I. Introduction

A. Recent Google Stock Performance

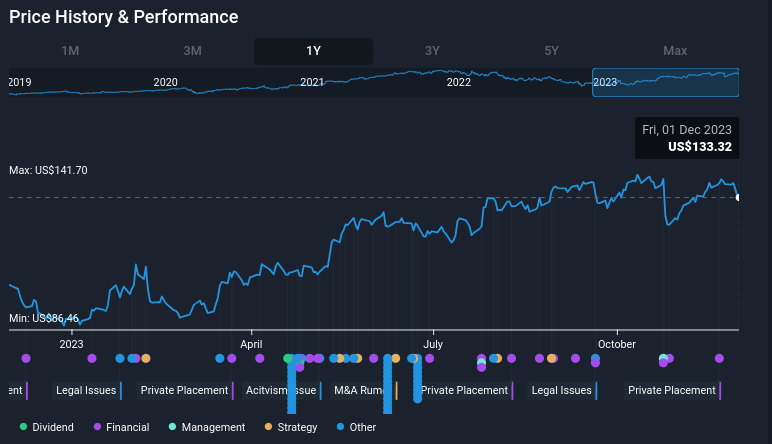

Google's stock performance in recent periods has reflected both positive and negative trends. Presently, Google stock stands at $133.32, within a 52-week range of $85.57 to $142.38. The short-term returns depict a slight decline over a week (-3.55%) but show consistent positive growth over one month (4.51%) and six months (7.20%).

However, year-to-date (YTD) and one-year returns stand notably high at 50.25% and 31.64%, respectively, indicating a strong performance compared to the broader market. Over longer periods of three and five years, Google's stock has seen substantial growth at 48.29% and 143.63%, respectively.

Source: simplywall.st

Several key factors influence Google's stock performance. The company's continued focus on innovation, particularly in AI-driven services like Search Generative Experience (SGE), Bard, and Assistant, has significantly contributed to positive user feedback and adoption rates. Moreover, advancements in ad formats utilizing Generative AI, the exponential growth of YouTube Shorts (with over 70 billion daily views), and the successful monetization of content have been instrumental in revenue generation.

Additionally, Google Cloud's consistent growth in Q3 revenue, amounting to $8.4 billion, showcasing a 22% increase, alongside major partnerships with leading companies, indicates a strong market presence and adoption of AI-optimized infrastructure. Recent hardware launches, including Pixel 8, Pixel 8 Pro, and Pixel Watch 2, have been well-received, indicating potential growth in the hardware segment.

B. Expert Insights on Google Stock Forecast for 2023, 2025, 2030 and Beyond

Looking ahead, experts anticipate optimistic growth trajectories for Google stock across different time frames. For the year 2023, the forecast suggests a target price of $149. This forecast is backed by the continuous advancements in Google's AI, which are improving ad experiences, user interactions, and overall efficiency in advertising. Additionally, Google's focus on the Retail vertical, with AI-driven solutions such as Search and PMax facilitating retailers to drive strong ROI, contributes to this positive Google forecast. The multi-format strategy of YouTube, emphasizing Shorts, connected TV, and subscription offerings, is seen as a significant driver for growth.

Moving further to 2025, the Google stock forecast increases to $202 based on EPS estimates. The Google stock prediction revolves around the continued integration of AI into advertising tools, which is expected to enhance effectiveness and decrease costs for advertisers. Furthermore, the expansion of the user base through improved creation tools, AI-driven content curation, and advanced ad solutions is anticipated to bolster user engagement and ad revenues. The ongoing partnerships and ecosystem development, exemplified by initiatives like Google News Showcase, are seen as vital in increasing user engagement and diversifying revenue streams.

Source: simplywall.st

Looking even further into 2030, the Google stock forecast raises substantially to $381. This bullish projection is underpinned by the maturation and wider application of AI across all Google services, leading to comprehensive and sophisticated user experiences. The anticipated expansion of market reach and dominance across various sectors, leveraging AI for transformative products and services, is expected to be a key driver for long-term growth. Additionally, the stability and diversification of revenue streams from ads, Cloud services, hardware, and emerging ventures are foreseen as contributing factors to sustain this growth.

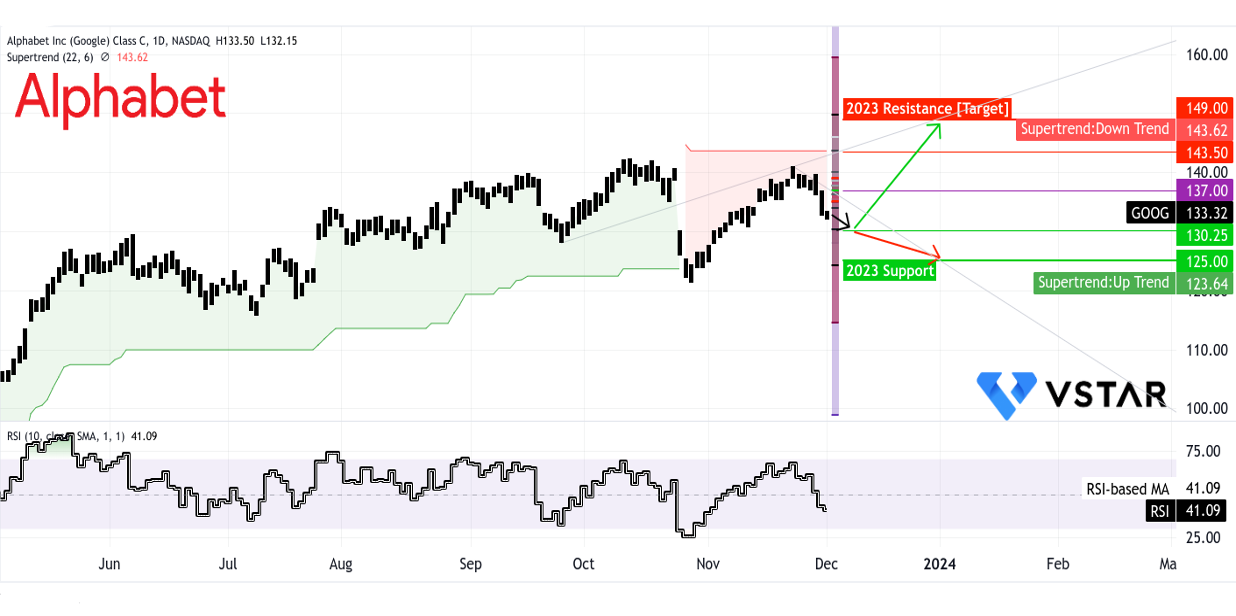

II. Google Stock Forecast 2023

By the end of 2023, the stock price of Google/Alphabet may hit $149, based on the momentum of the current trend. Also, the upside may be supported by the Santa Claus rally at the end of December 2023, following the green path projected through the momentum of November. The Relative Strength Index However, it signifies a downside where the stock price may hit $130.25, followed by $125 by the end of the year, marked by the red path. Also, looking at the supertrend, the price may retest the resistance at $143.50.

