I. Recent Palantir Stock Performance

Palantir Stock (PLTR) passed a volatile year, ranging between $7.28 and $27.50. However, the stock has experienced overall growth, closing a positive year in 2023.

Since the P/E ratio is high (260.1), investors might expect future growth to justify the current valuation. The Beta of 2.05 suggests the stock price might be more volatile than the overall market.

The remarkable 160-177% price surge in 2023 came with several factors, as shown below:

- The implementation of artificial intelligence fueled investor confidence in this stock.

- Positive GAAP operating profits, with a stable profitability

- The market crash in 2022 influenced the stock to rebound from the historic low.

- Introduction of AIP for business automation and workflow optimization.

As a software intelligence company, PLTR is still undervalued and has strong earnings growth possibilities. With the higher Beta value, any upward momentum in the stock market could positively impact PLTR stock.

Palantir's Business Model Is Strong

Source: fourweekmba.com

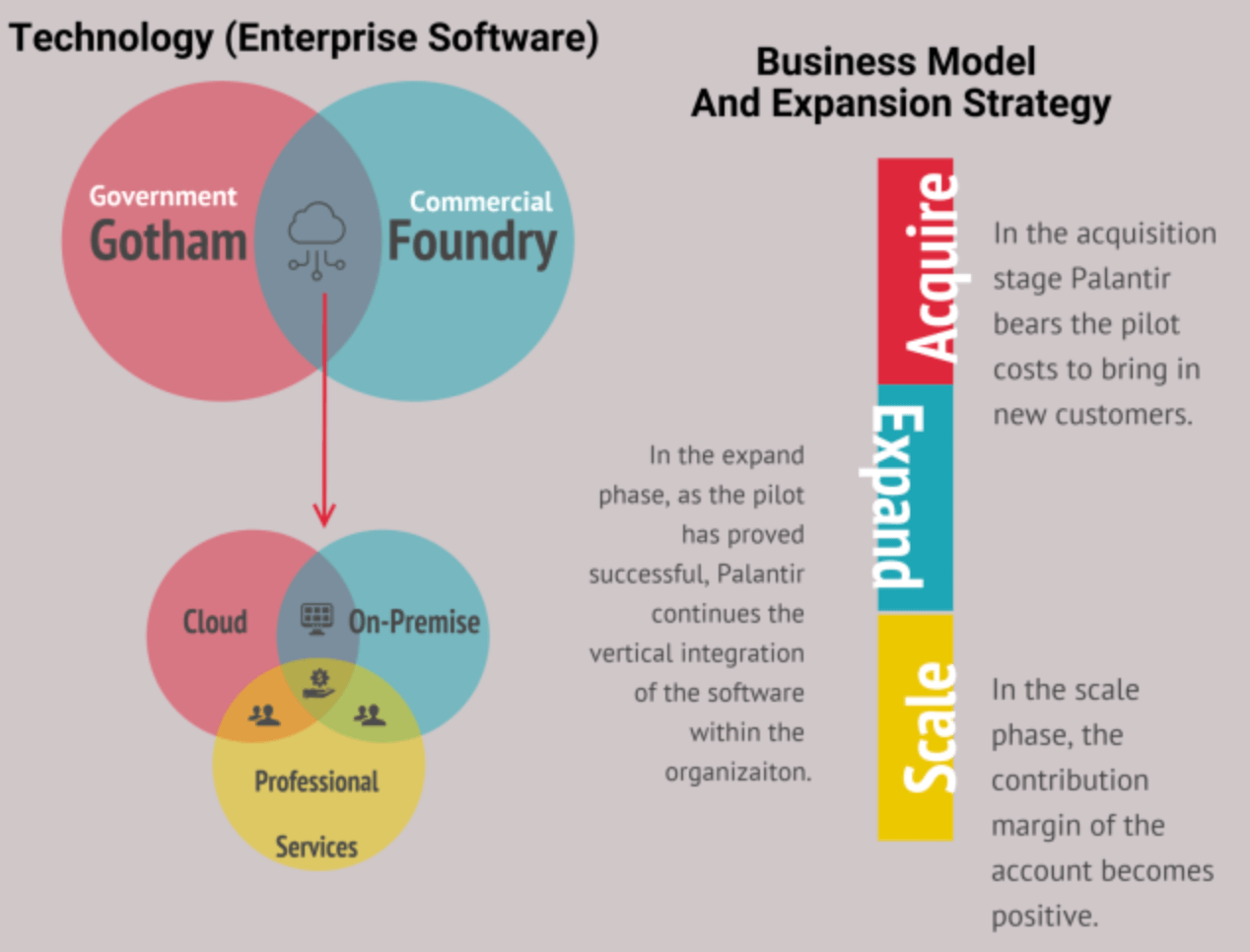

Since its launch in the middle of 2023, Palantir's main product, the Artificial Intelligence Platform (AIP), has attracted much interest. This platform uses sophisticated data visualization techniques, AI, and machine learning to extract insights from large datasets that can be used.

Commercial organizations employ the Foundry platform from Palantir, while government and intelligence-related use cases are the main focus of the company's Gotham platform.

