I. Recent ASML Stock Performance

Recent ASML stock price performance and changes

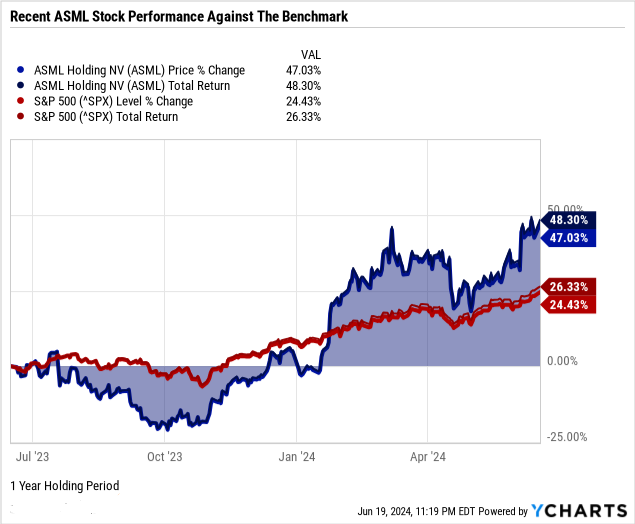

ASML Holding NV (NASDAQ: ASML), a key supplier to the semiconductor industry, has demonstrated remarkable stock performance in recent periods. With a market cap of $415 billion, ASML stock price has shown significant upward momentum. Over the past 52 weeks, its stock has fluctuated between $564 and $1,077.22, indicating substantial volatility and potential for high returns.

In the last six months, ASML stock price increased by an impressive 43%, compared to the S&P 500's 15.8%. Year-to-date, the stock has appreciated by 40.2%, nearly tripling the S&P 500's 15% gain. Over the past year, ASML stock has climbed by 47%, versus the S&P 500's 24.4%.

Source: Ycharts.com

Over three and five years, ASML has delivered returns of 58.2% and 445.1%, respectively, vastly outperforming the S&P 500's 31.7% and 88.1%. Over the past ten years, ASML's stock has skyrocketed by 1,038%, compared to the S&P 500's 180%. Including dividends, ASML's total return is 1,150% against S&P500's 238%, underscoring its exceptional long-term performance. ASML's robust performance reflects its critical role in the semiconductor industry and investor confidence in its growth prospects amid increasing demand for advanced lithography equipment.

Recent ASML Stock Performance: Influencing Factors

Several key factors have influenced the recent stock performance of ASML.

Financial Performance:

- Q1 2024 Results: ASML reported total net sales of €5.3 billion and a net income of €1.2 billion. The gross margin was 51%, exceeding the guidance due to favorable product mix and one-off items. These robust results likely bolstered investor confidence, positively impacting the stock.

Technological Advancements:

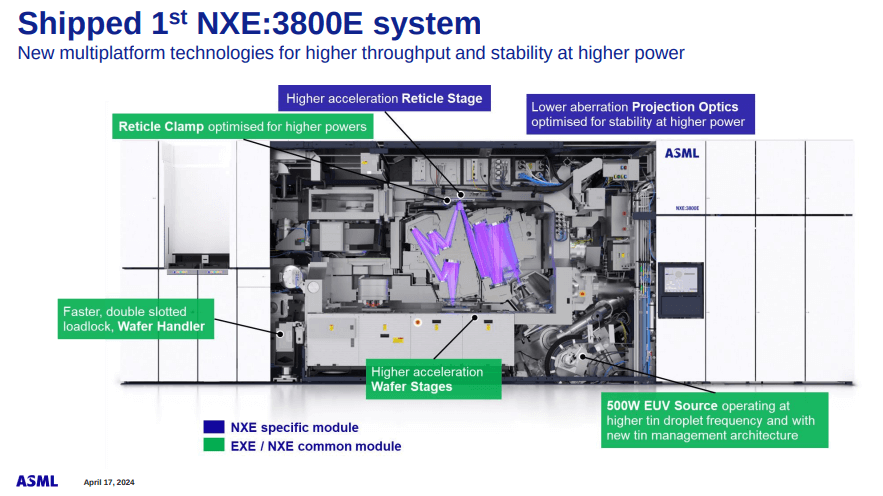

- EUV and High NA Systems: ASML's shipment of 12 EUV systems, recognizing €1.8 billion in revenue, and advancements in high numerical aperture (High NA) systems underline its technological leadership. These innovations are crucial for semiconductor manufacturing, driving future revenue growth and market share.

Market Dynamics:

- Semiconductor Industry Recovery: The broader semiconductor industry's recovery from the downturn, with improving inventory levels and tool utilization rates, has positively impacted ASML. The expectation of a stronger second half of 2024 aligns with industry trends, suggesting a favorable operating environment.

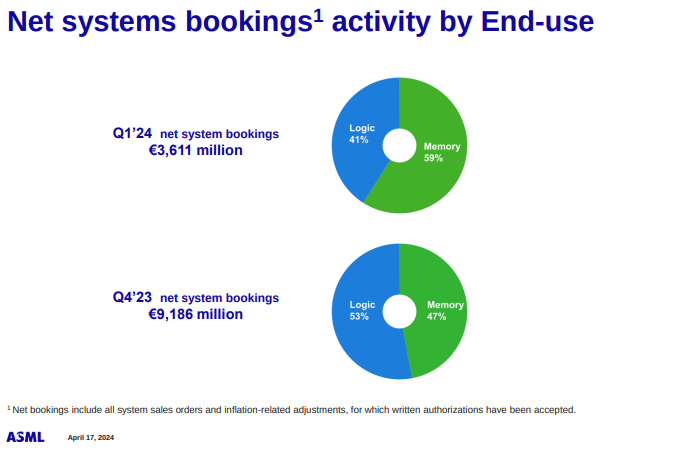

- Demand Drivers: Increasing demand for advanced memory technologies (DRAM, DDR5, HBM) and AI-related applications supports ASML's growth prospects. Memory and logic segments contribute significantly to its revenue, with ongoing transitions to advanced nodes driving future demand.

Source: Presentation Investor Relations Q1 2024

Strategic Initiatives:

- ASMl Stock Dividend and Share Buyback: The announcement of a 5.2% increase in the total dividend for 2023 and a share buyback program worth €400 million demonstrate ASML's commitment to returning value to shareholders. These initiatives likely enhance investor sentiment and support stock performance.

