Introduction

A. Recent Disney Stock Performance

With a recent closing price of $113.90, Disney stock (DIS) has demonstrated durability and upward momentum. The PE Ratio (TTM) of 69.72, representing strong earnings, and the beta of 1.41, which shows responsiveness to market fluctuations, impact the bullish trend.

Disney Stock (DIS) Peaked 52 Week High

Disney (DIS) is on a roll, hitting a new high for the year. With a 25% gain in 2024, it's outpacing the market significantly. While the momentum is strong, Disney still needs an 80% climb to recapture its all-time highs from three years ago.

Positive business developments

Disney's recent announcements reveal a renewed emphasis on profitability. During an analyst call, CEO Bob Iger highlighted their focus on building a profitable streaming service, revitalizing the film studio, and further investing in their successful parks segment.

This strategy has garnered positive attention, with Morgan Stanley raising its Disney price target based on the expectation that Disney's streaming services will soon reach profitability. Disney also maintains this goal for later in the year.

Furthermore, analysts are encouraged by Disney's continued investment in parks, viewing both streaming and parks as crucial for driving stock price growth. They anticipate improved performance from both segments as the year progresses.

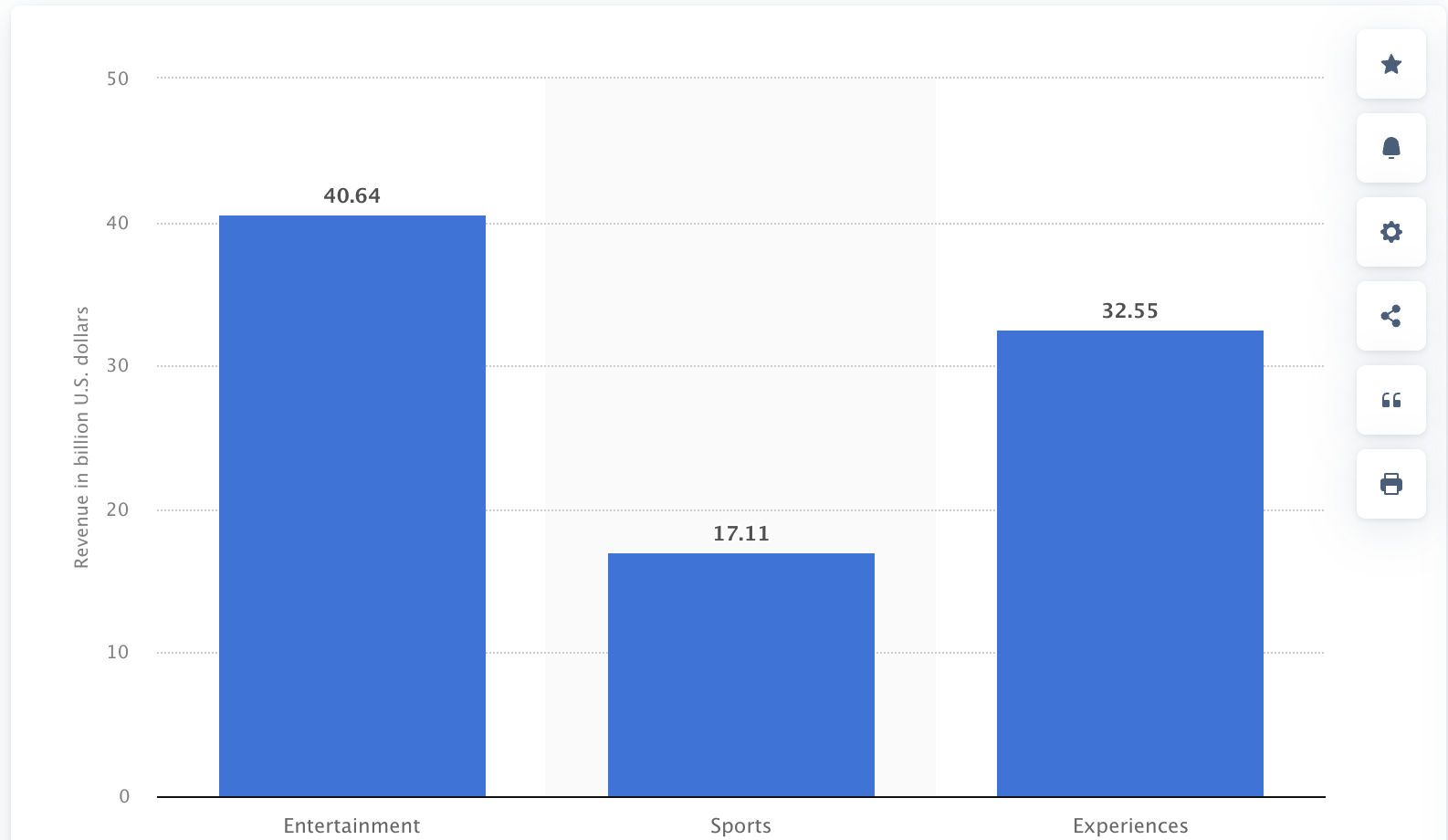

Source: statista.com

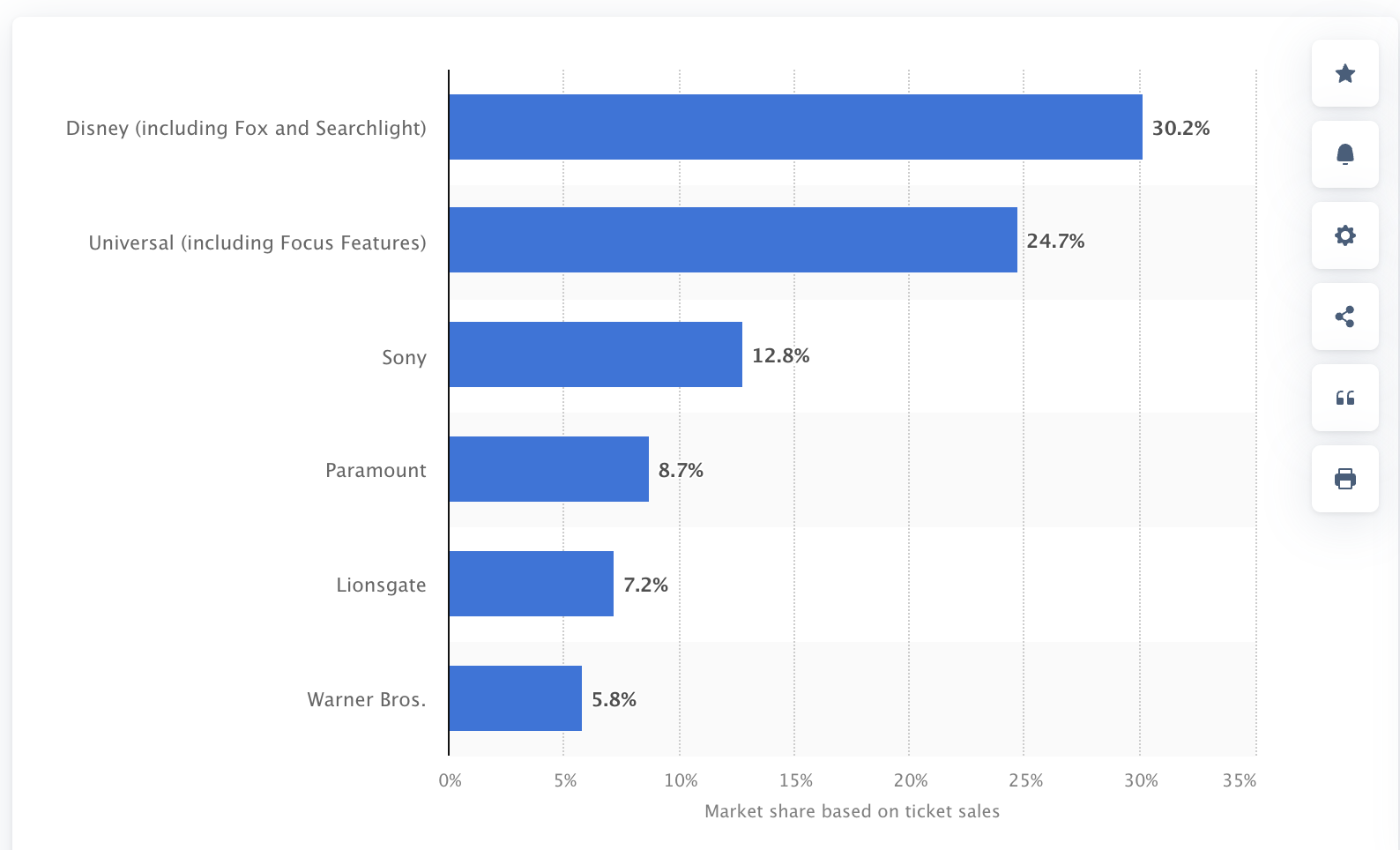

Disney Market Share of Ticket Sales

Based on data from Statista, Disney held the largest portion of ticket sales in the American movie market in 2023, accounting for a substantial 30.2%. The entertainment division emerged as its principal source of revenue, accumulating an impressive $40 billion in total.

Disney implements a comprehensive strategy by leveraging diverse channels, including theme parks, merchandise, television, film, and digital platforms, in order to captivate and captivate its audience.

Disney is widely recognized for its enduring family entertainment programs that appeal to individuals of all ages; the brand has become an icon of excellence. Notwithstanding its nontraditional approaches, Disney has consistently showcased the effectiveness of its business and expansion strategies. Disney's position among the top 10 global corporations in terms of brand value is truly remarkable.

Source: statista.com

Disney's Remarkable Acquisitions

Acquisition and merger are key elements to gauge the future growth of a company. In recent years, Disney has shown some decent acquisitions, which could be a crucial factor to look at. Let's see the list of companies that were bought by Disney:

|

Company Name |

Acquisition value |

|

Capital Cities/ABC |

$19 billion |

|

Fox Family Worldwide |

$5.3 billion |

|

Pixar |

$7.4 billion |

|

Marvel Acquisition |

$4.4 billion |

|

21st Century Fox |

$71.3 billion |

B. Expert Insights on Disney Stock Forecast for 2024, 2025, 2030 and Beyond

