I. Recent Netflix Stock Performance

Netflix's Rebound After Pandemic

After the pandemic boost in 2020, Netflix faced challenges in maintaining the same level of subscriber growth in 2021. The company struggled to meet its subscriber growth targets, closing the year with a 14.70% gain.

In 2022, Netflix doubled down on its investment in original content production as a strategy to differentiate itself from competitors. As a part of the business expansion, the company released some high-profile original shows and movies to attract and retain subscribers. However, the stock showed a massive discount, representing a 51.90% yearly decline.

Recently, Netflix focused on expanding its presence in international markets, particularly in Asia and Latin America. The company invested in local-language content to appeal to diverse audiences worldwide. As a result, the stock started in 2023 at 298.06 and increased to 486.88, representing a 63.99% yearly gain.

Netflix's Volatility Is High

Source: zacks.com

Its market valuation of $263.854 billion is impressive even if it trades 2,155,707 shares, which is less than the average of 3,625,895. NFLX exhibits more volatility than the market as a whole, with a beta of 1.22. Its noteworthy Price-Earnings Ratio (PE), which is 42.46, demonstrates investor confidence in the company's profitability. NFLX's EPS (Earnings Per Share) of $14.42 is indicative of its strong profitability.

Various factors, including changes in consumer behavior, competition dynamics, subscriber growth, and content additions, influence its performance. With bullish stock projections for 2024, 2025, and beyond, analysts expect Netflix will continue to expand as a result of its global expansion, original content, and technological advancements.

Expert Insights on Netflix Stock Forecast for 2024, 2025, 2030 and Beyond

In 2024, Netflix began at $486.88. Today, it's at $606.00, marking a 24% increase. Predictions suggest it'll reach $660 by year-end, up 36%. Mid-2024 might see $610. First-half 2025 could hit $804, then adding $181 to close at $985, a 63% rise.

Looking ahead to 2030, if Netflix maintains its 10-year growth rate, it could hit $2,926.02. This Netflix forecast implies a 377.84% increase from its current value.

Regarding Netflix's possibilities in 2024, analysts are optimistic. Their global outreach and creative content tactics will drive their continued achievement. In 2025, growing competition and changing viewing preferences can cause growth to slow down.

Before proceeding further, let's see what analysts project about NFLX target price:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coincodex |

$ 777.38 |

$ 787.76 |

$ 2,900.43 |

|

Coinpriceforecast |

$664 |

$991 |

$1,866 |

|

Stockscan |

$518.5 |

$792.0 |

$799.4 |

II. Netflix Stock Forecast 2024

Netflix showed multiple bullish signals, creating a long opportunity in 2024, targeting the 720.00 level.

Source: TradingView

Netflix is currently trading around the $606.80 price area. After strong bullish pressure from the $345 support level, the price surged higher quite impulsively and hit the $640 psychological price level.

Considering the current price action, a downside correction to the $500 key demand zone is highly possible. If it does so and pushes upward, we can expect the price to hit the $660 key resistance area in the coming days.

Let's see another NFLX Stock Forecast 2024, based on critical technical indicators:

- MACD: In the daily MACD outlook, the Histogram has been above the neutral line for a considerable time, which suggests an ongoing bullish trend.

- Average Directional Index (ADX): The current ADX line is below the 20.00 satisfactory zone, suggesting corrective momentum. Once the ADX overcomes the 22.00 to 25.00 zone, investors might expect a trend trading signal.

- Relative Strength Index (RSI): The RSI hovers above the 50.00 level but remains flat. It is a sign of a corrective market pressure where bulls are the ultimate winner.

A. Other NFLX Stock Forecast 2024 Insights: Is Netflix a good stock to buy?

As per an analyst from longforecast.com, Netflix stock (NFLX) is expected to expand in 2024, demonstrating the company's persistence and smart decisions. It is predicted to increase significantly by 51.8%, from $552 in May to $838 by December. Shifts in the market and business performance will probably impact fluctuations. The pattern indicates continuous growth from June's $647 to October's peak of $723, with possible spikes brought on by announcements or changes in the market. Analysts believe that Netflix will continue to innovate and grow, increasing investor confidence in the streaming industry.

NFLX Stock Price Target

In 2024, Netflix (NFLX) garnered positive ratings and predictions from analysts at TipRanks.com. Over the past three months, 36 analysts have weighed in, leaning towards a "Moderate Buy." Among them, 23 recommend buying, 12 suggest holding, and only one advises selling. The 12-month forecast is bullish, with an average NFLX price target of $657.61, indicating a potential 7.48% upside from the current $611.84. The highest Netflix price target of $800.00 reflects high optimism, while a conservative stance is shown with a low Netflix target price forecast of $440.00. Analysts foresee Netflix maintaining its growth path, offering investors promising returns.