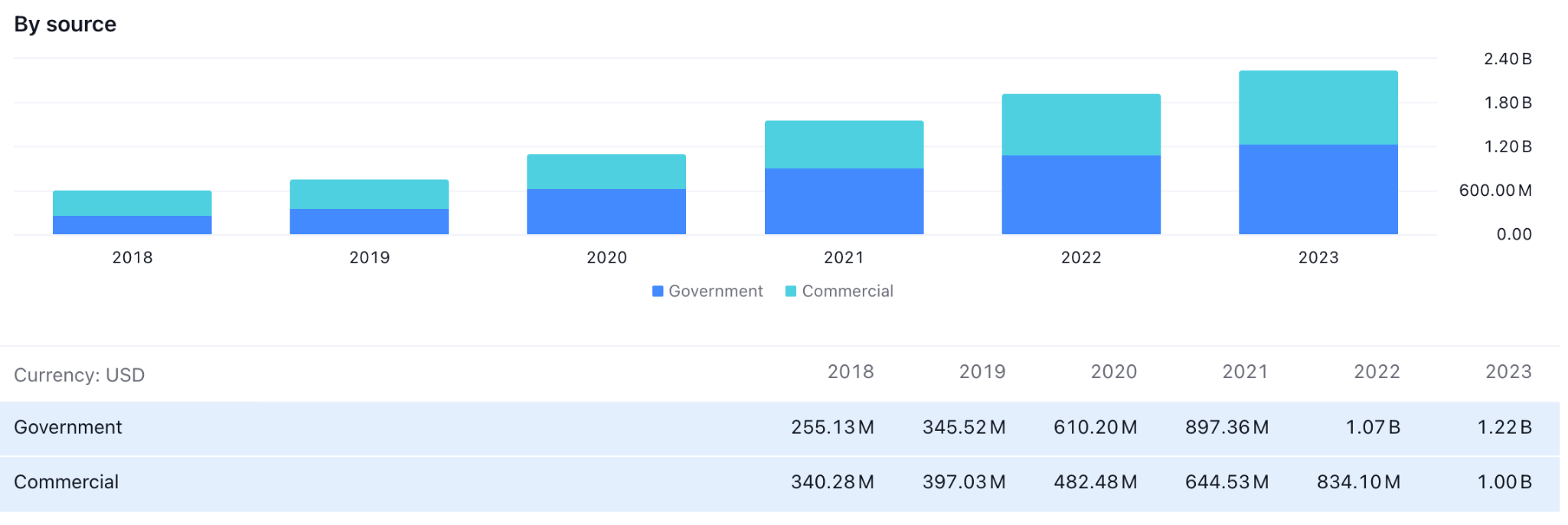

Government revenue in the fourth quarter came to $324 million, up 11% from the previous year and accounting for 54% of the overall revenue for the quarter and the year, which came to $1.2 billion.

Apart from its current three-year, $250 million contract with the Department of Defense, Palantir has also signed arrangements with other international governments. Moreover, the commercial division, which accounts for 46% of total sales, saw strong growth in Q4, with revenue of $284 million, up 32% from the previous year. Notably, sales in the U.S. business market increased by an astounding 70% to $131 million.

Palantir's fifth straight GAAP profitable quarter in Q4 highlighted the company's steady financial condition and upward trajectory.

Palantir's Business Collaboration

The company was recently awarded a $178.4 million contract by the U.S. Army, which assigns it the responsibility of developing and delivering the TITAN ground station system. Further, Palantir has established a collaborative alliance with the Ministry of Economy of Ukraine to conduct demining operations.

Government contracts provide Palantir with the benefit of durability and longevity, guaranteeing the company a consistent flow of revenue and nurturing robust customer relationships.

Furthermore, strategic partnerships with CAZ Investments and PwC are anticipated to strengthen the commercial segment in the upcoming quarters. Management is sanguine about the U.S. commercial market, forecasting a substantial increase of 40% by 2024, culminating in a cumulative value of $640 million.

Geopolitical Uncertainty

The CEO of Palantir, Karp, conveyed a sense of satisfaction regarding the company's operational engagement in Israel after a momentous occurrence on October 7. Furthermore, the company strengthened its alliance with the Israeli Ministry of Defence to supply technological solutions for military endeavors.

In a recent interview, Karp reaffirmed Palantir's membership in Western allies, including Israel, and this position. Furthermore, the organization prominently showcased its support for Israel by placing a full-page advertisement in The New York Times.

Expert Insights on PLTR Stock Forecast for 2024, 2025, 2030 and Beyond

Considering the ongoing market structure and fundamental outlook, investors might expect the buying pressure to extend in the coming year.

Moreover, the long-term price shows a decent long opportunity from the bottom set in 2023, which could be a confluence factor to bulls. However, the upcoming earnings report and analysts' opinions could provide more clues about the ongoing bullish possibility.

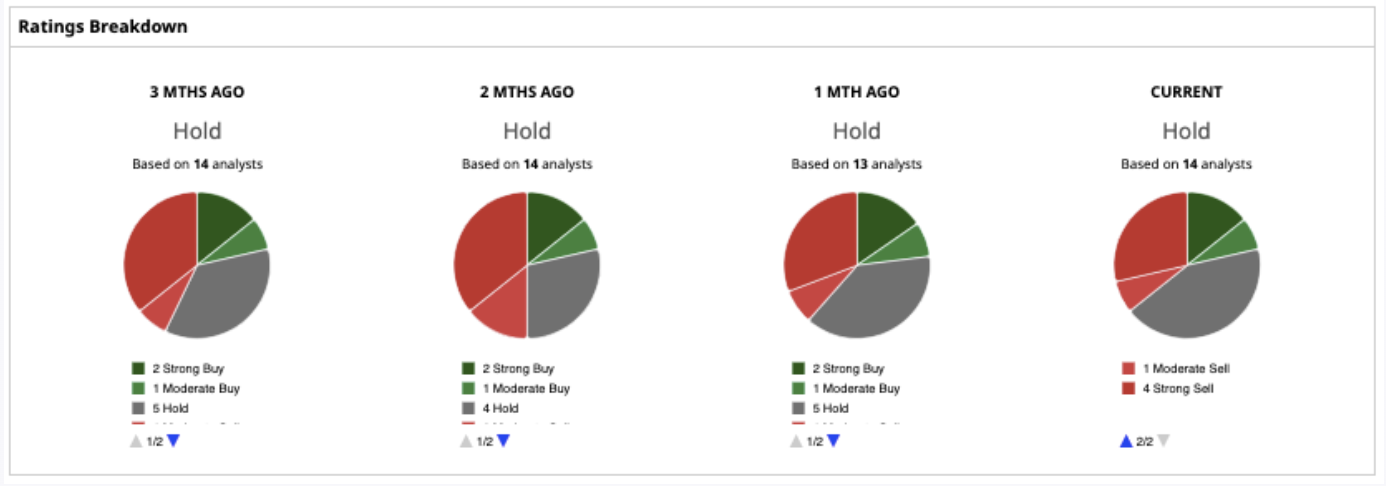

Before proceeding to the PLTR stock forecast based on technical and fundamental outlook, let's see analysts' opinions about Palantir forecast:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$29.87 |

$41.62 |

$85.41 |

|

Coincodex |

$ 14.99 |

$ 33.40 |

$ 180.38 |

|

Stockscan |

$39.42 |

$22.37 |

$41.19 |

II. PLTR Stock Forecast 2024

For PLTR stock prediction 2024, based on the ongoing bullish price action, PLTR might face a challenging phase in 2024. Investors should closely monitor how the price reacts to the weekly resistance, where a successful break could extend the upward pressure to the 45.00 level.

