I. Recent Lucid Stock Performance

LCID Forecasted Higher Capital Expenditure In 2024

Citing slower-than-anticipated EV demand, Lucid Group increased its capital expenditure forecast for this year and reaffirmed an annual production target below Wall Street expectations. The projections and subsequent stock decline of the luxury electric vehicle (EV) manufacturer underscore potential risks that investors may encounter due to the deceleration of EV demand from its peak and the intensification of global competition.

"Because we are increasing installed capacity from 30,000 to 90,000, we are implementing improvements in our Arizona facility first from a capital expenditure standpoint," said Gagan Dhingra, interim finance chief of Lucid.

To commence production of the Gravity SUV later this year, the organization anticipates increasing its capital expenditures from $910.6 million in 2019 to $1.5 billion in 2024.

Lucid Stock Tumbled To All-time Low

Lucid Group Inc. (LCID) shares reached an all-time low following the luxury electric vehicle (EV) manufacturer's announcement of production and delivery declines.

Lucid disclosed that fourth-quarter production of 2,391 Air sedans decreased by 32% compared to last year. Additionally, deliveries decreased 10% to 1,734 vehicles.

The company manufactured 8,428 electric vehicles and delivered 6,001 for the entire year, compared to 7,180 and 4,369 in 2022.

Lucid anticipates producing 9,000 automobiles in 2024, a marginal increase from the 8,428 automobiles manufactured in 2023. The average number of units anticipated by seven analysts surveyed by Visible Alpha for 2024 is 12,677.

LCID Faced A Change In The Management

Lucid's financial performance has become a focal point following earnings. The firm reported a substantial loss of $680 million for the first quarter of 2024, juxtaposed against the delivery of 1,967 luxury electric sedans. These results reflect Lucid's ongoing challenges as it endeavors to align production with demand and carve out market share within the competitive electric vehicle sector.

The resignation of Mike Bell, its Senior Vice President of Digital, also marks a pivotal change within the company's leadership, particularly as Bell has been an integral part of nurturing Lucid's software endeavors since joining the company in 2021.

Mike Bell, whose background includes significant roles at Apple and Intel, brought a wealth of experience in digital innovation to Lucid. During his tenure, he was instrumental in developing software for the automaker, which is scaling production and expanding its product lineup.

Lucid's foray into the luxury electric vehicle market has been met with both excitement and hurdles, as it struggles to establish consistent demand for its Lucid Air model while advancing the production of its upcoming Gravity SUV.

Derrick Carty, the company's Vice President of Platform Software, is temporarily stepping into the role. Carty's experience with software platforms will be crucial as he takes on interim responsibilities as a former Apple employee. Lucid's reliance on seasoned tech experts highlights the increasing convergence of automotive engineering and digital technology within the industry.

Expert Insights on Lucid Stock Forecast for 2024, 2025, 2030, and Beyond

The Lucid Stock (LCID) trades at a historic low from where a potential long opportunity is available depending on the price action. Investors should monitor the management's actions and upcoming quarterly earnings reports.

Before proceeding further, let's see what analysts think about Lucid Stock Forecast for 2024, 2025, 2030 and Beyond:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$3.08 |

$3.78 |

$7.32 |

|

Coincodex |

$ 4.57 |

$ 3.80 |

$ 17.29 |

|

Stockscan |

$14.15 |

$7.60 |

$8.49 |

|

BTTC Exchange |

$71.99 |

$79.93 |

$201.45 |

II. Lucid Stock Price Prediction 2024

Lucid stock (LCID) is trading at a record low, from where decent buying pressure might come after a solid breakout. LCID could aim higher and reach the 5.42 key resistance level within 2024 based on the current fundamental outlook.

The weekly LCID price shows potent ongoing selling pressure. The recent price trades below the 50-week EMA line with no sign of seller weakness.

Primarily, the ongoing downside pressure is solid and can move even lower until a bullish exhaustion appears. Moreover, no solid bottom is seen in the most recent price, which might make it even harder for bulls.

Looking at the volume structure, the high volume level since the beginning of 2023 has been at 3.24, which is just above the current price.

Based on the Lucid Stock Price Prediction 2024, a bullish breakout above the high volume line could be the first sign of a possible trend reversal. A successful breakout, with a daily candle above the 50-week EMA, could validate the long signal, targeting the 17.82 level.

A. Other Lucid Stock Forecast 2024 Insights: Will Lucid stock go up?

According to Tiprank, Lucid stock (LCID) has a moderate outlook where most analysts are neutral about future growth. As per the 12-month Lucid Group stock forecast, the stock could rise to the 3.26 level, while 7 out of 9 investors are neutral about this instrument.

Looking further, Zacks provided another outlook for this stock combining reports from 10 analysts, which showed a moderate buy signal.

According to short-term price targets from 10 analysts, Lucid Group's average target is $3.79. These forecasts vary, with the lowest LCID price target at $2.90 and the highest at $5.00. This average Lucid price target suggests a 33.45% increase from the last closing price of $2.84.