B. Key Factors to Watch for Netflix Stock Price Prediction 2024

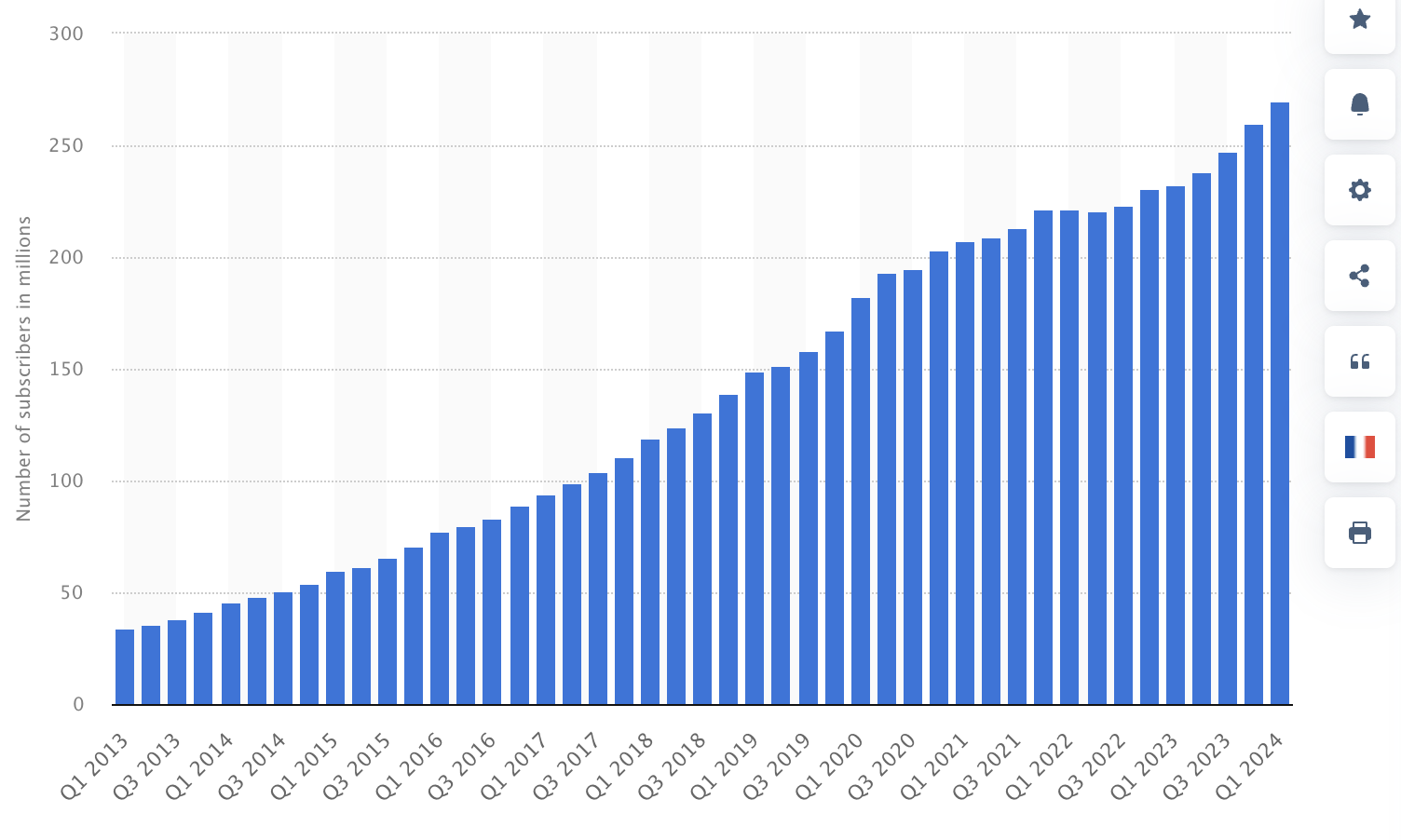

Netflix's Subscriber Growth

The quantity of Netflix subscribers is quite important. A significant increase in subscribers, especially worldwide, as shown in its most recent financial report, would indicate a sizable market and prospective earnings.

As per the above image, the subscriber growth shows upward traction, suggesting an increase in the customer base.

Revenue and Profitability

Monitoring revenue growth and important profit indicators like operating and net income is critical. A steady increase in revenue and expanding profit margins would signify successful content spending and efficient operations.

As per the current Earnings per share forecast, the Q3 and Q4 NFLX earnings could remain flat at 4.50, which is near the peak of Q1 2024. We may expect NFLX stock price to rise if the company can meet the forecasted EPS.

