I. Recent Ford Stock Performance

Ford Insider Purchase

According to a recent SEC filing, John Thornton, a Director at Ford Motor Co (NYSE:F), acquired 24,790 company shares on June 6, 2024. This acquisition increases his total ownership to 389,576 shares.

Ford Motor Company, a multinational corporation, is distinguished for its production and distribution of commercial vehicles and automobiles under the Ford brand and prestige vehicles under the Lincoln brand.

Each share was acquired for $12.08, for a total of approximately $299,471.20. This acquisition substantially increased Thornton's stake in the organization.

Insider transactions at Ford Motor Co have been evenly distributed over the past year, with two purchases and two sales. John Thornton has been particularly active, purchasing 24,790 shares.

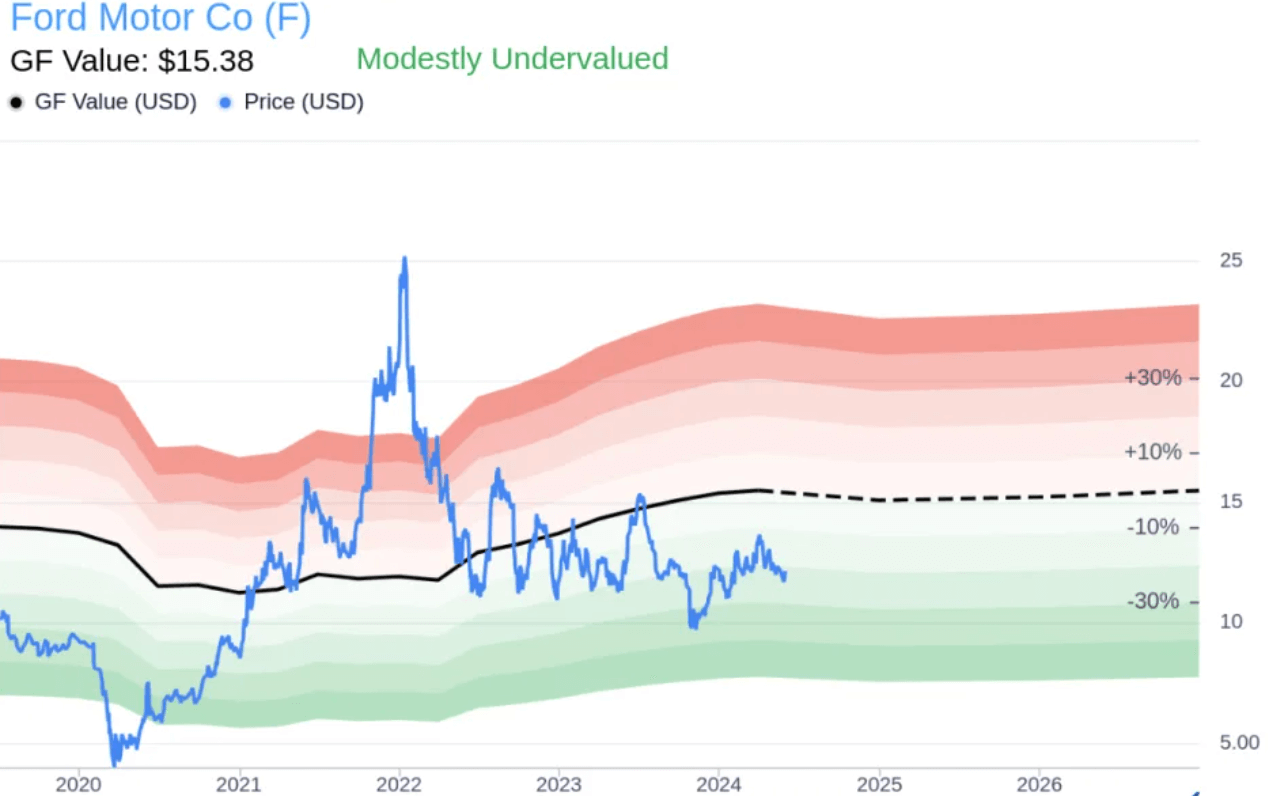

Ford Motor Co. has a price-earnings ratio of 12.53, lower than the industry median of 15.66, and a market cap of $48.51 billion. The price-to-GF-Value ratio of 0.79 suggests that the stock is modestly undervalued, as indicated by the GF Value of $15.38.

The GF Value is calculated by adjusting historical trading multiples for past returns and growth and estimating future business performance.

This insider purchase event may indicate to investors the stock's current price, as the insider's ownership of the company is increasing.

Biden's Fuel Standard Is Good For EV

The Biden administration enhanced vehicle gasoline mileage standards to encourage the adoption of emissions-free electric vehicles in the American automobile industry.

The U.S. Department of Transportation has announced the new standards, which are part of a series of White House regulations intended to motivate car manufacturers to produce more electric vehicles, as the New York Times reported.

The New York Times reported that the Environmental Protection Agency issued stringent new limits on exhaust pollution in April. The goal is to ensure that by 2032, most new passenger cars and light trucks sold in the US are all-electric or hybrids. This represents a substantial increase from the 7.6 percent of vehicles sold last year.

These more stringent measures may impact the stock prices of publicly traded automobile manufacturers developing electric vehicles like Ford.

Expert Insights on Ford Stock Forecast for 2024, 2025, 2030 and Beyond

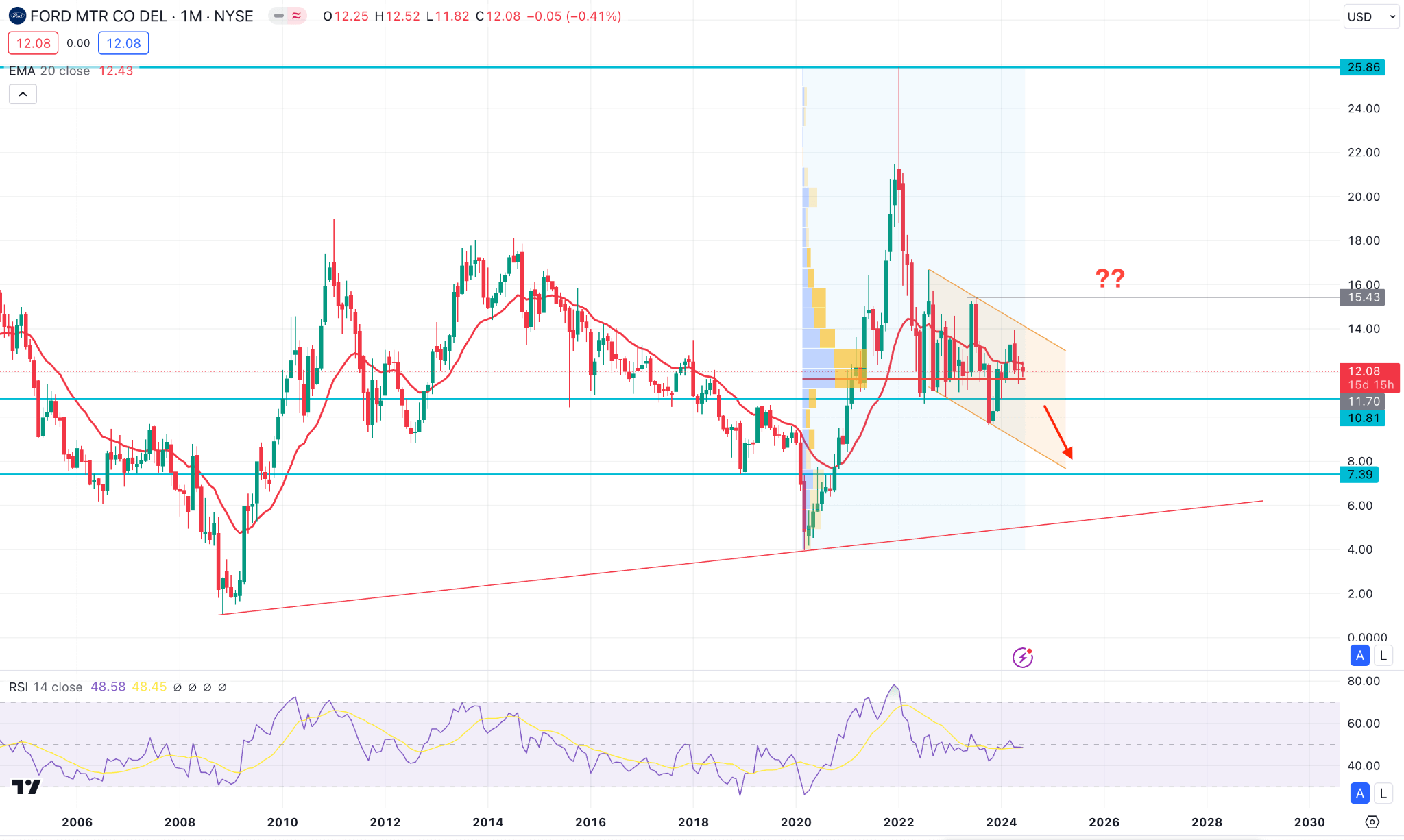

Ford Stock (F) trades within a tight range since the 2022 bottom, from where a valid breakout is needed before aiming for a stable trend.

