I. Recent Roku Stock Performance

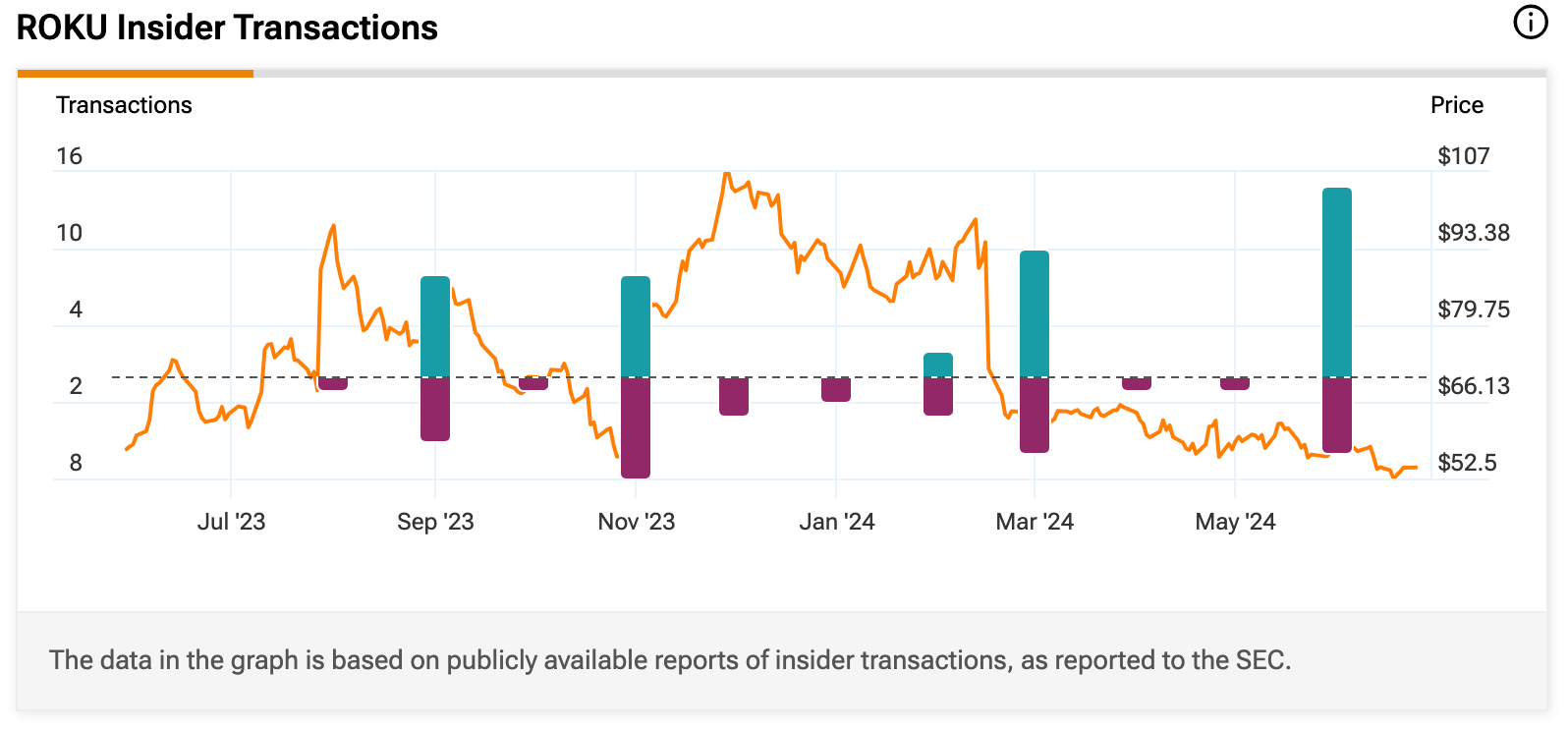

Roku Insider Trading

Investors frequently examine insider transactions to evaluate executives' perspectives on the stock's value and future. However, executives' perspectives on the company's future performance are not the sole determinant of the impact of such transactions.

Source: tipranks

According to a recent SEC filing, Stephen H. Kay, Roku Inc.'s Senior Vice President, General Counsel, and Secretary, sold $189,652 of the company's stock.

The filing also disclosed that on June 3, 2024, Roku withheld shares valued at $222,257 for $57.94 per share to satisfy income tax obligations associated with the vesting of restricted stock units (RSUs).

Kay's stock sales were executed by a pre-arranged 10b5-1 trading plan. This plan enables corporate personnel to dispose of shares at predetermined intervals, alleviating insider trading concerns.

Due to these transactions, Kay's direct holdings in Roku consist of 82,036 Class A Common Stock shares, which reflect the adjustments made post-sale and post-RSU vesting.

Roku's Move-On Streaming Business

Source: newsroom.roku.com

In the streaming industry, Roku Inc. has recently made strategic advancements. The company announced an expanded partnership with iSpot.tv to improve the measurement and optimization of ads for its advertisers. The reliable metrics that this collaboration will provide advertisers will highlight the distinct reach of ads on Roku's platform. In addition, to guarantee the authenticity of video ad inventory, iSpot.tv will incorporate Roku's Advertising Watermark technology.

In addition, Roku has collaborated with The Trade Desk (TTD) to improve the TV streaming advertising experience. This partnership offers advertisers enhanced resources for planning, purchasing, and evaluating advertising campaigns on streaming media.

Roku Advertisement Solution

Source: newsroom.roku.com

Roku Inc. (ROKU) recently introduced Roku Exchange, an innovative advertising technology platform. Utilizing Roku's extensive data and AI-driven optimization, this new solution enhances campaign performance by connecting premium ad inventory with advertiser demand.

The Roku Exchange is a central hub for supply integrations, equitable auctions, and ad decision-making within the Roku platform. It collaborates with Magnite's supply-side platform to engage with the broader programmatic landscape. Audience-based ad decisioning for various ad formats, programmatic access to inventory and identity data, and rich content signals for enhanced transparency and optimization are among the potent tools the platform provides to advertisers. AI-driven personalization further enhances audience engagement, which provides personalized ad experiences.

Expert Insights on ROKU Stock Forecast for 2024, 2025, 2030 and Beyond

Roku stock (ROKU) trades marginally low from where there is an open space to increase the share price towards the all-time high level.

Before proceeding to the in-depth ROKU Stock Forecast for 2024, 2025, 2030 and Beyond, let's see what analysts think about Roku stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$56.29 |

