I. Recent Eli Lilly Stock Performance

LLY Drug Sales Soared in 2024

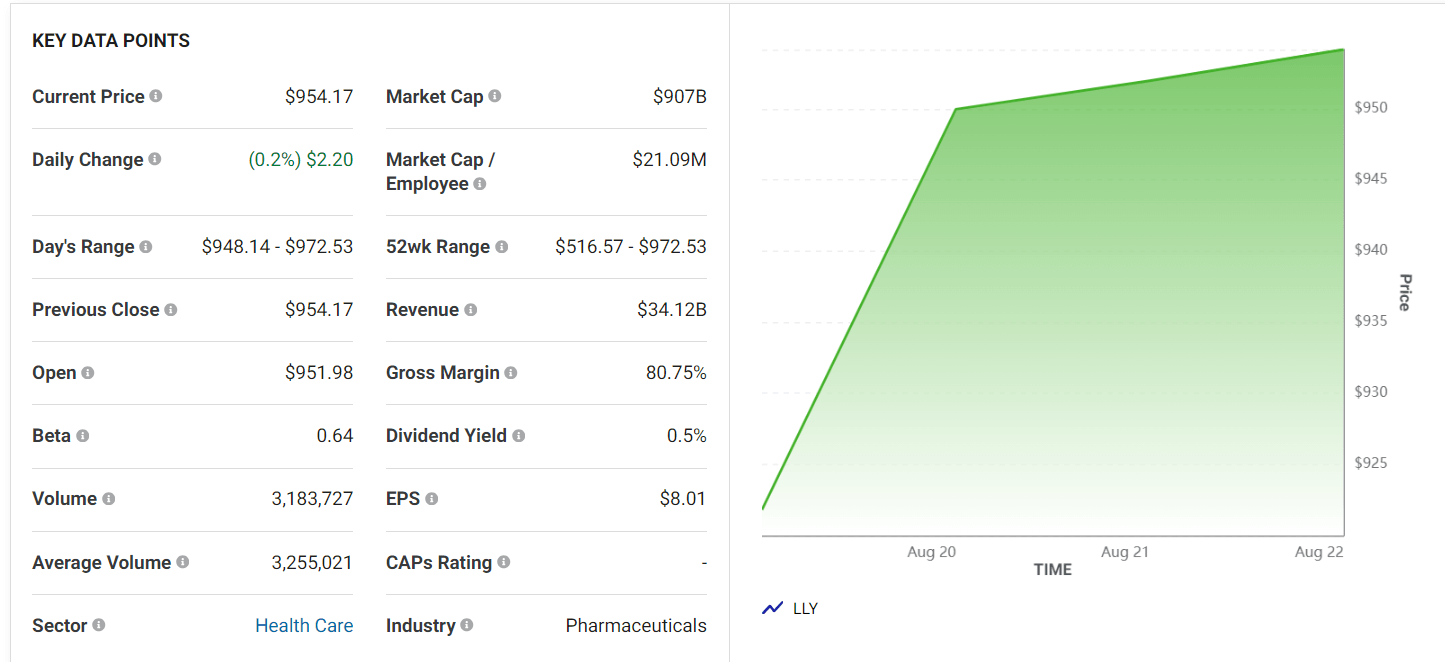

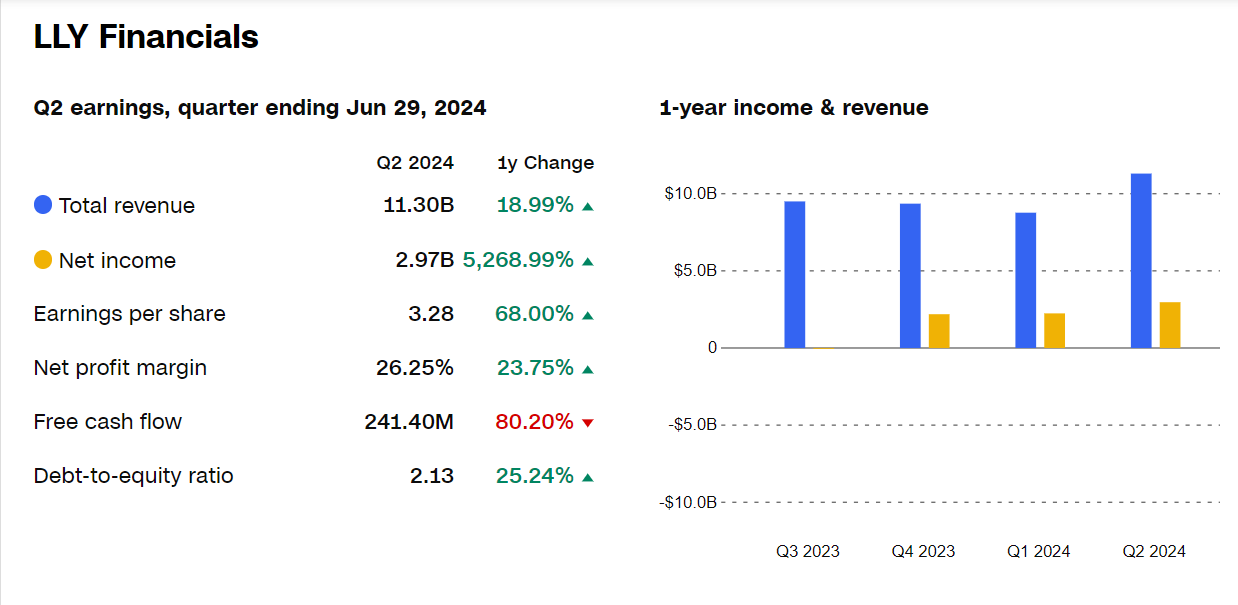

The updated LLY price target from Geoff Meacham suggests a potential 25% increase from the Aug. 19 closing price of LLY, yet this is far from assured. Eli Lilly's stock price has increased by 58% in the current year, significantly influenced by tripeptide success, a drug marketed as Mounjaro for diabetes alongside Zepbound for weight management. This dual action of the drug on GIP and GLP-1 receptors has given it an edge over competitors, contributing to an 86% sales increase during Q2, 2024.

