I. Recent Boeing Stock Performance

Recent BA stock price performance and changes

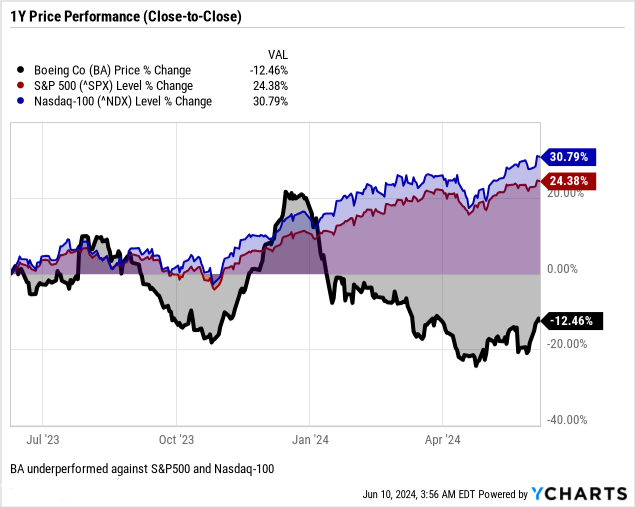

Boeing's stock performance has been underwhelming compared to broader market indices. With a market cap of $116.79B, Boeing's 52-week high and low prices stand at $159.70 and $267.54, respectively. Over the past year, Boeing experienced a meager 13% price return (close-to-close), significantly trailing behind the S&P 500's 31% return and Nasdaq-100's 24% return.

Several factors contribute to this subdued performance. Boeing faced persistent challenges, including the prolonged grounding of its 737 MAX aircraft due to safety concerns, global travel restrictions amid the pandemic, and supply chain disruptions. These issues have eroded investor confidence, leading to sluggish stock growth. Additionally, heightened competition in the aerospace industry, particularly from emerging market players, poses long-term threats to Boeing's market share and profitability.

Source: Ycharts.com

Main Influencing Factors

Boeing's recent stock performance has been significantly influenced by a range of internal and external factors. A primary internal factor is the company's strategic decision to slow down 737 production. This measure was taken to enhance quality and safety management systems, which although essential for long-term stability, has negatively impacted short-term revenues and delivery volumes. Specifically, Boeing's Q1 2024 results show an 8% decline in revenue compared to the previous year, primarily due to lower 737 deliveries and considerations related to the 737-9 grounding.

Financial performance also reflects substantial operational challenges, such as the $3.9 billion free cash flow usage and a core loss per share of ($1.13). Despite these setbacks, Boeing's backlog grew to $529 billion, indicating strong future demand. Notably, the commercial airplanes segment reported significant net orders, suggesting optimism for recovery once production issues are resolved.

Source: Q1 2024 Earnings Presentation

External factors also play a crucial role. Regulatory scrutiny and the need to comply with FAA standards have forced Boeing to implement comprehensive action plans, further slowing production. Additionally, global supply chain disruptions have compounded these challenges, affecting the availability of critical components and materials. Boeing's defense, space, and security segments provided some financial stability, with a modest increase in operating margins due to higher volume and improved performance. However, losses on certain fixed-price development programs partially offset these gains.

Expert Insights on Boeing Stock Forecast for 2024, 2025, 2030 and Beyond

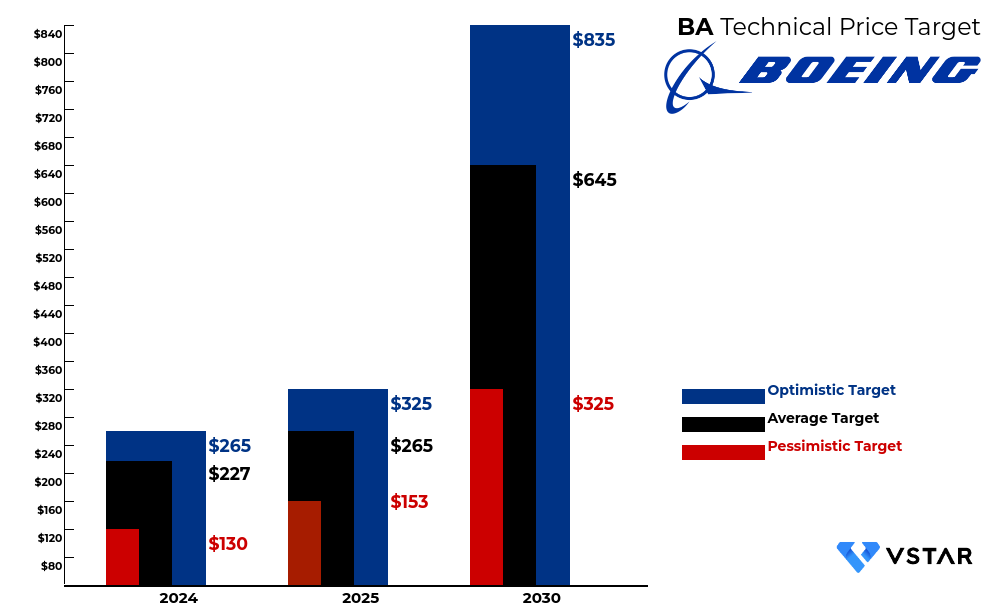

The recent performance of Boeing stock has been subject to scrutiny amidst varying expert forecasts for its trajectory into the future. The provided data presents a range of projections spanning 2024, 2025, and 2030, indicating a spectrum of optimism, moderation, and caution.

For Boeing stock price prediction 2024, the optimistic target stands at $265, reflecting bullish sentiments, while the average target of $227 represents a more conservative outlook. The pessimistic target of $130 signals apprehension or potential downside risks. Moving into 2025, the forecast continues this trend, with Boeing stock projections ranging from $153 to $325, showcasing the diverse perspectives on Boeing stock future performance.

