I. Recent Dell Stock Performance

DELL Forecast from Conference Call

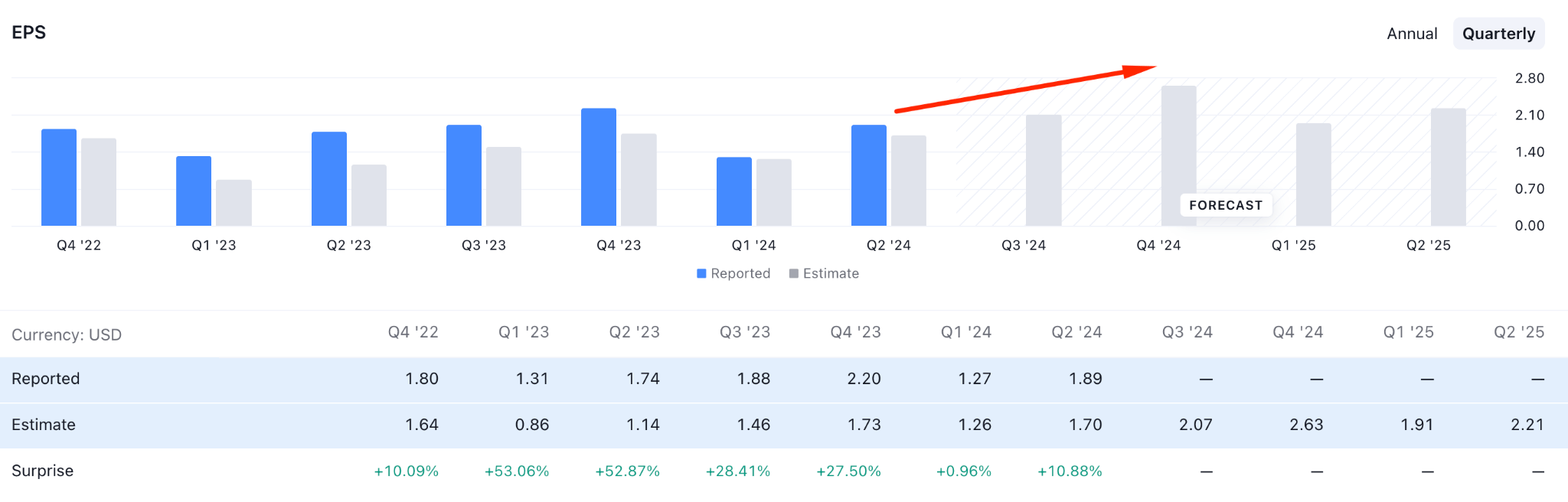

For the quarter ended August 2, Dell reported a 9.1% year-over-year revenue increase, reaching $25 billion, primarily driven by an 80% surge in servers and networking revenue to a record $7.7 billion. Meanwhile, EPS rose by 8.6% to $1.89.

According to Yahoo Finance, Wall Street's analysts predicted $24.5 billion in revenue and an EPS of $1.71, but the result exceeded expectations.

Dell projected full-year revenue on a conference call between $95.5 billion and $98.5 billion, with EPS expected at $7.80, plus or minus 25 cents. Meanwhile, analysts forecast slightly lower revenue of $96.3 billion and EPS of $7.70.

Dell estimates revenue between $24 billion and $25 billion for Q3, with EPS around $2, within a 10-cent margin. Analysts are slightly more optimistic, expecting $24.6 billion in revenue and $2.20 in EPS.

Wells Fargo Indicated A Strong Supply Chain in DELL

Wells Fargo highlights Dell's strong capital return strategy as a cornerstone of their investment thesis, emphasizing its dedication to shareholder returns through dividends and buybacks. This commitment, alongside Dell's focus on debt reduction, underpins Wells Fargo's Overweight rating.

The company also commends Dell's effective use of supply chain efficiencies, noting that its expansive product portfolio and seamless integration in software and hardware provide a unique edge. This positions Dell to benefit from the ongoing shift toward a hybrid, software-defined, multi-cloud data center environment.

Wells Fargo views Dell as presenting a compelling long-term risk/reward proposition driven by its strategic positioning and comprehensive offerings. They believe Dell is well-placed to capitalize on emerging technology trends, enhancing its appeal as a substantial investment opportunity.

Expert Insights on DELL Stock Forecast for 2024, 2025, 2030 and Beyond

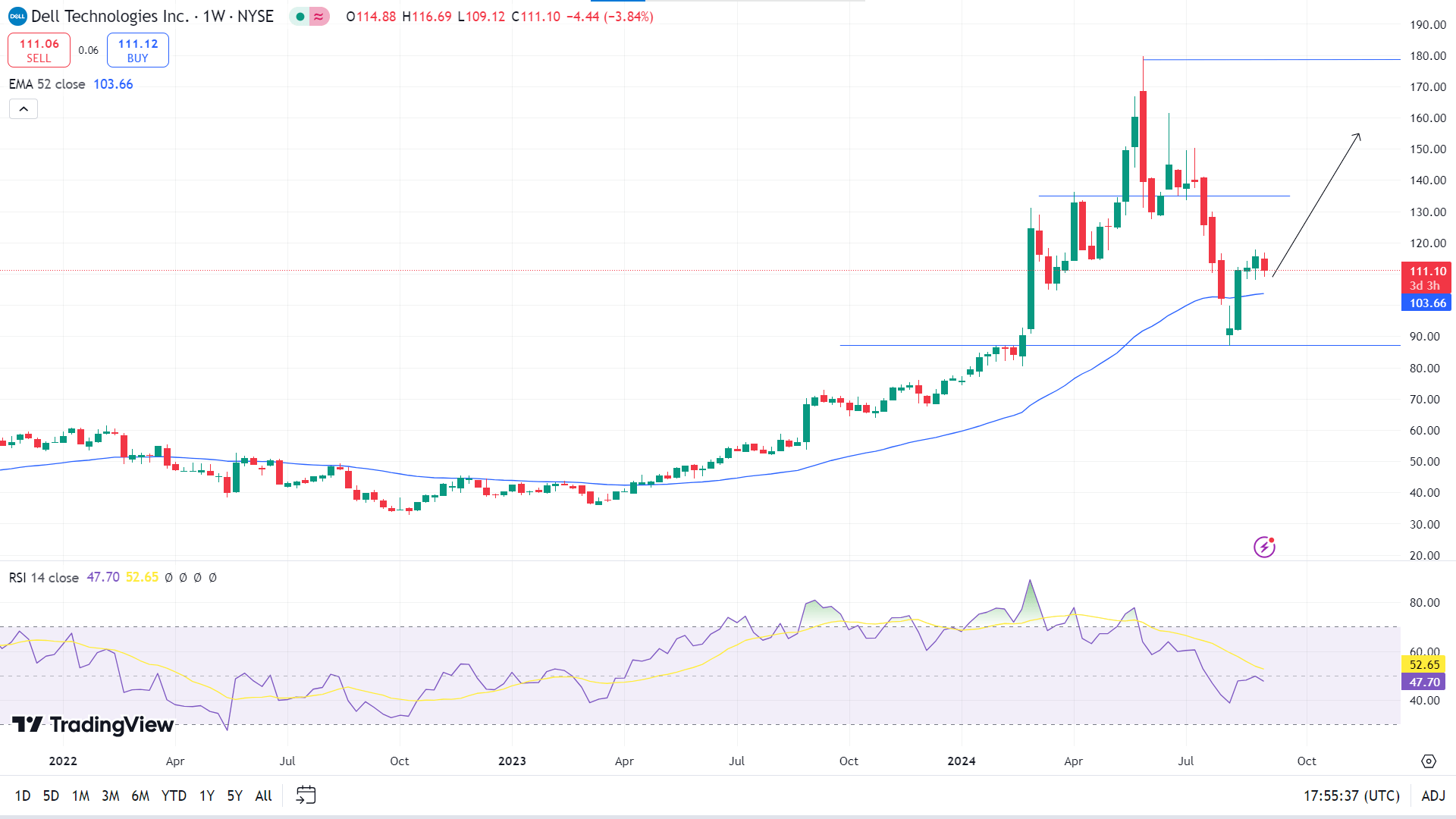

Dell stock price hit the ATH near 179.70 in May this year. Since then, the price has dropped, support is near 86.93, and it bounced back. So, the Q3 was bearish for the Dell stock price, and now, it may seek to meet the ATH or beyond. Before checking on details on the Dell stock forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about DELL stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$117 |