Macroeconomic Factors:

- Geopolitical and Economic Conditions: ASML's performance is also influenced by global economic trends, including semiconductor supply chain dynamics and geopolitical factors affecting tech supply and demand. While uncertainties remain, ASML's strong backlog and strategic investments position it well for future growth.

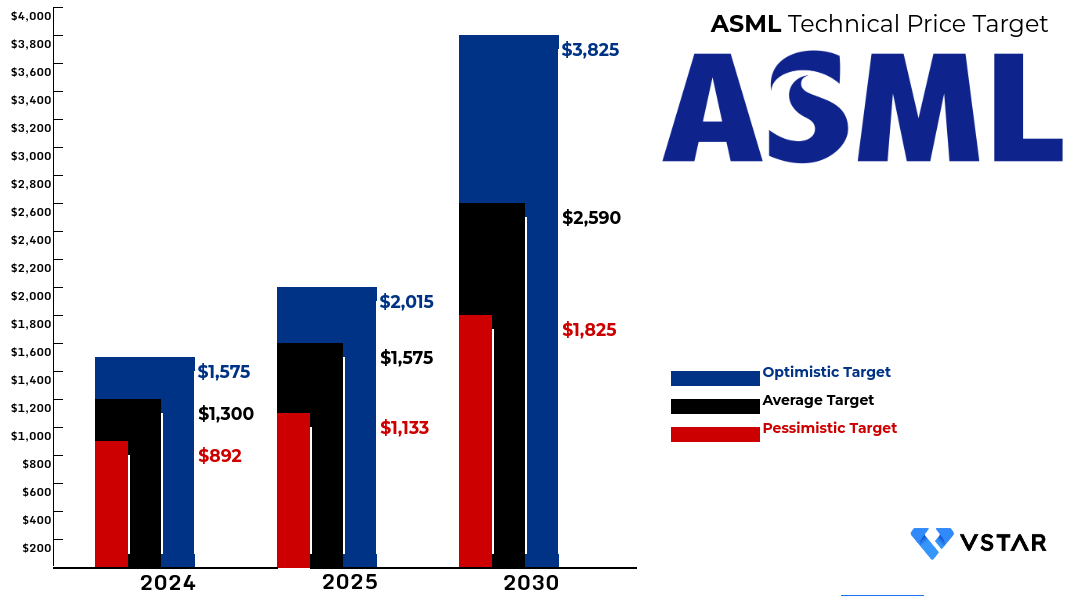

Expert Insights on ASML Stock Forecast for 2024, 2025, 2030 and Beyond

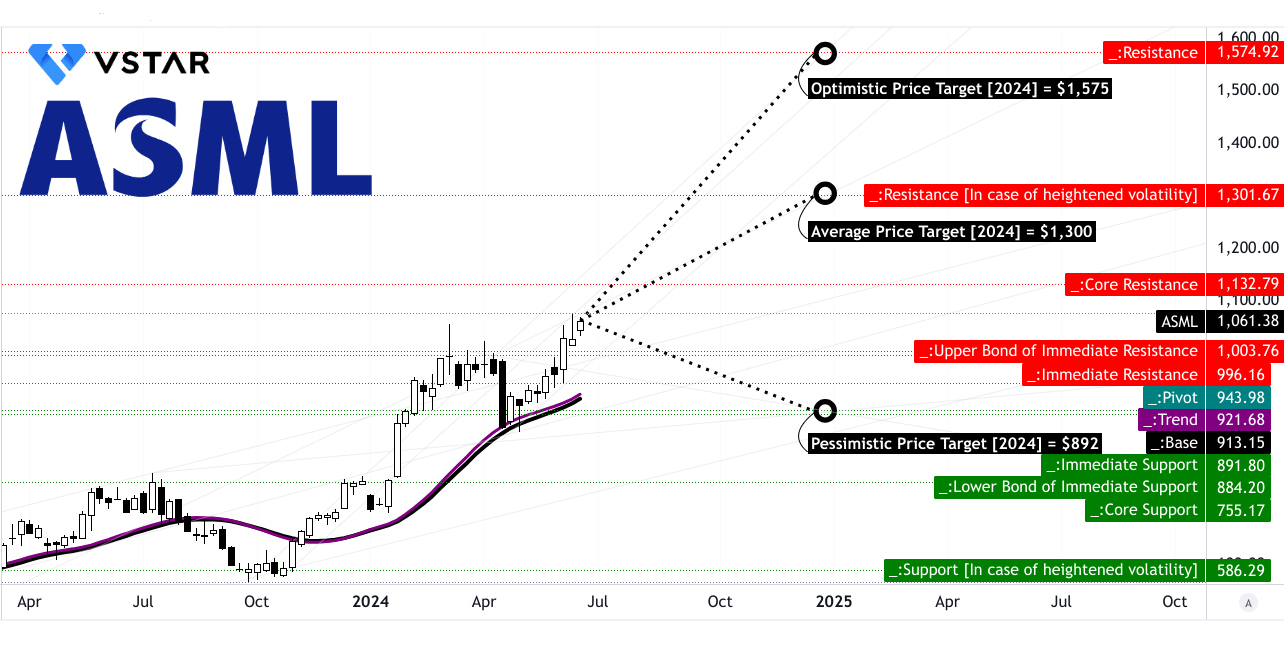

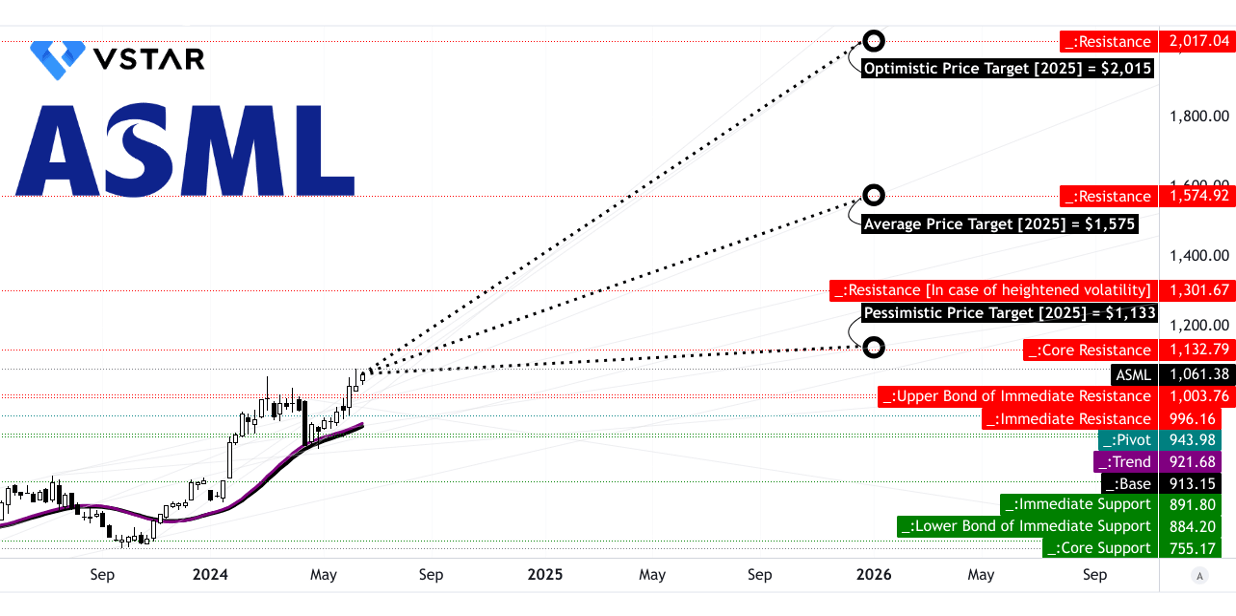

Technical insights on ASML stock forecast indicate a range of potential outcomes. For 2024, projections span from a pessimistic $892.00 to an optimistic $1,575.00, reflecting uncertainties in the semiconductor market and macroeconomic conditions. By 2025, forecasts suggest a more optimistic range, with the stock potentially reaching $2,015.00 or dipping to $1,133.00 in less favorable scenarios. Long-term projections for 2030 show a broader spread, from $1,825.00 to $3,825.00, highlighting both the company's growth potential and the inherent risks in the rapidly evolving tech sector.

Source: Analyst's compilation

II. ASML Stock Forecast 2024

Based on the technical analysis, by the end of 2024, the average ASML stock price target is $1,300.00, driven by the momentum observed in short-term price movements and projected through Fibonacci extension levels. In an optimistic scenario, the price could reach $1,575.00, reflecting a strong upward price momentum of the current swing. However, in a pessimistic scenario, the price might drop to $892.00 if downward momentum takes over, as projected by Fibonacci retracement levels.

