I. Recent Pfizer Stock Performance

Recent PFE stock price performance and changes

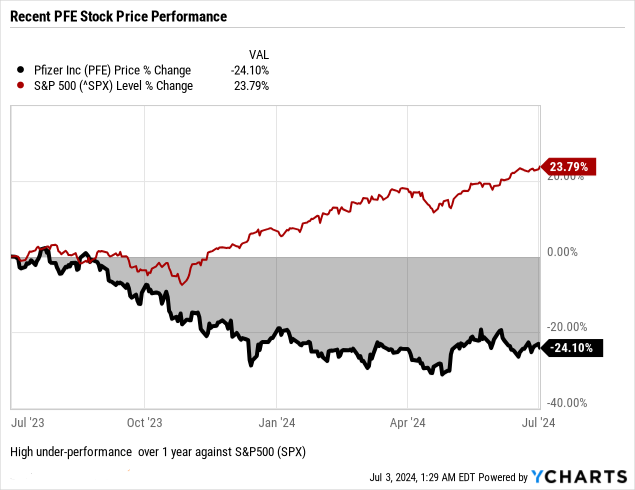

Over the past year, Pfizer experienced a significant decline of -24.1%, far below the S&P 500's 23.8% gain.

Source:Ycharts.com

Looking at different holding periods, Pfizer's performance remains weak:

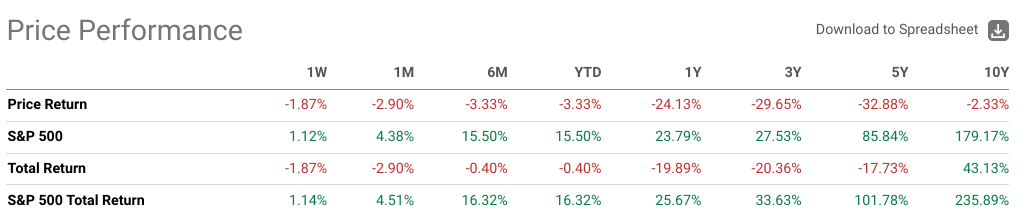

- Over the last six months, Pfizer stock declined by -3.3%, contrasting with the S&P 500's robust 15.5% increase.

- Year-to-date, PFE stock performance mirrors its six-month trend, down by -3.3%, while the S&P 500 rose by 15.5%.

- Over the last month, Pfizer stock has declined by -2.9%, underperforming the S&P 500's gain of 4.4%.

- Looking further back, Pfizer's performance over three years (-29.7%), five years (-32.9%), and ten years (-2.3%) indicates challenges in long-term growth compared to the S&P 500's more substantial gains.

Source:seekingalpha.com

Main influencing factors

Pfizer's recent stock performance in early 2024 reflects a complex interplay of factors influencing its financial health and investor sentiment. Key drivers include both positive and negative influences:

- Revenue Dynamics: Pfizer reported first-quarter revenues of $14.9 billion, a 19% decline year-over-year driven by decreased sales of Comirnaty and Paxlovid, partly offset by 11% operational growth in other products. The decline in COVID-19 vaccine revenues was expected due to reduced global demand and lower U.S. volumes as markets transitioned to commercial sales.

- PFE Earnings Growth: Adjusted diluted EPS for Q1 2024 was $0.82, benefiting from cost management initiatives and a favorable $0.11 impact from Paxlovid revenue adjustments. Despite revenue declines, Pfizer's focus on cost realignment and operational efficiencies bolstered profitability.

- Strategic Initiatives: Pfizer remains committed to its 2024 priorities, including achieving $4 billion in net cost savings and enhancing shareholder value through strategic capital allocation. This includes significant investments in R&D ($2.5 billion) and $2.4 billion in dividends, although no share repurchases were completed in the period.

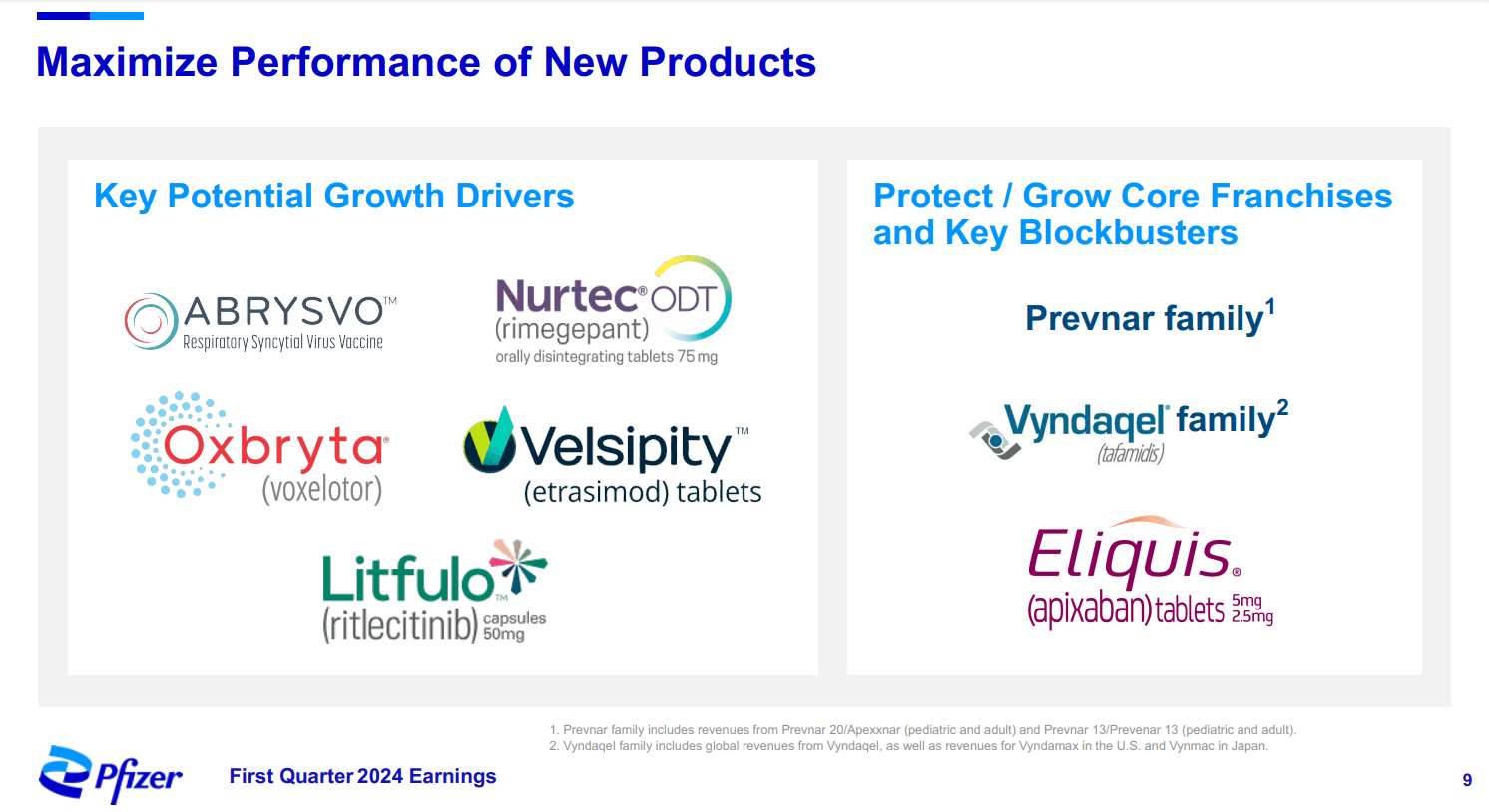

- Product Portfolio Performance: Non-COVID products like Vyndaqel, Eliquis, and the Prevnar family showed robust operational growth, reflecting Pfizer's diversified portfolio strategy. Oncology products like Ibrance and newer acquisitions from Seagen contributed to revenue diversification.