Before proceeding to the in-depth F stock forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about Ford stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$12.54 |

$15.69 |

$30.10 |

|

Coincodex |

$14.64 |

$13.00 |

$16.57 |

|

Stockscan |

$11.03 |

$10.28 |

$9.6612 |

|

Tradersunion |

$15.88 |

$18.72 |

$42.6 |

Il. Ford Stock Forecast 2024

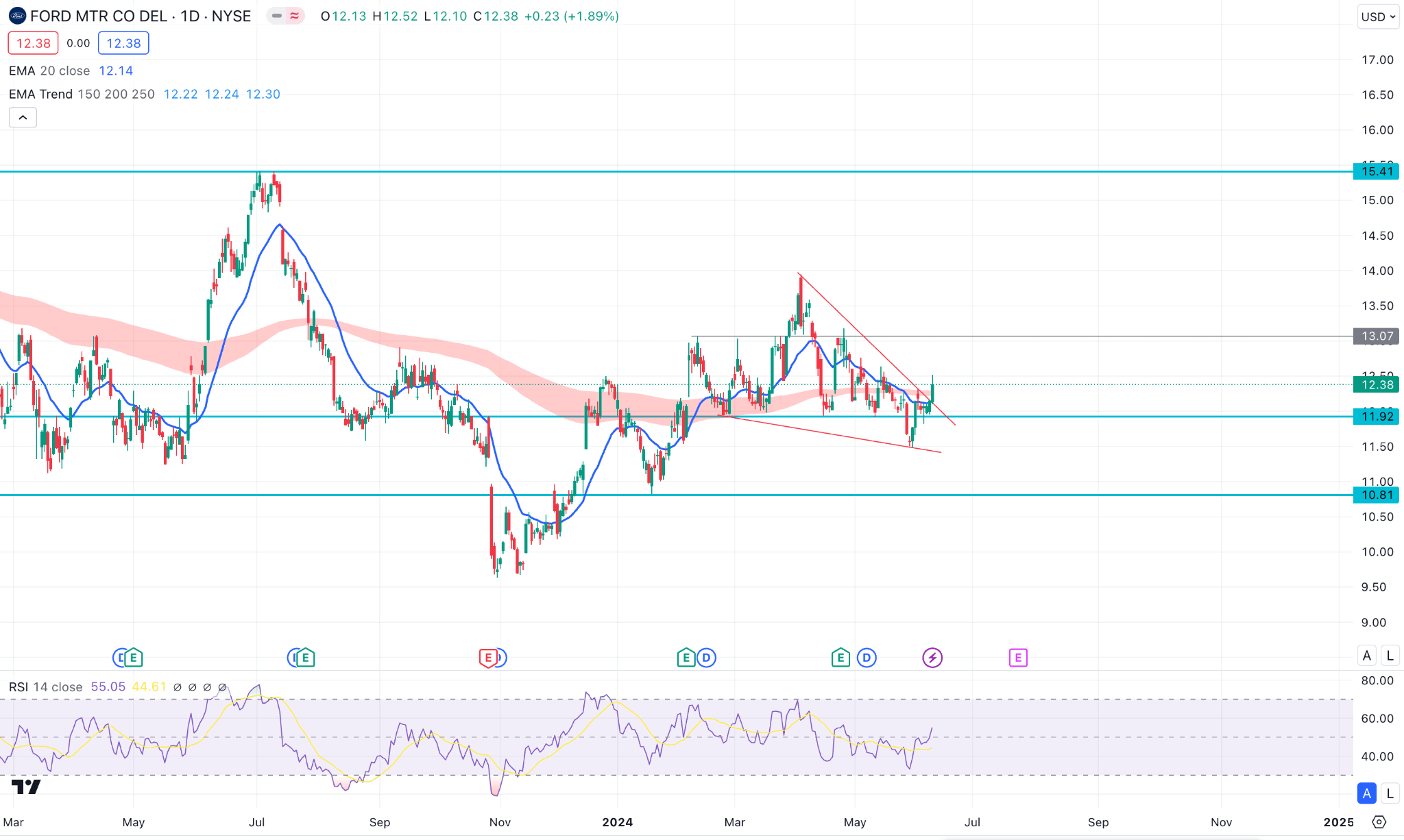

Ford stock (F) has remained sideways recently, creating a potential bullish opportunity from the falling wedge breakout. Considering the ongoing bottom formation, the stock is more likely to reach the 15.41 level by the end of 2024.

In the daily chart, Ford Stock (F) reached a crucial peak at the 15.41 level in 2023, from which a decent recovery came with a 37% discount towards the 9.65 level. Later on, the bottom is validated by making multiple swing highs above the 12.38 level, creating a potential opportunity in the long-term perspective.

Looking at technical indicators, the Moving Average wave consists of MA from 150 to 250, suggesting a minor bullish signal. The most recent price showed a bullish V-shape recovery above the MA wave, while the broader trend is sideways. Moreover, the 20-day Exponential Moving Average is closer to the current price, while the most recent daily candle showed a potential bullish reversal.

In the secondary window, the 14-day Relative Strength Index (RSI) shows the same outlook. The current level hovers above the 50.00 neutral line with a bullish slope.

Based on the Ford Stock Forecast 2024, the ongoing buying pressure is potent, which might take the price towards the 15.00 psychological line. However, a failure to hold the momentum above the 11.92 static line could be a challenging factor for bulls, which might extend the loss toward the 9.50 low.

A. Other F Stock Forecast 2024 Insights: Is Ford a good stock to buy?

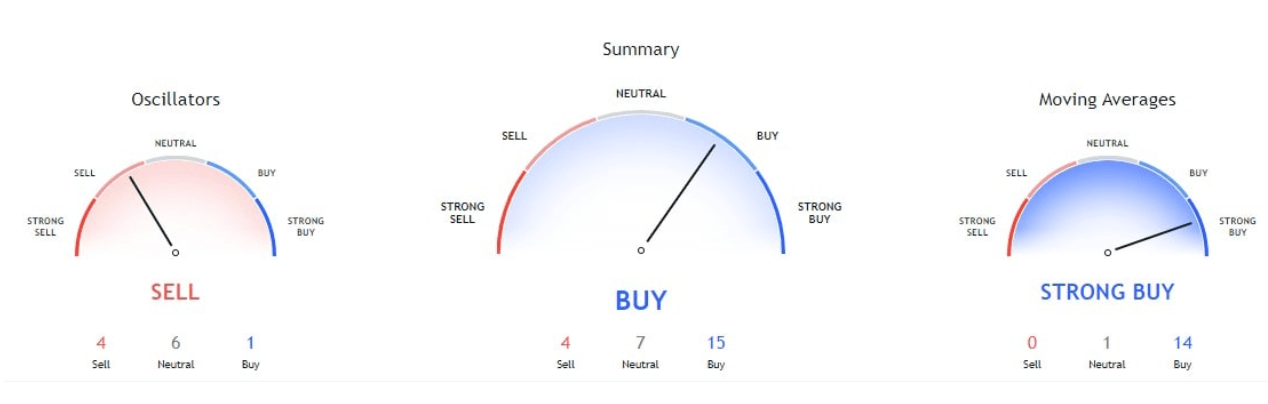

- Five analysts rated Ford Motor Company stock as a Strong Buy, two as a Moderate Buy, seven as a Hold, and three as a Strong Sell, accordingto Barchart. The average F stock price target for all 17 analysts is $13.52.

- According to MarketBeat, the average Ford price target for the 14 experts is $13.66, with four recommending a Buy, nine recommending a Hold, and one recommending a Sell.

- According to TipRanks, the average Ford stock price target for 15 specialists is $13.74, with six assigning a Buy rating, six assigning a Hold rating, and three assigning a Sell rating.