Source: tradingview.com

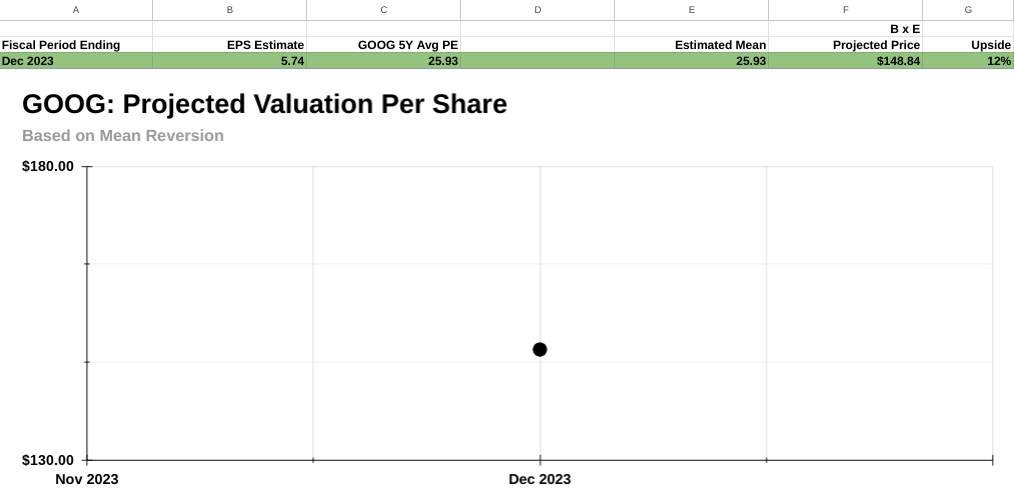

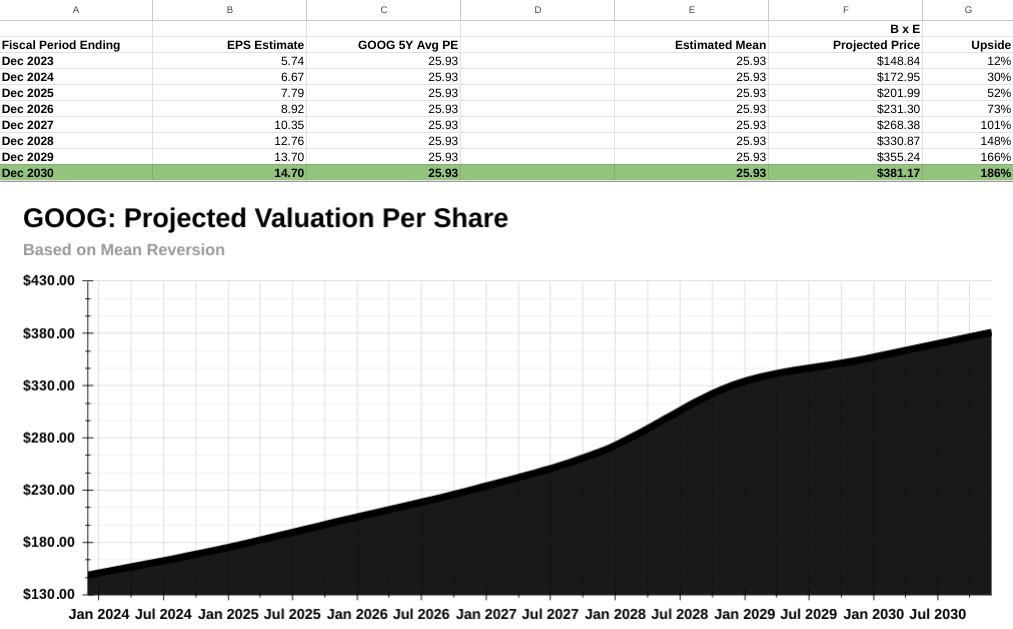

Looking at the price fundamentally, it is expected that the price of Google's stock may revert back to its historical mean of 26 based on mean reversion. In this scenario, the price may hit $149, showing an upside of 12%.

Source: Analyst's compilation

According to diverse sources, Google stock (GOOGL) is expected to show positive growth by the end of 2023, although forecasts differ in their projections. Traders Union suggests a potential rise to $156 USD, indicating a bullish long-term outlook. Conversely, coinpriceforecast.com predicts a year-end price of $142, reflecting a 60% increase from the starting price of $88.73 in 2023. Both forecasts anticipate substantial growth in Google's stock value.