- Market Outlook and Guidance: Pfizer reaffirmed its 2024 revenue guidance of $58.5 to $61.5 billion, despite challenges in the COVID product segment. The company revised its adjusted EPS guidance upward to $2.15 to $2.35, demonstrating confidence in operational efficiencies and strategic initiatives.

Expert Insights on Pfizer Stock Forecast for 2024, 2025, 2030 and Beyond

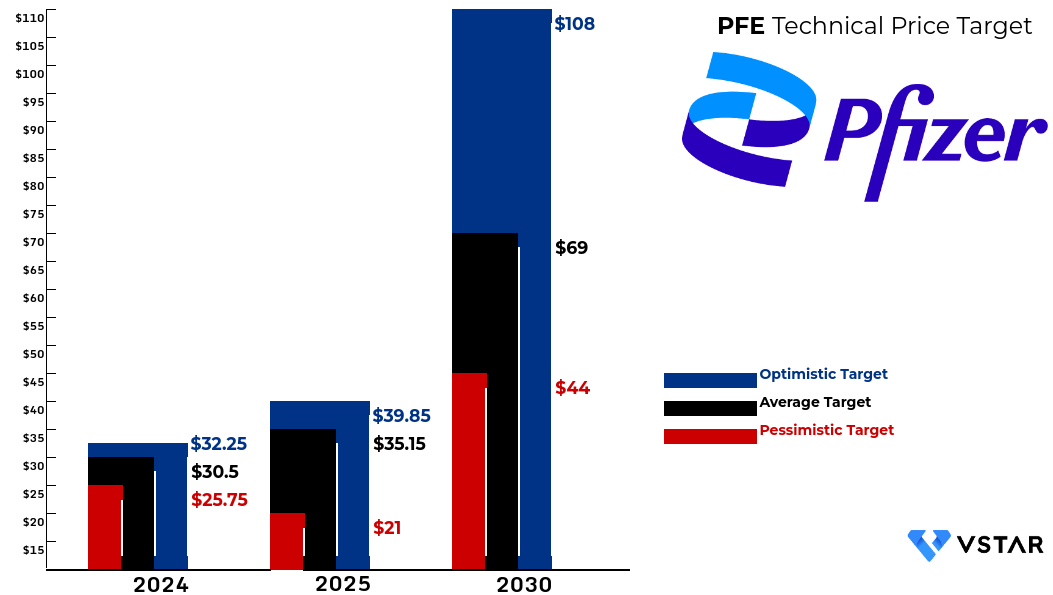

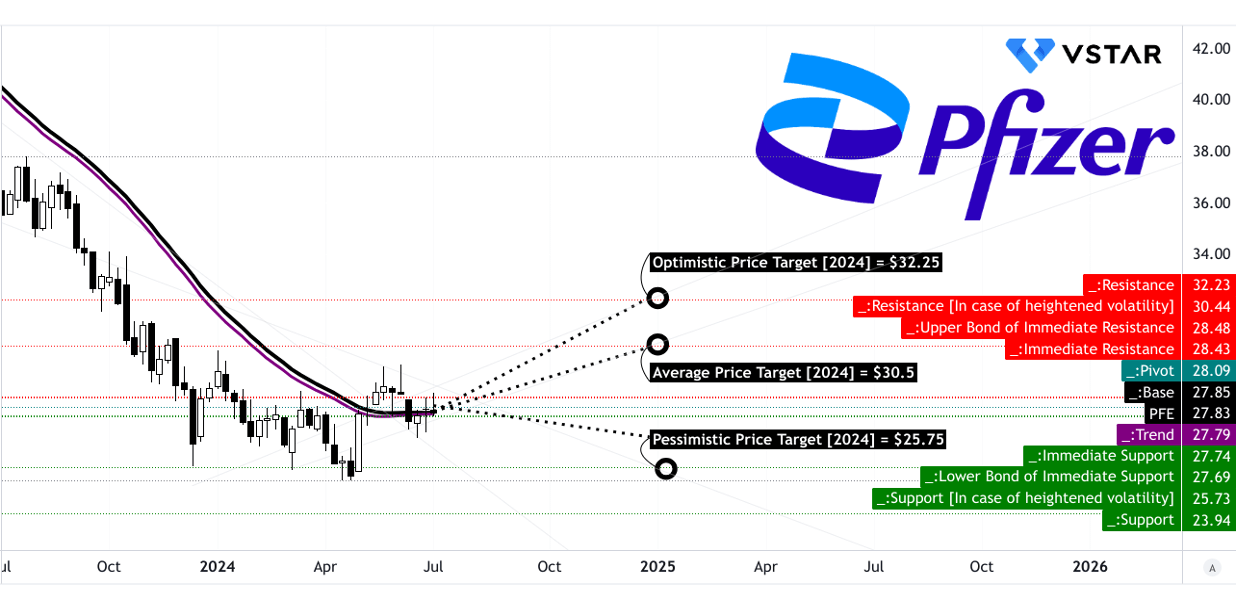

Recent Pfizer stock performance reveals fluctuating trends influenced by market conditions. Expert forecasts for Pfizer (NYSE: PFE) show a range of potential outcomes: by 2024, targets span $25.75 to $32.25, by 2025, $21.00 to $39.85, and by 2030, $44.00 to $108.00. These predictions reflect varying degrees of optimism and pessimism, underscoring the stock's potential volatility and long-term growth possibilities.

