I. Recent CCL Stock Performance

Carnival Starts A Strong Year in 2024

Carnival has undergone substantial transformations in recent times. The company established several records in its most recent fiscal first-quarter report, which was published in late March. Revenue increased by 23% year-over-year to $5.4 billion, surpassing the pre-pandemic high of $4.7 billion set in the first quarter of 2019.

This growth was driven by higher booking prices and increased capacity from introducing new ships. In the first quarter, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased from $382 million in the corresponding period of the previous year to $871 million.

Currently, cruising is more popular than ever, and Carnival's numerous brands are experiencing robust demand.

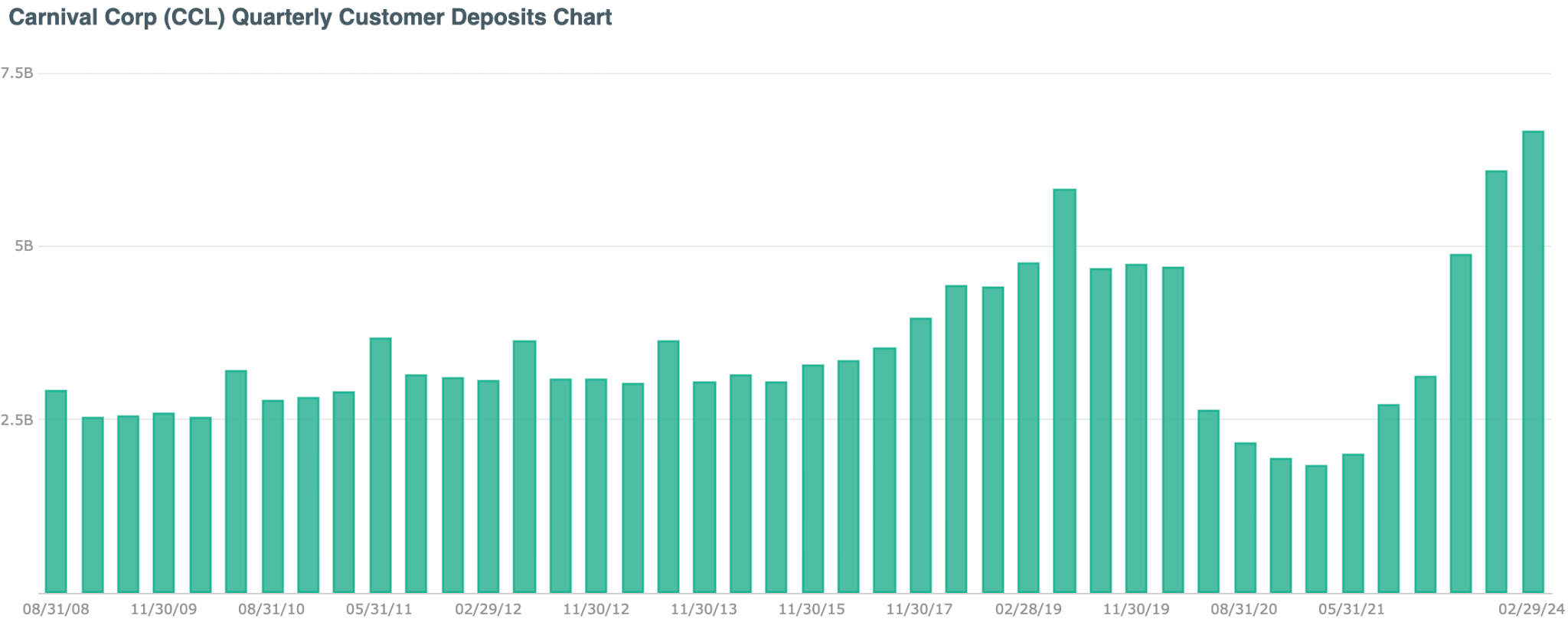

CCL Customer Deposit Soared

Source: discoverci

An indicator of significant insight is the increase in consumer deposits from $5.7 billion in Q1 2023 to $7 billion. These initial payments for future voyages, known as deposits, indicate the company's progress and prospective revenue. President and CEO of Carnival, Josh Weinstein, emphasized the following during the most recent CCL earnings call:

Trends observed in early 2024 prompted management to increase full-year guidance. Carnival has revised its adjusted EBITDA forecast from $5.6 billion to approximately $5.63 billion.

Additionally, the firm updated its projected adjusted earnings per share for 2024 from $0.93 in December to approximately $0.98. Carnival is projected to achieve profitability for the first time since fiscal year 2019 in 2024.

Carnival Corp Business Merge

Carnival Corp. (CCL) intends to merge its P&O Cruises Australia brand with Carnival. This realignment aims to enhance operational efficiencies in the South Pacific. Carnival stock price has shown positive movement with the news, adding to the recent upbeat Carnival earnings reports. Therefore, investors might consider it a positive factor for the stock, but more clues are needed before anticipating the price movement.

Christine Duffy, president of Carnival Cruise Line, expressed her enthusiasm for the opportunity to introduce some of our innovations to more cruise passengers in the region, thereby honoring the history and heritage of P&O Cruises Australia.

"In the coming months, we will explore ways to celebrate and honor P&O Cruises Australia, which has been a valued part of our legacy and a significant contributor to the South Pacific tourism industry," Weinstein indicated. "We appreciate the connection our P&O Cruises Australia guests, employees, travel advisor partners, public officials, and destinations have with our company and are committed to strengthening this relationship as we move forward as Carnival."

Expert Insights on CCL Stock Forecast for 2024, 2025, 2030 and Beyond

Carnival stock (CCL) remains sideways at the bottom, suggesting a long opportunity from a discounted price. However, buying a stock needs proper validation from technical and fundamental perspectives.

Before proceeding to the in-depth CCL stock forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about Carnival stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$18.57 |

