EURUSD

Fundamental Perspective

The EURUSD pair extended its decline for a second consecutive week, briefly reaching 1.0495 on Thursday, its lowest level in over a year. Although the pair managed a modest recovery by Friday, closing near 1.0520, the broader trend remained bearish. The U.S. dollar maintained its strength, buoyed by concerns over the global economic impact of evolving U.S. political dynamics. Despite this momentum, signs of overbought conditions emerged, limiting further appreciation.

Federal Reserve Chair Jerome Powell struck a cautious tone during a panel discussion, signaling that interest rate cuts would be gradual, given persistent inflation and the strong state of the economy. While not directly addressing political uncertainties, Powell alluded to potential challenges under the forthcoming Trump administration. His remarks tempered market expectations for aggressive rate reductions, with bets on a December cut retreating significantly. Robust US economic data, including an uptick in October's Consumer Price Index and better-than-expected Retail Sales, further bolstered the Dollar's position.

Meanwhile, the Euro struggled under the weight of weak economic performance. Germany's ZEW survey revealed deep pessimism, while Eurozone GDP growth for Q3 remained at 0.4%. Divisions within the European Central Bank over inflation risks added to the uncertainty, leaving markets to focus on critical economic releases and upcoming central bank commentary.

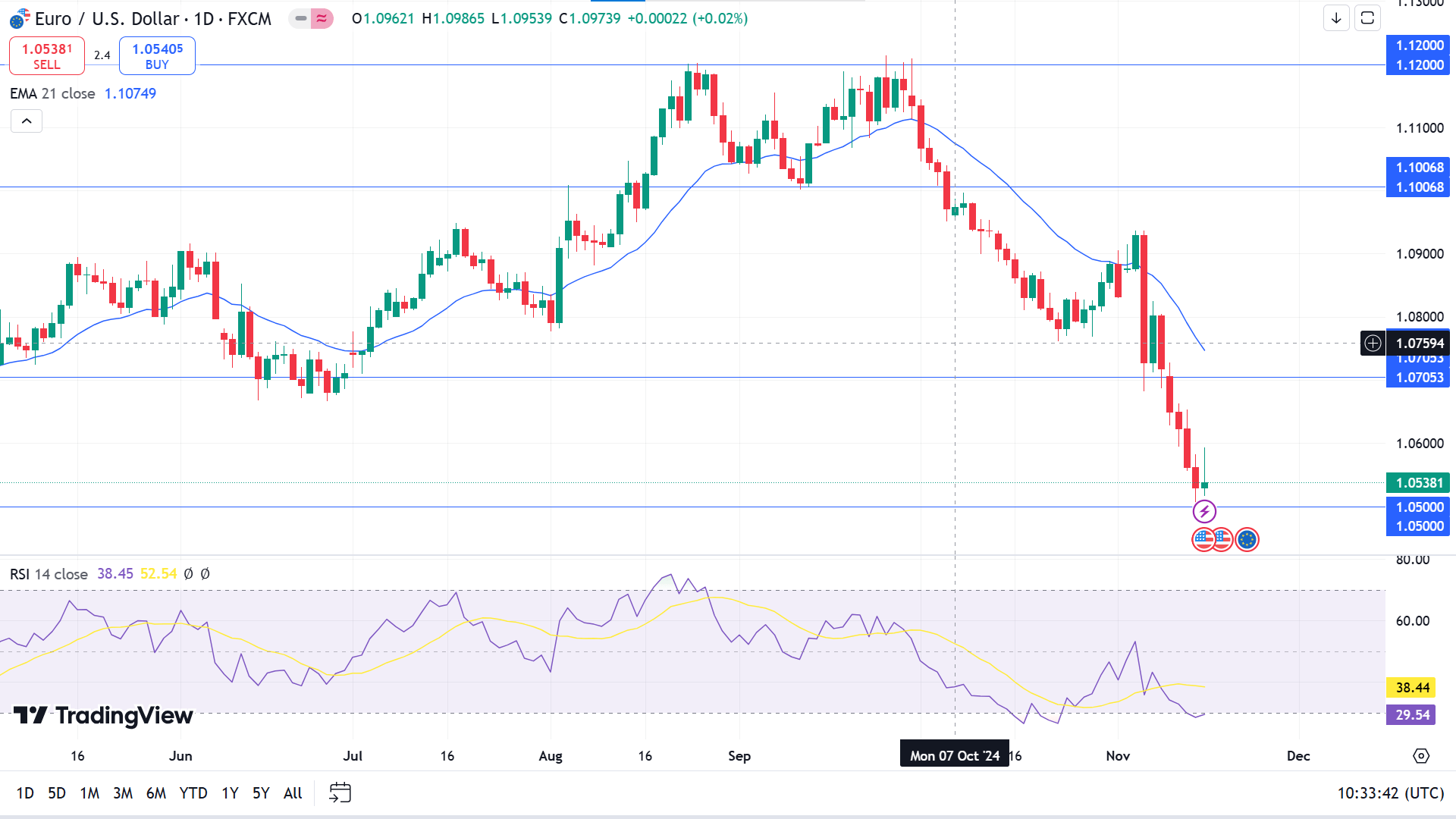

Technical Perspective

EURUSD posted another losing week, reaching a yearly low near 1.0500. This continued a bearish trend but left mixed signals as it approached a historic support level that sparked buyers' attention.

The daily chart reflects massive bearish pressure on the asset price, driving the price toward the year's low. EURUSD has been below the EMA 21 line for a long time, and the RSI dynamic line reaches the lower line of the indicator window due to recent sell pressure.

Applying the demand-supply concept to the asset, the area above 1.0500 seems an adequate buy zone. It can push the price back toward at least 1.0705, which is an acceptable resistance level that can extend further.

In contrast, if the price breaks below 1.0500 with a red candle and remains in that zone, the bullish signal won't be valid, and the sell signal may resume as it can continue to decline toward 1.0154 with consecutive selling pressure.

GBPJPY

Fundamental Perspective

The Japanese Yen weakened after Japan's Q3 GDP data showed the economy grew by 0.2% quarter-on-quarter, which was in line with expectations but slowing from 0.5% in Q2. Annualized growth reached 0.9%, exceeding forecasts of 0.7% but marking a sharp decline from 2.2% in the prior quarter.

Finance Minister Katsunobu Kato reaffirmed his commitment to addressing sharp currency fluctuations, stressing the need for stable exchange rates reflecting economic fundamentals. Economy Minister Ryosei Akazawa projected a modest economic recovery driven by improvements in employment and wages but warned of potential risks from global market volatility and slowing international growth.

Meanwhile, the UK's Q3 GDP rose by a mere 0.1% quarter-on-quarter, falling short of the 0.2% forecast and significantly decelerating from Q2's 0.5%. Despite the weak data, the Pound remained resilient, aided by market confidence in UK growth and a potentially overbought Dollar. Analysts at Capital Economics anticipate no immediate change in Bank of England policy, expecting rates to remain at 4.75% in December, with a potential 25 basis-point cut in February, as the data suggests economic stagnation rather than a looming recession.