B. Key Factors to Watch for LCID Stock Forecast 2024

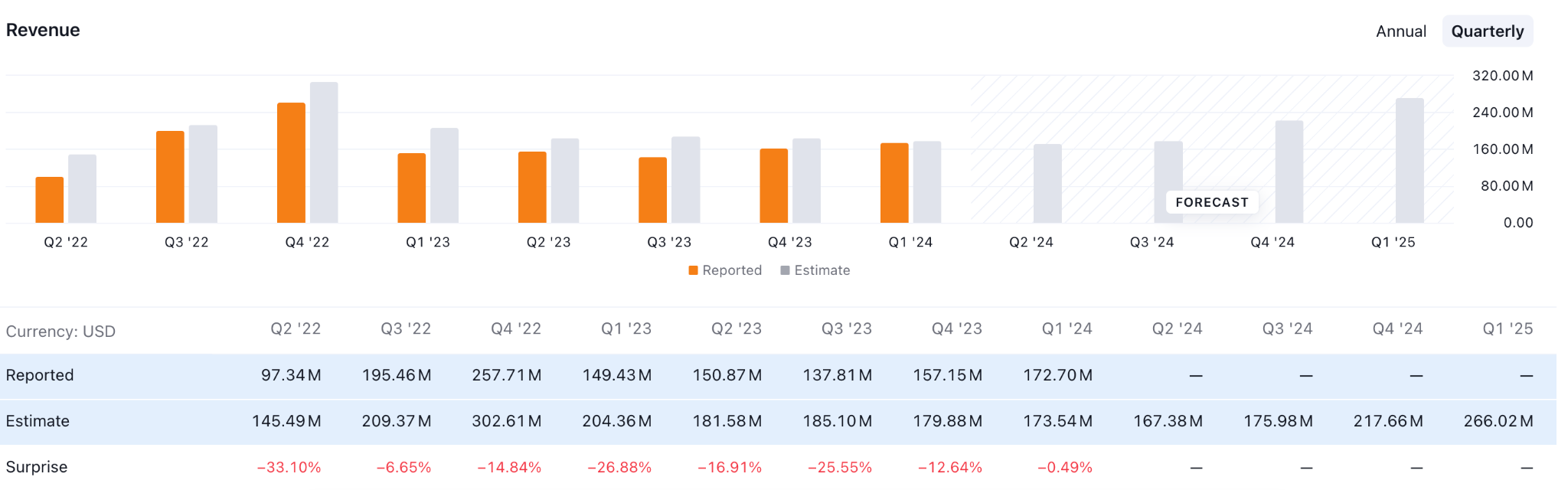

LCID Revenue Forecast 2024

For the quarter ending March 31, 2024, LCID reported a trailing twelve-month (TTM) revenue of $618.58 million, reflecting an 11.62% year-over-year decline. The company's net income (TTM) was -$2.73 billion, representing a 36.30% year-over-year decrease.