LLY Key Financial Metrics

While Wall Street sentiment is bullish on the LLY stock, with analysts anticipating further growth, the stock price currently trades at approximately 60 times forward earnings. This high valuation not only presents market optimism but also reflects significant risk. The stock could gain considerably if drivers like Tirzepatide and Kisunla deliver as expected. However, setbacks could lead the stock to a sharp decline, making this a high-stakes investment. LLY might offer substantial rewards for those comfortable with risk, but smart financial investors may prefer to hold on till getting a potential entry point.

Expert Insights on Eli Lily Stock Forecast For 2024, 2025, 2030, and Beyond

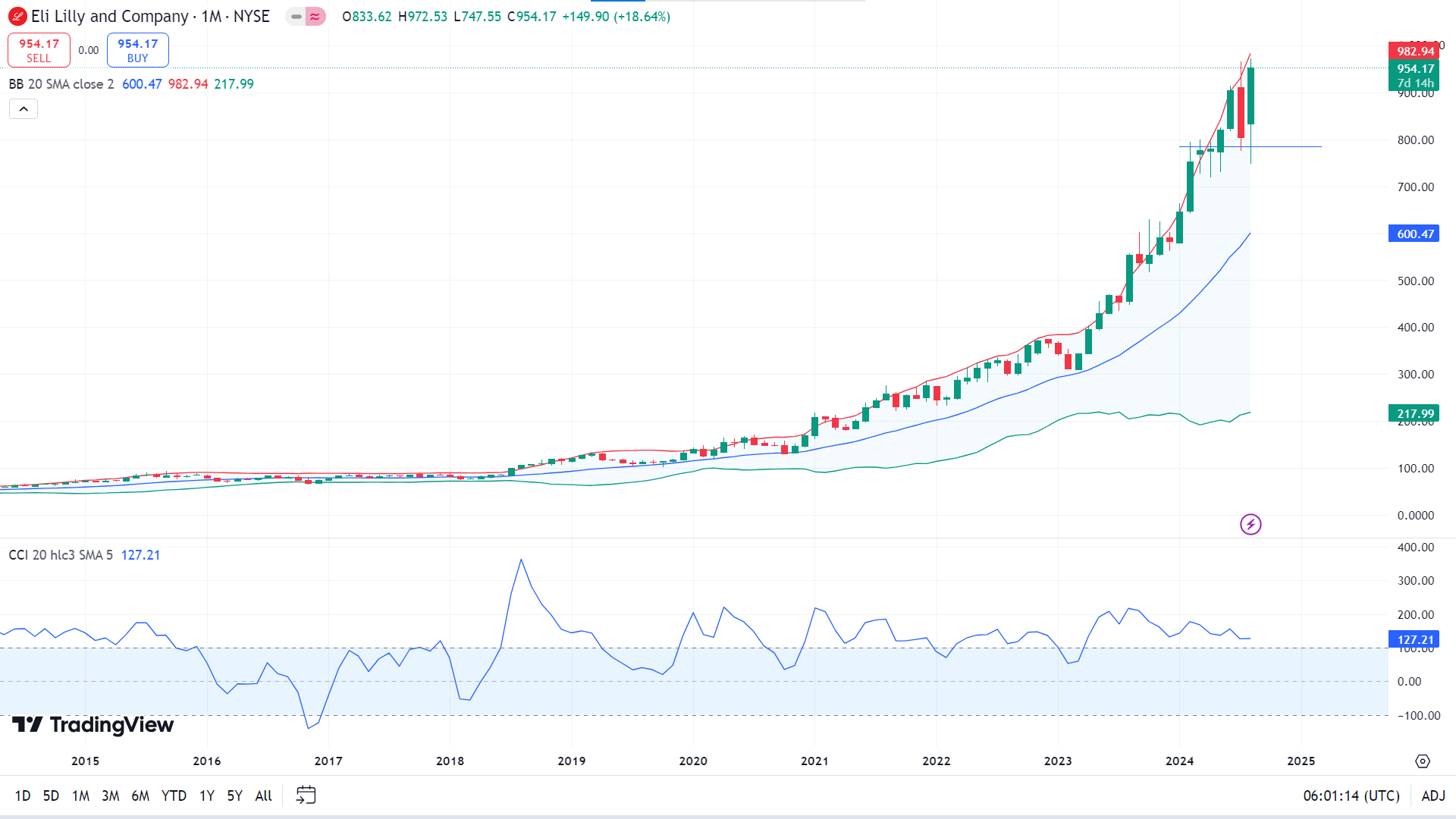

LLY stock price is gradually moving on an uptrend. It faced a significant decline near 747.55 from the high of 966.10 in July but recovered from the loss and is now soaring near the ATH. Before checking further details, let's see what experts forecast about 2024, 2025, 2030, and Beyond:

|

Providers |

2024 |

2025 |

2030 and beyond |

|

Coincodex |

$1008.36 |

$1207.40 |

$3959.94 |

|

Youthcouncilofindia |

$1092 |

$1140 |

$1895 |

|

Coinpriceforecast |

$1157 |

$1437 |

$2540 |

|

Stockscan |

$1204.25 |

$1895.19 |

$2795.80 |

II. Eli Lilly Stock Forecast 2024

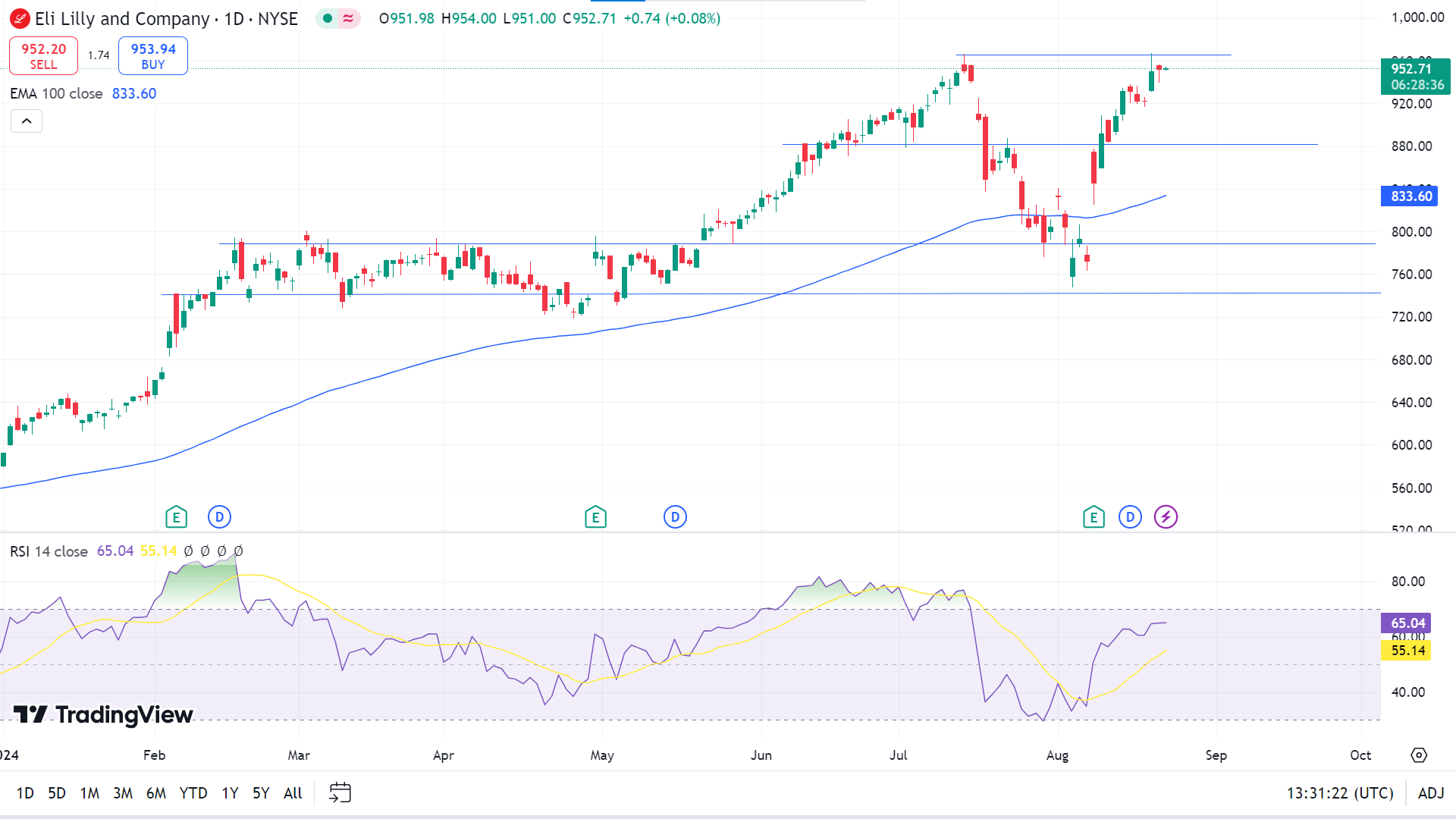

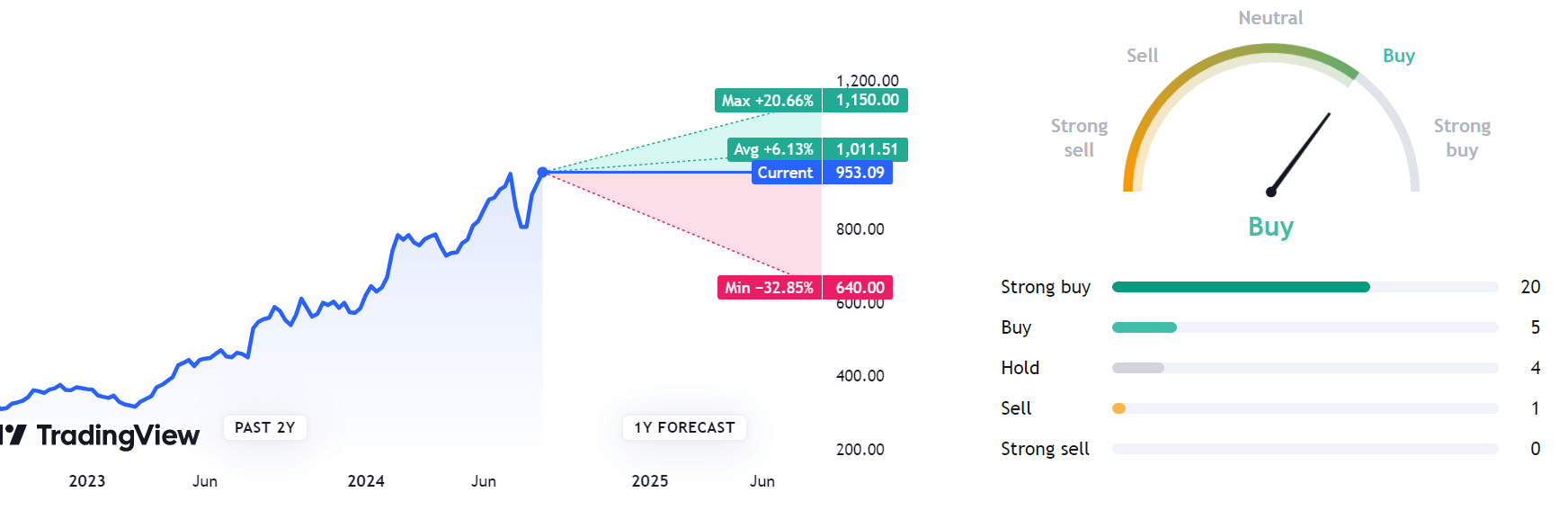

When writing, LLY stock price is 952.71, seeking to reach the previous ATH of 967.00. As many expert analysts anticipate, any breakout above that level can trigger the price to reach nearly 1150.00 by the end of 2024.