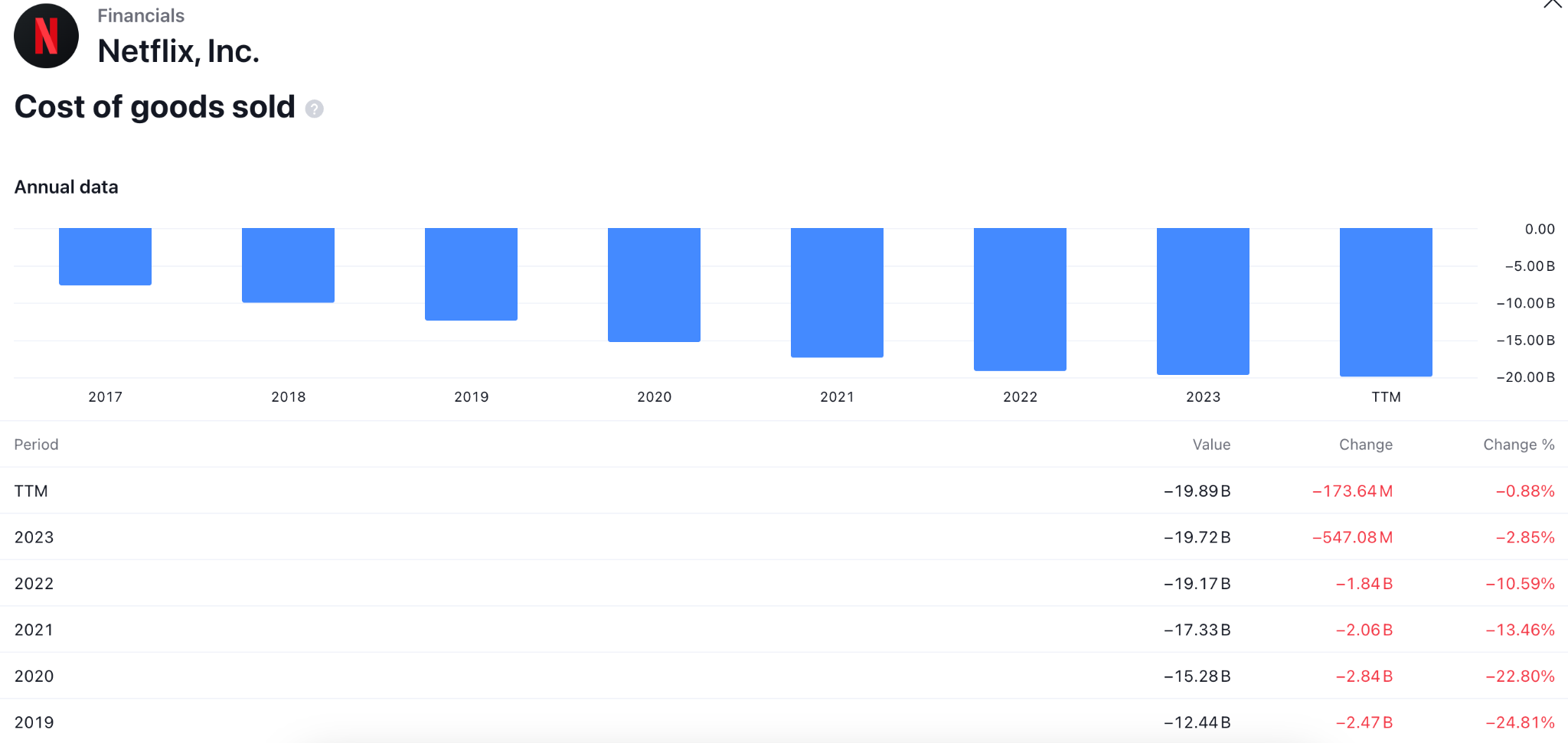

Spending on Content

Netflix makes a large amount of money by producing new content. Netflix investment strategy and profitability impact can be understood by tracking movements in content spending as a percentage of sales. Sustainability concerns could appear if content expenditure grows faster than revenue.

As per the above image, the cost of goods sold by the company remained higher in recent years, suggesting an increase in the direct cost.

