I. Introduction

Definition of Gas CFD Trading

Gas CFD trading refers to the practice of trading gas contracts for difference (CFDs) on financial markets. CFDs are derivative instruments that allow traders to speculate on the price movements of various assets without owning the underlying asset itself. In the case of gas CFD trading, traders are speculating on the price fluctuations of gas without actually purchasing or taking physical delivery of the commodity.

The Importance of understanding trading costs in Gas CFD trading

Understanding trading costs is crucial in gas CFD trading for several reasons. Firstly, trading costs directly impact the profitability of trades. These costs include spreads, commissions, overnight fees, and other charges imposed by brokers. Spreads refer to the difference between the buying and selling prices of a gas CFD. Brokers often charge a spread on each trade, and tighter spreads can result in lower trading costs. Commissions are fees charged by brokers for facilitating trades, and traders need to consider these costs when calculating their potential profits.

Secondly, trading costs affect the overall risk-reward profile of gas CFD trading strategies. High trading costs can erode potential profits and make it more challenging to achieve consistent returns. Traders must factor in these costs when developing and executing their trading strategies to ensure they align with their risk tolerance and financial goals.

Furthermore, understanding trading costs helps traders compare and choose the most suitable brokers or trading platforms. Different brokers may offer varying fee structures, spreads, and commissions. By considering the trading costs, traders can assess which broker provides the most favorable conditions for gas CFD trading.

Moreover, trading costs can impact the frequency and duration of trades. Higher costs may discourage traders from engaging in short-term or frequent trading strategies, as the expenses can eat into potential gains. Conversely, lower trading costs may incentivize more active trading approaches.

II. Spread Costs

Definition of spread

Spread is a fundamental concept in Gas CFD trading that refers to the difference between the buying and selling prices of a gas CFD. It represents the cost that traders pay to enter or exit a trade. Spread costs are a critical component of trading expenses, and understanding how they are calculated and managed is essential for successful Gas CFD trading.

How spread costs are calculated in Gas CFD trading

Spread costs in Gas CFD trading are typically calculated by multiplying the spread value by the size of the trading position. For example, if the spread on a gas CFD is $0.02 and the trader wants to enter a position with a size of 1,000 CFDs, the spread cost would be $20 (0.02 x 1000).

Factors that affect spread costs

Several factors can influence spread costs in Gas CFD trading. Firstly, market liquidity plays a significant role. Gas CFD markets with high liquidity tend to have narrower spreads because there are a larger number of buyers and sellers, making it easier for traders to enter and exit positions at competitive prices. On the other hand, markets with lower liquidity may have wider spreads as there are fewer participants willing to buy or sell at a specific price.

Source: wp.com

Volatility is another factor affecting spread costs. During periods of high volatility, such as significant news releases or market events, spreads tend to widen. This is because increased price fluctuations and uncertainty make it riskier for market makers and brokers to provide narrow spreads. As a result, traders may face higher spread costs when trading gas CFDs during volatile market conditions.

Furthermore, the type of trading account and the broker used can impact spread costs. Some brokers offer fixed spreads, which means the spread remains constant regardless of market conditions. Fixed spreads can provide transparency and predictability, allowing traders to calculate their costs accurately. However, fixed spreads may be wider than variable spreads during times of high market liquidity. On the other hand, brokers offering variable spreads may provide narrower spreads during normal market conditions but widen them during volatile periods.

Strategies for minimizing spread costs

To minimize spread costs in Gas CFD trading, traders can employ various strategies. Firstly, choosing a reputable broker with competitive spreads is crucial. Comparing the spread offerings of different brokers and selecting the one that provides the tightest spreads, especially during active trading hours, can help reduce trading costs.

Moreover, timing the trades is important. Gas CFD traders should aim to enter positions when market volatility is lower and liquidity is higher. During these periods, spreads are generally tighter, resulting in lower trading costs. Traders should also consider avoiding major economic announcements or events that can cause significant market volatility and widen spreads.

Additionally, employing scalping or day trading strategies can help minimize spread costs. These strategies involve entering and exiting positions quickly, taking advantage of small price movements. By keeping the holding period short, traders can reduce exposure to wider spreads that may occur over longer periods.