$79.60 |

$153.53 |

|

Coincodex |

$ 57.35 |

$ 95.98 |

$ 1,633.10 |

|

Stockscan |

$146.48 |

$217.91 |

$57.82 |

|

Coinlib |

$135.82 |

$230.29 |

$3,263.86 |

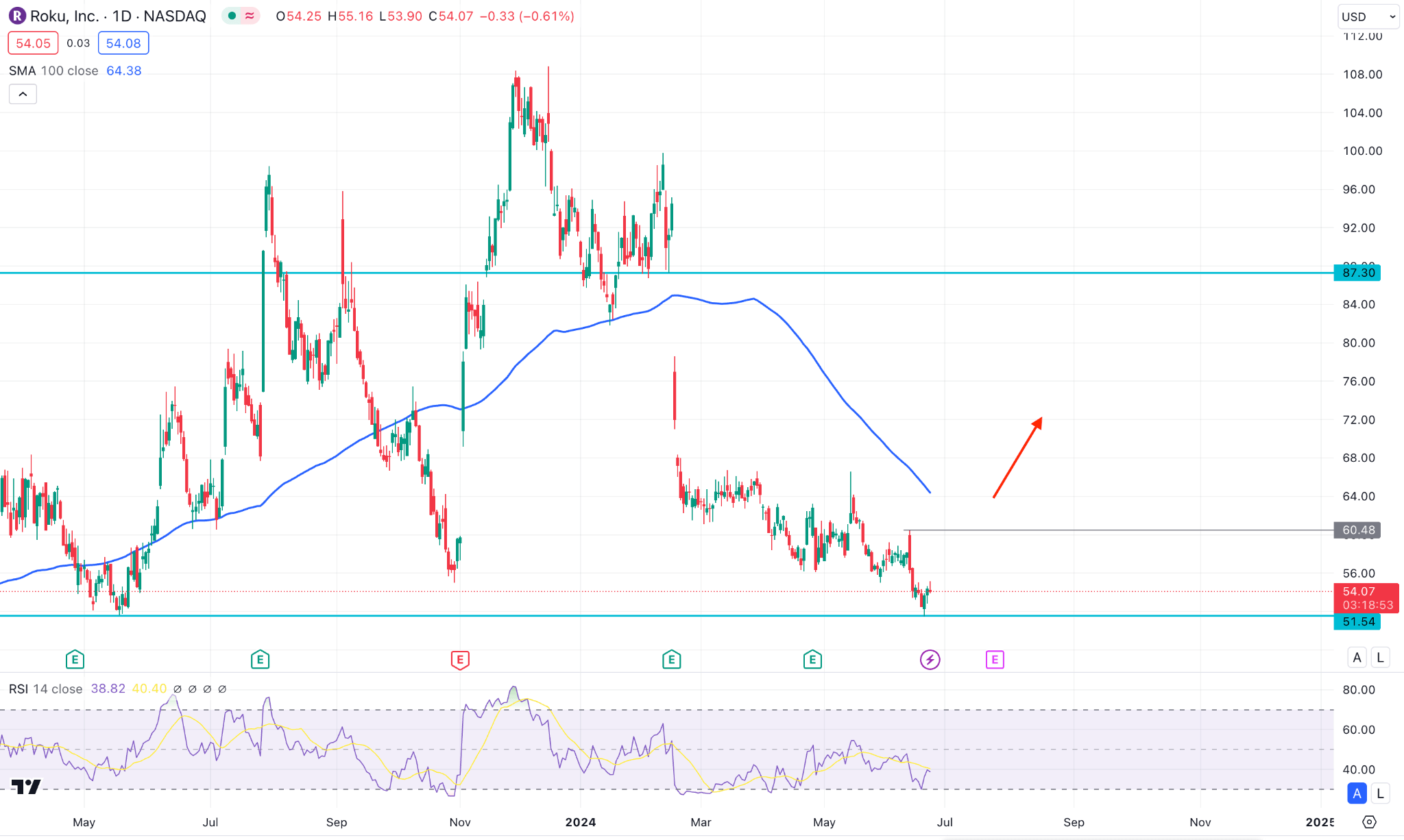

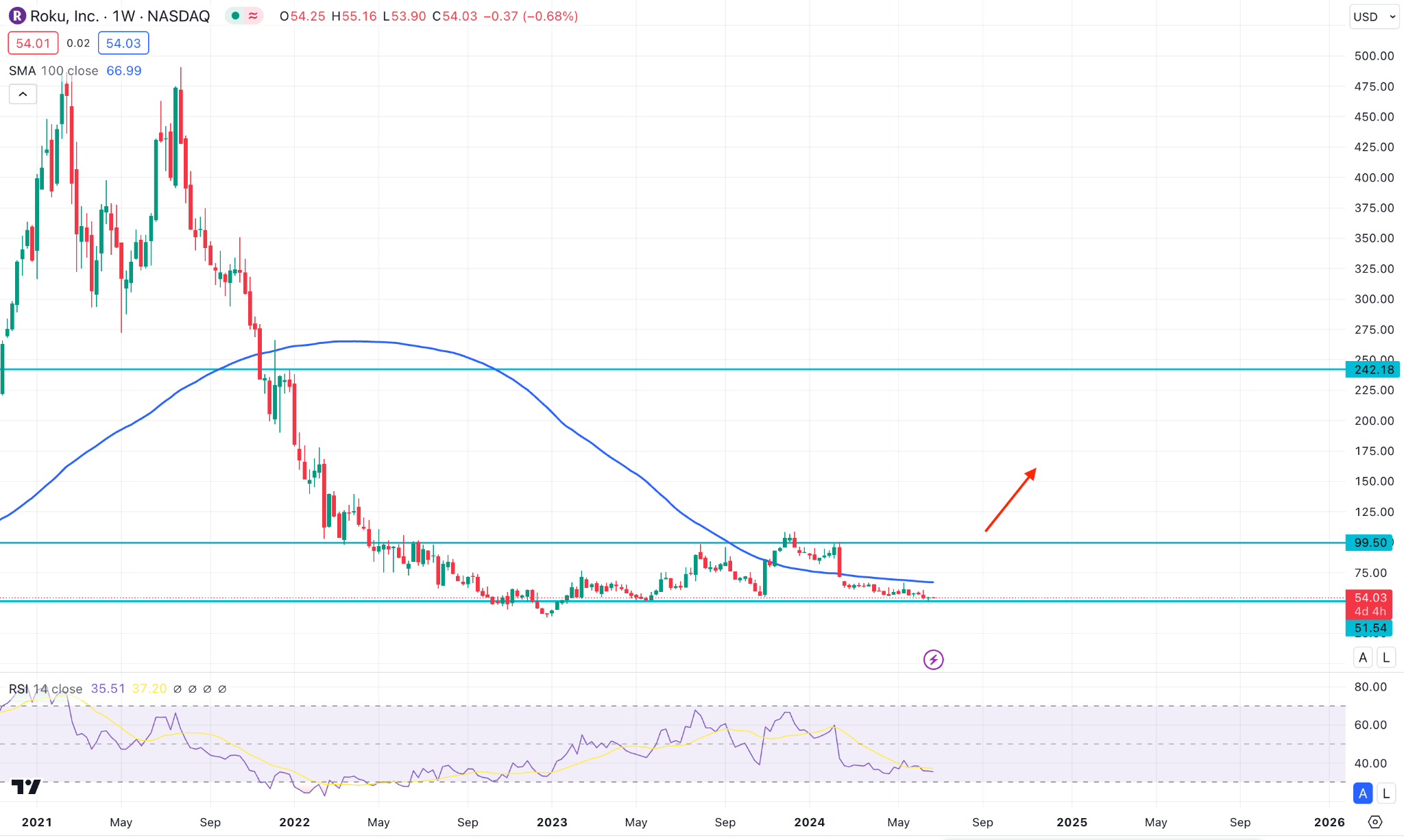

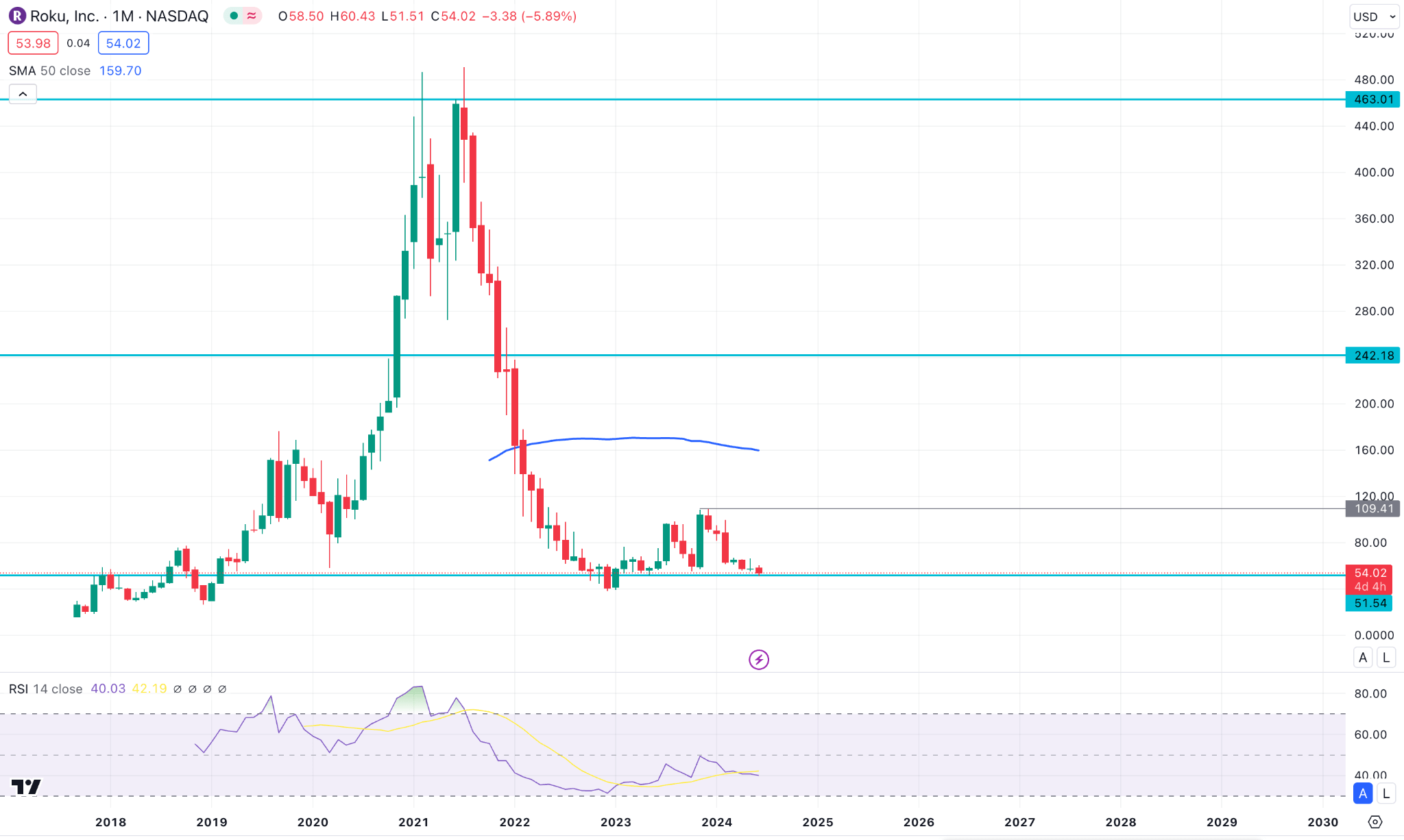

II. Roku Stock Forecast 2024

Based on the double bottom information, Roku stock is more likely to reach the 87.00 level by the end of 2024.

Roku stock experienced a massive crash from its November 2023 peak, bringing the stock price down to the $51.34 level. However, the price action has become sideways since March 2024, indicating weaker selling pressure. As the recent price action is sideways at the bottom, we may expect a bullish continuation after a valid breakout.

Looking at the broader context, the 100-day simple moving average (SMA) is above the current price with a downward slope. This indicates that the major market trend is still bearish and could drive the price below the $51.34 support level to capture sell-side liquidity.

Examining the indicator window, the Relative Strength Index (RSI) found a bottom at the 30.00 point and showed a rebound. However, buyers need a solid continuation to the 50.00 level in the RSI, aiming for the 70.00-80.00 area.

Based on the Roku Stock Forecast 2024, investors should closely monitor how the price reacts to the $60.00 swing high. A bullish recovery with a daily candle above this point could present a high-probability long opportunity. Another bullish approach