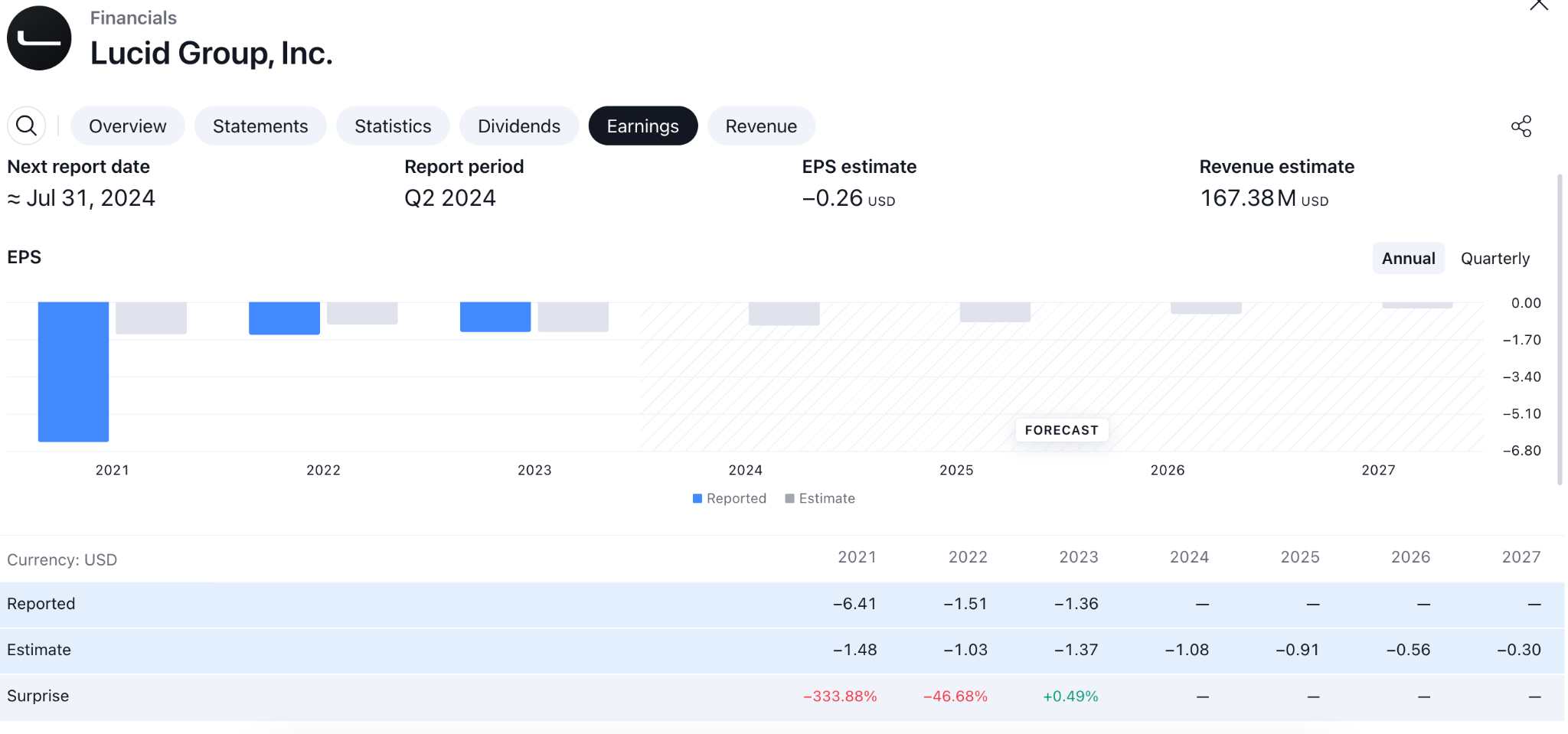

The forecasted revenue for Q2, Q3, and Q4 of 2024 are $167.38 million, $175.98 million, and $217.66 million, respectively. Any increase over this revenue could be a bullish factor for this stock.

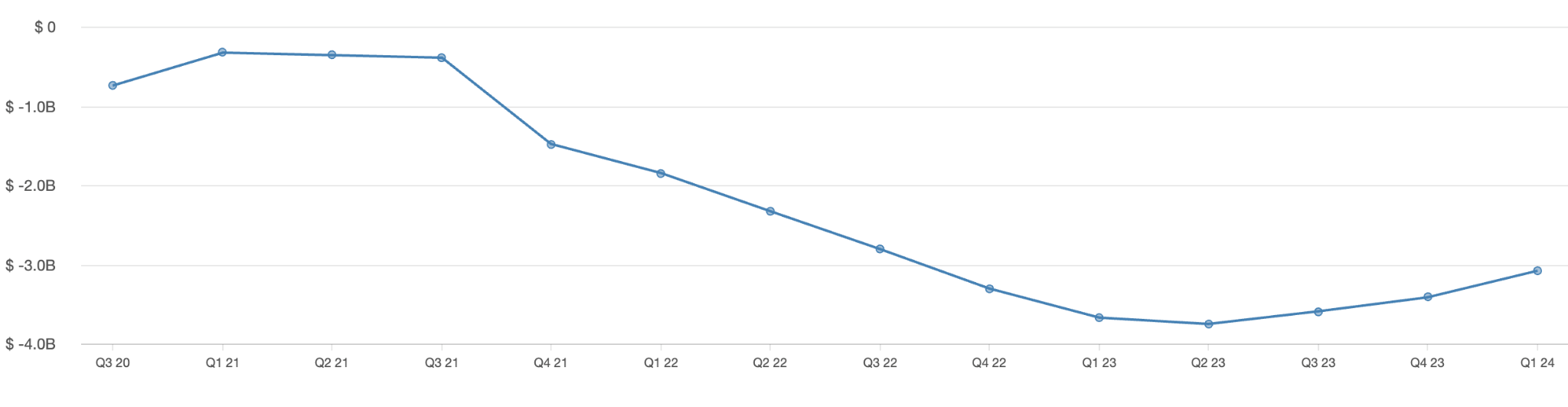

Lucid Cashflow for 2024

For the quarter ending March 31, 2024, Lucid Motors (LCID) recorded a trailing twelve-month (TTM) free cash flow of -$3.07 billion, reflecting a 16.16% year-over-year improvement. Despite this positive trend in free cash flow, Lucid Motors continues to face financial challenges, as indicated by its declining revenue and substantial net income losses. The company's stock performance and cash flow are under close scrutiny as it strives to achieve financial stability and growth in the competitive electric vehicle market.

Can Saudi Money Keep LCID Alive?

A subsidiary of the Saudi Public Investment Fund (PIF) recently disclosed the acquisition of Lucid's convertible preferred stock, valued at $1 billion. The funds not only supply Lucid with essential capital but also instill confidence in other investors as the PIF augments its existing 60% stake.