Source: Analyst's complication

II. Pfizer Stock Price Forecast 2024

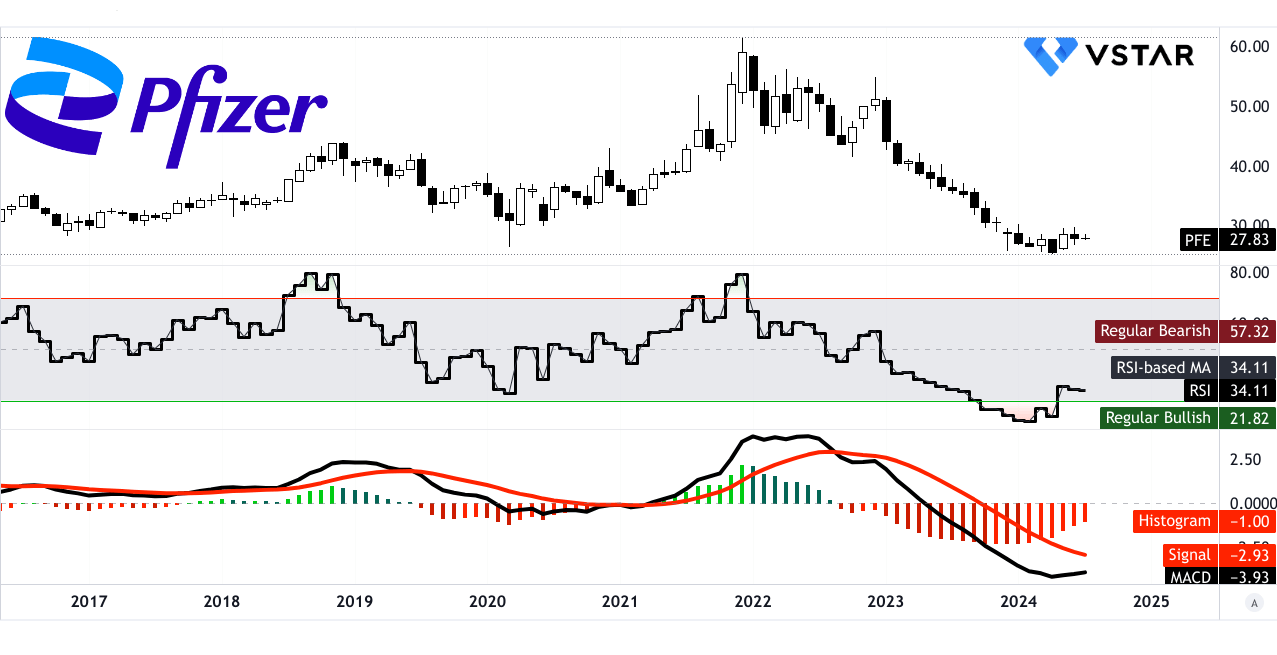

Based on technical analysis and insights, the predicted stock prices for Pfizer (NYSE: PFE) by the end of 2024 are as follows: the average PFE price target is $30.50, the optimistic price target is $32.25, and the pessimistic Pfizer price target is $25.75. These predictions are derived from the momentum of change-in-polarity over the short term, projected over Fibonacci extension and retracement levels.

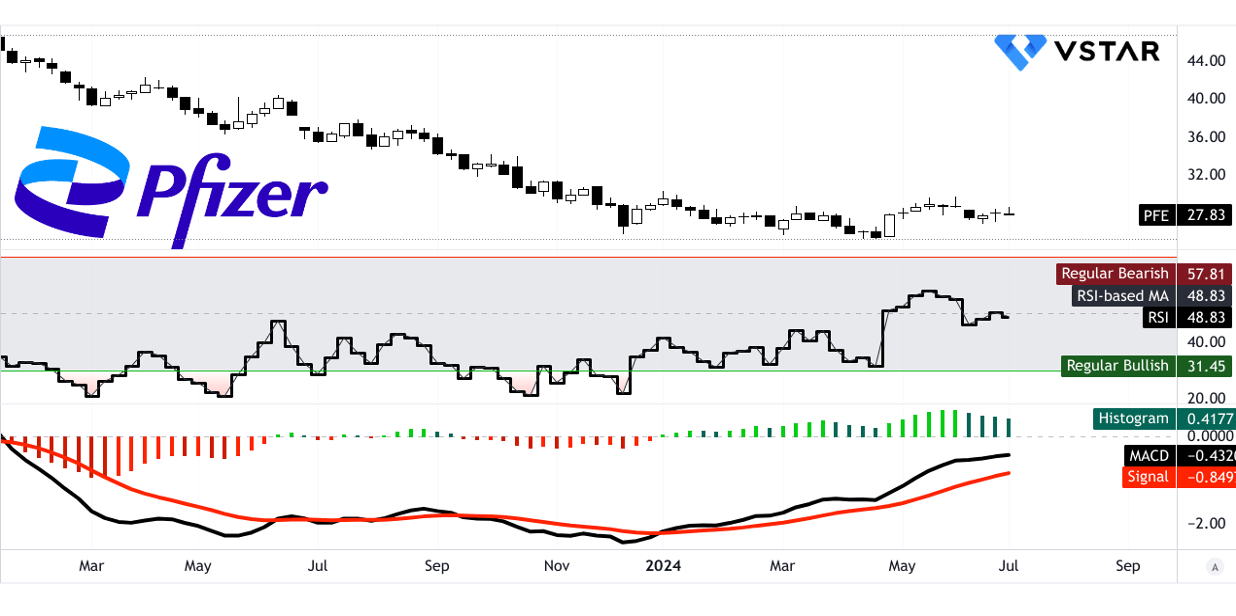

The current price of Pfizer is $27.83, which is close to the modified exponential moving average trendline of $27.79 and the baseline of $27.85. This indicates a stable sideways movement without significant deviation from the average, suggesting that the stock is currently experiencing limited volatility. The stock's sideways trend suggests limited immediate volatility, with resistance levels identified at $28.48 and pivot at $28.09. In case of heightened volatility, the resistance level is projected at $30.44. The primary support level is at $27.74, with core support at $23.94. In a highly volatile scenario, the support level could drop to $25.73. These levels provide a safety net for the pessimistic PFE stock price target of $25.75.

Source: tradingview.com

The Relative Strength Index (RSI) value of 48.83 indicates a neutral stance with no clear bullish or bearish divergence. The RSI line trend is sideways, aligning with the overall stock trend. Additionally, the Moving Average Convergence/Divergence (MACD) analysis shows the MACD line at -0.432 and the signal line at -0.849, with a histogram value of 0.4177, indicating a decreasing bullish trend. The weakening bullish momentum aligns with a conservative price movement projection, supporting the average PFE price target of $30.50.

Source: tradingview.com

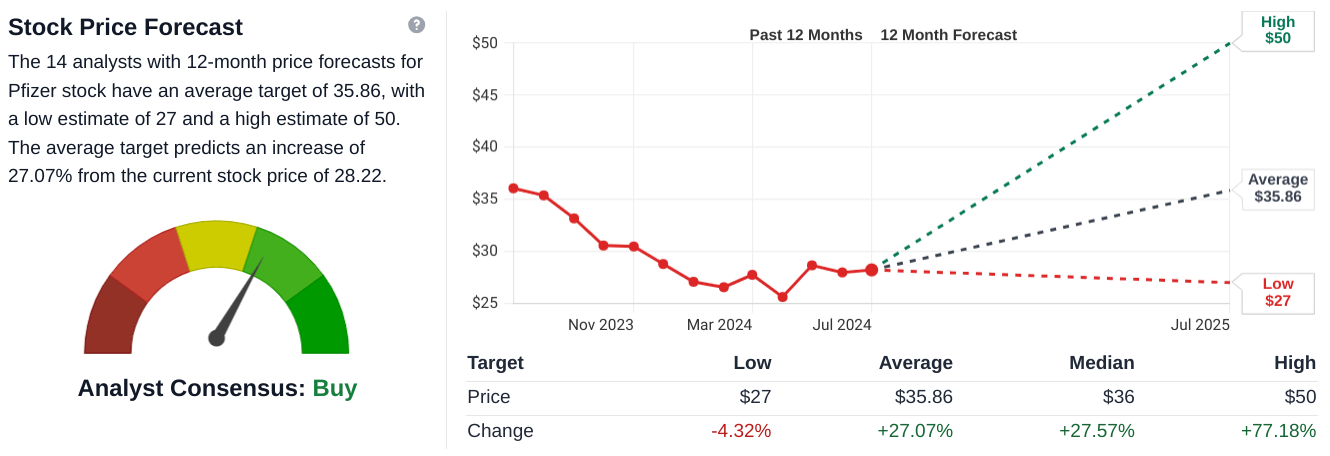

The forecasted stock price for Pfizer in 2024 varies among different sources, reflecting a range of analyst perspectives and methodologies. According to stockanalysis.com, the consensus among 14 analysts suggests an average target price of $35.86, indicating a potential 27.07% increase from the current price of $28.22. This optimistic outlook is supported by a high estimate of $50 and a low estimate of $27, showcasing a wide spectrum of expectations.