- Stock Analysisindicates that two analysts rated the shares as a Strong Buy, three as a Buy, six as a Hold, one as a Sell, and one as a Strong Sell, with an average 12-month price forecast of $13.78.

B. Key Factors to Watch for Ford Stock Predictions 2024

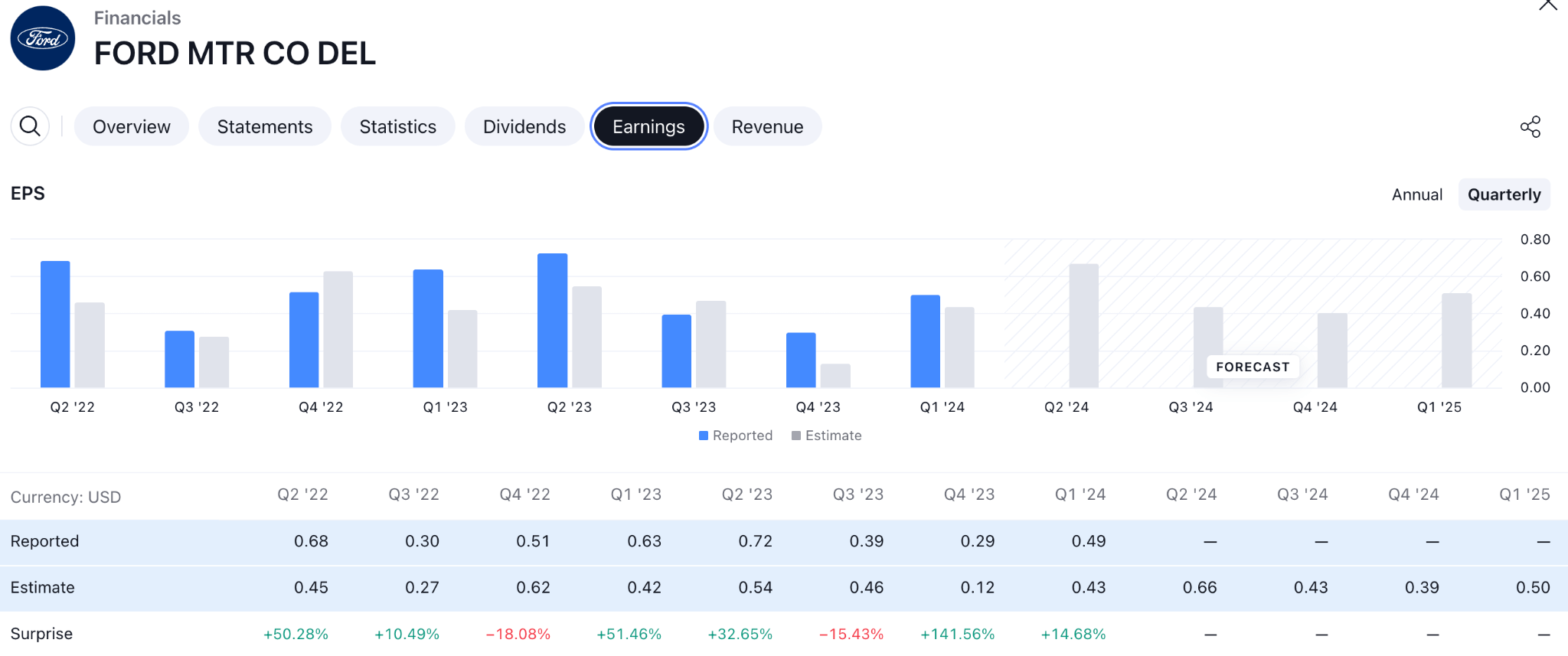

Ford Earnings Forecast 2024

Ford (F) maintained stable growth in quarterly earnings reports, the most recent of which showed a 14% increase and two consecutive bullish readings.

For Q2 2024, the forecasted EPS is $0.66, which is higher than the average of $0.47 for the last four quarters. Moreover, the forecasted Q3 and Q4 F earnings are $0.43 and $0.39, consecutively. If the company can maintain the upbeat result, we may expect the stock price to grow in 2024.

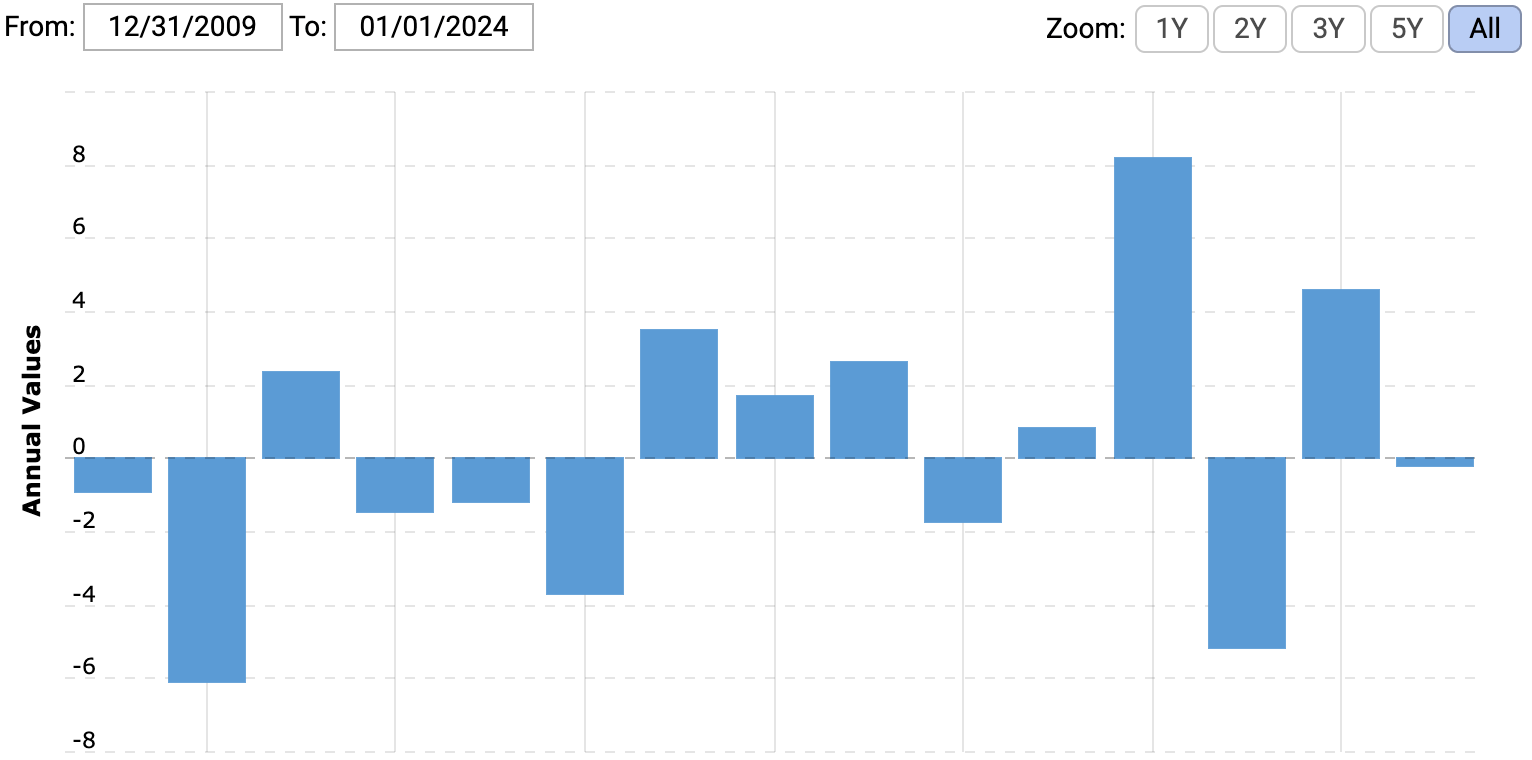

Ford Cash Flow Position

Source: macrotrends

From 2010 to 2024, Ford Motor's net cash flow has shown significant fluctuations. For the quarter ending March 31, 2024, Ford reported a net cash outflow of $5.124 billion, which marks a 71.89% improvement compared to the same quarter the previous year. However, for the twelve months ending March 31, 2024, the net cash outflow was $2.777 billion, representing a substantial 238.64% decline compared to the previous year.