$24.30 |

$49.00 |

|

Coincodex |

$14.90 |

$16.47 |

$ 18.99 |

|

Stockscan |

$8.84 |

$16.35 |

$56.48 |

II. CCL Stock Forecast 2024

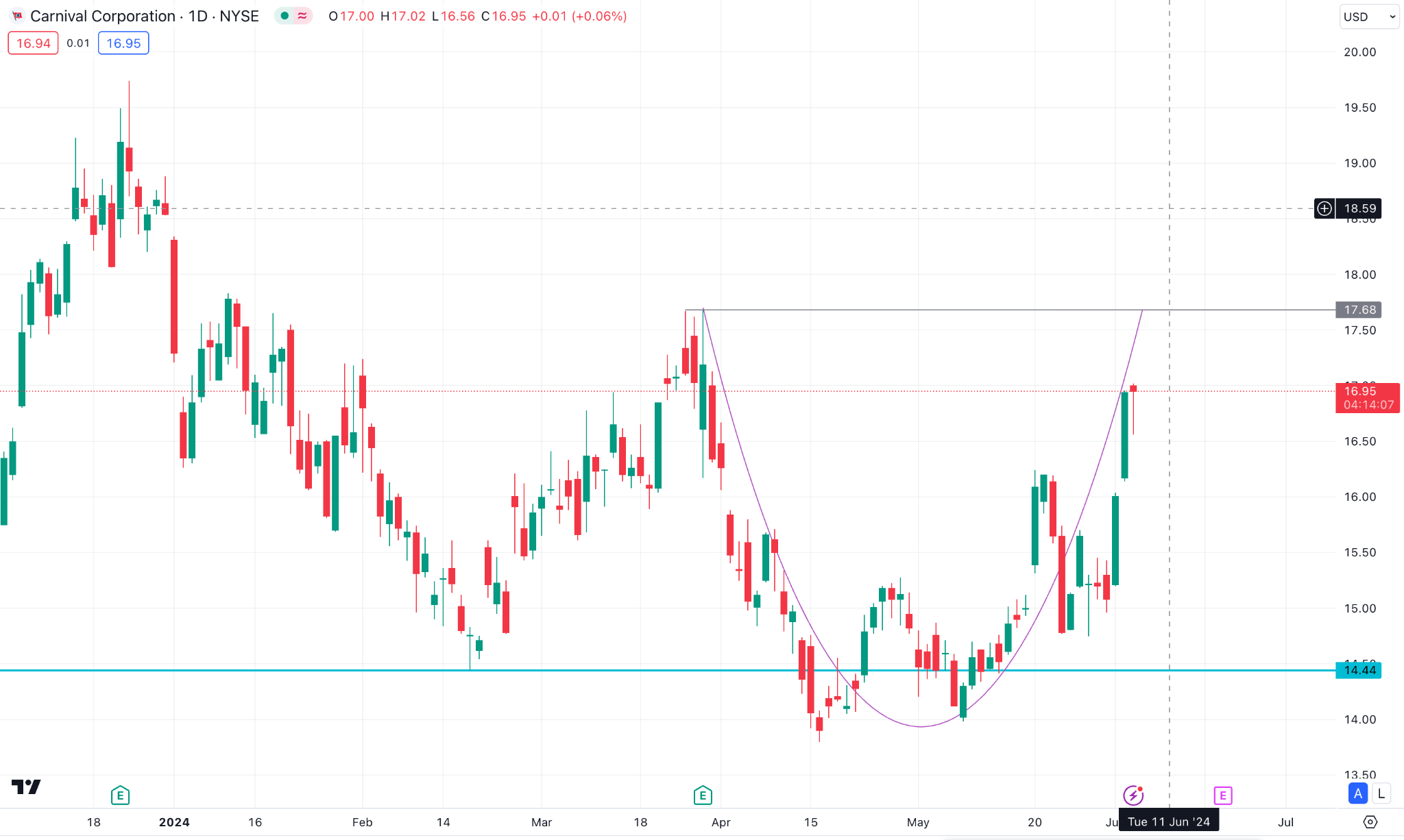

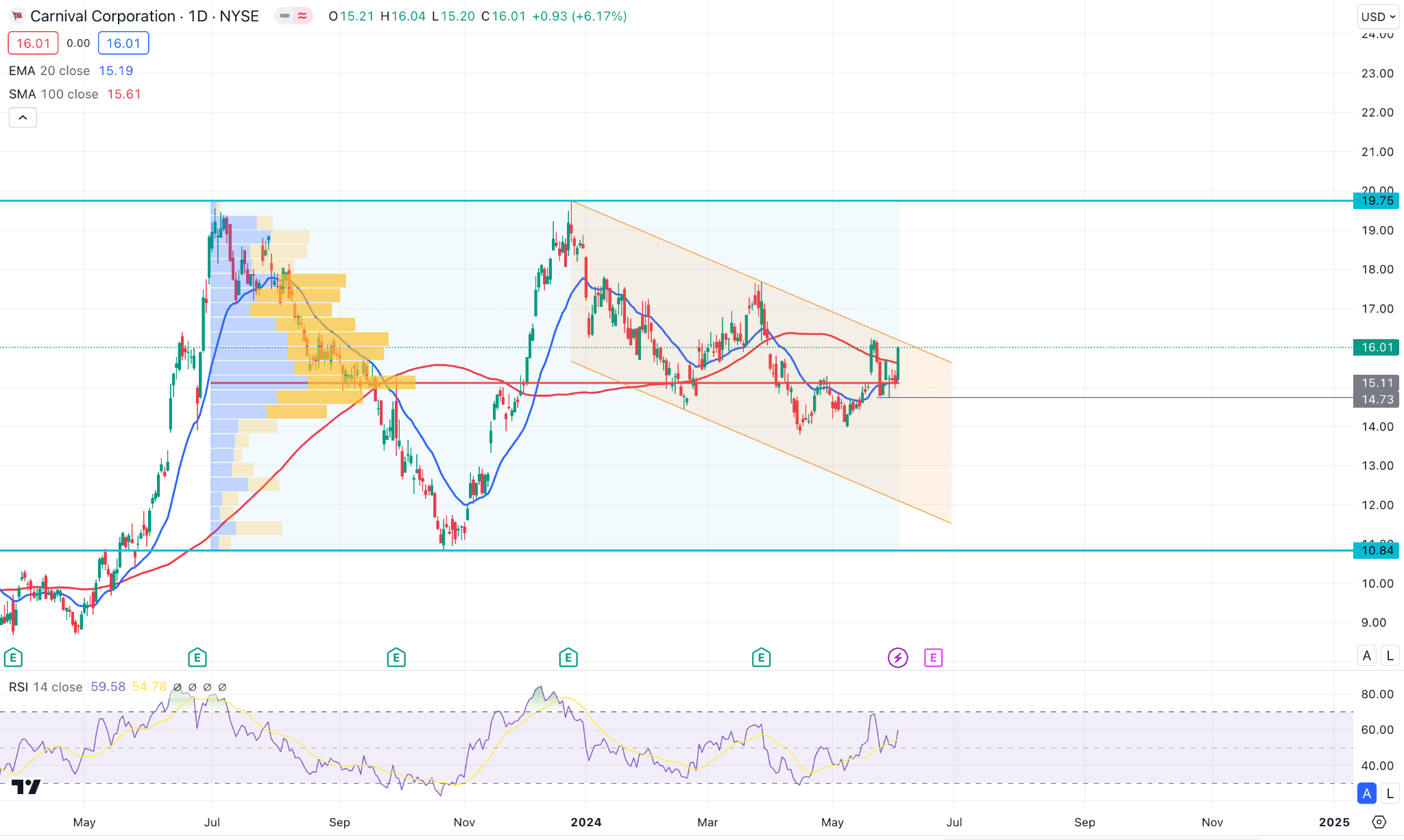

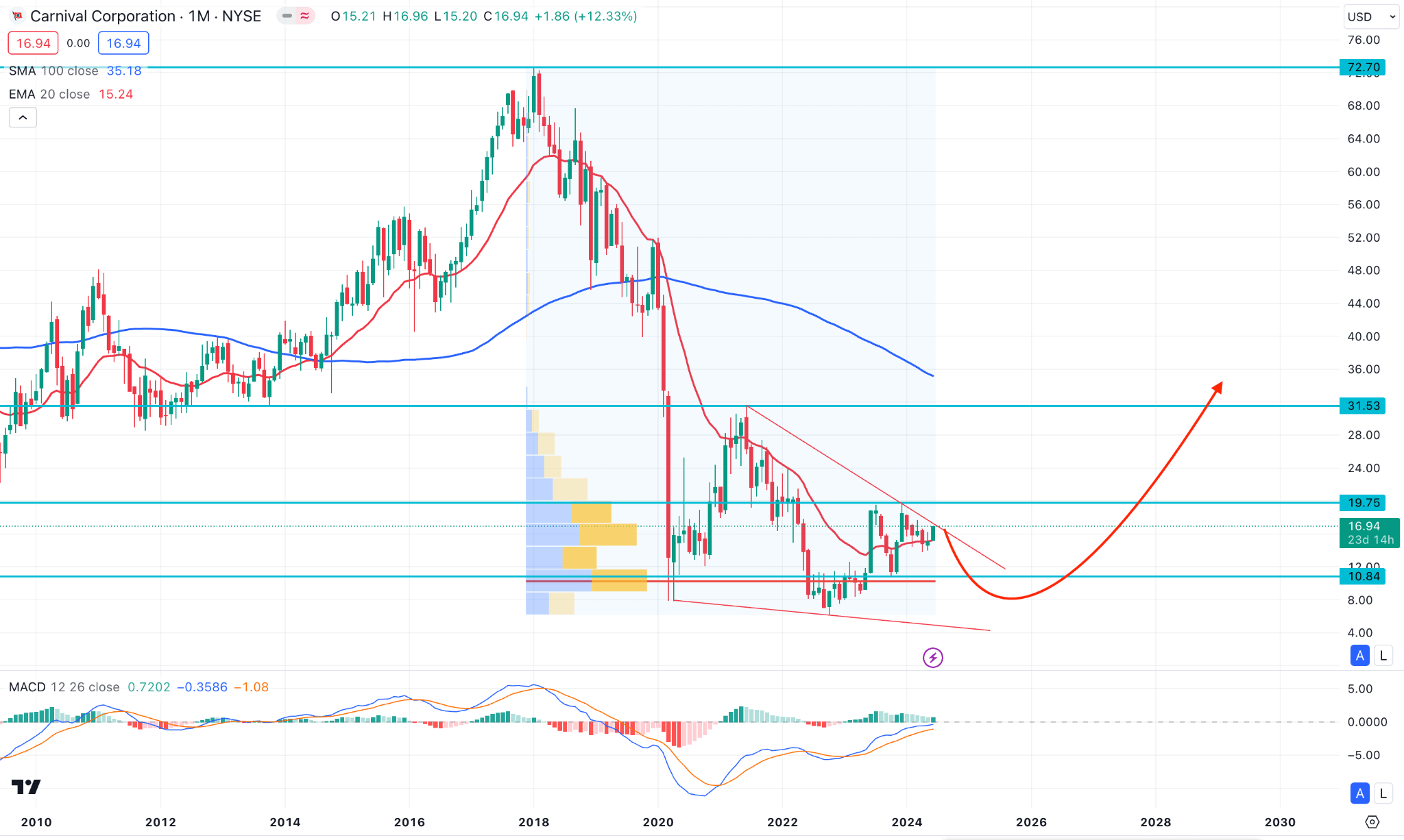

CCL has traded sideways in recent days, where a potential bullish breakout from the channel resistance could extend the upward pressure to the 19.75 level by the end of 2024.

In the daily chart of CCL, the most recent price shows a sideways momentum as the descending channel is active. A potential breakout would be the first sign of a trend reversal.

In the broader context, the prolonged buying pressure from the 10.84 low came with counter-impulsive bullish pressure but failed to break the 19.75 key resistance. Later, sideways momentum came below the 50% Fibonacci Retracement with an immediate bullish reversal. In that case, a potential bullish continuation could be a trend trading opportunity, targeting the existing near-term high.

In the main chart, the dynamic 100-day Simple Moving Average and 20-day Exponential Moving Averages are flat, suggesting a sideways momentum. Moreover, the 14-day Relative Strength Index (RSI) shows a buying pressure above the 50.00 line, which could extend above the 70.00 overbought area.

Based on the daily market outlook, the recent buying pressure is valid above the high volume line. Therefore, a valid daily candle above the 16.32 high could be a conservative, long approach that targets the 19.75 level.