In the weekly chart of PLTR, the ongoing buying pressure is potent as the 20-week EMA is below the current price. Moreover, a bullish rally is visible where the 15.59 level is the immediate support.

However, the bullish impulse from the weekly bottom of 5.91 suggests a bullish overextension from the dynamic line, which could work as a bearish factor as a mean reversion.

On the other hand, the Relative Strength Index formed a divergence with the main chart, which could be a confluence of bearish factors for PLTR stock forecast.

Based on the PLTR stock forecast for 2024, investors should wait for sufficient downside correction to complete before aiming for a bullish continuation. Any rebound from the 19.00 to 15.00 area could be the first sign of buying pressure for 2024. An upward pressure with a weekly candle above the 29.28 level could extend the buying pressure towards the 45.00 resistance level.

Let's see what other technical indicator says about the PLTR stock forecast for 2024:

- MACD: The Histogram shows a corrective downside pressure but remains above the neutral line. Meanwhile, the Signal line at the upward ceiling zone could indicate a potential downside correction in the main price.

- Ichimoku Cloud: The ongoing buying pressure is potent above the Ichimoku Cloud zone, while the future cloud looks bullish. Dynamic Tenkan Sen and Kijun Sen are below the current price and are working as near-term support. Based on this outlook, any downside correction towards dynamic lines could be a potential long signal.

- Average Directional Index (ADX): At the time of writing, the ADX line is at 37.40 level, which indicates an ongoing market trend. As the recent price shows a bullish higher high formation, investors might consider a trend extension until the ADX comes below the 20.00 line.

A. Other Palantir Stock Forecast 2024 Insights: PLTR buy or sell?

Analysts who are keeping an eye on the Palantir project that adjusted earnings per share will increase from $0.25 in 2023 to $0.33 in 2024. Therefore, considering the forward earnings multiple of 75x, PLTR stock appears to be considerably overvalued.

The consensus for Palantir price target on Wall Street is $20.67, less than the current price. However, Wedbush analyst Dan Ives recently increased the stakes by establishing a new highest PLTR price target on the Street, $35, in addition to maintaining an “Outperform" rating. This indicates a possible increase of approximately 42% from the present price.

According to Ives, PLTR is positioned favorably to take advantage of increased enterprise expenditure in the technology sector. He describes the company as "optimized" to capitalize on this trend.

Nonetheless, Wedbush's optimistic assessment of Palantir is still in the minority. Two analysts who cover PLTR stock recommend a "strong buy," one analyst suggests a "moderate buy," six analysts advise a "hold," one analyst suggests a "moderate sell," and four analysts recommend a "sell."

Another report from Techpedia suggests that PLTR stock price target could rise to $35.47 over the next 12 months.

B. Key Factors to Watch for Palantir Stock Prediction 2024

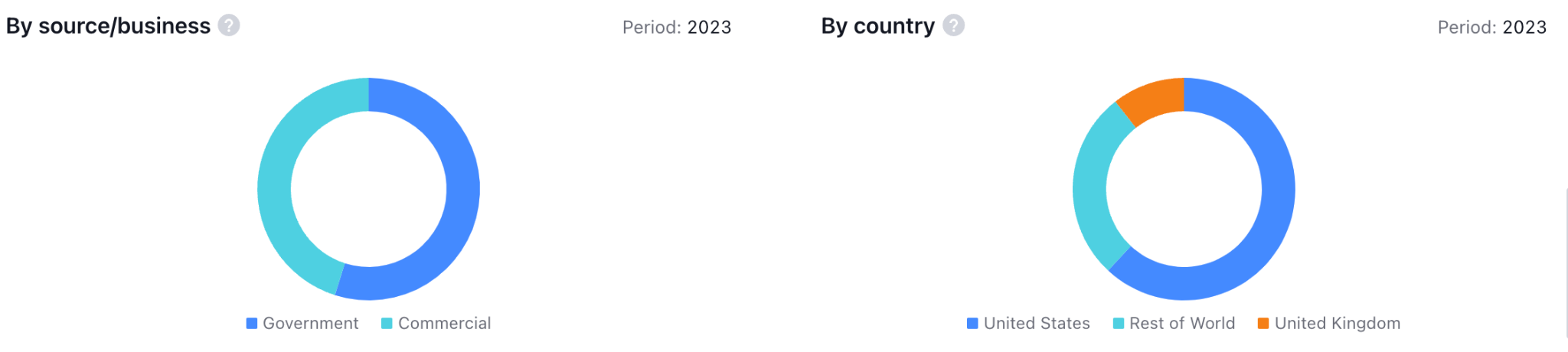

Palantir Revenue Segment

Government and commercial are two revenue segments of this company. As the recent year shows a surge in government revenue, it might be a crucial factor.

In 2023, the company generated $1.22 billion in government revenue, which is higher than last year's $1.07 billion.

For the coming quarters, investors should closely monitor this indicator as further collaboration with the government could indicate a surge in revenue, indicating a stock surge.

Liquidity Structure

The liquidity ratio is a crucial indicator when looking at a company's day-to-day business operations.

As per the above image, the company's current assets remain 5.55X higher than the current liability. This indicates that the company has enough cash and cash equivalent to run the day-to-day business.

EPS Forecast For 2024

Palantir has shown an amazing performance in quarterly earnings reports since Q4 2022, as shown in the above image. Moreover, the forecasted quarterly earnings forecast is solid for 2024, and investors should monitor how the actual report comes.

Any upbeat result could be a bullish factor for Palantir Technologies stock forecast, which could signal a long opportunity.

(1) Palantir Stock Forecast 2024 - Bullish Factors

Prominent macroeconomic developments can influence Palantir's short-term trajectory. It is worth mentioning that substantial news like interest rates has the potential to instigate substantial market fluctuations on PLTR stock.