Based on the most recent study, technical indicators show a bullish sentiment despite the Fear & Greed Index being at 39. DIS stock experienced 19 green days out of 30 in the past 30 days, with a 6.87% price swing. Given the prediction, the current price of DIS stock will be 12.21% higher than our Disney target price by the end of 2024.

With a small 3.78% rise in 2025, Walt Disney's stock estimation is $118.17, provided the average annual growth of the previous ten years continues.

If Walt Disney maintains its current 10-year average growth rate, the stock is expected to reach $142.29 in 2025 and above $300.00 by 2030.

Let's see analysts' opinions about this stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$137 |

$163 |

$252 |

|

Coincodex |

$170.36 |

$ 114.23 |

$ 137.54 |

|

Tradersunion |

$136.5 |

$157.28 |

$319.44 |

|

Longforecast |

$156 |

$213.00 |

$300.00 |

Disney Stock Forecast 2024

As per the current condition, Disney Stock (DIS) is more likely to extend the buying pressure and reach the $130.00 level before the end of 2024.

In the weekly Disney chart, the current price shows extensive buying pressure, with a bullish crossover in weekly Moving Averages.

Considering the ongoing rally base rally formation, upward pressure is potent, where any minor downside correction could be a long opportunity. In that case, the buying pressure might find resistance at the 126.64 level before reaching the 140.00 psychological area.

Let's see the outlook from other technical indicators:

- Relative Strength Index (RSI): The 14-week RSI reached the 70.00 line, suggesting a steady buying pressure. However, the recent level stalled in the area, which could be a confluence bullish factor.

- Moving Average Convergence Divergence (MACD): The MACD Histogram remained bullish above the neutral line, where the corrective vertical line suggests ongoing buyer activity.

- Average Directional Index (ADX): The ADX line found a bottom and rebounded above the 25.00 line, which suggests a valid bullish trend.

According to Coinpriceforecast, DIS is more likely to reach the peak and test the $137.00 level before the end of 2024.

A. Other DIS Stock Forecast 2024 Insights: Is Disney Stock a Buy?

Analysts from tipranks.com projecting the DIS Stock Forecast for 2024 see an average DIS price target of $117.90, indicating a possible gain of 3.48%.

22 Wall Street analysts have offered their opinions during the last three months, ranging from a high prediction of $136.00 to a low of $82.00. The wide range of predictions highlights the differing opinions on Walt Disney's future performance. The lowest objective denotes a possible decline, while the highest target expresses hope.

Disney stock is expected to reach an average target price of $112.75 in 2024, according to stockanalysis.com, with projections ranging from $76 to $136. This implies that the price might go away from its present level of $113.58 by -0.73%. Typically, analysts suggest "Buy" in most cases. The range of projections, from possible declines of -33.08% to gains of +19.74%, illustrates varying expectations.