However, a downside continuation below the 14.73 level could extend the loss towards the 10.44 support level.

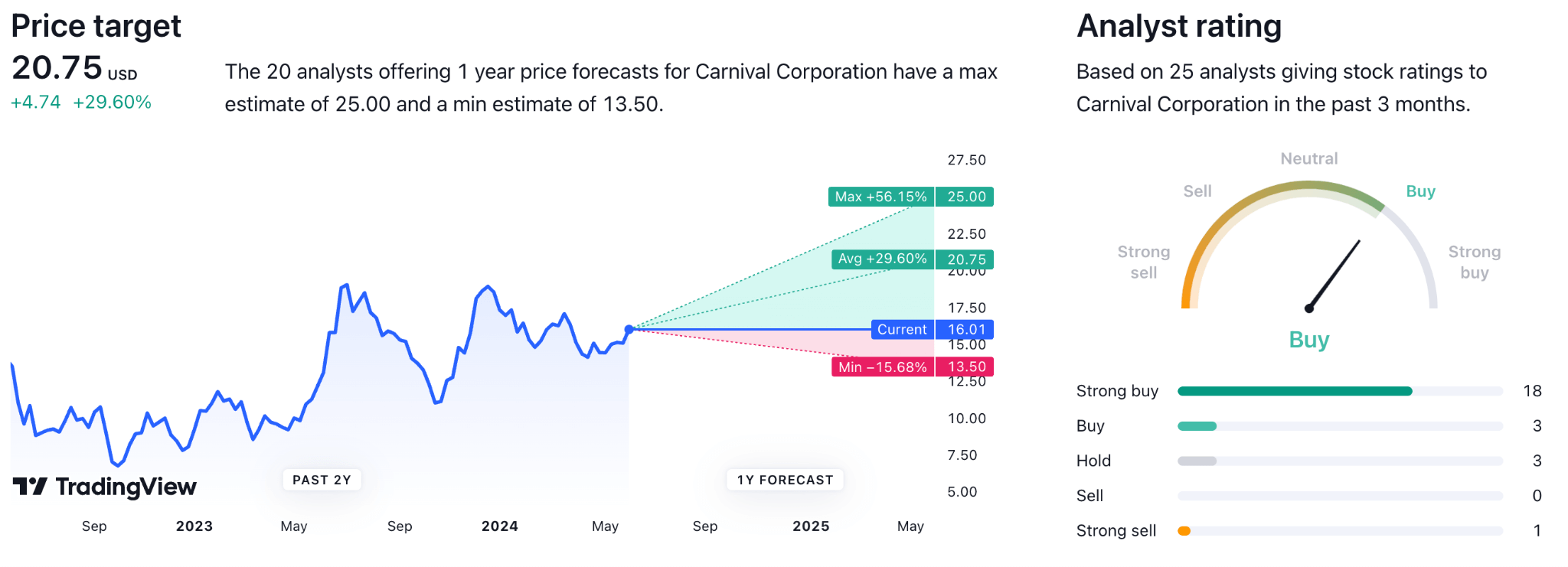

A. Other CCL Stock Forecast 2024 Insights: Is CCL a buy?

As per the current CCL forecast from TradingView, the one-year forecast says the stock could grow up to a 25.00 level, suggesting a 56% growth from the current price. However, the average forecasted growth is marked at 20.75 level.

The analysis came from a mix of 25 analysts, 18 of whom projected a strong buy, three of whom remained hold, and one of whom projected a strong sell.

As per the recent report from Benzinga, the divergence in assumptions can substantially affect analysts' price targets and recommendations. Regarding Carnival, no adverse recommendation has been issued by any analyst. Fourteen analysts have provided favorable ratings for CCL stock price target, with Stifel offering the highest CCL price target of $26 and Truist Securities offering the lowest CCL price target at $17.

B. Key Factors to Watch for Carnival Stock Forecast 2024

CCL EPS Forecast 2024

Since the massive loss in EPS of -892.23 %, CCL has maintained growth, and the most recent EPS forecast shows a 20.74% growth in Q1 2024. As the company maintains a positive EPS for over six consecutive quarters, we may expect a positive outcome in 2024. Moreover, the forecasted EPS for Q3 2024 is $1.10, which is the highest ever. If the company can maintain the current curve in the CCL stock earnings report, we may expect a buying pressure soon.