might come after a valid downward continuation with a sell-side liquidity sweep from the $50.00 psychological point. In both cases, investors should look for a valid candlestick formation on the daily chart with a bullish reversal pattern before aiming for the $87.00 target.

On the other hand, selling pressure is still active in the market, with the 100-day SMA exerting pressure on the bulls. In that case, corrective support pressure and recovery from the 100-day SMA area could resume the existing trend.

A. Other ROKU Stock Forecast 2024 Insights: Is Roku a buy?

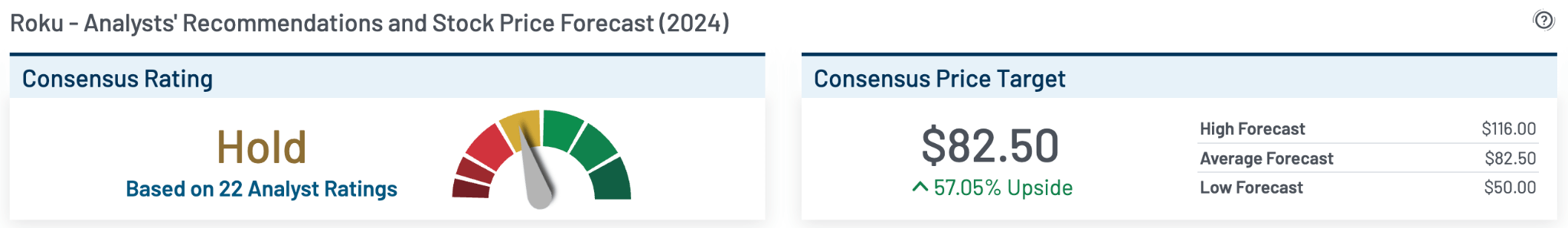

Source: marketbeat

As per the report from Marketbeat, analysts are on Hold for this stock, where the average Roku target price for 2024 is $82.50, which is 52% higher than the current price. The current projection is based on 22 analysts from different institutions.

Jason Bazinet, a Citi analyst, has reiterated his Hold rating on Roku's stock. He cites uncertainty regarding the company's long-term prospects in spite of prospective improvements in its financial metrics.

Eight of the 23 analysts who have evaluated Roku have assigned it a Buy rating, thirteen have assigned it a Hold rating, and two have assigned it a Sell rating. Following the release of its third-quarter results, the stock has experienced a significant increase, surpassing the average Roku stock price target of $87.84.

Roku's highest target price of $120 indicates a potential 18% increase in value over the next 12 months.