A. Other Google Stock Forecast 2023 Insights

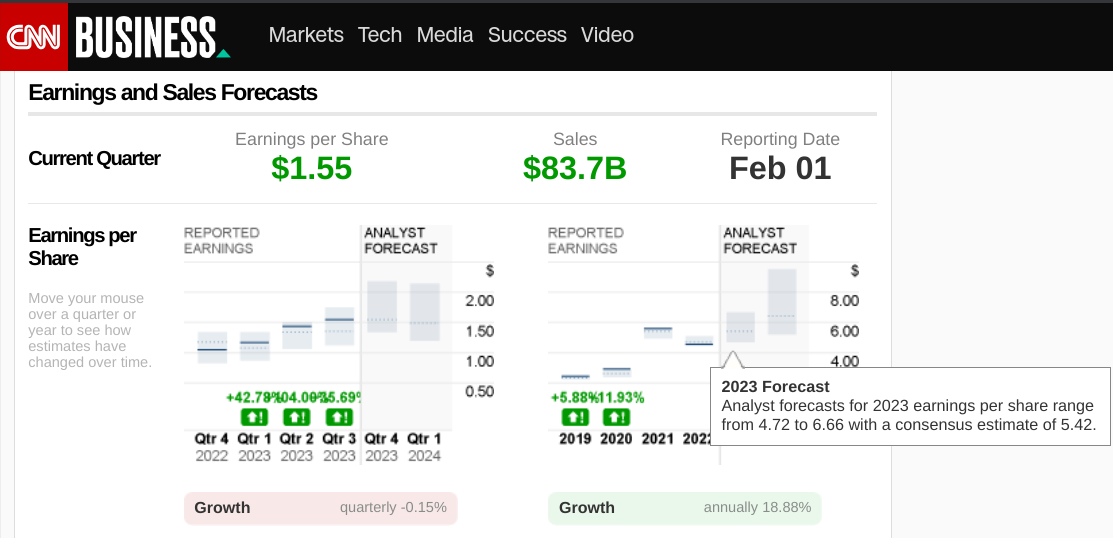

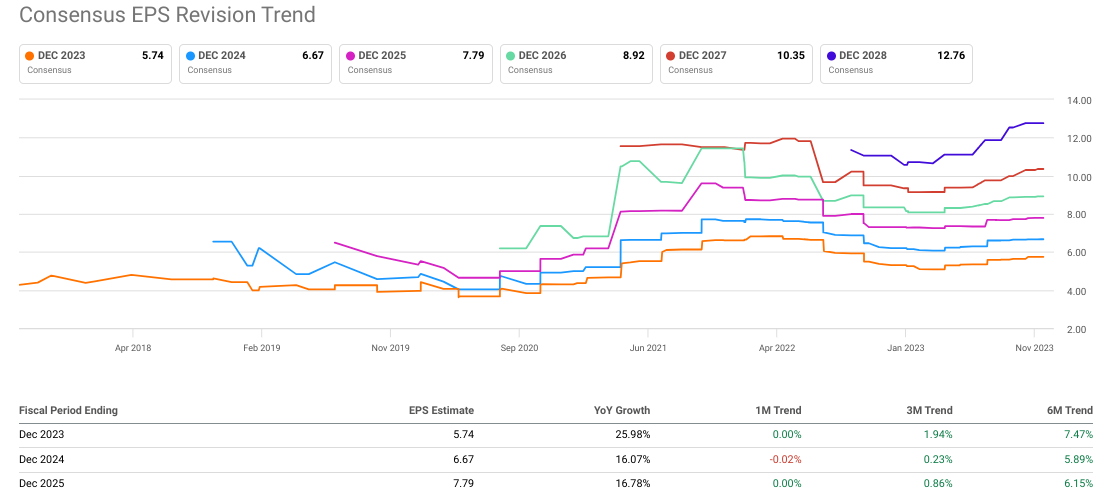

In analyzing Google stock forecast for 2023, two notable sources, the Wall Street Journal (WSJ) and CNN Business, offer insights into the anticipated earnings per share (EPS) and potential price targets. WSJ predicts a higher EPS of 5.74 for the year's end, translating to a more optimistic Google price target of $146.31, with an estimated upside potential of approximately 10% based on the current P/E ratio of 25.49 (Yahoo Finance). Conversely, CNN Business forecasts a slightly lower EPS of 5.42 by the end of 2023, projecting a Google stock target price of $138.16, indicating a 4% upside using the same P/E ratio.

Source: CNNBusiness

B. Key Factors to Watch for Google Stock Price Prediction 2023

GOOG Stock Forecast 2023 - Bullish Factors

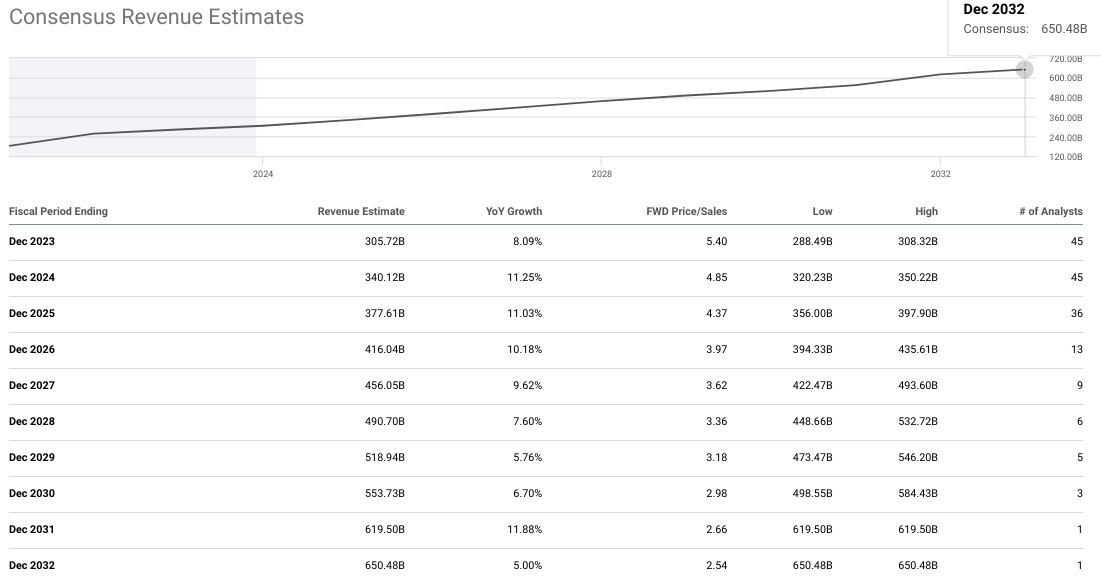

Strong Revenue Growth: The consensus estimates project a positive year-over-year revenue growth for Alphabet in 2023 and 2024. In 2023, an 8.09% YoY revenue growth is anticipated, showcasing continued expansion.

Diversification & Innovation: Alphabet's focus on AI-driven developments across various segments (Search, YouTube, Cloud) is a bullish indicator. Innovations like Generative AI applied to Search and enhancements in productivity tools (Bard, Workspace) indicate a commitment to technological advancements.

Google Cloud Growth: Google Cloud reported significant growth with Q3 revenue of $8.4 billion, up 22%, showcasing a strong uptrend in cloud services adoption among businesses, which could contribute positively to the company's overall revenue.

YouTube Momentum: YouTube continues to exhibit growth in both ads and subscription businesses. Features like YouTube Shorts, with over 70 billion daily views, demonstrate potential for continued user engagement and ad monetization.

Hardware Innovation: Positive consumer feedback on new hardware products like Pixel 8, Pixel 8 Pro, and Pixel Watch 2 could signal growth potential in the hardware segment, especially given the positive reception and adoption rates in the smartphone market.

Expansion in AI Services: Alphabet's emphasis on responsibly building and deploying AI across its offerings is an indicator of its commitment to staying at the forefront of transformative technologies.

GOOGL Stock Forecast 2023 - Bearish Factors

Potential Revenue Variability: While revenue growth is predicted, there might be a concern if the actual revenue falls short of consensus estimates. Factors such as market saturation, economic downturns, or regulatory challenges could impact revenue targets.

Competition & Market Challenges: Intense competition in various sectors like cloud services, advertising, and hardware could hinder Alphabet's growth. Regulatory scrutiny and increasing competition from other tech giants may affect market share and profitability.

Dependency on Ads: Google's reliance on ad revenues, while a major strength, also exposes it to risks associated with changes in ad market dynamics, consumer behavior shifts, or regulatory changes affecting targeted advertising.

Investment & Cost Management: Alphabet's commitment to AI and innovation requires significant investment. If cost management strategies fail to balance investments against profitability, it could impact the company's bottom line.

Regulatory Concerns: Alphabet, like other major tech companies, faces ongoing regulatory scrutiny. Any adverse regulatory changes or legal challenges could impact operations, revenues, or market sentiment.