The current stock price is $1,061.38, and the technical indicators suggest a robust upward trend. ASML stock price is currently trending upward, with the trendline at $921.68 and the baseline at $913.15, both derived from a modified exponential moving average.

Support and Resistance Levels: The primary support level is identified at $1,003.76, with a core support at $755.17. In case of heightened volatility, support is pegged at $884.20. Resistance levels are significant at $1,132.79 (core resistance) and $1,301.67 (in case of heightened volatility). The pivot of the current horizontal price channel is at $943.98, suggesting a strong foundation for upward movement if the price breaks above these resistance levels.

Source: tradingview.com

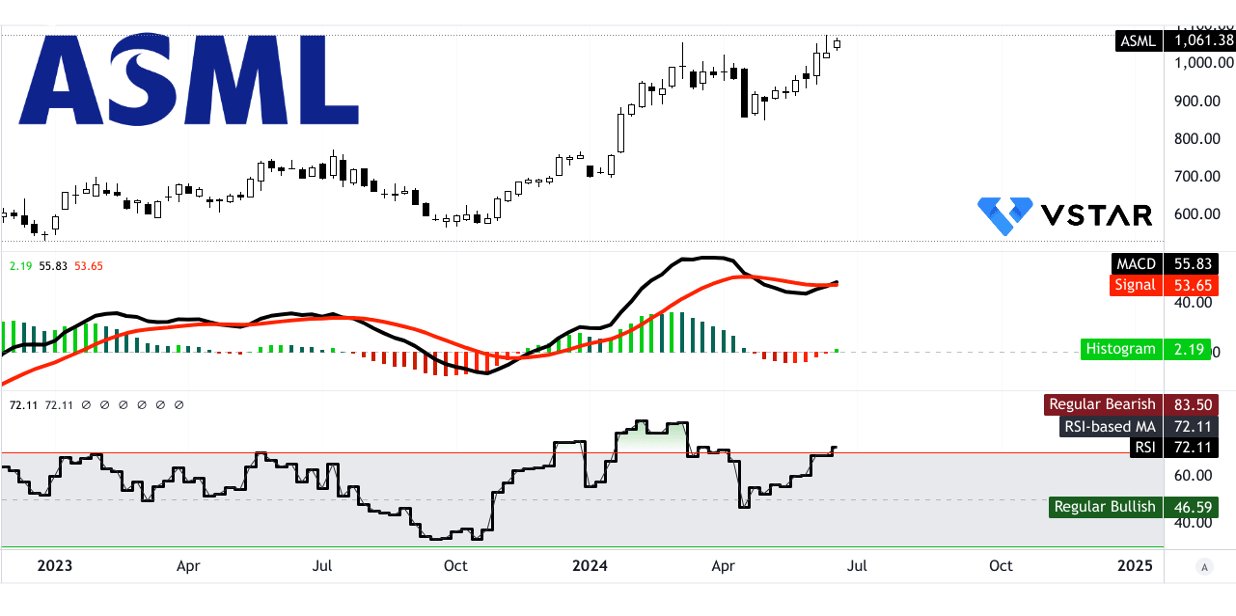

Relative Strength Index (RSI): The RSI is at 72.11, which is in the overbought territory but not at extreme levels. This indicates strong buying momentum, though the stock is nearing a potential overbought condition, warranting close monitoring for any signs of reversal.

Moving Average Convergence/Divergence (MACD): The MACD line at 55.83 and the signal line at 53.65, with a histogram reading of 2.19, all point to a bullish trend. The increasing strength of the trend is evident from the MACD indicator, reinforcing the forecast of a potential rise in the stock price.