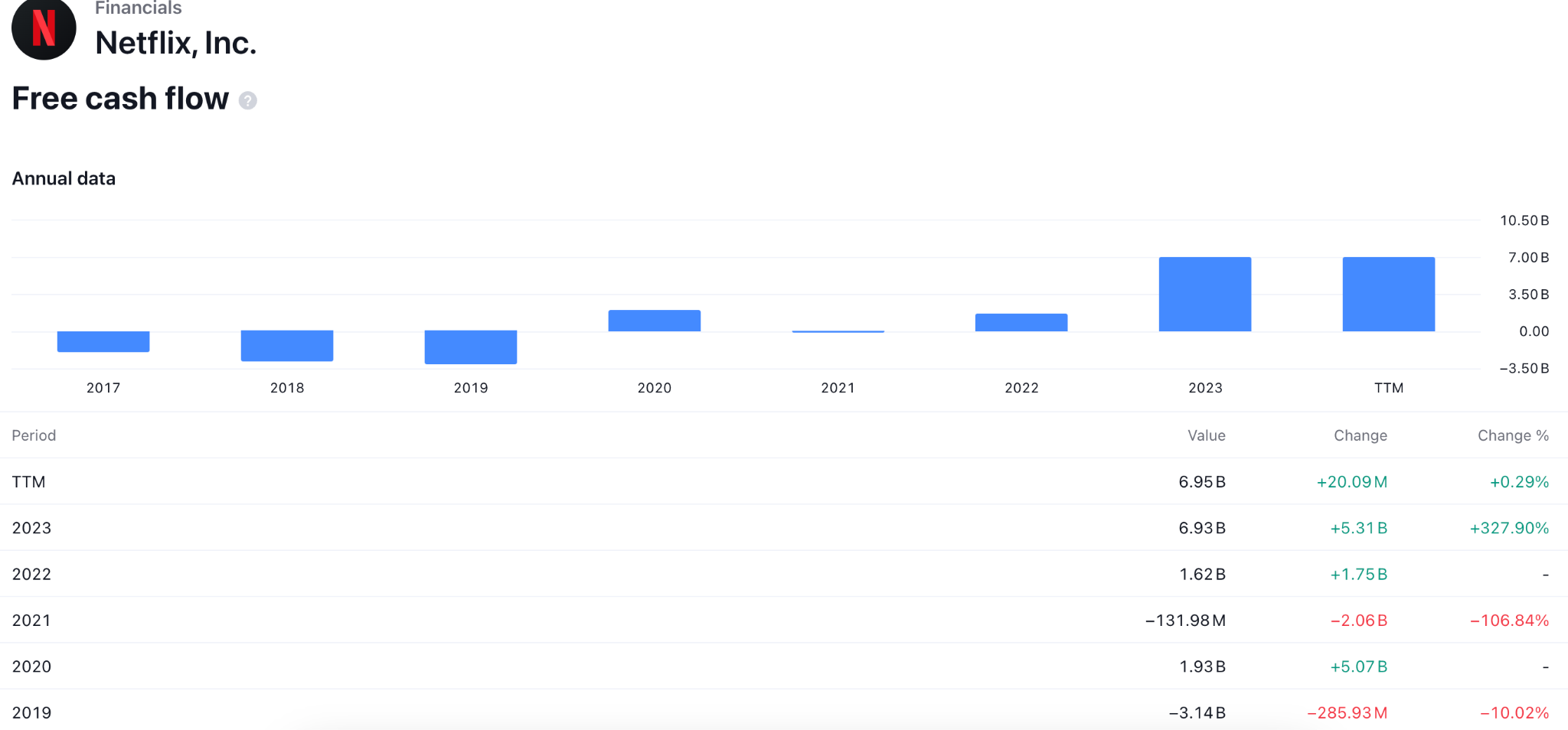

Free Cash Flow

Netflix's capacity to produce cash flow following investments is a critical factor to consider. Positive free cash flow is essential for content funding, debt repayment, and shareholder rewards. In 2023, the free cash flow was marked at $6.93 billion, which is a 227% increase from the previous year.

Netflix Stock Predictions 2024 - Bullish Factors

A number of variables support Netflix's bullish 2024 projection. First off, the firm expects more revenue due to its consistent subscriber growth, which is driven by its global expansion and engaging content. Secondly, user experience and retention are improved by investments in cutting-edge technology, such as AI-powered content recommendations. Thirdly, strategic acquisitions, like the recent gambling initiatives, facilitate long-term growth and income stream diversification.

Finally, Netflix's position in the market is strengthened by the continuous transition to digital streaming in the face of shifting media consumption patterns, which raises investor confidence and stock value.

NFLX Stock Prediction 2024 - Bearish Factors

Even with Netflix's bright future, there may still be obstacles to overcome in 2024. First, increased competition from emerging streaming services poses a risk to pricing power and market share, which might impede revenue growth. Second, rising debt levels and the cost of producing content may put pressure on profitability and restrict margin expansion. Thirdly, compliance issues arising from regulatory inspection of data privacy and content restrictions may cause disruptions to operations and negatively affect investor confidence.

Further influencing consumer purchasing and advertising budgets are macroeconomic issues like inflation and interest rate hikes, which could have an impact on Netflix's growth prospects and stock performance.

III. Netflix Stock Forecast 2025

The 639.26 level is a crucial barrier for Netflix stock. A successful break above this line could validate the V-shape recovery, increasing the possibility of reaching the 800.00 level by the end of 2025.

In the weekly price of NFLX, the ongoing buying pressure is potent above the 50-week EMA line. Moreover, the 100 SMA showed a bullish crossover at the 344.71 support level, showing a confluence bullish factor.

Meanwhile, the Relative Strength Index (RSI) showed a rebound from the 55.00 level, indicating buyers presence in the market. Moreover, the weekly MACD Histogram failed to hold the momentum and reached the neutral point. However, the Signal line is at the overbought zone with a bearish crossover, suggesting a challenge to bulls.

The fixed range high volume level indicator is another tool to find the future price of an instrument. It usually shows where the larger activity level stays. If the price shows a breakout from this high volume level, we may expect institutional investors' involvement in the market. As per the high volume level for NFLX, the most active level since July 2022 is at the 431.24 level. The current price shows a bullish signal above this line, suggesting an ongoing bullish trend. Moreover, the buying pressure could resume as long as the price holds the momentum above this crucial line.

Based on the Netflix Stock Forecast 2025, we expect the price to hit the 660.00 psychological resistance zone, from where a downside correction might occur toward the 100 SMA line.

The 639.26 level would be a crucial swing point to look at. An ongoing buying pressure with a stable market above this point could extend the bullish pressure above the 800.00 level by the end of 2025.