B. Key Factors to Watch for Roku Stock Prediction 2024

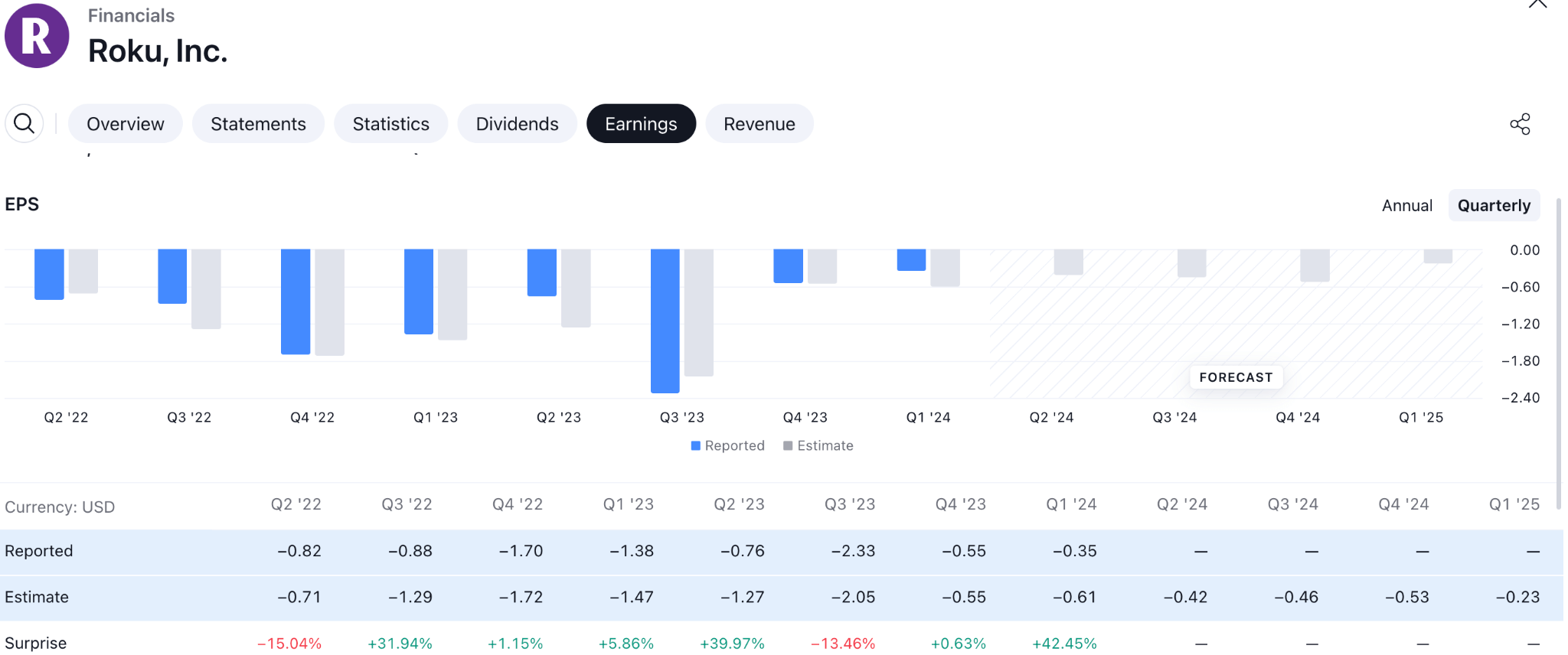

Roku EPS Forecast 2024

Roku showed an amazing business recovery, where the latest earnings per share showed an amazing 41% gain. Moreover, the average gain in the last 4 quarters was above the 20% satisfactory level. Considering the ongoing growth, the stock is more likely to show a decent upward pressure by the end of 2024.

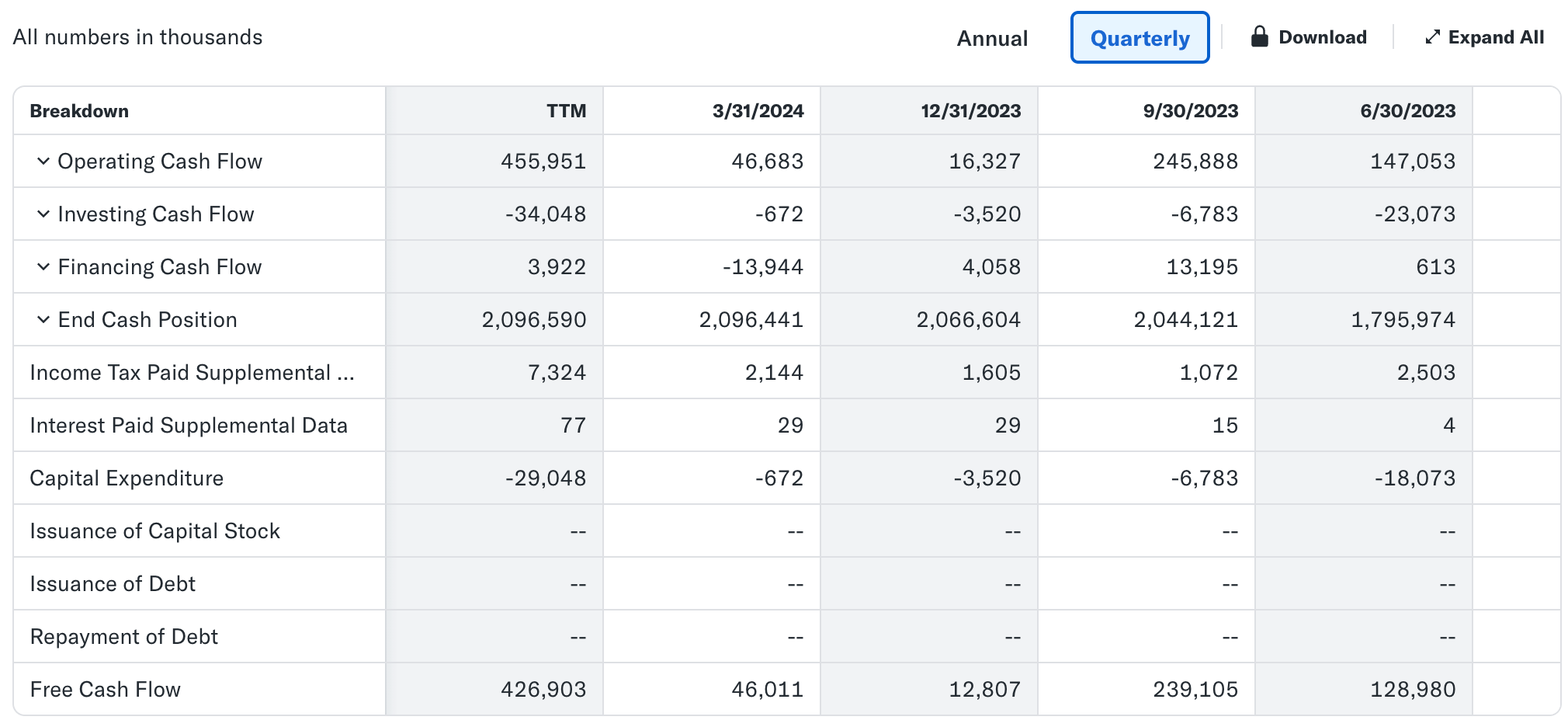

ROKU Cash Flow Position

According to the recent earnings report, ROKU showed a decent recovery in its cash and cash equivalent position. In the fourth quarter of 2023, the company had $12.80 million in cash in hand, which increased to $46.01 million in the latest quarter. The key driver for Free Cash Flow is operating activity, which is related to direct business operations.

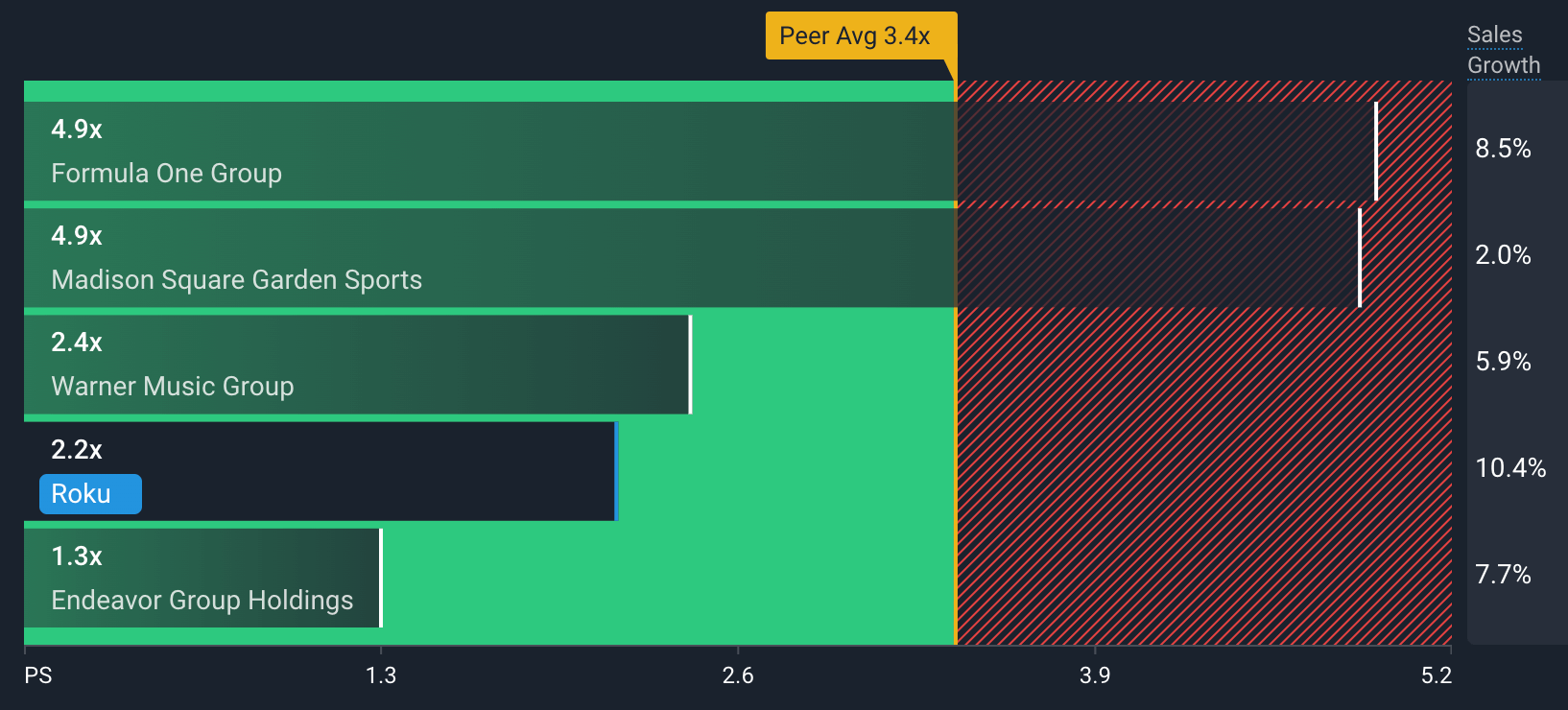

ROKU Financial Metric: P/S Ratio

Source: simplywall.st

ROKU Price to Sales ratio suggests a challenge for bulls as the current reading of 2.2X is lower than the industry average of 3.4X. Also, the current reading is lower than its peers, where the highest level is at 4.9X for Formula One Group.