In order to make wise selections, investors need to take multiple points of view into account. Keeping an eye on market developments and trends might assist in modifying investment plans appropriately. It takes attention and flexibility to navigate the market effectively when projections change.

B. Key Factors to Watch for Disney Stock Forecast 2024

Many significant financial indicators offer insightful information as investors predict Disney stock performance in 2024. Making sensible investment decisions and identifying trends that could affect the company's future are possible with careful examination of the income statements, balance sheets, and cash flow.

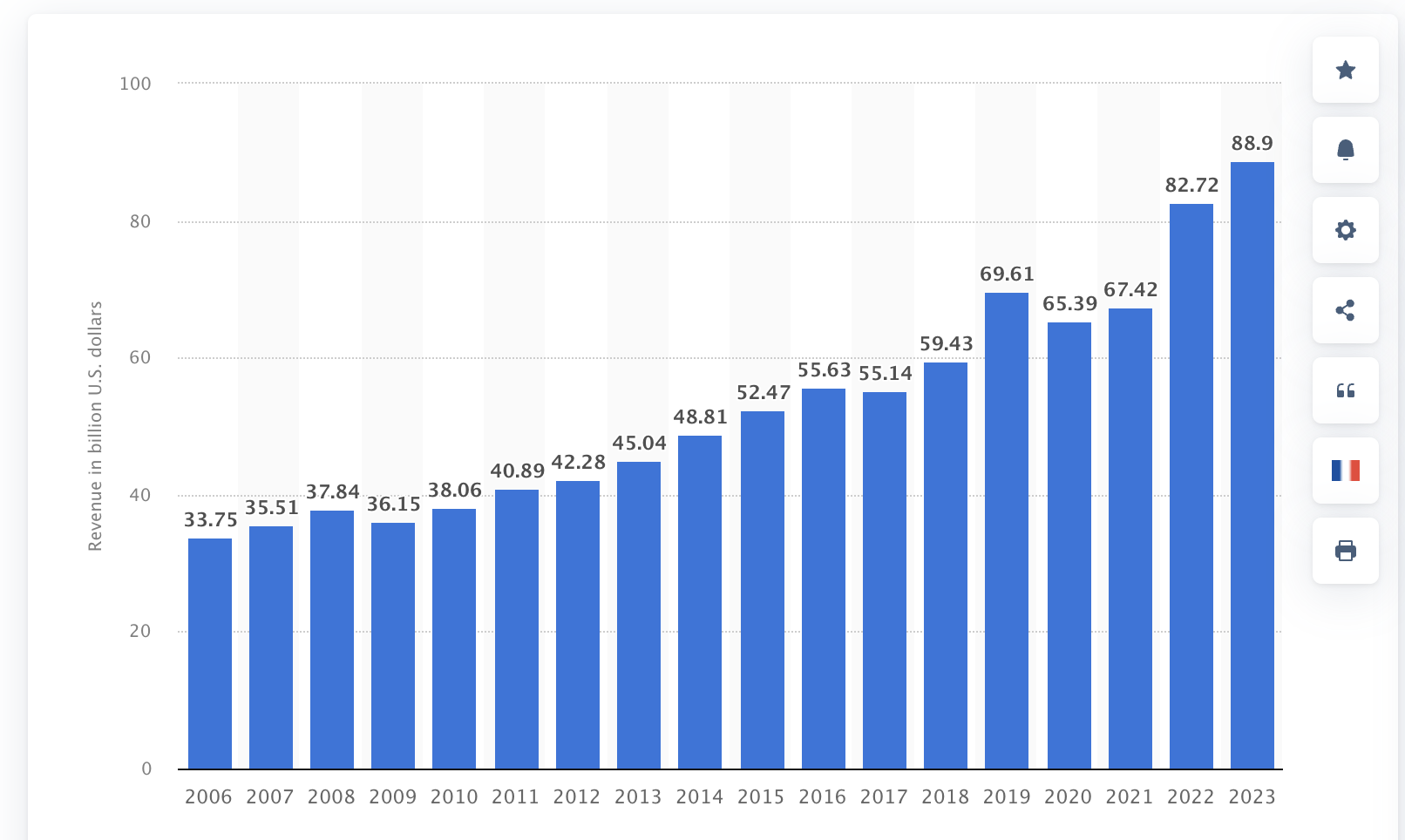

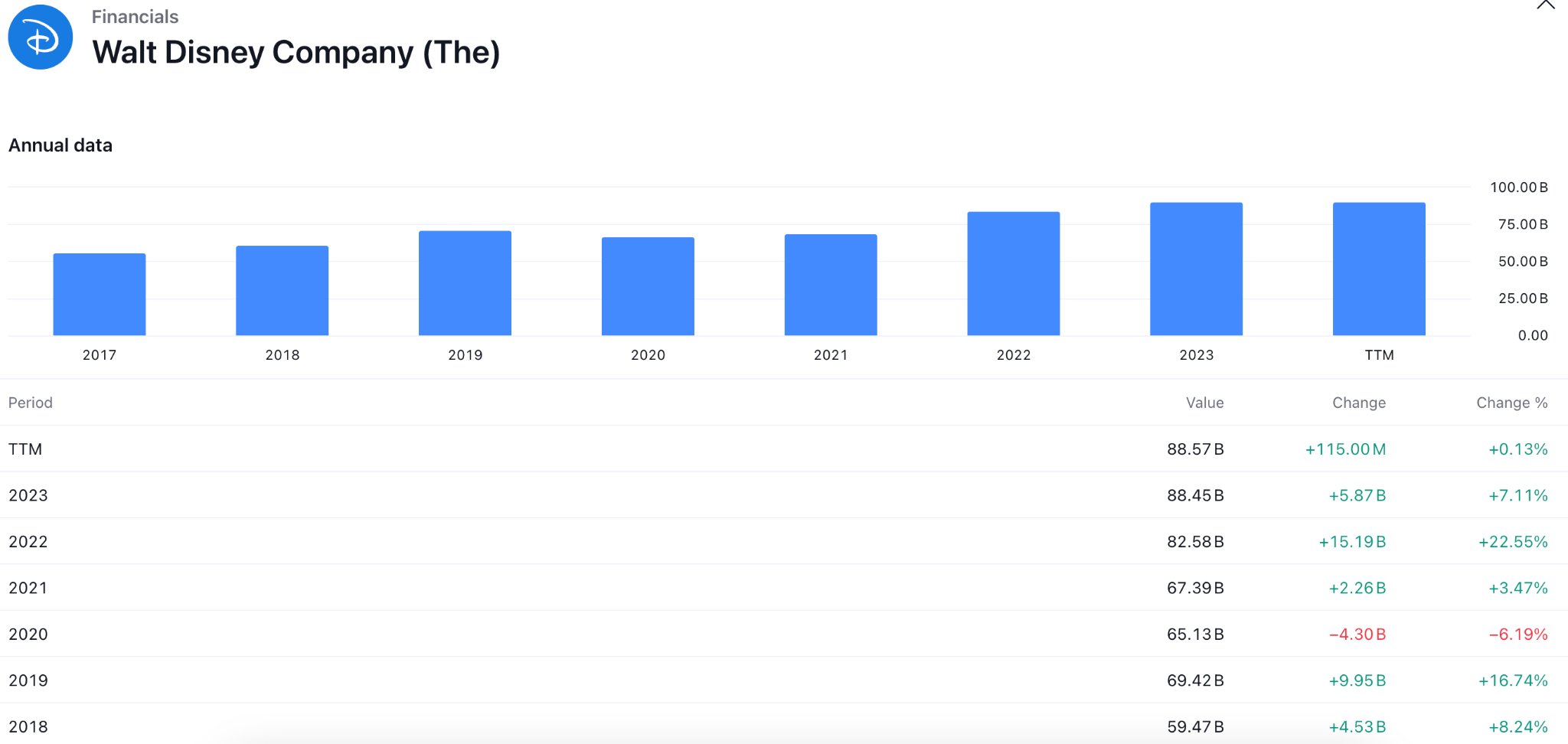

Revenue Growth

Disney's revenue increased steadily, ending September 2023 with a trailing twelve-month (TTM) total of $88.45 billion. The company's robust business model and ability to produce significant profit from a variety of operations are shown by this growing trend.

It is advisable for investors to monitor revenue patterns thoroughly and take note of Disney's growth-maintaining strategy. Disney can keep increasing its revenue by breaking into new areas, providing cutting-edge content, and establishing business alliances.

