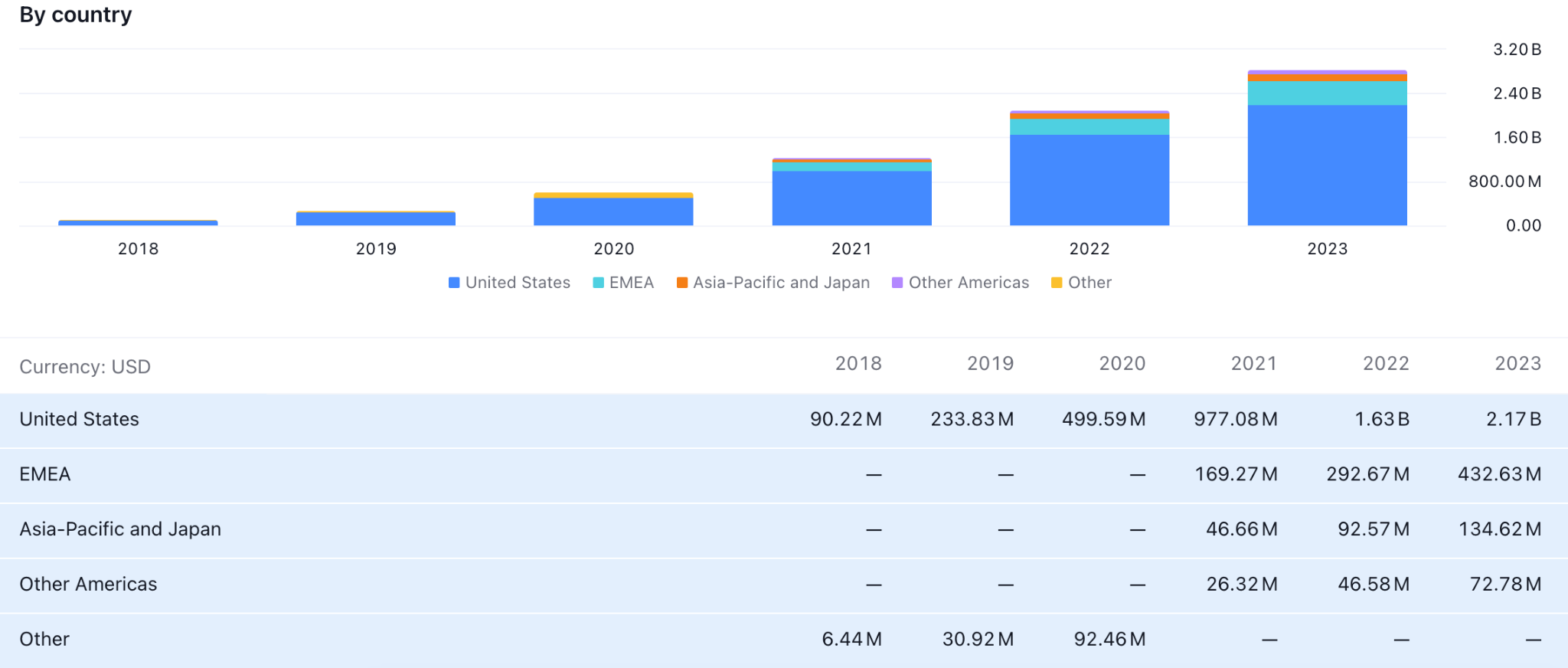

SnowFlake By Country Revenue Segment

According to recent full-year reports, SNOW has the largest revenue segment in the US. In 2023, revenue from the US came to $2.17 billion, which is the highest number in previous years. Therefore, we may expect Snowflake company's revenue to be influenced by US macroeconomic factors. Primarily, the interest rate decision and the Federal Reserve's monetary policy could directly affect the SNOW stock price in 2024 and 2025.

