I. Recent Qualcomm Stock Performance

QCOM December-Quarter Comments

According to JPMorgan analyst Samik Chatterjee, investors were expecting a double-digit revenue increase in the December quarter. On flat smartphone progress, Qualcomm, however, projected mid-single-digit expansion for the period, its fiscal Q1, he stated in a client note.

Chatterjee, however, believes that early advice might be conservative.

Nevertheless, he maintained his overweight assessment of Qualcomm stock but lowered his price target from 235 to 230.

Qualcomm's chip operations generated 86% of its total revenue in the June quarter. Qualcomm's remaining sales were derived from its technology licensing division.

73% of its revenue in the chip segment came from handsets, with the Internet of Things coming in second at 17% and the automotive sector at 10%. Device chip sales increased 12% annually to $5.9 billion in the third quarter of the fiscal year. Sales of automotive chips increased by 87% to $811 million. However, sales of IoT chips fell by 8% to $1.4 billion.

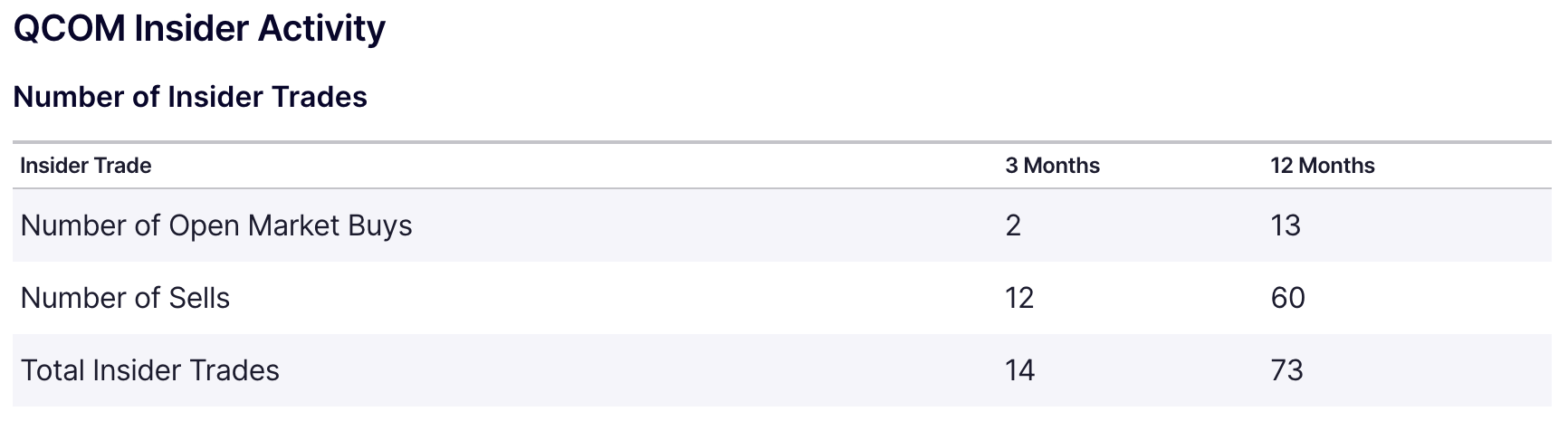

Qualcomm Inc. Insider Trading

Source: nasdaq.com

Qualcomm Inc. (NASDAQ:QCOM) Chief Financial Officer and Chief Operating Officer Akash Palkhiwala sold 3,000 shares of the business on August 8, 2024, for a price of $162.89 per share. The latest SEC filing contained documentation of the transaction. The insider now has 57,437 Qualcomm Inc. shares after this sale.

Qualcomm Inc. is a frontrunner in wireless technology research and development, having developed semiconductors, software, and services. The company's products are used in various wireless gadgets and mobile devices.

The insider has not made any stock purchases in the last year and has sold an aggregate of 22,000 shares. This latest deal is part of a larger pattern at Qualcomm Inc., where over the previous year, there have been 34 insider trading sales and no insider purchases.

On the day of the transaction, Qualcomm Inc.'s shares were valued at $162.89, giving the business a market value of roughly $183.23 billion. The stock's price-earnings ratio is 21.31, less than the industry average of 30.01.

With a price-to-gf-value percentage of 1.15, Qualcomm Inc. is slightly overvalued at $162.89, based on GF Values $141.28 estimate for the stock.

Expert Insights on QCOM Stock Forecast for 2024, 2025, 2030 and Beyond

QCOM stock is trading within bullish continuation momentum, and any dip could be a potential bullish signal. Before proceeding further, let's see Expert Insights on QCOM Stock Forecast for 2024, 2025, 2030, and Beyond:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$182 |