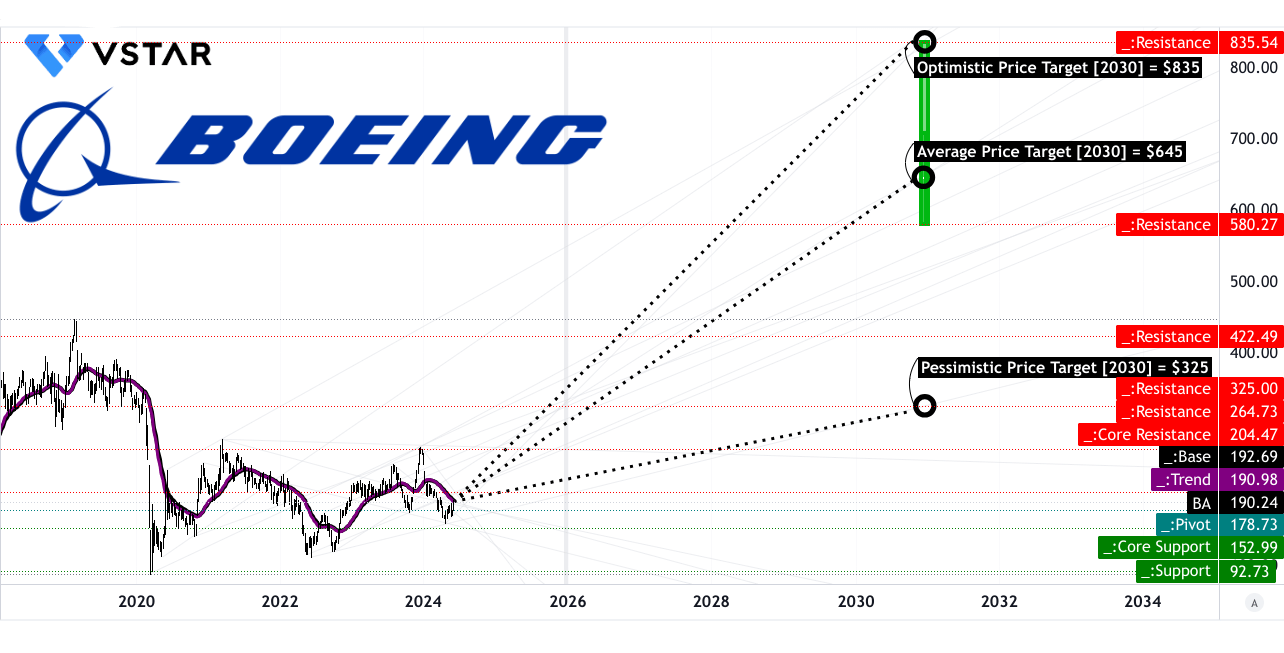

The most substantial disparity emerges in the 2030 BA forecast, where the optimistic target reaches $835, suggesting significant growth potential over the decade, while the pessimistic target remains notably lower at $325, underscoring lingering uncertainties or challenges.

Source: Analyst's Compilation

II. Boeing Stock Forecast 2024

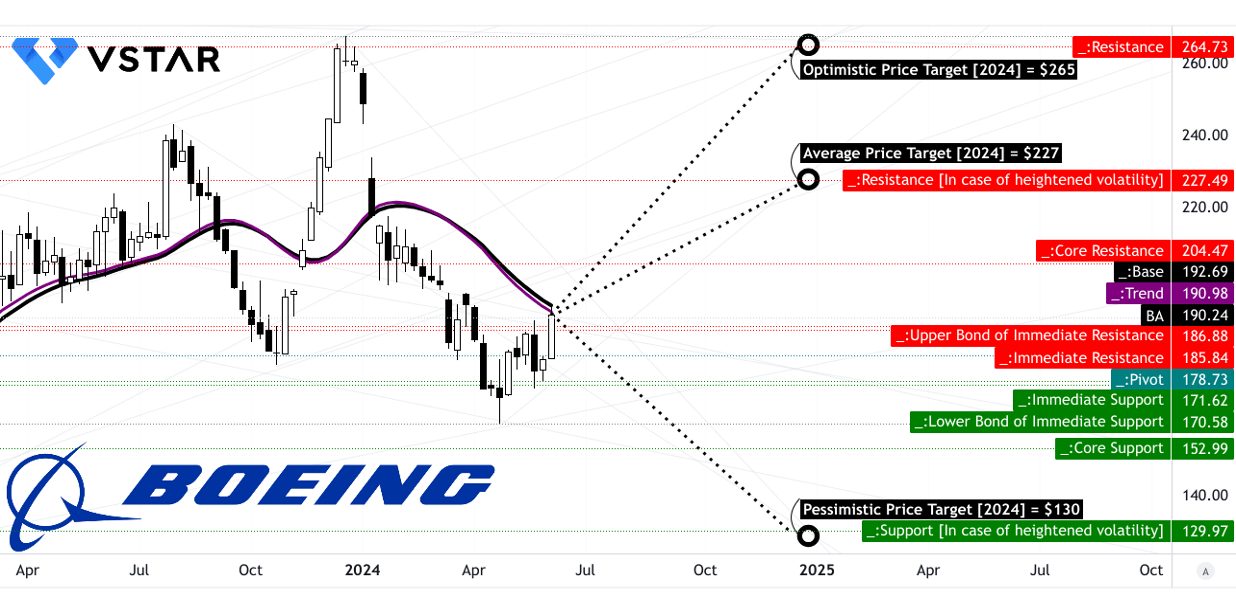

Boeing's (NYSE: BA) average price target by the end of 2024 is projected to be $227.00. This forecast is based on the momentum of change-in-polarity over the short-term, extrapolated over Fibonacci extension levels. Additionally, an optimistic Boeing price target of $265.00 is proposed, considering the upward price momentum of the current swing over the short-term and its projection over Fibonacci extension levels. Conversely, a pessimistic BA stock price target of $130.00 is outlined, reflecting the downward price momentum of the current swing over the short-term, projected over Fibonacci retracement levels.