However, this new $1 billion in funding may only offer temporary relief. In the latest full-year financial statement, Lucid had only $1.4 billion in cash and reported a loss of $2.8 billion, indicating that the company will continue to face financial difficulties.

Lucid Price Prediction 2024 - Bullish Factors

Strategic Investments The Saudi Public Investment Fund's (PIF) support is among the most significant bullish factors. PIF's recent $1 billion investment in Lucid was made via convertible preferred stock. This investment not only furnishes crucial capital but also enhances investor trust in the fiscal soundness and expansion prospects of Lucid.

Lucid is currently in the process of augmenting its manufacturing capabilities, a development that is anticipated to have a substantial positive impact on the delivery of vehicles. The Arizona-based AMP-1 assembly plant is expanding to produce tens of thousands of automobiles per year. This expansion is essential for satisfying the rising demand for luxury electric vehicles and enhancing revenue prospects.

An additional crucial element is Lucid's emphasis on cutting-edge battery technology and exceptional vehicle range. Consistently lauded and esteemed for its exceptional range and performance, the Lucid Air is a prominent luxury electric vehicle sector contender.

LCID Stock Price Prediction 2024 - Bearish Factors

Lucid has furnished crucial capital and enhanced investor trust in Lucid's fiscal soundness and expansion prospects, indicating a decline of 36.30% annually. Moreover, although free cash flow improved from the previous year to negative $3.07 billion, this figure still signifies significant cash depletion.

Multiple analysts have downgraded Lucid's stock. For example, Stifel Nicolaus recently reaffirmed its "hold" rating and decreased its price target per share from $5 to $4. This indicates a deficiency in trust regarding the organization's ability to fulfill financial obligations and its immediate operational achievements.

Lucid has encountered challenges in its production and delivery figures. The company manufactured and delivered 1,734 Lucid Air electric vehicles in the fourth quarter of 2023, a 32% decrease from the previous year.

III. Lucid Stock Price Prediction 2025

Locid stock aimed lower and hovers at an all-time low. Therefore, investors should closely monitor how the price sets the bottom, where a successful upbeat earnings report could take the price higher at the 30.92 level by the end of 2025.

As per the weekly LCID price, the ongoing market momentum is corrective, with no sign of buying pressure. Moreover, the most high volume level since the inception is at the 6.16 level, which could be a major level to look at. As the 50-week SMA is working as a resistance, a successful breakout above this line could signal a bullish reversal.

Looking at the RSI line, the recent level formed a bottom at the 30.00 level and showed a V-shape recovery. However, the current level is still below the 50.00 neutral line, from where downside pressure might continue.

Based on the Lucid Stock Price Prediction 2025, a valid bullish pressure above the 6.50 level with a consolidation could be a long signal, aiming for the 30.92 resistance level.

On the other hand, the weekly MACD Histogram remains above the neutral line, while RSI is aimed higher from the bottom. In that case, if bulls fail to form an upward continuation, it might resume lower. However, before confirming the downside pressure, the MACD Histogram should rebound below the neutral line.

A. Other Lucid Stock Price Prediction 2025 Insights: Is Lucid a good stock to buy?

According to Tradnigview, 11 analysts provide their outlook for the Lucid Stock (LCID). As per analysts' projections, the stock could reach a 4.00 level by the end of 2025. The successful upward pressure and reaching the 4.00 level could indicate a 40% price surge from the current price.

If the EV industry expands over the next few years, Lucid Group is likely to sell a respectable number of vehicles. However, competing with major players like Tesla and Ford will remain difficult for Lucid.

Although BlackRock and Saudi Arabia's PIF are optimistic about LCID stock, a report from Nasdaq.com predicts it will reach only $15 by 2025. While this would yield a solid return on investment, larger competitors such as Tesla and Ford may offer more promising growth opportunities.

B. Key Factors to Watch for Lucid Stock Forecast 2025

LCID Revenue Forecast 2025

As per the earnings projection, LCID could maintain a surge in Revenue in 2025. The estimated revenue for 2025 is $1.77 billion, up from 2024's $735 million. A successful reach of the projected earnings could be a potential long opportunity in this stock.