In the daily market trend, LLY trades within a stable bullish trend. The mid-2024 came with massive selling pressure. However, instead of a bearish continuation, the price formed a bottom and aimed higher with a bullish V-shape recovery. As long as the current bottom is valid, the upcoming price direction could be bullish for this stock.

Meanwhile, during this period, the downside risk is near 640.00. Looking at the daily chart, the price is floating above the EMA 100 line, reflecting bullish pressure. In contrast, the RSI indicator window supports positive price pressure as the dynamic signal line floats at 65.04, leaving buyers optimistic as the price may head toward a new ATH and meet analyst expectations.

In the meantime, the ADX indicator value of 27.14 indicates that bulls may lose power at this level and can return to the nearest support near 776.60. Any breakout can trigger the price toward the next support near 640.00.

A. Other Eli Lilly Stock Forecast 2024 Insights

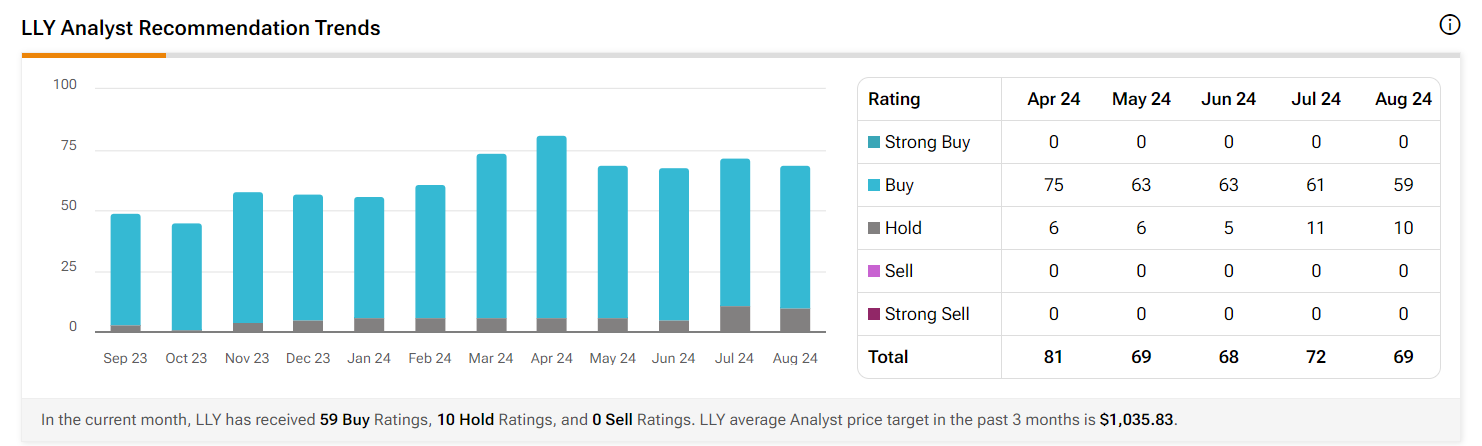

According to a recent report from Tipranks, LLY stock is one of the most potential stocks. As of the August 2024 report, no investors are suggesting selling it. However, 59 investors suggested buying it, and 10 suggested holding it. Thus, according to analysts, the asset possesses the potential to reach the average price of 1035.83 for the past three months.

Looking at the forecast, LLY has the potential to reach a high of 1150.00 in 12 months. Meanwhile, on the negative side, the price can reach 856.00.

In this forecast, 19 analysts have anticipation, whereas 17 suggest buy and hold, with suggestions coming from 2 of them. In contrast, there is no selling suggestion.

B. Key Factors to Watch for LLY Stock Forecast 2024

LLY Earnings Estimate For 2024

The earning estimation is 4.42 for the next year, between 3.82 and 5.01. This is a positive sign for the stock price, as EPS is among the key indicators that drive the asset price. Additionally, LLY beat the earnings expectations by 100% for the previous 12 months.