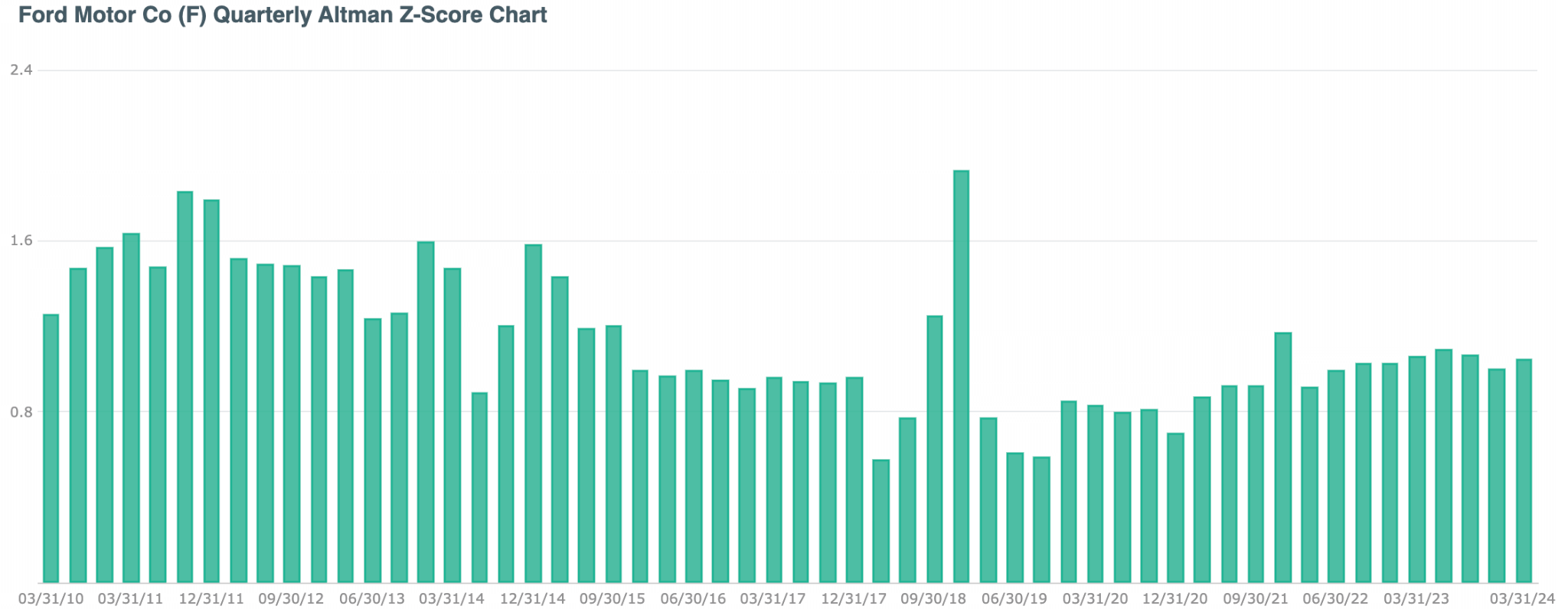

Ford Altman Z Score

Source: discoverci

During the quarter ending on March 31, 2024, Ford Motor Co's Altman Z-score stood at 1.04, outperforming its peers in the Auto Manufacturers - Major industry group, which had an average score of -27.12 for the same period.

From March 31, 2010, to March 31, 2024, Ford Motor Co's average Altman Z-score was 1.13, compared to the industry's average of -9.16. As the company showed an upbeat score, we may expect the risk of bankruptcy at low.

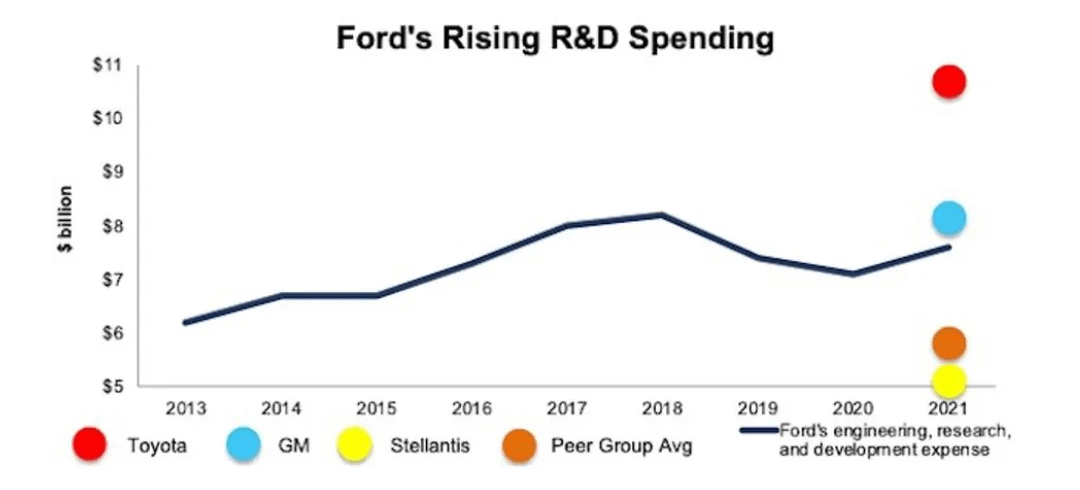

Ford Stock Prediction 2024 - Bullish Factors

- Ford has aggressively expanded its electric vehicle inventory, featuring successful models such as the Mustang Mach-E and the F-150 Lightning. Ford could achieve a larger market share through ongoing innovation and new releases. Ford's investments in EV charging infrastructure and partnerships can also increase the appeal of its EVs, potentially resulting in higher sales and a higher stock value.

- Ford stock is trading at a relatively low price-to-earnings (P/E) ratio, approximately 6.8x as of June 2024, compared to its historical performance and competitors. If the company's earnings potential is realized, this could suggest potential for expansion.

- The continued revenue growth from popular models and the expansion of EV sales can positively influence the stock price. Monitoring quarterly earnings reports for upward trends can indicate a bullish outlook.

Ford Motor Stock Forecast 2024 - Bearish Factors

- The potential for market saturation and the erosion of Ford's market share may result from increased competition from established manufacturers (such as Tesla, GM, and Volkswagen) and new entrants (such as Rivian and Lucid Motors). Competitors' aggressive pricing strategies may affect Ford's profit margins, which could necessitate price reductions.

- Ford could only uphold investor confidence if it meets production targets and experiences lower-than-expected sales for the F-150 Lightning and other EVs. Lightning's negative evaluations or the failure to meet quarterly production targets may serve as bearish indicators.

- Complex engineering, supply chain management, and marketing strategies are necessary for Ford's successful transition to a significant EV manufacturer. If Ford experiences setbacks in these areas, its EV deployment could be delayed, and investor confidence could be harmed. Examples include production delays, battery safety concerns, or negative publicity regarding factory working conditions.