Market Fluctuations

Disney stock is impacted by the stock market's fluctuations. The cumulative value of all Disney shares is reflected in the market capitalization, which stands at $207.04 billion. Short-term shifts are evident in recent stock moves, such as the range of $112.27 to $115.19 at the time of writing. Investors should remain watchful about these shifts, taking into account elements such as the prevailing economic circumstances, sectoral patterns, and corporate announcements.

Maintaining a focus on the 52-week range makes it easier to determine the adaptability of the stock to movements in the market.

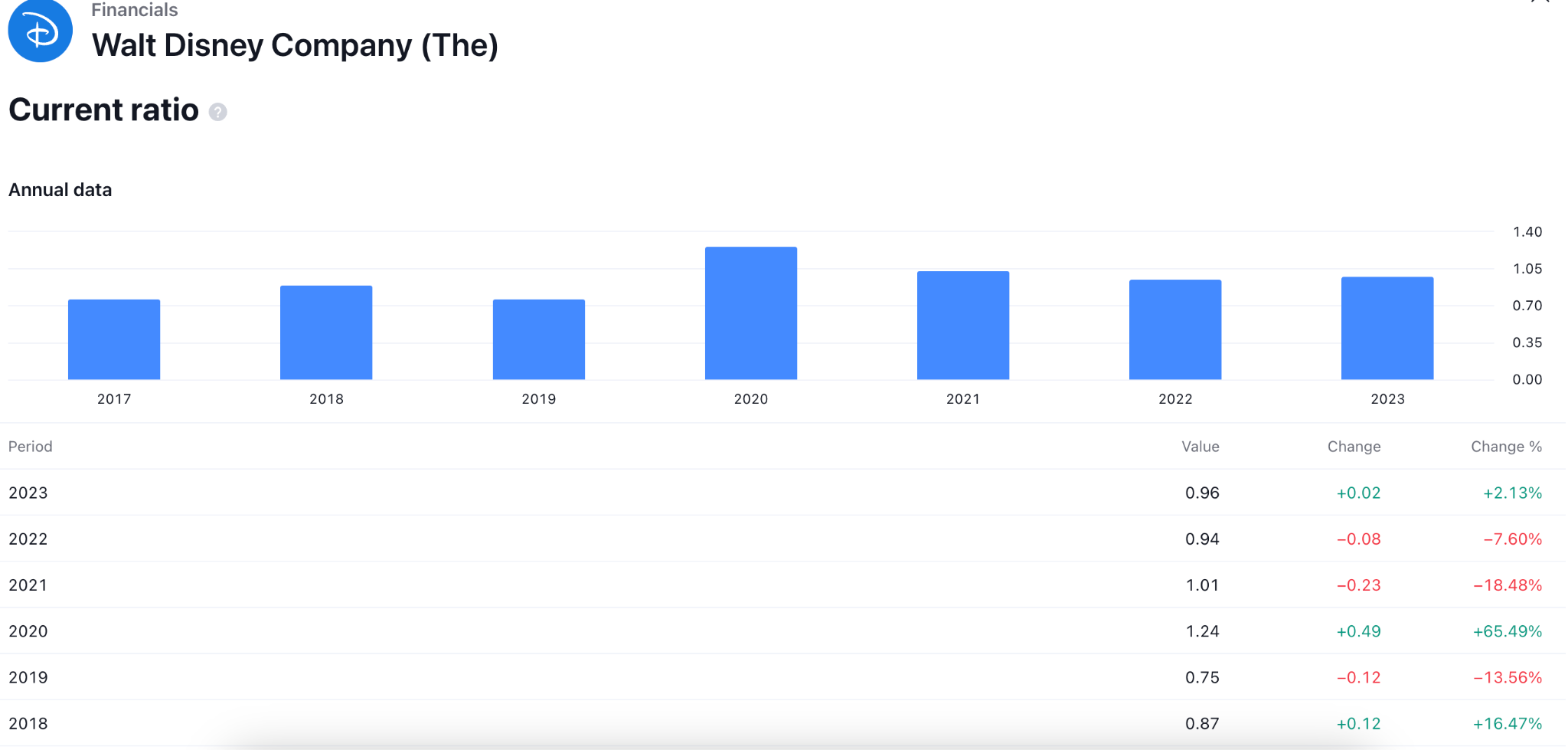

Financial Health and Liquidity

Disney has a strong financial foundation, as can be shown by thoroughly reviewing its balance sheet. The corporation has a diverse portfolio of both current and non-current assets, totaling $205.58 billion in assets. Interestingly, the $14.18 billion in cash and cash equivalents covers operating demands and strategic initiatives with liquidity.