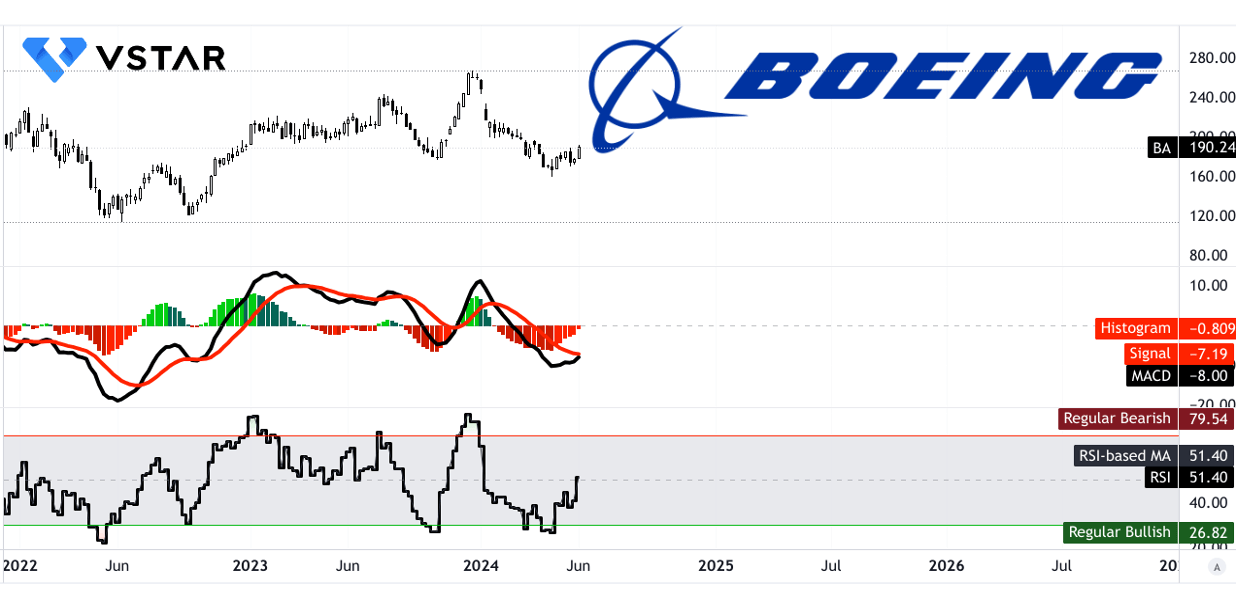

BA stock is currently priced at $190.24 with a modified exponential moving average trendline of $190.98 and a baseline of $192.69. The direction of the stock price is noted as upward, suggesting positive momentum. In terms of support and resistance levels, primary support is estimated at $186.88, with a pivot of the current horizontal price channel at $178.73. Core resistance is identified at $204.47, with potential heightened volatility resistance at $227.49. Core support and support in case of heightened volatility are calculated at $152.99 and $129.97, respectively.

Source: tradingview.com

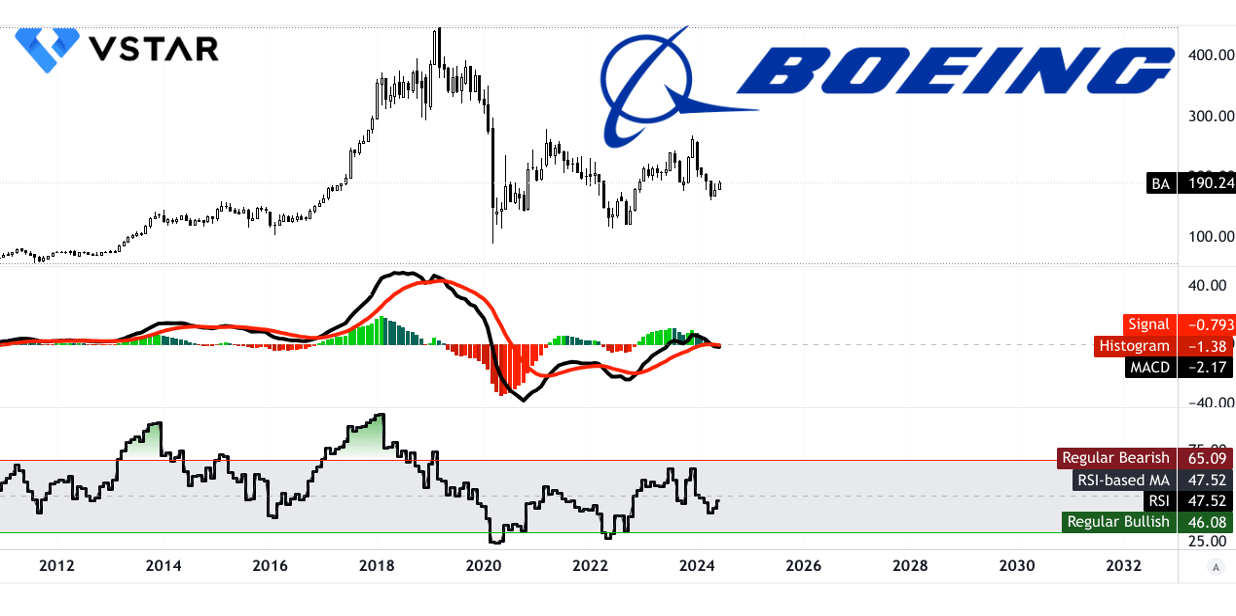

The Relative Strength Index (RSI) stands at 51.4, indicating a neutral stance with an upward trend. Moving Average Convergence/Divergence (MACD) indicators suggest a bearish trend with decreasing strength, as the MACD line (-8) falls below the signal line (-7.19), with a negative MACD histogram (-0.809).

Source: tradingview.com

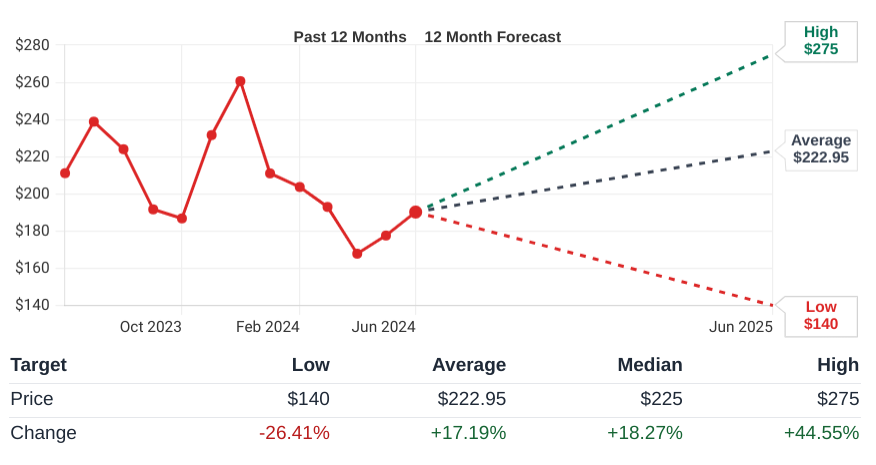

The Boeing stock forecast for 2024 indicates a generally positive outlook with some variations in predicted targets. According to TipRanks, the average BA price target is $215.43, with estimates ranging from a low of $140 to a high of $270. This average suggests a 13.24% increase from the current price of $190.24. Similarly, StockAnalysis provides an average target of $222.95, with a high of $275 and a low of $140, indicating a 17.19% potential increase. CoinPriceForecast predicts the stock will reach $200 by mid-2024 and $214 by year-end, representing a 12% increase from the current price.