$263 |

$532 |

|

Stockscan |

$179.53 |

$231.15 |

$251.78 |

|

Coincodex |

$ 137.43 |

$191.48 |

$324.75 |

|

Stockraven |

n/a |

$173.69 |

$268.34 |

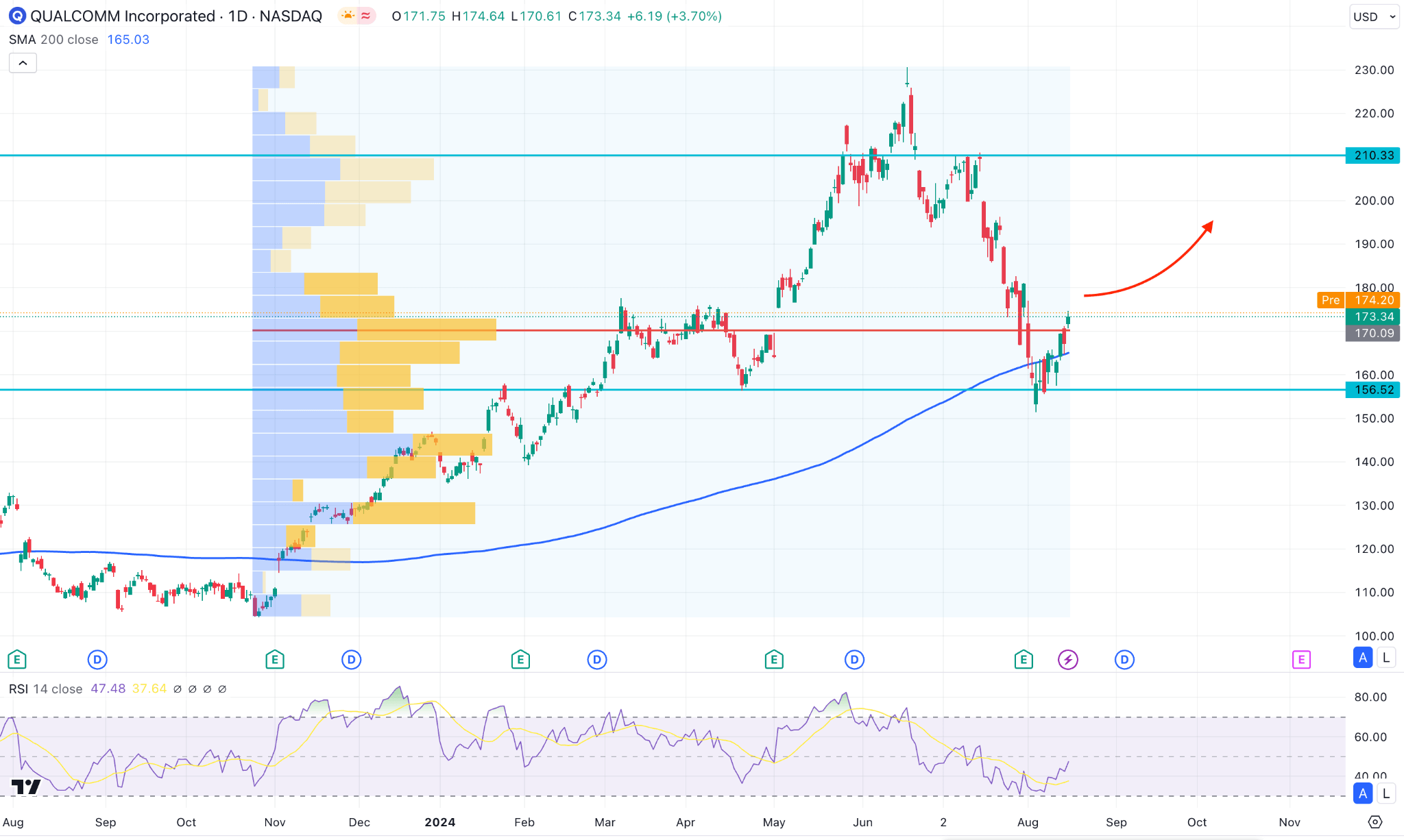

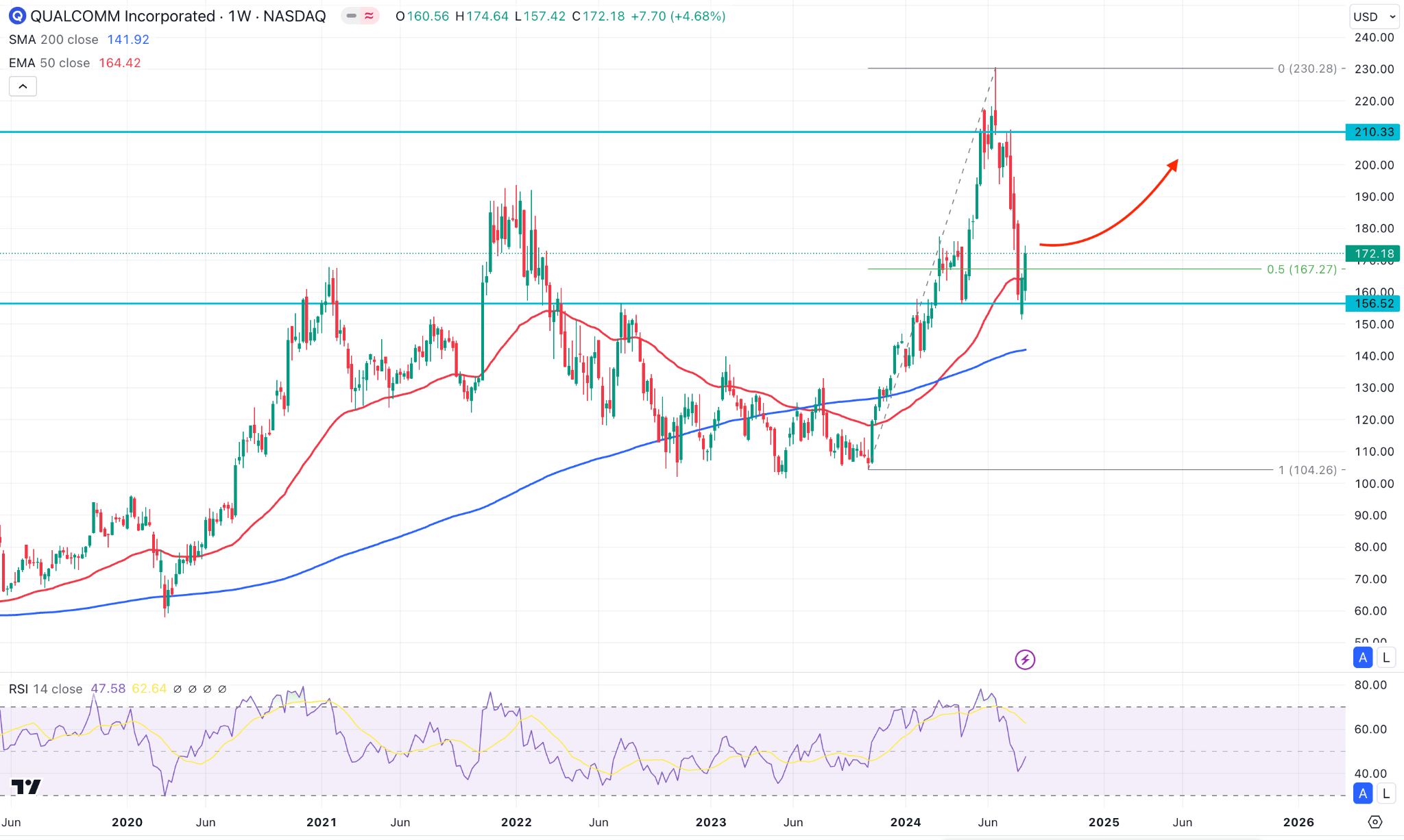

II. QCOM Stock Forecast 2024

Based on the current market outlook, the ongoing buying pressure could offer a decent trend trading opportunity in this stock, leading the price above the 200.00 psychological level by the end of 2024.