On the other hand, investors need to evaluate Disney's liabilities, such as its short- and long-term debt, to make sure its financial commitments are still reasonable.

Cash Flow Dynamics

Analyzing Disney's operating cash flow provides important information about the company's financial situation. The operating cash flow of $13.02 billion over the TTM period indicates a solid cash generation from the company's core operations. Investors want to concentrate on the net change in cash, which represents recent swings at -$1.27 billion. An investor can assess Disney's capacity to finance expansion plans, settle debt, and provide value to Disney shareholders by analyzing the cash flow trends.

Recent developments

Disney's comeback picked up steam on February 8, when the company's shares saw a noteworthy 11.5% increase after its fiscal first-quarter results release. Notwithstanding flaws, the outcomes showed a promising trend toward streaming profitability. Investor confidence was bolstered by Disney's strategic initiatives, which included a joint venture for sports streaming with Fox and Warner Bros.

Discovery that is scheduled to launch in the fall of 2025 and partnerships with Reliance Industries in difficult areas like India. Disney's plans to raise pricing at Disney World, together with the company's 50% dividend hike and strong theme park performance, contributed to the company's growing confidence in its diverse strategy for long-term growth.

Disney Stock Predictions for 2024 - Bullish Factors

With over 200 million users combined, Disney's streaming services—Disney+, ESPN+, and Hulu—continue to build their customer bases. Disney's focus on producing original content and growing internationally is a major source of revenue potential for this area.

Disney's enormous content collection, which includes well-known brands like Pixar, Marvel, and Star Wars, continues to be a key component of its success. New Marvel phases, Star Wars shows, and Pixar movies are just a few examples of upcoming releases that are expected to increase income and engagement on a variety of platforms.

Disney's theme parks are expecting more visitors as a result of the post-pandemic recovery in international travel. The impending revenue recovery and steady increase are indicated by the pent-up demand for immersive entertainment as well as Disney's ongoing park expansions and attractions.

DIS Stock Forecast 2024 - Bearish Factors

Disney is the industry leader in entertainment, but there are worries about market saturation, particularly in streaming, where Netflix, Apple TV+, and Amazon Prime Video are all tough rivals. This competition could hamper Disney's projected expansion in subscribers and market share.

Disney bears considerable expenses for its large-scale investments in technology, content creation, and theme park upgrades. These expenditures, while necessary for long-term growth, may temporarily impair profitability, particularly if revenue growth doesn't outpace cost increases.

Concerns about antitrust and content censorship pose further regulatory dangers. Increased regulatory scrutiny might affect Disney's finances and investor sentiment, resulting in compliance expenses, content limitations, or divestitures. Disney will need to overcome these obstacles if it wants to continue to prosper.

Disney Stock Forecast 2025

Considering the ongoing market development, Disney stock (DIS) is more likely to extend the buying pressure and reach the 160.00 level, which is above the crucial Fibonacci Retracement level.

In the weekly Dinney Stock (DIS) price, the ongoing bullish pressure is more likely to reach the Fibonacci Retracement level from the 2021 high to the 2023 low, which is at the 140.77 level.

The bullish crossover among dynamic lines with a rising RSI line suggests significant buyer activity in the market. In that case, the ongoing momentum could find resistance at the 140.00 level before reaching the 170.00 psychological line.

Disney Stock Forecast 2025 Using Bollinger Bands

In the recent market condition, DIS found a bottom at the Lower Bollinger Bands, where a bullish breakout has come from. Moreover, a considerable correction is seen from the middle Bollinger Bands before reaching the peak.

According to this context, a considerable downside correction is pending by the middle of 2024 before offering a long opportunity. A solid downside momentum and a bullish reversal from the MIddle Bollinger Bands could be a decent long opportunity, anticipating a new high above the 120.00 level.

Disney Stock Forecast 2025 Using Supply Demand

The ongoing buying pressure from the 79.27 bottom came with a solid rally base rally formation, where the near-term demand zone is at 96.32- 88.46.

As long as the current Disney share price trades above this crucial zone, we may expect the buying pressure to extend in the coming days. Considering the ongoing bullish wave, the price is more likely to reach the 127.47 supply level within 2025.

According to the report from Coinpriceforecast, DIS may continue moving higher and reach the $163.00 level, while Longforecast suggests it to be above the $213.00 level.

A. Other DIS Stock Prediction 2025 Insights: Disney Stock Buy or Sell?

As per topgraphs.com, the beginning of January 2025 at $246.11, a significant increase of 118.05% over the previous month, the projections indicate a steady climb for the duration of the year. The projected DIS stock price soars to $275.20 by December 2025, a whopping 143.82% gain.

The stock projections from analysts of Stockscan.io for Disney (DIS) in 2025 show a changing environment. A high Disney stock price target of $138.54 and a low DIS stock price target of $64.32 indicate significant swings in the estimated price of $101.43. With prices surging at roughly $131.82 and $131.95, respectively, in January and February, which indicate a bullish trend, there have been gains from current rates. Initially, prices are expected to take a significant dip in April and May, falling to $99.13 and $82.45, respectively, signaling a bearish turn.

B. Key Factors to Watch for Disney Stock Price Prediction 2025

Disney projects an average stock price of $120 by 2025, highlighting its outstanding streaming metrics, post-pandemic recovery, and blockbuster releases. Projections for 2026 call for an average stock price of $125, propelled by the expansion of streaming, well-run theme parks, and prosperous franchises. The prognosis calls for an average stock price of $135 in 2027, with record-breaking films and 200 million Disney+ members among the milestones.

As we go toward 2028, a revolutionary phase is expected to focus on lucrative streaming and sustainable growth, with an average stock price of $145. Disney's strategic adaptability fits very well with streaming trends and successful blockbuster brands, but managing issues like growing expenses and competition from other streaming services requires careful planning.

Financial Performance and Projections

Disney's income statement analysis shows steady growth, with operating income of $9.935 million showing ongoing profitability. The net income available to common shareholders is positive and continuing operations are trending upward. At 1.22, earnings per share (EPS) provide a positive image. Moreover, the current quarterly forecast is set to be positive as shown in the above image.

Balance Sheet Strength

Disney's balance sheet indicates strength with strong assets totaling $205.579 billion, including $32.763 billion in current assets. Goodwill, intangible assets, and property, plant, and equipment are examples of non-current assets that make an important contribution. With liabilities of $92.567 billion, financial stability is ensured by a manageable debt structure.