A. Other NFLX Stock Forecast 2025 Insights: Should I buy Netflix stock?

Analysts from longforecast.com predict Netflix (NFLX) will rise in 2025, rising from $838 in January to $1668 in December - a spectacular 202% increase. Predictions show a consistent upward trend driven by market demand and calculated actions.

Analysts from coincodex.com predicted that based on the average annual growth rate observed over the last ten years, Netflix's forecasted stock price for 2025 is $794.38. It is projected that the price of NFLX stock will rise by 29.78%.

B. Key Factors to Watch for Netflix Stock Price Prediction 2025

Consider the following important variables in order to forecast Netflix stock price in 2025:

Financial Outlook 2025: Is Netflix stock a good buy?

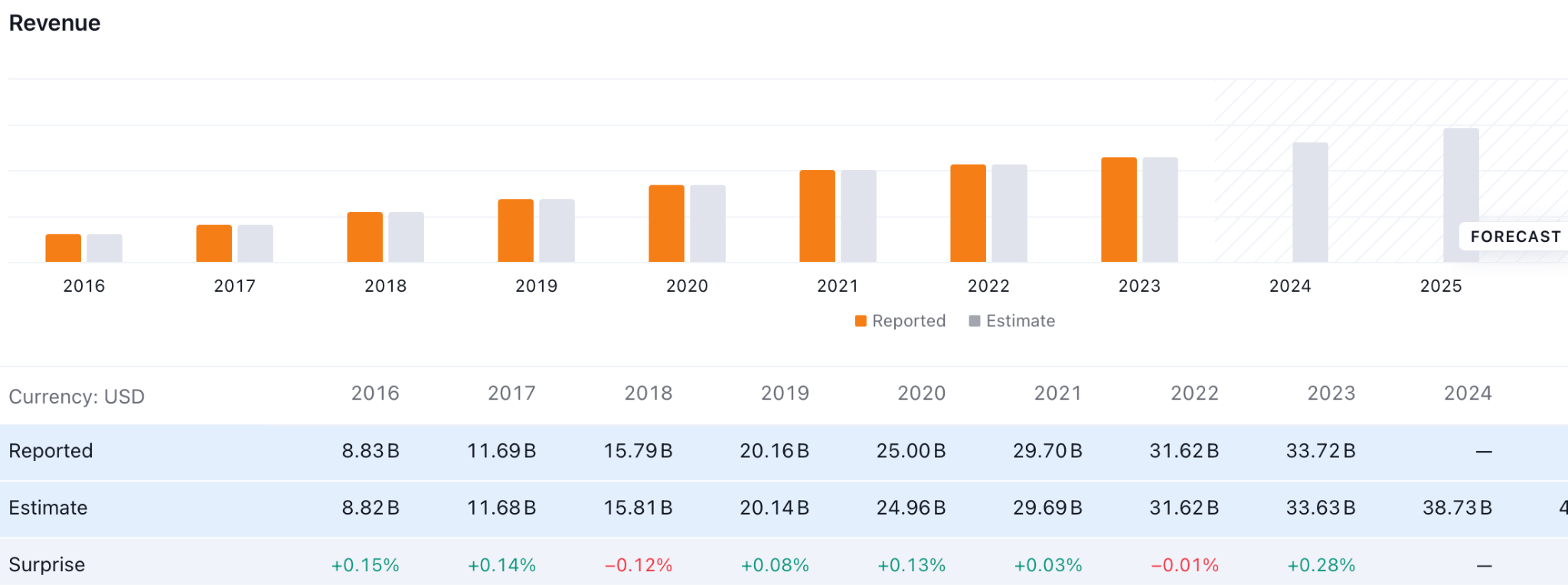

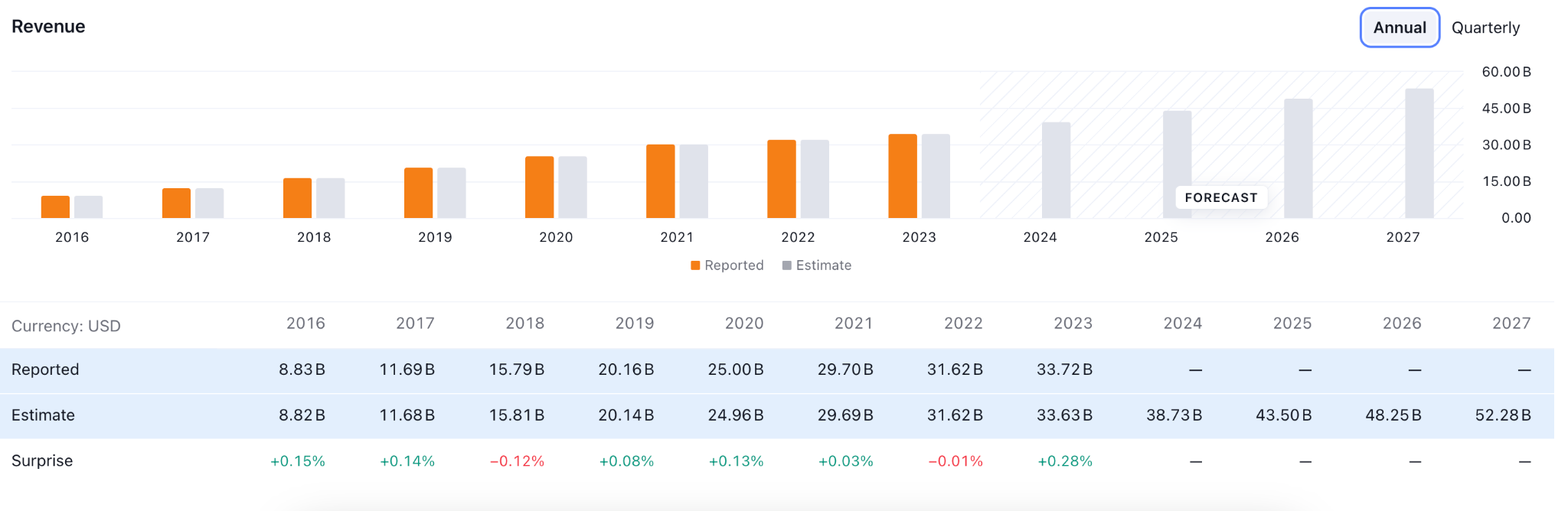