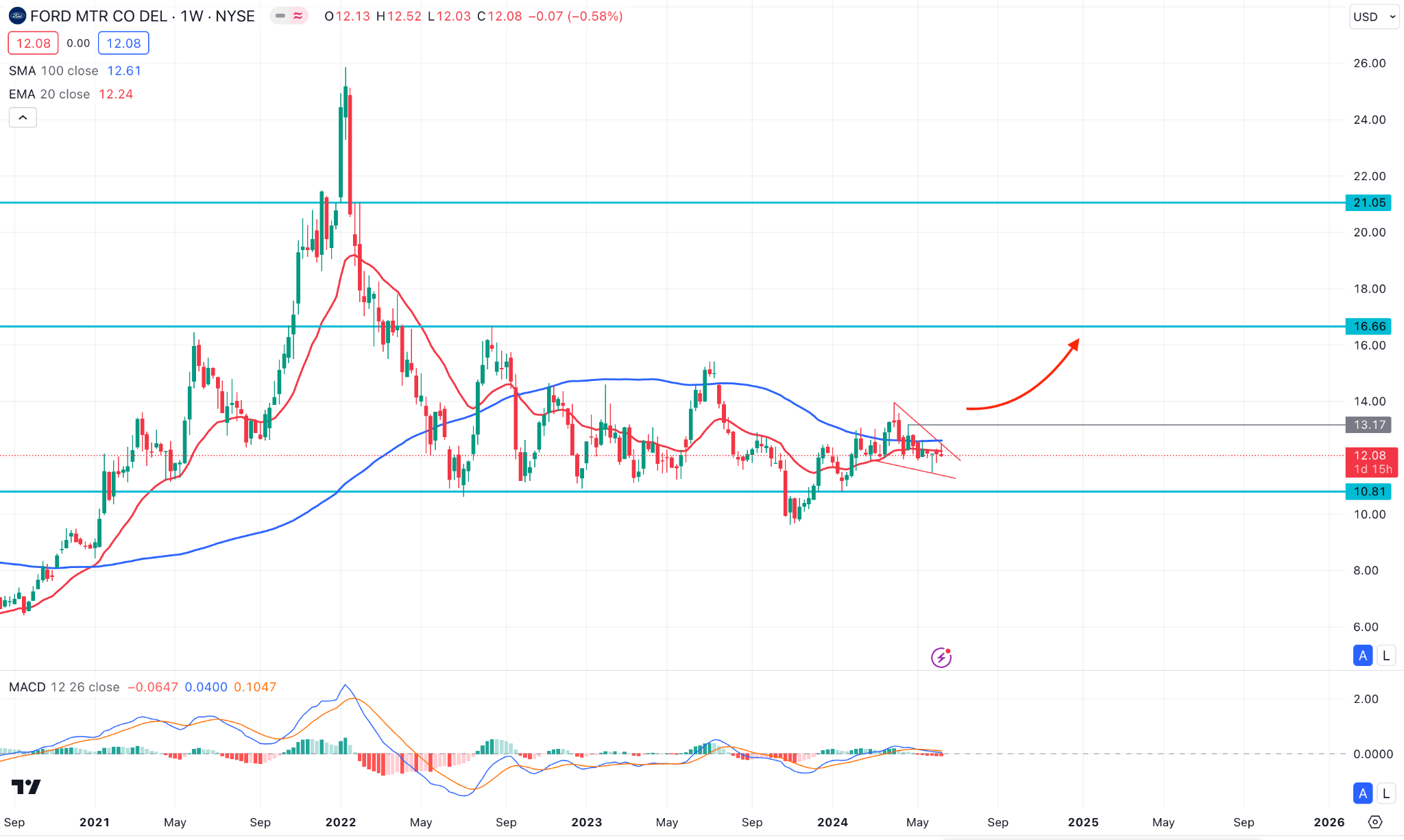

Ill. Ford Stock Forecast 2025

As per the current consolidation, a valid bullish breakout with a solid weekly close above the 14.00 psychological line could open a long opportunity in F, where the main aim would be to test the 21.05 resistance level by the end of 2025.

A prolonged consolidation is visible at the weekly price, with recent downside pressure potent below the dynamic 100-week Simple Moving Average (SMA). This stock is more likely to move down as long as the 100-week SMA works as resistance. Meanwhile, the near-term resistance level of the 20-week Exponential Moving Average (EMA) adds to the bearish pressure, creating an opportunity to reach the 10.81 support level.

In the indicator window, the Moving Average Convergence Divergence (MACD) indicator suggests a corrective price action, with the histogram remaining near the neutral point. Moreover, the signal line peaked in the positive area and rebounded lower, indicating that the overall market structure is sideways. In that case, a potential breakout could create a trend trading opportunity.

Based on the Ford Stock Forecast 2025, a high-probability long opportunity might arise after a valid breakout above the 100-week SMA level. A conservative long approach would be to wait for a weekly candle to close above the 13.17 resistance level, which could extend the momentum toward the 20.00 psychological level.

On the other hand, ongoing selling pressure might create a bearish continuation opportunity. Before anticipating more selling pressure, a downside move below the 10.81 level is needed.

A. Other Ford Stock Price Prediction 2025 Insights: Is Ford stock a buy?

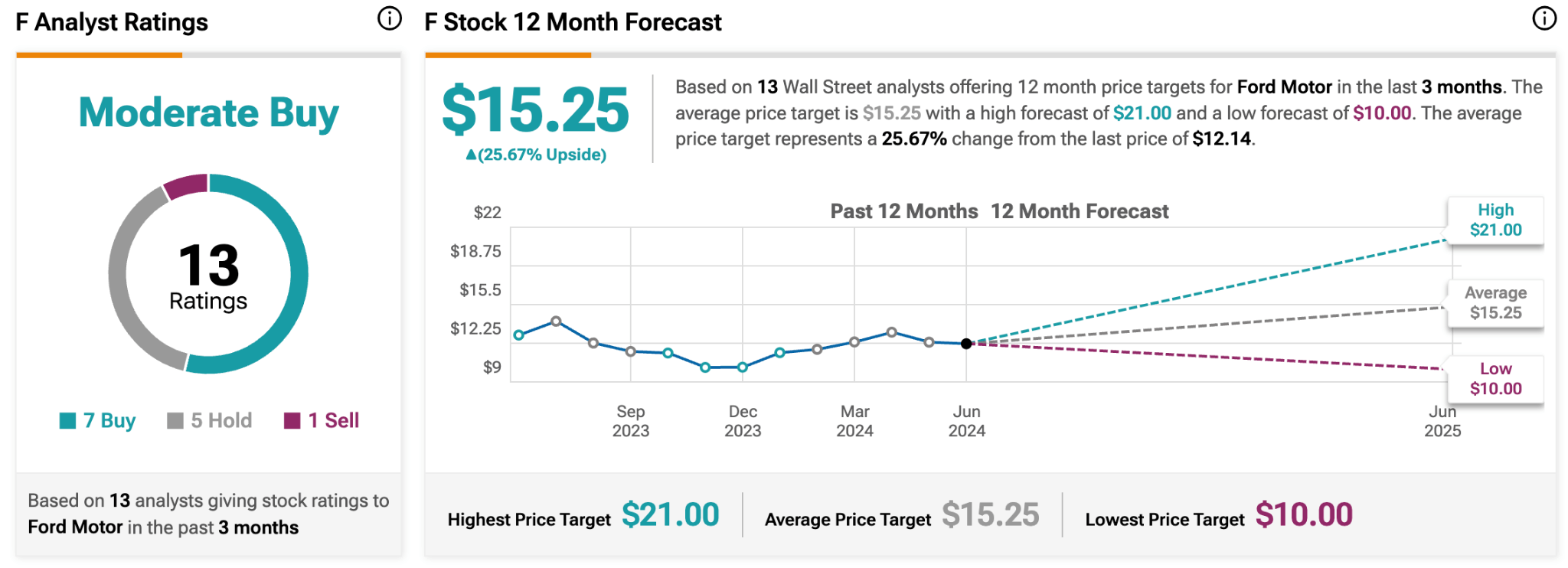

Source: tipranks

According to a report from Tiprank, Ford Stock (F) has an upbeat projection for 2025. As per the report, seven analysts anticipate a buy, while 5 are hold.

F stock price could reach the $21.00 level, the highest targeted level, in the upcoming 12 months. However, the projected low price within the year is $10.00.