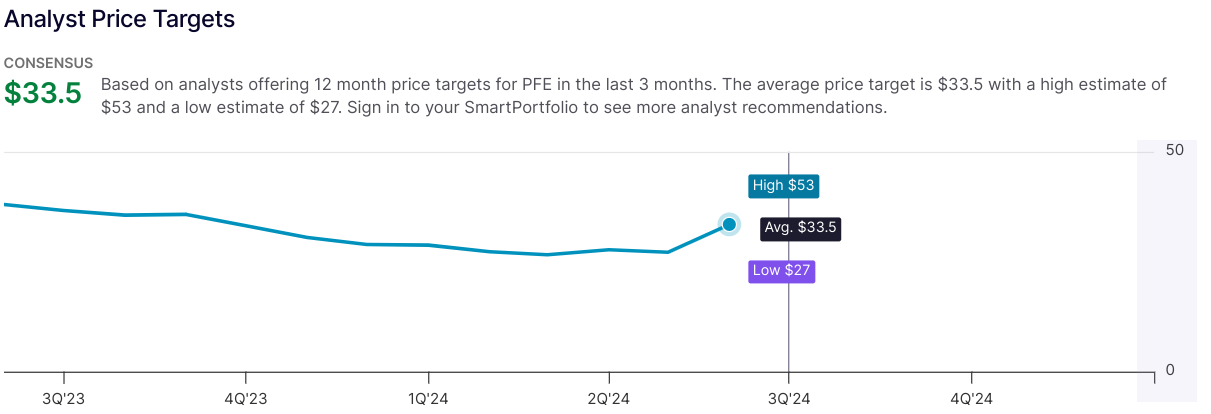

Similarly, tipranks.com reports a slightly lower average PFE target price of $33.50, derived from 15 Wall Street analysts. Here, the forecasts range from a low of $27 to a high of $53, emphasizing considerable divergence in expert opinions. This diversity in forecasts could stem from varying methodologies, including fundamental analysis, market sentiment, and technical indicators.

On the other hand, coinpriceforecast.com provides a more conservative outlook, projecting a modest increase to $29.18 by the year-end, reflecting a 3% rise from the current price.

Source:stockanalysis.com

A. Other Pfizer Stock Forecast 2024 Insights: Pfizer stock buy or sell?

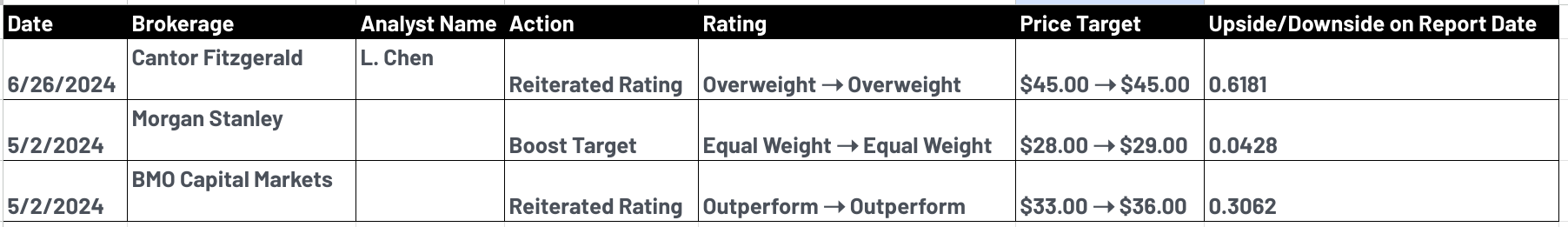

For 2024, analysts from various financial institutions offered differing perspectives on Pfizer's (NYSE: PFE) stock outlook. Cantor Fitzgerald's L. Chen reiterated an "Overweight" rating with a price target of $45.00, suggesting a slight upside potential. This indicates their confidence in Pfizer's future performance relative to the market.

Moreover, Morgan Stanley adjusted their price target from $28.00 to $29.00 while maintaining an "Equal Weight" rating. This modest increase reflects a neutral stance on Pfizer's expected performance compared to its peers. Meanwhile, BMO Capital Markets reiterated an "Outperform" rating and raised their price target from $33.00 to $36.00. This indicates a more optimistic outlook, suggesting they believe Pfizer will outperform market expectations.

Source:marketbeat.com

B. Key Factors to Watch for PFE Stock Forecast 2024

PFE Forecast 2024 - Bullish Factors

Pfizer (NYSE: PFE) demonstrates several positive indicators that could support a bullish outlook for 2024. Firstly, the company has raised its adjusted diluted EPS guidance to $2.15 to $2.35, reflecting confidence in its cost realignment program and strong underlying business performance. This upward revision suggests improved profitability expectations, which could bolster investor confidence.

Source:seekingalpha.com

Strategically, Pfizer's focus on oncology leadership is yielding results, with a 19% operational growth in oncology revenues driven by acquisitions and strong commercial execution. The expansion into biologics and breakthrough therapies, such as Tivdak for cervical cancer and gene therapies like Beqvez for hemophilia B, underscores Pfizer's innovation pipeline strength and potential for revenue diversification.

Financially, Pfizer's gross margin improved significantly by 530 basis points to 79.6% in Q1 2024, driven by favorable sales mix and effective cost management strategies. This margin enhancement, alongside disciplined expense control despite integrating Seagen's operations, indicates operational efficiency and potential for margin expansion.

Pfizer Stock Price Forecast 2024 - Bearish Factors

Despite these strengths, Pfizer faces notable challenges that could temper its stock performance in 2024. The company's revenue projections, while robust, heavily depend on the seasonal demand and regulatory landscapes for COVID-19 vaccines like Comirnaty. Approximately 90% of Comirnaty sales are expected in the second half of the year, introducing significant revenue concentration risk.

Furthermore, Pfizer's operational revenues outside of COVID products declined by 19% in Q1 2024 compared to the previous year, highlighting ongoing challenges in non-COVID segments. Lower demand for established drugs like Ibrance in certain markets adds to these concerns, reflecting competitive pressures and market dynamics.