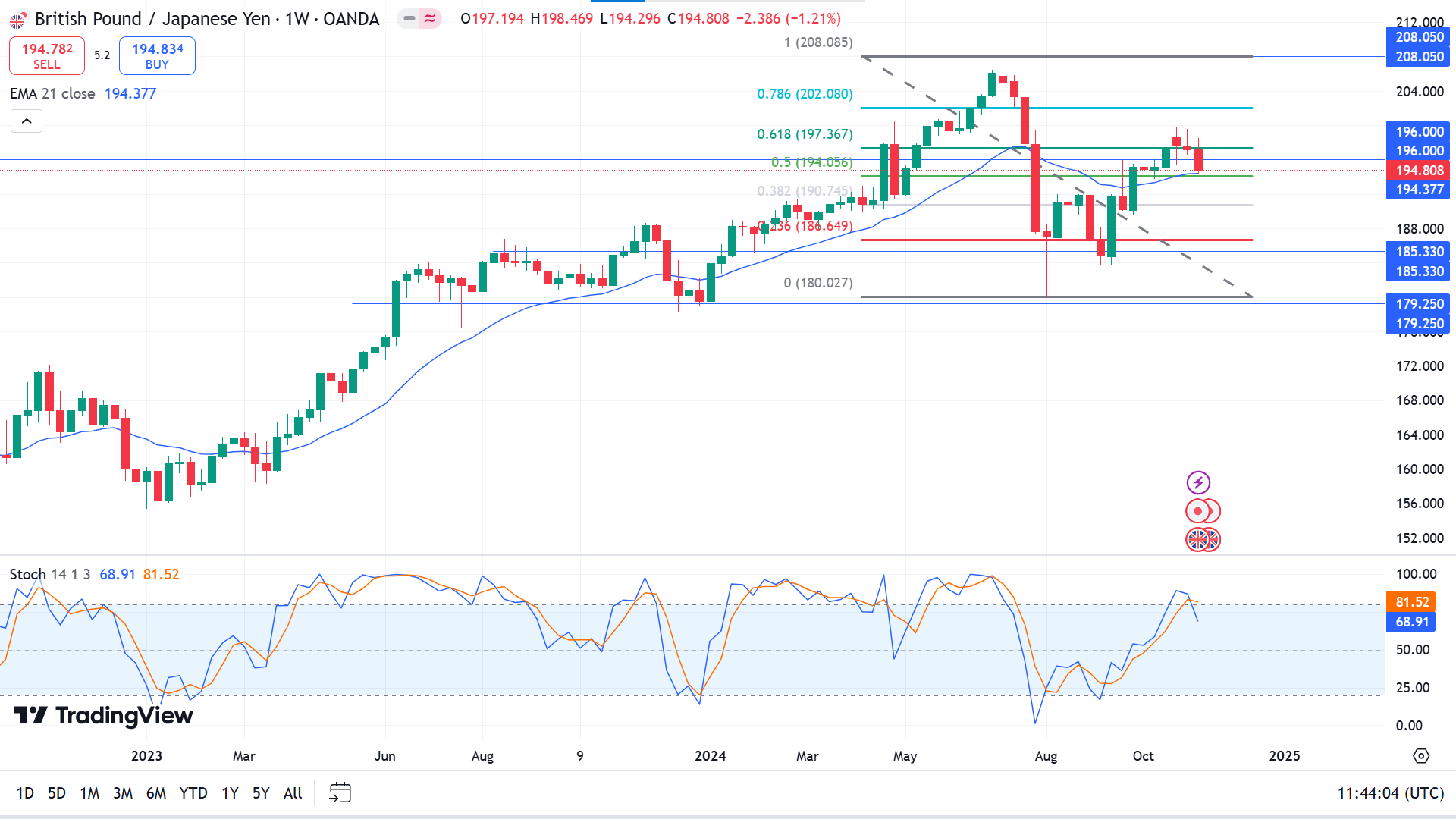

Technical Perspective

A solid red candle after two doji candles with red bodies in the weekly chart confirms buyer domination may look at this level and imply a selling opportunity. The price couldn't sustain above the historical demand-supply zone of 196.00, which indicates the price may resume a bearish trend and dive into the demand zone, accumulating buy pressure to match the demand-supply.

On the daily chart, the overall trend remains bullish as the price remains above the EMA 21 line. In contrast, the Stochastic indicator reading remains neutral, with dynamic signal lines edging downside at the upper line of the indicator window.

Applying Fibonacci retracement on the daily chart, the price bounced back, started declining from the 0.618 area, and reached below the historic 196 level. It indicates that a selling opportunity toward the 185.33 area, according to price action 179.25- 185.33 will be an elegant buy zone.

Meanwhile, any green candle closing above the 0.618 level of the Fibonacci retracement will deny the current sell signal and enable a buying opportunity toward the 208.05 level.

NASDAQ 100 (NAS100)

Fundamental Perspective

U.S. stocks ended Friday lower as investors weighed Federal Reserve statements and economic data. The Nasdaq Composite dropped 2.2% to 18,680.1, with the S&P 500 down 1.3% to 5,870.6 and the Dow Jones Industrial Average slipping 0.7% to 43,445. Technology stocks saw sharp losses, falling 2.5%, while utilities posted slight gains. Over the week, the Nasdaq declined 3.2%, the S&P 500 shed 2.1%, and the Dow fell 1.2%.

Federal Reserve officials provided mixed signals on monetary policy. Chicago Fed President Austan Goolsbee remained optimistic about achieving economic goals and hinted at continued easing. Boston Fed President Susan Collins noted that a December rate cut was possible but uncertain, while Chair Jerome Powell suggested no urgency to lower rates. According to the CME FedWatch tool, this tempered market expectations for a December cut, with probabilities declining to 58% from 72%.

Economic data painted a mixed picture. Retail sales in October surpassed forecasts, driven by auto purchases, with September figures revised upward. Industrial production, however, declined for a second month due to a Boeing strike and hurricane disruptions. Meanwhile, New York manufacturing surged in November, reaching a near three-year high as orders and shipments rebounded, showing strength in some areas.