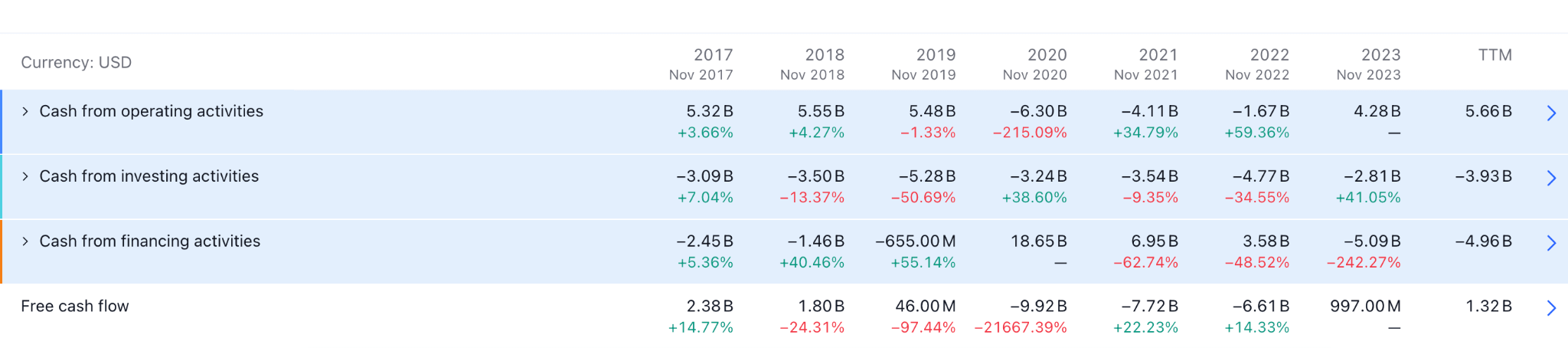

CCL Cash Flow

Carnival's debt before the pandemic was approximately $10 billion, a customary sum for sizable, well-established corporations. Although the debt incurred an approximate $30 billion increase due to the pandemic, an additional $20 billion reduction will restore it to pre-pandemic levels.

Carnival has achieved noteworthy advancements in reducing its debt, which once exceeded $40 billion. The corporation successfully repaid $6 billion of this debt in 2023. Carnival is doing well, as evidenced by its $5.4 billion in liquid assets and its intention to utilize its expanding cash flow from operations to reduce its debt further. With $4.3 billion in cash from operations in 2023, the company was well-positioned to continue debt management and reduction.

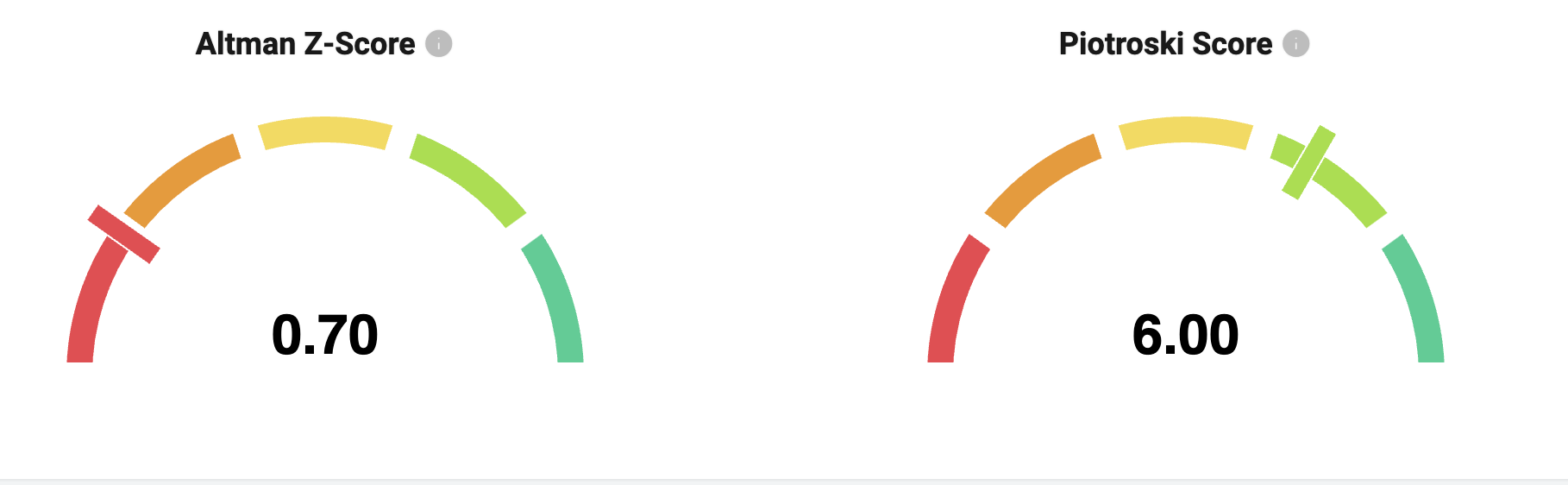

Carnival Key Financial Scores

Source: stockinvest.us

Altman Z score is a metric used to determine whether a company is likely to file for bankruptcy. Any number below 1.8 is considered a risky position. Carnival's current score is 0.70, which indicates that the company needs to perform better to eliminate the possibility of bankruptcy.

Piotroski score is another metric for determining a stock's valuation. The higher the number, the more stable it is, with numbers 8-9 considered the strongest position. For CCL, the current number is 6.0, which indicates a moderate valuation position.

Carnival Cruise Stock Forecast 2024 - Bullish Factors

- Carnival has made notable progress in reducing its debt. In 2023, following a zenith of more than $40 billion, the business recouped $6 billion. This pattern is anticipated to persist as the company employs its expanding cash from operations, which amounted to $4.3 billion in 2023. The continuous debt reduction initiative enhances Carnival's financial standing and bolsters investor trust.

- Carnival maintains a strong liquidity position, evidenced by its $5.4 billion in available funds and a current ratio of 0.36. The company's considerable liquidity allows it to navigate economic downturns and pursue business expansion.

- Since the end of the pandemic, Carnival has disclosed robust booking patterns and increased occupancy rates, which augur favorably for revenue expansion in 2024. Consumer confidence in the travel industry also signals a positive outlook for CCL.

CCL Stock Price Prediction 2024 - Bearish Factors

- A formidable obstacle is the fierce competition from other cruise lines, particularly those that have recuperated more rapidly and are in a stronger financial position. For example, Royal Caribbean and Norwegian Cruise Line have demonstrated more robust recovery trajectories.

- Carnival Corporation has accrued significant debt to maintain operations during the pandemic. Limited in its capacity to invest in expansion and fleet enhancement, the company's finances may be strained by the high-interest payments on this debt.

- Carnival may be required to issue additional shares to maintain liquidity and manage its debt, resulting in share dilution. This may diminish the value of existing shareholders' investments and CCL stock price.

III. Carnival Stock Forecast 2025

As per the current market structure, CCL showed valid buyers presence in the market, which can extend the upward momentum toward the 32.00 level by the end of 2025.

In the weekly chart of CCL, the recent price showed strong buying pressure as a valid bottom, which is visible at the 10.84 level. As the current price exceeds the crucial bottom, we may expect the buying pressure to extend in the coming weeks.

In the main chart, the 100-week Simple Moving Average is below the current price and shows a bullish slope. Moreover, the most recent weekly candle trades are bullish from the 20-week EMA line, which suggests a confluence of bullish factors from the structure.

In the secondary window, the Relative Strength Index shows ongoing buying pressure as the current level remains bullish above the neutral 50.00 line.

Based on the Carnival Stock Forecast 2025, the valid bullish continuation above the 20-week EMA line signals ongoing buying pressure. In that case, the primary aim for this stock is to test the 24.00 level. Moreover, a stable market above the 19.75 level could extend the gain towards the 31.53 resistance level.

On the bearish side, a failure to hold the price above the 13.80 support level could be an alarming sign to bulls, which might lower the price towards the 10.00 area.