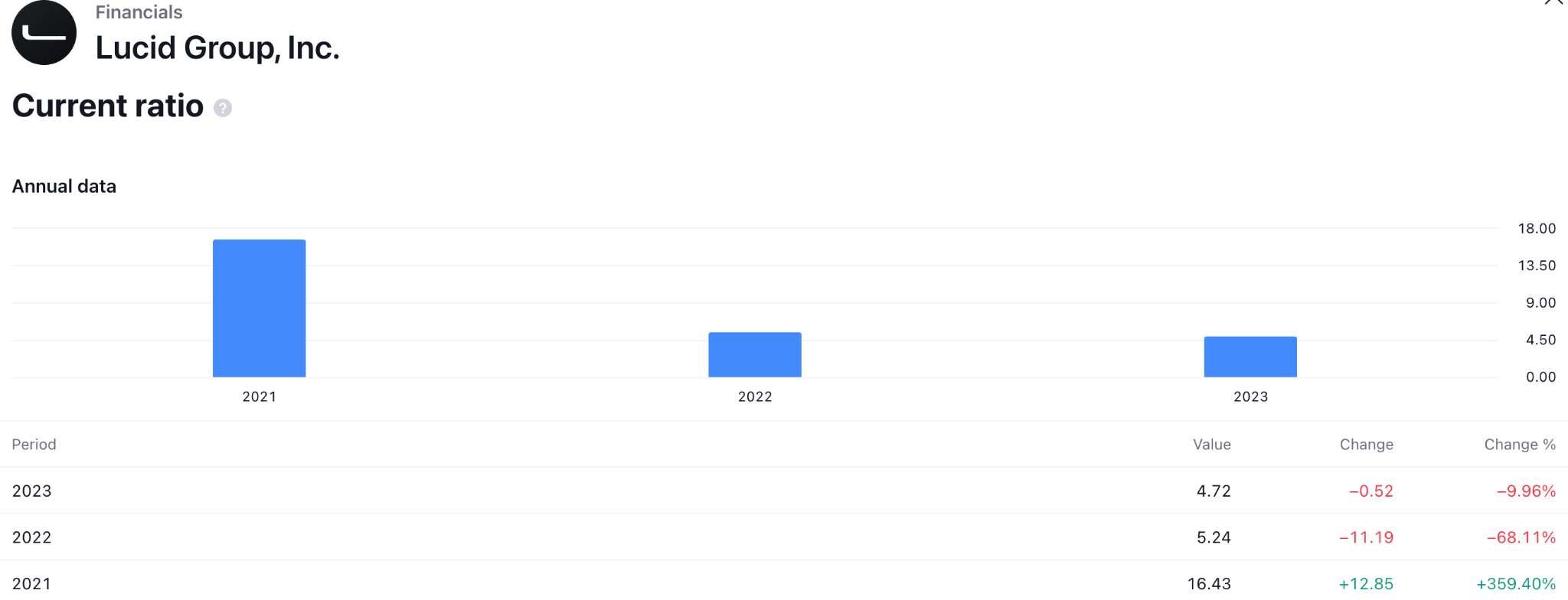

Lucid stock prediction 2025 - LCID Liquidity Position Analysis

In the liquidity position of LCID, the current ratio remains at the 4.72 level, down from 5.24 in the previous year. Investors should closely monitor how it rebounds as the current ratio keeps moving lower. However, the quick ratio reached the 4.12 mark in 2023, after remaining at the 4.03 level in 2022.