Source: stockanalysis.com

A. Other BA Stock Forecast 2024 Insights: Boeing stock buy or sell?

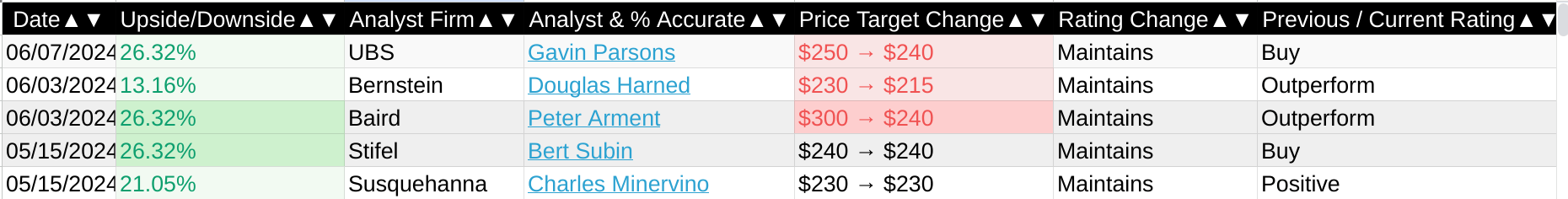

The stock forecast for Boeing (NYSE: BA) in 2024 suggests a mixed outlook among analysts. Analysts from major institutions have provided varied price targets and ratings for Boeing's stock. These are essential to understand the expectations for Boeing's market performance:

- UBS: Analyst Gavin Parsons maintains a 'Buy' rating with a revised BA price target of $240, suggesting a 26.32% upside.

- Bernstein: Douglas Harned has an 'Outperform' rating, adjusting the target from $230 to $215, indicating a 13.16% upside.

- Baird: Peter Arment also keeps an 'Outperform' rating, lowering the target from $300 to $240, with a 26.32% upside.

- Stifel: Bert Subin maintains a 'Buy' rating with a consistent Boeing price target of $240, reflecting a 26.32% upside.

- Susquehanna: Charles Minervino keeps a 'Positive' rating with a BA price target of $230, indicating a 21.05% upside.

Overall, analysts exhibit a cautiously optimistic view on Boeing, with price targets mostly in the range of $215 to $240, and a couple of higher outliers. This indicates confidence in Boeing's potential for recovery and growth, albeit with some reservations likely tied to the company's recent challenges and market conditions.

Source: Benzinga.com

B. Key Factors to Watch for Boeing Stock Predictions 2024

Boeing Stock Forecast 2024 - Bullish Factors

Quality Improvement Initiatives: Boeing's proactive measures to address quality control issues, including collecting employee feedback and engaging in a comprehensive quality action plan, indicate a commitment to enhancing product standards. These initiatives can foster investor confidence in the company's long-term sustainability and market competitiveness.

Strong Demand Across Portfolio: Despite short-term challenges, Boeing emphasizes robust demand across its portfolio. The company's ability to secure significant orders, such as those from American Airlines and Ethiopian Airlines, underscores market confidence in Boeing's products, potentially bolstering investor optimism.

Positive Defense Segment Performance: Boeing's Defense & Space segment witnessed notable order bookings and revenue growth. With a backlog of $61 billion and solid demand, particularly highlighted in the FY 2025 presidential budget, the defense sector's stability could contribute positively to overall financial performance.

Boeing Stock Forecast 2024 - Bearish Factors

Production Challenges: Boeing's admission of deliberately slowing production, particularly in the commercial airplane segment, to address quality and safety concerns may impact short-term financial performance. Lower delivery volumes, as evidenced by reduced 737 deliveries, could lead to revenue declines and margin compression, potentially dampening investor sentiment.

Source: seekingalpha.com

Cash Flow Concerns: Despite expectations of improved cash flow in the latter part of 2024, Boeing anticipates another sizable use of cash in the second quarter. Continuous monitoring of liquidity levels suggests ongoing financial pressures, raising apprehensions about the company's ability to meet its debt obligations and maintain an investment-grade rating, which could unsettle investors.

Uncertainty Surrounding Strategic Deals: Negotiations with Spirit AeroSystems present uncertainties regarding terms, financing, and divestment strategies. The complexity of such deals, coupled with ongoing factory stabilization efforts, may prolong decision-making processes, creating investor unease regarding Boeing's strategic direction and potential implications on financial performance.