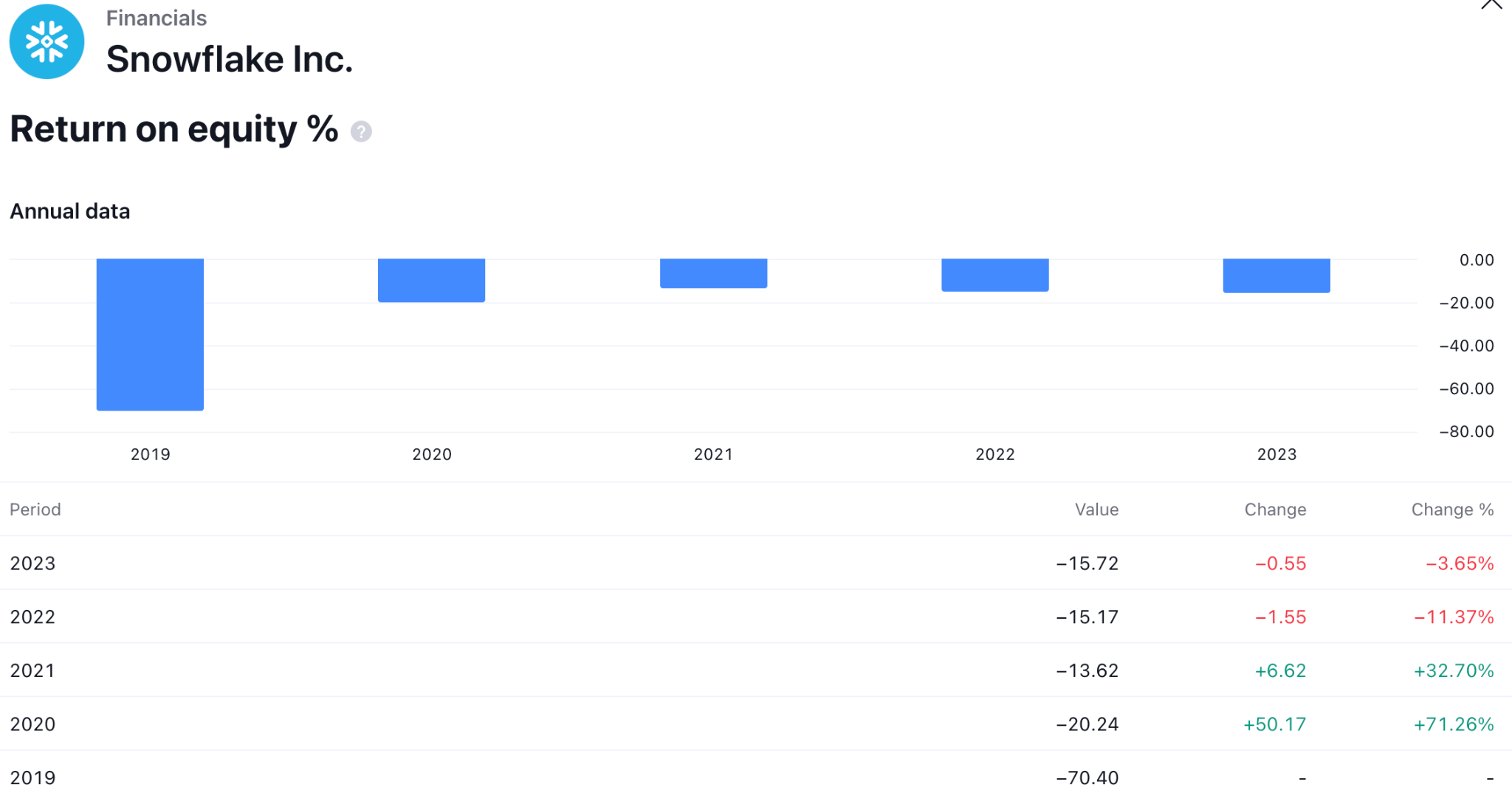

SnowFlake Return On Equity Analysis

The return on equity for Snowflake failed to show a positive outlook in recent years. The return on equity measures the company's net income divided by its shareholders' equity. As the current numbers are negative, we may consider shareholders' returns to be negative.