Streaming Business

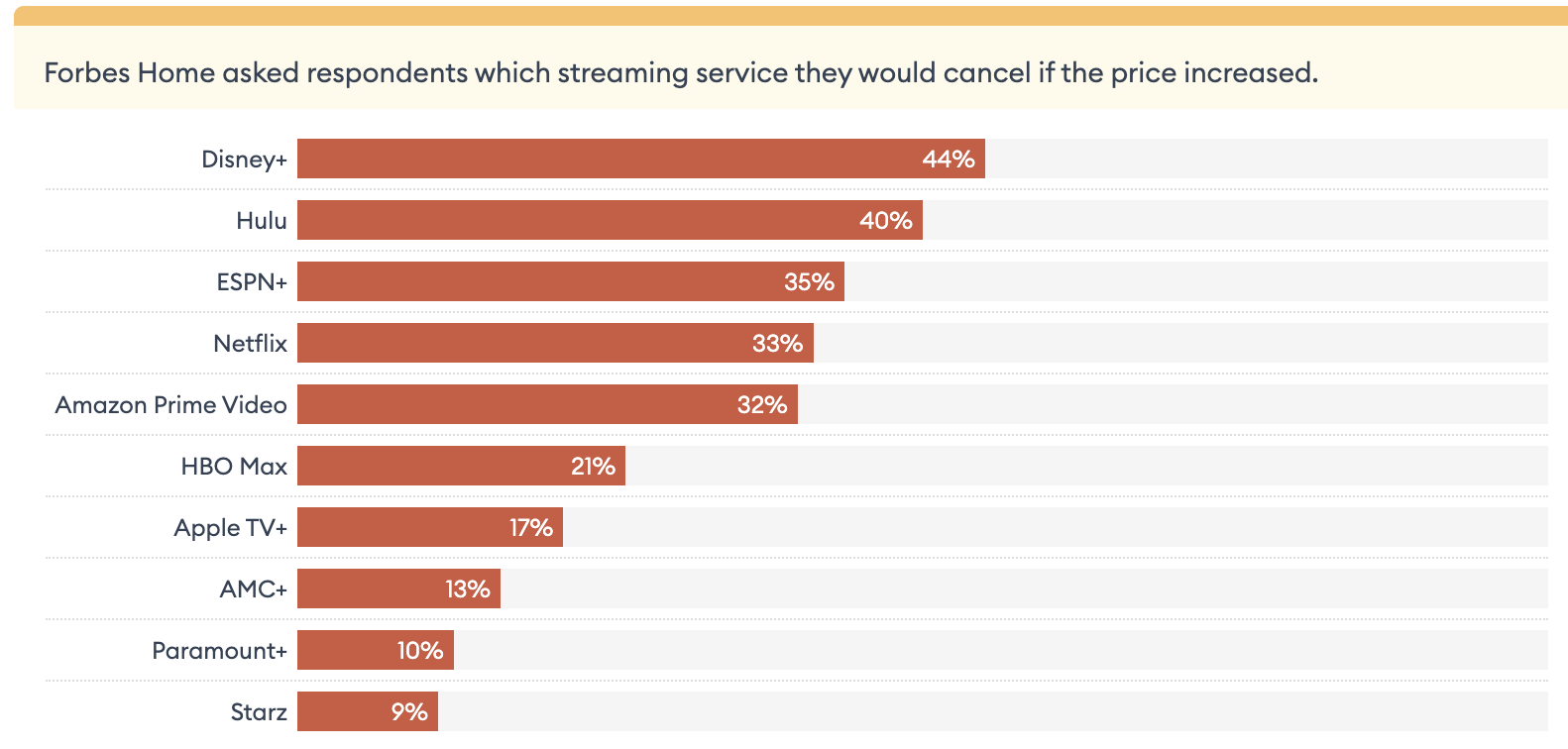

Source: forbes.com

The continued success of Disney+ and its ability to attract and retain subscribers is crucial. Look for subscriber numbers, churn rate (cancellation rate), and average revenue per user (ARPU).

Moreover, the quality and quantity of content offered on Disney+ and other streaming platforms like Hulu and ESPN+ will significantly impact subscriber growth and engagement. A closer attention to these factors could help investors to find the price direction for this stock in 2025.

Disney Stock Price Prediction for 2025 - Bullish Factors

Disney's revenue has increased steadily over the years, reaching $88.9 billion in the TTM that ends in September 2023. Media networks, parks, studio entertainment, and direct-to-consumer services are some of the origins of this increase. It is encouraging because parks, resorts, and cruises are predicted to recover after the pandemic.

Disney's streaming services have done well, particularly Disney+ with its expanding global subscriber base, as have Hulu and ESPN+. Disney's heavy involvement in this space is helpful as streaming grows in popularity.

Disney has a good film schedule for 2025, with highly anticipated movies like the Avatar sequels, and legendary properties like Marvel and Star Wars. With $205.6 billion in assets and $99.3 billion in equity, Disney has a secure financial position that allows for strategic initiatives and investments, which improves the stock's prospects.

DIS Stock Forecast 2025 - Bearish Factors

There is a negative outlook on the possibility of rising labor, content creation, and marketing expenses. Investors should keep a close eye on this issue because increased spending could have an impact on Disney's overall financial situation.

After experiencing a standstill due to the epidemic, the film and television production pipelines continue to face obstacles. Any hiccups or delays in this process could prevent content from being released on schedule, which could have an effect on box office receipts and viewer engagement.

Many platforms are fighting for the attention of subscribers in the increasingly competitive streaming market. Disney+'s impressive expansion may be hampered by increased competition, which might make it more difficult to keep and acquire members. This could also have an impact on the stock's spectacular rise.

Disney Stock Forecast 2030 and Beyond

Disney stock (DIS) found a solid bottom at the 79.27, from where an ongoing bullish impulse is present. Therefore, the long-term Walt Disney stock forecast is solid, which may test the 202.99 level within 2030.

In the monthly timeframe, the recent price shows a stable momentum above the 79.27 static level. Moreover, the dynamic 20-month EMA is violated by bulls but the 100-month SMA is still protected.

In that case, investors should monitor how the price reacts on the 120.00 to 130.00 zone as a successful break above this area could open the room for reaching the 200.00 level.

Let's see 2030 Disney stock forecast from other technical indicators:

- Relative Strength Index (RSI): The 14-month. RSI reached the 70.00 line, with no sign of a downside reversal. It is a sign of an ongoing strong trend, which could extend the buying pressure in the coming months.

- Moving Average Convergence Divergence (MACD): The histogram remains steady above the neutral line, while the signal line is above the histogram with a bullish continuation opportunity.

- Average Directional Index (ADX): The ADX line showed a strong rebound from the 20.00 line, suggesting an ongoing market trend in the monthly chart.