$163 |

$363 |

|

usastocksforecast |

$140 |

$161.91 |

$468.42 |

|

Stockscan |

$136.16 |

$134.57 |

$174.37 |

|

Coincodex |

$135.37 |

$142.99 |

$411.97 |

II. DELL Stock Forecast 2024

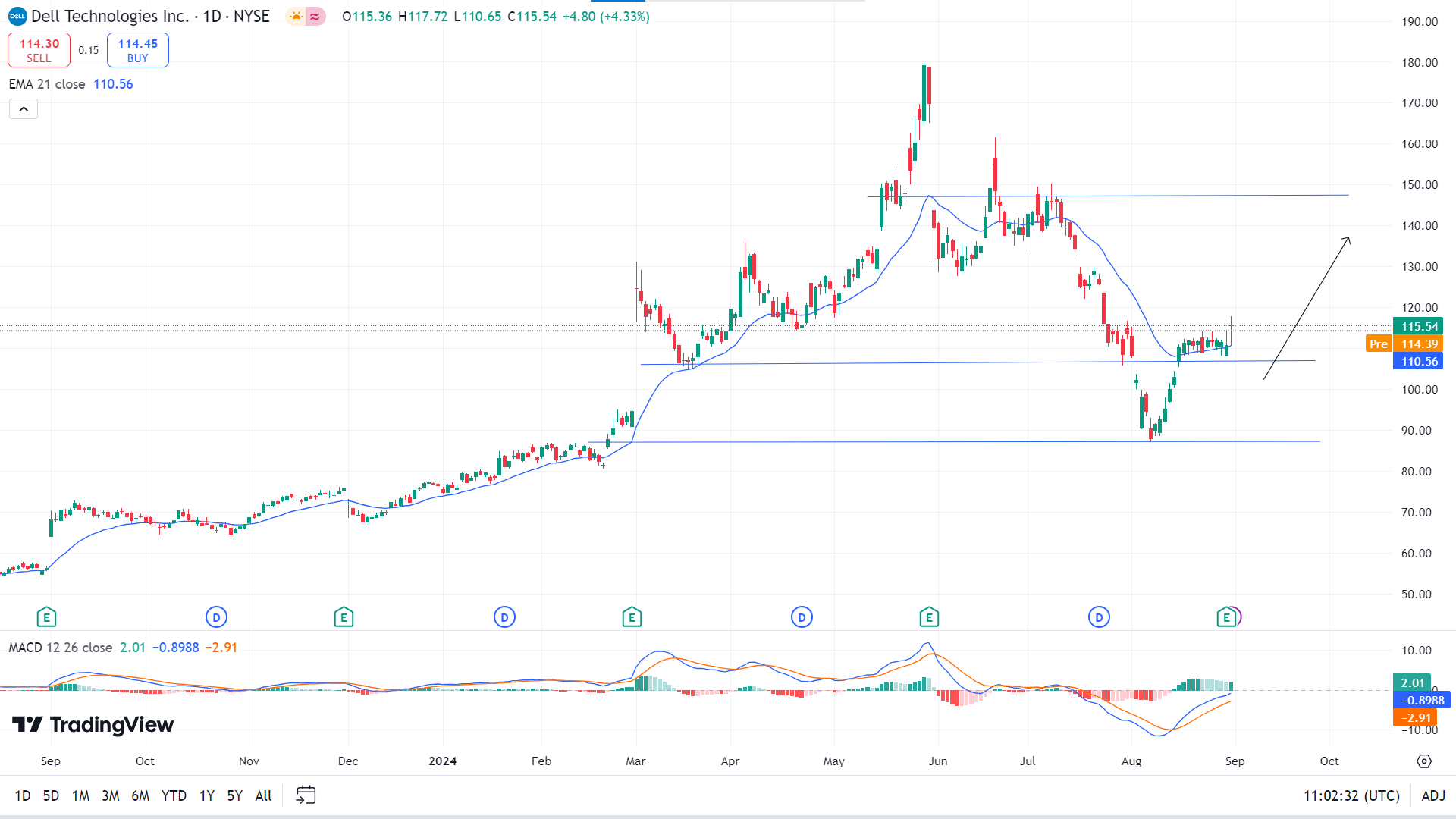

The DELL stock bounced back from the August low of 86.93 and may reach the ATH of 179.70 by the end of 2024.

In the broader outlook, the price made a significant high and reached the significant level of 180.00 level. Since then, significant selling pressure has come, creating a counter-impulsive momentum.

In the near-term price action, the price consolidates above the EMA 21 line, breaking an acceptable previous resistance of 106, which now acts as a support level. In contrast, the MACD indicator window suggests bullish pressure through the signal lines edging upside and green histogram bars above the midline. The price might hit the nearest resistance of 147 due to this bullish pressure. Meanwhile, any breakout may trigger the price toward the next resistance near 179.70, the ATH.

Meanwhile, the price is still below the EMA 50 line, acting as a dynamic resistance, and the ADX indicator reading is still below 25, indicating the recent bullish pressure may lose power and the price may decline toward the primary support near 106.00 before making an upward movement, whereas the next support is near 87.00.

A. Other Dell Stock Forecast 2024 Insights

Dell stock price soared nearly 50% in 2024 YTD, significantly outpacing the broader market. Despite this performance, analysts still see more growth in the room.

S&P Global Market Intelligence reports that the consensus price for Dell is 152.17, indicating a potential 30% upward movement from the current price level. The consensus rating stayed Buy.

UBS Global Research, a financial service firm, maintained its Outperform ratings on DELL, equivalent to buy, although it decreased the Dell price target from $164 to $158 due to the earnings report.

David Vogt, UBS analyst, enlightens the increasing demand for AI servers and substantial margin in Dell's Infrastructure Solutions Group (ISG) as crucial drivers, which might lead the stock price further upward through multiple expansions.