Moreover, the forthcoming Palantir earnings report is anticipated to be pivotal in PLTR's subsequent substantial movement. The trajectory of expansion in the forthcoming quarters continues to be ambiguous. Palantir maintains its strong performance in the government sector, and its most recent quarterly earnings reports have presented encouraging figures concerning its commercial expansion.

(2) PLTR Stock Forecast 2024 - Bearish Factors

The difficulty resides in Palantir's dependence on proprietary technology that is custom-designed for particular clients, including the Defence Department. Although military contracts can generate financial gains, they do not generally result in substantial expansion.

In addition, as demonstrated by its difficulties with the National Health Service in the United Kingdom, Palantir's proprietary nature and somewhat contentious reputation may impede its ability to secure civilian contracts. When political factors change, contracts may become obsolete within the domain of politics.

III. Palantir Stock Price Forecast 2025

For Palantir stock forecast 2025, based on the ongoing fundamental outlook and the technical price behavior, Palantir Stock (PLTR) has a higher possibility of extending a buying pressure above the 50.00 level and reaching the 66.92 Fibonacci Extension level.

In the weekly price of PLTR, the ongoing bullish pressure shows an upward pressure as the recent price trades within a bullish rally-base-rally formation. Moreover, the most recent bottom, at the 15.59 level, is a crucial support level to look at. The high volume level remained at the support line, which is working as a confluence bullish factor for PLTR stock forecast 2025.

Based on this outlook, upward pressure is potent, where the primary target would be the 43.62 level, which is the 161.8% Fibonacci Extension level from the existing price swing. Also, a stable market above the 30.00 psychological level could extend the buying pressure above the 66.92 Fibonacci Extension level.

As per the Elliott Wave theory, wave 1 was formed in 2023 with a downside correction on wave 2. Later on, a new swing high is formed, signaling a possible bullish wave of wave 3.

As per the Elliot wave theory, Wave 3 would be the longest than Wave 1, suggesting a strong long signal within 2025.

A. Other PLTR Stock Price Prediction 2025 Insights: Is Palantir a Buy?

According to the latest market outlook from Parkev Tatevosian, CFA, the PLTR share price has a higher possibility of moving beyond the 100.00 level and reaching the 105.00 level by the end of 2025.

Even a highly skeptical analyst, like Tyler Radke of Citi, couldn't ignore the undeniable progress made by Palantir. He significantly increased his projection for 2024 free cash flow by an impressive 55%. Considering this, the analyst forecasted the PLTR stock price to reach the $25.00 level by the end of 2025.

B. Key Factors to Watch for Palantir Stock Price Prediction 2025

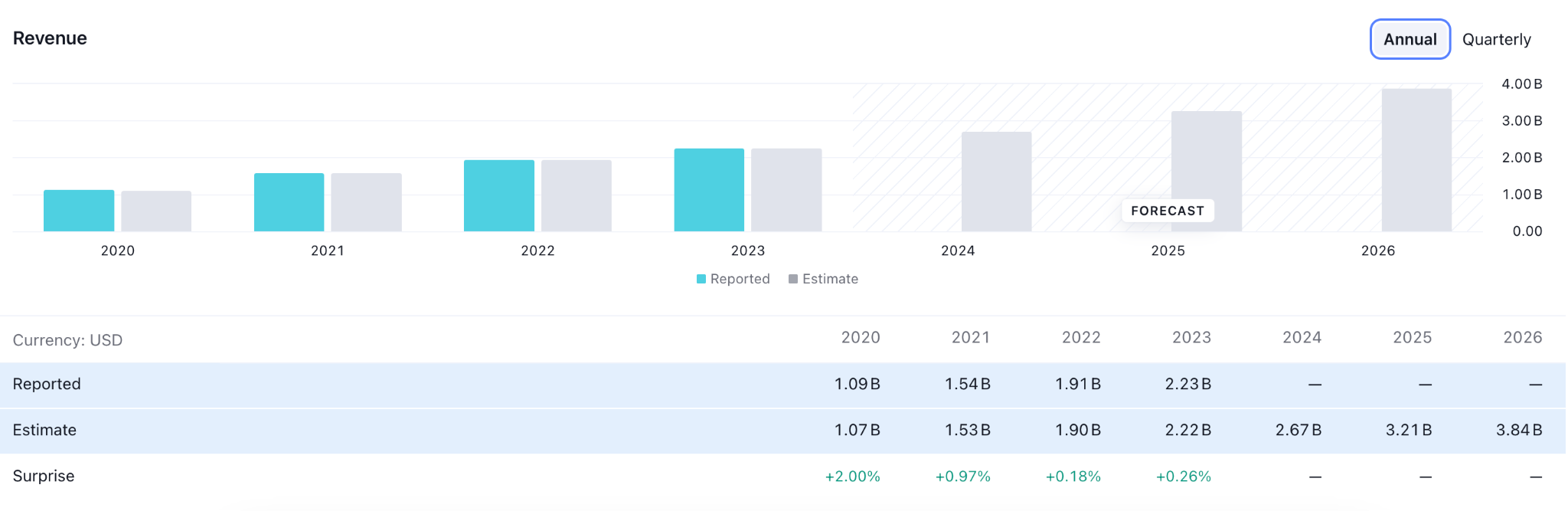

PLTR Revenue Forecast 2025

PLTR has shown an amazing performance in recent years, as it recently showed upward momentum. As a result, the yearly revenue peaked at the $2.23 billion level in 2023, which is higher than the $1.91 billion in the previous year.

Considering the ongoing PLTR forecast, the revenue could move higher and peak at $3.84 billion by the end of 2025.

Palantir EPS Forecast

As per the latest data, PLTR earnings per share reached the $0.25 level in 2023, which is a significant achievement in the last three years. Moreover, the stock price is likely to maintain the upward trajectory as the EPS forecast for 2025 is set at the $0.40 level, which is significantly higher than this year's actual result.

Company Strategy

- Palantir has established a solid presence in government contracts, particularly within defense and intelligence agencies. However, they have expressed interest in growing their commercial business. Investors will closely monitor the balance between these sectors. Potential growth in profitable commercial contracts may positively impact the stock price.