In the broader context, the bullish wave initiated from November 2023 came with a valid range breakout, making a decent bullish rally. Later on, we saw a bearish base formation before making another swing high at the 230.00 psychological level.

After forming a top at the 230.00 level, the price went bearish, forming a valid bearish reversal candlestick formation. As a result, the counter-impulsive bearish pressure took the price below the high volume level. In that case, investors should closely monitor how the price reacts at the discounted zone, from where a recent recovery is pending.

Based on the QCOM Stock Forecast 2024, investors should closely monitor how the price trades at the 156.52 static line. The primary intention for this stock is to find a bearish recovery below this line, which could offer a bearish continuation signal. In that case, a daily candle below the 150.00 psychological line could lower the price towards the 110.00 level.

On the other hand, the broader market outlook is still bullish, where a recovery above the high volume line signals a trend reversal. In that case, a valid daily candle above the 182.44 swing high could increase the bullish possibility, aiming for the 210.33 resistance level.

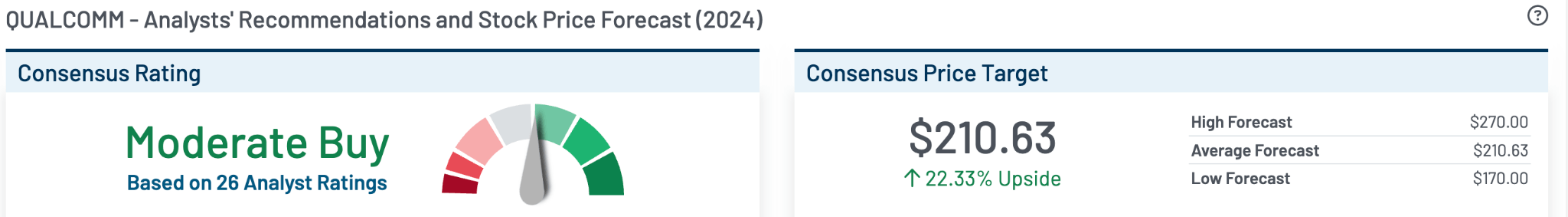

A. Other Qualcomm Stock Prediction 2024 Insights

According to a recent report from Marketbeat, QCOM stock has a moderate buy rating and aims to test the $210.00 level by the end of 2024. Of the 26 analysts, 15 are on the buy side, while 10 remain on Hold.

Qualcomm stock has increased dramatically, from $105 each share a year before to $200 at the date of the last check.

Following Microsoft's introduction of its new line of Copilot+ PCs, all of which were initially powered solely by Qualcomm's Snapdragon X Series of processors, benchmark analyst Cody Acree increased the firm's cost target on Qualcomm to $240 from $200 and maintained its buy rating on QCOM stock.

This Windows and joint OEM launch, which features Qualcomm's processors, according to the analyst, is "a watershed event for the company as it places Qualcomm as a direct competitor for the first time in the mainstream laptop market."

One of Qualcomm's primary investment drivers, according to Acree, is the company's possible share gains in the AI PC market.

B. Key Factors to Watch for Qualcomm Stock Forecast 2024

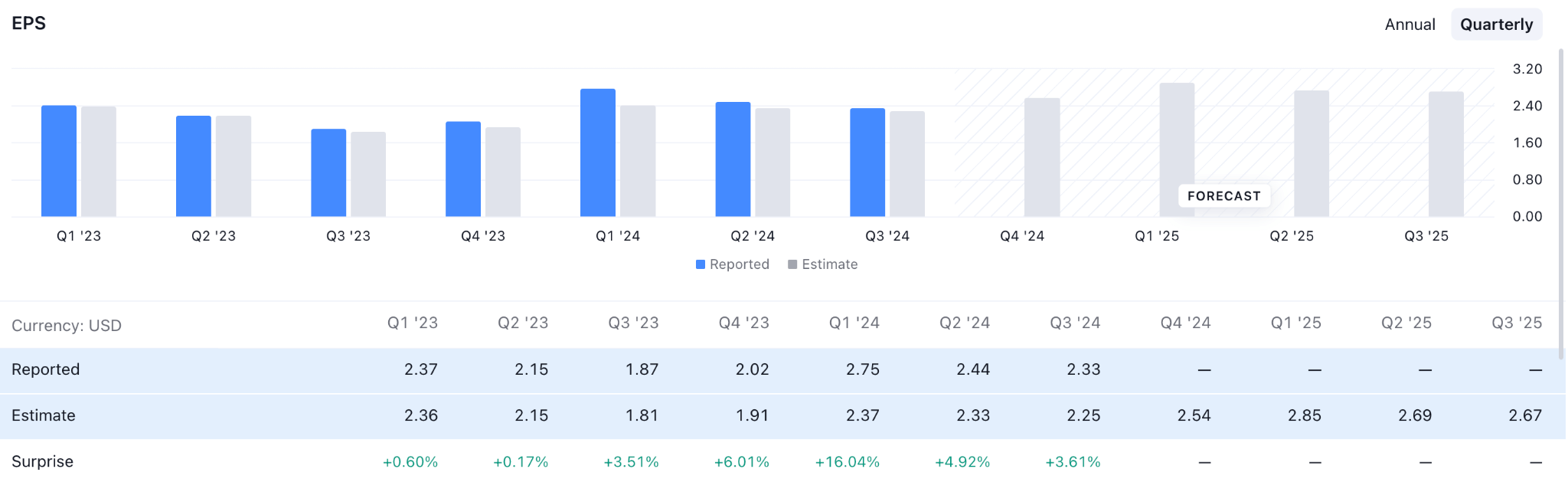

Qualcomm Quarterly EPS Forecast

According to the recent actual Earnings Per Share (EPS), the company maintains stable growth. The latest number in Q3 2024 showed a 16% revenue growth. Also, quarterly earnings have been consistently growing for the last seven quarters, which suggests stable growth.