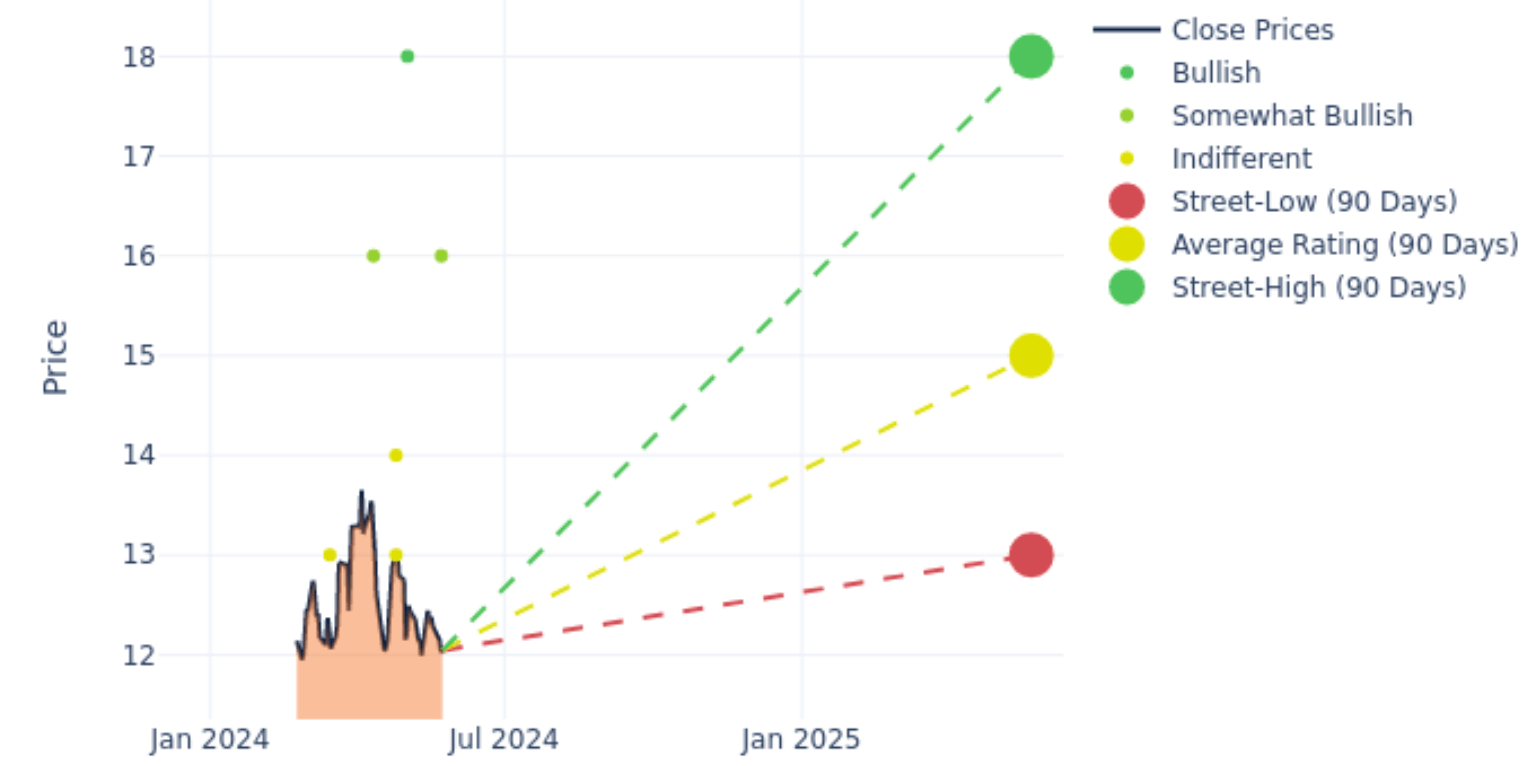

Source: markets.businessinsider

Another report from Businessinsider provided 12-month F price target assessments, which show an average Ford price target of $15.00, a high estimate of $18.00, and a low estimate of $13.00. The current average represents a 7.14% increase from the previous average Ford price target of $14.00.

B. Key Factors to Watch for F Stock Forecast 2025

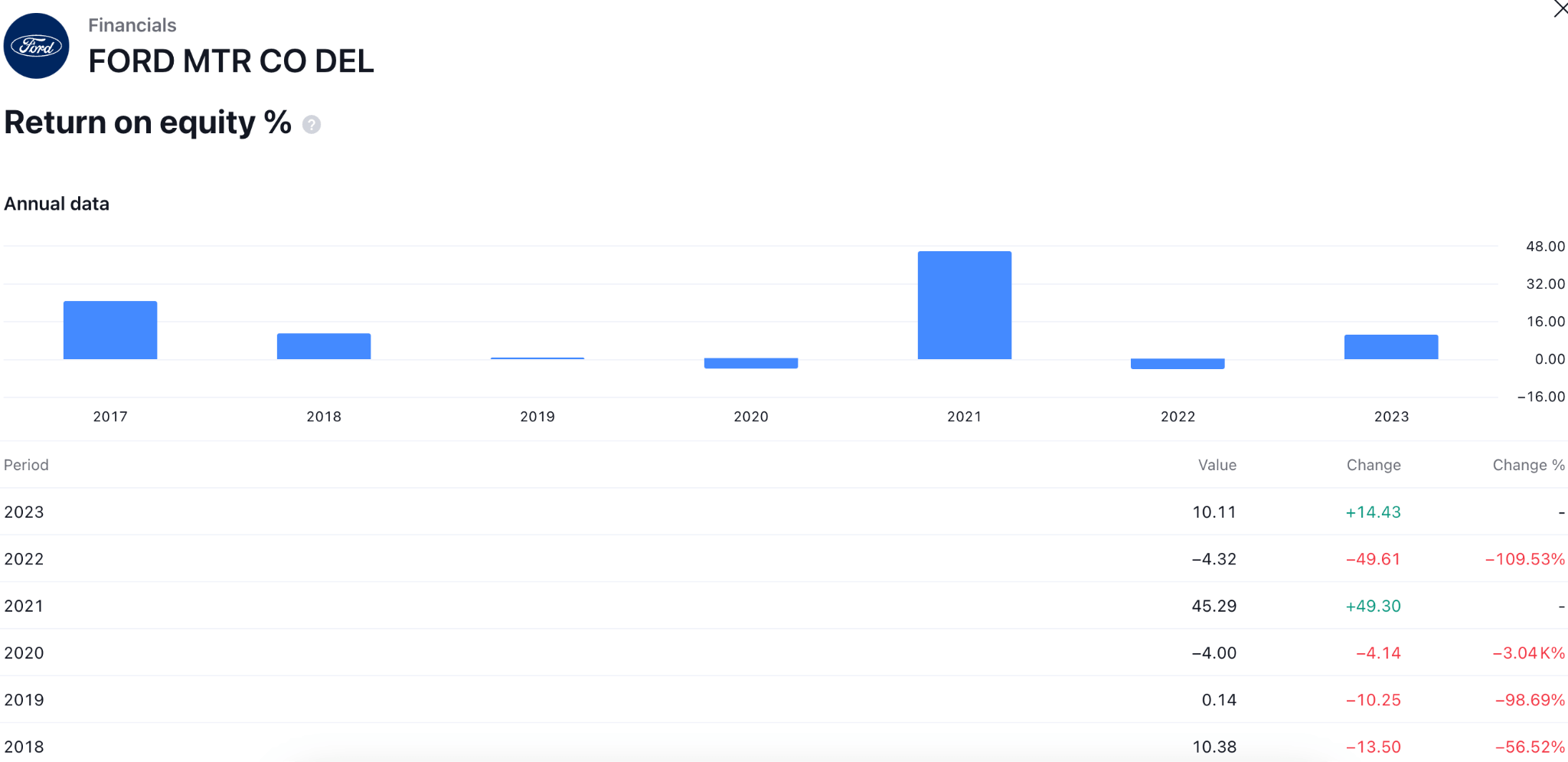

Ford Return On Equity Analysis

Return on equity defines a company's profitability to shareholders. A higher number means higher profitability, which has a positive impact on the share price.

As per the recent reading, a mixed sentiment is visible, where the rebound in 2021 of 49.30 is eliminated in the next year by coming to -49.61. In the next year, the report came positive again at +14.43, which indicates a positive full-year return. In that case, another positive report in the full year of 2024 could be an additional long signal for F in 2025.