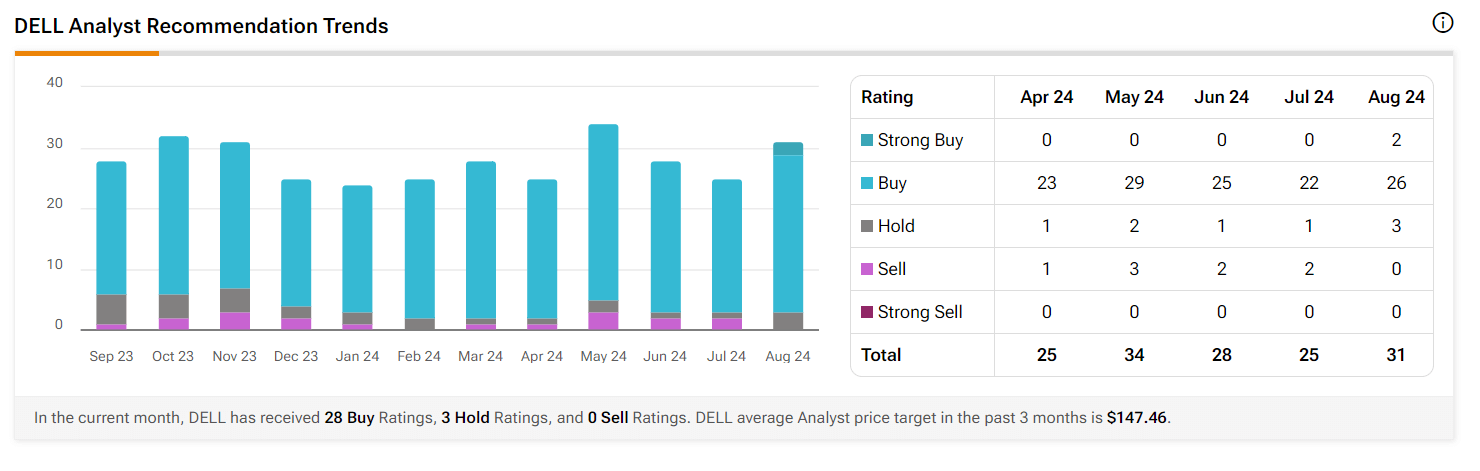

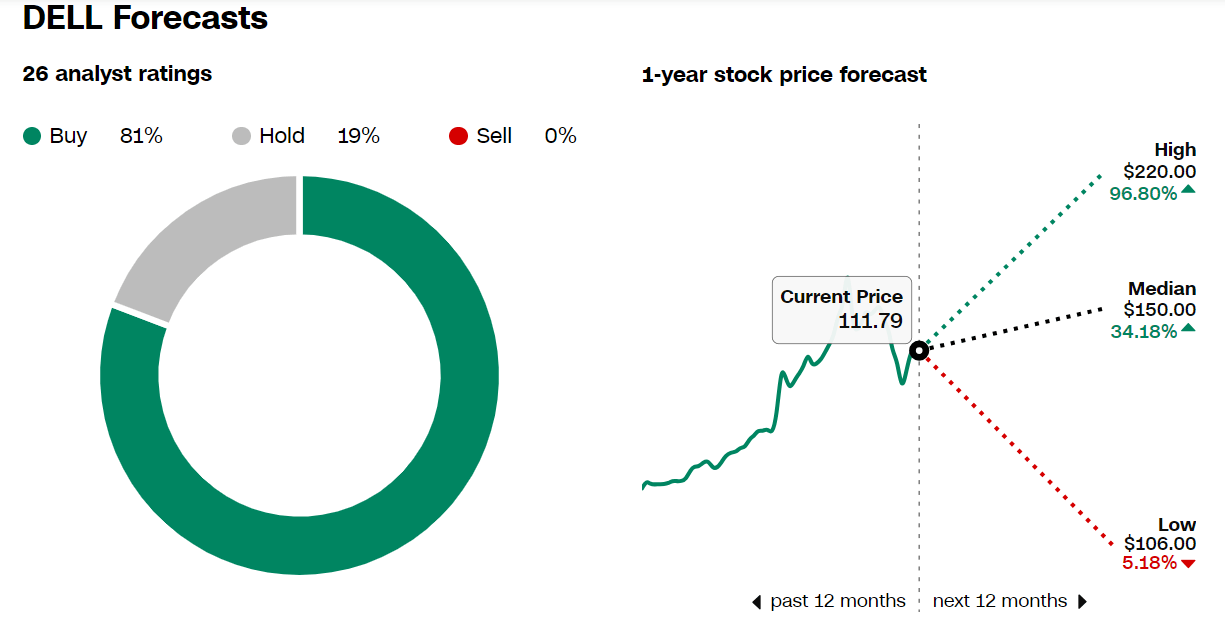

According to Tipranks, thirty-one analysts have given their ratings on the DELL stock price as of August 2024. Two of those analysts suggest a strong buy, twenty-six suggest buying, and three suggest holding the asset. In contrast, there are no sell ratings from analysts, and the average price for the past three months is 147.46, making the DELL stock a potential stock for the longer term.

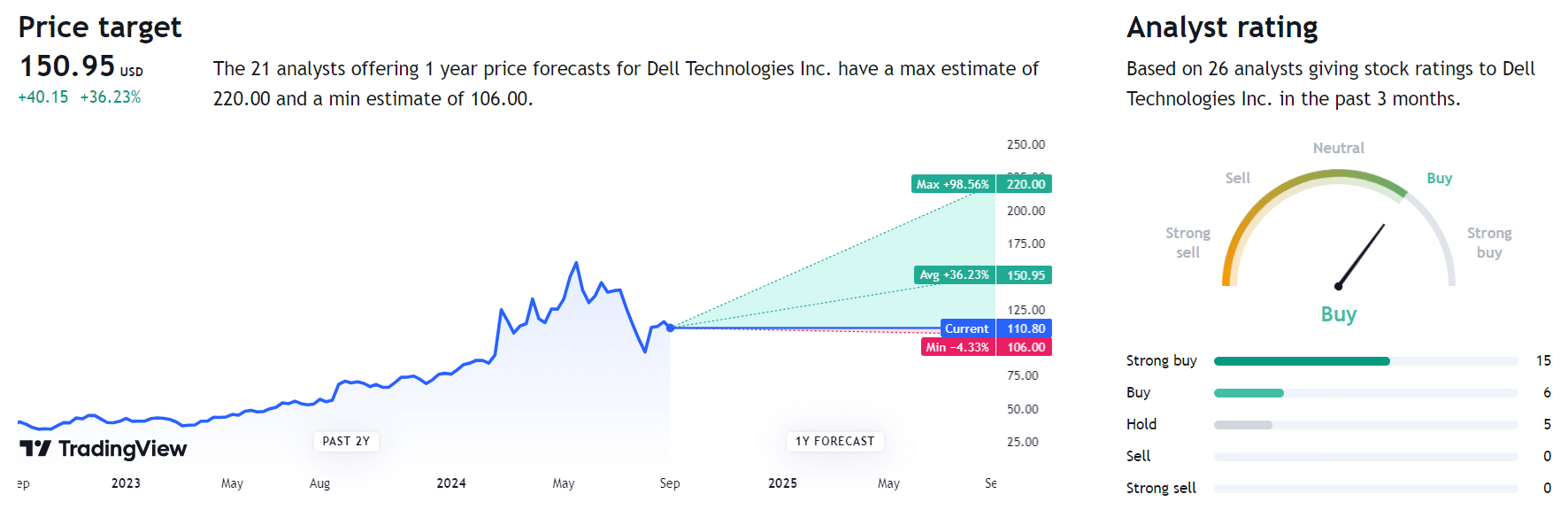

Another famous analysis firm, CNN, reports its analysis on the DELL stock price, in which twenty-six analysts participate. Eighty-one percent suggest buying the asset, and nineteen percent suggest holding it, while no selling suggestions are made, making the DELL stock an attractive investment. They indicate the price can soar to $220 in twelve months. Meanwhile, according to their prediction, the median price is $150, and the low they suggest is $106.