Lastly, traders can also consider using limit orders instead of market orders. Limit orders allow traders to specify the maximum price they are willing to pay or the minimum price they are willing to receive for a gas CFD. By using limit orders, traders can potentially execute trades at better prices, reducing spread costs.

III. Commissions

Definition of commission

Commissions are a significant aspect of trading costs in Gas CFD trading. They refer to the fees charged by brokers for facilitating trades. Understanding how commission costs are calculated and considering strategies to minimize these costs are essential for traders aiming to optimize their profitability.

How commission costs are calculated in Gas CFD trading

Commissions in Gas CFD trading are typically calculated based on the size of the trading position. Brokers may charge a fixed commission per lot or a percentage-based commission on the traded volume. For example, a broker might charge $10 per lot, or 0.1% of the trading volume, as a commission. If a trader executes a trade with a position size of 10 lots, the commission cost would be $100 (10 lots x $10 per lot).

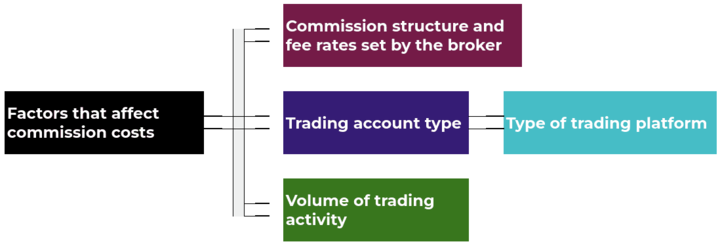

Factors that affect commission costs

Several factors can affect commission costs in Gas CFD trading. The commission structure and fee rates set by the broker are the primary determinants. Different brokers may have varying commission structures, and traders should carefully compare and select brokers that offer competitive commission rates.

The trading account type may also impact commission costs. Some brokers offer different account types, such as standard accounts or premium accounts, with varying commission structures. Premium accounts often require higher minimum deposits but offer lower commission rates, making them more cost-effective for traders with larger trading volumes.

Additionally, the volume of trading activity can affect commission costs. Brokers often offer volume-based commission tiers, where traders who trade higher volumes can benefit from lower commission rates. As trading volume increases, traders may qualify for reduced commission rates, leading to lower overall commission costs.

Furthermore, the type of trading platform used can influence commission costs. Some brokers charge higher commissions for accessing advanced trading platforms that offer additional features and functionality. Traders should assess whether the benefits provided by these platforms justify the higher commission costs.

Strategies for minimizing commission costs

To minimize commission costs in Gas CFD trading, traders can consider several strategies. Firstly, as mentioned earlier, comparing commission rates among different brokers is crucial. Traders should select brokers that offer competitive commission structures, considering factors such as account types, volume-based discounts, and the overall trading costs associated with the broker.

Consolidating trades can also help reduce commission costs. Instead of executing multiple small trades, traders can combine them into larger trades, thereby reducing the number of commissions paid. However, this approach should be balanced with the need to manage risk and take advantage of market opportunities.

Another strategy is to negotiate commission rates with the broker. Especially for high-volume traders, brokers may be willing to offer lower commission rates or provide customized commission structures to attract and retain their business. It is worth exploring such possibilities and engaging in negotiations with brokers to potentially secure more favorable commission terms.

Additionally, traders can consider using commission-free trading accounts or promotional offers provided by certain brokers. Some brokers may waive commissions for specific trading instruments, specific time periods, or as part of promotional campaigns. Taking advantage of such offers can significantly reduce commission costs.

Lastly, traders should ensure that commission costs are weighed against other factors such as spreads, platform functionality, customer support, and overall trading conditions. A broker with slightly higher commission rates but offering tight spreads or superior trading tools may still be more cost-effective in the long run.

IV. Overnight Financing Costs

Definition of overnight financing costs

Overnight financing costs are an important consideration in Gas CFD trading. They refer to the charges or fees incurred for holding positions open overnight. Understanding how overnight financing costs are calculated and implementing strategies to minimize these costs are crucial for traders aiming to optimize their trading performance.