Netflix's financial forecasts provide information on cash flow and revenue growth. Important metrics include operational margins and subscriber growth. Strong projections, driven by thriving content and worldwide expansion, point to auspicious revenue growth. As per the above image, the revenue growth looks potent, as the recent NFLX forecast showed an increase in revenue from 2023.

Netflix Stock Prediction 2025: Content Strategy

Partnerships and original content investments are essential. Content variety draws in subscribers. Growing content libraries are an indicator of future growth. The company has already invested to create good content, as shown in the cost of goods sold section.

International Expansion

Revenue is diversified by the expansion of worldwide markets. Gaining popularity in new markets indicates possibilities for expansion.

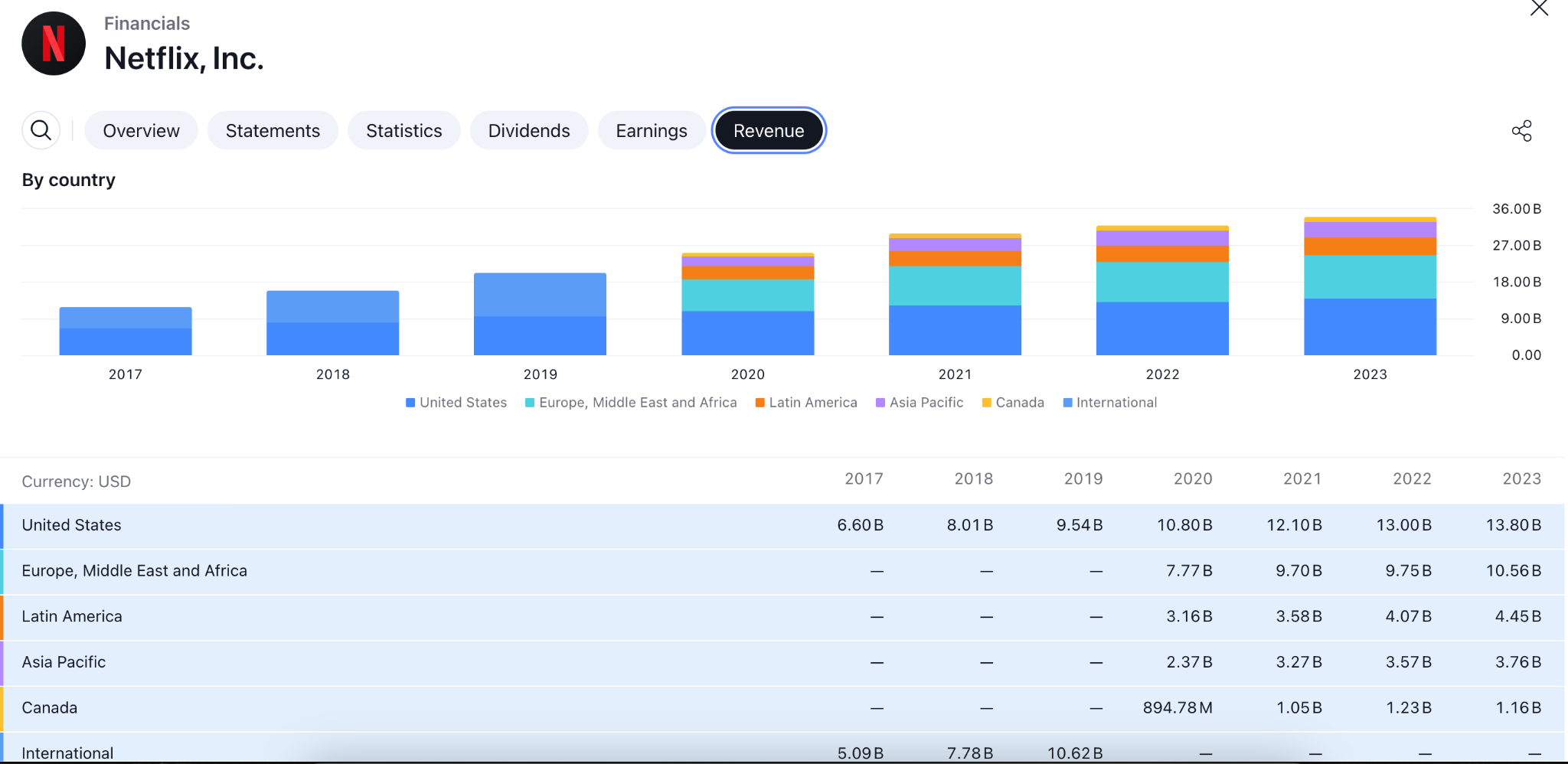

As per the above image, the United States section remains the major revenue generator for the company. Therefore, the US economy and the consumer behavior of the country could be a matter to look at.