- Foundry serves as Palantir's central data platform. If Foundry continues to be adopted by both existing government clients and new commercial clients, it could indicate a promising growth outlook.

(1) Palantir Stock Price Forecast 2025 - Bullish Factors

Palantir has set high growth targets. If they manage to surpass their goal of achieving over 30% annual revenue growth from 2021 to 2025 and reaching $4 billion or more in revenue by 2025, it would be a significant indicator of positive market sentiment.

At present, Palantir's business is largely dependent on government contracts. If commercial clients, particularly in high-growth industries such as healthcare or finance, where to embrace Foundry at a higher rate, it could bring in new sources of revenue and generate interest from potential investors.

If a major bank successfully implements Foundry in fraud detection, it could ripple effect and attract other businesses in the same field.

With the expansion of Palantir's business, increased operating margins are anticipated. Showing consistent profitability would be a significant victory for investors and may result in a higher valuation.

(2) PLTR Stock Price Prediction 2025 - Bearish Factors

There is disagreement regarding whether Palantir genuinely qualifies as AI. In contrast to passive systems such as ChatGPT, Palantir's technology is operational, performing critical functions, including directing military operations and managing hospital schedules.

Additionally, a substantial portion of Palantir's data is generated by machines instead of humans. The Foundry, a system developed by Palantir, requires substantial installation, and, by its proprietary characteristics, Palantir retains the majority of the long-term value compared to its clients.

Given this positioning, PLTR stock may be more closely associated with a "machine Internet" company than with an authentic investment in artificial intelligence.

IV. PLTR Stock Forecast 2030 and Beyond

For PLTR price prediction 2030 and beyond, the recent surge in Artificial Intelligence, with a collaboration with the government, might extend the buying pressure of PLTR stock in 2030 by taking the price above the 100.00 psychological resistance level.

Looking at the monthly chart of PLTR, the current price trades at the 50% Fibonacci Retracement level from its all-time high and low price. Moreover, the latest monthly candle suggests a bullish continuation as it trades higher after a range breakout with a monthly close.

The dynamic 20-month EMA is the immediate support at the 26.28 line, which could be a crucial level to look at. Moreover, the secondary window suggests ongoing buying pressure as the MACD Histogram remained stable above the neutral line with a bullish signal line.

Based on the PLTR Stock Forecast 2030 and Beyond, investors should closely monitor near-term levels to find long opportunities. A bullish continuation with a new high above the current all-time high of 45.12 level could be a long opportunity toward the 108.78 Fibonacci Extension level.

- Support levels for PLTR Stock Forecast 2030 and Beyond to look at: 26.28, 10.00 and 5.77

- Resistance levels for PLTR Stock Forecast 2030 and Beyond to look at: 25.42, 45.12, 69.43 and 108.78.

A. Other Palantir Stock Forecast 2030 and Beyond Insights: PLTR stock buy or sell?

According to a report from 247wallst, Palantir's stock price by 2030 could soar by the company's robust growth trajectory. During the exclusive fourth quarter of 2023, the organization exhibited a noteworthy 20% growth in revenue and an astounding more than 200% surge in net income.

Considering the ongoing yearly revenue development of over 25%, its revenue could readily exceed $7 billion by 2030. When combined with enhanced operational efficiencies, the company's net profit margins are anticipated to increase from the present 15% to more than 25% within the same year.

With a conservative forward price-to-earnings (P/E) ratio of 25, PLTR market cap may reach approximately $50 billion by the conclusion of the current decade.

Another report from BTTC Exchange provided a positive outlook for PLTR stock. Based on their hypothesis, Palantir price prediction could reach the $30.26 level by the end of 2030.

B. Key Factors to Watch for Palantir Stock Price Prediction 2030 and Beyond

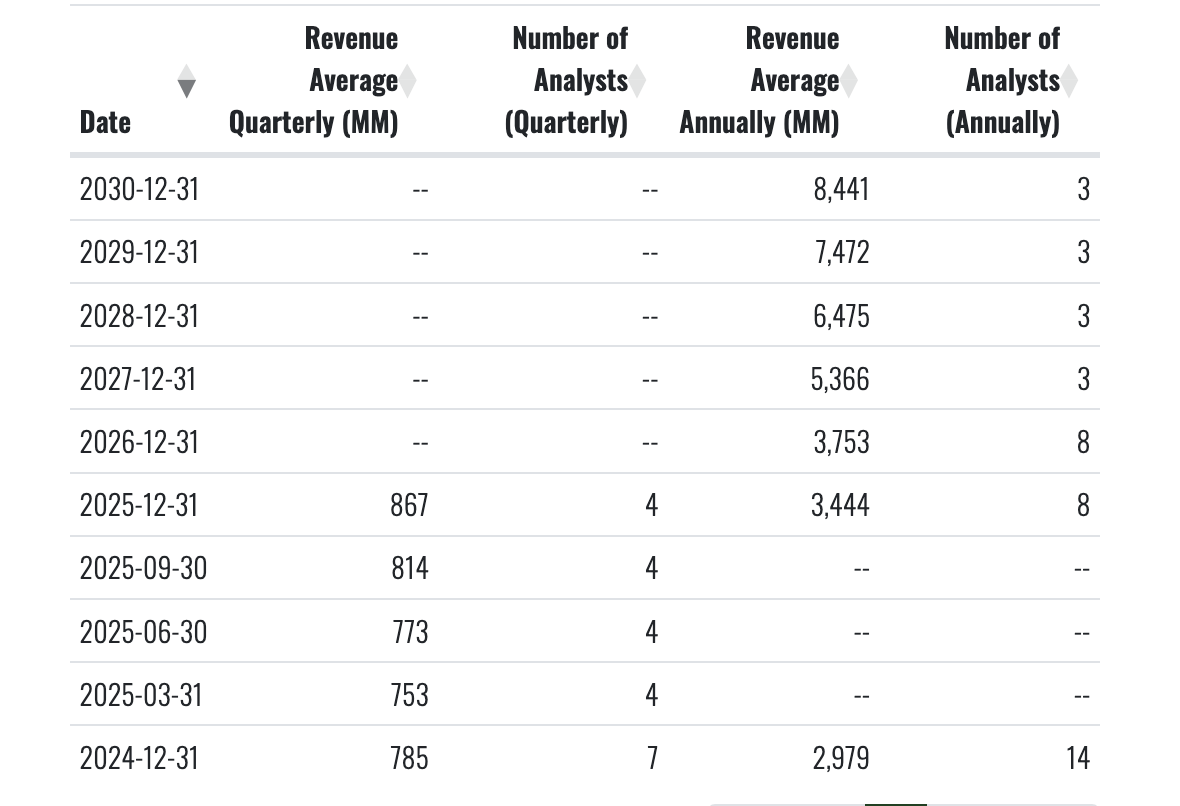

PLTR Stock Earnings Forecast 2030

Source: fintel.io

Palantir Stock (PLTR) has upbeat projections for investors, which need to be monitored before gauging the possible stock price surge.