Following the momentum, the current EPS forecast for Q4 2024 is $2.54, which is higher than the actual number of $2.33.

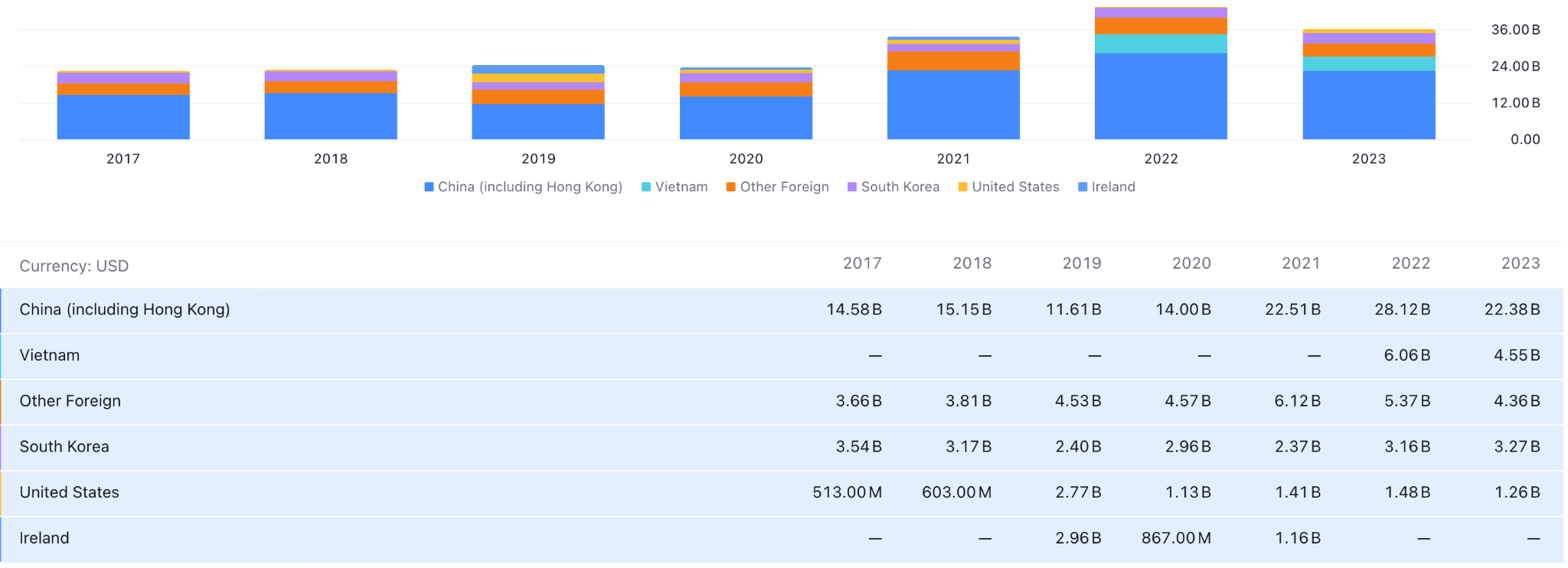

QCOM By Country Revenue Segment Analysis

As the above image shows, China is QCOM's largest revenue contributor. Therefore, China's microeconomic factors could directly affect the QCOM business.

GDP growth is a crucial indicator of a country's performance. China's steady 5.0% GDP growth in 2024 suggests a strong position against its counterpart, the US (2.8%). Since the economy is expanding, investors might expect business growth in QCOM in 2024 and beyond.

QCOM Stock Prediction 2024 - Bullish Factors

- With the release of its Snapdragon X processors, Qualcomm is taking major steps toward upending Advanced Micro Devices (AMD) and Intel (INTC)'s dominance in the PC industry. These processors strongly emphasize AI capabilities, in line with Microsoft's (MSFT) Copilot+ initiative to improve AI-powered encounters on Windows PCs.

- In the fiercely competitive smartphone market, there is gossip that Qualcomm will be the sole chip supplier for Samsung's upcoming Galaxy S25 smartphone.

- Additionally, the business is concentrating on developing the "AI PC" market in partnership with Arm Holdings, utilizing Arm-based Qualcomm chips to provide cutting-edge AI features.

QCOM Forecast 2024 - Bearish Factors

- Qualcomm continues to depend heavily on mobile chip sales, even in the face of growth in other industries. Analysts are worried that overall revenue growth may be hampered by the predicted lack of strength in the growth of AI-related smartphone chips.

- There has been pressure on Qualcomm's valuation, particularly compared to rivals with greater forward price-to-earnings multiples like AMD and Nvidia. This discount indicates doubts about Qualcomm's capacity to benefit from the AI boom to the same degree as its competitors.

III. QCOM Stock Forecast 2025

In the weekly price of QCOM, the ongoing buying pressure is questioned as sufficient recovery is not seen. In that case, a decent consolidation is pending, with the main aim of testing the 230.28 psychological line by the end of 2025.

In the broader weekly price index, the ongoing buying pressure has been seen since 2020, when the multi-year high was at 230.28. The buying recovery has become questionable because the most recent price showed massive selling pressure from that top.

Primarily, the bearish weekly candle below the 50-week EMA line with an immediate recovery signals a Golden Cross continuation signal. Moreover, the 200-week Simple Moving Average is below the 50-week EMA, which is working as a major support.

On the other hand, the 14-week Relative Strength Index (RSI) moved below the 50.00 neutral point and became sideways. It is a sign that a bullish reversal needs a valid price action, before aiming for the current swing high.

Based on the QCOM Stock Forecast 2025, the bullish reversal is highly possible as the 200-week SMA remains protected at the bottom.

In that case, a valid consolidation and a bullish break could offer a long opportunity, aiming for the 210.23 resistance level. In this path, a bullish weekly candle above the 190.00 level could extend the upward pressure above the 230.00 area in the coming weeks.