B. Key Factors to Watch for DELL Stock Prediction 2024

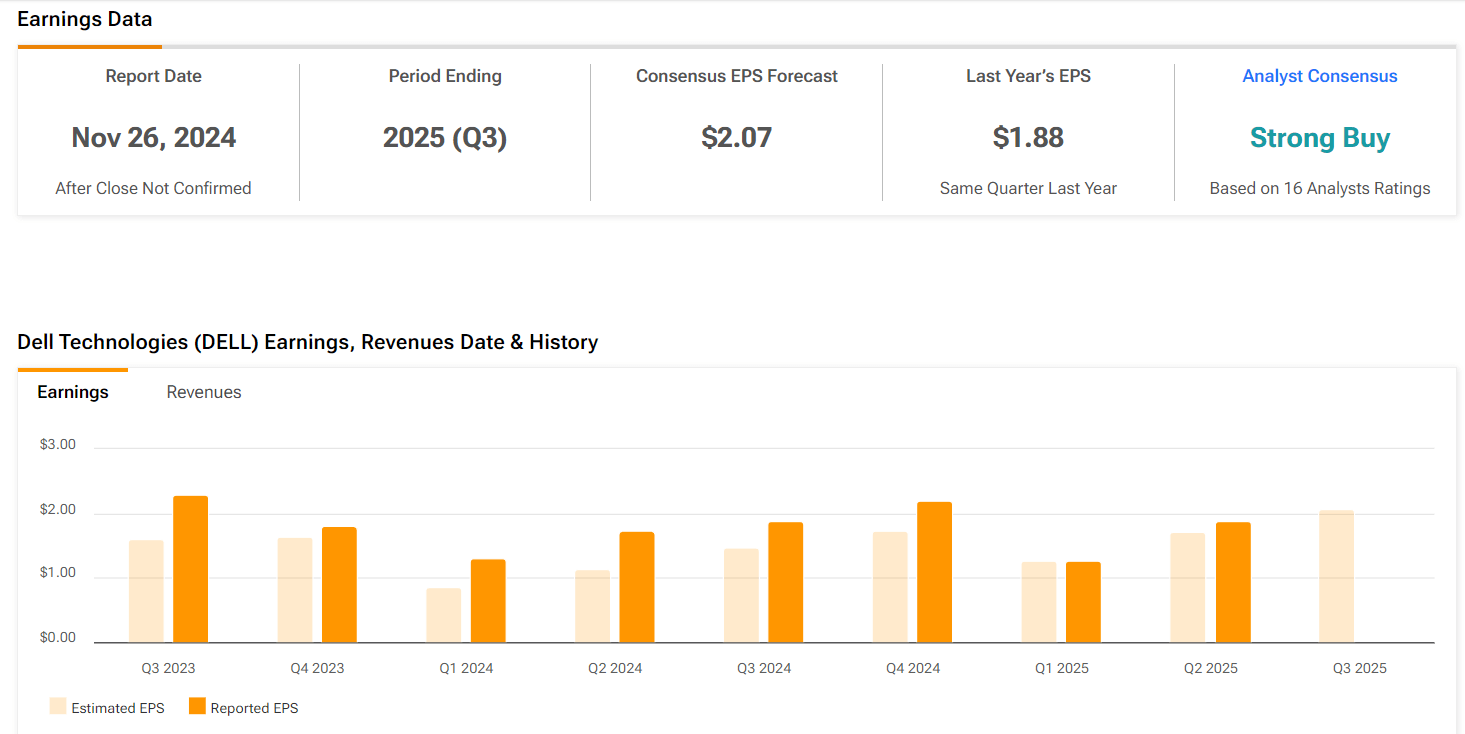

DELL EPS Forecast 2024

Earnings per share is a crucial indicator for determining the future price of a stock. For DELL, the recent reading showed consistent growth with an upbeat result for consecutive 7 weeks.

Moreover, the current projection from upcoming earnings reports is positive, where the fiscal Q3 of 2024 could provide a higher outcome. If the company can maintain the growth, it would offer a decent investment opportunity for this stock.

DELL Valuation & Dividend Yield

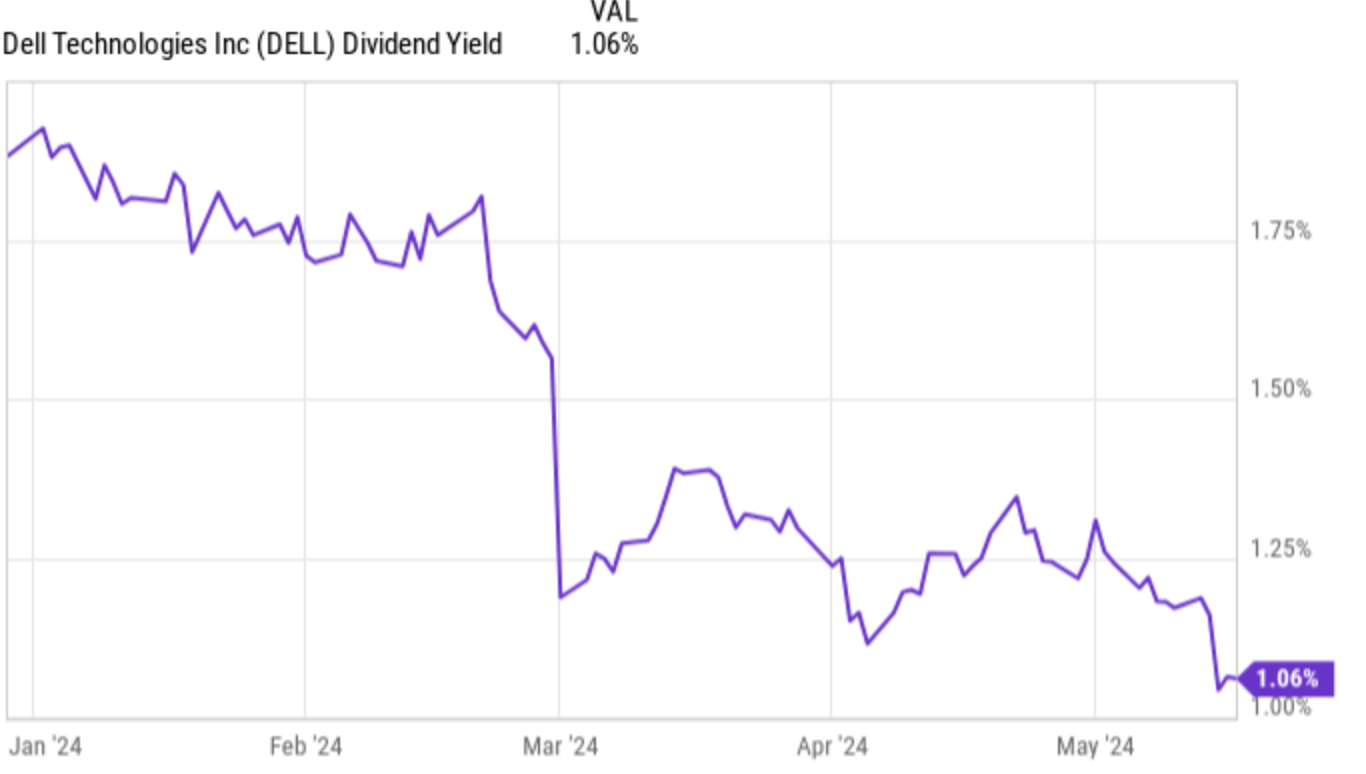

More so than short-term profit estimates, valuation expansion has been the main driver of Dell's recent advances. The stock's future price-to-earnings, price-to-free-cash-flow, and enterprise value-to-EBITDA ratios have all increased this year, indicating that investors are now required to pay a bigger premium compared to the company's financial performance. Based on projections for the future, these measurements compare the stock price to several profitability indices.