III. Pfizer Stock Price Forecast 2025

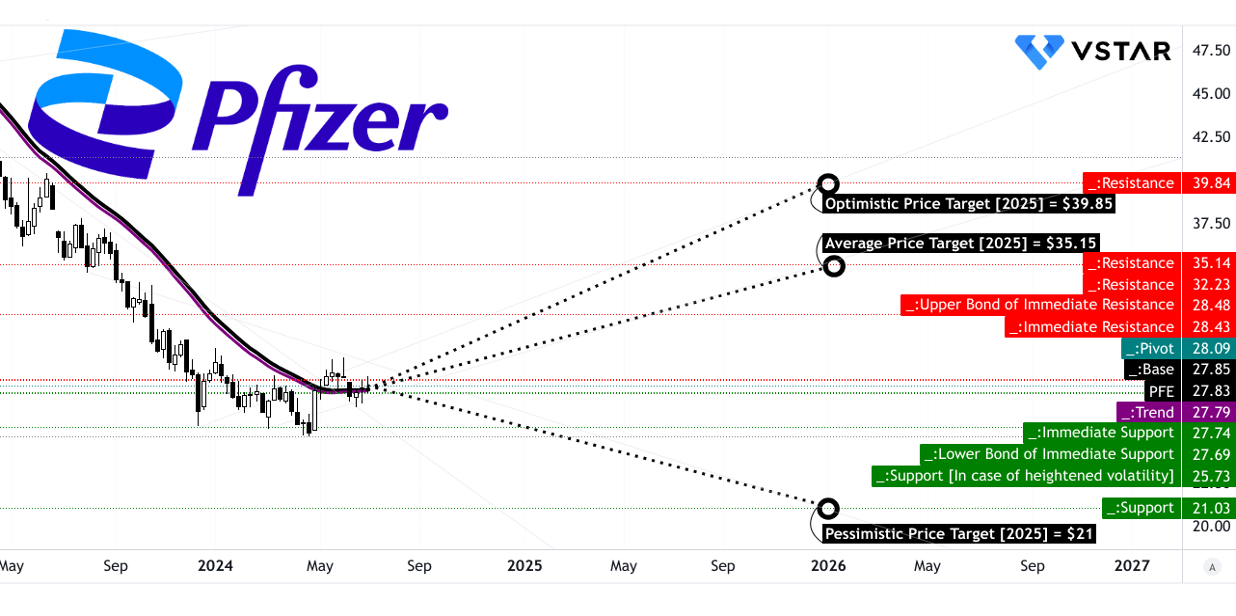

Based on the technical analysis, Pfizer (NYSE: PFE) is predicted to have varying price targets by the end of 2025. The average PFE price target is set at $35.15, which reflects a moderate bullish momentum projected over Fibonacci extension levels. The optimistic Pfizer price target stands at $39.85, indicating strong upward price momentum based on current swing projections. Conversely, the pessimistic PFE stock price target is $21.00, considering potential downward price momentum based on mid-term Fibonacci retracement levels.

Currently, Pfizer stock is priced at $27.83, exhibiting a sideways trend as evidenced by the trendline and baseline near the current price. The primary resistance level is identified at $28.50, with the pivot of the current horizontal price channel at $28.09. In case of heightened volatility, resistance levels are marked at $32.23 and $35.14, which align with the core resistance level of $35.14.

Source: tradingview.com

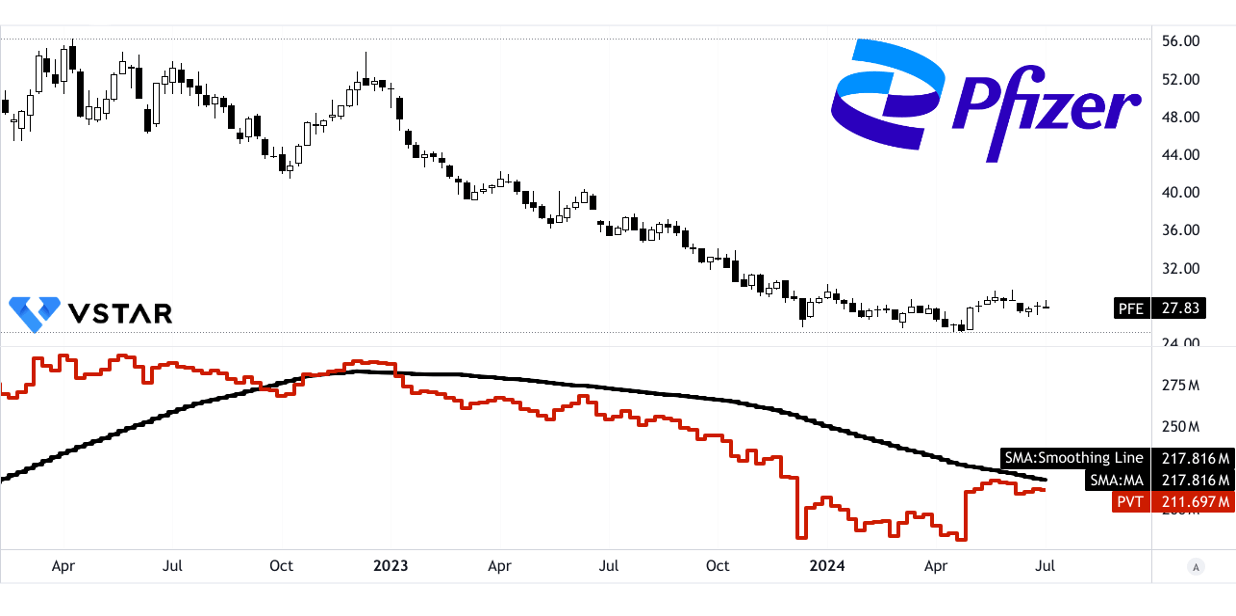

The Price Volume Trend (PVT) analysis shows a line value of 211.697 million, with a moving average of 217.816 million, indicating a bearish prevailing stock price momentum. However, this also suggests a possible conclusion of the current accumulation phase. Key support levels are at $27.70 and $25.73, with core support at $21.03, reflecting the pessimistic price target scenario.

Source: tradingview.com

CoinPriceForecast: Predicts Pfizer stock to reach $30 by mid-2025, with a modest increase of 9% from the year's start.

LongForecast: Provides a detailed monthly breakdown, suggesting PFE stock could range from $29.01 to $32.37 by December 2025, reflecting potential gains of 3.5% to 16.5% throughout the year.

CoinCodex: Forecasts a more conservative rise to $28.84 by year-end 2025, implying a 2.19% increase.

These forecasts vary in their optimism but generally anticipate moderate to moderate-high growth for Pfizer stock through 2025, influenced by market conditions and company performance.