However, the ROE number was lowest in 2019, when it kept rising. The latest data for 2023 is -15.72, which is still in a negative zone. In that case, we may expect a stable gain from Snowflake stock once the ROE exceeds the neutral point and reaches the positive zone.

SNOW Stock Prediction 2025 - Bullish Factors

- Snowflake has demonstrated consistent revenue growth, with a notable increase in year-over-year revenue. The company's most recent earnings report showed impressive growth figures, underscoring its ability to scale and attract new customers. The management's decision to expand the revenue would be a crucial factor to look at to gauge the upcoming revenue forecast.

- Snowflake's innovative Data Cloud platform, which allows seamless data sharing and collaboration across various cloud environments, has been a key differentiator. Continued enhancements and new features could attract more customers.

- Developing tailored solutions for specific industries, such as healthcare, finance, and retail, can help Snowflake capture niche markets and differentiate itself from competitors.

Snowflake Stock Prediction 2025 - Bearish Factors

- With maturation, Snowflake's growth rate may decelerate. The company's inability to sustain its historically robust growth rates may result in diminished investor confidence and a subsequent decline in stock valuation.

- Revenue projections could be adversely affected by decreases in expansion rates among existing customers or slower-than-anticipated growth in new customer acquisitions.

- Geopolitical tensions, economic recessions, inflation, or rising interest rates may all result in organizations' decreased IT expenditures, which could impact Snowflake's revenue growth. Organizations may opt to postpone or curtail their expenditures on cloud data solutions in times of economic instability.

- Prolonged market volatility and changes in investor sentiment concerning high-growth technology stocks have the potential to induce substantial fluctuations in stock prices.

IV. SNOW Stock Forecast 2030 and Beyond

SNOW remains under pressure due to the ongoing selling pressure. However, a bullish reversal from the channel breakout could be a potential long opportunity, targeting the $405.00 level by the end of 2030.

In the monthly time frame, the overall market momentum is bearish, where the most recent price remains within an ascending channel. As the existing market trend is bearish, any downside continuation from the channel breakout could be a valid short opportunity in SNOW stock.

In the long-term projection, SNOW stock price hovers below the most significant level since the inception, which also indicates a confluence bearish signal.

Based on the SNOW Stock Forecast 2030 and Beyond, investors should closely monitor how the price trades at the near-term channel support, from where a valid bottom formation is pending. The first buy signal might come after having a bearish pressure below the 110.68 support level with an immediate bullish reversal. However, the conservative bullish approach for Snowflake stock is to find a bullish impulse and go long once the re-accumulation phase is over.

In both cases, the primary aim for SNOW stock is to test the 300.00 psychological line. Moreover, a stable market above the 237.34 resistance level could extend the buying pressure above the 405.00 level by the end of 2030.

A. Other Snowflake Stock Price Prediction 2030 and Beyond Insights: Snowflake stock buy or sell?

According to a report from Nasdaq.com, Snowflake earned $2 billion in yearly revenue from a clientele of 7,828 clients. However, management anticipates the company's addressable market reaching $248 billion by 2026. Snowflake is in its nascent stages of venturing into global markets, as evidenced by the fact that 81% of its revenue is generated in the Americas.

Although investors may hold high hopes for 2030, Snowflake is strategically positioned to establish itself as a dominant force in the data industry over the long term, rendering it a financially secure investment option for the foreseeable future.

Another report from 247wallst, suggests that Snowflake has successfully instilled tremendous investor confidence in its development prospects and business strategy. Its promising future is predicated on its groundbreaking data platform, considerable market potential, and the pervasive digital transformation in numerous industries. In conjunction with a positive financial performance trend, SNOW stock price may increase substantially by 2030.

Based on the company's sustained revenue growth and margin expansion, which sustain an average annual growth rate of 25% until 2030, the projected earnings per share (EPS) in 2030 could approximate $5.00, compounded annually from the 2024 base. Based on a moderate price-to-earnings (P/E) ratio of 50 for 2030, which is below the current P/E of 209 but takes into consideration valuation compression over time, the prospective stock price in 2030 could be calculated as follows: 2030 EPS ($5.00) multiplied by 2030 P/E (50) equals $250.