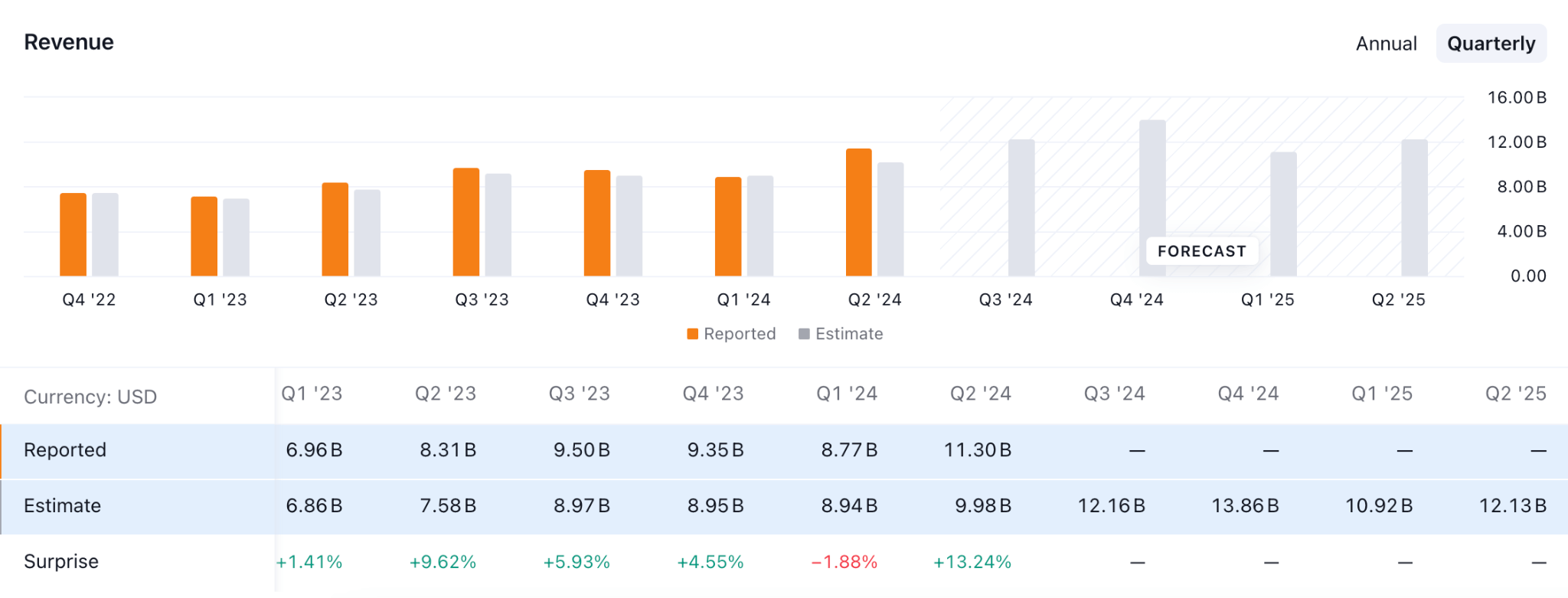

LLY Revenue Forecast for 2024

Meanwhile, the sales forecast for the next quarter is $12.13 billion, within a range of $11.36 billion and $12.66 Billion. In the previous 12 months, the LLY stock price beat sales expectations 75% of the time.

These data from earnings reports, sales reports, etc., are essential factors while anticipating the stock price, which enables the opening of potentially profitable trading positions.

Lilly Stock Forecast 2024 - Bullish Factors

- High Potential Drugs: Potential drugs, including Jardiance, Mounjaro, Taltz, Zepbound, and Verzenio, can boost the stock price of the LLY. Each drug is poised to make considerable contributions in its respective fields.

- Strategic Acquisitions: The acquisition of Morphic, with its promising drug MORF-057 for inflammatory bowel disease, highlights Eli Lilly's strategic approach to bolstering its portfolio through carefully selected acquisitions.

- Operational Efficiency: Backed by a strong balance sheet, Eli Lilly's focus on cost management and operational efficiency is expected to drive net income growth beyond revenue growth, supporting a positive outlook for LLY

Eli Lilly Stock Prediction 2024 - Bearish Factors

- Regulatory Challenges: Increased competition from many other pharmaceutical companies could impact total market revenue for LLY stock, and it could face regulatory challenges due to new drugs.

- Patent Expiration: Some of the LLY drugs are approaching patent expiration, which may lead to the introduction of generic alternatives and negatively impact the stock price.

III. Eli Lilly Stock Forecast 2025

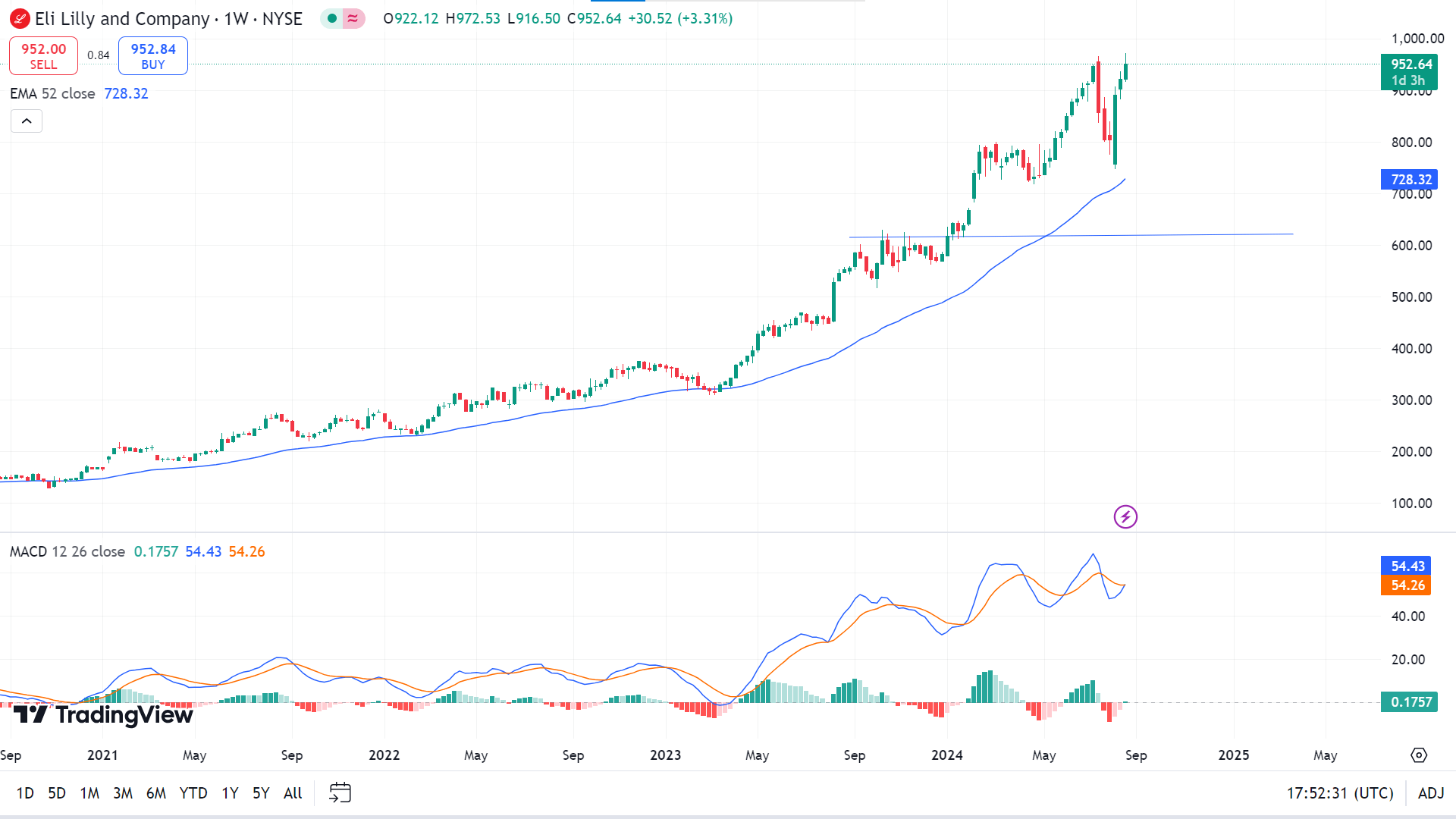

The weekly chart reveals that the LLY stock price just hit the ATH near 972.53 and may reach the anticipated level of 1437.00 by the end of 2025.