III. Google Stock Forecast 2025

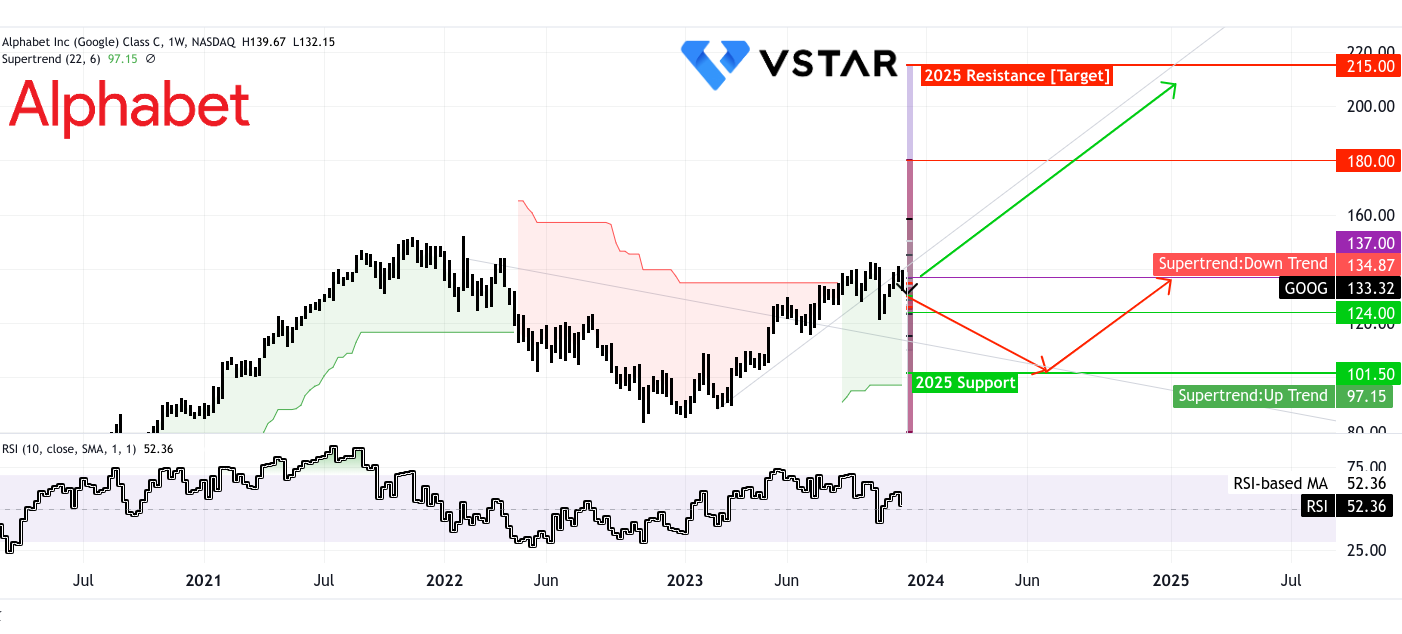

The stock price of Google may hit $215 by early 2025, marked by the green path, which serves as a vital resistance based on the Fibonacci retracement. On the other side, the price may reach $180 due to price corrections based on any potential recessive development (marked by red arrow). In both scenarios, $137 may serve as a major pivot level.

Looking at other indicators, such as the supertrend, the prices are showing a prevalence of bullish momentum. Where RSI signifies a neutral state, breeding the possibility of further upside over the short- to mid-term.

Source: tradingview.com

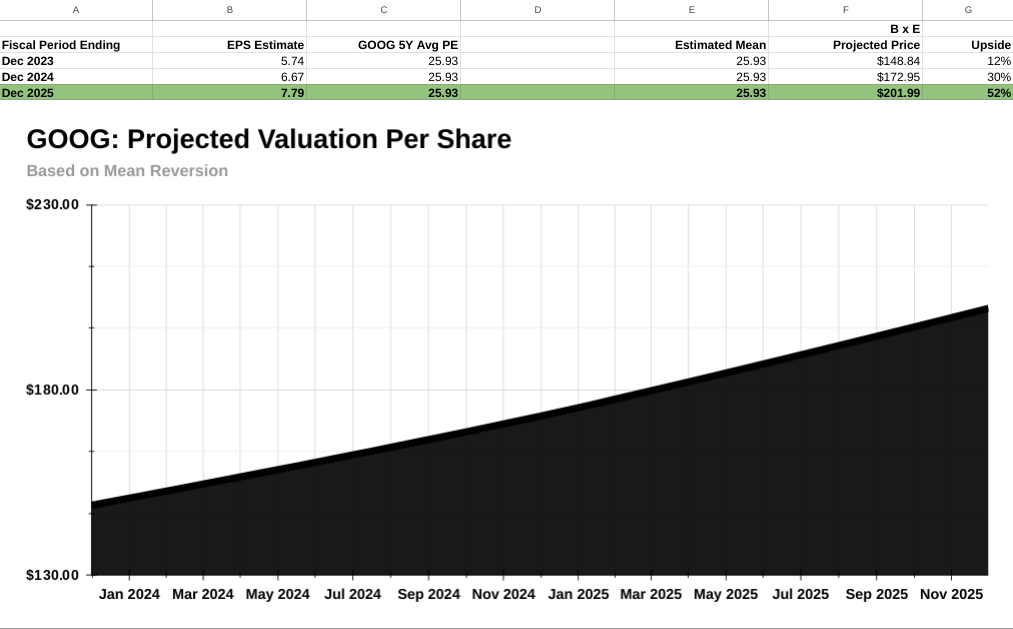

According to the mean-reversion theory, the price may continue to revert back to the long-term historical mean of near 26. The theory suggests a 52% upside with a Google target price of $202 by 2025. The comprehensive take on the theory is based on the assumption or tendency of Google's financial performance to not experience weakness over the mid-term; therefore, all the upside lies in price movement.

Source: Analyst's compilation

Various forecasting platforms offer a range of predictions for Alphabet Inc. (GOOG/GOOGL) stock prices in the coming years. According to CoinPriceForecast.com, the forecast indicates a climb to $147 in the first half of 2024, reaching $166 by the year's end, reflecting a 25% increase from the current price. Over the subsequent five years, predictions suggest a significant rise, potentially reaching $318, marking a 92% increase from the current value. CoinCodex.com forecasts a more conservative growth rate, projecting a stock price of $187.23 by 2025, assuming an average yearly growth rate akin to the last decade, indicating a 43.33% increase.

However, differing significantly, other platforms provide diverse forecasts: WalletInvestor predicts a price of $127.09 USD at the beginning of 2025, Long Forecast estimates $231 USD, while Traders Union suggests a figure around $173.55 USD by the same period.

A. Other Google Stock Forecast 2025 Insights

Analysts and financial institutions offer varying insights and forecasts for Alphabet Inc. (GOOG/GOOGL) stock, reflecting diverse perspectives on the company's future performance heading into 2025.

Piper Sandler's Thomas Champion, RBC Capital's Brad Erickson, and Wedbush's Scott Devitt present bullish sentiments with Buy ratings, forecasting positive upsides ranging from 6.17% to as high as 36.51%.

However, Brian White's downgrade of Google from Strong Buy to Hold and Monness, Crespi, Hardt's omission of specific targets suggest a more reserved stance.