III. Boeing Stock Price Prediction 2025

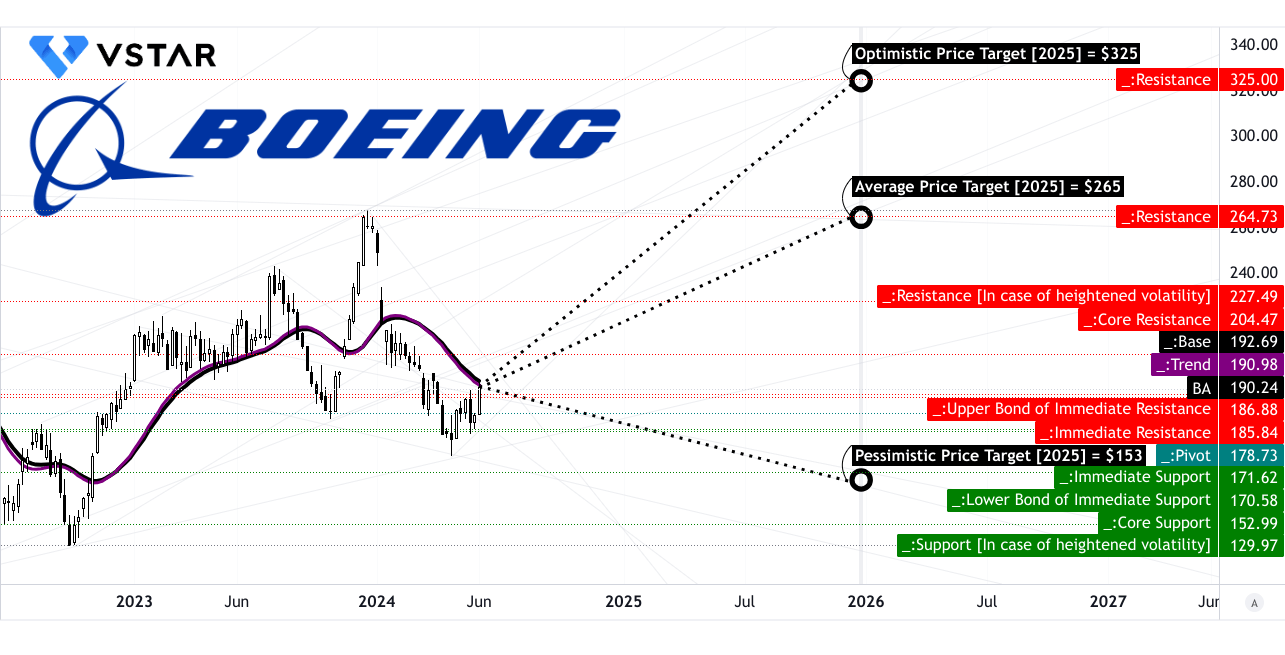

Based on technical analysis and current market trends, the projected average price target for Boeing (NYSE: BA) by the end of 2025 is $265.00. This prediction is rooted in the momentum of change-in-polarity over the mid-term, further supported by Fibonacci extension levels. Optimistically, the stock could reach as high as $325.00 if the upward price momentum of the current swing persists over the mid-term. However, if negative market conditions prevail, the pessimistic BA price target could see the stock fall to $153.00, reflecting a downward momentum projected over Fibonacci retracement levels.

Source: tradingview.com

The current price of Boeing stock at $190.24, slightly below its modified exponential moving averages trendline of $191 and baseline of $193, suggests a near-term upward trajectory. The overall direction of the stock price is upward, aligning with the technical indicators. The primary support is noted at $186, while significant resistance levels include the core resistance at $205 and an upper resistance at $265. These levels are essential as they define potential breakout or breakdown points. The pivot of the current horizontal price channel at $179, alongside core support at $153 and heightened volatility support at $130, provides a comprehensive range within which the stock might fluctuate under different market conditions.

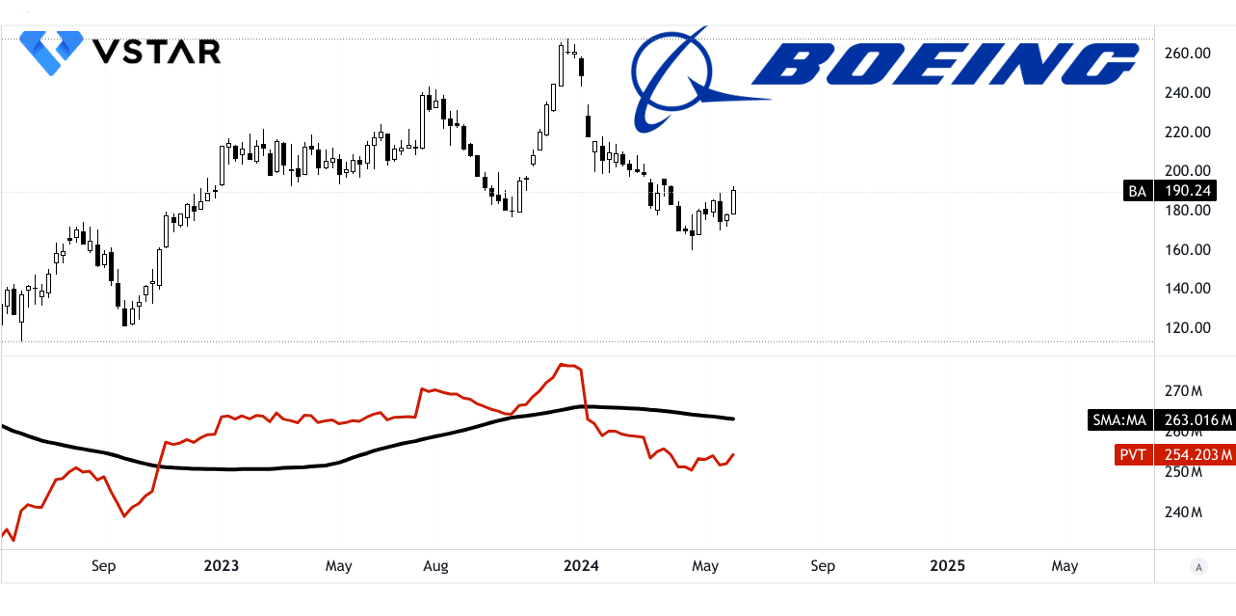

Moreover, the Price Volume Trend (PVT) line at 254.203 million and the moving average at 263.016 million indicate a prevailing bearish sentiment.

Source: tradingview.com

The Boeing stock price predictions for 2025 vary between $208 and $250. Coincodex.com predicts a modest rise to $208, based on historical growth trends, implying a 9.34% increase. Conversely, coinpriceforecast.com suggests a more bullish outlook, forecasting a range of $239 to $293 by year-end, marking a significant 54% surge. Discrepancies arise from differing methodologies and data interpretations. Factors like market sentiment, global economic conditions, and Boeing's performance in aerospace innovation and competition will heavily influence actual outcomes. Investors should evaluate these forecasts cautiously, considering broader market dynamics and company-specific factors for informed decision-making.