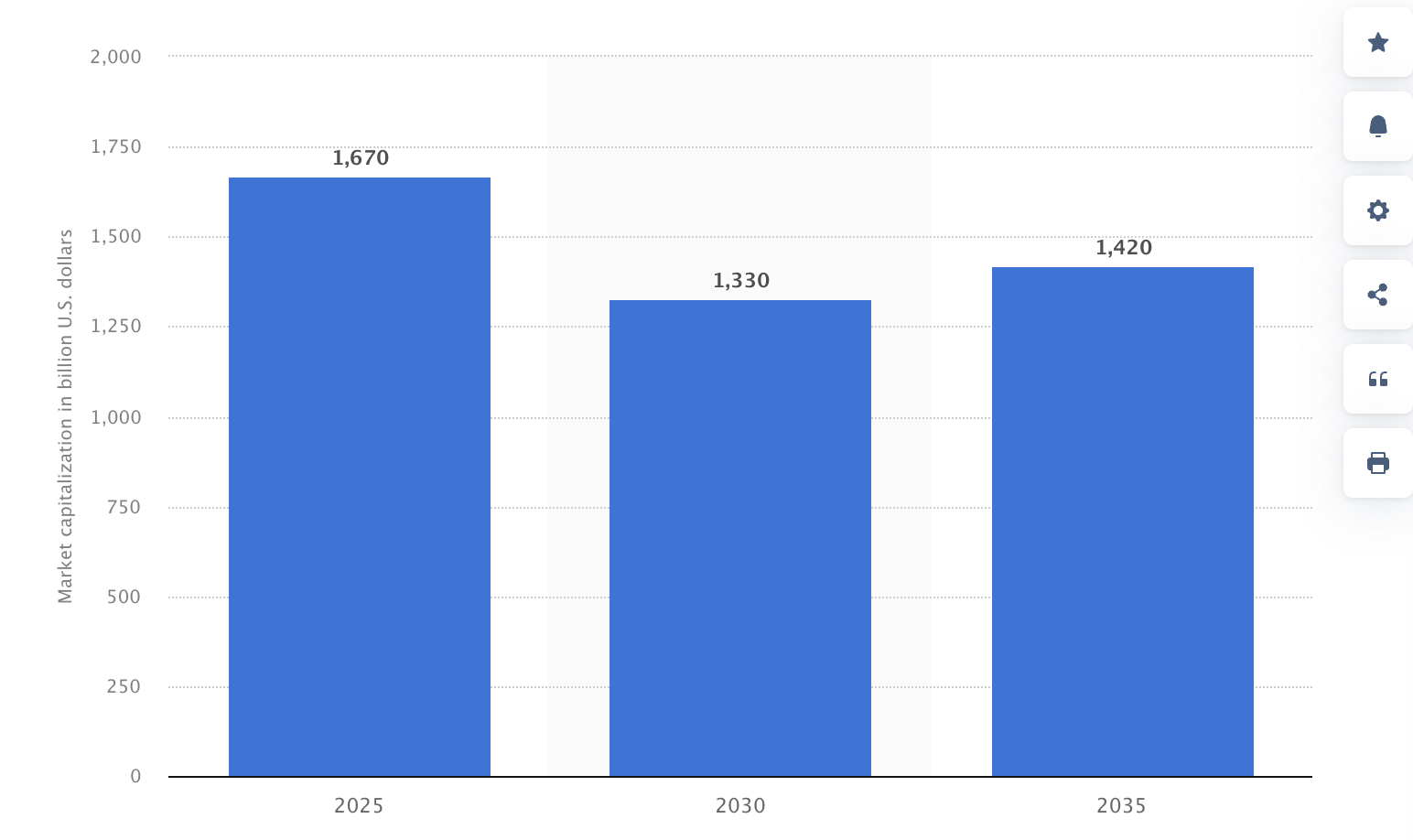

EV Market Cap Projection For 2025

The Electric Vehicle industry is the talk of the town now, especially after the emerging need for renewable energy. As a result, the EV industry is forecasted to soar in 2015, reaching $1670 billion in the market cap. In that case, the launch of new and affordable vehicles could be a potential bullish opportunity for LCID investors.

Lucid Stock Price Prediction 2025 - Bullish Factors

Lucid is implementing strategic initiatives to enhance its global market presence. This entails venturing into untapped markets in Europe and the Middle East, both of which are anticipated to generate heightened sales and enhance brand awareness on an international scale.

In spite of the present financial difficulties, analysts anticipate a significant surge in revenue for Lucid in the coming years. It is anticipated that Lucid's revenue will experience substantial growth in 2024, with certain projections indicating that it may surpass $1 billion. The expansion of market reach and increased production contribute to this growth.

LCID Stock Price Prediction 2025 - Bearish Factors

In the fiercely competitive EV market as a whole, Lucid encounters formidable competition from well-established manufacturers as well as other EV startups. This fierce competition may exert pressure on Lucid's stock price and market share. Furthermore, unfavorable circumstances, such as the impact of winter storms on electric vehicle (EV) performance, serve to diminish investor confidence even more.

In spite of having obtained $1 billion in funding from the Saudi Public Investment Fund (PIF), Lucid continues to grapple with a significant capital burn rate. Cash on hand at Q1 of 2024 amounted to a meager $2.12 billion, an amount that is deemed inadequate to maintain ongoing operations without supplementary funding.

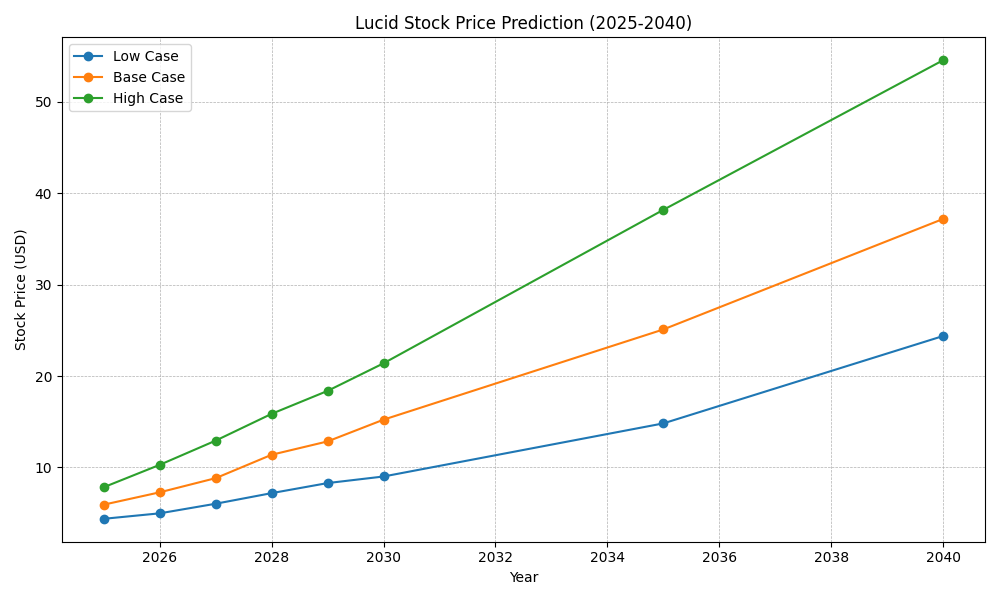

IV. Lucid Stock Price Prediction 2030 and Beyond

The Lucid stock price prediction depends on fundamental factors, where upbeat earnings reports are needed to anticipate a bull run. However, the ongoing surge in the EV industry could be a long signal, where any confluence buying pressure above the 17.86 level could take the price to the 33.57 level by the end of 2030.