Despite a 20% dividend rise, the stock's dividend yield decreased as its price increased. With Dell's forward yield currently hovering around 1%, the same investment generates half as much dividend income as it did earlier in the year. For retirees who rely on dividend income for cash flow and investors who are income-focused, this is a crucial consideration.

DELL Stock Price Prediction 2024 - Bullish Factors

- The possible divestment of SecureWorks may remove the margin drag and inject significant capital into the company, magnifying cash flow.

- The stock may rise sharply shortly due to analysts' increasing confidence about the business's revenue prospects, as evidenced by their resounding agreement to raise EPS projections.

- Demand for the infrastructure solutions group (ISG) of Dell, which comprises networking, storage, and server products, is expected to rise as companies move to cloud environments and build out their data centers. Dell is well-positioned to profit from the current scenario thanks to its leadership in hybrid cloud solutions and hyper-converged infrastructure (HCI).

- Dell received a sizable cash infusion from VMware's subsidiary in 2021, which it utilized to reduce debt and fortify its balance sheet. Dell will be in better financial shape to make smart acquisitions that will broaden its product line and increase its market share.

DELL Share Price Prediction 2024 - Bearish Factors

- Dell Technologies Inc. (DELL) released substantially lower adjusted free flow (FCF) for its quarterly period ending August 2, disappointing investors on August 29. The share price has been declining as a result. Its fundamental value appears strong nonetheless. That might make this a great deal for DELL.

- The demand for PCs and laptops may be relaxing as the pandemic-driven increase in distant work and education becomes more commonplace despite the worldwide PC and laptop market being increasingly overflowing. Dell's total revenue may suffer if its consumer section experiences sales declines.

III. DELL Stock Forecast 2025

On the weekly chart, the price heads toward the primary resistance near 135.00. Any breakout will trigger the price to reach the previous ATH of 179.00 or beyond, as many experts suggest 220.00 by the end of 2025.

We know that the 52-week moving average is a convenient scale for determining future movements of any financial assets. The price is floating above the EMA 52 line on the weekly chart, which supports the positive pressure on the asset price. As the bulls are in play, the price may head to reach the primary resistance near 135.00, and a breakout may drive the price toward the next resistance, which is also the ATH near 179.00 or beyond around 220.00 by the end of 2025.

In the meantime, the RSI indicator scenario is different. Although the reading remains neutral, the signal line floating below the midline is edging lower, which declares that the price might start to drop from this level. If the RSI signal line continues to edge downward, the price of DELL stock can fall toward the nearest support near 103.65, followed by the next support near 87.00, before flying to the moon.

A. Other DELL Stock Forecast 2025 Insights

Looking at the price forecast of the TradingView, twenty-six analysts gave their ratings on the DELL stock. Fifteen of them gave “strong buy” ratings, six of them gave the asset only “buy” ratings, and five of them suggested “hold” in the past three months, which makes the stock a potential investment asset for the future. In the meantime, they anticipated that the maximum price DELL stock could hit would be 220, with an average and low of 150.95 and 106.00, respectively.

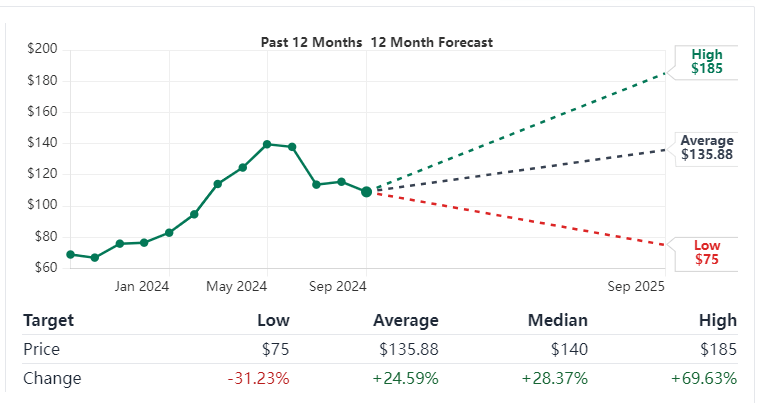

Another popular platform, Stock Analysis, published its outlook on DELL stock, where sixteen analysts gave ratings. Seven anticipated a “strong buy,” seven gave ratings of only “buy,” and two of them gave “hold” suggestions, while no sell recommendations were made.

As per analysts' projections, the highest Dell stock price target for 2025 is above $180.0. In the bearish scenario, the lowest DELL target price would be $75.00, which signals a wider gap.