In light of anticipated growth over the subsequent half-decade, the outlook indicates that Snowflake stock price could reach approximately $250 by 2030. However, the precise value will be contingent upon forthcoming events.

B. Key Factors to Watch for Snowflake Stock Forecast 2030 and Beyond

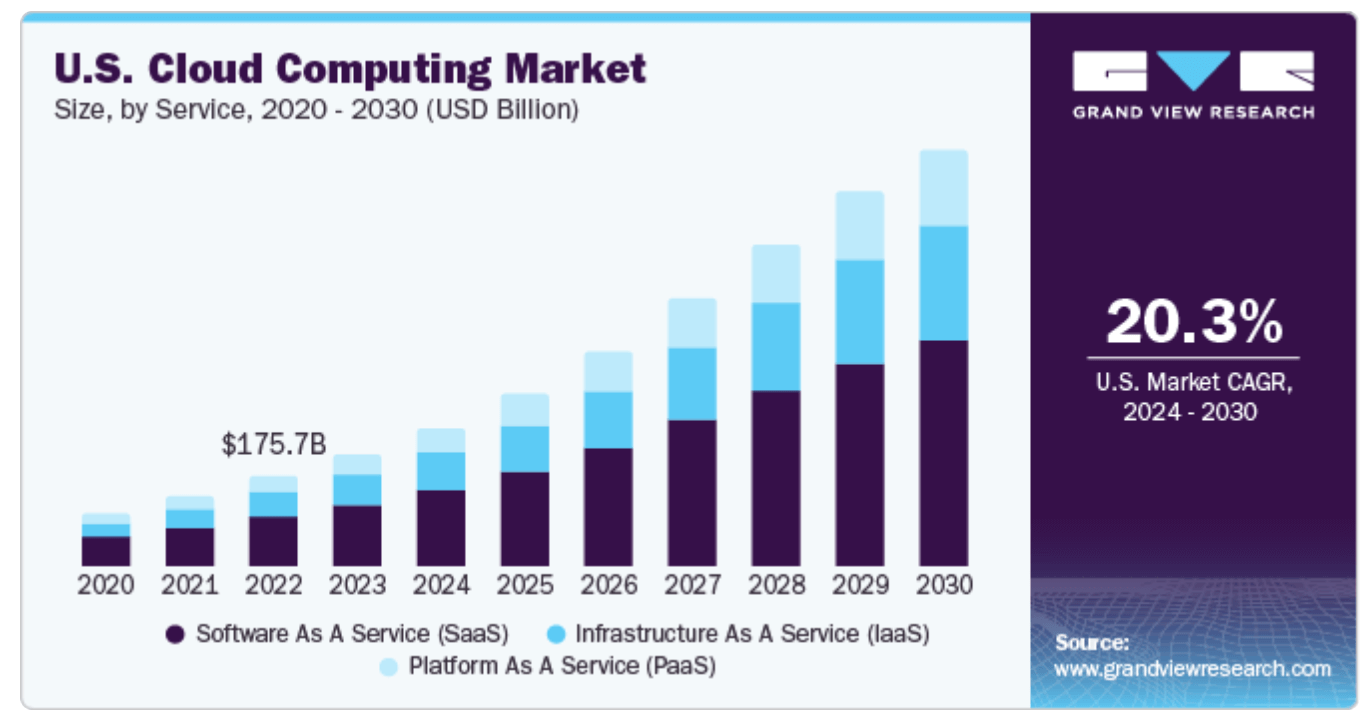

SNOW Cloud Computing Segment

Snowflake showed a remarkable surge in cloud-based data platforms, with the latest full-year revenue for the cloud-based segment coming in at $2.67 billion in 2023.

Moreover, the upcoming earnings report could be positive, as the cloud-based business could surge in the coming year. According to the current projection, the cloud-based business's market cap could grow by 20% yearly.