Source: tradingview.com

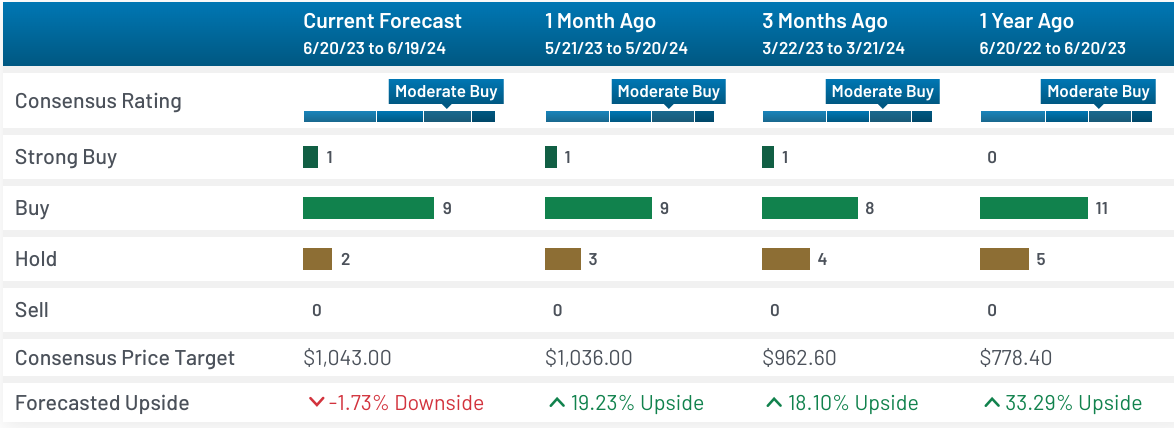

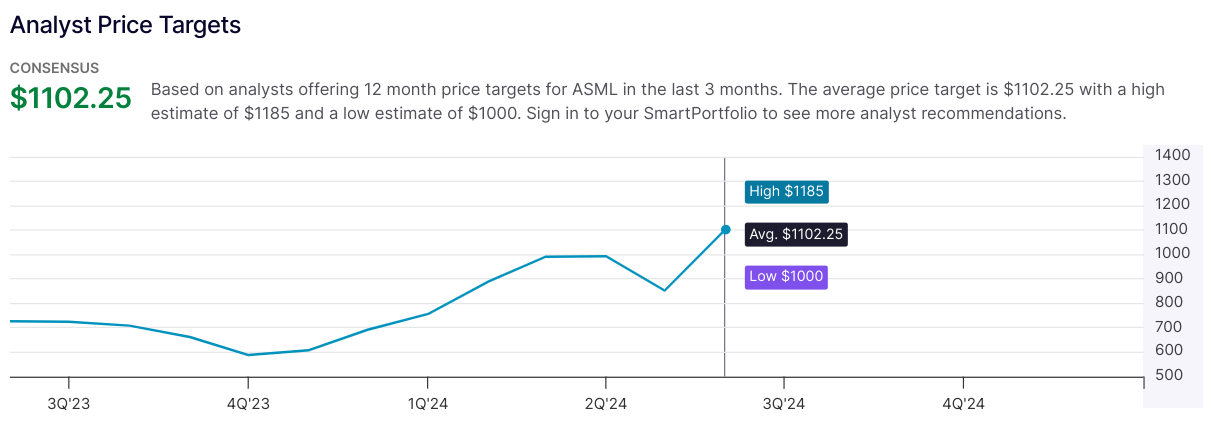

The ASML stock forecast in 2024 presents varying perspectives from different sources, reflecting both optimism and caution among analysts. According to tipranks.com, the average ASML price target is $1,102.25, suggesting a modest 3.85% increase from the current price of $1,061.38. This indicates a relatively conservative outlook with a narrow potential upside. Similarly, as per stockanalysis.com, the average ASML price target is $1,043, suggesting a slight -1.73% drop from the current price of $1,061.38.

Source: stockanalysis.com

In contrast, coinpriceforecast.com provides a more bullish long-term projection, predicting ASML to potentially reach $1,200 by the end of 2024, implying an 18% increase from mid-year 2024 levels. This outlook is notably more optimistic, driven by expectations of sustained growth and market conditions favoring the company.

Marketbeat.com aggregates various analyst opinions, showing a consensus rating of "Moderate Buy" with price targets ranging from $778.40 (reflecting a bullish 33.29% upside potential from a year ago) to $1,043.00. This range highlights the divergence in analyst sentiment, with some expecting substantial growth and others more conservative in their estimates.

Source: marketbeat.com

A. Other ASML Stock Forecast 2024 Insights: ASML stock buy or sell?

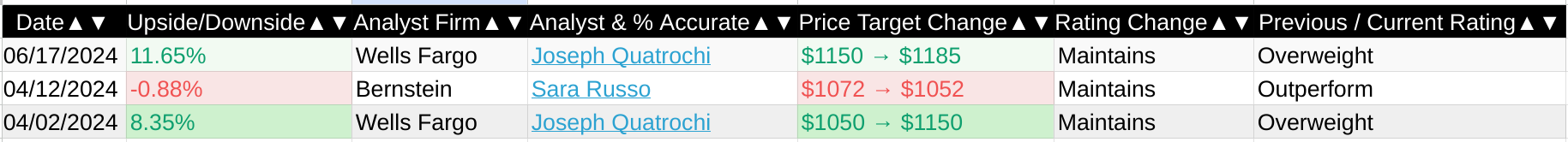

Several financial institutions have provided their insights and projections for ASML's stock performance in 2024. Wells Fargo, through analyst Joseph Quatrochi, has maintained an "Overweight" rating on ASML, suggesting a positive outlook on the stock. Quatrochi's price target for ASML has seen an upward revision twice this year: from $1050 to $1150 in early April, and further to $1185 in mid-June, reflecting an 11.65% upside. These revisions indicate strong confidence in ASML's growth potential and market position.

In contrast, Bernstein's analyst Sara Russo has also maintained a positive "Outperform" rating on ASML but has slightly adjusted the price target downward. In April, Russo revised the ASML stock price target from $1072 to $1052, indicating a modest downside of -0.88%. This adjustment may reflect a more cautious approach, possibly considering the external challenges that could impact the semiconductor industry and ASML's performance.

Source: benzinga.com

B. Key Factors to Watch for ASML Stock Prediction 2024

ASML Forecast 2024 - Bullish Factors

Outlook: The company's guidance for Q2 2024 anticipates net sales between €5.7 billion and €6.2 billion with a gross margin of 50-51%. Maintaining its 2024 outlook similar to 2023 signals stability and confidence in its market position, reassuring investors amidst industry volatility.

Industry Recovery: The semiconductor industry is expected to recover in the latter half of 2024, driven by increased demand for advanced technologies. ASML is well-positioned to capitalize on this recovery, supported by its technological innovations and customer demand for advanced lithography tools.