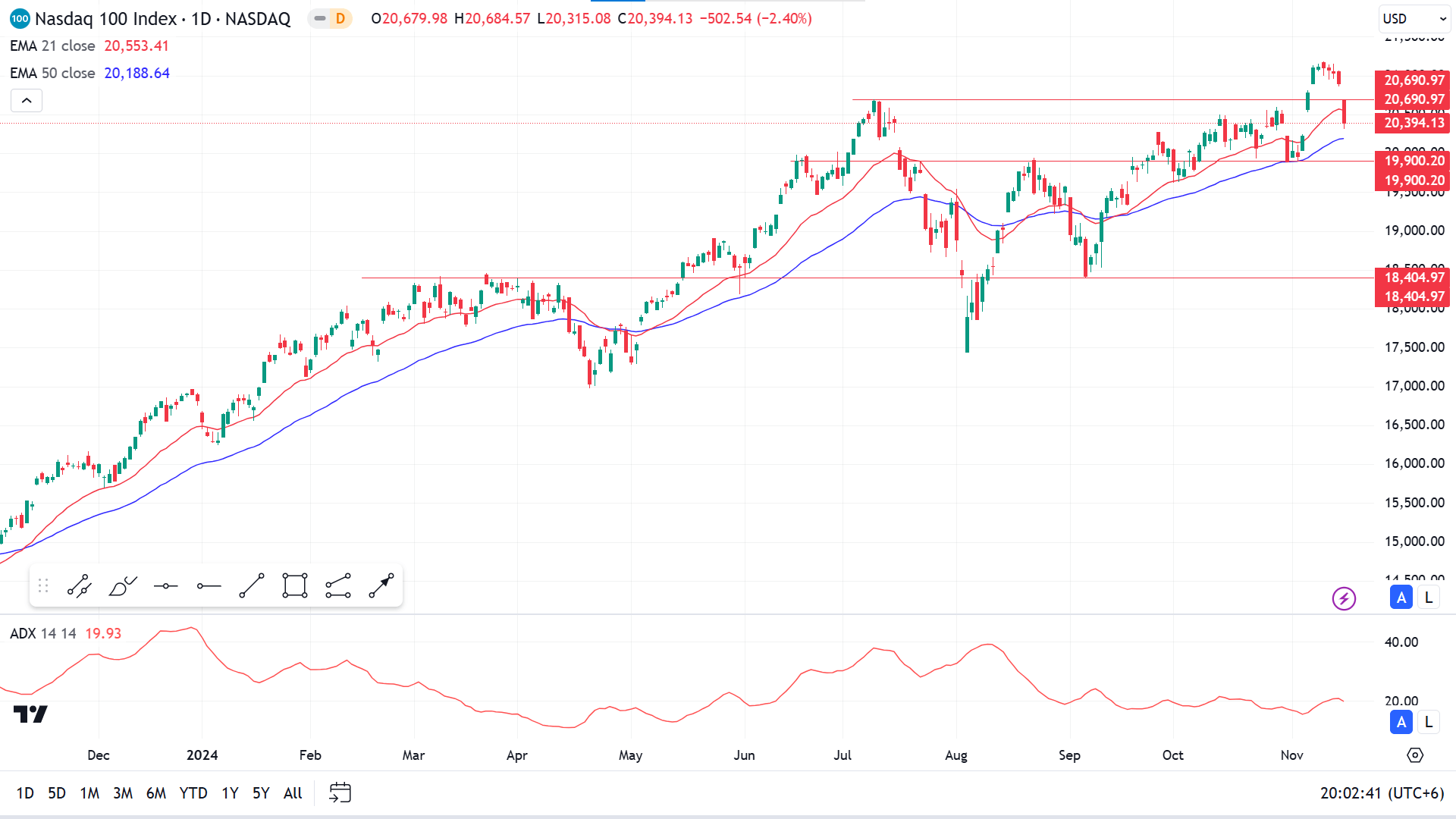

Technical Perspective

The last candle closed red after a solid green candle on the weekly chart, although the average trend remains bullish, leaving buyers optimistic for the upcoming week.

The price couldn't sustain above the previous peak of 20690.97 and reached below it, leaving mixed signals as it floats between the EMA 21 and EMA 50 lines. Meanwhile, the ADX reading reaches below 25, reflecting the current bullish trend that may weaken.

The broader market context suggests that buyers may hold on until the price reaches the 19900.20 level, which seems like a possible buy zone that can drive the price toward the ATH of 21,182.02 or further.

However, any red candle closing below 19900.20 will refuse the bullish setup and enable a selling opportunity toward the next possible support near 18,400.97.

S&P 500 (SPX500)

Fundamental Perspective

Global stocks marked their sharpest weekly decline in two months on Friday, while the 10-year U.S. Treasury yield reached a 5.5-month high. Economic data and comments from Federal Reserve officials pointed to a slower pace of rate cuts ahead. Fed Chair Jerome Powell highlighted steady economic growth, a resilient labor market, and inflation above the 2% target as reasons for a measured approach to monetary easing.

According to the Commerce Department, retail sales increased 0.4% in October, exceeding the anticipated 0.3%, with September's growth revised up to 0.8%. Additionally, the Labor Department reported a surprising 0.3% increase in import prices for October, driven by higher fuel and goods costs, against an anticipated 0.1% drop.

Earlier post-election market rallies were fueled by optimism over President-elect Donald Trump's pro-growth policies, including tax reductions, higher tariffs, and deregulation. However, market enthusiasm has cooled. Markets have grown cautious as investors reassess the Fed's rate-cut trajectory and potential shifts in legislative policies.

For the week, the S&P 500 dropped 2.08%, the Nasdaq declined 3.15%, and the Dow shed 1.24%, reflecting broader market adjustments and fading post-election momentum.

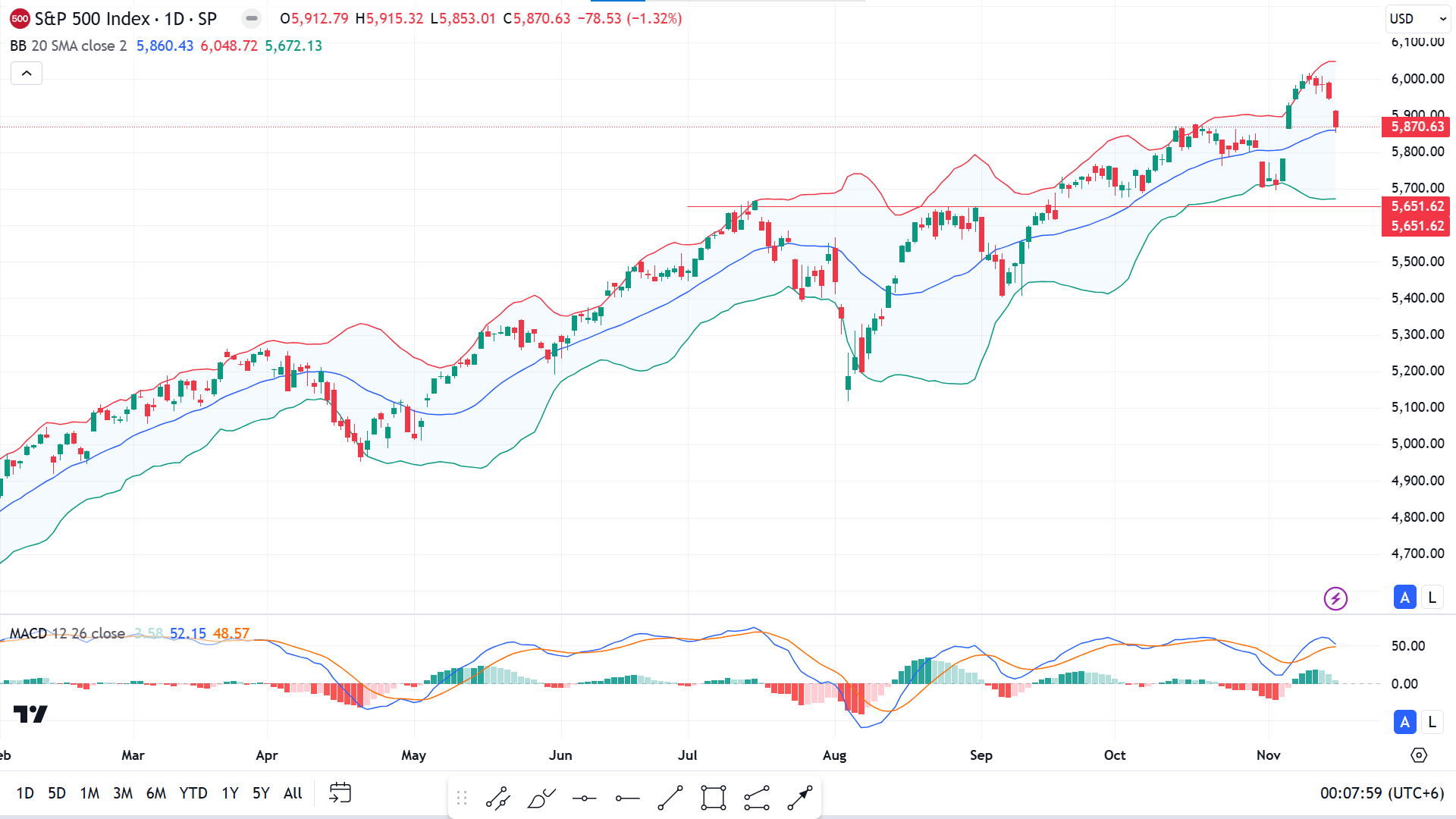

Technical Perspective

The bullish trend remains intact on the weekly chart as it hit ATH last week, although the candle closed far below the opening price, making the whole candle red.