A. Other CCL Stock Forecast 2025 Insights: Is CCL a good stock to buy?

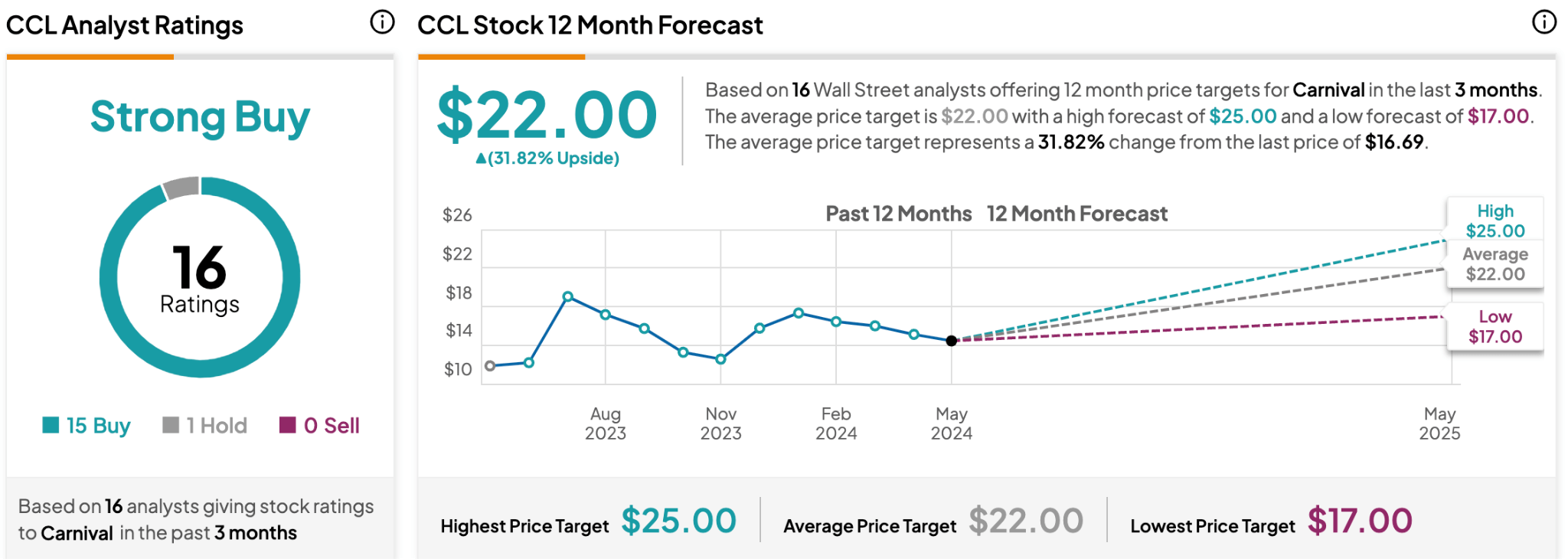

According to the latest report from Tiprank, the analysts' projection shows the highest level, reaching $25.00. The projection comes from 16 analysts, 15 of whom are strongly bullish on this stock.

Source: tipranks

However, the average CCL target price is $22.00, which could be reached by the end of 2025.

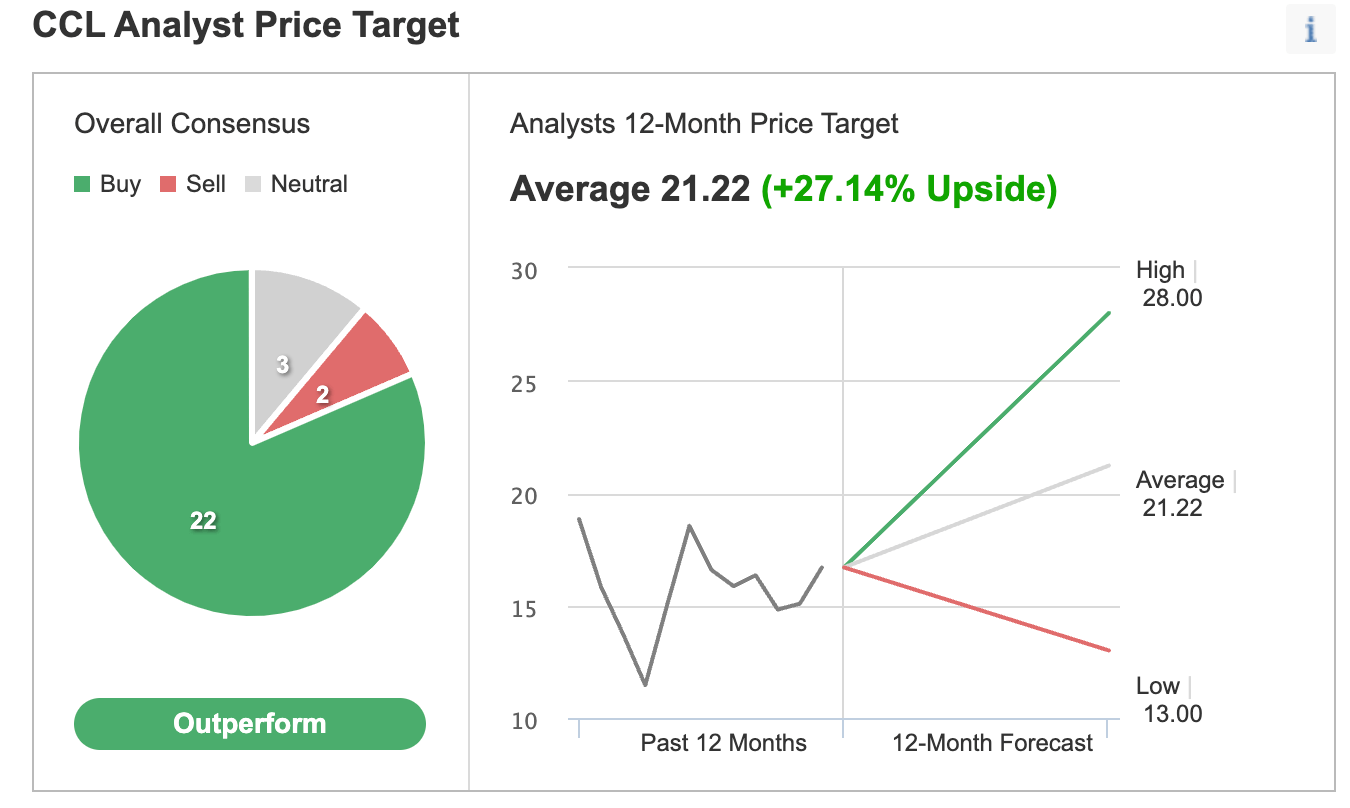

Source: investing.com

According to another report, 22 analysts are strongly bullish on this stock. The highest CCL price target for the next 12 months is $28.00. However, the average targeted price is $21.22, with a low Carnival price target of $13.00.