As per the above image, the analysts expect the average yearly revenue in 2030 to reach up to 8441 MM, which is 3X higher than the yearly revenue reached in 2023.

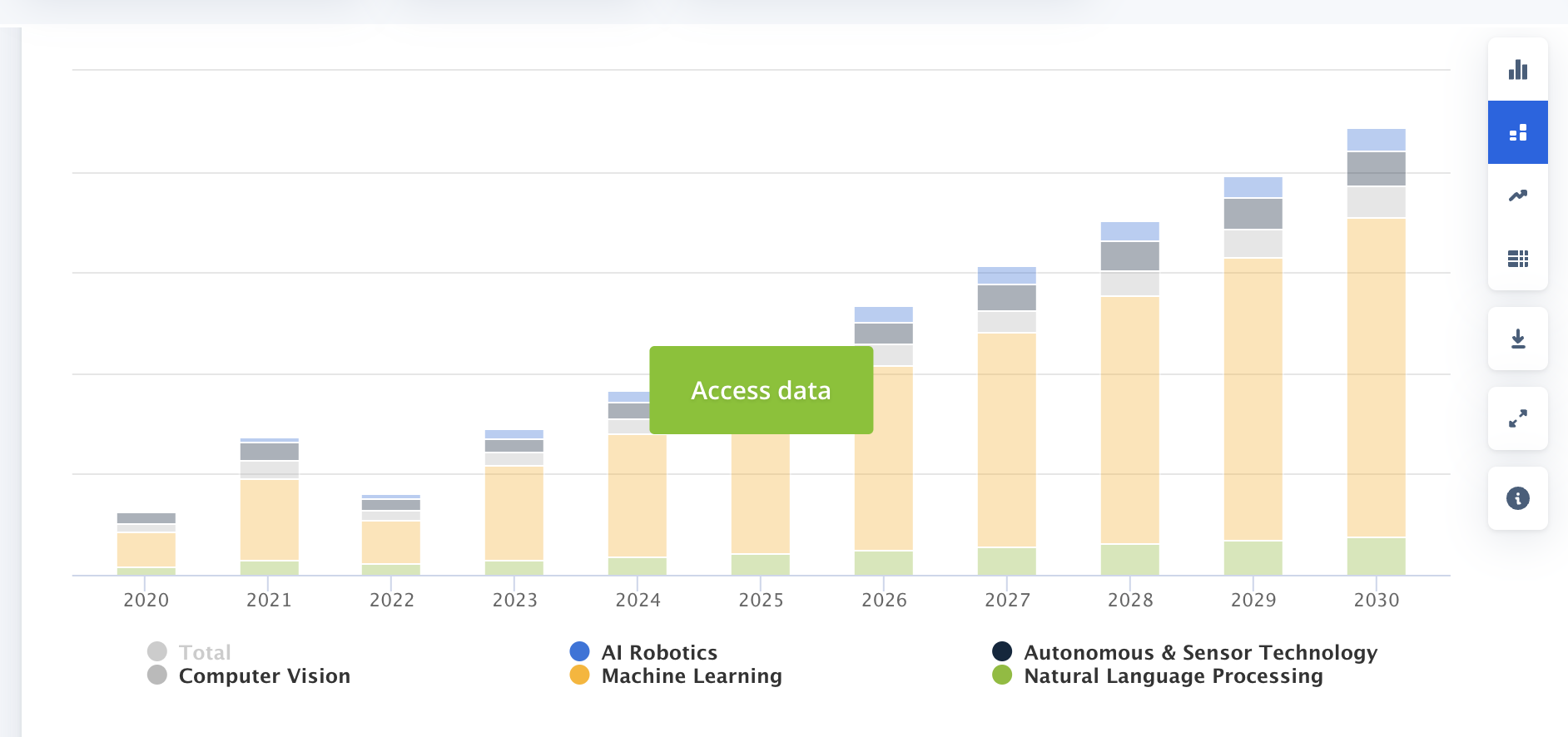

Artificial Intelligence Market Cap

Artificial Intelligence (AI) is the future, and the ongoing surge and investors' involvement in this field could be crucial factors for this stock.

As per the latest data, the annual growth of the AI market cap could take the overall market cap to $738.80bn by 2030. Considering this, investors should keep a close eye on the implementation of AI by PLTR, which could create a decent long opportunity for this stock.