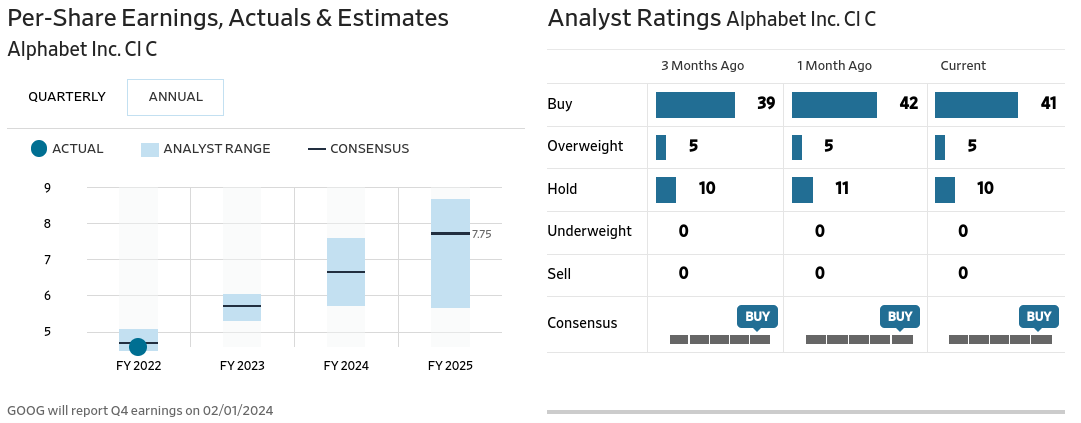

Lastly, the Wall Street Journal (WSJ) offers insights into the anticipated EPS. WSJ predicts a higher EPS of 7.75 for the year's end, leading to a optimistic Google price target of $197.55 in line with technicals, with an estimated upside potential of approximately 48% based on the current PE ratio of 25.49 (Yahoo Finance).

These divergent perspectives underscore the complexity and uncertainty inherent in predicting stock market movements, given the dynamic nature of the market, company performance, and external factors. Google's multifaceted business operations, including its dominance in search, innovative strides in AI and cloud services, and expansion into various sectors, contribute to diverse viewpoints among analysts.

B. Key Factors to Watch for Google Stock Price Prediction 2025

GOOGL Stock Forecast for 2025 - Bullish Long-Term Factors

AI Integration and Innovation: Alphabet's substantial investments in artificial intelligence across its product spectrum (Search, YouTube, Cloud, etc.) could lead to sustained improvements in user experiences, operational efficiencies, and the development of new revenue streams.

Google Cloud Growth: With an expanding customer base, particularly among top companies globally, Google Cloud's consistent revenue growth signals potential for long-term profitability. AI-driven solutions and innovative services could further solidify its position in the cloud computing market.

YouTube Monetization and Expansion: Continued investments in YouTube Shorts, creator tools, and AI-powered advertising solutions indicate Alphabet's commitment to monetizing its vast user base, potentially translating into sustained revenue growth from YouTube.

Diversification Beyond Advertising: Efforts to diversify revenue streams, notably through Google Cloud and hardware products like Pixel phones, could reduce Alphabet's dependency on advertising and contribute to long-term financial stability.

Responsible AI Deployment: Alphabet's emphasis on deploying AI responsibly could earn trust among users, mitigate regulatory risks, and position the company as a leader in ethical and responsible technology development.

GOOG Stock Forecast for 2025 - Bearish Long-Term Considerations

Regulatory Challenges: Ongoing regulatory scrutiny and potential antitrust issues might lead to increased regulatory constraints, affecting Alphabet's business practices, market dominance, and future growth opportunities.

Competition and Innovation Risk: As the technology landscape evolves rapidly, Alphabet faces the risk of competitors introducing disruptive innovations, potentially eroding market share or diminishing its competitive edge.

Economic Volatility and Market Fluctuations: Global economic uncertainties or market fluctuations could impact advertising spending, a primary revenue source for Alphabet, affecting its long-term growth trajectory.

Execution of AI Strategies: While AI integration presents growth opportunities, any missteps or public backlash related to AI-driven products or services could harm Alphabet's reputation and hinder long-term adoption.

Dependency on Advertising: Alphabet's heavy reliance on advertising revenue might pose challenges if market dynamics shift, consumer behavior changes significantly, or new ad-blocking technologies gain traction.

Google Stock Prediction 2025: Long-Term Strategy and Development Prospects

AI-First Approach: Alphabet's commitment to being an AI-driven company reflects a strategic direction toward leveraging AI across its diverse portfolio to enhance user experiences, drive operational efficiencies, and foster innovation.

Diversification Initiatives: Efforts to expand revenue streams beyond advertising, particularly with Google Cloud and hardware products, suggest a strategic focus on diversification to reduce dependency on a single revenue source.

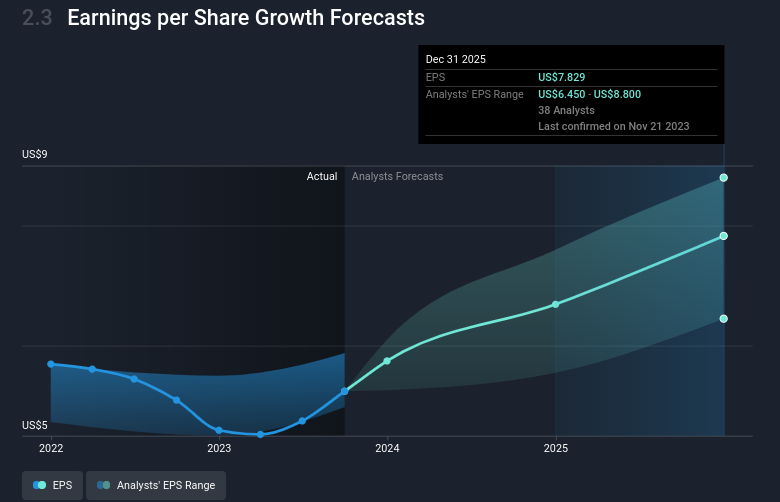

Earnings per Share (EPS):

- Dec 2024: The estimated EPS increases to $6.67, showing a continued positive trend with 16.07% YoY growth.

- Dec 2025: The EPS estimate further rises to $7.79, demonstrating a sustained growth rate of 16.78% YoY.

Analyst Revisions for EPS:

- Up Revisions: There have been 33 upward revisions for EPS estimates over the last three months.

- Down Revisions: 5 downward revisions, suggesting a more optimistic outlook among analysts.

Source: seekingalpha.com

Revenue Estimates:

- Dec 2024: Revenue estimate increases to $340.12 billion, showing a more substantial 11.25% YoY growth.

- Dec 2025: Revenue is forecasted to rise to $377.61 billion, maintaining an 11.03% YoY growth rate.

Analyst Revisions for Revenue:

- Up Revisions: There have been 33 upward revisions for revenue estimates in the past three months.

- Down Revisions: 9 downward revisions, indicating slightly more caution among analysts regarding revenue projections compared to EPS.

Forward P/E Ratio:

- Dec 2024: Forward PE decreases to 19.99, indicating potential growth in relation to the estimated earnings.