A. Other Boeing Stock Forecast 2025 Insights: Is Boeing stock a buy?

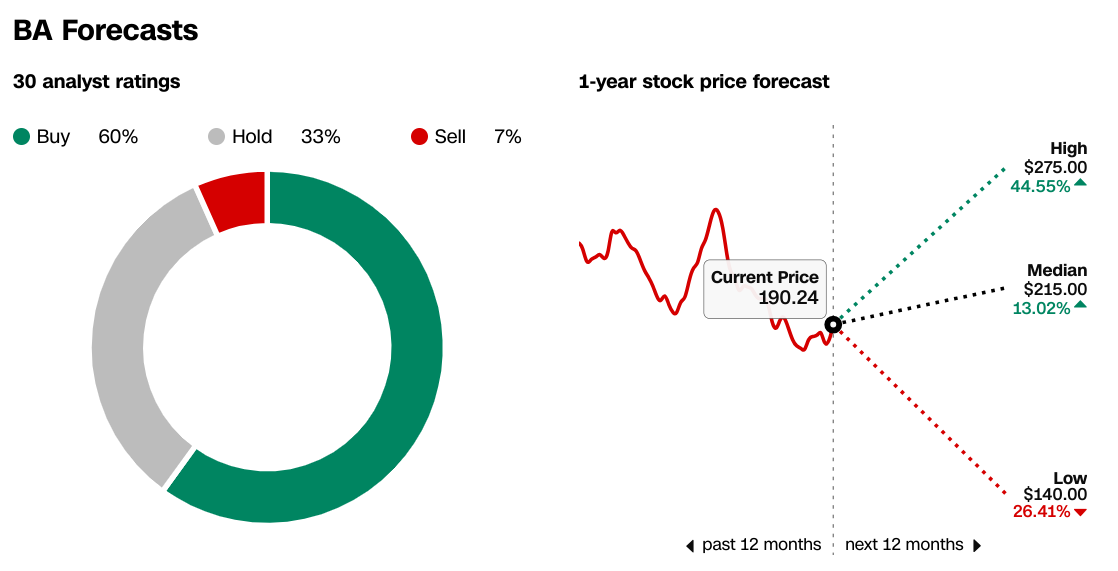

Boeing stock price prediction 2025 is influenced by various analysts' ratings and price targets from major institutions. According to CNN.com, out of 30 analyst ratings, 60% recommend buying, 33% suggest holding, and 7% advise selling Boeing stocks. The 1-year stock price forecast ranges from a high of $275.00 (44.55% increase), a median of $215.00 (13.02% increase), to a low of $140.00 (26.41% increase) from the current price of $190.24.

Source: CNN.com

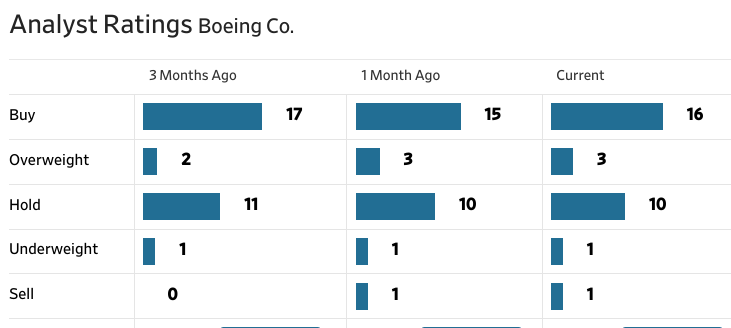

Similarly, WSJ.com presents analyst ratings indicating shifts in sentiment over time. Three months ago, there were 17 buy ratings, 11 holds, and no sells. Currently, there are 16 buys, 10 holds, and 1 sell. This indicates a relatively stable outlook with slight adjustments in recommendations.

The stock price targets from WSJ.com echo those of CNN.com, with a high of $275.00, a median of $215.00, and a low of $140.00, suggesting a consensus among analysts. The average Boeing target price stands at $214.94, slightly below the median. These forecasts indicate cautious optimism, with potential for significant growth but also some downside risk.