B. Key Factors to Watch for Dell Stock Forecast 2025

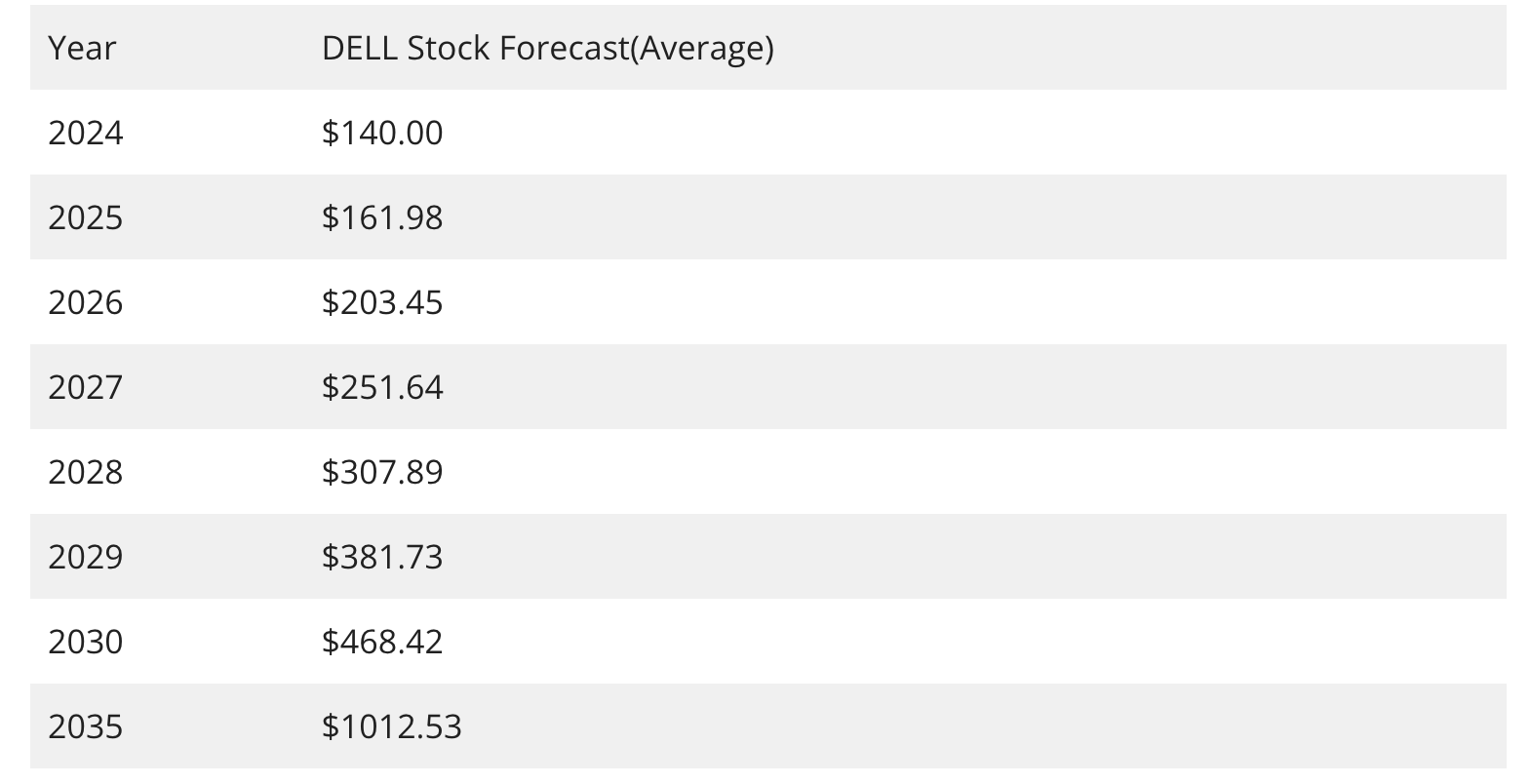

DELL Revenue Forecast 2025

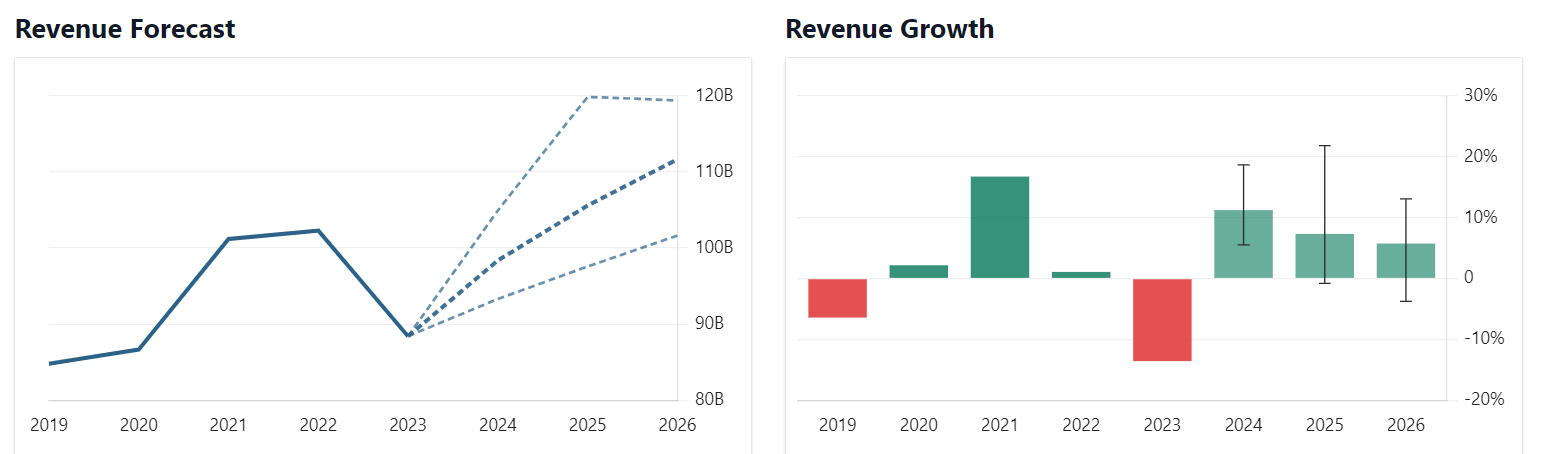

When seeking critical factors for a company's stock, revenue growth, earnings growth, etc., must be considered to check the stock's potential for the future.

The chart above shows revenue growth in recent years and the forecast for the future. However, past performance doesn't guarantee future growth for any asset. In the past year, 2023, revenue growth declined, adjusted in 2024, and is expected to continue in the upcoming years.

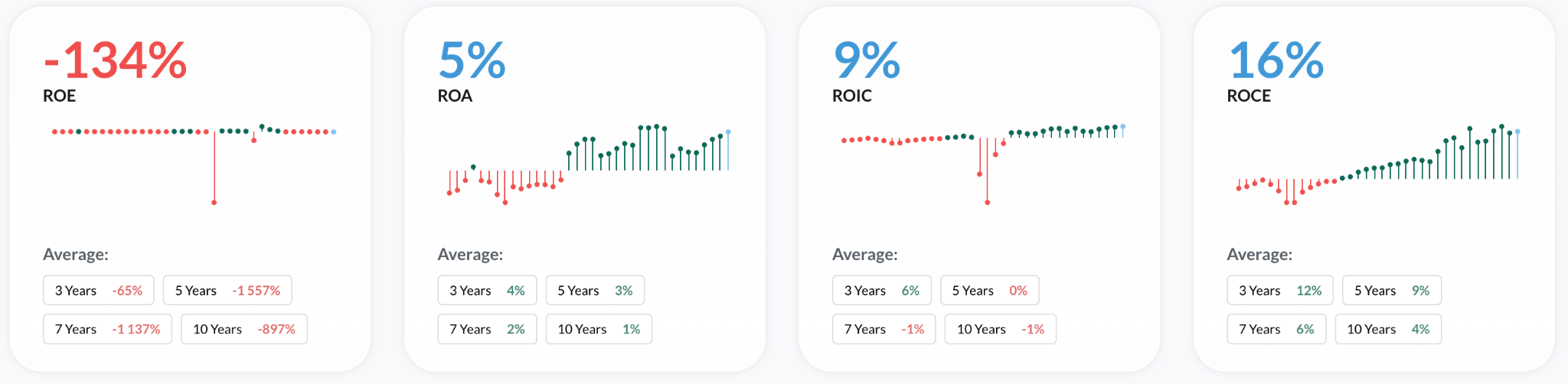

DELL Profitability Analysis

Although the Return on Asset and Return on Capital Employed showed a positive outlook, the Return on Equity failed to show a positive outlook. In that case, investors should remain cautious, where an improvement in ROE could be a bullish factor for this stock.

DELL Forecast 2025 - Bullish Factors

- Investors' increasing focus on Environmental, Social, and Governance (ESG) elements is in line with Dell's dedication to long-term viability, which includes cutting carbon emissions and supporting recycling initiatives. This focus may drive up the price of the stock by drawing in a greater number of institutional buyers with an interest in ESG.

- Dell has been expanding its presence in developing economies, especially in Asia-Pacific. Due to the acceleration of digital transformation and economic expansion, particularly in business and consumer markets, Dell may experience substantial sales increases in these areas.

- Dell's broadened business strategy has resulted in steady growth in earnings and profits, which may sustain optimism among investors. Strong sales in significant categories may contribute to positive revenue surprises, which may cause analysts' share price targets to be revised upward.

- The company's focus on shareholders' returns through dividends and share buybacks will increase investors' confidence in the stock, which might be positive for the share price.

Dell Stock Predictions 2025 - Bearish Factors

- Dell's revenue in lucrative industries may be impacted by businesses delaying or cutting back on stakes in emerging fields like cloud infrastructure or artificial intelligence in a weaker economic climate.

- In the PC and laptop sectors, Dell is fiercely rivaled by firms like Lenovo, HP, and Apple; in the enterprise market, its competitors include Cisco, HPE, and IBM. These rivals could use disruptive pricing tactics or provide better products, which would reduce Dell's position in the market.