Looking at the weekly price of LLY, there is a stable upward pressure with no sign of a divergence at the all-time high level. Instead of forming a bearish continuation, the price found a bottom at the 700.00 psychological line and created bullish pressure from there. However, the immediate resistance of the May 2024 high is still protected, suggesting a limit to bulls. Looking at the long-term structure, the upward pressure is potent, and any trend trading strategy might work as a potential investment opportunity.

As the chart above shows, the price has remained above the EMA 52 line for longer. The price hovering near the 52-week high means the asset has the potential to reach resistance. In this context, a valid upward pressure above the 965.00 level with a weekly close might resume the existing trend above the 1500.00 area.

Meanwhile, although the dynamic signal lines of the MACD indicator window remain in bullish territory, the histogram bars are still red and below the midline, suggesting hope for sellers. So, the price can be returned to the nearest support, which is near 754.02, as a correction before reaching a new ATH.

A. Other LLY Stock Forecast 2025 Insights

Looking at the price prediction from Tradingview, 30 analysts give ratings on the LLY stock for the upcoming year. Twenty suggest a strong buy, and four suggest a hold position. At the same time, only one analyst suggests selling on the LLY stock for the next year. The highest position for the price analysts anticipate is near 1150.00, and the lowest level they predict is 640.00, while the average price they suggest is 1011.51 by the end of 2025.

Another platform Stockscan suggests that the average price of LLY stock may hit 1895.19 by the end of 2025. In contrast, the expected low is near 1856.68, and the high they anticipate is 1907.04, a 98.74% increase.

B. Key Factors to Watch for Eli Lilly Stock Forecast 2025

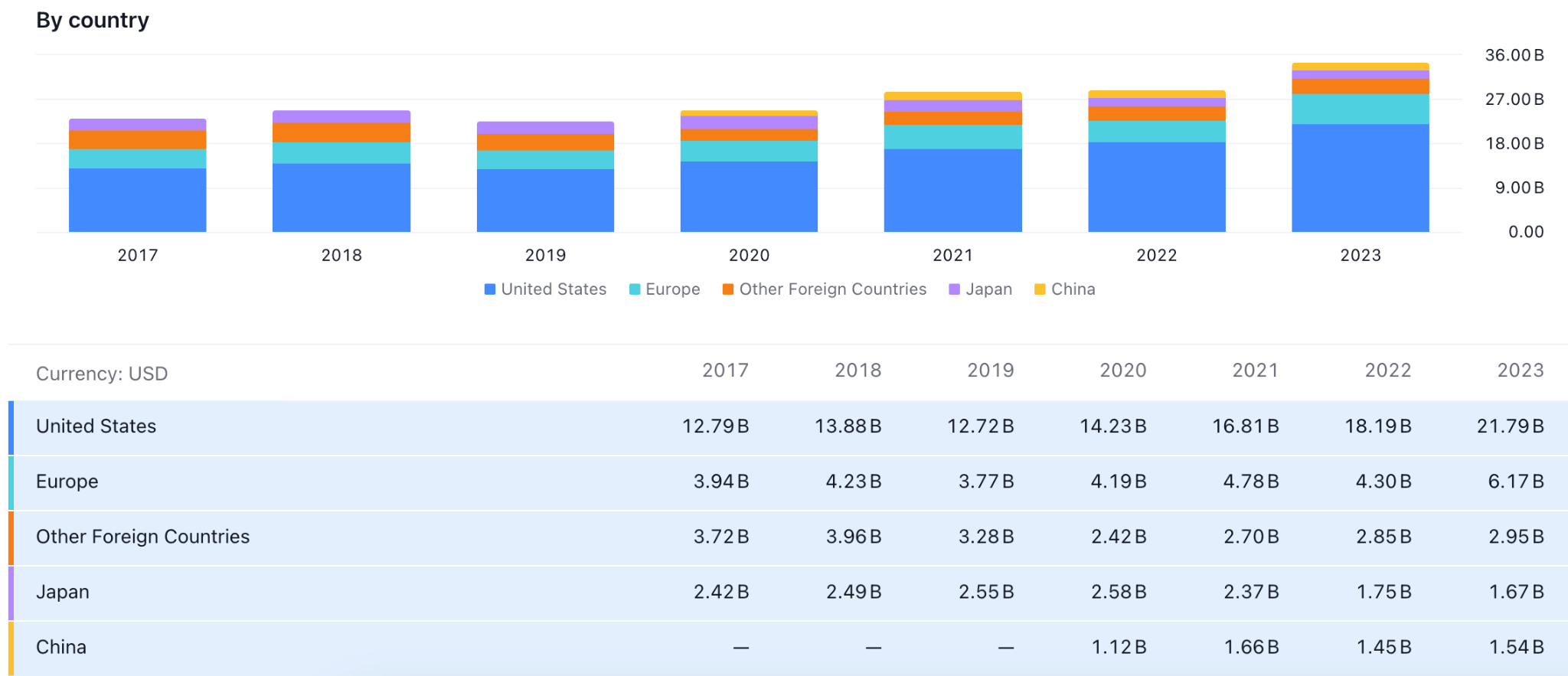

LLY By Country Revenue Analysis

Eli Lilly is expected to see continued revenue growth driven by its strong product pipeline, which includes key drugs like Zepbound, Mounjaro, and Verzenio. Analysts predict these products will rapidly contribute to top-line growth, particularly as they soar further in market penetration.