On the bearish side, a failure to hold the price above the 50-week EMA could be challenging for bulls. In that case, a weekly close below the 150.00 level could find the 200-week SMA as immediate support.

A. Other Qualcomm Stock Prediction 2025 Insights

Qualcomm's valuation of $231 billion has increased by 43% in the last year, considerably outperforming the overall market.

Even though it recently dropped 5% from its peak of $230 in mid-June, investors may be able to take advantage of this dip as a strategic buying possibility.

With a forward P/E ratio of 25.09, Qualcomm is fairly valued. This implies that although the stock isn't cheap, it isn't expensive either.

In contrast, QCOM is trading at a fair discount to some of its competitors in the tech sector.

Qualcomm's earnings for the upcoming fiscal year could reach $11.21 per share, according to the current sell-side agreement. If Qualcomm meets these goals and dispels the myth that it is an "AI dud," QCOM stock may increase several times over.

For example, if shareholders rerate QCOM to a forward multiple of 20, the price would rise to $225 per share, more than 41% above the going rate.

Even though it might be more of an ambitious goal, an increase to between 25 and 30 times forward revenue could cause Qualcomm's prices to rise by over double from where they are now.

Regardless of what the doubters say, when you compare this to the likelihood that this already significantly discounted chip stock encounters additional multiple compression, you can clearly see that the risk/reward balance is in your favor.

Remember that weakness might persist in the coming months, but if you can withstand the volatility and are prepared to wait, you might want to consider purchasing Qualcomm stock at a lower price.

B. Key Factors to Watch for Qualcomm Stock Prediction 2025

QCOM Debt Structure

Looking at the debt structure, a company with higher debt finance risks higher monthly interest costs, increasing the possibility of a budget deficit. Although debt finance is cheaper, the rising interest rate could be a challenging factor for any company.

For QCOM, the current debt finance is $14.55 billion, compared to cash and cash equivalent of $7.77 billion. Investors should closely monitor the performance, where any business expansion could be challenging in 2025.

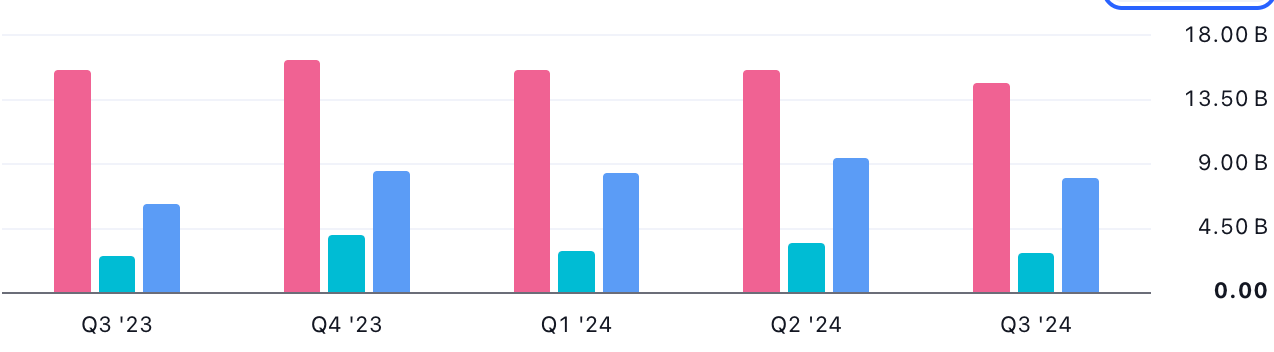

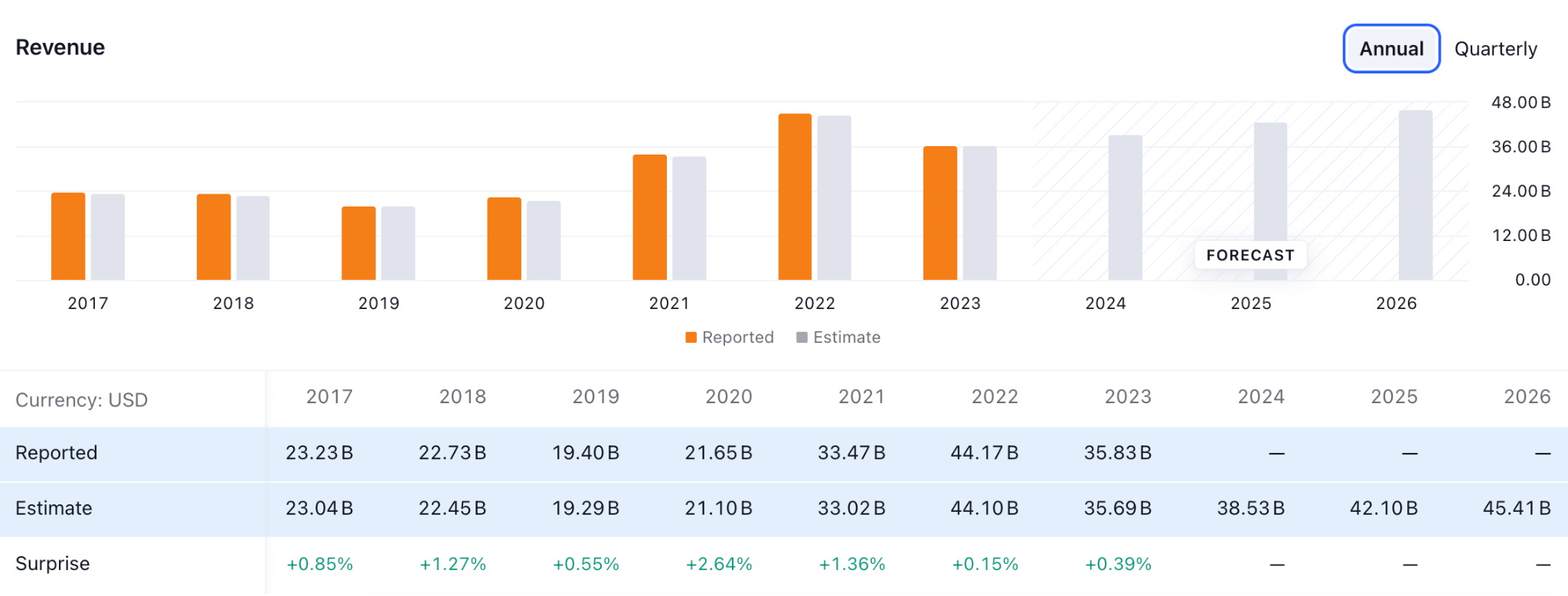

QCOM Revenue Projection 2025

QCOM's yearly revenue maintained upward traction since 2017, although the percentage is not satisfactory.