According to Coinpriceforecast, the price may move higher towards the 252.00 level, while Tradersunion forecasted it to be at the 314.99 level.

A. Other DIS Stock Forecast 2030 and Beyond Insights: Is Disney a Good Stock to Buy?

Analysts from topgraphs.com forecast a remarkable ride for Walt Disney stock in 2030, with a consistent upward trend suggesting strong growth opportunities. The projection indicates bullish momentum throughout the year, with a start price of $359.53 in January 2030 - a stunning 218.54% increase from the current price. The projected share price rises to $369.97 by December 2030, a significant 227.79% increase. These estimates demonstrate Disney's potential to generate significant profits thanks to its robust business strategy, popular streaming services, and post-pandemic recovery. Disney stock might appeal to investors looking for long-term gains, but they should be cautious given market volatility.

Looking ahead, analysis from freejobpoint.com, points to some encouraging trends for Disney. Building on past successes, Disney stock is expected to fluctuate between $235 and a peak of $269 in 2030. Forecasts indicate a potential low of $280 and a potential high of $300 by 2035. It is anticipated that in 2040, there will be a gradual increase, beginning at $310 and peaking at $328. Disney stock is expected to reach a minimum of $430 in 2050, during a period of prosperity. These observations provide investors with a preview of possible long-term growth as Disney's appeal grows. Remain informed when making wise investment choices.

B. Key Factors to Watch for Disney Stock Forecast 2030 and Beyond

So, is Disney stock a good buy? Disney stock projections for 2030 and beyond are analyzed by taking into account a number of important variables, such as market trends, industry dynamics, financial performance, and future development potential. The following is a summary of the key components to watch:

Disney - Business Specific Factors

Source: statista.com

Considering the management's perception, investors should closely monitor how the management shows their perspective on these fields:

- The strength and depth of Disney's content library, including iconic franchises like Marvel, Star Wars, and Pixar, are crucial long-term assets.

- The company's ability to continue creating high-quality and engaging content will be essential.

- The ability to expand its global reach, diversify its revenue streams, and enter new markets will be crucial for long-term growth.

- The vision, strategic decision-making, and execution capabilities of Disney's leadership team will play a significant role in navigating the future price direction.

Industry-specific Factors

- Disney's competitive landscape will persistently be influenced by the media and entertainment industry's enduring transformation. The company should monitor what competitors are doing and how they can become a threat.

- Alterations in governmental regulations pertaining to the production of content, the ownership of streaming rights, and intellectual property may have an effect on the business model and profitability of Disney.

- The future success of Disney may be impacted by enduring changes in consumer preferences concerning the consumption of content, experiences at theme parks, and brand loyalty.

Macroeconomic Factors for Disney Stock Price Prediction 2030 and Beyond

Long-term macroeconomic factors include the following matters:

- Long-term economic patterns, specifically in pivotal economies such as the United States and China, have the capacity to exert a substantial influence on consumer expenditure and the overall revenue prospects of Disney.

- Streaming technology, virtual reality, and artificial intelligence advancements have the potential to substantially transform the media and entertainment industry, necessitating Disney to innovate and adjust in order to maintain its competitive edge.

- Alterations in worldwide demographics, including the expansion of developing countries' middle classes and the aging of populations, may present Disney with fresh prospects in particular markets and content segments.

Disney Stock Predictions 2030 and Beyond Bullish Factors: Will Disney Stock Go Up?

Disney's revenue has been rising gradually, and it just reached $88.9 billion. Its substantial income generating is seen in this growing trend.

DIS provides stability against market fluctuations with its many business areas, which range from media networks to amusement parks. It is a pioneer in the streaming era because of its ownership of well-known content developers like Pixar and Marvel.

Disney's financial strength, which supports future expansion, is demonstrated by its $205.6 billion in assets and $99.3 billion in equity.

Let's see what other factors that can affect Disney stock in 2030 and beyond:

Content and Franchises

- Star Wars, Marvel, and Disney animation are powerhouses. Disney's ability to keep these relevant and create engaging new content within them will be crucial.

- Disney has a history of strategic acquisitions (Pixar, Marvel). Identifying and integrating valuable properties could be a growth driver.

- Disney+ is a global platform. Catering content to diverse audiences and emerging markets will be important.