Considering the upcoming price projection, investors should find a P/S ratio to reach near the average mark before considering a safe buy.

Roku Stock Forecast 2024 - Bullish Factors

- The number of active accounts on Roku has steadily increased. As of Q1 2024, Roku reported 71.6 million active accounts, representing a 17% year-over-year increase. The continued growth of active accounts can enhance the company's financial health, resulting in higher ad revenues and subscription fees.

- Roku has a substantial and active user base. This results in an increase in the number of eyes on the ads, which is a significant source of revenue for Roku. In a robust advertising market, Roku may experience an increase in its ARPU (Average Revenue Per User).

- Roku is no longer solely concerned with hardware. They are diversifying their product line by introducing Roku Originals and their own Roku Channel. This has the potential to generate new revenue streams and increase user engagement.

Roku Stock Forecast 2024 - Bearish Factors

- The streaming device market is becoming saturated with participants such as Apple TV, Chromecast, and Amazon Fire Stick. This competition can exert pressure on Roku's pricing and market share.

- Advertising generates a substantial portion of Roku's revenue. However, economic downturns or recessions may reduce advertising budgets. Furthermore, consumer behavior or privacy regulation alterations may also influence advertising expenditures.

- Roku negotiates content licensing agreements with streaming services to provide them on its platform. These expenses are increasing, which could potentially reduce Roku's profit margins.

III. Roku Stock Forecast 2025

Based on the recent consolidation in the Roku stock, a solid rectangle breakout could take the price above the 242.00 level by the end of 2025.

In the Roku stock weekly chart, the recent price trades sideways within a rectangle pattern, with the dynamic 100-week SMA acting as immediate resistance. Since the beginning of 2024, the price action indicates a bearish continuation, with no sign of a bullish recovery from the rectangle support.

In the weekly Relative Strength Index (RSI), the recent level shows a downside continuation aimed at the 30.00 oversold level. This indicates extreme selling pressure in the market, which can cause further downward pressure in the main price chart. On the other hand, a potential double bottom formation is seen at the trend support level, but proper validation is yet to occur before anticipating a bullish wave.

Based on the Roku stock forecast 2025, an immediate bullish continuation with a valid weekly candle above the $100.00 psychological level could activate long-term bullish strength, aiming for the $252.00 level by the end of 2025. In that case, investors should closely monitor how the price trades in the $50.00 to $40.00 zone, from where bullish exhaustion could trigger the long opportunity.

However, the long-term market trend remains sideways until the $100.00 level is protected. Therefore, the ongoing selling pressure might lower the price below the $50.00 level, potentially creating a new bottom.

A. Other ROKU Stock Price Prediction 2025 Insights: Is Roku a good stock to buy?

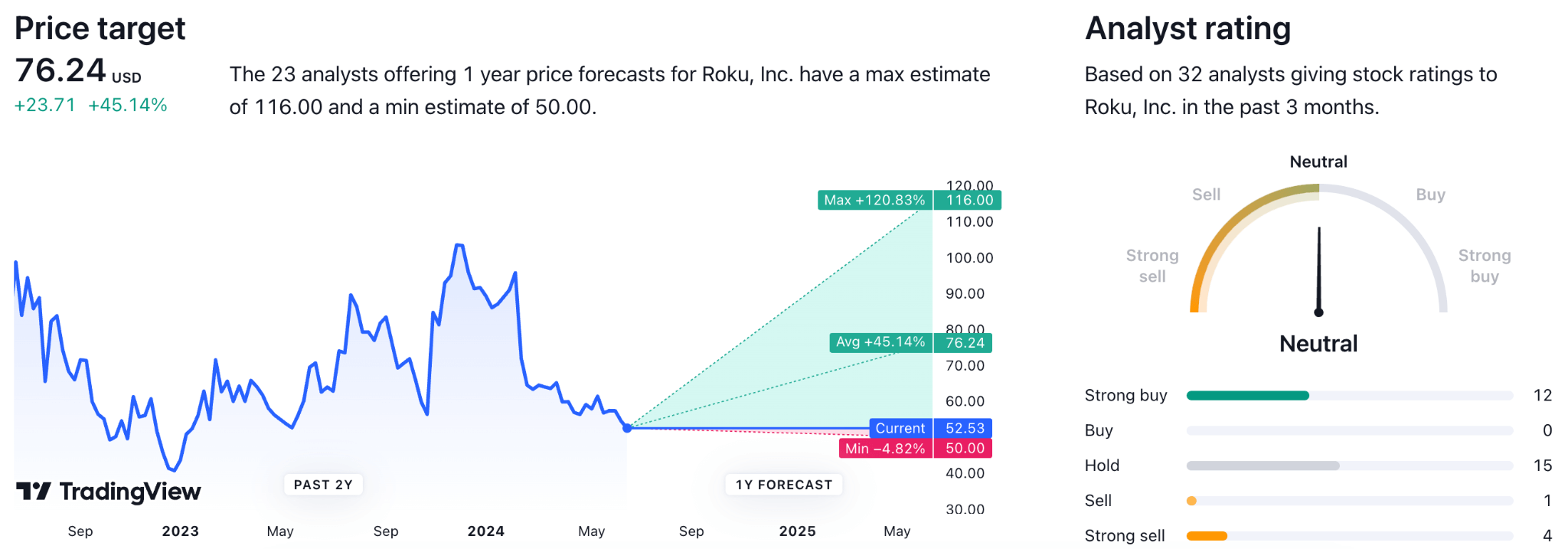

According to the analysts' projection on TradingView, ROKU has a neutral position based on ratings from 32 analysts. Of them, 12 analysts project a buy, aiming to reach a maximum of 116.00.