On the daily chart, the price remains in the upper channel of the Bollinger Bands indicator, reflecting a bullish trend. The MACD indicator reading also supports positive pressure on the asset price. Still, the green histogram bars of the indicator window are fading, indicating decreasing bullish pressure.

Following the market context, the buy signal remains intact till the price is above 5,651.62, and short-term buyers will reconsider their position if a red candle finishes below that level. If the price remains below 5,651.62, the bullish signal will be banished and may spark sell opportunities.

Gold (XAUUSD)

Fundamental Perspective

Gold (XAU/USD) extended its corrective trend last week, dipping to $2,540 per troy ounce, a two-month low, before finding initial support. After a 30% rally from January to October's high of $2,800, the precious metal has dropped approximately 9% in November. This downturn follows a strong October, where Gold defied rising U.S. Treasury yields and benefited from expectations tied to Donald Trump's reelection bid.

The trend shifted suddenly after Trump secured his second term as U.S. president. The USD rallied sharply, with the Dollar Index (DXY) hitting a 2024 high above 107.00, exerting pressure on Gold and broader commodity markets. Concerns over Trump's likely policy shifts—such as tariffs on European and Chinese imports and relaxed corporate regulations—have raised inflationary fears. These developments could push the Federal Reserve (Fed) to reconsider its current easing stance or even adopt tighter monetary measures.

Geopolitical tensions, particularly the wars in Ukraine and between Israel and Hamas, remain critical to Gold's appeal as a safe-haven asset. Escalations in these conflicts have consistently supported prices, limiting the scope of selling pressure.

Gold's future hinges on fiscal and monetary developments. Deeper pullbacks remain possible, but the eventual implementation of policy changes could provide a foundation for recovery, restoring some of the metal's lost gains.

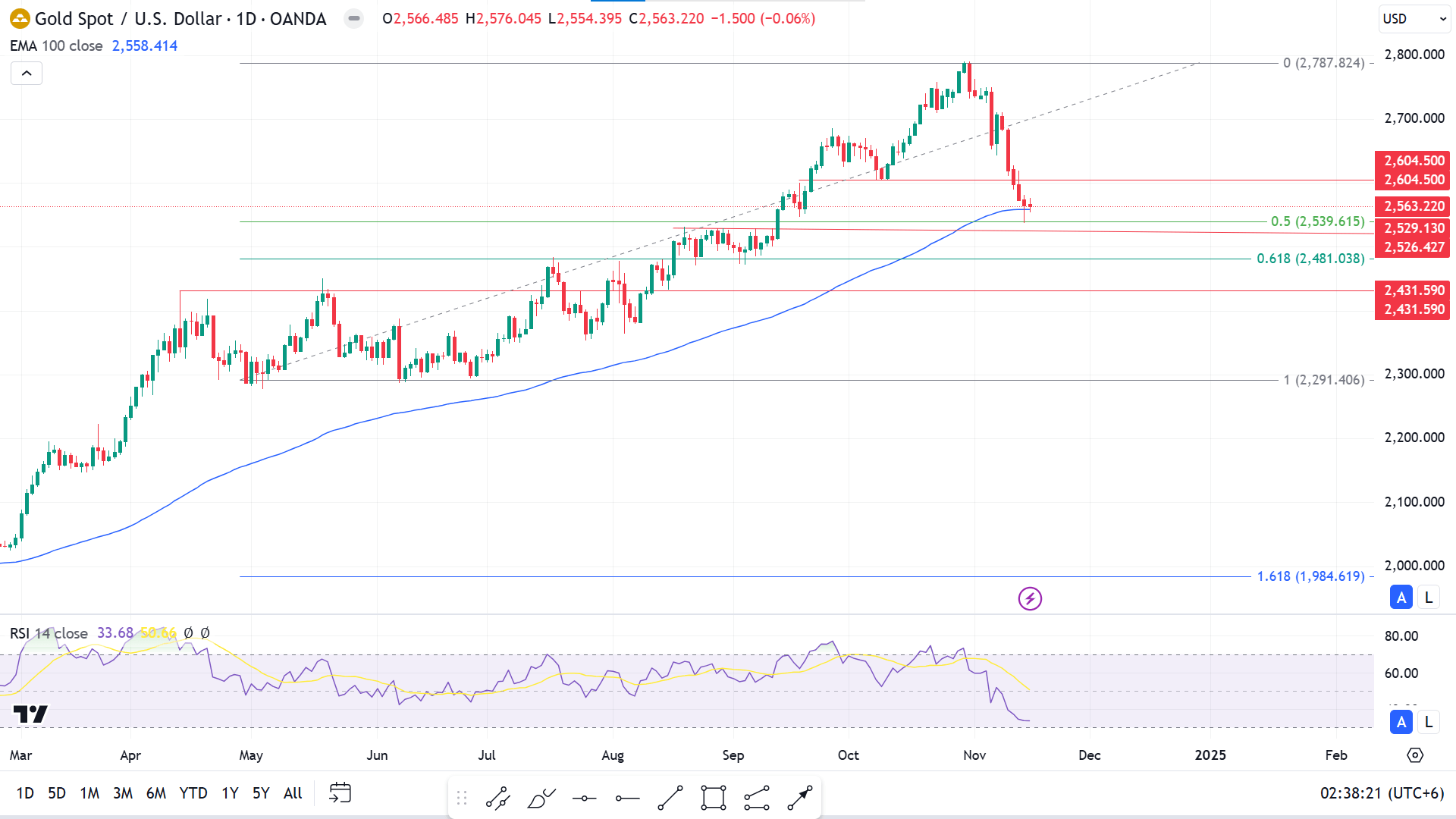

Technical Perspective

The precious metal extended its loss for the second consecutive week, and the weekly chart confirms fresh selling pressure from the ATH, near 2790, which could be an opportunity for buyers as the overall trend remains bullish.

The recent bearish pressure drives the price toward the EMA 100 line. In contrast, the dynamic RSI signal line reaches the lower line of the indicator window, supporting the bearish pressure, although the ultimate trend remains bullish.

According to the market context, the price declined to the 0.50% Fibonacci Retracement level, reaching below the previous low near 2604.50, sparking a short-term selling opportunity toward the 0.618% Fibo Retracement level near 2481.03. Note that the Fibo 0.50%- 0.618% level is a remarkable retracement zone where short-term trends change.