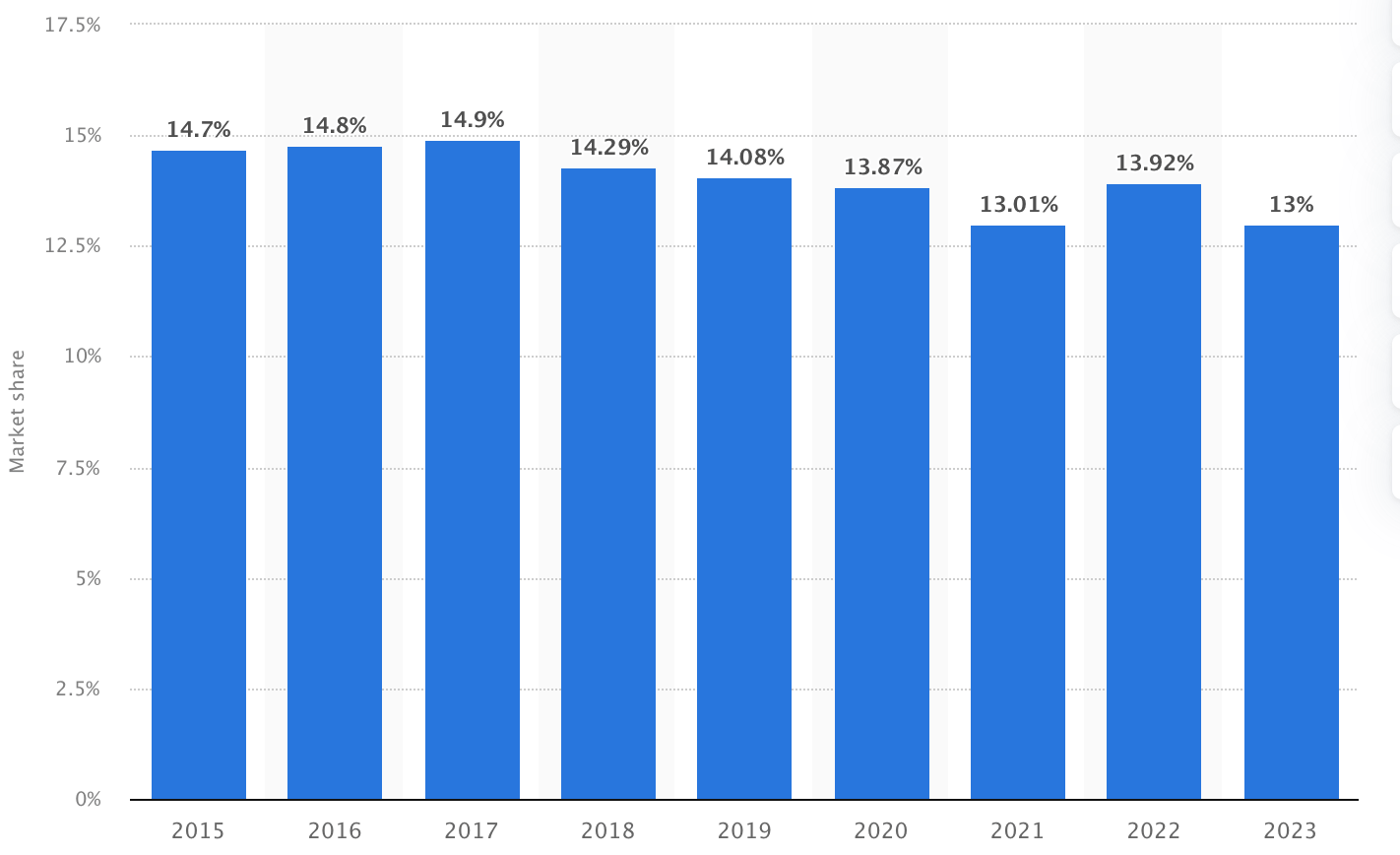

Ford (F) Market Dominance

Source: newsweek

Ford has strong market dominance in the industry. The report from 2023 shows that the company holds 13% of the US market share, more than its peers.

However, the industry might find a push from EV and artificial intelligence, where a strong fluctuation might be seen for the F market dominance. Investors should closely monitor how the company implements innovation to maintain market dominance in 2025.

Ford Stock Projections 2025 - Bullish Factors

- Ford's electric vehicle lineup is anticipated to expand by 2025, introducing new EVs, Mustang Mach-E, next-generation models, and F-150 Lightning. This can bolster Ford's market position in the electric vehicle (EV) sector.

- Ford could secure its position in the expanding EV market if it maintains strong sales momentum for the F-150 Lightning and expands its EV offerings with successful new models. For instance, Lightning would demonstrate favorable indicators if it surpasses its initial annual production objectives or achieves high customer satisfaction ratings.

- Ford Pro, the commercial vehicle and services division, has the potential to be a growth generator. A bullish indicator would be the continued success in securing large fleet contracts for electric commercial vehicles. Monitoring Ford Pro's significant partnerships or contract victories would be pertinent.

Ford Stock Forecast 2025 - Bearish Factors

- Ford may experience financial duress and potentially undermine its EV strategy's long-term viability if it cannot achieve profitability on its EVs due to high battery costs or low production efficiency. Therefore, it is crucial to monitor the latest information regarding the costs of batteries and the profit margins of Ford's electric vehicles.

- Persistent semiconductor shortages and supply chain disruptions, including logistical constraints or shortages of other critical components, may delay manufacturing and delivery times.

- The potential IPO of Ford Model E could potentially harm the stock price and reflect unfavorably on Ford's overall EV strategy if it fails to meet expectations, raises less capital than expected, or encounters negative investor sentiment. It would be beneficial to monitor Ford Motor news and analyst predictions regarding the valuation of the Ford Model E after the IPO.

IV. Ford Stock Price Prediction 2030 and Beyond

As per the future fundamental sentiment, Ford stock could soar above the 25.86 level by the end of 2030.

In the monthly time frame, Ford is experiencing ongoing selling pressure within a descending channel, with the most recent price hovering below the channel resistance.

Looking at the broader context, a bullish swing in 2020 peaked at the 25.86 level in 2022 but failed to sustain above the 18.00 psychological line. As a result, a bearish correction with counter-impulsive momentum took the price below the 10.00 psychological line before moving sideways.

As bulls have failed to maintain momentum above the all-time high area, investors should remain skeptical about upward pressure in the coming years. The 20-month moving average is above the current price, acting as resistance, while the high volume level is within the current price range.

In the indicator window, the sideways market is evident from the Relative Strength Index (RSI), which hovers around the 50.00 area for a considerable time.

Based on the Ford stock forecast for 2023 and beyond, investors should look for a valid breakout from the channel resistance, with a monthly candle closing above the 15.43 level before anticipating a move toward the 25.00 psychological level.

On the other hand, a downtrend continuation opportunity might arise after a valid break below the high volume line. In that case, a short opportunity would be valid, aiming for the 7.39 support level.

A. Other Ford Stock Forecast 2030 and Beyond Insights: Ford stock buy or sell?

Source: libertex

As per the report from Libertex, Ford is anticipated to sell nearly 1.24 million electric vehicles annually by 2030. Therefore, Ford's stock price is anticipated to fluctuate between $57.43 and $93.66 in 2026. The AI Pickup forecasts a more conservative range of $43.29 to $45.97 for Ford shares from 2026 to 2030, indicating that the company may not achieve the high profits that many traders, brokers, and exchanges anticipate.

Another Forbes report suggests Ford intends to have electric vehicles (EVs) account for at least 40% of its total vehicle sales by 2030. The substantial orders and extended wait times for Ford's current EV models suggest a robust demand. However, an oversupply of EVs could result from the ambitious production objectives of established companies and new market entrants.

Ford is equipped to transition to electric vehicles (EVs) by capitalizing on its profitable internal combustion engine (ICE) business and substantial cash reserves to navigate a potentially oversaturated EV market.

B. Key Factors to Watch for F Stock Forecast 2030 and Beyond

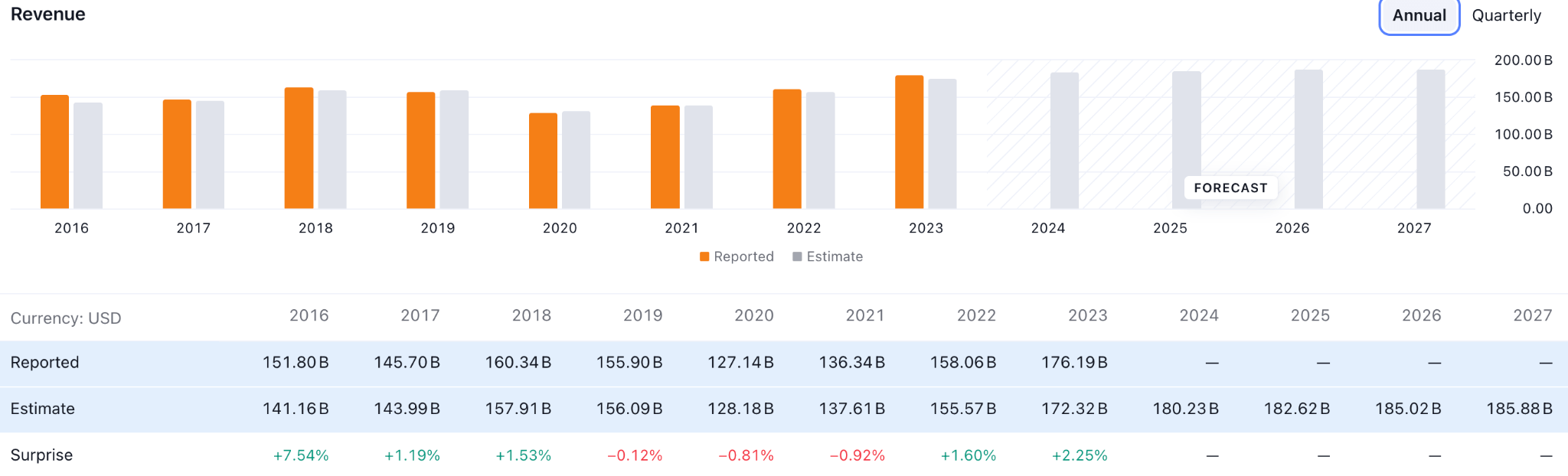

Ford Revenue Forecast

In the analysts' projection, Ford (F) has an upbeat projection, maintaining the growth in the yearly earnings review. From 2019 to 2023, the average actual revenue was $149.96 billion, whereas the latest full-year revenue shows the highest number of $172.32 billion.