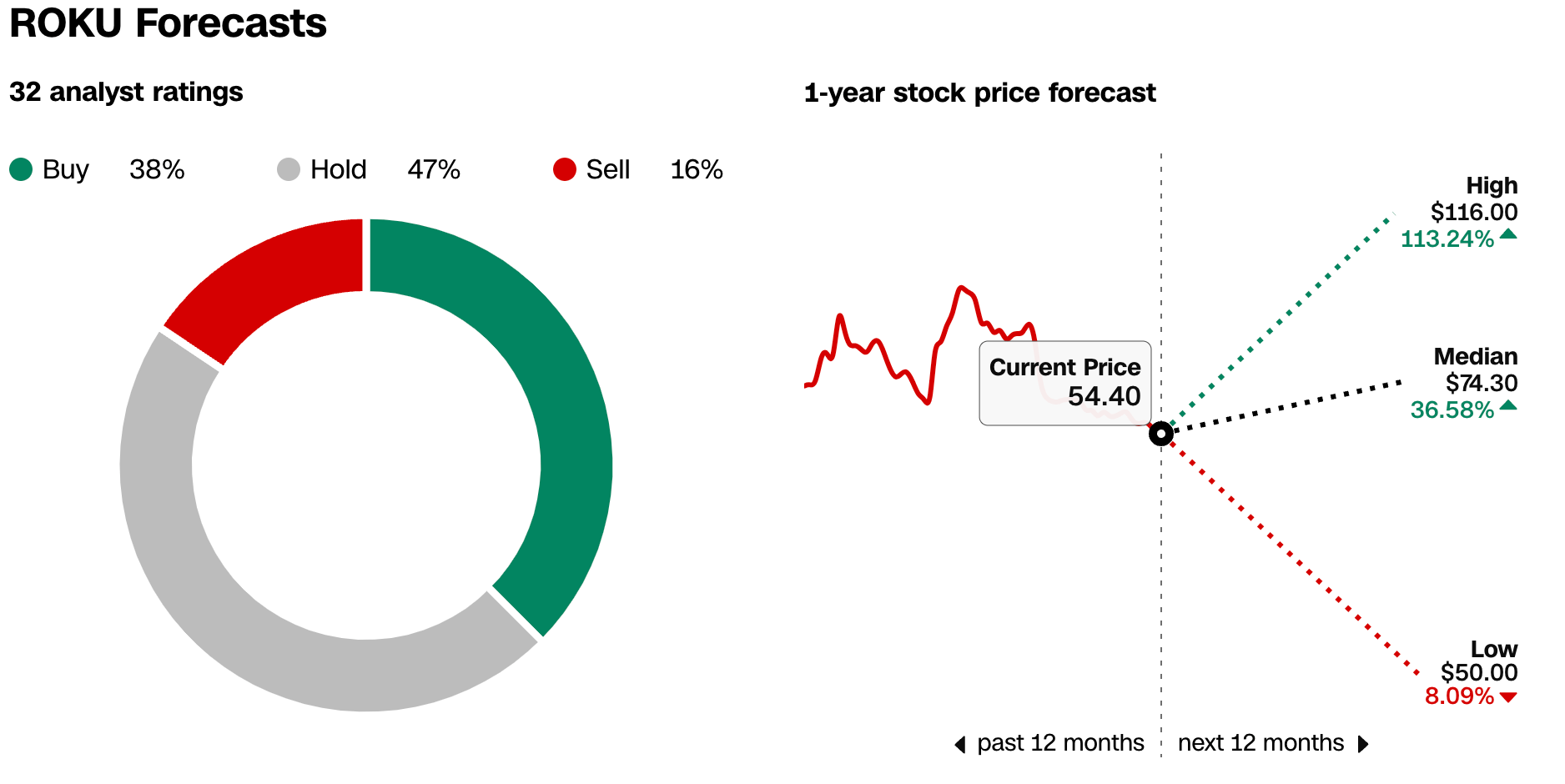

According to a recent report from CNN.com, ROKU has a neutral opinion. 47% of analysts are on hold, while 38% are long.

Source: edition.cnn.com

Based on this outlook, the 12-month forecast for this stock in mid-2025 has a maximum point at the 116.00 level, while the lowest Roku price target level is 50.00.

B. Key Factors to Watch for Roku Stock Forecast 2025

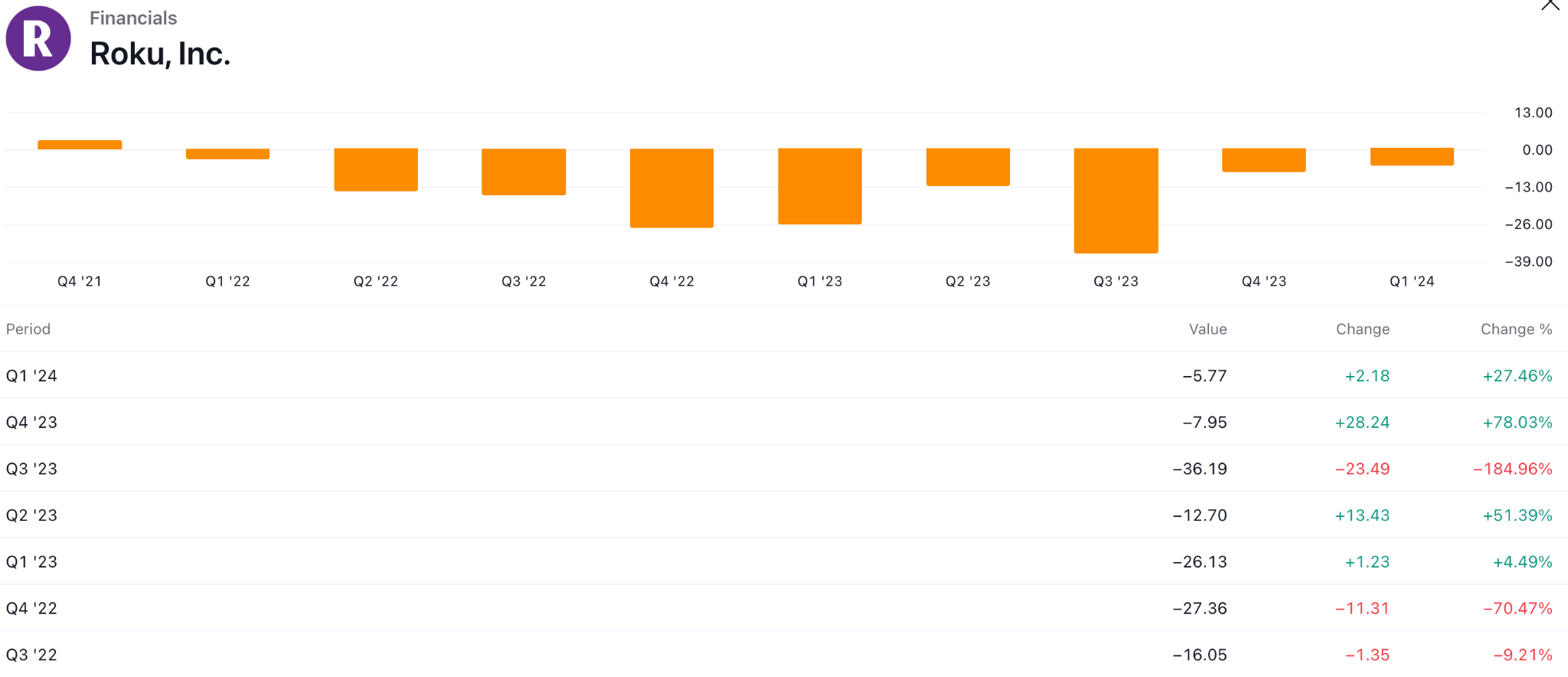

ROKU Profitability Analysis

As per the above image, ROKU showed an amazing recovery in Net profit margin, growing 78.03% before offering another 27% in the latest quarter.

However, the earnings are unsatisfactory as the company has not been profitable for a long time. In that case, investors should remain cautious anticipating the future price of this stock, a positive Net profit with stability could be a bullish factor in 2025.