According to the monthly chart of LCID, intense selling pressure is seen below the 20-month EMA line. Moreover, the downside continuation is seen after having a minor swing high at the 17.86 level.

As the ongoing selling pressure is present with no solid bottom formation, we may expect a bull run after forming a valid breakout. Primarily, a bullish exhaustion at the top with a monthly close above the 17.86 level might open a long opportunity, targeting the 45.00 level.

According to the Fibonacci Retracement level from the all-time high to the low zone, the current price trades at the discounted zone. In that case, any bullish price action in the lower timeframe could be a potential long signal until the price reaches the 50% Fibonacci Retracement line.

A. Other Lucid Stock Forecast 2030 and Beyond Insights: Is Lucid stock a buy?

According to a report from Cryptorank, investors might consider Lucid stock for long-term investment. Effective trading strategies for Lucid Motors stock can be beneficial over time as the industry recovers. According to market analysis, Lucid Motors' stock valuation is expected to experience significant growth by 2030. This positive outlook will enhance Lucid Motors' investment prospects considerably. Projections indicate that the LCID stock price will reach $41.36 by 2030.

Another report from Poltenbell provided another optimistic outlook for LCID, showing the price could reach up to the $21.40 level by the end of 2030.

B. Key Factors to Watch for LCID Stock Forecast 2030 and Beyond

LCID Earnings Forecast 2030

Lucid stock (LCID) might keep eliminating the loss in the coming years, where the current forecasted Earnings Per Share for 2027 is -$0.30, which is higher than -$1.36 for 2023. However, a successful business might need a positive EPS, which might come after crucial steps from the management.