Netflix Stock Projections 2025 - Bullish Factors

First, several positive indicators for Netflix's stock in 2025 The combination of strong subscriber growth and ongoing foreign development into fast-growing areas like Brazil and India inspire optimism. Delighted unique content debuts and well-timed alliances improve sentiments.

Enhanced investor trust is further reinforced by increased profitability achieved through cost-cutting initiatives and efficient operations. Long-term growth is promoted by partnerships with tech companies and advancements in streaming technologies, which boost competition.

NFLX Stock Price Prediction 2025 - Bearish Factors

Pricing flexibility and market dominance in the streaming space are at risk due to growing competition from both traditional media and new entrants. Risks to operations arise from regulations pertaining to content standards and data privacy. Sluggish subscriber growth and higher churn are caused by saturation in established markets.

Economic downturns have an effect on subscriber acquisition and revenue since they lower consumer spending. Growing content expenses are exceeding revenue growth, which is compressing margins and profitability.

IV. Netflix Stock Forecast 2030 and Beyond

A successful break above the 750.00 level with a monthly close could extend the gain for NFLX towards the 1000.00 level by the end of 2030.

A clear sell-side liquidity sweep is visible from the 230.00 level in the NFLX stock, creating a possibility of a bullish V-shape recovery. Moreover, the current price hovers above the 20-month SMA line, suggesting an ongoing bullish trend.

Investors should closely monitor how the price trades at the 750.00 level, which could be a major level for bulls. A successful bullish pressure above this line with a valid recovery could be a potential long opportunity.

On the other hand, a failure to break this zone could invalidate the V-shape formation, from which a buy-side liquidity sweep could be a potential short signal.

A. Other NFLX Stock Forecast 2030 and Beyond Insights: Is Netflix stock a buy?

According to the analysts at coincodex.com, if Netflix continues to expand at its current 10-year average rate, the stock is expected to reach $2,951.55 by 2030. If this prediction comes true, the current value of NFLX stock would have increased by an extraordinary 377.84%.

Analysts at coinpriceforecast.com anticipated that Netflix will increase in price by 26% during the next few months, from $1,866 to $2,352. in $1,866 in the beginning of 2031, it will grow to $1,905 in the first half of the year before closing at $1,946 this year. From the most current value, this indicates a tremendous rise of +218%.

B. Key Factors to Watch for Netflix Stock Price Prediction 2030 and Beyond

Netflix Revenue Forecast 2030

It's necessary to evaluate Netflix's projected margins, cost control, and revenue growth. Future projections refer to the steady growth in subscribers and revenue diversification.

As per the current reading, the Revenue for 2027 might come at $52.28 level, which is the highest level. Moreover, the forecasted revenue from 2024 to 2027 maintains an upward growth, signaling an increased momentum.

Corporate Strategy

Netflix's long-term goals, which include investing in content and developing new technologies, will impact stock performance. By placing intense focus on strategic partnerships, creative content, and personalized user experiences, Netflix will increase subscriber acquisition and retention.

Diversification

Distributing revenue sources such as games and goods outside of subscriptions can prevent dependency risks.