Meanwhile, the sell signal will be invalid if the price bounces and a green daily candle closes above 2604.50; it will indicate that the bullish trend may resume and continue toward the ATH or above.

Bitcoin (BTCUSD)

Fundamental Perspective

Bitcoin (BTC) climbed 16% earlier this week, reaching a record high of $93,265, but faced a modest pullback as profit-taking increased. Despite optimism that Bitcoin could surpass $100K in the coming weeks, selling pressure from miners and investors could prompt a correction toward $78K. The cryptocurrency has risen 35% since the U.S. presidential election on November 5, with valuation metrics like the Market Value to Realized Value (MVRV) ratio indicating it remains below overvaluation levels.

Futures trading in Bitcoin, especially in the BTC/USDT pair, has surged, with cumulative volumes hitting $129 billion across significant exchanges, $50.2 billion of which came from Binance. Such elevated activity in the derivatives market, often accompanied by sharp price increases, heightens market volatility. While this volatility can attract demand, it typically precedes price corrections, urging traders to act cautiously until the market stabilizes.

Miners have added to the selling pressure by realizing profits. The Miner Position Index (MPI), which measures Bitcoin outflows from miners, reached a yearly high of 3.56. Similar levels have historically signaled price declines.

Large deposits on Binance by the Bhutanese government and other significant holders further weigh on market sentiment. These developments suggest that Bitcoin's upward momentum may face temporary disruptions before potentially resuming its rally.

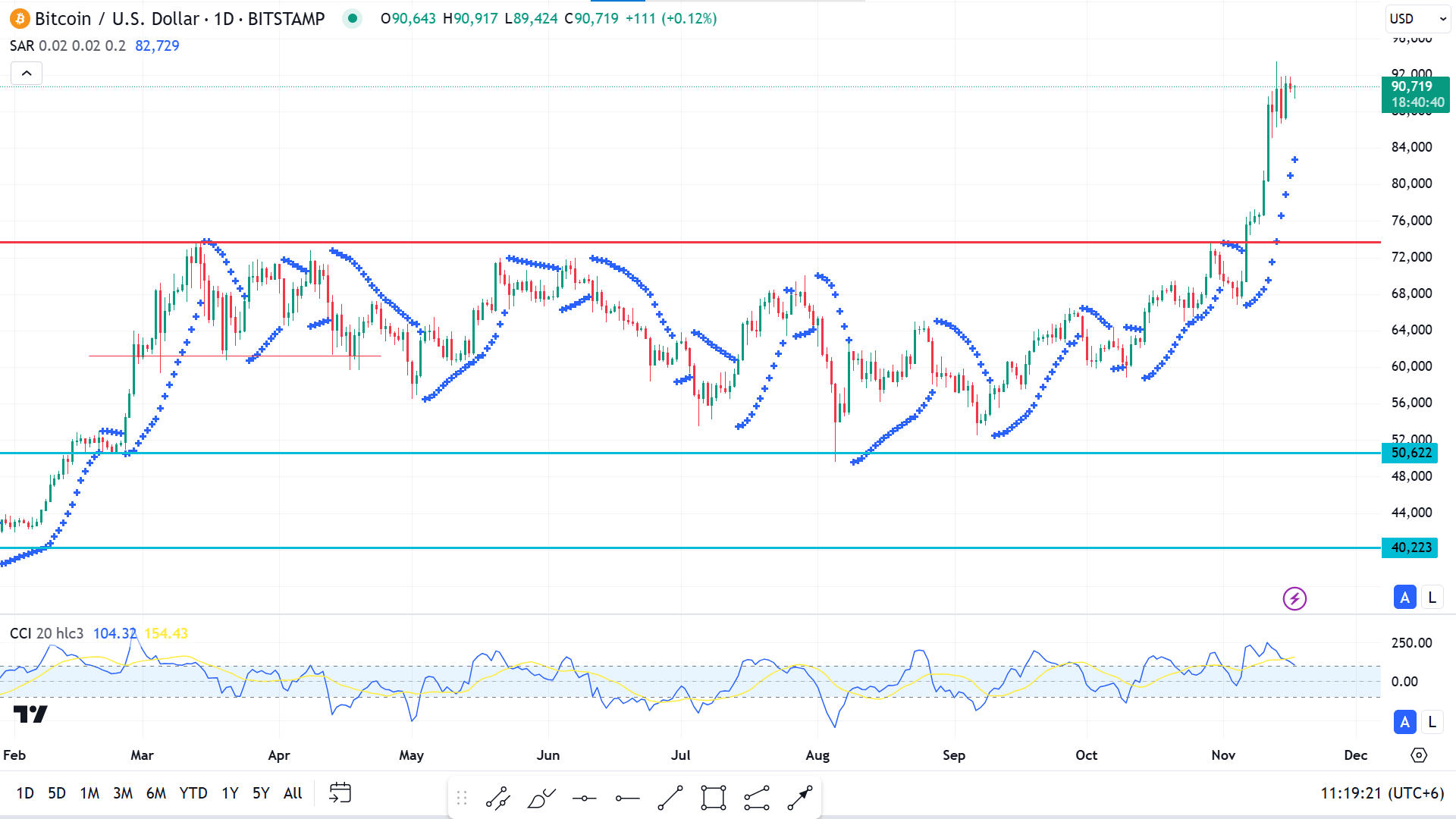

Technical Perspective

Finally, the price broke above the rectangle pattern it had remained in since the first quarter of this year and recently reached ATH, declaring significant bullish pressure on the asset price. As many crypto experts anticipate, it may soon get the 100K.

The BTCUSD pair's sideway phase on the daily chart is over, and the price is currently floating near the ATH of 93,483. The parabolic SAR indicates a solid bullish trend. In contrast, the CCI dynamic line edge is lower, although it remains above the upper line of the indicator window, indicating that bulls may be losing power at this point.

According to price action, the buy zone is detected near the 73700.00 -75000.00 area, validating the breakout and enabling buy opportunities, as it doesn't suggest opening a long position at the top.

Meanwhile, if the price declines and remains below the 72700.00 level, it will deny the buy signal. If this occurs, buyers may reconsider, as it will indicate that the price may re-enter the rectangle pattern and reach at least the primary support near 63282.00.

Ethereum (ETHUSD)

Fundamental Perspective

Ethereum (ETH) is hovering near the $3,000 mark, increasing exchange reserves and declining network activity weigh its price. If ETH rebounds from the $2,817 support level, it could break its current downtrend and rally by 60%.

ETH has declined since reaching a three-month high of $3,372 on Tuesday. A rise in exchange reserves is a crucial factor. Data from CryptoQuant shows an increase of over 141,000 ETH, valued at $430 million, in the past 24 hours. Such a rise typically signals heightened selling pressure, likely contributing to ETH's 7% dip over the last two days.

Falling network activity has added to the bearish sentiment. Ethereum's transaction fees, a proxy for user engagement, fell sharply from 5.65K ETH on Wednesday to 3.88K ETH on Thursday, ending an uptrend that had persisted since November 9.

In parallel, Ethereum exchange-traded funds (ETFs) recorded net outflows of $3.2 million on Thursday, their first since November 4, as reported by Coinglass. However, trading activity remained robust, with volumes exceeding $1.63 billion, marking their highest level since the ETFs' initial launch.