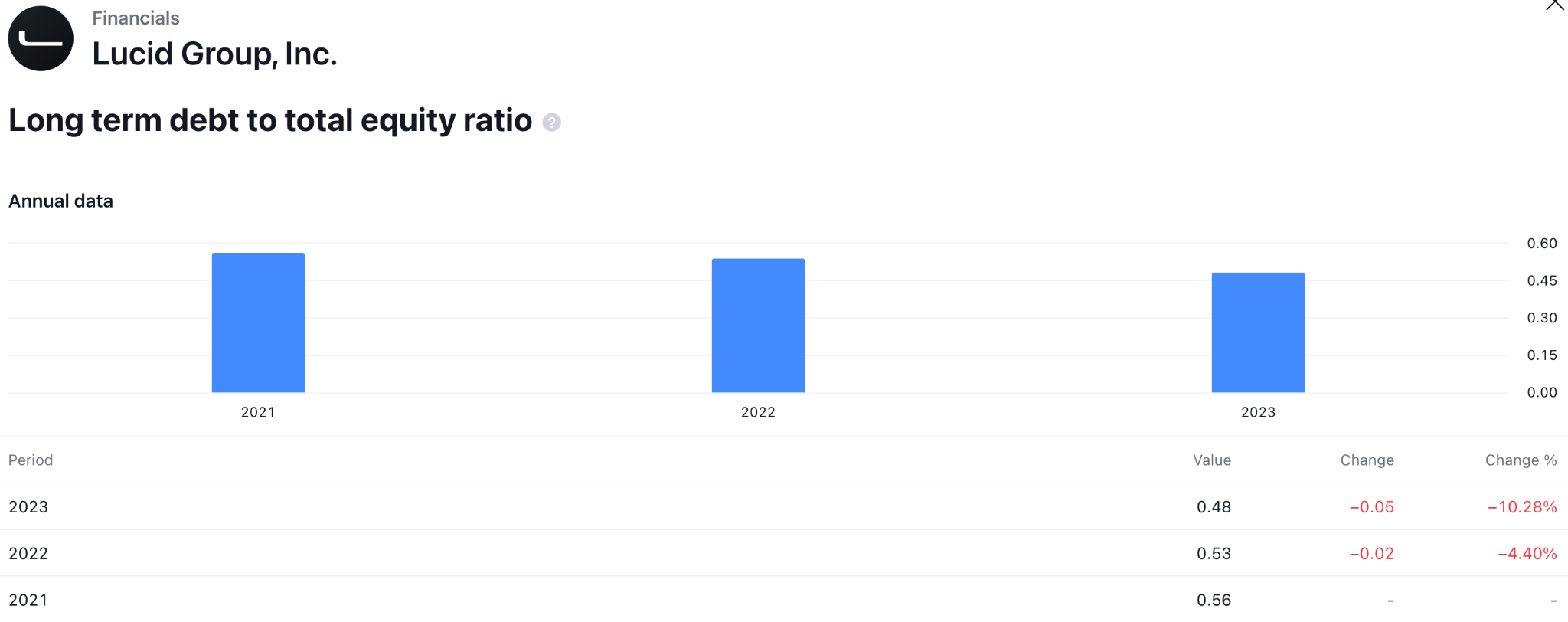

The Risk Of Insolvency

The long-term debt to an asset determines the leverage of a company, which indicates insolvency. As per the current reading, the ratio marked at 0.45 in 2023, which is within the satisfactory level. However, any surge in the number could signal a risk for the company.

Lucid Stock Prediction 2030 and Beyond - Bullish Factors

- Lucid is a technological champion in electric vehicles. The company's continued development of novel technologies could provide it with a competitive advantage, leading to a higher stock price.

- Establishing strategic alliances with other firms operating within the automotive sector may facilitate Lucid's business expansion and bolster its stock valuation.

- As Lucid increases production capacity and vehicle deliveries, the company's revenue and profitability are anticipated to rise, which may increase the stock price.

- An expansion of Lucid into untapped markets, such as Europe or China, has the potential to substantially augment the company's revenue and stock value.

- For instance, introducing an SUV or a more affordable vehicle as part of Lucid's product line expansion beyond the Air sedan could potentially attract new customers and increase the stock price.

Lucid Stock Price Prediction 2030 and Beyond - Bearish Factors

- Ruling manufacturers such as Ford and General Motors are making substantial investments in electric vehicles as the market for such vehicles becomes more competitive. This could impact Lucid's market share and stock price.

- Obstacles to upscaling production or ensuring quality control may result in setbacks, product recalls, and reputational harm for Lucid, which could negatively affect the stock price.

- Alternative companies that produce battery technology that is more cost-effective or efficient may gain a competitive advantage over Lucid.

V. Conclusion

A. Lucid Stock Outlook: Lucid stock buy or sell?

Lucid stock price is at an all-time low. The company is grappling with production issues and fierce competition. Analysts offer a mixed bag of predictions, with some expecting a moderate increase and others a significant rise by 2030.

Several factors will influence the Lucid Motors stock prediction:

- Lucid stock price prediction 2024: Overcoming production hurdles, achieving positive earnings reports, and capitalizing on the Saudi PIF investment will be crucial for the 2024 price.

- LCID stock forecast 2025: Potential revenue growth, the expanding EV market, and successfully navigating competition are key factors for the 2025 price.

- Lucid stock forecast 2030 and beyond: Lucid's long-term success hinges on technological advancements, strategic partnerships, potential market expansion, and achieving profitability.

Investing in CFDs on LCID is risky due to the company's high volatility and uncertainty. Consider waiting for clearer signs of profitability before making such an investment.

B. Trade LCID Stock CFD with VSTAR

If you're considering trading LCID stock CFDs (Contracts for Difference), VSTAR offers some features that might be appealing:

- Potential for High Returns: The EV market is booming, and if LCID overcomes its production challenges, the stock price could soar. CFD trading allows you to magnify your potential returns but also magnifies your potential losses.

- Copy Trading: VSTAR boasts a copy trading feature. This allows you to automatically copy the trades of experienced investors, potentially helping you profit from their strategies, especially if you're new to CFD trading. Keep in mind past performance is not necessarily indicative of future results.

- Regulatory environment: VSTAR is a multiple-regulated broker where the fund's security is a primary object.

- Portability: Opportunity to trade from the mobile app, allowing investors to buy and sell a trading instrument from any time, anywhere.

In conclusion, Lucid stock price faces a bumpy near future. However, the company has long-term potential if it can overcome its current challenges and capitalize on its strengths in the growing EV market.

FAQs

1. Is Lucid expected to go up?

Lucid Group Inc (LCID) has a consensus rating of Hold with a current average price target of $3.03, which is slightly higher than its last closing price of $2.75.

2. What will Lucid stock price be in 2025?

Lucid stock predictions in 2025 vary, with estimates ranging from as low as $0.09 to as high as $12.89.

3. What will Lucid stock be worth in 5 years?

In the next 5 years, Lucid stock price is estimated to potentially cross the $50 mark, depending on the company's success in establishing itself in the luxury EV market.

4. What will Lucid stock be worth in 2030?

By 2030, Lucid stock price may reach the target of around $17.86 and $45.

5. What is the future of Lucid Motors?

Lucid Motors faces challenges with demand and production scale. However, it has plans to expand its product lineup, enter new markets, and has financial support from the Saudi government. The company aims to improve its economy of scale and has enough cash to last into 2025.