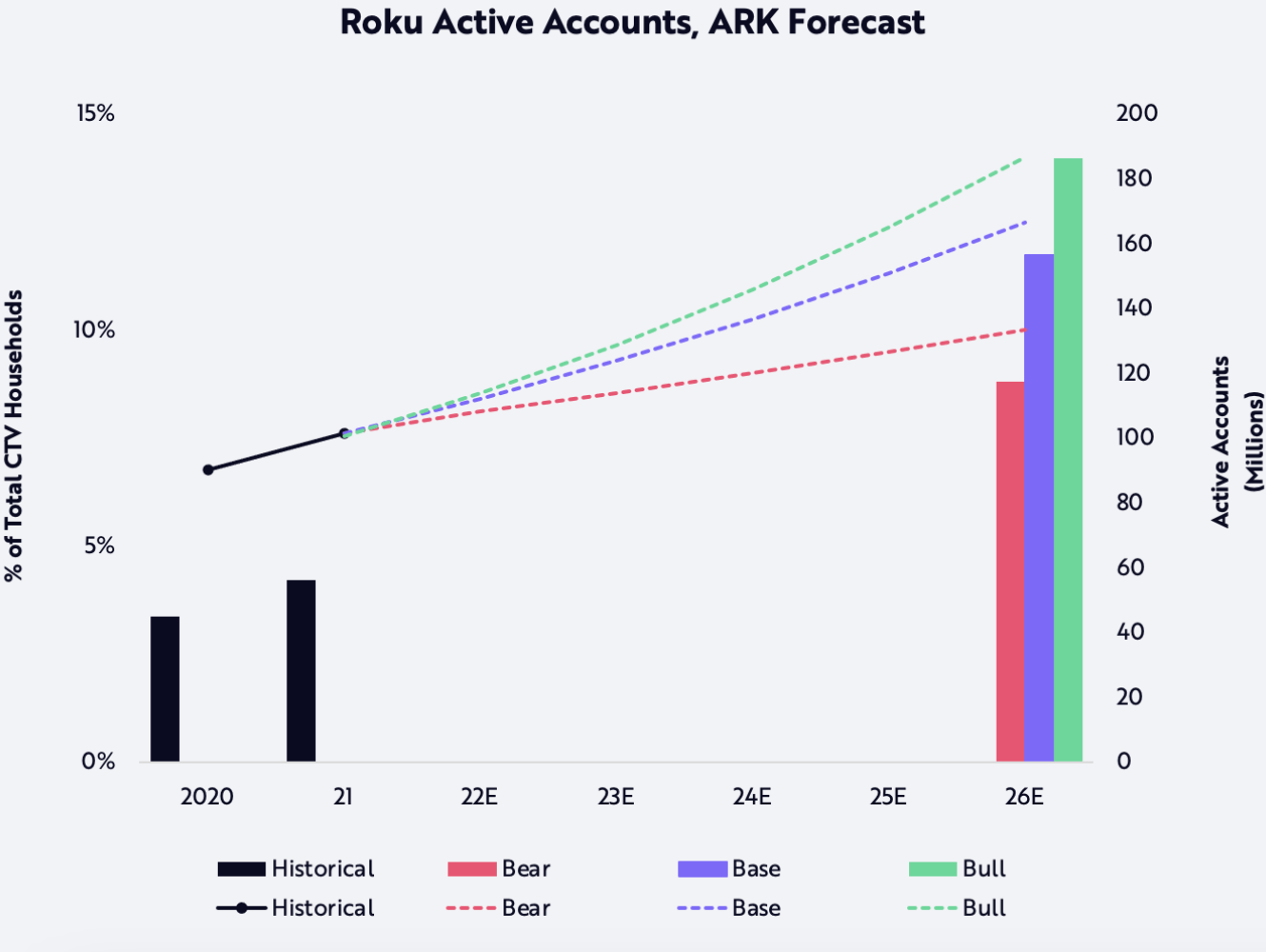

ROKU Active Account Forecast

Source: ark-invest

In just six years, after launching its streaming player in Mexico in October 2015, Roku shot to the top of the TV streaming market in terms of total hours streamed. Roku has continuously dominated the local connected TV (CTV) markets it enters, even though it took it a little longer to achieve market dominance in Canada.

According to the base case scenario from ARK investors, Roku will continue to do well in its current markets, aggressively enter new areas with large TV viewing, and add 23% more active customers every year to reach 157 million by 2026. In our bear and bull scenarios, respectively, Roku's active accounts will grow by 16% and 27% yearly to reach 117 million and 186 million active accounts by 2026.

ROKU Stock Forecast 2025 - Bullish Factors

- Advertising-supported video-on-demand (AVOD) services are experiencing an increase in prevalence. Roku is advantageously situated to capitalize on this development, as its platform is designed to facilitate advertising. As a result of the robust growth in AVOD, the Roku platform may experience an increase in advertising expenditures.

- Roku's strategic emphasis on international markets, such as Europe and Latin America, has the potential to generate substantial growth opportunities. The company's initiatives to localize content and establish partnerships with regional content providers can increase the number of international users and diversify revenue streams.

- Roku Originals represents the organization's initial venture into producing original content. If these programs acquire popularity and Roku can monetize them through advertising or subscriptions effectively, it could serve as a new revenue source and be positive for the stock.

ROKU Stock Forecast 2025 - Bearish Factors

- By 2025, the streaming device market is expected to become even more competitive. New competitors with substantial financial resources, such as tech titans like Amazon or Google, may introduce more sophisticated devices or undercut Roku on price. This could result in a decrease in Roku's market share.

- As the market matures, Roku's development in active accounts may slow, particularly in critical regions such as North America. Roku's revenue from advertising and subscription services may be affected if it cannot maintain its user growth rate.

- Consumers are already subscribed to numerous streaming services. If subscription fatigue occurs and users become more selective, Roku's capacity to generate revenue from subscriptions offered on its platform may be affected.

IV. Roku Stock Forecast 2030 and Beyond

If the company can maintain revenue growth and reach a positive net profit margin, the stock may move beyond the 463.00 level by the end of 2030.

In the monthly time frame, Roku stock trades sideways, with the broader context showing extreme selling pressure. After peaking in 2021, the stock tumbled and moved below the $50.00 level with no sign of a bullish recovery.

A sideways market has been evident since 2023 in the near-term price action, with no visible buying pressure.

The recent price indicates a real distribution phase, where manipulation and a bearish reversal from the swing high could present a potential short opportunity.

Considering the Roku Stock Forecast 2030 and Beyond, the price is more likely to extend the loss and move below the $40.00 level by the end of 2030.

For investors, finding a valid bottom is crucial before anticipating a long movement. The primary aim of the current price zone is to look for a bullish breakout above the $109.00 level before aiming for the $400.00 psychological point.

On the other hand, the recent immediate swing low at $51.44 is crucial as sufficient liquidity is present below this line. The price could drop below this crucial support before a bullish run and grab the liquidity. This scenario could create a high-probability long signal. Close attention is needed to the $50.00 to $35.00 price zone, as bullish exhaustion could present a long-term investment opportunity.

A. Other ROKU Stock Price Prediction 2030 and Beyond Insights: Roku stock buy or sell?

According to a recent report from Nasdaq.com, Roku is confronted with a substantial market opportunity. Television advertising expenditures are anticipated to surpass $344 billion by 2026, according to the IMARC Group.

Anthony Wood, the CEO of Roku, envisions a future in which all television advertising is transmitted. If Roku can sustain an annual revenue growth rate of 25% through 2030, its market capitalization could quintuple to $48.5 billion by the decade's end. Due to its substantial growth potential, Roku is an attractive investment opportunity for investors seeking undervalued growth equities.

According to the report from Poltenbell, Roku forecast is that it will reach $153.76 by the end of 2025, $620.65 by the end of 2030, and rise further to $2,257.83 by 2040.