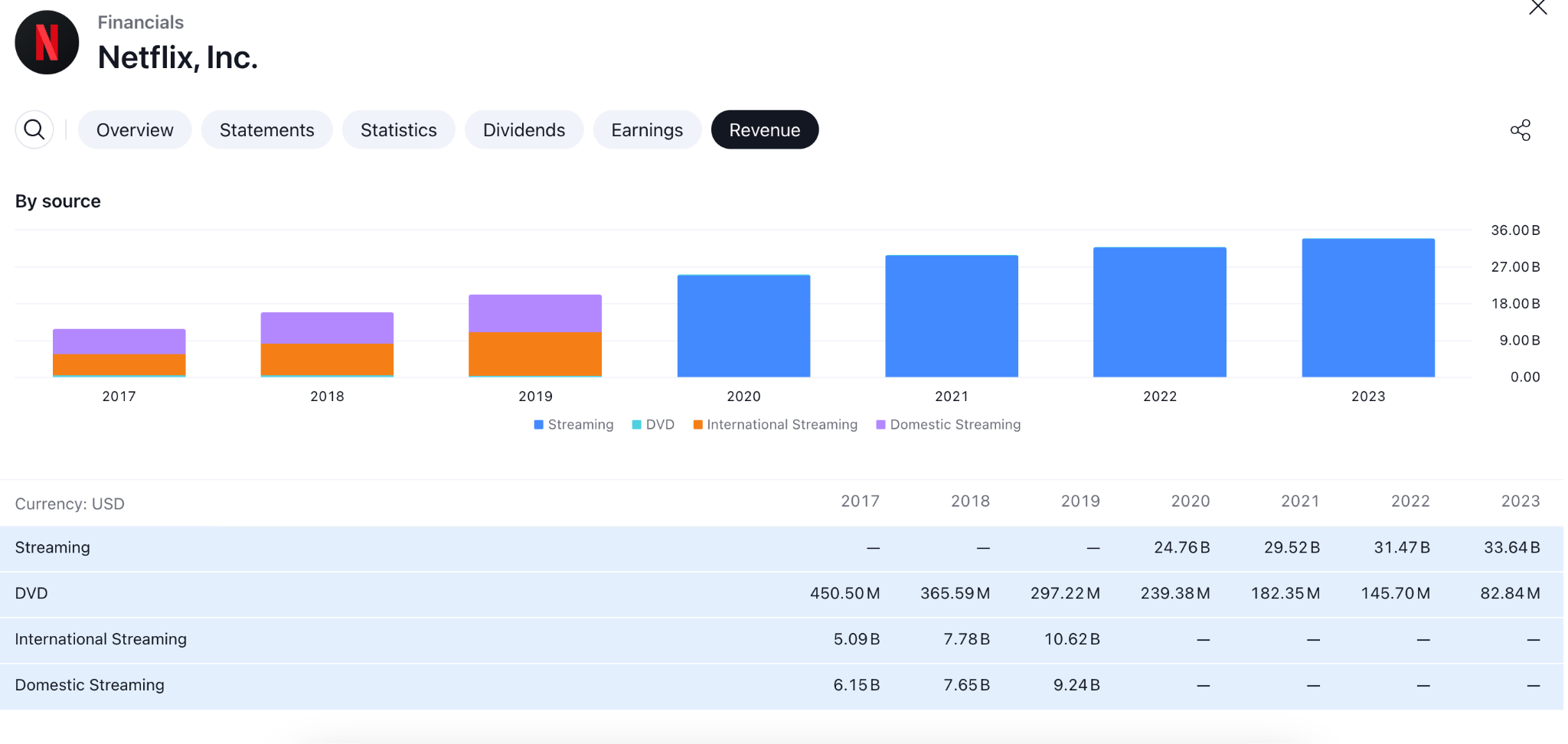

As per the above image, the streaming business brought $33.64 billion in revenue in 2023, while the revenue from DVD came at $82.84 million. It is clear that the company is focusing on the streaming business mostly, which needs to form a more stable position to eliminate the competitive threat.

Competition

Source: statista.com

Investors should consider several Netflix competitors. Although the company is number 1, based on the graph shown above, the closest competitor is the Amazon Prime Subscribers. Therefore, investors should closely monitor how these companies perform to find the competitive threat.

Netflix Stock Price Forecast 2030 and Beyond - Bullish Factors

Growing their business into profitable markets such as Africa and India, helped by rising internet usage and demand for digital content. Subscriber growth is fueled by localizing content and working with local creators. Taking a chance on gaming and products diversifies sources of income. User happiness is increased via individualized recommendations and cutting-edge streaming technology. Netflix strengthens its position in the competitive streaming market through strategic agreements.

NFLX Price Prediction 2030 and Beyond - Bearish Factors

Growing rivalry from both new and old rivals weakens market dominance. Restrictions on content and data privacy threaten business operations. Subscriber growth slows, and churn rates increase in mature markets. Economic downturns impact entertainment spending. Growing content expenses put pressure on profitability. Growth may stop, and competitiveness may be lost if innovation isn't pursued.

Conclusion

Netflix stock is expected to rise favorably in 2024, 2025, and beyond due to the company's outstanding content, global expansion, and growing user base. According to conservative projections, there could be substantial increases by 2030, with a continuous increase in value.

How to Invest in Netflix

You can buy Netflix stock from VSTAR with other instruments from forex, stocks, indices, commodities, and cryptocurrencies with these benefits:

- Handly trading experience with the VSTAR mobile app.

- Regulated platform

- Lots of trading instruments

- Premium trading tools, market signals, and trading analysis.

- Top-notch customer support.

Although Netflix has a higher possibility of growing, investors should monitor its performance on a month-to-month basis. The best approach is to look at quarterly performance, which often helps investors gauge the long-term projection.

FAQs

1. Will Netflix stock go up?

The current sentiment around Netflix stock is mixed, with some analysts suggesting a potential decline in the near term.

2. How much is Netflix worth in 2024?

As of May 2024, Netflix's market capitalization is approximately $278.68 billion.

3. What will Netflix stock price be in 2025?

Analysts have varying predictions for Netflix stock price in 2025, with an average estimate of around $643.26.

4. What is the Netflix stock price prediction 2040?

Looking ahead to 2040, predictions suggest that Netflix stock could reach an average price of $1,140.51.