How overnight financing costs are calculated in Gas CFD trading

In Gas CFD trading, overnight financing costs are calculated based on the size of the trading position, the applicable interest rate, and the duration for which the position is held overnight. The interest rate used is typically derived from interbank lending rates and may be adjusted by the broker to incorporate their own charges.

Factors that affect overnight financing costs

Factors that can influence overnight financing costs in Gas CFD trading include the prevailing interest rates, the broker's adjustment or mark-up on the interest rate, and the size and duration of the position. Higher prevailing interest rates or significant adjustments by the broker can result in higher overnight financing costs. Larger positions or longer holding periods also lead to increased financing costs.

Furthermore, the type of trading account and the broker used can impact overnight financing costs. Some brokers may offer different account types with varying financing rates. Premium accounts may have lower financing rates, making them more cost-effective for traders holding positions overnight. It is important for traders to compare the financing rates offered by different brokers to select the one that aligns with their trading strategy.

Strategies for minimizing overnight financing costs

To minimize overnight financing costs in Gas CFD trading, traders can consider several strategies. Firstly, closing positions before the end of the trading day can help avoid overnight financing costs altogether. This approach is commonly used by day traders, who aim to exit all positions before the market closes to avoid any additional charges.

Another strategy is to select brokers that offer competitive financing rates. Traders should compare the rates offered by different brokers and choose the one with the most favorable terms. Even a slightly lower financing rate can make a significant difference in the long run, particularly for traders who frequently hold positions overnight.

Moreover, traders can consider utilizing leverage to reduce the size of their positions and consequently decrease overnight financing costs. By using leverage, traders can gain exposure to larger positions with a smaller initial capital requirement. However, it is essential to exercise caution and manage the risks associated with leverage effectively.

Additionally, traders can explore hedging strategies to potentially offset or reduce overnight financing costs. Hedging involves opening a second position that acts as a counterbalance to an existing position. By carefully managing the size and direction of the hedging position, traders can potentially mitigate some of the financing costs associated with holding positions overnight.

Furthermore, adjusting trading strategies to focus on shorter-term trades can help minimize overnight financing costs. By aiming for quick entry and exit points, traders can avoid the need to hold positions overnight, thereby eliminating or reducing financing charges.

Lastly, staying informed about changes in interest rates and market conditions can be beneficial. By keeping track of economic news and events that can impact interest rates, traders can anticipate potential changes in financing costs. This knowledge can help traders make informed decisions about when to enter or exit positions to minimize financing charges.

V. Other Fees and Charges

In addition to spread costs, commissions, and overnight financing costs, there are several other fees and charges that traders may encounter in Gas CFD trading. Understanding these fees, how they are calculated, and implementing strategies to minimize them are essential for traders to effectively manage their trading costs and optimize their profitability.

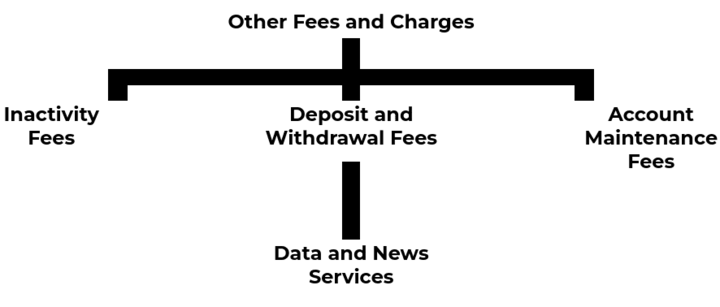

Examples of other fees and charges associated with Gas CFD trading

● Inactivity Fees: Some brokers may impose inactivity fees if a trader does not engage in trading activities over a certain period of time. These fees are typically charged to maintain an active account and vary among brokers. Traders should be aware of the specific inactivity fee policies of their chosen broker and take the necessary actions to avoid or minimize such charges.

● Deposit and Withdrawal Fees: Brokers may impose fees for depositing or withdrawing funds from the trading account. These fees can vary depending on the payment method used, such as bank transfers, credit cards, or e-wallets. Traders should consider the applicable fees when selecting the most cost-effective payment method.