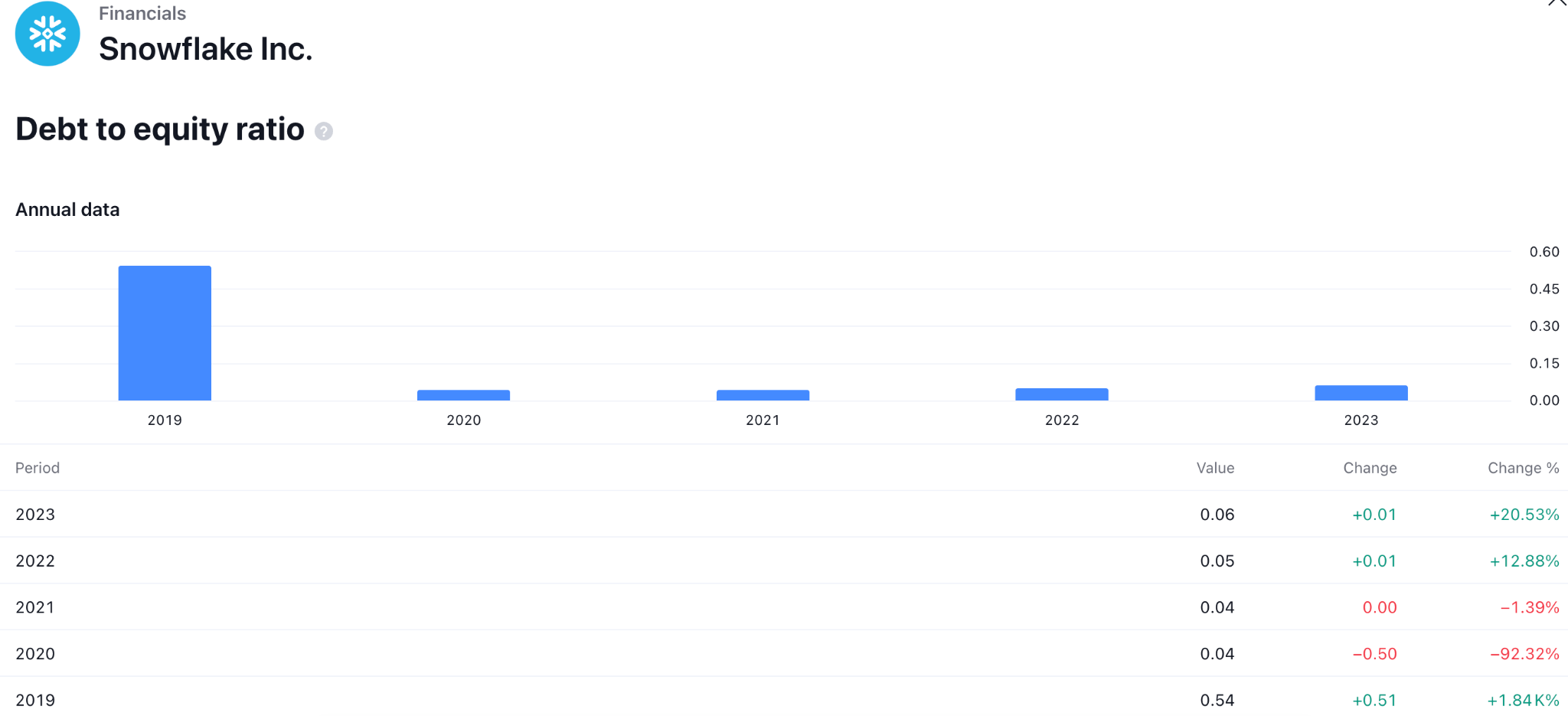

SNOW Debt To Equity Analysis

The debt-to-equity ratio is used to assess a company's financial leverage and measure the extent to which it is financing its operations through debt versus wholly-owned funds.