Revenue growth is another crucial factor when selecting any stock by country. The chart above shows that the major revenue of the LLY stock comes from the US, which means the microeconomic factor in the US could directly affect LLY's business.

LLY EPS Forecast For 2025

EPS, or earnings per share, is another key factor when evaluating potential stocks for investment decisions. The EPS beats 100% of the previous 12 months, which is very positive for the LLY stock and indicates that the share price may beat analysts' expectations of reaching 1150.00 by the end of 2025.

LLY Stock Prediction 2025 - Bullish Factors

- Solid Pipeline and New Products: The introduction of new drugs, including Zepbound, Mounjaro, and Verzenio, is expected to drive robust revenue growth in the upcoming year as these drugs gain broader market acceptance by that period.

- Strategic Acquisitions: Strategic acquisitions, such as purchasing Morphic and its promising asset MORF-057, might strengthen the LLY portfolio and enhance the company's competitive position.

- Expansion: The company is now focusing on expanding in the emerging market, which may diversify its revenue stream while delivering new growth opportunities. Therefore, LLY will be declared a potential stock by the end of 2025.

LLY Forecast 2025 - Bearish Factors

- Market Saturation: Some LLY drugs may face market saturation by the end of 2025, specifically in established markets, which may affect revenue growth.

- CompetitiveChallenges: Many companies are already dealing with and entering the fields of oncology, diabetes, and immunology. So, no wonder Eli Lilly will have to face pressure to maintain its contribution to the market, which could impact its profitability and pricing power.

- Regulatory Issue: Lilly may face regulatory issues regarding approvals and pricing for its new product launches, which could impact its price performance.

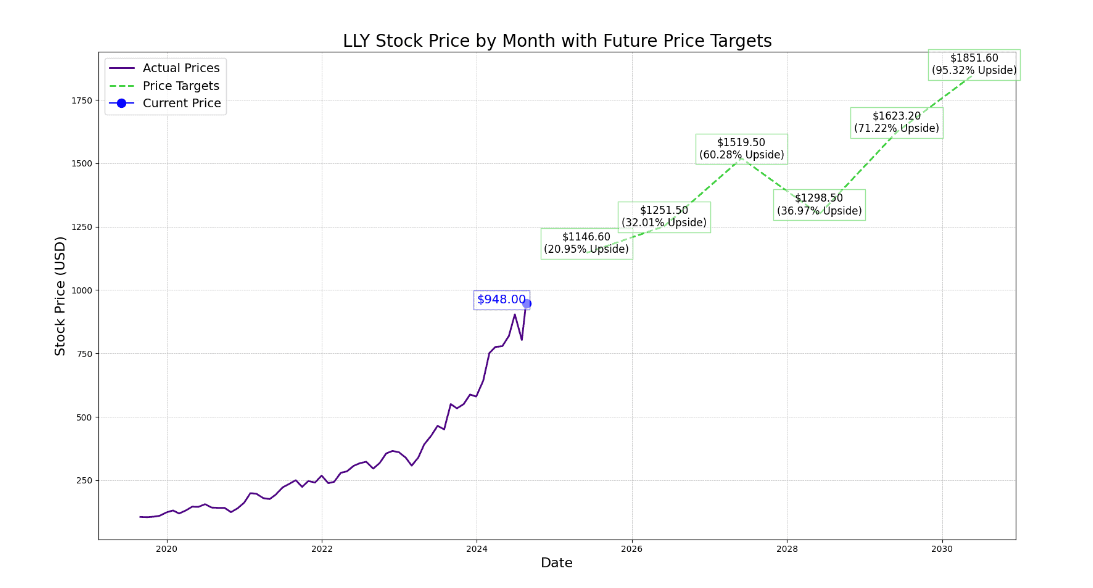

IV. Eli Lilly Stock Forecast 2030 and Beyond

The monthly chart shows the price is on a solid uptrend and may seek to reach 1851.00 over the next five years in 2030 or beyond.

The monthly timeframe of LLY represents the multi-year view, where the most bullish pressure came during the post-Covid days. Also, the current monthly candle represents a strong upward continuation as the bearish engulfing candlestick is fully reversed with a bullish one. However, the bullish tren since 2010 came with now significant downside recovery, which suggests a pending crash. Priamrily, a pump and dump scheme could appear in this stock, which will validate near-term price actions.

The Bollinger Band shows the price moving along the upper band for extended periods, indicating significant bullish pressure on the asset price. Meanwhile, the signal line at the CCI indicator moves above the upper line, supporting the bullish pressure. According to the current structure, the LLY stock price can hit 3958.65 by the end of 2030.

In contrast, when the price on the upper band of the Bollinger bands for a longer period indicates a possible retracement soon. So, any pause in the current uptrend may drive the price to drop at the nearest support, near 785.00, followed by the next support, near 601.74.

A. Other Eli Lilly Stock Forecast 2030 and Beyond Insights

Due to its strong financial performance, Eli Lilly's revenue has increased by 60% since 2016, while net income has soared by 91%. Despite a modest 7% annual revenue growth rate, the stock price has skyrocketed by 828%, driven by its future drug pipeline anticipation. In 2016, Eli Lilly traded at 13 times earnings, but this multiple has expanded to 125, reflecting the market's increasing company valuation.

Analysts anticipate a P/E ratio of 60 in 2025, with an EPS of $19.11, which may achieve the Eli Lilly price target goal of $1,140. This forecast is based on expected revenue growth of 18.37% to $52.80 billion and net income reaching $17.29 billion. By 2026, a lower P/E ratio of 50 combined with an EPS of $25.03 is expected to push the stock price to $1,251.50, supported by continued financial growth.