● Account Maintenance Fees: Some brokers charge account maintenance fees to cover administrative costs associated with managing and servicing trading accounts. These fees are typically charged on a periodic basis, such as monthly or quarterly. Traders should review the account maintenance fee policies of their broker and assess the impact of these charges on their overall trading costs.

● Data and News Services: Access to real-time market data, news feeds, and research tools may come with additional fees. These services can be valuable for informed trading decisions, but traders should carefully evaluate the necessity and cost-effectiveness of such services in relation to their trading strategy and budget.

How these fees and charges are calculated

The calculation of these fees and charges varies depending on the broker and the specific terms and conditions. Traders should refer to the broker's fee schedule or consult their customer support to understand the calculation methods for each fee or charge.

Strategies for minimizing other fees and charges

To minimize other fees and charges in Gas CFD trading, traders can consider the following strategies:

● Selecting a reputable and transparent broker is crucial. Traders should thoroughly research and compare the fee structures of different brokers. Choosing brokers with competitive fee offerings and clear fee schedules can help minimize unexpected or excessive charges.

● Maintaining an active trading account can help avoid inactivity fees. Traders should regularly review their trading strategy and engage in trading activities to demonstrate activity in their accounts.

● Carefully assessing the deposit and withdrawal fee policies of brokers and selecting cost-effective payment methods can reduce associated charges. Traders should consider the processing time, fees, and convenience of each payment method when choosing how to fund and withdraw from their trading accounts.

● Evaluating the necessity and cost-effectiveness of additional services, such as data and news feeds, is important. Traders should assess whether the benefits gained from these services justify the additional fees incurred.

● Regularly reviewing the fee structures of brokers and staying informed about any changes in their fee policies is essential. Broker fee structures can change over time, and traders should be proactive in evaluating the ongoing competitiveness of the fees and charges associated with their chosen broker.

It is crucial for traders to consider these other fees and charges in conjunction with spread costs, commissions, and overnight financing costs to accurately assess the overall trading costs and their impact on their profitability. By effectively managing and minimizing these fees and charges, traders can optimize their trading performance and achieve better results in Gas CFD trading.

VI. Total Trading Costs

How to calculate total trading costs in Gas CFD trading

Total trading costs encompass all the expenses associated with Gas CFD trading, including spread costs, commissions, overnight financing costs, and other fees and charges. Calculating and managing total trading costs is crucial for traders to accurately assess the profitability of their trades and optimize their overall trading performance.

To calculate the total trading costs in Gas CFD trading, traders need to consider the following components:

● Spread Costs: Spread costs are calculated by multiplying the spread value by the size of the trading position. For example, if the spread on a gas CFD is $0.02 and the trader wants to enter a position with a size of 1,000 CFDs, the spread cost would be $20 (0.02 x 1000).

● Commissions: Commissions are charged by brokers for facilitating trades. The calculation of commission costs depends on the broker's fee structure, such as fixed commissions per lot or percentage-based commissions on the traded volume. For example, if a broker charges $10 per lot and a trader executes a trade with a position size of 10 lots, the commission cost would be $100 (10 lots x $10 per lot).

● Overnight Financing Costs: Overnight financing costs are calculated based on the size of the trading position, the applicable interest rate, and the duration for which the position is held overnight. The interest rate is typically derived from interbank lending rates, with adjustments made by the broker. Traders can calculate the overnight financing costs by multiplying the position size by the interest rate and the duration held.

● Other Fees and Charges: Other fees and charges, such as inactivity fees, deposit and withdrawal fees, account maintenance fees, and fees for data and news services, are specific to the broker and the services utilized. These fees and charges are typically outlined in the broker's fee schedule, and traders should refer to the relevant information to calculate the associated costs accurately.

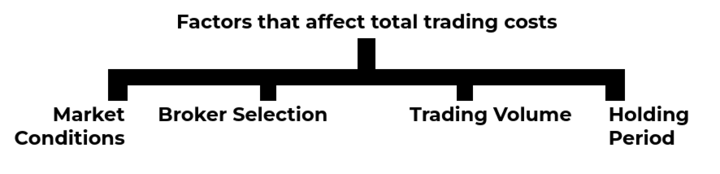

Factors that affect total trading costs

Several factors can influence the total trading costs in Gas CFD trading:

● Market Conditions: Market liquidity and volatility can affect spread costs. Higher liquidity generally leads to tighter spreads, reducing trading costs. Conversely, high volatility can result in wider spreads, increasing trading costs. Traders should consider market conditions when evaluating their total trading costs.