In the latest full-year actual revenue, the company showed $35.83 billion in revenue, up from the projected $35.69 billion. Moreover, the projected revenue for the coming year is positive, where the full-year revenue for 2025 could come to $42.10 billion. The upbeat projection signals a positive sentiment for the stock, which might open a long opportunity.

Qualcomm Stock Price Prediction 2025 - Bullish Factors

- Qualcomm has shown excellent financial performance, with net income growing by 18% and revenues rising by 11% yearly in Q3 2024. With continued high revenue growth, positive momentum could be sustained in 2025.

- Experts, including those at Bank of America, anticipate a possible recovery in sales of high-end smartphones. This would be advantageous for Qualcomm because of its dominant position in the mobile chipset market. This might enable the business to surpass analysts' earnings projections and support an upward trend in the stock price.

- With the release of its Snapdragon X series system-on-a-chip structure for AI-PCs, Qualcomm may see a large increase in revenue. The successful implementation of this innovation could establish Qualcomm as a major player in the AI hardware market, boosting investor confidence even though initial sales figures haven't been made public.

QCOM Stock Forecast 2025 - Bearish Factors

- Although the market's reaction and adoption rate are still unknown, Qualcomm's new AI-PC chips are expected to be a significant growth engine. Stock prices may drop if there are hindrances or lower-than-expected revenue in this sector, disappointing investors.

- Other semiconductor firms like Nvidia and AMD are fierce rivals of Qualcomm, especially in the fields of artificial intelligence and high-performance computing. Additionally, these rivals are vying for market share in the AI and mobile chip sectors, which may put pressure on Qualcomm's pricing power.

IV. QCOM Stock Forecast 2030 and Beyond

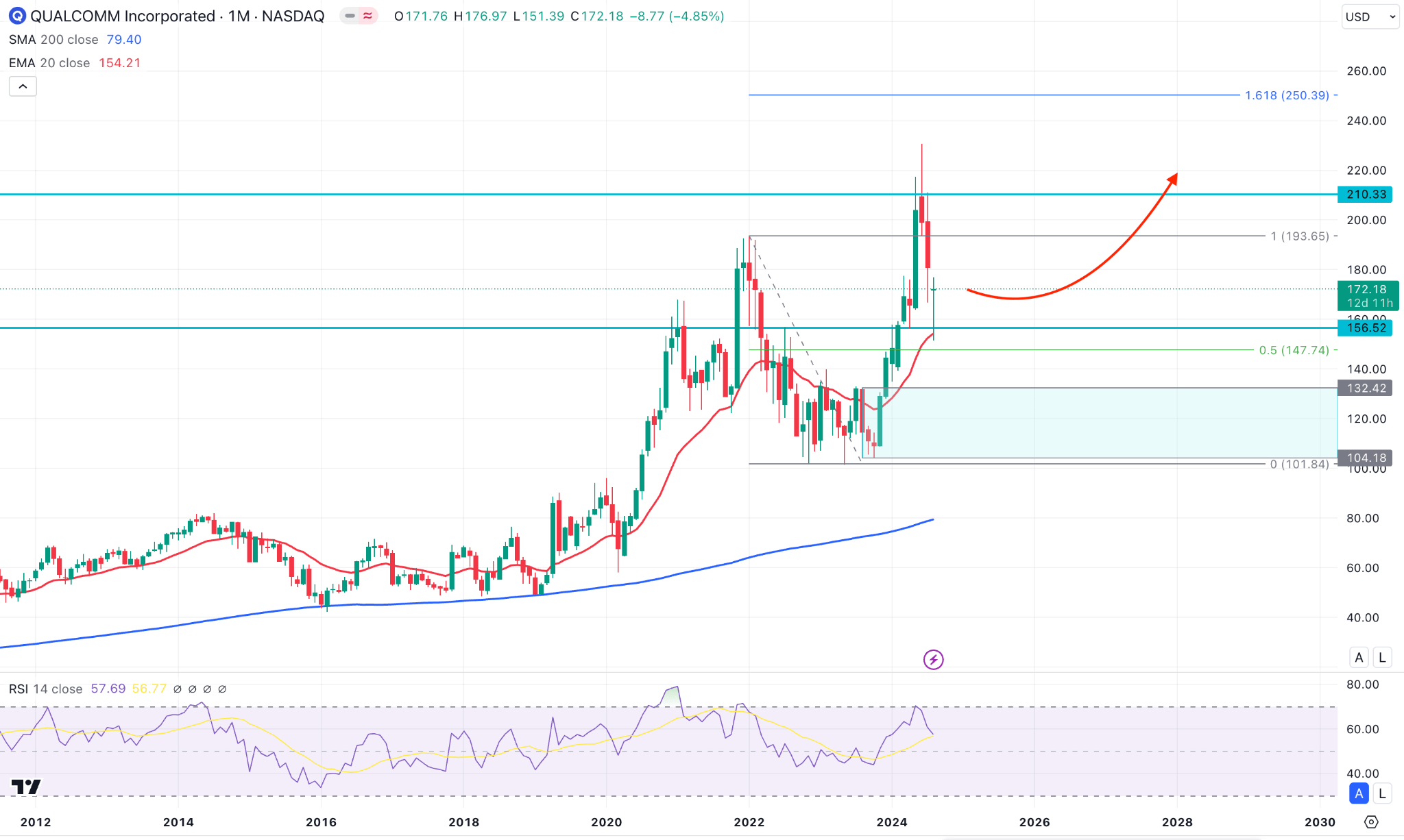

The ongoing bullish trend is valid in the QCOM price, where the bullish continuation might find a ceiling at the 250.39 Fibonacci Extension level by the end of 2030.