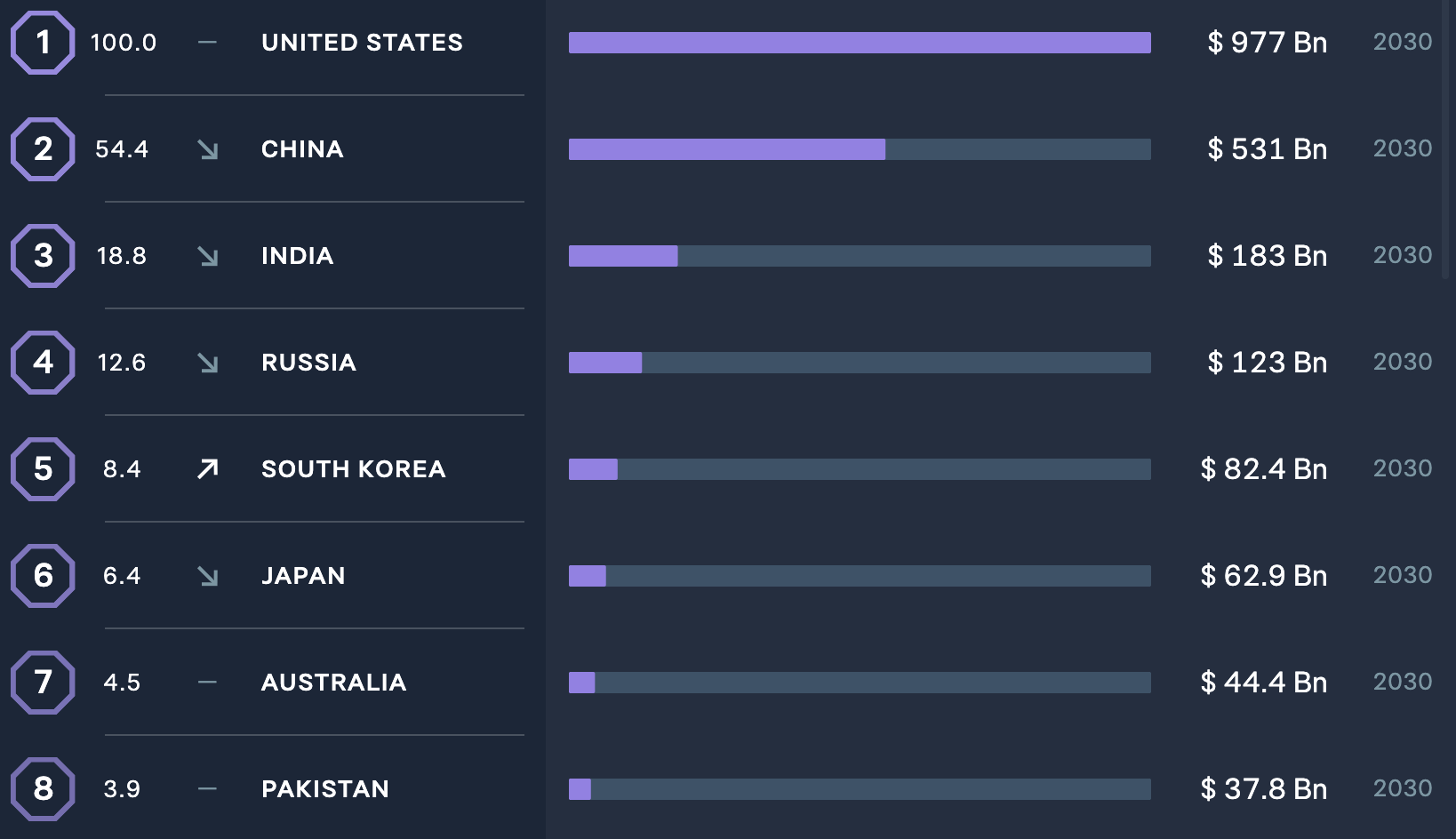

Military Expenditure Forecast 2030

Palantir operates the business where the main revenue factor is the Government in defense sectors. Considering the ongoing geopolitical uncertainty, major countries are increasing budgets in the defense sector, which could be a beneficial factor for Palantir.

Dependency on Debt Financing

Palantir boasts a strong financial position. Unlike many companies, they haven't relied heavily on loans, avoiding burdens from rising interest rates. Their healthy cash reserves of over $3.6 billion act as a buffer, allowing them to invest in growth without worrying about immediate financial limitations.

(1) Palantir Stock Forecast 2030 and Beyond - Bullish Factors

Palantir maintains a leading position in the realm of technological advancements, consistently augmenting its capabilities in data analytics and software. Palantir is strategically positioned to leverage the growing recognition of the significance of data-driven decision-making among governments and businesses, expanding its market presence.

Strategic alliances and contracts with significant organizations, such as large corporations and government agencies, provide Palantir with a steady revenue stream and strengthen its market position. These collaborations also provide prospects for additional growth and advancement.

Palantir, on account of its expanding international foothold, possesses abundant prospects to broaden its market reach beyond its existing regions. By expanding into untapped markets and industries, the organization can enhance its revenue diversification and exploit latent growth opportunities.

(2) PLTR Stock Forecast 2030 and Beyond - Bearish Factors

Due to its judicious debt financing strategy, interest rates do not significantly jeopardize Palantir's financial stability. The organization is a formidable cash generator with a cash reserve of over $3.6 billion. Therefore, it is improbable that interest rate changes will substantially impact its trajectory, given the continuation of its growth patterns.

Moreover, elevated interest rates could potentially mitigate the pace of revenue expansion marginally. Although Palantir's dependence on debt is relatively low, the potential constraints on corporate and government IT expenditure may hurt its clientele.

V. Palantir Stock Price History Performance

A. PLTR Stock Price Key Milestones

- 2019: Focus: Primarily, government contracts, establishing itself as a key player in data analytics for defense and intelligence agencies.

- 2020: Palantir showed continued government contract wins, but whispers of commercial expansion emerge. However, this year's attention was paid to the Initial Public Offering (IPO) filing.

- 2021: Successful IPO with high initial stock price. Increased focus on securing commercial clients. Palantir stock soared to 92% from the yearly opening and closed with a 22% loss.

- 2022: The company showed continued commercial growth alongside ongoing government contracts. Due to profit taking, PLTR stock continued pushing down, and the year closed with a 69% loss.

- 2023: PLTR showed strong commercial billings and customer acquisition. The key event for this stock is its commercial sector success, as well as its low debt and high cash reserves. Overall, the stock soared and closed the year with a 186% gain.