● Broker Selection: Different brokers offer varying fee structures, spreads, commissions, and financing rates. Traders should compare brokers and choose the one that provides competitive rates and terms that align with their trading strategy and budget.

● Trading Volume: The size of the trading position affects spread costs, commissions, and financing costs. Higher trading volumes can result in higher costs. Traders should consider their position sizes carefully to manage trading costs effectively.

● Holding Period: Overnight financing costs are directly influenced by the duration of holding positions overnight. Traders should evaluate the necessity of holding positions overnight and consider shorter holding periods to minimize financing costs.

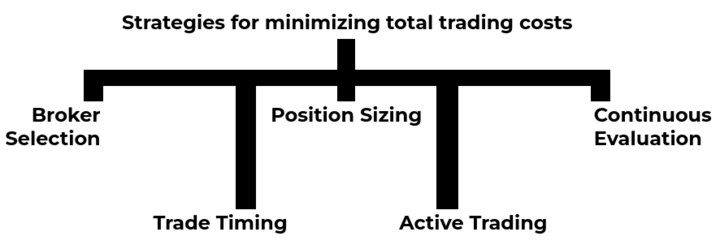

Strategies for minimizing total trading costs

To minimize total trading costs in Gas CFD trading, traders can consider the following strategies:

● Broker Selection: Choose reputable brokers with competitive spreads, commissions, financing rates, and transparent fee structures. Carefully evaluate the overall trading conditions provided by brokers to ensure cost-effectiveness.

● Trade Timing: Take advantage of periods with higher market liquidity and lower volatility to reduce spread costs. Avoid major economic announcements or events that can lead to increased trading costs.

● Position Sizing: Optimize position sizes based on risk management and capital allocation. Using appropriate leverage can help reduce overall trading costs.

● Active Trading: Engage in active trading to avoid inactivity fees and optimize trading opportunities. Regularly review and adjust trading strategies to maintain activity in the trading account.

● Negotiate Terms: For high-volume traders, negotiate commission rates and other fee structures with brokers to potentially secure more favorable terms.

● Continuous Evaluation: Regularly review fee schedules, service offerings, and trading conditions provided by brokers. Stay informed about changes in fee structures and consider switching brokers if more cost-effective options become available.

VII. Comparison with Physical Gas Trading Costs

Gas CFD trading costs and physical gas trading costs differ significantly due to the nature of the two approaches. Understanding the distinctions and weighing the pros and cons of each can help traders make informed decisions about which method suits their trading objectives and risk tolerance.

Differences between Gas CFD trading costs and physical gas trading costs

● Spread Costs: In Gas CFD trading, spread costs are incurred as the difference between the buying and selling prices of CFDs. In physical gas trading, bid-ask spreads are prevalent, which represent the price difference between the buying and selling prices of the physical gas commodity.

● Commissions: Gas CFD trading involves the payment of commissions to brokers for facilitating trades. In physical gas trading, commissions are typically not applicable, but traders may encounter fees related to logistics, storage, transportation, and delivery of the physical gas.

● Overnight Financing Costs: Overnight financing costs arise in Gas CFD trading when positions are held overnight. Physical gas trading does not typically involve overnight financing costs since the gas is bought and sold in real-time without the need to hold positions overnight.

● Other Fees and Charges: Gas CFD trading may involve various fees and charges, such as inactivity fees, deposit and withdrawal fees, and account maintenance fees. In physical gas trading, there may be expenses related to storage, transportation, insurance, and regulatory compliance.