Source:coincodex.com

A. Other Pfizer Stock Forecast 2025 Insights: Is PFE a buy?

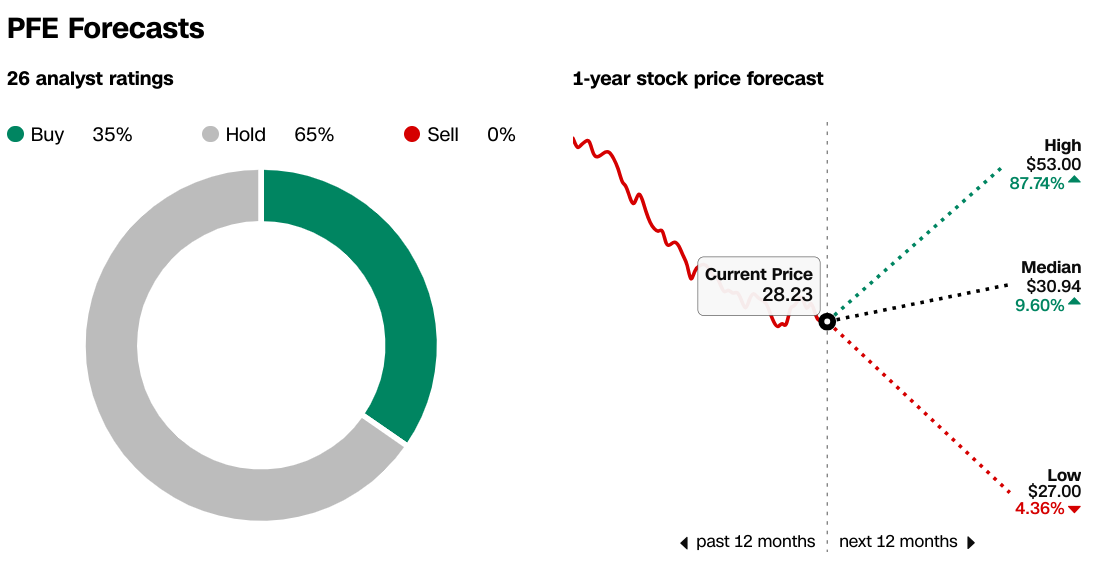

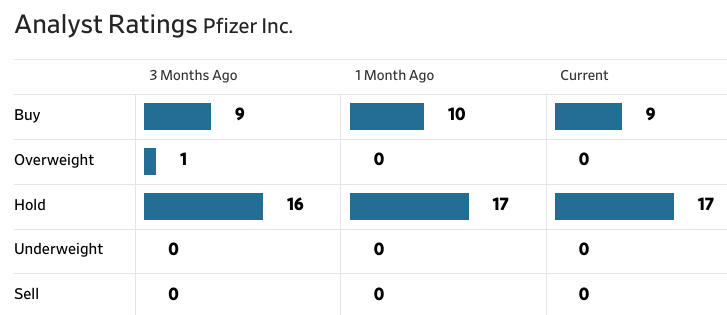

Based on recent analyst ratings, Pfizer (NYSE: PFE) shows a varied outlook for its stock price in 2025. Analysts listed on nasdaq.com have provided a consensus average PFE price target of approximately $33.5, derived from a range of estimates. The highest estimate stands at $53, reflecting significant potential upside, while the lowest estimate is $27, indicating more conservative expectations.

Source:Nasdaq.com

CNN.com reports a similar sentiment with 35% of analysts rating Pfizer as a "Buy," suggesting confidence in its future performance. Meanwhile, 65% recommend "Hold," implying a cautious stance among a majority of analysts. No analysts currently recommend selling the stock.

Source:CNN.com

According to WSJ.com, recent trends in analyst ratings show a stable outlook with 9 analysts rating Pfizer as "Buy," and 17 as "Hold." There has been no recent change in underweight or sell recommendations, indicating a consensus around the stock's current stability.

Source:WSJ.com

B. Key Factors to Watch for PFE Stock Forecast 2025

Pfizer Stock Forecast 2025 - Bullish Factors

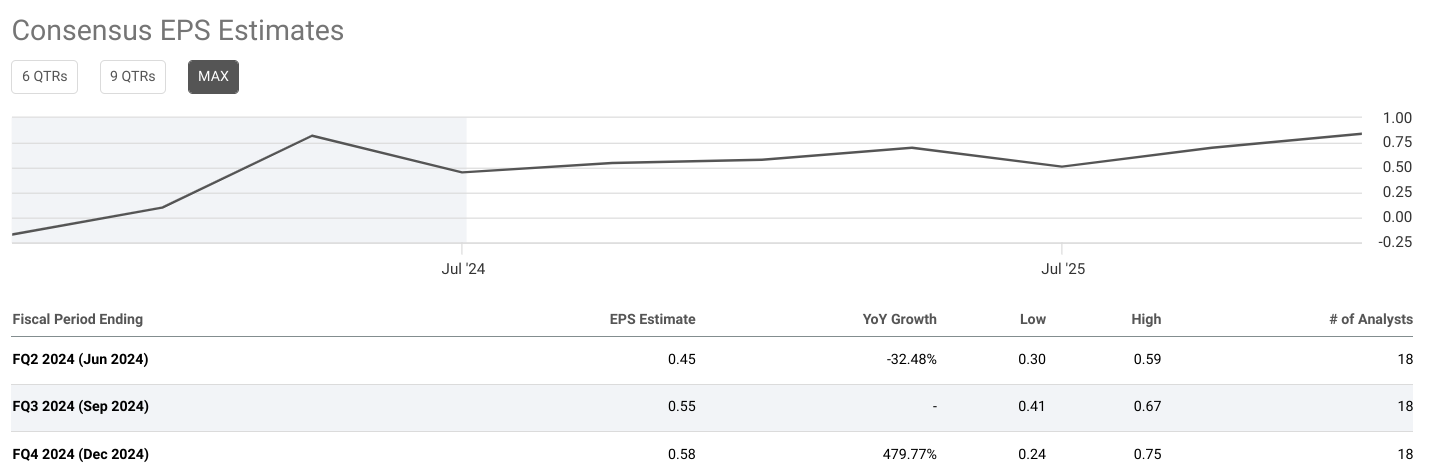

Pfizer (NYSE: PFE) appears poised for a positive trajectory in 2025, supported by several key bullish factors. Firstly, the company's financial forecast indicates robust earnings growth, with consensus EPS estimates rising from $2.35 in 2024 to $2.75 in 2025, driven by expected increases in operational efficiencies and revenue expansion across key product lines such as oncology and vaccines. This represents a significant year-over-year growth of 16.84%.

Strategically, Pfizer's focus on oncology leadership is a major catalyst. The company's recent acquisitions and strong commercial execution in oncology, highlighted by the successful integration of Seagen's portfolio, underscore its commitment to expanding market share and driving revenue growth. For instance, the strong performance of products like Padcev and Xtandi in oncology reflects Pfizer's ability to capitalize on therapeutic advancements and market demand, which bodes well for sustained revenue growth.

Moreover, Pfizer's pipeline innovation, evidenced by promising Phase 3 trials across multiple therapeutic areas including oncology and hematology, positions the company favorably for future blockbuster drug approvals. The potential approvals of products like Beqvez for hemophilia and osivelotor for sickle cell disease could significantly enhance Pfizer's revenue diversification and market competitiveness.

Source: Q1 2024 Earnings

Pfizer Stock Price Forecast 2025 - Bearish Factors

Despite these bullish indicators, Pfizer faces certain bearish factors that could impact its stock performance in 2025. One notable concern is the reliance on COVID-19 related products like Comirnaty and Paxlovid for a significant portion of revenue. While Pfizer anticipates strong sales in the second half of 2024 for these products, the potential waning of COVID-19 vaccine demand as global vaccination rates stabilize could pose a revenue risk beyond 2025.