In the following years, the stock is projected to reach $1,519.50 by 2027 and $1,623.20 by 2029 as revenue and net income continue to increase. By 2030, with an EPS of $46.29 and a P/E ratio 40, the stock could rise to $1,851.60, reflecting sustained growth and investor confidence in Eli Lilly's long-term prospects.

B. Key Factors to Watch for LLY Stock Forecast 2030 and Beyond

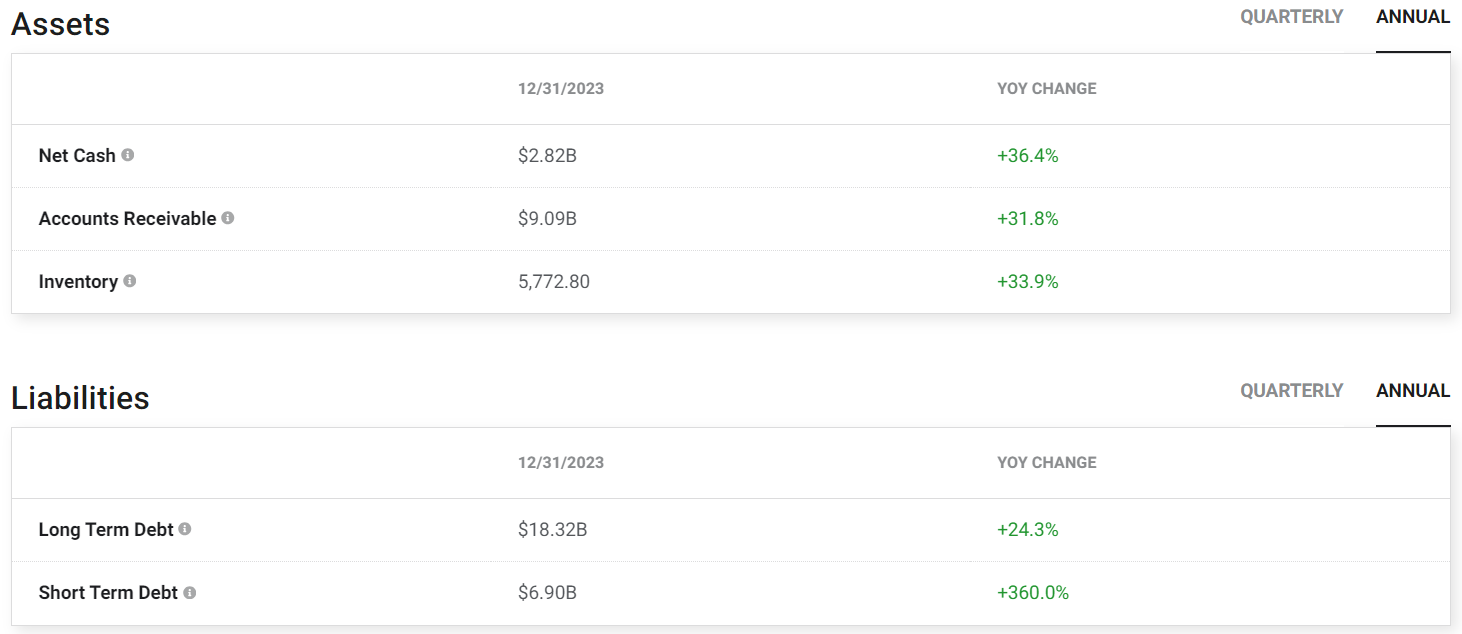

LLY Balance Sheet Position

The chart below reveals annual asset and liability growth information, which confirms that the data makes LLY stock attractive for the next five years.

As per the latest data, the yearly assets position showed a moderate surge, suggesting a business growth. The current assets position showed an average of 30% year-over-year growth, which is higher than the 24% growth in long-term debts.

LLy Growth Estimate

The growth estimate chart, earning estimate chart, and revenue estimate chart from Yahoo Finance show that the LLY stock price may soar and meet 2795.80 by the end of 2030.

LLY Stock Price Forecast 2030 and Beyond - Bullish Factors

- Balance Sheet Position: Strong Asset's position for the company has already provided a hope for bulls. If the company can maintain the growth, we may expect the growth to be extended by the end of 2030.

- Revenue Growth: LLY's revenue may reach $96.67 billion by the end of 2030, with continuous annual growth affected by the universal market expansion and solid product pipeline.

- Market Confidence: Following revenue growth, EPS, net income, etc, reflects investors' confidence, which may be sustained till 2030 to meet analysts' expectations.

Eli Lilly Stock Price Prediction 2030 and Beyond - Bearish Factors

- Competition and Valuation risk: With time, LLY may face competition from similar companies besides market saturation for its primary products. Moreover, many experts expect the P/E ratio to drop near 40 by 2030. These factors will negatively impact LLY stock price.

V. Conclusion

A. Eli Lilly Stock Outlook

Eli Lilly stock has already provided a massive return to investors since its inception and is likely to provide more in the coming years. Considering the most recent recovery after the market crash in 2024, the upward possibility is solid and can break the record high by the end of 2024.

Also, the growth is likely to extend in 2025 as the fundamental structure, earnings forecast and by country revenue remains solid. Following the trend, the 1437.00 to 1500.00 area is most likely to be tested before forming a decent recovery.

The upward pressure might find a relief after reaching the 1500.00 psychological line. In that case, a massive selling pressure might appear as a part of the liquidity grab before heading towards the 1850.00 area by the end of 2030.

B. Trade LLY Stock CFD with VSTAR

Trading a Stock CFDs, instead of buying the stock can provide opportunity to make money from bullish and bearish movements. Also, the cost of buying and selling a stock is lower compared to actual buying. Leverage is also a function to consider that can boost the gain by multiple times with a minimum deposit.

VSTAR offers a wide range of trading opportunity in LLY stock as you can buy this instrument from anywhere through the VSTAR mobile app. Also the daily market analysis, market sentiment report, top-notch customer support, deeper liquidity and maximum funds safety can make your trading journey fruitful.