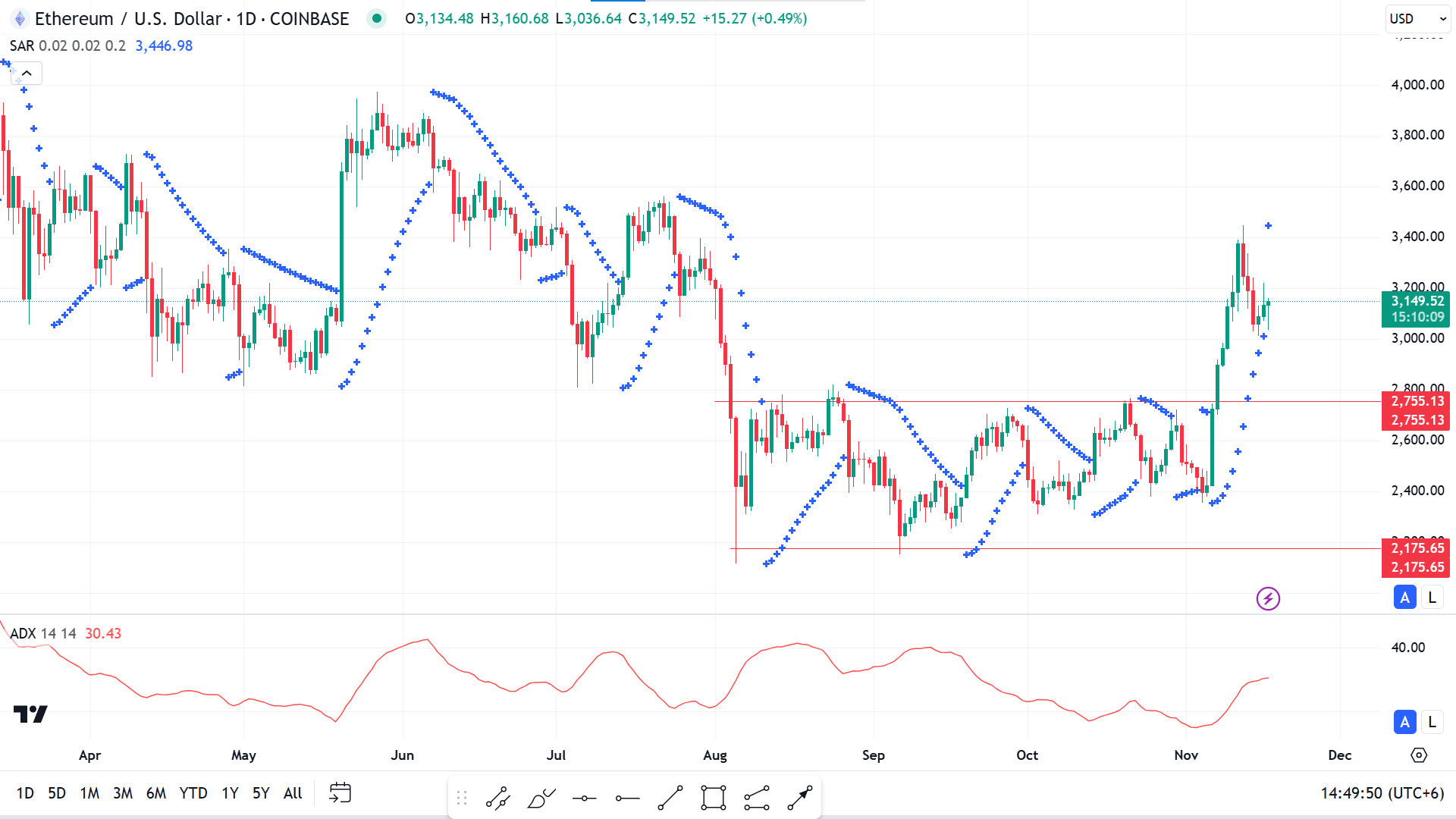

Technical Perspective

The weekly chart confirms a successful breakout from the 2175.65 to 2755.13 range, declaring a significant bullish force. However, if the current candle on the weekly chart finishes as a doji with a small red body, it will indicate a pause or buy-off environment.

The recent price surge in ETHUSD is remarkable, as the Parabolic SAR confirms the uptrend, while the ADX indicator supports the trend, as the reading remains above 25, indicating sufficient strength of the current trend.

Applying the price action concept, it seems the price above 3000 is the ultimate buy. The bullish setup is valid until the price remains above the previous range top of 2755.13. Additionally, reaching near that level would validate the breakout and enable elegant buying opportunities.

On the other hand, if the price fails to remain above 2755.13, it will disaffirm the bullish setup and may drive sellers optimistic toward the range low near 2175.65.

Tesla Stock (TSLA)

Fundamental Perspective

Tesla (TSLA) shares fell 5.7% on Thursday following a Reuters report suggesting the Trump administration may eliminate the $7,500 tax credit for electric vehicle (EV) buyers as part of broader tax reforms. This credit, a key component of Biden's Inflation Reduction Act, has been a significant driver of EV adoption. Tesla's decline continued into Friday's premarket trading, with shares down over 1%.

Sources cited in the report indicated that Trump's energy policy team is evaluating the removal of the incentive, with Tesla representatives reportedly in favor of the move. The potential cut comes as post-election market enthusiasm surrounding Trump's economic policies appears to cool, further pressuring Tesla's stock. Despite the dip, Tesla shares remain 15% higher than their post-election levels and have gained over 25% this year after a rocky start.

However, the company faced additional headwinds this week when it recalled 2,400 Cybertrucks due to a defective component that could lead to power loss and heightened collision risks.

Elon Musk, a vocal Trump supporter and major campaign donor, is poised for a prominent role in the new administration. Trump announced this week that Musk, alongside Vivek Ramaswamy, will co-lead an initiative to address government inefficiencies, further cementing their alliance.