B. Key Factors to Watch for CCL Stock Price Prediction 2025

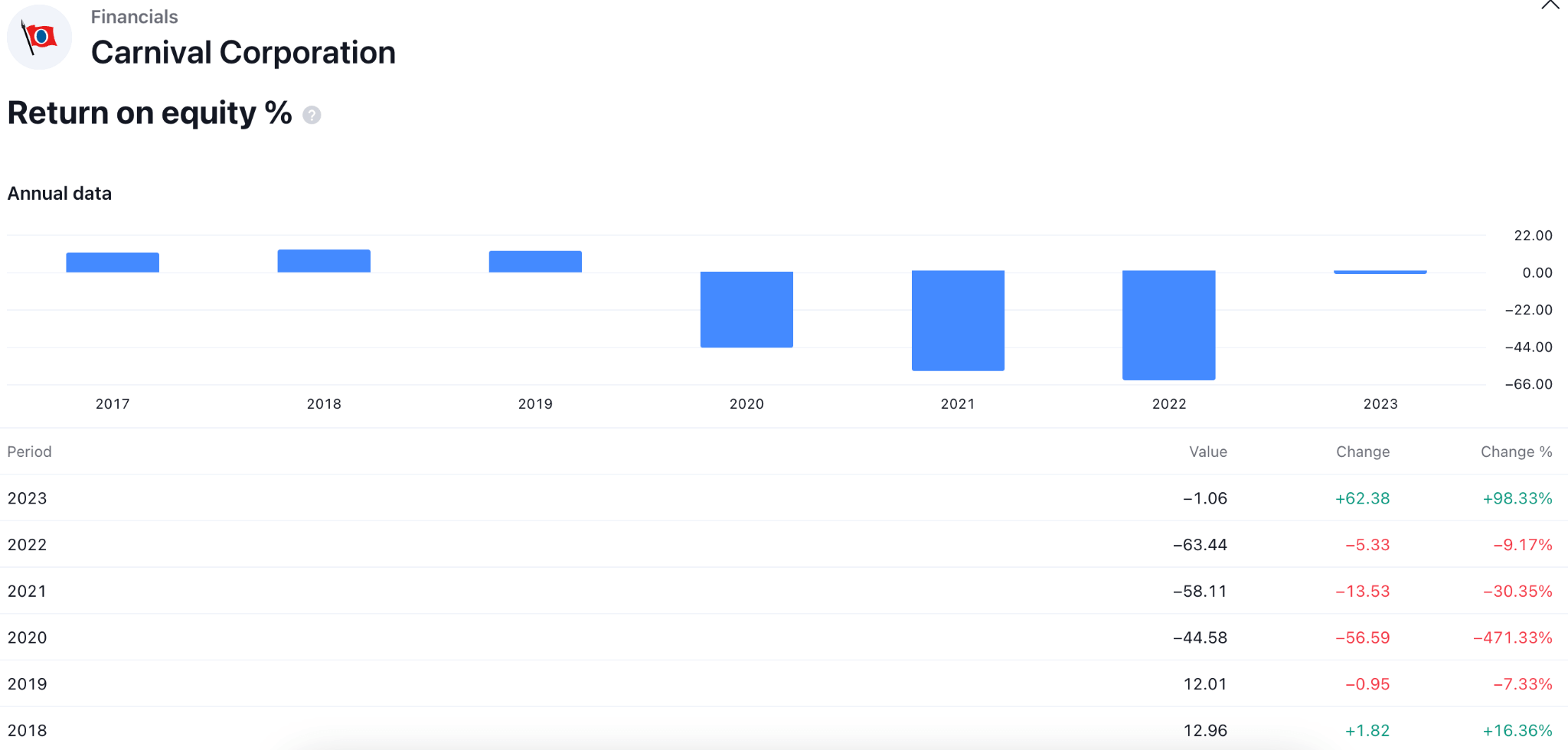

CCL Return On Equity Analysis

Return on equity is a metric used to determine a company's profit efficiency. The higher the number, the higher the efficiency for shareholders. For CCL, the recent number was not satisfactory, as 2020, 2021, and 2022 showed negative outcomes. However, the company reached the positive zone in 2023, which might be the primary sign of a positive ROE in 2025.

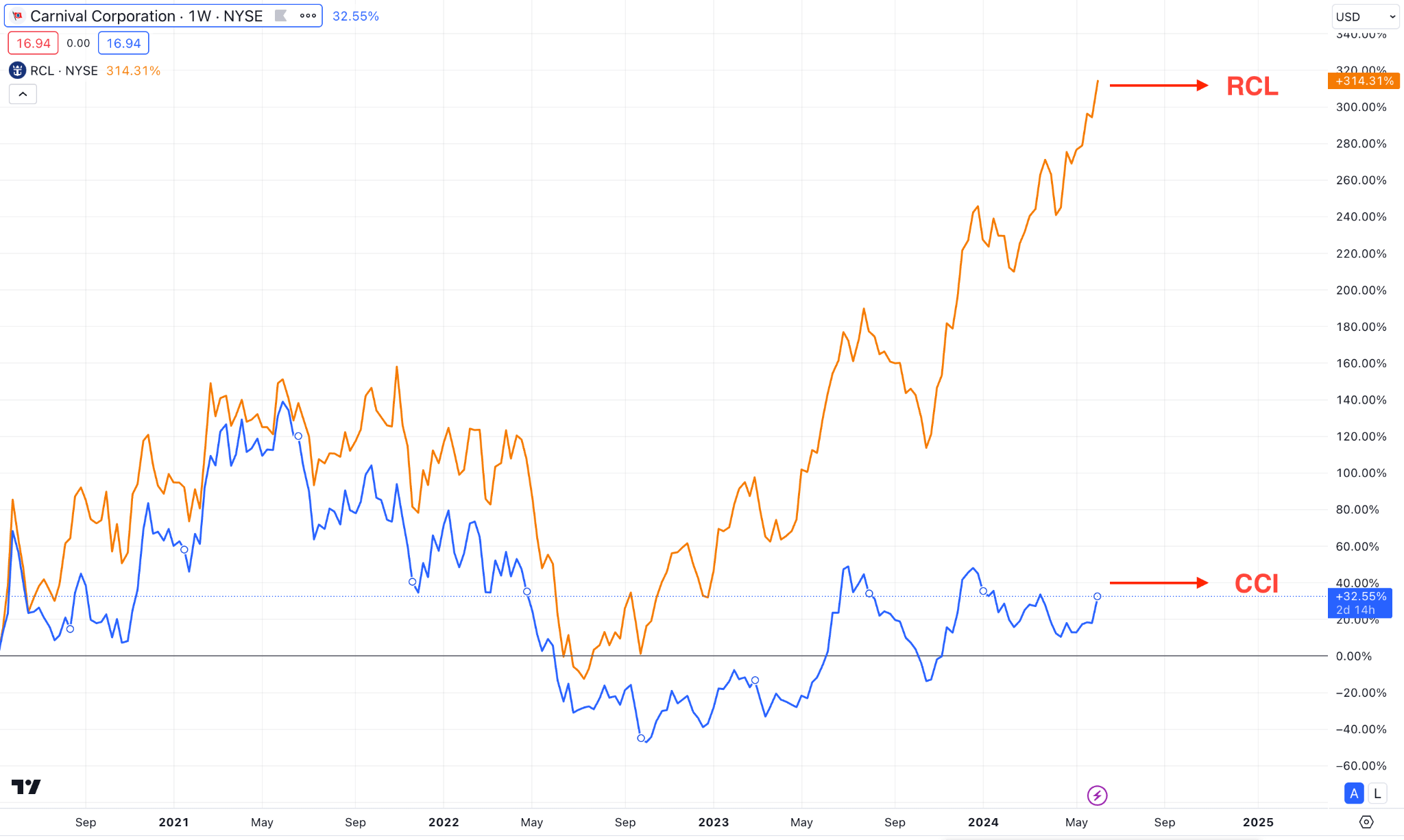

Competitive Factor

Carnival stock has increased by a mere 50% compared to its industry rival, Royal Caribbean Group (NYSE: RCL), in the past year as the cruise sector recovers from the closure caused by the pandemic. Carnival's predicament is even more severe, as its stock price has decreased by 70% in the last five years, whereas Royal Caribbean's has increased by 10%. Royal Caribbean has recouped every inch of ground lost during the pandemic, while Carnival stock remains in purgatory.

CCL Stock Prediction 2025 - Bullish Factors

- Carnival is introducing new vessels outfitted with more efficient technologies and cutting-edge amenities to modernize and expand its fleet. These novel vessels are anticipated to appeal to a wider range of clients and augment earnings using enhanced operational efficacy and reduced fuel expenditures.