In the monthly timeframe, the recent price showed a bullish reversal from the 132.42 to 104.18 demand zone, creating a new swing high. However, the price failed to remain steady above the 193.65 swing high, limiting the upward possibility.

Looking at the monthly chart, the 100-month SMA is the major support, which is near the 80.00 level. As the current price is way above the current price, we may expect a downside correction as a mean reversion. Moreover, the 50-month EMA is the immediate support from the current price, and it showed a valid bullish reversal candlestick.

Based on the QCOM Stock Forecast 2030 and Beyond, a consolidation is pending as the profit from the all-time high is over. In that case, a range breakout from the 145.00 to 173.00 area could open the bullish possibility towards the 250.00 level.

On the other hand, a failure to hold above the immediate dynamic support could be challenging for bulls. A monthly candle below the 147.00 level could lower the price and find support from the 104.18 level.

A. Other Qualcomm Stock Prediction 2030 and Beyond Insights

QCOM's business has a good chance of exceeding past averages in the upcoming five years. It is true that no organization can ensure such a result, and Qualcomm stock could be negatively impacted by events like industry downturns, the company's entry into stronger chip markets, and other unknowable factors.

Still, Qualcomm leads its handset segment, which generates the lion's share of revenue. Since it is very unlikely to change in the near future, Qualcomm should benefit from this advantage alone.

In addition, Qualcomm frequently sees sharp rises in earnings and revenue during prosperous periods. Qualcomm investors should also profit if they can resume these growth rates when circumstances improve.

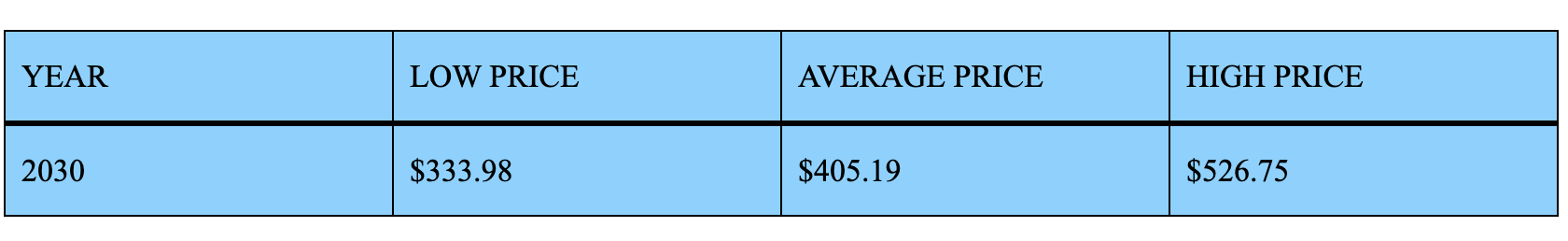

Source: markettalkz.com

By 2029, another report anticipates a roughly 13% increase, bringing the average price to $405.19.

A major turning point in Qualcomm's 6G growth initiatives may occur in 2030. The company's position as a leader in this new technology could strengthen its standing in the market. Technological developments in AI chips and neuromorphic computing may create new opportunities for mobile and Internet of Things (IoT) devices. It's possible that Qualcomm will play a bigger part in allowing next-generation modes of transportation and smart city facilities.