ASML Stock Price Forecast 2024 - Bearish Factors

Economic Uncertainty: Global macroeconomic conditions, including inflationary pressures and potential economic slowdowns, could impact ASML's financial performance. Reduced capital expenditures by semiconductor manufacturers due to economic uncertainty could affect ASML's order inflow and ASML revenue.

Supply Chain Challenges: Ongoing supply chain disruptions pose risks to ASML's production and delivery timelines. Delays in component availability or logistical challenges could hinder the company's ability to meet its delivery schedules, impacting revenue and profitability.

III. ASML Stock Forecast 2025

Based on technical analysis, the predicted price range for ASML stock by the end of 2025 spans from a pessimistic low of $1,133 to an optimistic high of $2,015, with an average ASML price target of $1,575. These predictions derive from the momentum of change-in-polarity over the mid-term, as projected over Fibonacci extension levels, and take into account the current swing's upward price momentum. This analysis considers both potential bullish and bearish scenarios, incorporating technical factors such as support and resistance levels, trendlines, and price volume trends.

Trendline and Baseline: The current trendline for ASML is at $921.68, while the baseline is at $913.15, both derived from a modified exponential moving average. The stock is currently trading at $1,061.38, indicating a solid upward direction. This upward trajectory aligns with the average ASML price target of $1,575 by the end of 2025.

ASML Stock Analysis 2025 - Support and Resistance Levels

- Primary Support: Positioned at $996.16, suggesting a strong buying interest around this level.

- Core Resistance: At $1,132.79, slightly above the current price, this level needs to be breached for the stock to approach its optimistic ASML target price of $2,015.

- Resistance in High Volatility: At $1,301.67, this indicates a potential upper boundary in case of heightened market activity.

- Core Support: Located at $755.17, this serves as a critical floor, ensuring stability in worst-case scenarios.

Source: tradingview.com

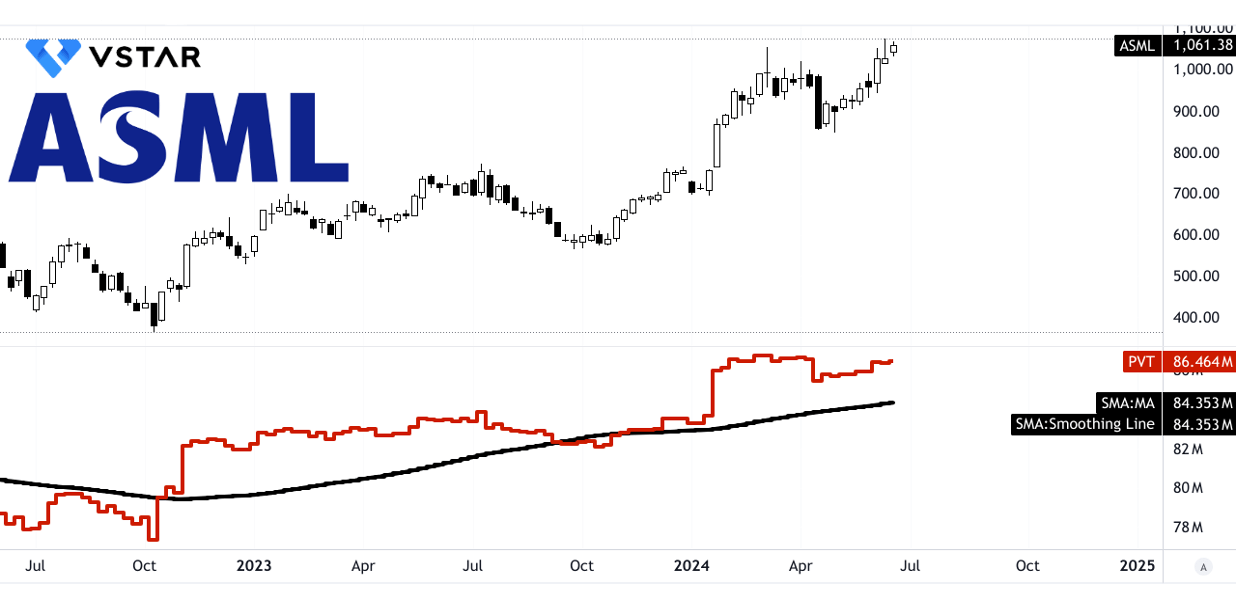

Price Volume Trend (PVT): The PVT line stands at 86.464 million with a moving average of 84.353 million. With the prevailing bullish momentum, the robust PVT values reflect substantial trading activity, indicating underlying investor interest and potential for growth.

Momentum and Fibonacci Projections: Utilizing Fibonacci extension levels, the average and optimistic price targets are derived from the stock's mid-term momentum. The bearish scenario, suggesting a lower target of $1,133, accounts for potential retracement over similar Fibonacci levels.

Source: tradingview.com

ASML stock forecast for 2025 shows varied predictions. Coinpriceforecast.com is highly optimistic, projecting the stock price to reach $1,987 by year-end 2025, representing an 87% increase from 2024's year-end estimate. In contrast, coincodex.com offers a more conservative forecast of $1,341.50, suggesting a 26.39% rise.

A. Other ASML Stock Forecast 2025 Insights: ASML buy or sell?

The consensus price target for ASML, based on analyst data (on nasdaq.com) from the past three months, averages at $1102.25. This includes a high estimate of $1185 and a low estimate of $1000, indicating a significant range of expectations.