B. Palantir Stock Price Return and Total Return

Based on the current market data, PLTR is trading at the $23.98 level. Considering this, the return to investors is as follows:

|

Timeframe |

Return |

|

1 Week |

-9.43% |

|

1 Month |

+55% |

|

6 Months |

+71% |

|

Year to date |

+39.63% |

|

1 Year |

+201.56% |

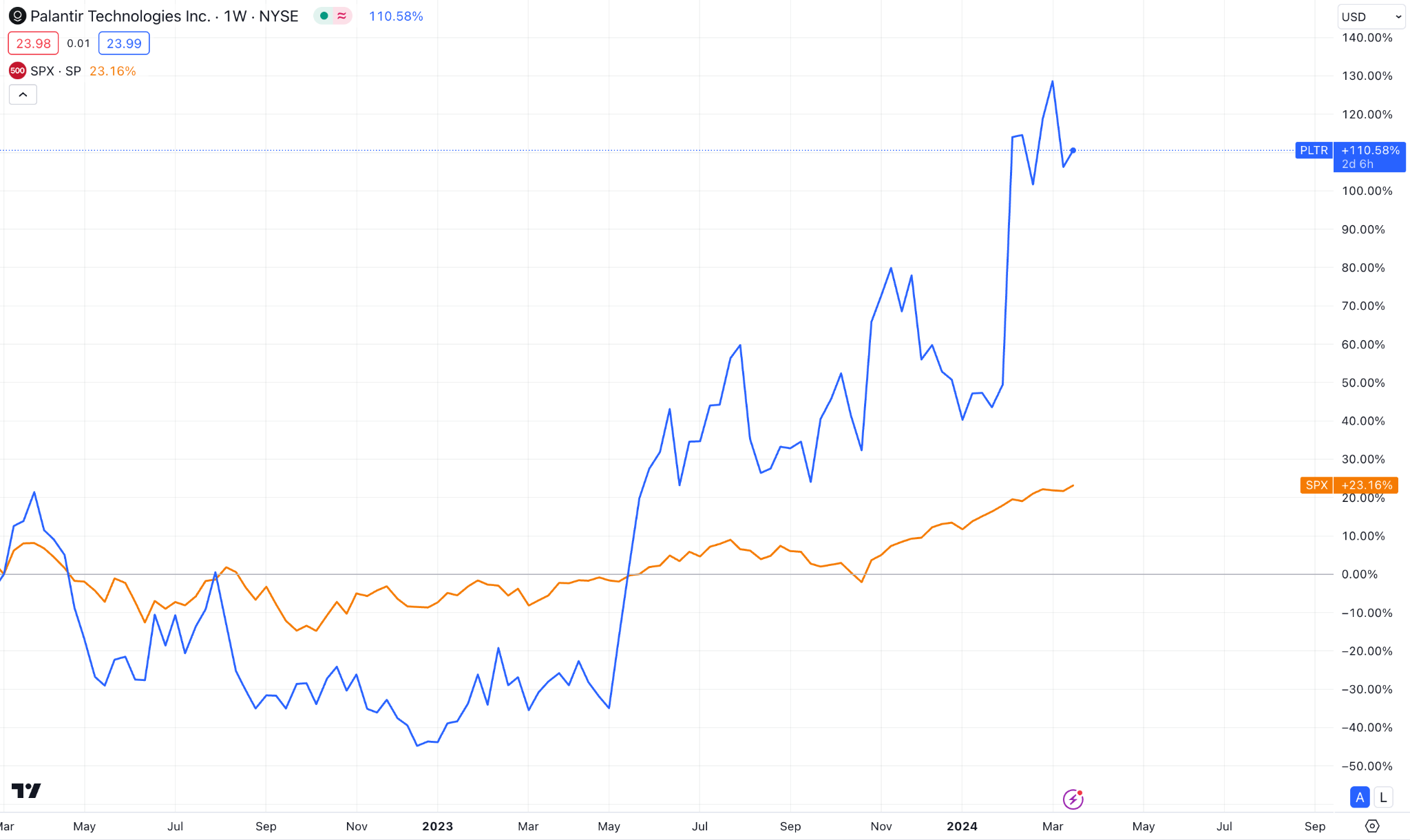

If we compare the last 1 year's data with the S&P 500, we would see an upbeat result in Palantir share price, providing a 110.50% price surge. In the meantime, the S&P 500 generated a 23.16% gain.

VI. Conclusion

Palantir (PLTR) has experienced considerable volatility throughout its history, culminating in significant gains in 2023, propelled by achievements in the commercial sector. According to analysts, future projections are clouded by the presence of both bullish and adverse elements.

The year 2024 is marked by unpredictability, as upward and downward corrections are possible. Investors must diligently observe earnings reports, government contracts, and broader market trends to make well-informed judgments.

In 2025, substantial expansion is possible, as certain analysts forecast a surge in price exceeding $100. Sustained commercial expansion and optimistic earnings projections are pivotal in attaining this expansion.

The outlook for the future beyond 2030 is optimistic. Palantir is strategically positioned to take advantage of the growing market for artificial intelligence and the escalating military spending. Global expansion and debt management will contribute significantly to the company's future success.

In addition, the growth possibility of this stock depends on how investors manage risks, where a reliable trading platform plays a vital role. A reliable platform like VSTAR could smooth your trading experience and make your journey hassle-free.

Open a trading account in VSTAR broker and expand your trading portfolio in stocks, indices, metals, and cryptocurrencies, and enjoy key features like these-

- Lower spread with no hidden costs.

- Execute a trade with the speed of light.

- A multi-regulated environment to provide maximum safety for funds.

- The maximum portability of trading experience through the VSTAR Mobile App.

In summary, Palantir offers a compelling investment prospect with potential gains and drawbacks. It is imperative for investors to meticulously evaluate their risk tolerance and undertake a comprehensive investigation through the VSTAR platform before reaching any conclusions concerning PLTR stock.

FAQs

1. Is Palantir a good stock to buy?

Palantir offers high growth potential in a promising sector with established government contracts, but the stock's premium valuation, lack of consistent profit, and volatility require careful consideration.

2. Is Palantir a Buy, Hold, or Sell?

The average analyst recommendation for PLTR stock leans toward Hold, with a price target slightly below the current price.

3. What is the prediction for PLTR stock?

The average 12-month Palantir stock price target is $19.67, with a range of $5.00 to $35.00.

4. What is the price prediction for PLTR in 2025?

The average PLTR stock price prediction for 2025 is $27.31, with a high of $37.70 and a low of $16.92.

5. What is the 5-year forecast for Palantir?

Analysts predict an annualized earnings growth of 85% for Palantir over the next five years.

6. What is the stock price of PLTR in 2030?

The average Palantir stock price prediction for 2030 is $37.50, with a high of $45.75 and a low of $29.25.