As per the current observation, SNOW has a positive outlook. Its debt-to-equity ratio rose from 0.04 to 0.06 from 2020 to 2023 for the full year. If the company maintains its growth, we may expect SNOW stock price to grow in the long term.

Snowflake Forecast 2030 and Beyond - Bullish Factors

- The market for cloud data warehouses is anticipated to expand significantly in the coming years due to factors such as the proliferation of cloud computing, big data analytics, and the Internet of Things. Snowflake, as a market leader in this industry, is strategically positioned to capitalize on this expansion.

- With its cloud-based architecture, Snowflake can scale to satisfy businesses' expanding data requirements. Furthermore, its architecture prioritizes efficiency, allowing users to efficiently and rapidly query extensive datasets.

- Snowflake has gained recognition for its pioneering efforts in data warehousing. The ongoing allocation of resources to research and development can enable the company to maintain a competitive edge and introduce novel attributes and functionalities that appeal to its clientele.

SNOW Stock Prediction 2030 and Beyond - Bearish Factors

- Amazon Redshift, Microsoft Azure Synapse Analytics, and Google BigQuery, among other major competitors in the cloud data warehousing industry, regularly compete for market share. This competition may exert pricing and margin pressure on Snowflake.

- Snowflake's infrastructure predominantly depends on cloud service providers such as Amazon Web Services (AWS) and Microsoft Azure. A potential consequence of price increases or modifications to service terms by these providers is a potential decline in Snowflake's profitability.

- The landscape of data warehousing is constantly changing. Emerging technologies may threaten Snowflake's existing business model. Innovativeness and adaptability are required for the business to remain ahead of the curve.

V. Conclusion

A. Snowflake Stock Outlook

Despite recent price pressures, Snowflake's strategic advancements in AI and partnerships, particularly with Nvidia, set a strong foundation for future growth.

Let's see the price forecast for SNOW stock:

- 2024: Analysts have varied price targets, with estimates ranging from $105 to $240. A bullish breakout could push the price to around $180 by the end of 2024, assuming the company can leverage its recent partnerships and maintain its growth momentum.

- 2025: The forecast for 2025 suggests that Snowflake stock could reach as high as $220. This assumes the company can continue expanding its product offerings and sustain its revenue growth.

- 2030: Long-term projections are particularly optimistic. Assuming a compounded annual growth rate of 25%, the estimated EPS for 2030 could be around $5.00. With a moderate P/E ratio of 50, this could place SNOW stock price at approximately $250 by 2030.

B. Trade SNOW Stock CFD with VSTAR

If you're considering trading SNOW stock CFDs (Contracts for Difference), VSTAR offers some features that might be appealing:

- CFD trading allows you to magnify your potential returns with proper leverage.

- Perform your trading activity under a multiple-regulated broker where the fund's security is a primary object.

- The mobile app allows investors to trade with maximum portability, buying and selling a trading instrument at any time, anywhere.

- Under SNOW CFDs, traders can benefit from both selling (short) and buying (long).

- Expand the trading portfolio in other stocks, indices, precious metals, commodities, currency pairs, and cryptocurrencies.

Snowflake's potential for significant growth, driven by its pioneering data platform and strategic initiatives, positions it well in the competitive landscape of cloud data warehousing. This presents both opportunities and risks for investors considering Contracts for Difference (CFDs).

FAQs

1. Is Snowflake a good stock to buy now?

Snowflake Inc. (SNOW) is currently rated as a Zacks Rank 3 (Hold), indicating that it is expected to perform in line with the market in the near term.

2. What will SNOW stock be worth in 5 years?

Forecasts suggest that SNOW stock could reach around $405 by 2030.

3. What is the future of SNOW stock?

The future of SNOW stock shows potential for growth, with analysts giving it a consensus rating of Moderate Buy. The company is also seen as a strong player in the Generative AI market.

4. Who are the biggest investors in Snowflake?

The largest institutional shareholders include Vanguard Group Inc. and Blackrock Inc. Iconiq Strategic Partners V LP is the largest individual Snowflake shareholder.