IV. DELL Stock Forecast 2030 and Beyond

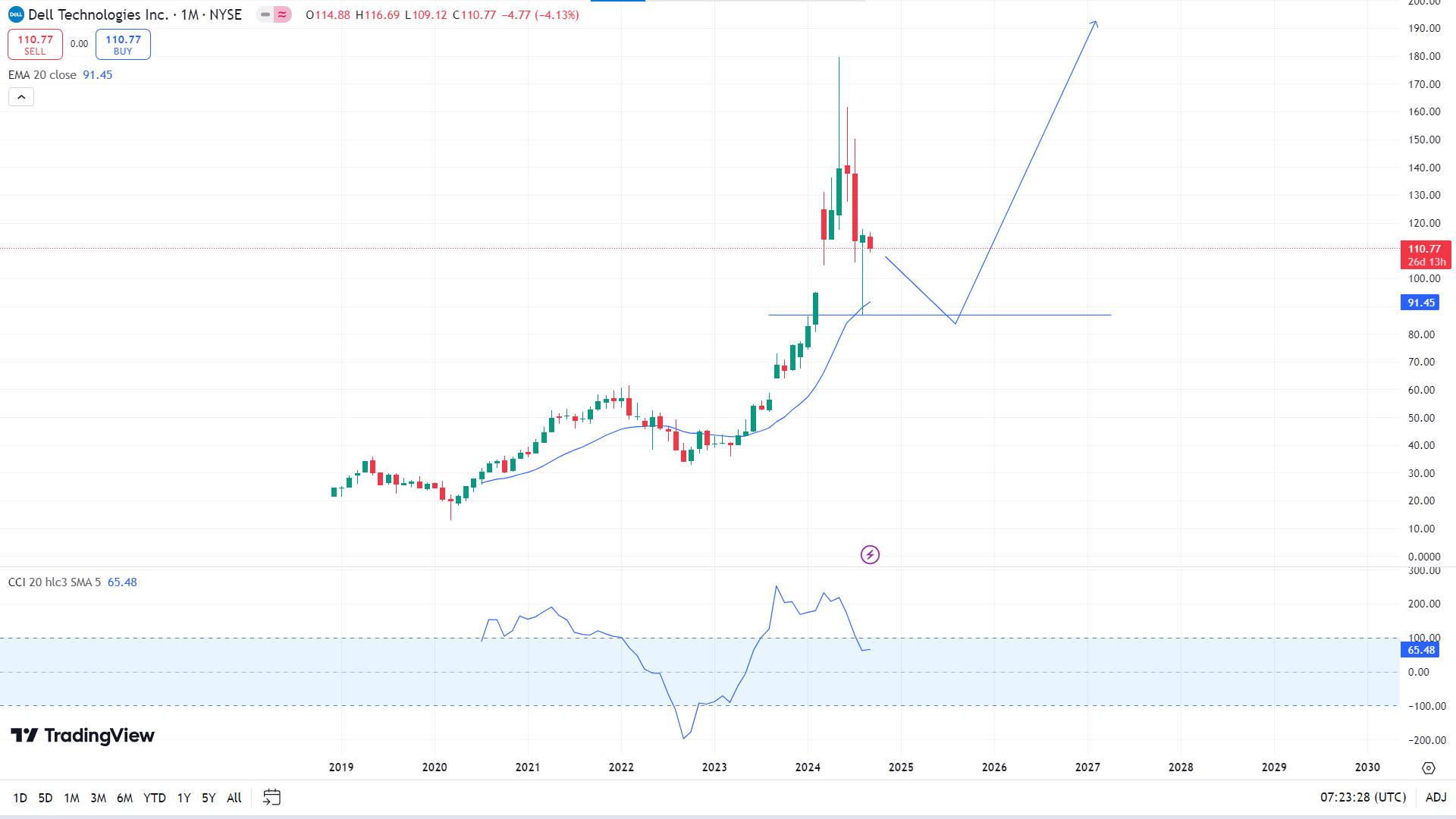

DELL stock price can soar toward the ATH of 179.70; a breakout can trigger the price toward the anticipation level of 220.00 or above at nearly 360.00 by the end of 2030.

In the monthly time frame, the DELL stock is trading within a buying pressure, where the current price remains at the premium zone on the multi-year timeframe. Also, the price has become volatile after reaching a record high during the COVID-19 pandemic, suggesting a possible reversal as a Pump and Dump. Therefore, in a broader context, investors should remain cautious when looking for a long-term opportunity.

In the above image, the price is above the EMA 20 line, bounces back after landing, and declares positive pressure on the asset price, which can hit the ATH of 179.70 or further upside.

Meanwhile, the scenario in the CCI indicator window differs as the dynamic signal line edges lower. It reaches below the upper line of the indicator window due to recent selling pressure on the asset price, which may lead the price toward the primary support near 91.00. And a breakout can trigger the price toward the next support near 63.55.

A. Other Dell Stock Forecast 2030 and Beyond Insights

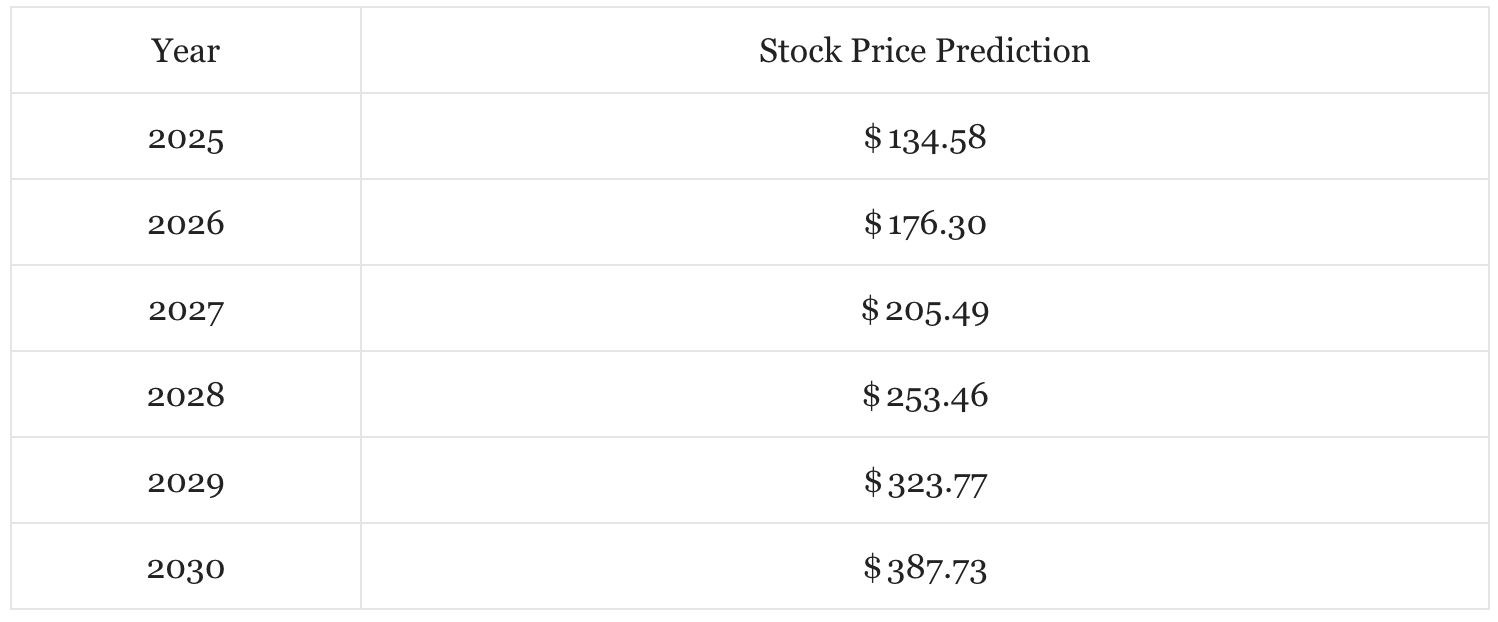

According to Youthcouncilofindia, the estimation for the DELL stock at the start of 2030 would be $323.77, which might extend and close the year at $387.73. However, the future price depends on the company's average annual growth over the previous ten years.