- Dec 2025: Forward PE ratio further drops to 17.12, potentially signaling increased investor confidence in future earnings.

Analysis:

- Both EPS and revenue estimates demonstrate consistent growth expectations for Alphabet (Google) over the forecasted period.

- Analysts' revisions showing a higher number of upward revisions indicate increased confidence in the company's future performance.

- The declining forward P/E ratios suggest a favorable perception of future earnings potential in relation to the stock's price.

IV. Google Stock Forecast 2030 and Beyond

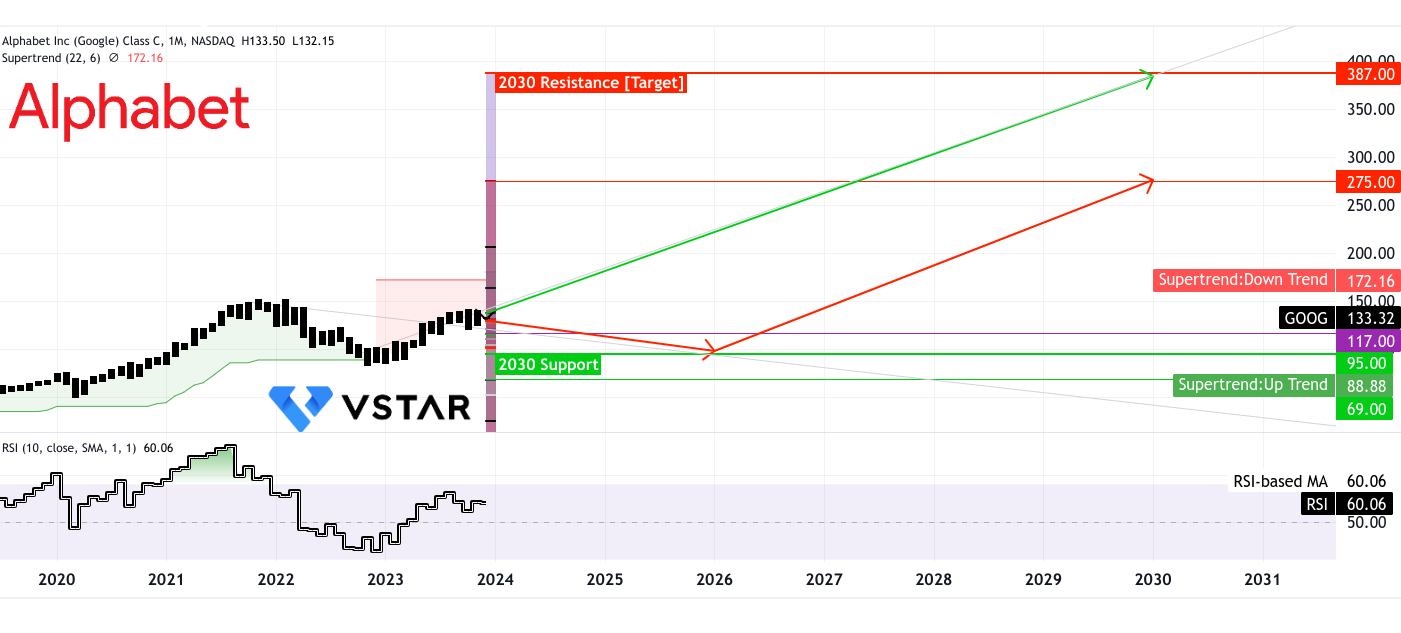

By the end of 2030, Google's stock price may hit $387, based on the current momentum (since 2020), marked by the green arrow. The projection is based on the Fibonacci retracement based on the golden ratio. However, reaching $387 is not just a straight line. The price may experience a change of polarity at $275 and $200 in between.

On the downside, the price may hit $95 in an adverse business environment initiated by the Supertrend and Fibonacci Retracement. However, after hitting the long-term support, the price may still follow the upward trajectory over $175 to hit $275. Looking at RSI, the prices may have massive upside, as the indicator may move over the level of 50 over the long term, which may form a higher high pattern in the price.

Source: tradingview.com

At the mean reversion, the price holds 186% upside by 2030 to hit $381 in line with technicals. The stock has never experienced a significant downside except in 2022; therefore, based on that perspective, the current projection is still conservative. On a positive note, the long-term average P/E's upward shift is also not considered.

Source: Analyst's compilation

Is Google a buy? The price forecasts for Alphabet Inc. (GOOG/GOOGL) in the year 2030 from various sources:

Traders Union's long-term price forecast suggests that Google (GOOGL) could reach $299.75 USD by 2030 and $464.12 USD by 2034, indicating a significant increase in the stock price over this period.

CoinPriceForecast.com: Predicts Google stock price to rise from $318 to $399 by 2030, representing a 25% increase. It is anticipated to start the year at $318, reaching $325 in the first half and ending at $332, approximately a 149% increase from today's price.

CoinCodex.com: Alphabet stock forecast that by 2030 will potentially reach $460.51, maintaining its current 10-year average growth rate. If this Google stock prediction materializes, GOOG stock price would grow by 252.53% from its current value.

WalletInvestor: WalletInvestor analysts predict Google stock to be priced at $102.180 USD at the beginning of 2028. This forecast doesn't specifically mention the price for 2030, focusing instead on the early 2028 price.

Traders Union: These forecasts present a range of potential outcomes, with some predicting substantial growth for Alphabet Inc.'s stock by 2030, while others offer more conservative estimates.

A. Other Google Stock Forecast 2030 and Beyond Insights

The forecast for Alphabet Inc. (GOOG/GOOGL) stock in 2030 reflects a balance of opportunities and challenges the company faces. Positioned as a dominant force in online search and engagement, Google's stronghold in digital ad spending and its Android operating system for smartphones place it favorably to leverage the transition to mobile search from desktop. Moreover, Alphabet's profitable search business supports innovations like Waymo, Mandiant, Bard AI chatbot, and moonshot projects in its X Development division.

However, Alphabet confronts hurdles, notably the ongoing antitrust legal battle with the U.S. Department of Justice, potentially impacting its monopoly in internet search. Additionally, its investments in high-risk ventures may impact overall profitability, while competitors like Microsoft's ChatGPT-powered Bing pose strong challenges in the AI landscape.

The company's strengths include an attractive forward earnings multiple, exposure to burgeoning tech trends like online advertising and cloud computing, and valuable user data from platforms like Gmail, search, and YouTube. Yet, antitrust risks, uncertain ROI from high-risk investments, and the need to maintain leadership in AI technology present significant weaknesses.

Analysts foresee a positive trajectory for Google, with projected EPS growth and revenue expansion. Morningstar and CFRA analysts highlight Google's robust core businesses, especially in search and cloud, anticipating accelerated revenue growth, bolstered by increasing demand for AI tools and features. They maintain a positive outlook on the stock, with buy ratings and price targets indicating upside potential. However, they advise conducting thorough research before investment decisions.