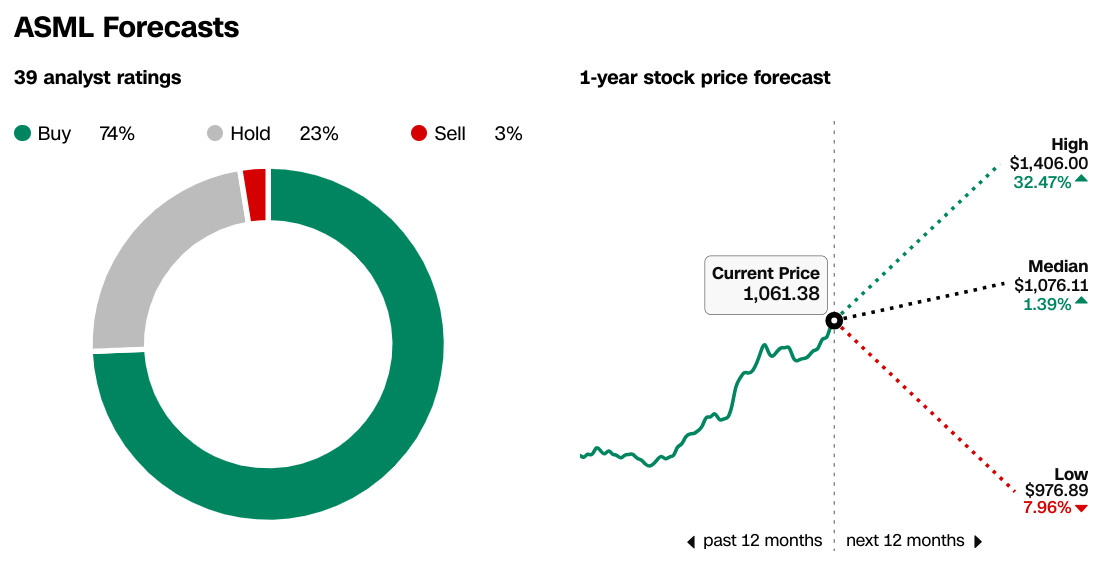

Source:Nasdaq.com

According to CNN.com, the 1-year stock price forecast ranges from a high of $1406.00, representing a potential increase of 32.47% from the current price, to a low of $976.89, a possible decline of 7.96%. The median forecast stands at $1076.11, just slightly above the current price of $1061.38. In terms of analyst ratings, 74% of the 39 analysts recommend buying ASML, 23% suggest holding, and only 3% advise selling.

Source:CNN.com

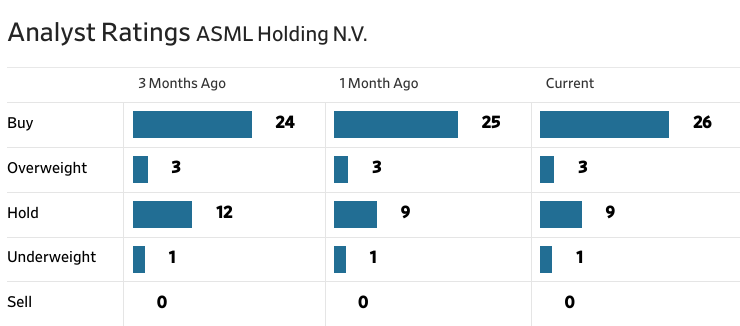

Data from WSJ.com also shows a high target of $1406.00 and a low target of $976.89, with a median estimate matching CNN's at $1076.11. The average ASML price target is slightly higher at $1114.18. The current analyst ratings indicate 26 buy recommendations, 3 overweight, 9 hold, 1 underweight, and no sell ratings. This distribution underscores a general consensus towards a positive outlook on ASML stock, with minimal bearish sentiment.

Source:WSJ.com

B. Key Factors to Watch for ASML Stock Prediction 2025

ASML Share Price Forecast 2025 - Bullish Factors

Technological Leadership and Innovation: ASML's pioneering EUV lithography technology continues to be a significant competitive advantage. The successful deployment of high-NA EUV systems and the upcoming NXE:3800E system highlight ASML's ability to meet the demands of cutting-edge semiconductor fabrication, crucial for industries like AI and advanced computing.

Source: Presentation Investor Relations Q1 2024

Market Demand and Order Backlog: With significant order bookings totaling nearly EUR 13 billion over the past six months and a backlog of EUR 38 billion as of Q1 2024, ASML is well-positioned for robust revenue growth. This backlog provides revenue visibility and stability, supporting optimistic revenue forecasts for 2025.

Source: seekingalpha.com

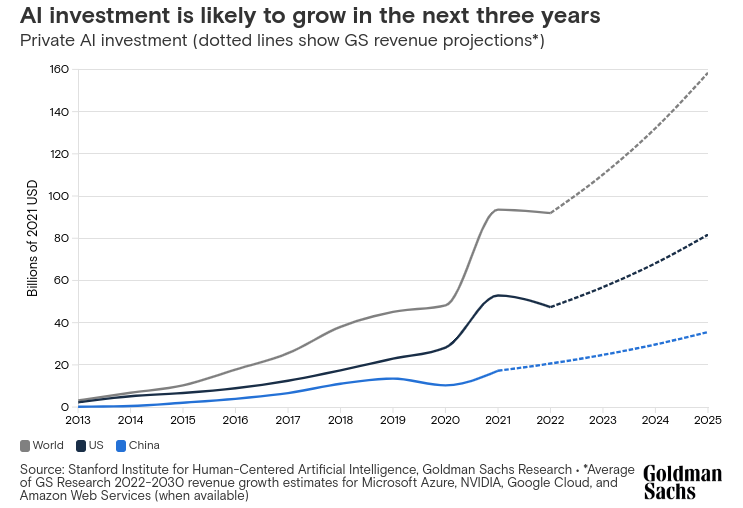

Industry Recovery and Macro Trends: The semiconductor industry's recovery and continued investments in AI, memory (DDR5, HBM), and logic sectors bode well for ASML's top- and bottom-line growth trajectory. As per Goldman Sachs, these investments could be around $200 billion by 2025. The company's strategic focus on preparing for new fabs and capacity expansions aligns with anticipated market demand in 2025 and beyond.

Source: Goldman Sachs

ASML Stock Price Prediction 2025 - Bearish Factors

Cyclical Nature of the Semiconductor Market: ASML's revenue is heavily influenced by cyclical trends within the semiconductor industry. While 2025 is expected to benefit from a recovery phase, any macroeconomic downturn or fluctuations in semiconductor demand could impact ASML's revenue projections adversely.

Execution Risks and Technological Challenges: Despite technological advancements, the transition to new systems like High NA EUV involves execution risks. Delays in technology adoption or unexpected technical challenges could affect ASML's revenue growth and profitability targets.

Competitive Landscape: While ASML currently enjoys a near-monopoly in EUV lithography, competition from emerging technologies or potential disruptions in supply chains could pose threats. Moreover, geopolitical tensions affecting global supply chains may introduce uncertainties in ASML's operational environment.