If the company maintains the growth in the coming years, we may anticipate the stock price to soar in 2030 and beyond.

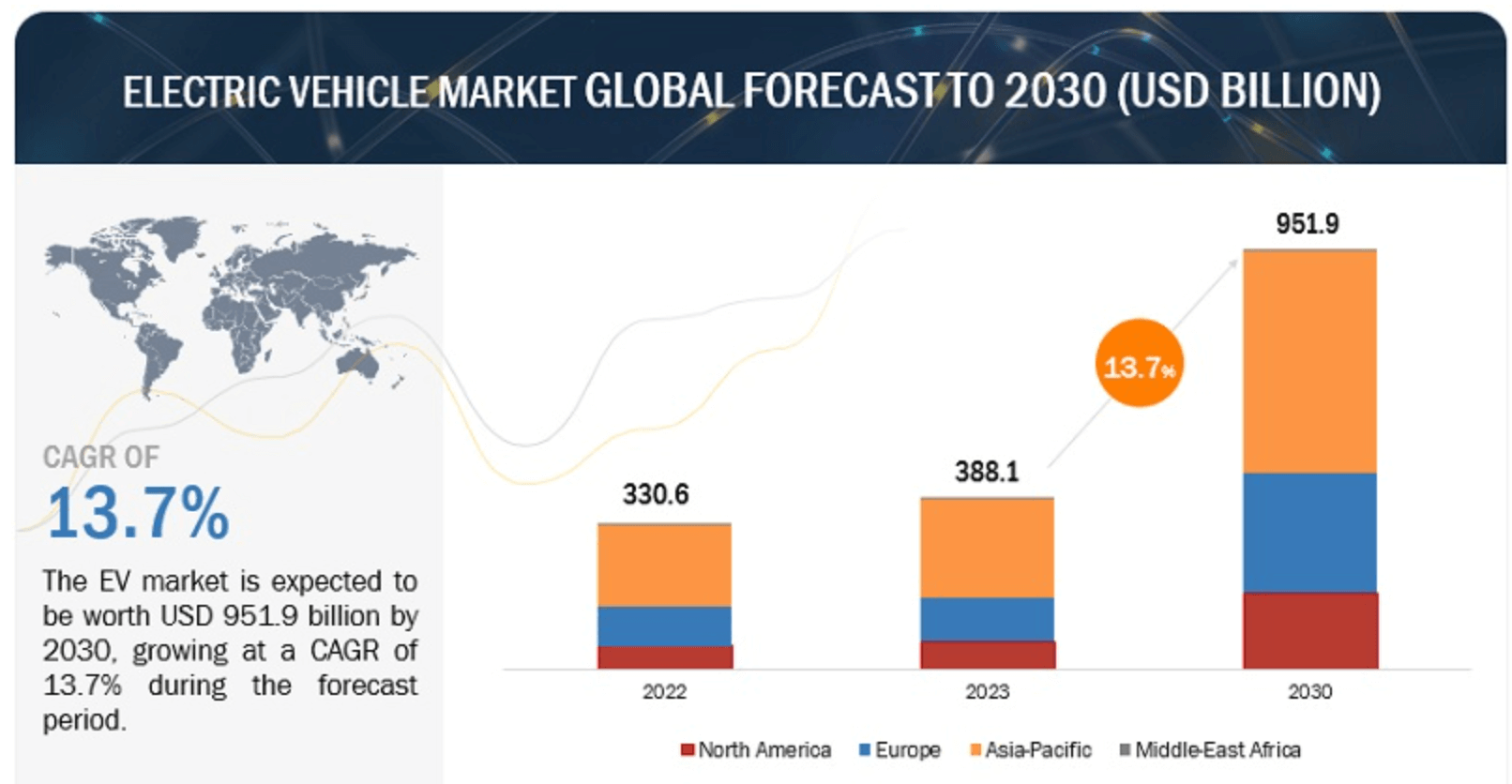

EV Market Growth 2030

Source: marketsandmarkets

The EV market has had a positive CAGR of 13.7% since 2022, which might take the market cap to $951.9 billion market cap by the end of 2030. Considering the growth in the forecasted period, Ford (F) could have a strong market position, creating a decent stock growth.

Ford Stock Forecast 2030 and Beyond - Bullish Factors

- Ford is expected to have a wide selection of electric vehicles in various segments, including sedans, pickups, and SUVs, by 2030, which could give the company a substantial market share.

- Ford's overall strategy would be positively impacted, and its valuation could increase if Ford Model E succeeds in its transition to a public corporation and establishes itself as a leader in the electric vehicle industry. Monitoring the Ford Model E's performance following the IPO and its influence on Ford's financial situation would be crucial.

- Ford has the potential to establish a devoted customer base willing to pay a premium for its products if it successfully transitions to electric vehicles while maintaining its brand reputation for innovation and reliability. In this context, monitoring brand perception surveys and customer satisfaction reports would be pertinent.

Ford Stock Forecast 2030 and Beyond - Bearish Factors

- Long-term economic instability, a global recession, and fluctuations in the prices of basic materials such as steel, aluminum, and rare earth metals may impact electric vehicle battery production costs and profit margins.

- Ford may forfeit a lucrative revenue stream if it fails to address substantial obstacles in developing and deploying commercially viable AV technology by 2030. Safety incidents involving Ford's AV prototypes or delays in introducing self-driving cars are examples.

- Ford's core business model and stock price could be affected if entirely new transportation solutions, such as hyperloop systems or flying vehicles, emerge, resulting in its potential to be left behind. It would be prudent to remain informed about the latest developments in alternative transportation technologies.

V. Conclusion

A. Ford Stock Outlook: Is Ford stock a good buy?

Analysts predict Ford stock could see moderate growth in 2024 and 2025, with more significant gains by 2030. Here's a breakdown of the price forecasts:

- Ford stock price forecast 2024: Analysts project prices ranging from $11.03 to $15.88, with a potential bullish opportunity pushing the stock toward the $15.41 level.

- Ford stock forecast 2025: The stock price could reach between $10.00 and $21.00, with a valid breakout above $14.00 potentially opening a long opportunity to test the $21.05 resistance level.

- F forecast 2030 and Beyond: Projections for 2030 are more varied, with some analysts suggesting prices could soar to between $43.29 and $93.66, driven by Ford's aggressive EV expansion and market penetration.

For those who wish to capitalize on short-term price fluctuations without possessing the actual shares, investing in Ford (F) stock through Contracts for Difference (CFDs) may prove advantageous. CFDs enable investors to leverage their positions, which has the potential to increase their gains (and losses). CFDs may provide a flexible and efficient method of trading Ford stock, particularly for those who intend to capitalize on market volatility and price trends in the coming years in light of the anticipated price fluctuations and market dynamics.

B. Trade F Stock CFD with VSTAR

Trading Ford stock CFDs with VSTAR offers several compelling benefits:

Tight Spreads: VSTAR provides competitive and tight spreads, ensuring that traders can enter and exit positions with minimal cost, which is crucial for maximizing profitability, especially in a volatile market.

- Multi-regulated Broker: VSTAR is regulated by the ASIC, MiFiD, FSC, and CySEC, ensuring that the trading environment is secure, transparent, and adheres to strict regulatory standards.

- Advanced Trading Platforms: VSTAR offers advanced trading platforms equipped with powerful tools and analytics, enabling traders to make informed decisions quickly and efficiently.

- Leverage Options: VSTAR provides leverage options, allowing traders to enhance their market exposure with a smaller initial capital outlay.

- Comprehensive Support: VSTAR offers robust customer support, ensuring that traders have access to assistance whenever they need it.

By choosing to trade or buy Ford stock CFDs with VSTAR, investors can take advantage of these benefits, positioning themselves to capitalize on the anticipated movements in Ford stock price over the coming years.

FAQs

1. What is the highest price Ford stock has ever been?

The Ford stock highest price ever was $21.26 on January 14, 2022.

2. Will Ford stock go up?

The average 12-month price forecast from analysts is $14.31, suggesting a potential increase from the current price.

3. What is the F dividend for 2024?

For 2024, Ford has paid a quarterly dividend of $0.15 per share, with the most recent payment made on June 3, 2024.

4. What will Ford stock be worth in 2025?

Analysts predict that the Ford stock price could be 21.05 by the end of 2025.