Pros and cons of Gas CFD trading vs. physical gas trading

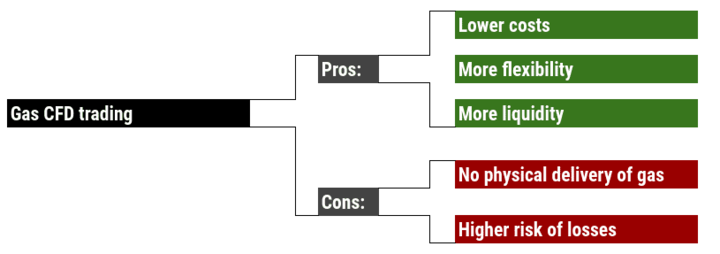

Gas CFD trading

Pros:

● Lower costs: CFD trading costs are typically lower than physical gas trading costs because CFD traders do not have to pay for the physical delivery of gas.

● More flexibility: CFD traders can trade on margin, which means that they can control a larger position with a smaller amount of capital. They can also trade in both directions, meaning that they can profit from both rising and falling prices.

● More liquidity: CFD trading is more liquid than physical gas trading. This means that there are more buyers and sellers in the CFD market, which makes it easier to trade and get a good price.

Cons:

● No physical delivery of gas: CFD traders do not receive the physical delivery of gas, which means that they cannot use the gas for their own purposes.

● Higher risk of losses: CFD trading is a leveraged product, which means that traders can lose more money than they invest.

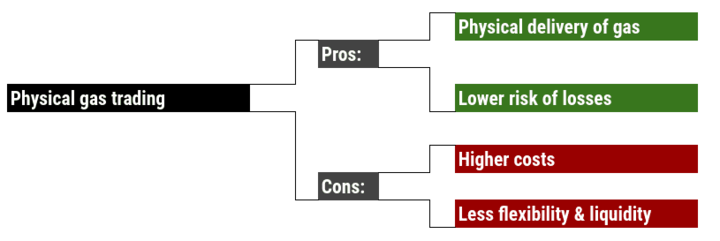

Physical gas trading

Pros:

● Physical delivery of gas: Physical gas traders receive the physical delivery of gas, which means that they can use the gas for their own purposes.

● Lower risk of losses: Physical gas trading is not a leveraged product, which means that traders cannot lose more money than they invest.

Cons:

● Higher costs: Physical gas trading costs are typically higher than CFD trading costs because physical gas traders have to pay for the physical delivery of gas.

● Less flexibility: Physical gas traders cannot trade on margin, which means that they cannot control a larger position with a smaller amount of capital. They can also only trade in the direction of the market, meaning that they can only profit from rising prices.

● Less liquidity: Physical gas trading is less liquid than CFD trading. This means that there are fewer buyers and sellers in the physical gas market, which can make it harder to trade and get a good price.

VIII. Conclusion

Summary of key points

● Trading costs are an important consideration in Gas CFD trading.

● Spread costs, commissions, overnight financing costs, and other fees and charges can all impact profitability.

● Traders should carefully consider the factors that affect trading costs when choosing a broker and developing a trading strategy.

● There are a number of strategies that traders can use to minimize trading costs.

Importance of considering trading costs in Gas CFD trading

Trading costs can have a significant impact on profitability in Gas CFD trading. Even small differences in trading costs can add up over time, so it is important to consider these costs when making trading decisions.

Final thoughts and recommendations

By understanding the factors that affect trading costs and implementing strategies to minimize them, traders can improve their profitability in Gas CFD trading.

Here are some final thoughts and recommendations:

● Choose a reputable and transparent broker. When choosing a broker, it is important to select one that is reputable and transparent about its fee structure. This will help you avoid unexpected or excessive charges.

● Consider your trading strategy. The trading strategy you use can have a significant impact on trading costs. If you are planning to trade frequently, you may want to choose a broker with lower spreads and overnight financing costs.

● Use limit orders. Limit orders allow you to specify the maximum price you are willing to pay or the minimum price you are willing to receive for a gas CFD. This can help you avoid paying wider spreads.

● Trade during liquid hours. Liquidity refers to the ease with which an asset can be bought or sold. Trading during liquid hours, such as during the European and US trading sessions, can help you get better prices and lower trading costs.

● Avoid overnight positions. If you can, avoid holding positions overnight. This will help you avoid overnight financing costs.