- Carnival has improved its margin performance by implementing numerous cost management strategies. These endeavors include streamlining operations, optimizing petroleum usage, and capitalizing on economies of scale.

- By having a diversified presence in numerous geographic markets, Carnival mitigates its reliance on any one region and effectively distributes risk. The company's capacity to appeal to consumers internationally safeguards against economic contractions in specific regions and facilitates consistent revenue expansion.

Carnival Stock Forecast 2025 - Bearish Factors

- Carnival Corporation's substantial debt burden is anticipated to be a significant concern until 2025. The obligation to service this debt will continue to deplete cash flow, preventing the business from investing in expansion and fleet enhancements. The continuous financial burden may impede the performance of stocks.

- Ongoing financial challenges and competitive pressures may contribute to the persistent negative sentiment among investors and analysts. Analyst downgrades precipitated by unfavorable market conditions or poor financial performance may result in diminished investor confidence and a decline in the stock price.

- In 2025, the worldwide economy might encounter challenges, including inflationary forces, escalating interest rates, or a possible deceleration in economic growth. Inclement weather may cause consumers to reduce their discretionary spending, adversely impacting cruise bookings and revenue.

IV. CCL Stock Forecast 2030 and Beyond

For Carnival stock price prediction 2030 and beyond, as per the current price action, a successful breakout from the falling wedge could validate the long-term bullish opportunity, taking the price toward the 72.70 level within 2030.

In the monthly chart of CCL, the ongoing price action is corrective, which is at the multi-year low. However, a valid bullish reversal could come with a bottom formation, creating a base for a possible bullish trend.

The volume structure's most significant level is just below the 10.84 static line, which suggests ongoing buying pressure. In that case, a bullish trend reversal is possible as long as the current price hovers above the crucial high volume line.

In the main chart, the bullish 20-month EMA carry is visible, which suggests a strong bullish continuation signal. Moreover, the 100-month SMA is way above the current price, suggesting a possibility of bullish momentum as a mean reversion.

Based on the CCL Stock Forecast 2030 and Beyond, a valid falling wedge breakout could validate the long-term bullish signal. In that case, a bullish monthly candle above the 19.75 line could activate the long-term bullish signal, targeting the 40.00 level. Moreover, a stable market with consolidation above the 31.53 resistance level could open the room for reaching the 72.70 resistance level.

On the bearish side, a failure to extend the upward pressure above the 24.00 level could be an alarming sign to bears. In that case, a valid bearish reversal below the 13.89 low could lower the price below the 10.00 area.

A. Other Carnival Stock Forecast 2030 and Beyond Insights: CCL stock buy or sell?

According to a recent report from fintel.io, Carnival is more likely to maintain its positive revenue from 2025, reaching the highest level in 2031. Moreover, the forecasted annual EBITDA for the company in 2028-11-30 is 7,555MM. Considering the growth and revenue projection, the forecasted annual earnings of Carnival Corporation & plc in 2031-11-30 is 3.90 per share.

Source: fintel.io

Moreover, Motleyfool provided an optimistic outlook for CCL, projecting the stock price to grow in the future. The key factor for the upbeat share price came from the solid recovery from the pandemic, with a pent-up demand for vacations. The upbeat forecast is also supported by the record revenue, and demand in recent quarters.

As per the report, the stock is trading 75% down from the pre-pandemic high, which may remain until 2030. Despite the optimistic forecast, the report showed no promising outcome from this stock, with a growth of over $1000.