Source: WSJ.com

B. Key Factors to Watch for BA Stock Forecast 2025

Boeing Stock Price Prediction 2025 - Bullish Factors

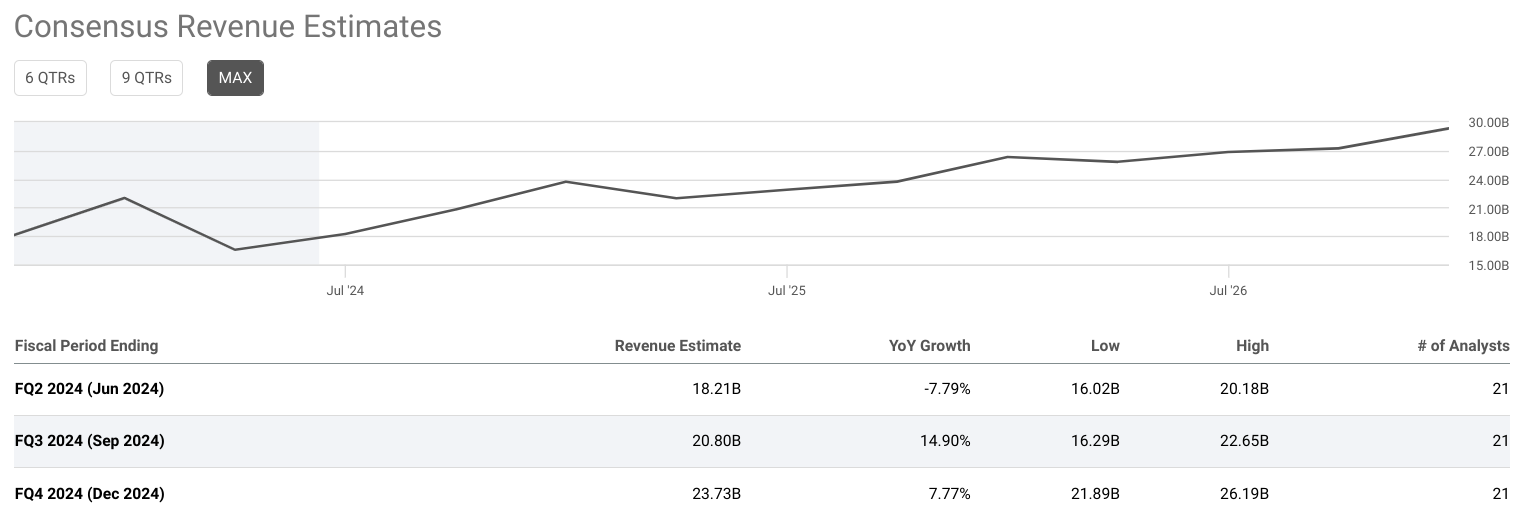

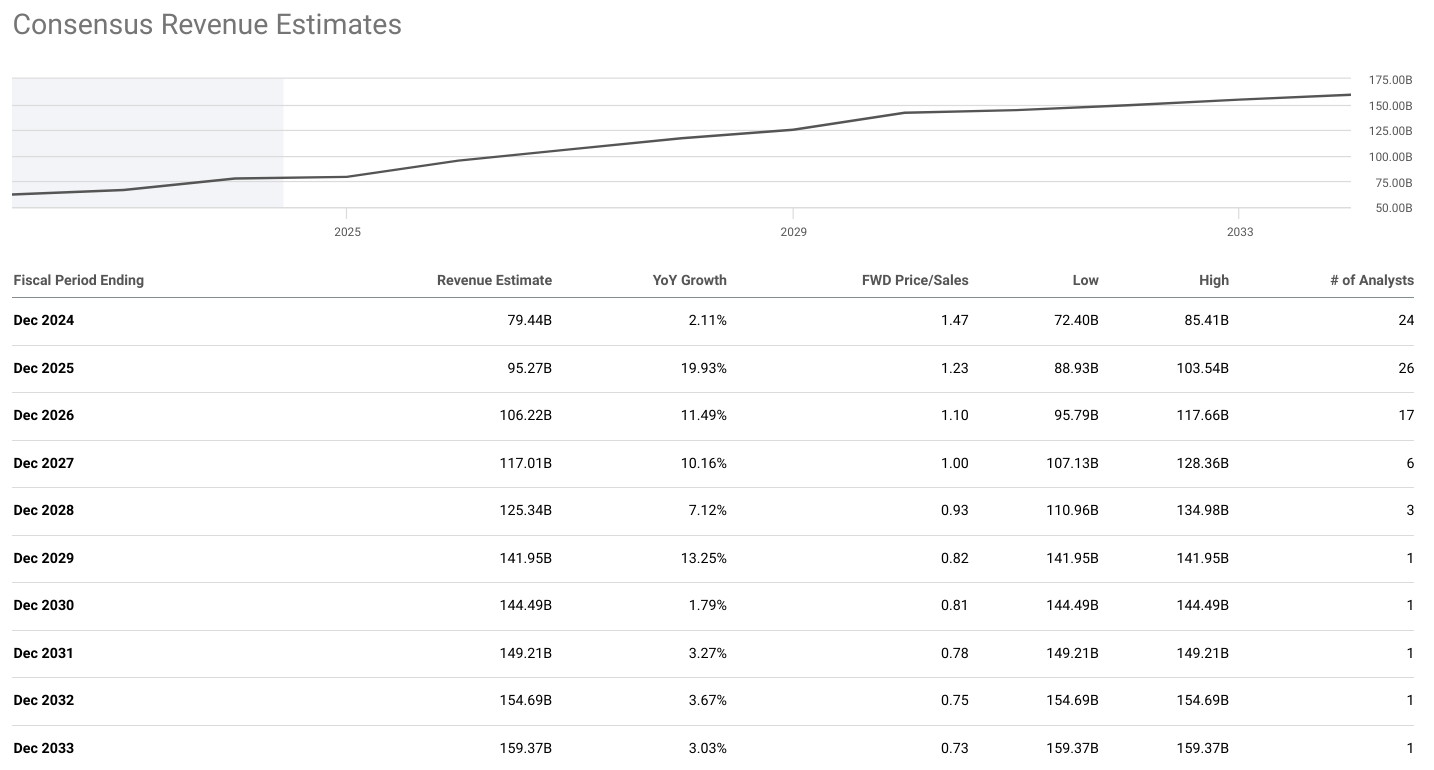

Revenue Growth: Analysts anticipate a significant uptick in revenue for Boeing by the end of 2025, with estimates suggesting a 19.93% year-over-year growth. This growth is attributed to strong demand across Boeing's portfolio, particularly in its commercial aviation segment.

Product Orders: Despite recent setbacks, Boeing continues to secure substantial orders for its aircraft, such as the 125 net orders booked in the last quarter alone. These orders not only bolster revenue but also underline sustained demand for Boeing's products.

Boeing Stock Price Prediction 2025 - Bearish Factors

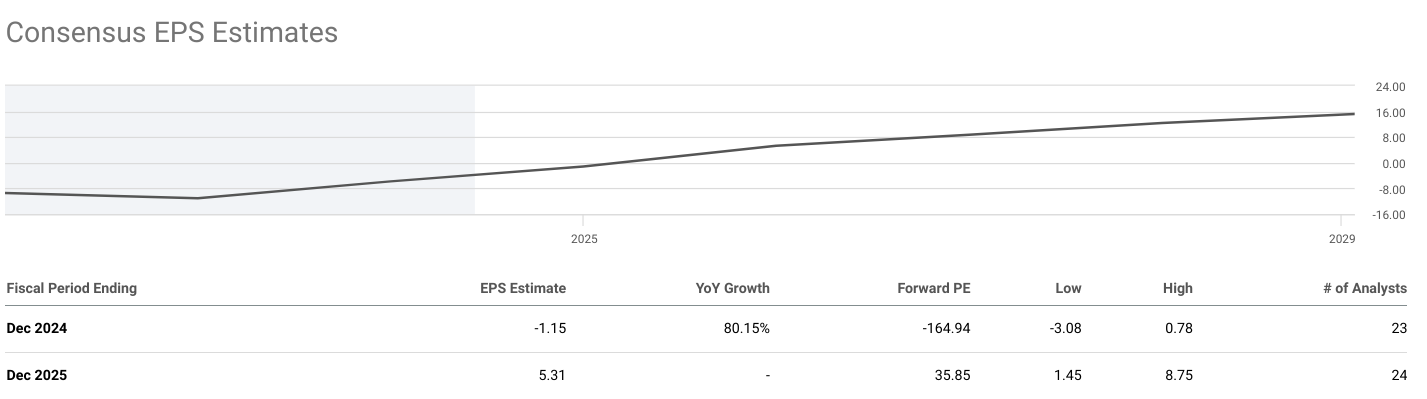

EPS Volatility: While revenue is projected to surge, EPS estimates paint a less optimistic picture. The consensus forecasts suggest a negative EPS in 2024 with a YoY growth of 80.15%, followed by an EPS improvement to $5.31 in 2025. This volatility in BA earnings growth may concern the company's profitability.

Source: seekingalpha.com

Quality Control Challenges: Boeing's recent quality control issues, highlighted by the door plug depressurization incident, raise concerns about product safety and regulatory compliance. Ongoing efforts to address these challenges, while commendable, may indicate systemic issues that could impact investor confidence.

Production Delays: Slowed production rates, particularly in the commercial aviation segment, pose a risk to revenue generation and cash flow. Delays in delivering aircraft, attributed to quality improvements and supply chain constraints, could hinder Boeing's ability to meet customer demand and realize projected revenue targets.

IV. Boeing Stock Forecast 2030 and Beyond

Source: tradingview.com

Based on current technical analysis and projected trends, Boeing stock (BA) is anticipated to experience substantial growth by 2030. The average BA price target for the end of 2030 is $645.00, reflecting a significant rise from its current price of $190.24. This projection is grounded in the momentum of change-in-polarity over the long term, analyzed through Fibonacci extension levels. The optimistic scenario predicts a price of $835.00, driven by strong upward price momentum over the same period, again calculated via Fibonacci extensions. Conversely, the pessimistic forecast, which considers potential downward price movements through Fibonacci retracement levels, suggests a lower bound of $325.00 by 2030.