Additionally, the competitive landscape in the pharmaceutical industry remains intense, with challenges such as patent expirations and generic competition affecting revenue streams from established blockbuster drugs like Eliquis and Prevnar. Pfizer's ability to effectively navigate these challenges through ongoing innovation and strategic acquisitions will be crucial for maintaining market leadership and sustaining revenue growth.

Furthermore, macroeconomic factors such as regulatory changes and global economic conditions could impact Pfizer's operational costs and profitability margins, potentially affecting investor sentiment and stock valuation.

IV. Pfizer Stock Price Forecast 2030 and Beyond

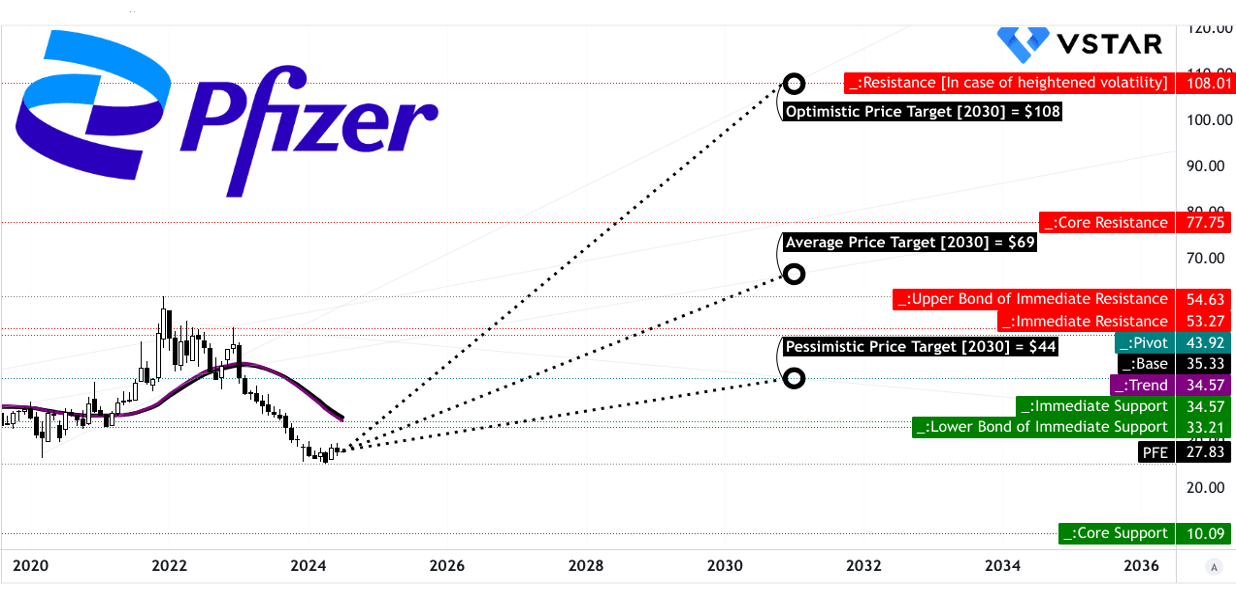

Based on current technical analysis, Pfizer stock (NYSE: PFE) is projected to reach an average price target of $69.00 by the end of 2030. In an optimistic scenario, driven by strong upward momentum and favorable market conditions, the stock could potentially hit $108.00. Conversely, under a pessimistic outlook, which factors in potential downward swings and market volatility, the price might drop to $44.00.

A detailed analysis of the tradingview charts provides additional insights supporting these forecasts. Currently, PFE stock is trading at $27.83, indicating a sideways movement as reflected by its trendline at $34.57 and baseline at $35.33. This suggests that the stock is consolidating within a horizontal price channel. The primary resistance level is identified at $33.21, while a core resistance level is pegged at $77.75, indicating significant upward barriers that the stock must breach to realize the higher price targets.

The pivot of the current horizontal price channel at $43.92 serves as a crucial midpoint, with a secondary resistance at $54.63. This range indicates potential volatility and trading opportunities.

Source: tradingview.com

The RSI at 34.11 points towards an undervalued condition, with the RSI line trending upwards, signaling a possible bullish divergence. This could indicate an upcoming positive price movement if buying momentum increases.

The MACD indicator shows a bearish trend with the MACD line at -3.93 and the signal line at -2.93, but the decreasing strength of this trend suggests that the bearish momentum may be waning. The MACD histogram at -1 reinforces this view, indicating a potential trend reversal.

Source: tradingview.com

The PFE stock predictions through 2030 vary, indicating potential growth but with differing magnitudes. Coinpriceforecast.com predicts a substantial rise, with a projected 70% increase by 2030 and further escalations in subsequent years, driven by optimistic market sentiment and strategic developments. Conversely, coincodex.com forecasts a more conservative growth trajectory, expecting a 13.86% increase by 2030.

Source:coinpriceforecast.com

A. Other Pfizer Stock Forecast 2030 and Beyond Insights: Is PFE a good stock to buy?

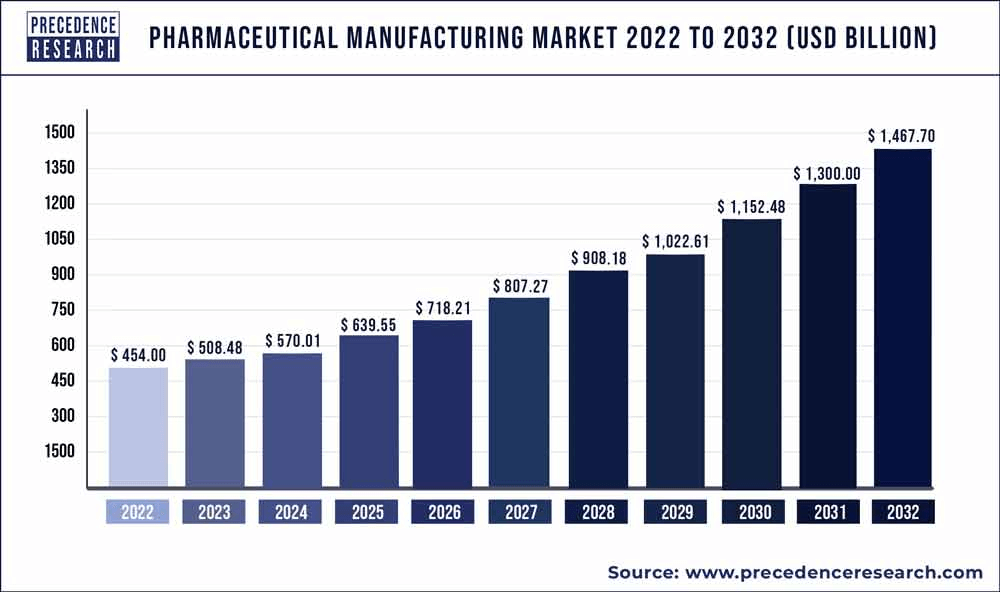

As per precedenceresearch.com, the global pharmaceutical market revenue was $508.48 Billion in 2023 and may hit $1.467.7 trillion by 2032. The market may grow at a solid CAGR of 12.5% during 2023 to 2032. The market trend here may benefit Pfizer's top-line growth considerably.