B. Key Factors to Watch for Qualcomm Stock Forecast 2030 and Beyond

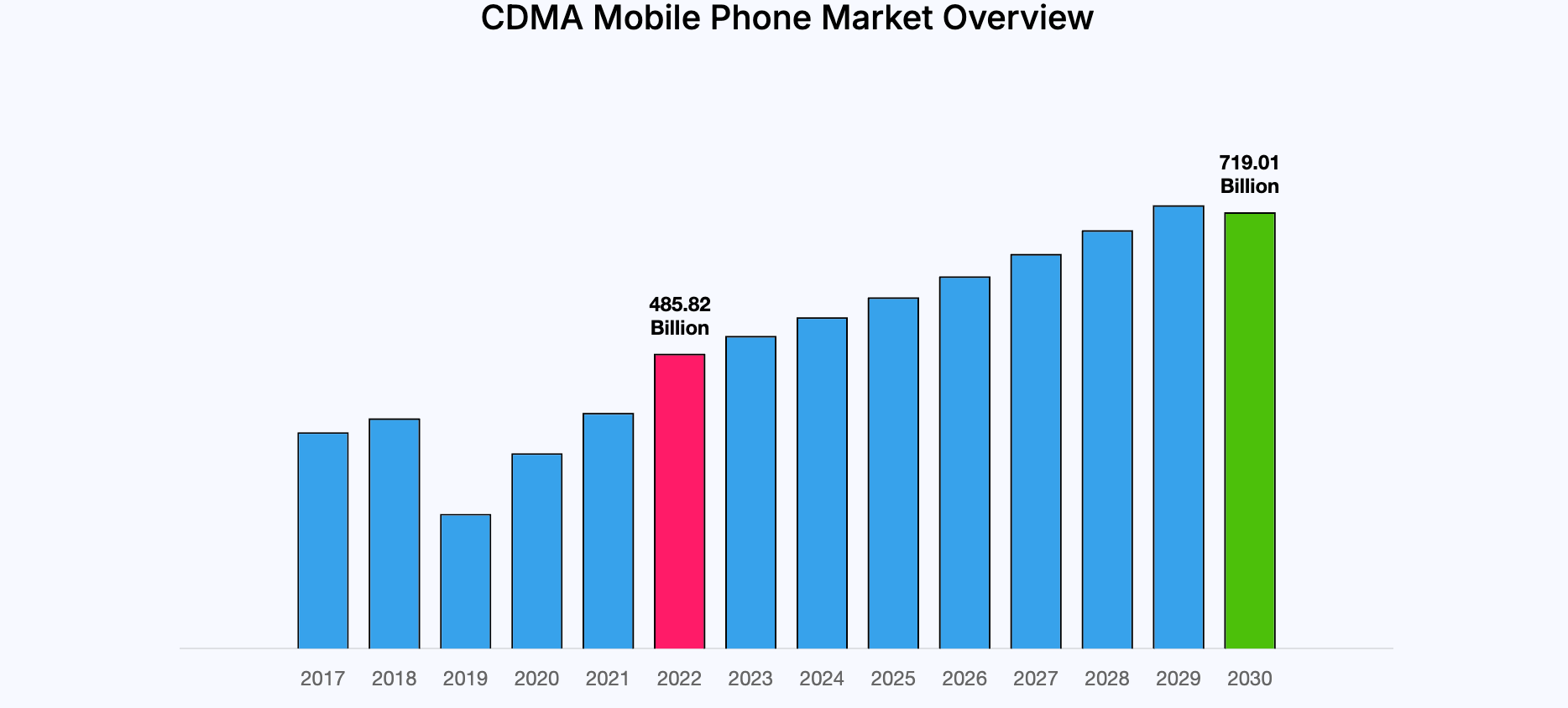

CDMA Market Cap Projection in 2030

Source: reportprime.com

The major revenue segment for QCOM is the CDM technology, which represents 80% of the revenue.

However, the modern world is evolving to 5G and probably 6G networks within 2030, while CDMA could lag behind. Therefore, the adoption of new technology (like OFCDMA) could keep the company on track.

Moreover, the CDMA technology is widely used in some regions, where the transition might need more time. A focus on these regions by developing and improving services could be a revenue-generating factor.

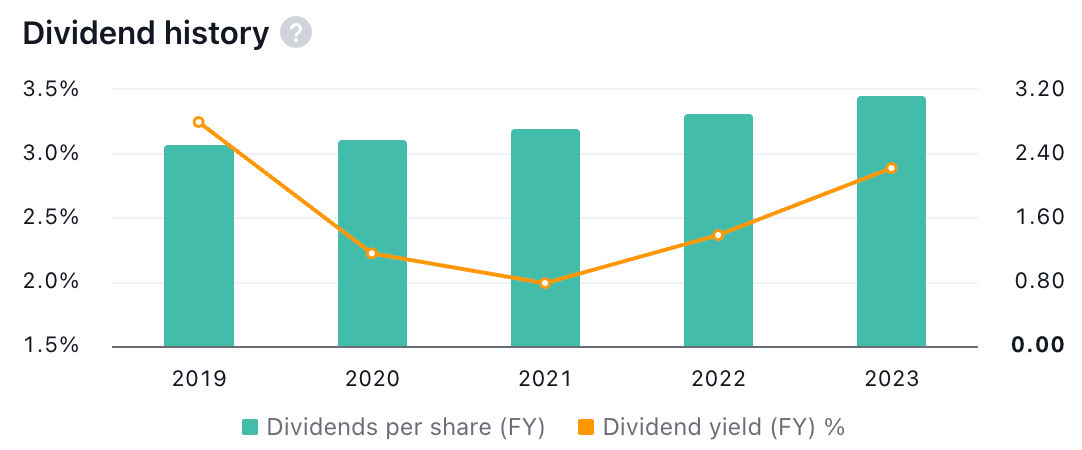

QCOM Dividend Structure

QCOM shows a stable business, as revenue has remained steady for more than five years. Moreover, the greater part of the revenue goes to investors as a dividend, which could be a great money-making opportunity.

As per the current data, the company's Dividend yield is 2.88%, up from 1.99% in 2021. Investors might expect a stable return from the dividend if the company maintains its growth.

QCOM Stock Forecast 2030 and Beyond - Bullish Factors

- Being a pioneer in 5G technology, Qualcomm is ideally positioned to continue leading the way as the globe moves to 6G and other cutting-edge wireless standards. With continued investments in cutting-edge wireless technologies, Qualcomm may be able to maintain its position as a major facilitator of global connectivity, which could result in steady revenue growth over the coming ten years.

- Qualcomm is gaining traction in the automotive industry, especially with its Snapdragon Digital Chassis system, which facilitates autonomous driving, linked car technologies, and in-car multimedia systems. As the industry shifts toward electric and autonomous vehicles, Qualcomm's technology may become standard in upcoming models, resulting in long-term revenue growth.

- Qualcomm is emphasizing sustainability and incorporating eco-friendly technologies into its goods. As more people and companies value eco-friendly technologies by 2030, this could improve Qualcomm's market position and image while also keeping pace with global trends toward ecological consciousness.

Qualcomm Stock Prediction 2030 and Beyond - Bearish Factors

- A wider range of economic factors, such as probable downturns or slowdowns in important markets like China, may affect Qualcomm's consumer demand. Due to its global presence, Qualcomm's revenue is susceptible to changes in the economy, and a recession could harm its financial performance.

V. Conclusion

A. Qualcomm Stock Outlook

Qualcomm (QCOM) offers a decent investment opportunity. Its wide range of revenue segments could potentially earn investors money.

For 2024, the QCOM might extend the current momentum and close the year nearly at the $200.00 area. However, the upward pressure depends on various factors, where the smartphone segment could be a crucial one.

For 2025, the buying pressure might extend and reach the $230.00 level, where the AI PC market could face a gain, apart from the mobile chipset segment. However, the global economic factor could be another area for this stock in 2025.

If the next-generation wireless technology is adopted, the stock could lead to prices above $400.00 by 2030.

Currently, QCOM could be a promising investment opportunity for long-term traders and HODLers. In other words, finding a proper swing point and grabbing the opportunity from the short-term price fluctuation could be another opportunity for investors.

B. Trade QCOM Stock CFD with VSTAR

CFD trading is a blessing to investors, as modern people don't like the hassle of following multiple conditions and steps in buying and selling a stock. Also, the handy approach through the VSAR Mobile app, supported by valuable market insights, could boost anyone's profit potential.

With VSTAR, you can benefit from tight spreads, enabling you to enter and exit trades with minimal cost. This is particularly useful in a volatile stock like Qualcomm, where price movements can be swift and significant. Also, the muti-regulated environment, mobile portability, wide range of asset types, regular market analysis, and top-notch customer support.

Moreover, VSTAR's platform is user-friendly, offering advanced tools and real-time data to help you make informed trading decisions.

By trading QCOM Stock CFDs with VSTAR, you can participate in the market's upside while managing your risk effectively, making it a valuable option for both novice and experienced traders.