IV. ASML Stock Forecast 2030 and Beyond

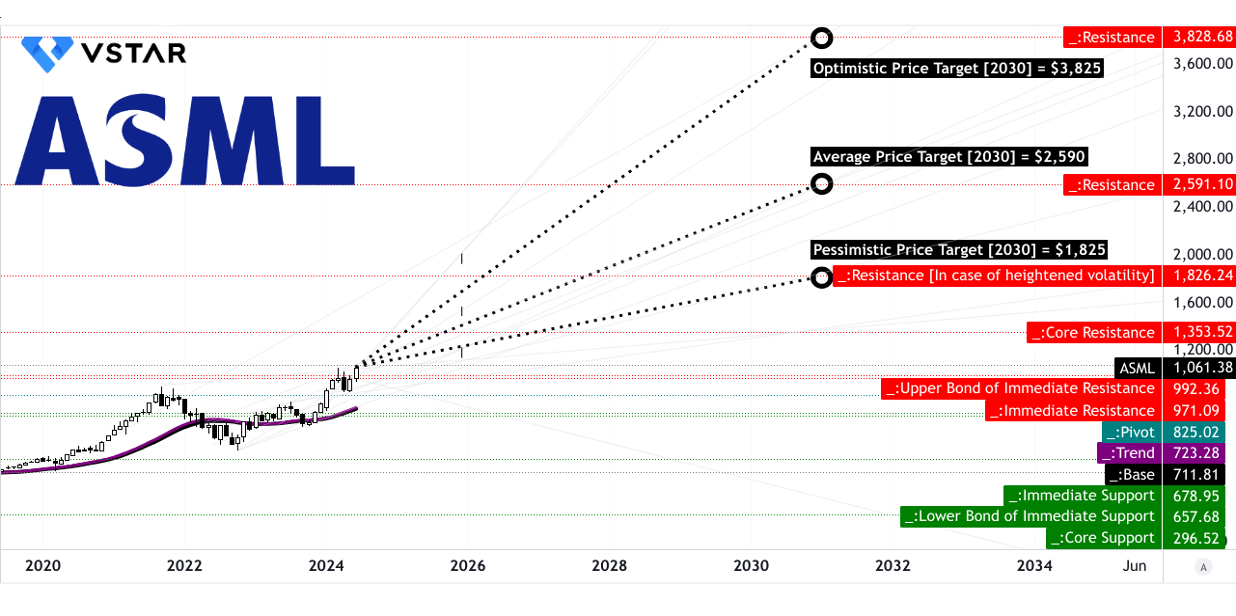

Based on a comprehensive technical analysis, ASML (NASDAQ: ASML) is projected to have an average price target of $2,590 by the end of 2030. This target is derived from the momentum of change-in-polarity over the long-term, projected over Fibonacci extension levels. In a more optimistic scenario, the price could reach as high as $3,825, driven by sustained upward price momentum. Conversely, in a pessimistic scenario, the price might settle at $1,825, influenced by downward price momentum projected over Fibonacci retracement levels.

ASML is currently priced at $1,061.38 with an upward direction in its stock price. The trendline and baseline, modified exponential moving averages at $723.28 and $711.81 respectively, indicate a strong underlying support and ongoing bullish trend.

ASML Stock Price Prediction 2030 and Beyond Support and Resistance Levels:

- Primary Support: At $992.36, this level provides a cushion for the stock in case of minor pullbacks.

- Pivot of Current Horizontal Price Channel: At $825.02, indicating a key level of price consolidation.

- Core Resistance: At $1,353.52, and heightened volatility resistance at $1,826.24 and $2,591.10.

- Support Levels: Significant support at $657.68, essential during market downturns.

Source: tradingview.com

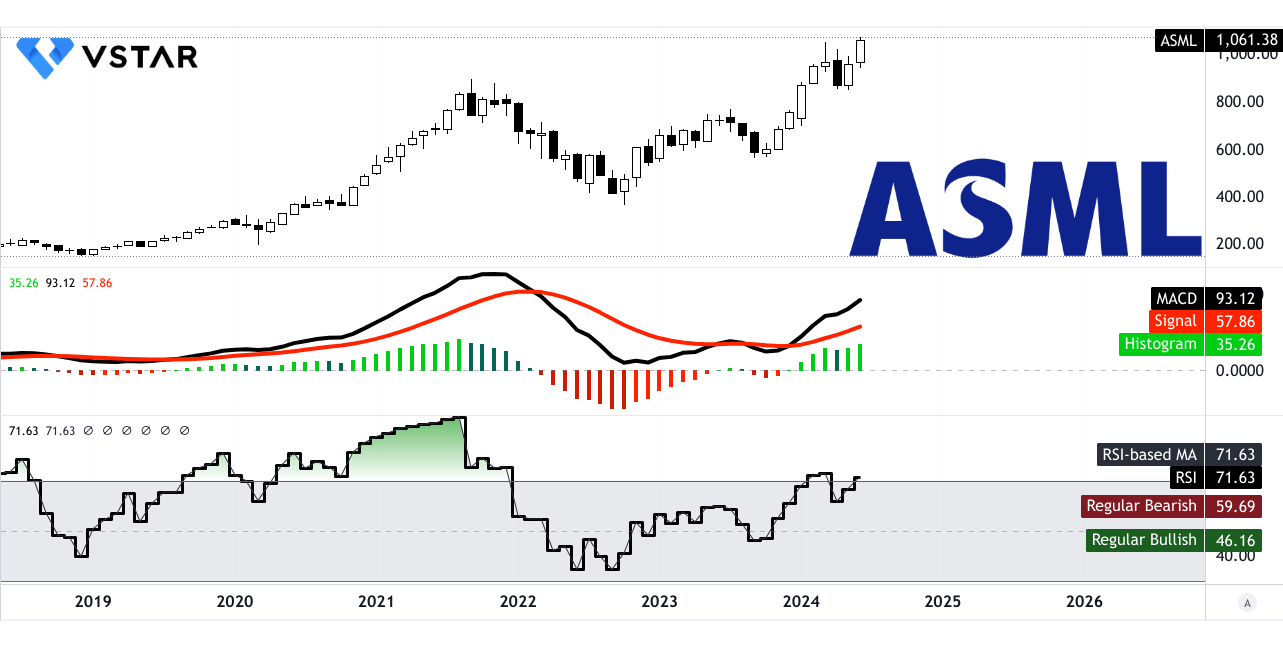

Relative Strength Index (RSI): The RSI value stands at 71.63, which is above the regular bullish level of 46.16, indicating strong bullish momentum. Despite a minor bearish divergence, the upward trend of the RSI line supports a bullish outlook.

Moving Average Convergence/Divergence (MACD) Indicator: The MACD line at 93.12 and the signal line at 57.86, with a histogram value of 35.26, suggest an increasing bullish trend. The strength of this trend further reinforces the optimistic price projections.