As per the above image, the forecasted growth looks promising, while the ongoing surge in Artificial Intelligence (AI) could boost the upside pressure.

Meanwhile, according to usastockforecast, three analysts gave a “strong buy”, while one suggested selling the asset. Based on the above image, the stock is more likely to grow 300% in the next 6 years and reach beyond the $450 level by the end of 2030. The stock would be more promising at that time and could grow above the $1000.00 level by 2035.

B. Key Factors to Watch for Dell Stock Prediction 2030 and Beyond

DELL Revenue Forecast 2030 & Beyond

Revenue data is a must-check item when evaluating key factors for forecasting. DELL's revenue growth is expected to be driven by its ongoing focus on cloud and edge computing solutions, artificial intelligence, and enterprise infrastructure leadership.

The chart above contains revenue estimation and reported data for the previous years, alongside forecasting upcoming years. It is visible that the revenue growth beats estimation consecutively, which is very positive for the DELL stock price.

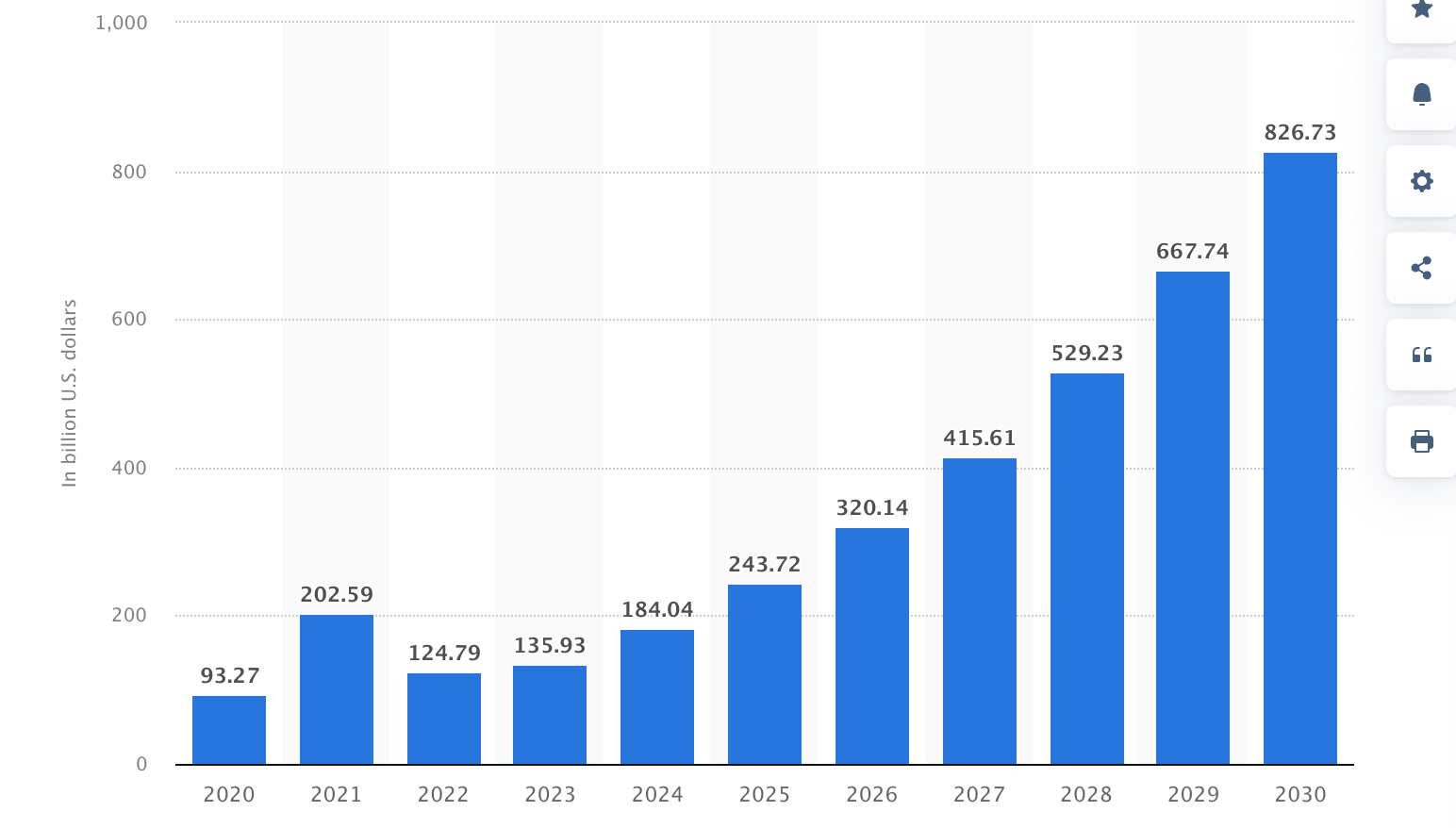

AI Market Cap in 2030

In 2023, the global AI market was valued at roughly $142.3 billion and is anticipated to grow at a compound annual growth rate (CAGR) of over 36%, potentially approaching nearly $2 trillion by 2030. In 2024 alone, the AI market is expected to expand by around 40%, highly surpassing the global economic growth and broader technology sector, projected at a modest 2.7%.

Dell Stock Forecast 2030 and Beyond - Bullish Factors

- Although the analysts pointed out Dell will be under pressure to demonstrate margin improvement, they stated that the company's AI server products for business customers might encourage long-term, AI-driven expansion.

- The technology industry has placed artificial intelligence at the forefront, particularly with the release of large language models (LLMs) such as ChatGPT and Gemini. The ongoing AI uprising has impacted the semiconductor industry, and as a result, chipmaker shares have increased dramatically. However, data centers also gain a great deal from the rise in AI, not just semiconductor stocks.

- Even though PC sales are slowing down globally, Dell's strong brand recognition and range of goods in emerging markets can boost unit sales, particularly in regions where the middle class is growing.

Dell Stock Forecast 2030 and Beyond - Bearish Factors

- Although artificial intelligence and data centers have groundbreaking capabilities, their energy consumption raises some concerns. According to Goldman Sachs Research, servers use between 1% and 2% of the world's total power, which at first glance seems reasonable. In just ten years, they will probably increase from 3% to 4%.

- Rapid technological advances by rivals or recent entrants may surpass Dell's innovation efforts, resulting in market share losses in important areas such as edge computing, storage facilities, or artificial intelligence solutions.

V. Conclusion

A. Dell Stock Outlook

DELL stock is trading at a record high, where a higher volatility is seen in recent years. In that case, investors should remain cautious about determining the future stock as a buy. However, the ongoing surge in the Artificial Intelligence and Data Center sector could be a strong bullish factor for this stock.

In this structure, the immediate buying possibility is present in 2024 and 2025, which might take the price above the 200.00 level. However, the long-term projection for 2030 and beyond might need a clear market with a range formation before anticipating the 350.00 to 400.00 area.

B. Trade DELL Stock CFD with VSTAR

Trading CFDs often allows traders to benefit from bullish and bearish movements, where a trustworthy and reliable platform like VSTAR can be a good choice.

In VSTAR, traders can jump into trading by maintaining the maximum funds' safety from the multi-tiered regulation. Also, the mobile portability, faster execution, top-notch customer support, and wide range of asset availability could offer a long-term investment opportunity in DELL stock through VSTAR.