Price charts indicate a sideways current trend, with key technical levels identified. The stock is presently at $190.24, slightly below the trendline and baseline figures ($190.98 and $192.69, respectively), indicating a consolidation phase. Primary resistance levels are observed at $264.00 and $204.47, with significant resistance at $422.00 and extreme resistance in the case of heightened volatility at $580.00. Core support is strong at $153.00, with significant support at $93.00. These levels highlight potential areas of price action where buying and selling pressure could intensify.

The Relative Strength Index (RSI) value of 47.52 suggests neither overbought nor oversold conditions, and its upward trend indicates potential for future bullish movement. However, the MACD indicator presents a bearish histogram (-1.38), with the MACD line below the signal line, although the bearish trend appears to have stabilized.

Source: tradingview.com

The forecasts for Boeing stock reveal bullish sentiments, indicating substantial growth potential. Coincodex.com predicts a steady rise, with an estimated 70.84% increase by 2030. Meanwhile, coinpriceforecast.com projects even more aggressive growth, suggesting a potential 158% surge by 2030.

Source: coinpriceforecast.com

A. Other Boeing Stock Forecast 2030 and Beyond Insights: Is Boeing a buy?

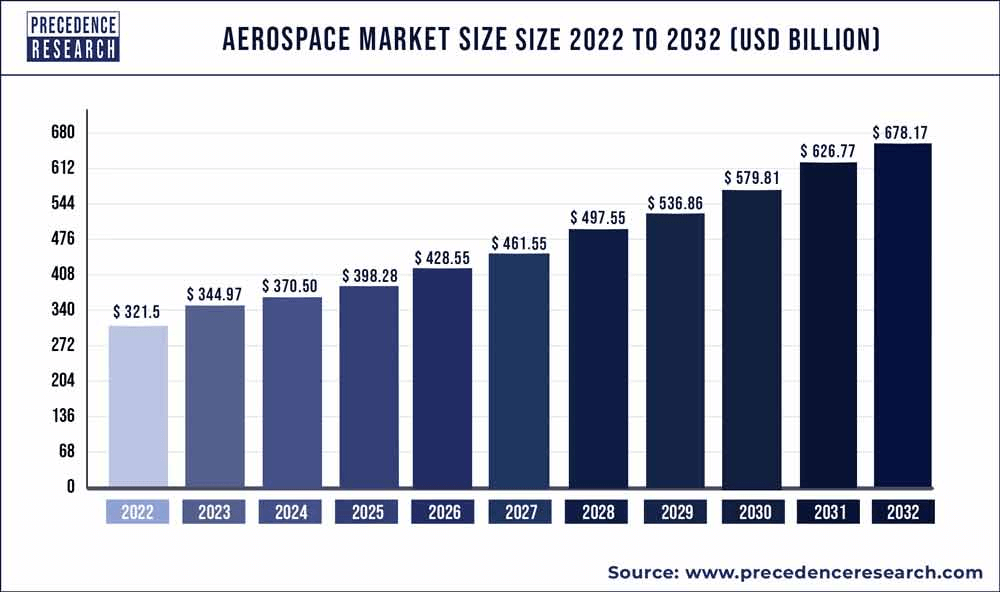

As per precedenceresearch.com, the global aerospace market may hit $678.17 billion by 2032 based on a CAGR of 7.80% during 2023 to 2032. This trend and growth will benefit Boeing's topline progress over the long-term alongside the major positive shifts in the space industry.

Source: precedenceresearch.com

B. Key Factors to Watch for BA Stock Forecast 2030 and Beyond

Boeing Stock Forecast 2030 and Beyond - Bullish Factors

Revenue Growth: Consensus revenue estimates project a steady increase from $79.44 billion in 2024 to $159.37 billion by 2033, indicating sustained growth potential. This growth is fueled by strong demand across Boeing's portfolio, particularly in defense and global services.

Source: Seekingalpha.com

Diversification: Boeing's diversified portfolio across commercial airplanes, defense, and global services provides a buffer against sector-specific challenges. Strong performance in Boeing Defense & Space and Boeing Global Services segments contributes to overall stability.

Boeing Stock Predictions 2030 and Beyond - Bearish Factors

Debt Burden: Boeing's significant debt balance, albeit decreasing, poses a financial risk, especially amidst ongoing cash flow challenges. The need to prioritize investment-grade ratings may constrain strategic initiatives or limit flexibility in adverse market conditions.

Supply Chain Risks: Boeing's supply chain vulnerabilities, as evidenced by supplier non-conformances and factory constraints, could disrupt production schedules and impact financial performance. Managing supplier relationships and stabilizing the supply chain are critical for mitigating these risks.

V. Conclusion

A. Boeing Stock Outlook: Is Boeing a good stock to buy?

Boeing stock (NYSE: BA) is expected to see varied price targets over the next decade. For Boeing stock prediction 2024, analysts predict an average BA price target of $227, with optimistic estimates reaching $265 and pessimistic views at $130. Moving into 2025, forecasts show a broader range, with average targets around $265, optimistic highs at $325, and lows near $153. By 2030, projections suggest substantial growth, with average targets around $645, optimistic scenarios reaching $835, and pessimistic estimates at $325. These predictions consider Boeing's recovery efforts, ongoing challenges, and market conditions.

B. Trade BA Stock CFD with VSTAR

The Boeing stock outlook remains cautiously optimistic. The company's backlog, strong demand across its portfolio, and improvements in quality control are positive indicators. However, production challenges, regulatory scrutiny, and debt burdens remain significant concerns.

For those trading Boeing stock CFDs (Contracts for Difference), it's essential to consider the volatility and leverage risks associated with CFDs. Overall, a balanced approach with a focus on long-term gains might be prudent, especially given the expected volatility in the aerospace sector.

Trading Boeing stock CFDs with VSTAR offers several advantages:

- Tight Spreads: VSTAR provides competitive, tight spreads, reducing the cost of trading and enhancing profit potential.

- Deep Liquidity: The platform guarantees reliable and fast order execution, thanks to its deep liquidity.

These benefits make VSTAR a compelling option for those looking to trade Boeing stock CFDs, combining cost efficiency, regulatory security, and user-friendly features to enhance trading experiences.

FAQs

1. Is Boeing stock expected to go up?

The consensus analyst price target for Boeing stock is $222.95.

2. Will Boeing pay dividends in 2024?

As of the latest information, Boeing did not pay a dividend last year, and there is no clear indication that it will resume dividend payments in 2024.

3. What will the Boeing stock price be in 2025?

The projected average Boeing stock price target by the end of 2025 is $265.00.

4. What do analysts say about BA?

The consensus analyst rating for Boeing is a Moderate Buy with a consensus price target of $232.36.