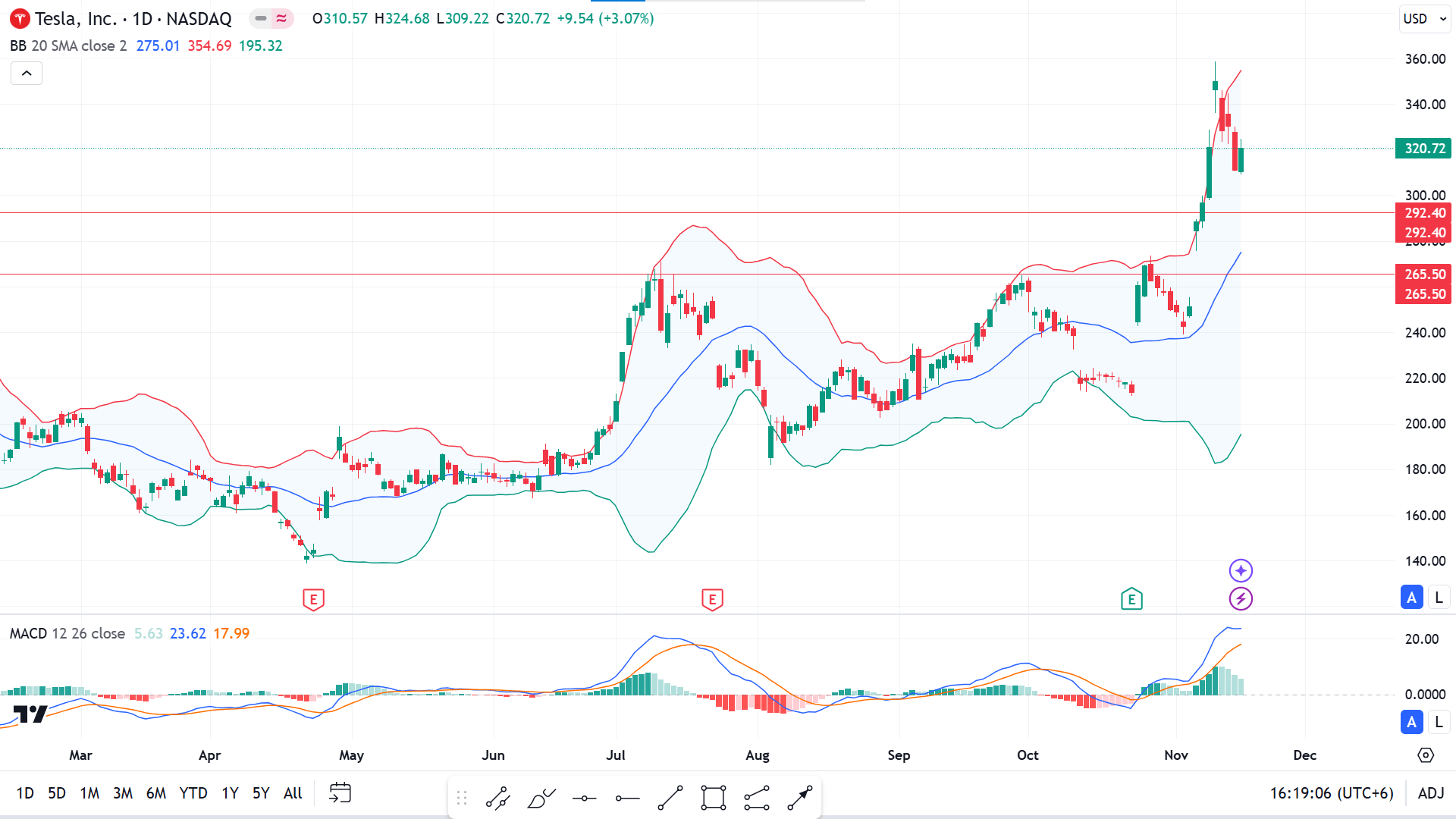

Technical Perspective

Tesla stock reached its yearly peak last week. Breaking above the previous high reflects significant bullish pressure, leaving buyers optimistic for the upcoming weeks.

The trend is highly bullish on the daily chart while getting a pause after hitting the yearly peak. TSLA stock price gets some barrier on the upper line of the Bollinger Bands indicator. In contrast, the MACD indicator reading supports the bullish pressure with fading green histogram bars and dynamic signal lines above the midline of the indicator window.

Gathering the recent market context, price action traders may seek to open adequate long positions between the 292.40- 265.50 range, as it will validate the bullish breakout.

On the other hand, bulls may fail below that range and trigger sellers to become optimistic, as a red daily candle below the level might spark sellers toward 220.76.

Nvidia Stock (NVDA)

Fundamental Perspective

Amid a year defined by the surge in artificial intelligence (AI) innovation, Nvidia (NASDAQ: NVDA) has emerged as a standout winner. With advanced solutions dominating the computing market, the semiconductor leader has soared by 203.57% year-to-date, including a 7.74% gain in the last month. Under Jensen Huang's leadership, Nvidia's commanding position has drawn significant investor interest.

However, concerns loom over Nvidia's valuation, now equivalent to roughly 12% of the U.S. GDP. These concerns, not limited to Nvidia, echo warnings from analysts about a potential AI-driven market bubble reminiscent of the dot-com era. The company's upcoming Q3 2025 earnings report, scheduled for November 20, is expected to provide further clarity. Nvidia forecasts $32.5 billion in revenue, and Wall Street analysts remain optimistic.

Several Wall Street analysts have recently adjusted their price targets. HSBC's Frank Lee raised his target to $200, citing robust data center growth, representing a 36.78% potential upside. Christopher Rolland of Susquehanna increased his target to $180, pointing to solid product momentum, while Oppenheimer's Rich Schafer raised his to $175, expecting solid demand from cloud and enterprise sectors. Despite valuation worries, the consensus outlook for Nvidia's performance remains positive.

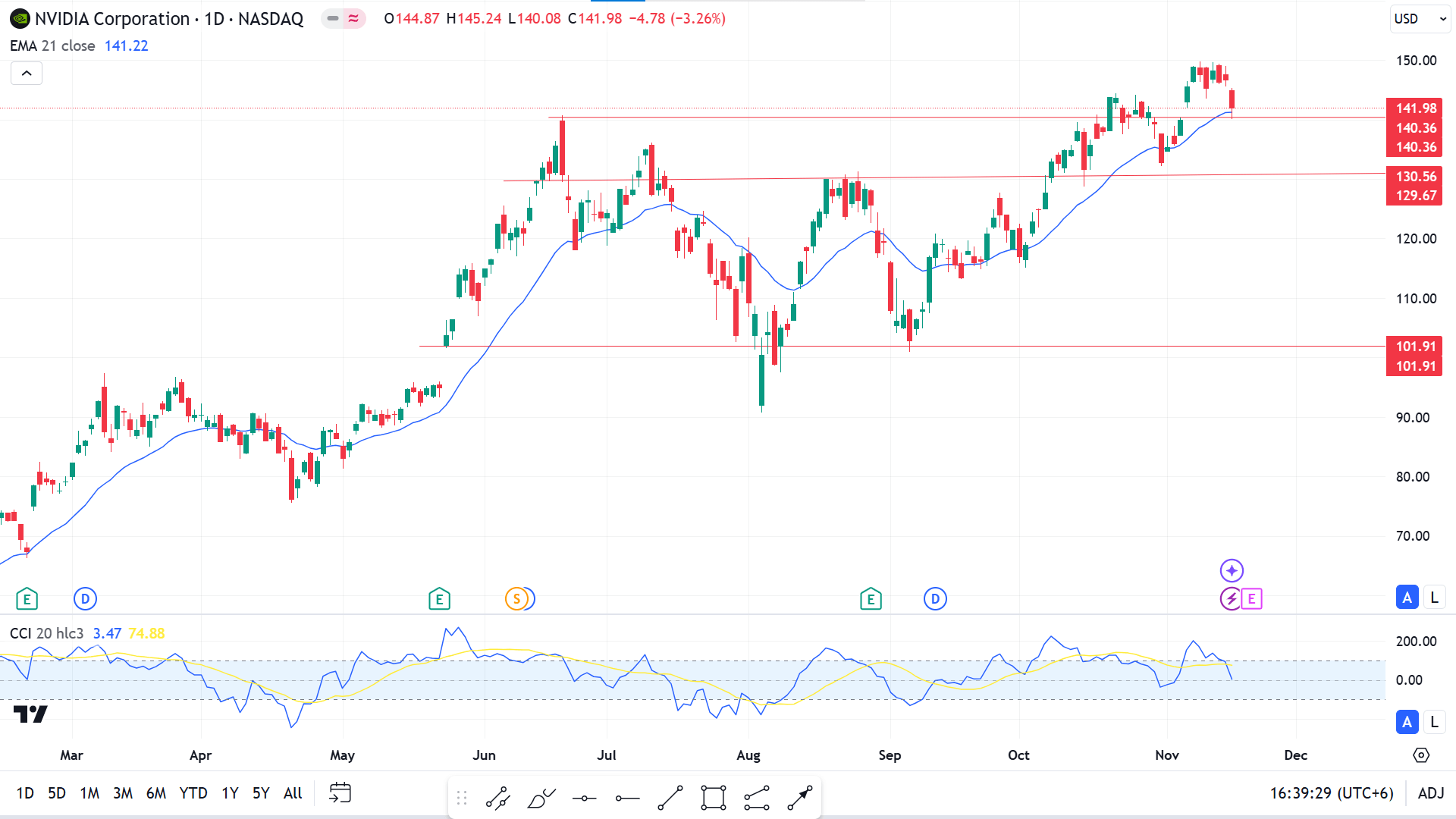

Technical Perspective

The NVDA share price remains in a straight bullish trend on the weekly chart. It has recovered from the recent loss and may head to create a new peak.