Looking ahead, AI technology remains pivotal for Google's future. Analysts anticipate continued AI investment, expecting revenue growth in the 6% to 11% range through 2025. Maintaining a leading position in AI is critical, as it could impact Google's search dominance. Merrill Lynch analysts recognize Alphabet's strength in search technology, Android, and YouTube, foreseeing the company trading at a premium due to its tech leadership, high margins, and robust cash flow for buybacks.

B. Key Factors to Watch for Google Stock Price Prediction 2030 and Beyond

GOOG Stock Forecast 2030 - Bullish Factors

- AI Development & Adoption: Alphabet's deep investment in AI technology, such as SGE and Bard, is expected to positively impact user engagement and ad performance. AI's integration into Search and other services could unlock higher utility, engagement, and conversion rates, potentially enhancing user experiences and ad effectiveness.

- Revenue Growth Trajectory: Consensus EPS and revenue estimates forecast steady growth through 2030. This signifies confidence in Alphabet's ability to expand its top and bottom lines, particularly as revenue estimates display a consistent upward trajectory, suggesting a positive future performance.

Source: seekingalpha.com

- AI for Ads: Tools like Performance Max (PMax) and Gen AI are delivering strong ROI, enhancing advertiser experiences, and promising an uplift in conversions, showcasing the potential for increased returns and efficiency in ad spend.

- YouTube Growth: YouTube continues to show resilience and strength in ad revenues, with indications of stabilization post-brand advertising headwinds. Features like NFL Sunday Ticket are well-received, hinting at opportunities for YouTube's subscription strategy and viewer engagement.

GOOGL Stock Forecast 2030 - Bearish Factors

- Antitrust & Regulatory Risks: Alphabet faces ongoing antitrust challenges, posing potential uncertainties in its operational landscape. Regulatory actions against Big Tech could impact future strategies and market dominance.

- High-Risk Investments: Alphabet's commitment to high-risk, high-reward ventures may lead to increased capital expenditure and weigh on short-term profitability, potentially impacting margins and overall financial performance.

- Competition in AI Landscape: Competitors with significant AI capabilities, like Microsoft, pose a threat. Falling behind in AI innovation might challenge Alphabet's position in the internet search market and other tech domains.

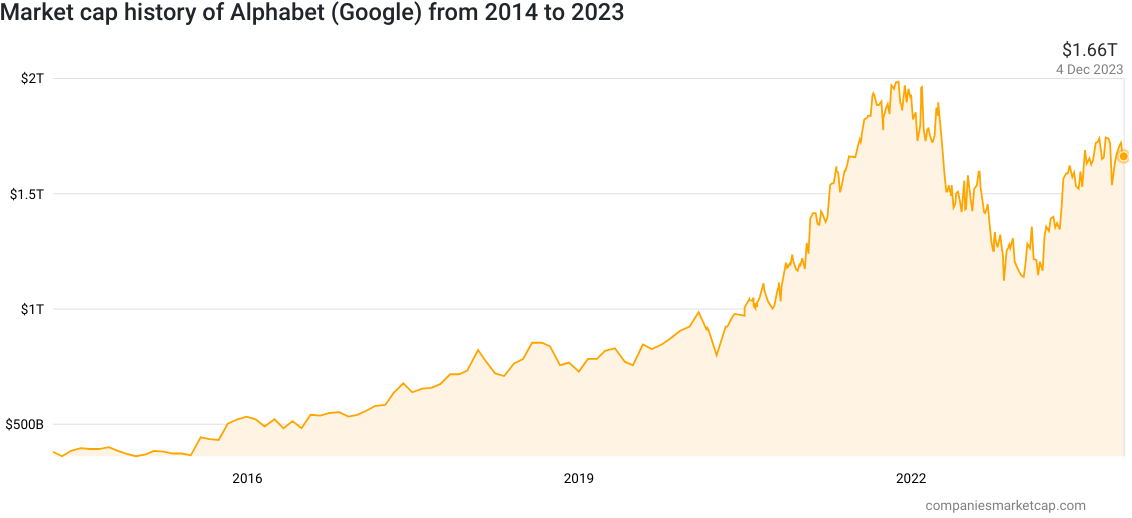

V. Google Stock Price History Performance

Google Stock Price History

- 2014:

- Market Cap: Approximately $359.50 billion

- Growth Factors:

- Innovations: Google continued innovating its search algorithms and expanding its services, consolidating its dominance in online search and advertising.

- Expansion: Strategic acquisitions and ventures like Nest Labs and robotics companies laid the groundwork for diversification beyond its core business.

- 2015:

- Market Cap: Around $528.16 billion

- Growth Factors:

- Revenue Streams: Increased revenue from advertising, especially mobile ads, as Google refined its advertising platforms and expanded into new markets.

- Cloud and Services: Growth in Google's cloud services and the introduction of new products like Pixel phones showcased the company's diversification efforts.

- 2016:

- Market Cap: $539.06 billion

- Growth Factors:

- Continued Innovation: Enhanced focus on AI and machine learning applications across various services, contributing to improved user experiences.

- Strategic Investments: Acquisitions like Apigee and ongoing advancements in autonomous driving (Waymo) signaled Google's commitment to tech innovation.

- 2017:

- Market Cap: $729.45 billion

- Growth Factors:

- AI Advancements: Continued investments and breakthroughs in AI, including improvements in voice search and machine learning applications, bolstered investor confidence.

- YouTube Growth: Substantial growth in YouTube viewership and ad revenues contributed significantly to Google's overall valuation.

Source: companiesmarketcap.com

- 2018:

- Market Cap: $723.55 billion

- Growth Factors:

- Ad Revenue: Despite stable market cap, Google's ad revenue remained a driving force, maintaining its position as a top advertising platform globally.

- Diversification Efforts: Ongoing expansions into hardware and cloud services aimed at diversifying revenue streams for sustainable growth.

- 2019:

- Market Cap: $921.13 billion

- Growth Factors:

- Cloud Services: Strengthened presence in the cloud market, winning major clients and demonstrating growth potential in a competitive landscape.

- AI Integration: Further integration of AI into various products and services, improving user engagement and efficiency.

- 2020:

- Market Cap: $1.185 trillion

- Growth Factors:

- Pandemic Response: Despite global economic challenges, increased reliance on digital services, including Google's, drove up usage and revenues.

- Cloud Adoption: Continued growth in Google Cloud adoption by businesses seeking digital transformation and AI-driven solutions.

- 2021:

- Market Cap: $1.917 trillion

- Growth Factors:

- Ad Dominance: Continued dominance in the online advertising space amid digital transformation across industries.

- AI and Innovation: Advancements in AI, hardware innovations (Pixel devices), and expansion into emerging tech markets.

- 2022:

- Market Cap: $1.145 trillion, experienced a massive price dip of over 40%.

- Factors Impacting Decline:

- Market Volatility: Global economic uncertainties and market corrections impacted tech stocks, including Google, leading to a decline in market cap.

Source: companiesmarketcap.com

- 2023:

- Market Cap: $1.658 trillion

- Factors Contributing to Rebound:

- Market Recovery: A resurgence in investor confidence, driven by strong financial performances, continued innovation, and strategic developments.