Streaming Dominance

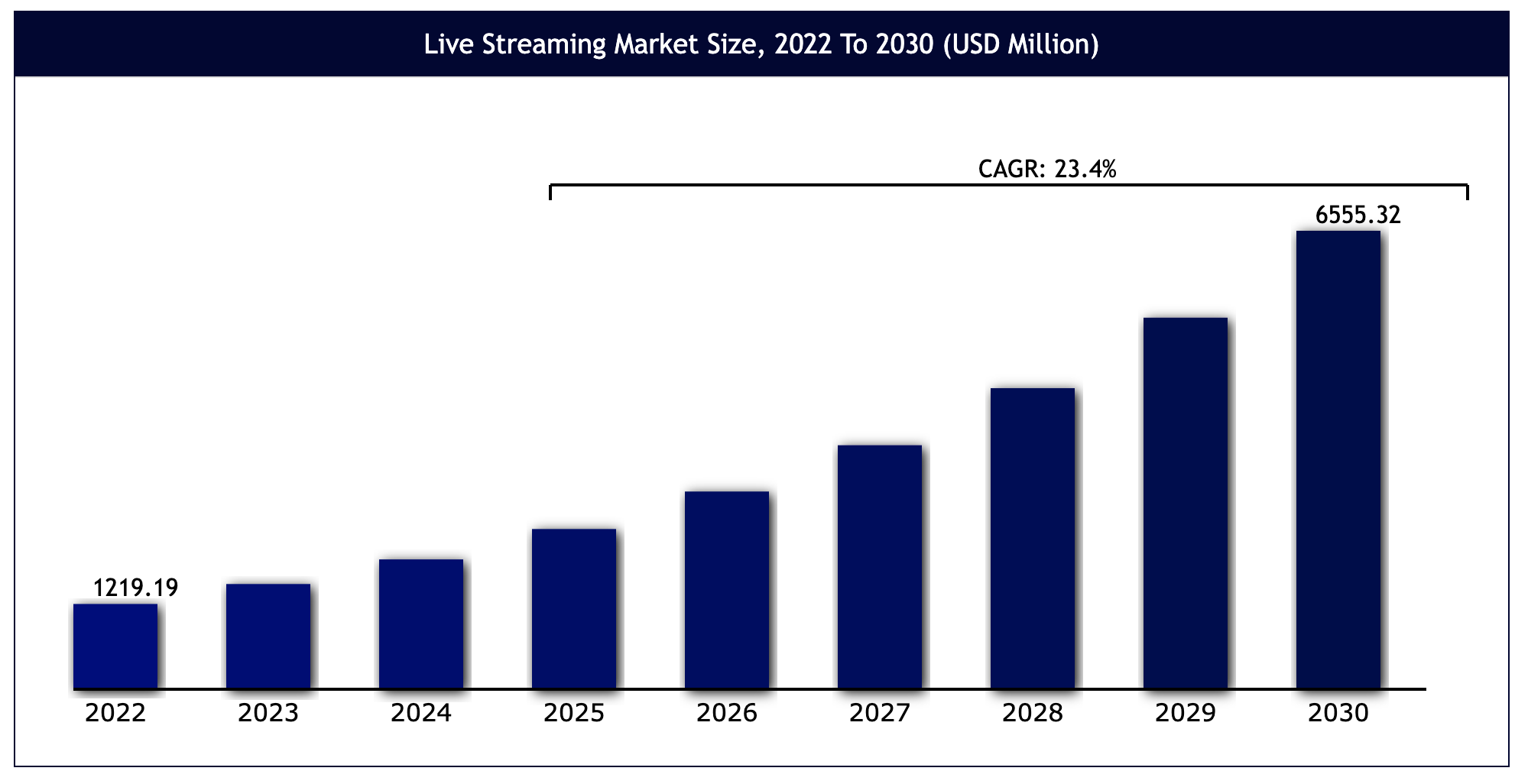

Source: vantagemarketresearch.com

- Subscriber base expansion and maintaining a competitive edge against other streaming giants will be paramount.

- Understanding how people consume content (mobile, interactive experiences) and adapting delivery methods is key.

Theme Parks and Experiences

- Building new theme parks in strategic locations and incorporating cutting-edge technology like VR will be attractive.

- Creating unique guest experiences that extend beyond rides and shows will be a differentiator.

- The potential of the Metaverse for immersive storytelling and experiences needs to be explored. AI can personalize guest experiences, optimize park operations, and enhance content creation.

DIS Stock Forecast 2030 and Beyond - Bearish Factors

The continuous rise in operating costs, especially in areas like general operations, sales, and administration, may have an effect on profitability as a whole. Maintaining continuous expansion requires efficient cost management.

With $42.1 billion in outstanding long-term debt, Disney is a cause for concern, particularly in light of existing debt repayment patterns. Investors ought to keep a close eye on the company's debt management and reduction plans.

Disney has revealed positive net income each and every time, but there have been variations. Investors must carefully examine the variables causing these fluctuations and evaluate Disney's capacity to sustain steady profitability.

Even with positive stock forecasts, results might be impacted by sentiment and market circumstances. To meet or exceed these projections, Disney will need to skillfully navigate shifting consumer tastes and industry trends.

Disney Stock Price History Performance

Disney stock has seen a turbulent ride over the last five years due to various market and company-specific variables. Analyzing the historical data from March 6, 2019, to March 6, 2024, gives us important information about the course of the stock.

- 2019: Disney stock began trading at $136.37 in March 2019 and fluctuated, peaking at $143.34 in August 2019. In addition, the company announced a substantial DIS dividend in July. December 2019 saw the stock close the year at $144.63, and it started 2020 strong at $145.29. However, the COVID-19 pandemic struck hard, resulting in a precipitous drop to a low of $79.07 in March 2020, which represented the difficult times for the business.

- 2020: Disney stock increased to $131.87 in August 2020, when the market rebounded. The rest of the year demonstrated the company's persistence and the market's trust in its recovery, which saw a constant rising trend that ended at $181.18.

- 2021-2022: DIS stock began 2021 at $182.26 and reached a top of $193.23 in March, indicating optimism despite persistent difficulties. $154.89 was the year's final value in December. The stock began 2022 at $146.70 and fluctuated, but it remained over $100, ending in December at $86.88.

- 2023-2024: Disney stock started to rise in 2023; it started the year at $99.19, and by March 2024, it had reached $112.87. Notable occurrences included a dividend in December 2023 and a peak in February 2024 at $115.19.

Disney stock is clearly traded, with significant monthly volumes ranging from millions to billions of shares, according to volume data analysis. As a result, the instrument did not disappoint investors by providing higher returns on a monthly and yearly basis.

Based on the current market data, DIS stock is trading at 110.32 level. Considering this, the return to investors is as follows:

|

Timeframe |

Return |

|

1 week |

-1.51% |

|

1 month |

+16.06 |

|

6 months |

+38.26 |

|

Year to date |

+26.32 |

|

1 year |

-9.81% |

Conclusion

An in-depth analysis of Disney's stock history indicates significant turning points impacted by various variables. Investors must consider pricing projections for 2024, 2025, and 2030. Although accurate forecasts depend on numerous factors, keeping an eye on industry trends and milestones can help inform choices.

The analysis conducted by VSTAR highlights the significance of trading CFDs on Walt Disney Stock as a dynamic way to profit from market fluctuations. As the outlook develops, paying close attention to price movements and heeding VSTAR's recommendations will help shape comprehensive investing plans for handling Disney stock.

How to buy Disney Stock

Finding a regulated and trustworthy platform to buy Disney stock is crucial, and VSTAR would be a good choice for trading this stock. Moreover, trading cost is a crucial factor to look at. In VSTAR, investors can buy their favorite stock CFDs with the following trading benefits:

- Super Low Trading Cost

- Deep Liquidity

- Lightning Fast Execution

- Fully Regulated

The mobile portability could be another benefit for traders as they can open or close a position directly through the VSTAR mobile app. Besides, extensive learning materials, regular market analysis, and top notch customer support could make your trading journey flawless with VSTAR.

FAQs

1. Is Disney a Buy, Hold, or Sell?

Based on the current price near the 52-week high, many analysts would likely rate it a hold.

2. Is Disney stock expected to rise?

Most analysts expect modest upside potential given the strong brand and streaming growth.

3. What is the analyst price target for DIS?

According to recent analyst reports, the average 12-month price target for DIS is around $125.

4. What is the forecast for Disney stock?

Forecasts call for mid-to-high single digit revenue and earnings growth driven by Disney+ and parks recovery.

5. What is the Disney stock prediction for 2025?

Estimates range from $130 to $150 per share by 2025 if they execute well.

6. Who is the largest shareholder of Disney?

The Vanguard Group is the largest institutional shareholder, owning around 7.5% of Disney's outstanding shares.