B. Key Factors to Watch for CCL Stock Forecast 2030 and Beyond

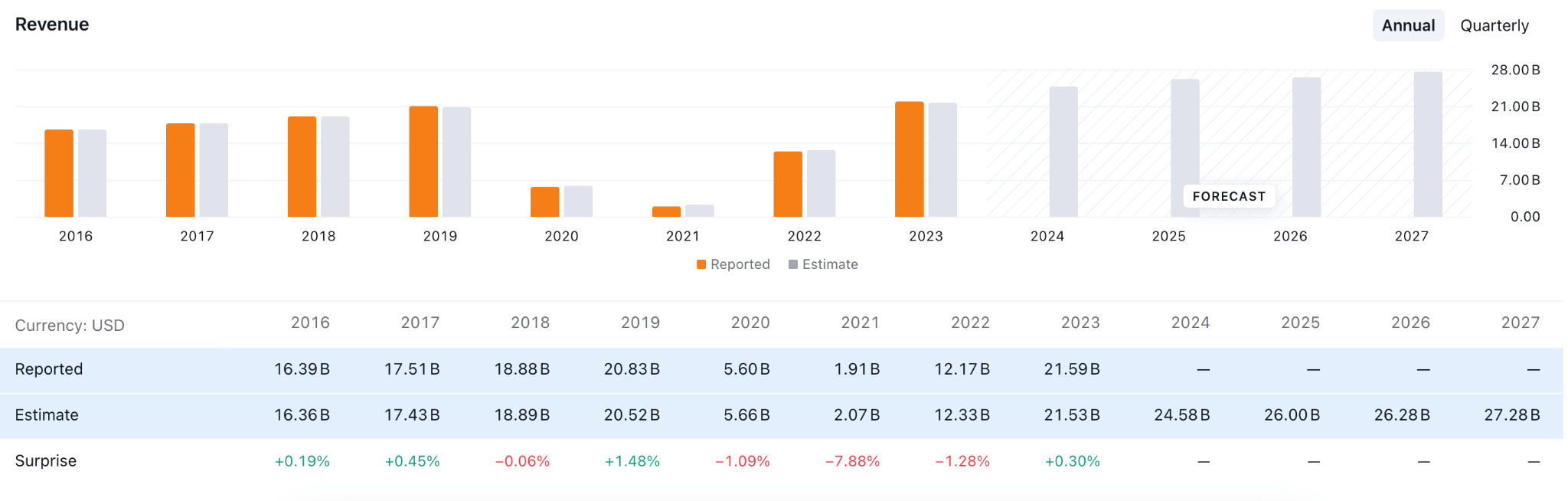

CCL Revenue Forecast

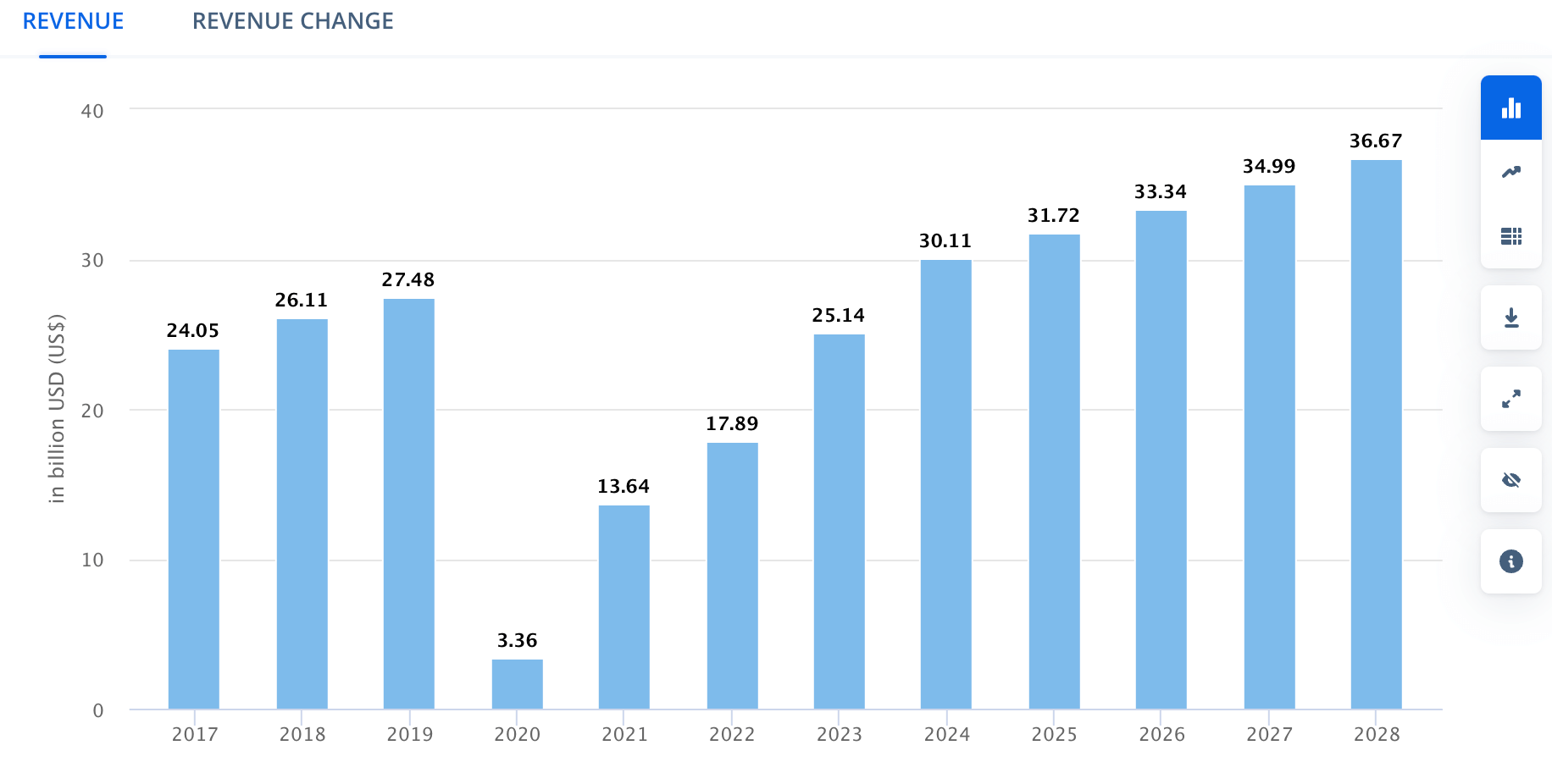

Revenue growth is a strong fundamental indicator for a company, and any upbeat revenue over 20% is considered a strong bullish factor for the stock. For CCl, the anticipated revenue from 2024 to 2030 remains higher than the previous reports, indicating potential business growth in the coming years.

However, investors should keep a close eye on the report, where any upbeat earnings could validate the investment opportunity.

Cruise Industry Growth

Source: statista

Industry growth is a crucial indicator for understanding what is happening globally. According to Statista data, the cruise industry's revenue in 2024 will be 30.11 billion, which might grow to 36.67 billion in 2028. Following the growth, Carnival Company may benefit from the higher revenue generation in 2030 and beyond.

CCL Business Expansion

The foremost cruise operator in the world, Carnival Corporation, is implementing a strategic move to strengthen the reputation of its Carnival Cruise Line (CCL) brand.

By integrating P&O Cruises Australia into CCL by March 2025, the latter will augment its fleet with two vessels and fortify its foothold in the South Pacific region. This expansion further increased overall capacity, and in addition to the two Excel-class ships, CCL announced it would deploy in 2027 and 2028.

Nearly 60% of the Australian cruise market is currently controlled by CCL, which operates 19 ships. Given CCL's greater scope, the P&O Australia absorption is anticipated to increase operational efficiency, which may result in enhanced performance in the region in 2030 and beyond.

CCL Stock Forecast 2030 and Beyond - Bullish Factors

- Carnival has established strategic alliances and partnerships with prominent industry participants, augmenting its market penetration and operational capacities. These partnerships have the potential to generate novel products and enhanced client satisfaction, thereby stimulating increased interest in Carnival's cruise services.

- Increasing consumer expenditure on experiences, an aging population with more free time, and rising disposable incomes in emerging markets are all elements that contribute to the cruise industry's anticipated expansion. As an industry leader, Carnival is in an advantageous position to leverage these developments, which supports a positive outlook on its stock.

- Carnival has made substantial investments in health and safety protocols in response to concerns that emerged throughout the pandemic to safeguard the well-being of its passengers. These enhanced protocols are anticipated to expand revenue in 2024 due to increased booking rates and bolstered consumer confidence.

- Carnival is optimizing operational efficiency and customer engagement by implementing digital technologies. Anticipated outcomes include providing personalized services via mobile applications, enhanced data analytics to facilitate targeted marketing, and establishing online booking platforms that foster customer loyalty and satisfaction, sustaining revenue expansion.

CCL Stock Forecast 2030 and Beyond - Bearish Factors

- Carnival is susceptible to geopolitical risks stemming from its extensive international operations, encompassing regional conflicts, political instability, and alterations in trade policies. Such uncertainties may disrupt operations, resulting in increased expenses and decreased profits.

- Technological advancements, including integrating artificial intelligence, automation, and improved onboard experiences, are assuming a critical role within the travel sector. Financial constraints could impede Carnival's capacity to invest in and implement these technologies, thereby potentially lagging behind its technologically adept competitors.

- Carnival may risk its fleet becoming antiquated if it lacks the financial resources to purchase new vessels and renovate existing ones. An aging fleet has consequences, including higher maintenance expenses, decreased operational effectiveness, and lowered customer satisfaction, which can adversely affect the company's competitive standing.

V. Conclusion

A. CCL Stock Outlook

Carnival Corporation has exhibited substantial resilience and progress as it strategically positions itself for future development and navigates post-pandemic recovery. The company's effective management and strong demand are evident in the company's robust financial performance in early 2024, characterized by a substantial increase in revenue and customer deposits.

Carnival's strategic realignment, which involves integrating P&O Cruises Australia into its operations, is designed to increase efficiency and broaden its market presence in the South Pacific.

Carnival's initiatives to mitigate debt, fortify liquidity, and implement innovative technologies to improve visitor experiences have provided investors with justification for optimism. The favorable outlook for Carnival is emphasized by the positive stock forecasts from various analysts, who anticipate substantial growth in the years ahead.

Carnival is well-positioned to capitalize on the anticipated growth of the cruise industry and the growing consumer demand for cruising as it continues to expand on its legacy and implement strategic expansions.

B. Trade CCL Stock CFD with VSTAR

You can buy Carnival Stock (CCL) stock from VSTAR with other instruments from forex, stocks, indices, commodities, and cryptocurrencies with these benefits:

- Experience profits from buy and sell, both from VSTAR CFDs

- VSTAR mobile apps provide seamless trading from anywhere, anytime.

- VSTAR is a regulated platform that ensures the maximum safety of clients' funds.

- Copy trading function can offer to make money by following expert traders' activity directly to your trading account.

From this point forward, it will be essential to preserve the financial health, technological advancement, and operational efficiency of CCL to achieve long-term profitability and sustain growth.

FAQs

1. Is CCL a good buy right now?

CCL has a consensus analyst rating of "Moderate Buy" with a potential upside of 16.6%.

2. Is Carnival stock expected to rise?

Yes, the general sentiment is positive, with expectations for revenue growth and a return to profitability in the near future.

3. What is the 12-month forecast for CCL stock?

The average 12-month price forecast for CCL stock is $22.00, with a high estimate of $25.00 and a low estimate of $11.00.

4. What is the CCL outlook for 2024?

For fiscal 2024, analysts expect Carnival's revenue to rise 13% to $24.3 billion, its adjusted EBITDA to grow 31% to $5.4 billion, and for it to return to full-year profitability with $1.2 billion in net income.