- Cloud and AI Growth: Persistent growth in Google Cloud adoption and advancements in AI applications contributing to positive investor sentiment.

Google Stock Price Performance Analysis

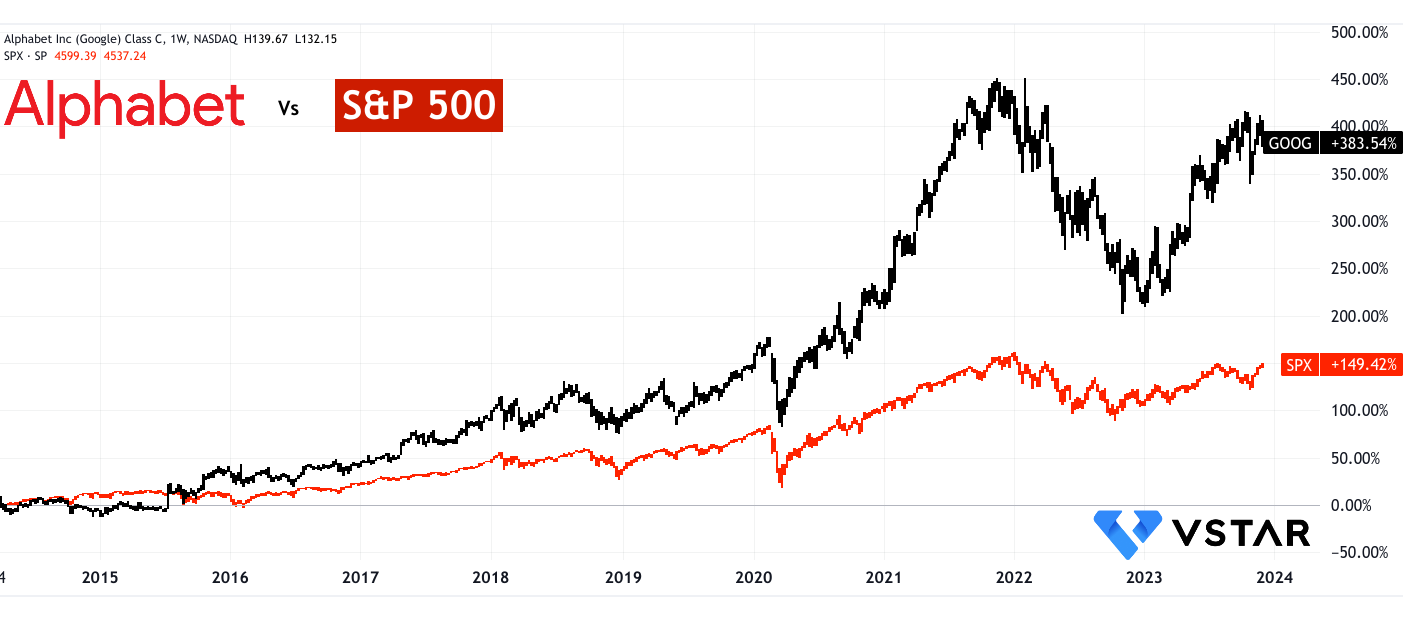

Over various timeframes, Google stock demonstrated varying levels of returns compared to the S&P 500 index:

- Weekly: Google stock experienced a slight decline (-3.55% over 1 week) compared to the S&P 500 (0.77% over 1 week).

- Monthly: Over the 1-month and 6-month periods, Google stock showcased moderate positive returns (4.51% and 7.20%, respectively) outperforming the S&P 500 (8.42% and 8.85%).

- Year-to-date and Yearly: On a YTD and 1-year basis, Google stock significantly outperformed the S&P 500 with returns of 50.25% and 31.64% compared to 19.67% and 12.71%, respectively.

Extended Periods: Over 3, 5, and 10 years, Google consistently outpaced the S&P 500, delivering impressive returns of 48.29%, 143.63%, and near 385% against the S&P 500's 25.45%, 66.46%, and near 150%, respectively. Google's consistent long-term outperformance against the S&P 500 indicates its sustained growth trajectory and strong market position over extended periods.

Source: tradingview.com

VI. Conclusion

Will Google stock go up? Google's stock forecasts indicate potential growth opportunities in the coming years, backed by technological innovations and diversification efforts.

Google Stock Price Prediction

Google Stock Forecast for 2023

- Forecasted range: $148-$149 by the end of 2023.

- Analysts from WSJ predict a higher EPS and Google stock price target, while CNN Business offers a slightly lower EPS projection, leading to different price targets.

- The bullish factors for 2023 include strong revenue growth, diversification, innovation in AI-driven developments, Google Cloud growth, YouTube momentum, and hardware innovation.

GOOGL Stock Forecast for 2025

- Predictions range from $202 to $215 by early 2025, with different platforms offering varying forecasts.

- Bullish factors for 2025 encompass continued AI integration and innovation, Google Cloud growth, YouTube monetization, and diversification beyond advertising.

GOOG Stock Forecast for 2030

- Forecasts range from $381 to $387 by 2030, with differing estimates across multiple sources.

- Factors influencing 2030 Google stock predictions include sustained AI development, revenue growth trajectory, AI for ads, YouTube growth, regulatory risks, high-risk investments, and competition in the AI landscape.

Google Stock Outlook & Investment Recommendations: Is Google a good stock to buy?

Google's stock outlook remains positive, supported by continued innovations in AI, strong revenue growth, diversification efforts, Google Cloud expansion, and YouTube's promising monetization strategies.

Should I buy Google stock? Consider Google as a potential long-term investment, given its strong market position, continuous innovation in AI and tech, diverse revenue streams, and potential for growth in various sectors. However, investors should conduct thorough research, evaluate risk tolerance, and consider potential regulatory challenges and competition.

How to buy Google stock

Trading Google Stock CFDs with VSTAR

Advantages:

- Leverage: Up to 1:200 leverage depending on the instrument, allowing traders to access larger positions with smaller capital.

- Lower Trading Costs: $0 commission with transparent trading costs can maximize potential profits.

- Global Market Access: Exposure to a wide range of Asia, US, and international stocks.

- Fast Execution: Trades executed at the best market prices within milliseconds.

Risks: CFD trading involves leverage, which magnifies both potential profits and losses. Traders should carefully manage risk and be aware of the market volatility.

FAQs

1. Is Google stock a buy or a hold?

Most analysts rate Google stock as a buy or strong buy, citing its leadership in digital advertising, cloud computing, AI, and more.

2. What is the fair price of Google stock?

Based on analyst price targets, the fair value price for Google stock is around $150.

3. How high will Google stock go?

Some optimistic forecasts see Google stock potentially reaching $200 per share or more in the coming years.

4. What will Google stock be worth in 2025?

Wall Street analysts estimate Google's stock price could reach around $170 per share by 2025.

5. What will Google stock be worth in 2030?

At its current growth rates, Google could be worth $250-300 per share or more by the end of the decade.