The price is gradually moving in a bullish trend on the daily chart. Due to recent bullish pressure, it is floating above the EMA 21 line. The CCI indicator reading remains neutral, with the signal line edging lower below the upper line of the indicator window.

According to the price action concept, buyers control the asset price. If the price floats above 140.36, it can potentially retouch the ATH or beyond that level, as 130.56-140.36 seems an elegant buy zone at the current bullish trend.

Meanwhile, if the price continues to decline below the 130.56-140.36 zone, the buy signal will be invalid, and sellers may be sparked toward the primary support near 116.15.

WTI Crude Oil (USOUSD)

Fundamental Perspective

West Texas Intermediate (WTI), the benchmark for US crude oil, hovers near $68.40 on Friday, holding steady as a sharp decline in US fuel inventories counterbalances oversupply concerns.

The Energy Information Administration (EIA) reported an increase of 2.089 million barrels in US crude oil inventories for the week ending November 8, slightly exceeding market expectations of a 1.85 million-barrel rise. However, gasoline inventories fell sharply by 4.4 million barrels to their lowest level in two years, defying forecasts of a 600,000-barrel build. This significant drawdown in fuel stocks has supported oil prices despite broader uncertainties.

A strengthening US Dollar (USD) may restrict further price increases, as a higher USD makes oil more expensive for holders of other currencies, potentially reducing demand. The US Dollar Index (DXY) trades near 106.90 after hitting a year-to-date high of 107.05 earlier this week.

Adding to market pressures, OPEC recently revised its global oil demand growth forecasts downward for 2024 and 2025, citing weaker consumption in key economies such as China and India, which marks OPEC's fourth consecutive downgrade. Meanwhile, Dennis Kissler of BOK Financial noted that expectations of policy changes under a Trump-led Congress could pose additional challenges.

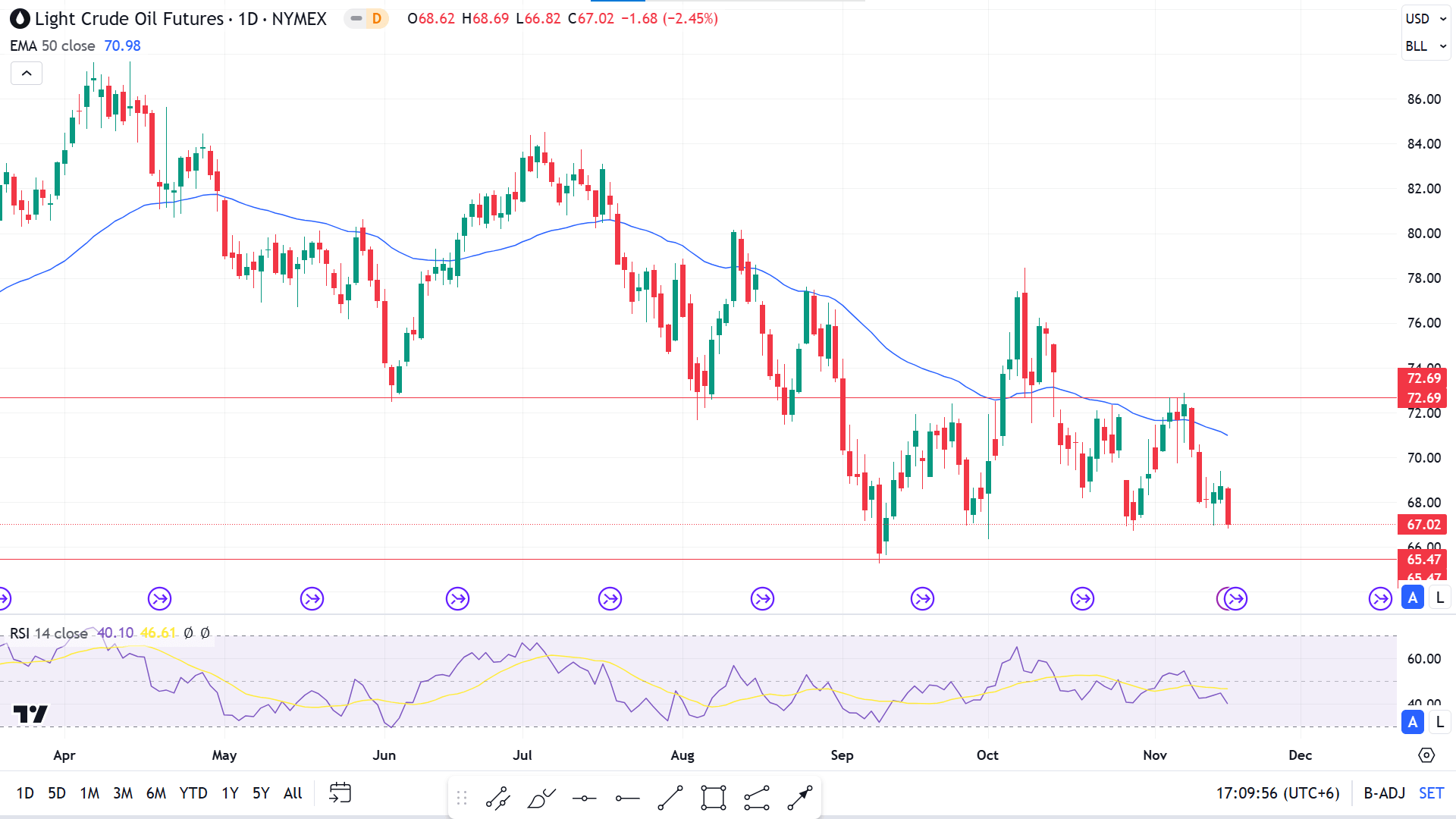

Technical Perspective

The price resumes on the bearish trend, with the last candle finishing solid red after a doji candle, indicating a bearish continuation.

The crude oil price creates a head-and-shoulder pattern on the daily chart, reaching the neckline, which sends a mixed signal to investors. The price floats below the EMA 50 line, and the RSI dynamic line floats below the midline of the indicator window, sloping downside, supporting the recent bearish pressure.

According to the current market context, the 65.47-67.02 zone can be an adequate buy zone, which can trigger the price back to the resistance of the 72.09 level.

On the other hand, breaking below the yearly low of 65.47 will banish the buy signal and may solidify the bearish trend toward a new low near 59.22.