Source: precedenceresearch.com

B. Key Factors to Watch for Pfizer Stock Prediction 2030 and Beyond

Pfizer Stock Price Forecast 2030 and Beyond - Bullish Factors

Strong Pipeline and Innovation: Pfizer's robust pipeline, highlighted by advancements in oncology with promising drugs like Tivdak and Lorbrena, positions it well to achieve leadership in cancer treatments. The company's focus on developing biologics and expanding its portfolio could lead to significant revenue growth, especially with plans to increase blockbuster drugs from 5 to 8 by 2030.

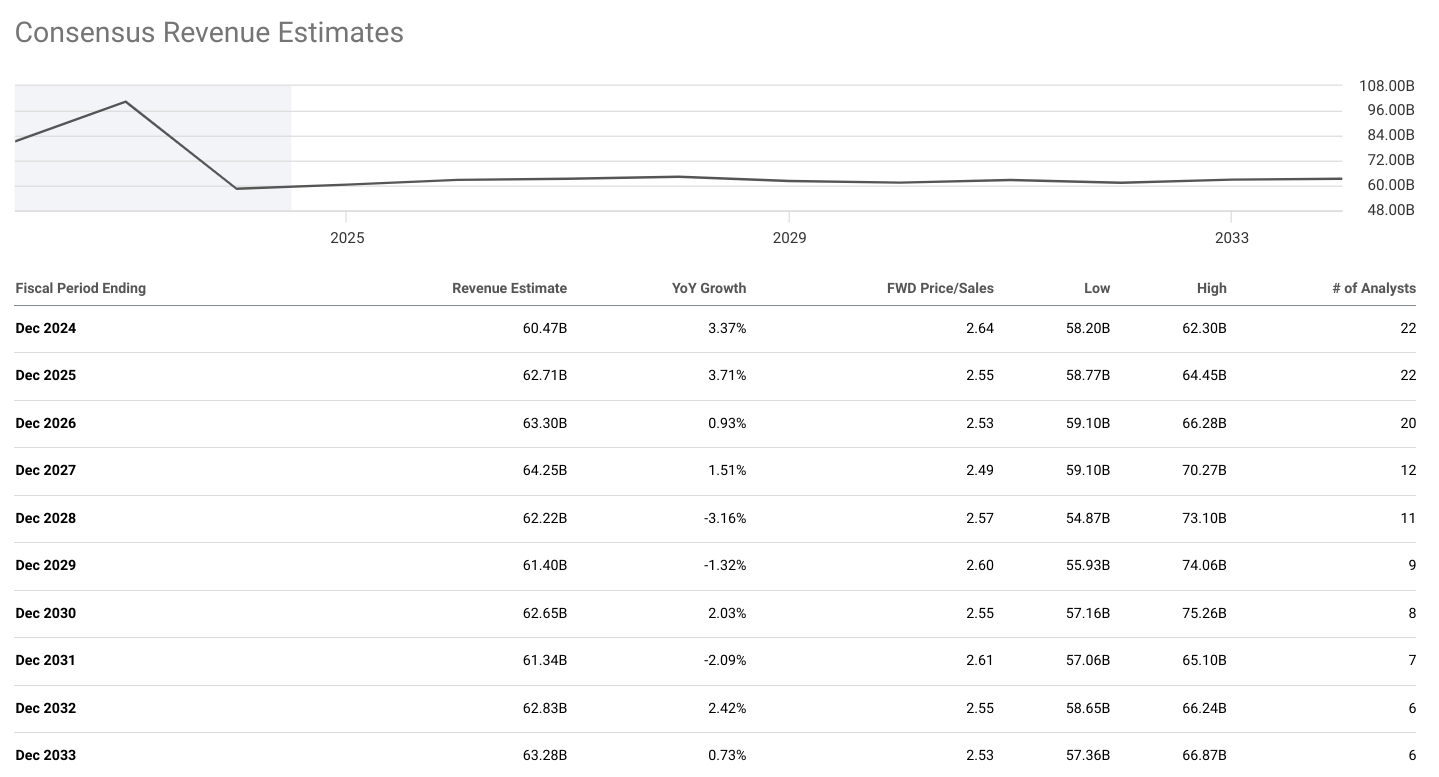

Financial Stability and Growth: Despite near-term challenges, Pfizer's financial forecasts suggest resilience. Consensus EPS estimates show steady growth, from $2.35 in 2024 to $2.83 by 2030, indicating a positive trajectory. Revenue estimates also demonstrate modest growth, reaching $62.65 billion by 2030, up from $60.47 billion in 2024, driven by sustained demand across its key products and new launches.

Source:seekingalpha.com

Strategic Acquisitions and Partnerships: The acquisition of Seagen's oncology products and ongoing partnerships enhance Pfizer's market position and product diversification. These initiatives are expected to contribute to revenue streams and bolster market share in critical therapeutic areas.

PFE Stock Forecast 2030 and Beyond - Bearish Factors

Regulatory and Market Risks: The pharmaceutical industry is subject to stringent regulatory scrutiny and market volatility. Changes in healthcare policies, patent expirations, or unexpected competition could pose challenges to Pfizer's revenue growth and market position.

Economic and Global Health Trends: Macroeconomic factors and global health trends, including potential shifts in healthcare spending or pandemic-related disruptions, may impact Pfizer's operations and financial performance unpredictably.

V. Conclusion

A. Pfizer Stock Outlook: PFE buy or sell?

Pfizer's stock price outlook for the coming years shows a wide range of potential outcomes. For 2024, technical forecasts place the PFE stock price between $25.75 and $32.25, reflecting cautious optimism amidst current market conditions. By 2025, predictions vary more significantly, with targets from $21 to $39.85, highlighting the stock's volatility and the uncertain market landscape. Looking further ahead to 2030, forecasts range from $44 to $108, indicating potential for substantial growth driven by Pfizer's robust pipeline and strategic initiatives.

Investment recommendations suggest a conservative approach‘rated as a hold' for 2024, considering the company's mixed recent performance and external market pressures. However, Pfizer's strategic cost management and focus on revenue diversification present a solid case for long-term growth. Trading Pfizer stock through Contracts for Difference (CFDs) could offer flexibility and potential gains, but it requires careful risk management due to the stock's volatility.

B. Trade PFE Stock CFD with VSTAR

Trading Pfizer stock CFDs with VSTAR presents several advantages. VSTAR offers tight spreads and zero commission, which can enhance profitability. The platform also ensures deep liquidity and fast order execution, crucial for effective trading. Additionally, VSTAR is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing a secure trading environment. The user-friendly interface, combined with low minimum deposits and negative balance protection, makes it accessible for both professional traders and beginners. With these benefits, VSTAR is a competitive choice for trading Pfizer stock CFDs.

FAQs

1. Is Pfizer a buy, sell or hold?

Pfizer is currently rated as a hold by analysts.

2. What is the target price for Pfizer?

The average target price for Pfizer is around $34.50.

3. What is the price prediction for Pfizer?

Analysts predict that Pfizer stock could reach around $35.69 within the next 12 months.

4. What will Pfizer stock be worth in 5 years?

Analysts believe that Pfizer's market cap could grow significantly, potentially reaching around $350 billion.