B. Key Factors to Watch for Roku Stock Forecast 2030 and Beyond

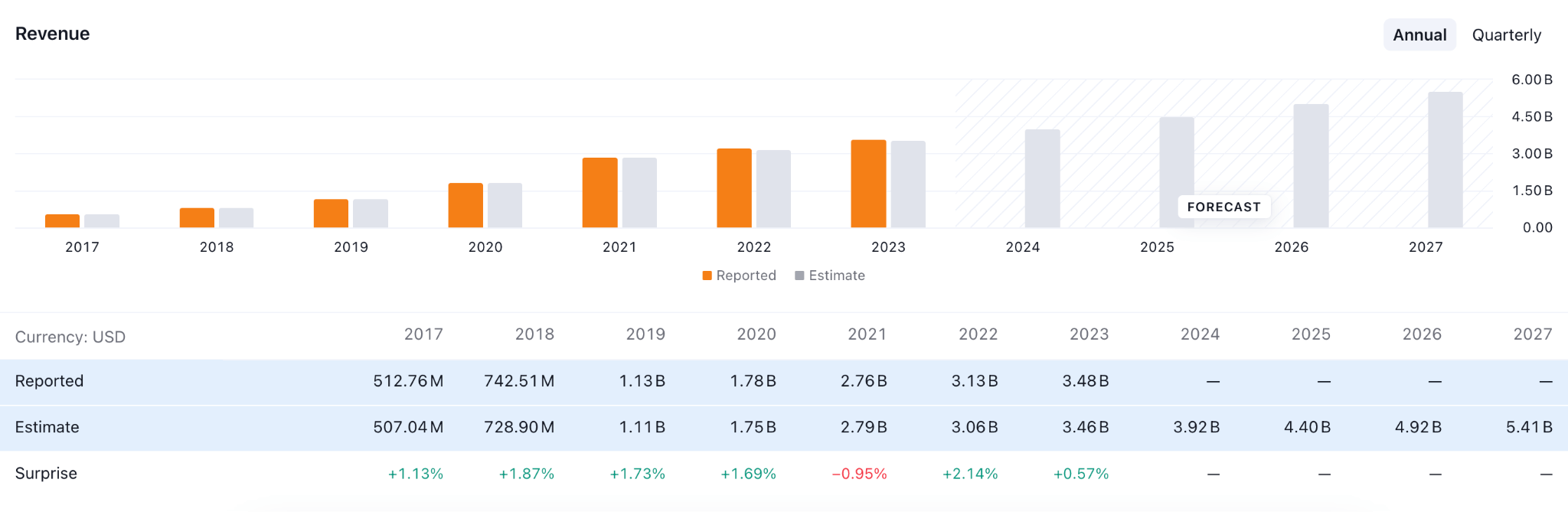

ROKU Revenue Forecast

As per the above image, ROKU is more likely to maintain upward traction in revenue, taking the yearly number to $5.41 billion by the end of 2027. Also, the company has a positive growth forecast from 2025 (at $4.40 billion), which is higher than 2023's actual $3.43 billion.

Considering the stable growth forecast, investors might find it attractive to buy from major dips in the coming years.

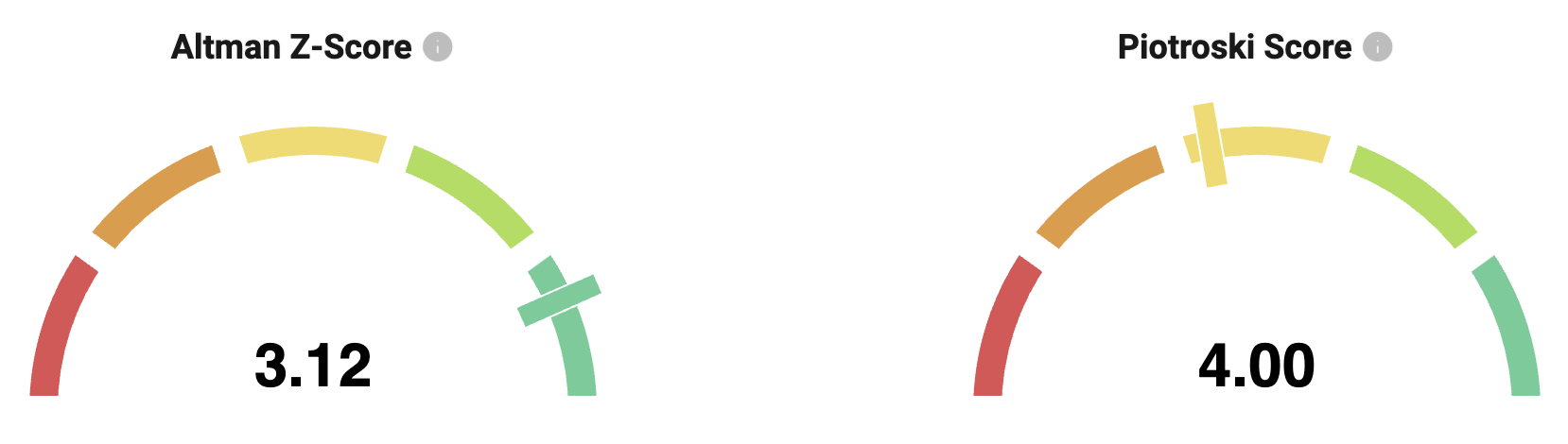

ROKU Business Stability

According to the data from the Altman Z-score, ROKU maintains a stable position, as its current number is 3.12. Considering this number, the chance of bankruptcy is low, which might be a bullish factor for this stock.

On the other hand, the Piotroski Score shows the company in a moderate position, with a current number of 4.00. In that case, a higher number from the current point could work as a confluence upward signal, showing business stability by the end of 2030.

ROKU Stock Forecast 2030 and Beyond - Bullish Factors

- Streaming may emerge as the primary method of entertainment consumption by 2030. Roku, a prominent streaming device and platform provider, could be well-positioned to capture a substantial portion of this vast market.

- Roku has become a significant participant in the streaming ecosystem. Roku's platform could work parallelly with traditional TV, ensuring its status as a critical service for accessing digital content.

- The Roku could expand beyond its current focus on streaming entertainment. There are spaces to expand the business in cloud gaming, fitness applications, and educational content and become a 360-degree solution for consumers.

ROKU Stock Prediction 2030 and Beyond - Bearish Factors

- The rate of technological advancement is accelerating. By 2030, streaming devices such as Roku may become obsolete due to the emergence of wholly new methods of entertainment consumption. New technologies could entirely disrupt the streaming market, potentially leaving Roku behind.

- Investors should closely monitor this platform's active account number. The company can expand its user base after a mature position in regions such as North America and certain parts of Europe. Still, associated revenue streams may be restricted, as it will be difficult to maintain high growth rates.

- A larger technology company seeking to expand its presence in the streaming market may find Roku an appealing acquisition target. Individual investors may impact its stock value if the company is incorporated into another company following an acquisition.

V. Conclusion

A. Roku Stock Outlook: Roku buy or sell?

Based on the current observation, ROKU trades at the discounted zone in 2024, from where a considerable correction is pending. The upcoming price direction depends on how the price trades at the long-term consolidation, as shown in the Roku Stock Forecast 2025. Moreover, future prices depend on how the company performs in the quarterly earnings report, where a positive return of 20% or above could signal a stable business.

The outlook is optimistic based on financial indicators, where the liquidity and cash flow position suggest business stability. Overall, the recent implementation of subscription-based businesses with a surge in advertisement revenue could be a long-term bullish factor.

Although the growth has potential, it is important to consider the risks of market volatility and competitive pressures. The flexibility of Contracts for Difference (CFDs) can be advantageous for investors wishing to invest.

B. Trading ROKU Stock CFDs with VSTAR

VSTAR provides several compelling advantages that can improve your investment strategy:

- Ultra Low Spread: VSTAR offers competitive, narrow spreads, guaranteeing that you can enter and exit trades at a minimal cost.

- Premium Market Analysis Tools: VSTAR's advanced market monitor feature enables traders to monitor real-time market fluctuations closely. This tool offers critical insights and alerts, enabling traders to make informed decisions swiftly and efficiently.

- Advanced Trading Tools: VSTAR provides various advanced trading tools, such as technical analysis indicators, charting software, and risk management features.

- Educational Resources: VSTAR offers market analysis, expert insights, and podcasts to assist traders in improving their knowledge and abilities.

Investors can capitalize on these advantages to optimize their investment in Roku stock CFDs with VSTAR. VSTAR's comprehensive platform and support system can assist you in achieving your investment goals, whether you are a seasoned trader or new to CFDs.

FAQs

1. Is Roku stock expected to go up?

The average 12-month price target is around $81, suggesting a potential increase from the current price.

2. What is the Roku stock forecast for 2025?

Roku stock is expected to reach an average price of $127.07 in 2025, with estimates ranging from $36.22 to $217.91.

3. What will Roku stock price be in 2030?

Roku stock could exceed $463.00 by the end of 2030.

4. What is the prospect for Roku stock?

Roku is expected to grow its earnings and revenue significantly, with earnings per share (EPS) expected to grow by 75.6% per year. However, the stock has received a consensus rating of "Hold" from analysts.