Source: tradingview.com

The forecasts for ASML (NASDAQ: ASML) stock from various sources suggest significant growth leading up to 2030 and beyond. According to coinpriceforecast.com, projections show a steady increase, with a potential rise of over 200% by 2030. Meanwhile, coincodex.com predicts even more substantial gains, estimating a 307.68% increase by 2030. These forecasts are optimistic, assuming continued technological advancement and market demand for ASML's semiconductor equipment.

Source:coinpriceforecast.com

A. Other ASML Stock Forecast 2030 and Beyond Insights: Is ASML a buy?

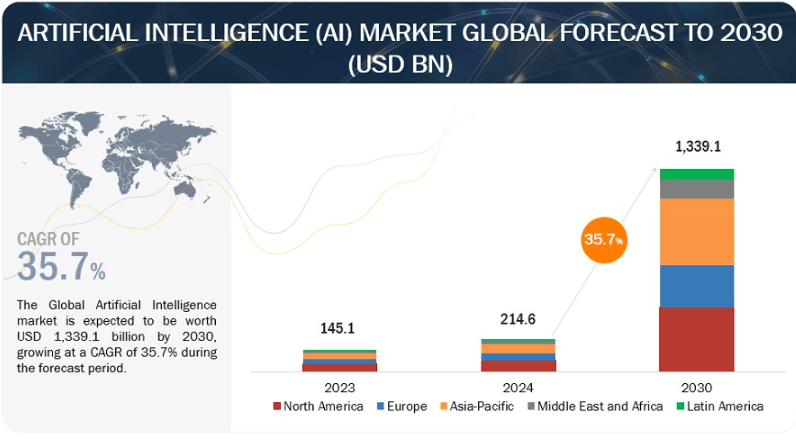

ASML benefits from broader semiconductor industry trends like increasing demand for advanced semiconductor nodes, driven by applications in AI , energy transition, and electrification. This demand is expected to support long-term growth. As per marketsandmarkets.com, AI market may hit $1.339 trillion at a massive growth rate of 35.7% (CAGR).

Source: marketsandmarkets.com

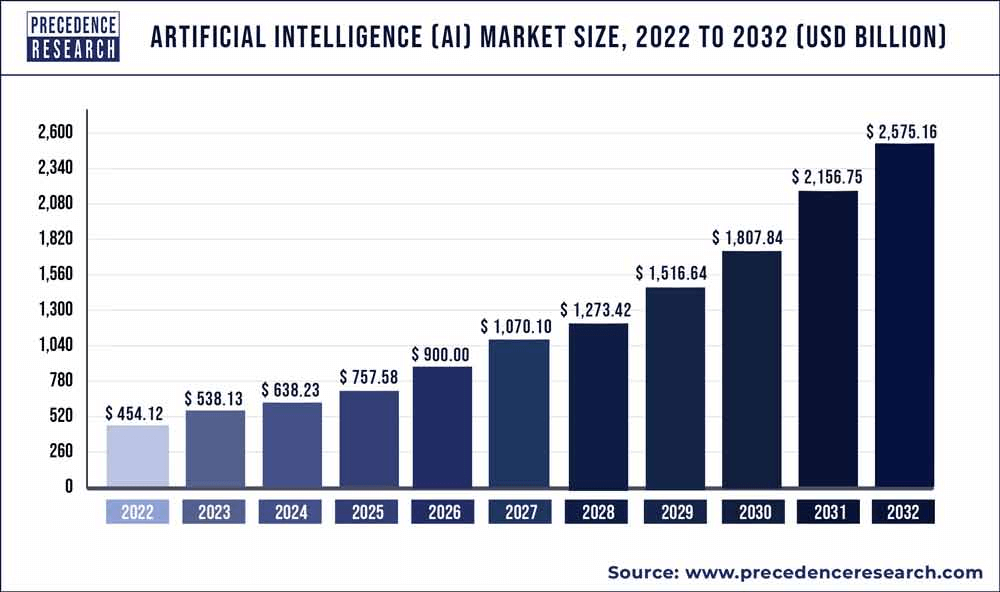

More optimistically, precedenceresearch.com projected the AI market to hit $2.575 trillion by 2032 at a CAGR of 19% from 2023 to 2032.

Source: precedenceresearch.com

B. Key Factors to Watch for ASML Stock Prediction 2030 and Beyond

ASML Stock Forecast 2030 and Beyond - Bullish Factors

Market Expansion and Innovation: The company's focus on expanding into emerging markets such as AI-related applications and advanced memory technologies like DDR5 and HBM bodes well for future revenue growth. Their investments in R&D (EUR1.32 billion in Q1 2024) underscore their commitment to staying ahead in technology.

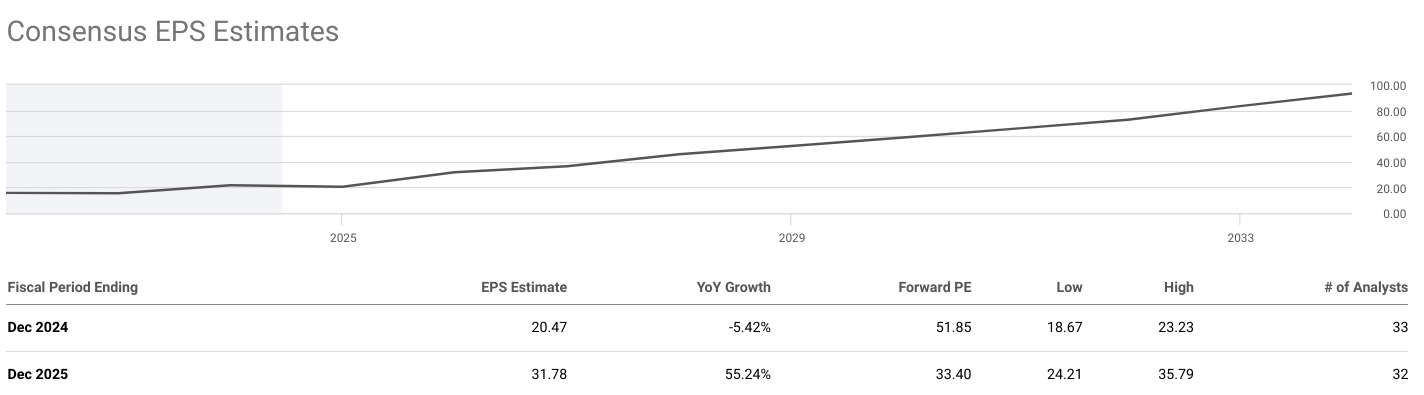

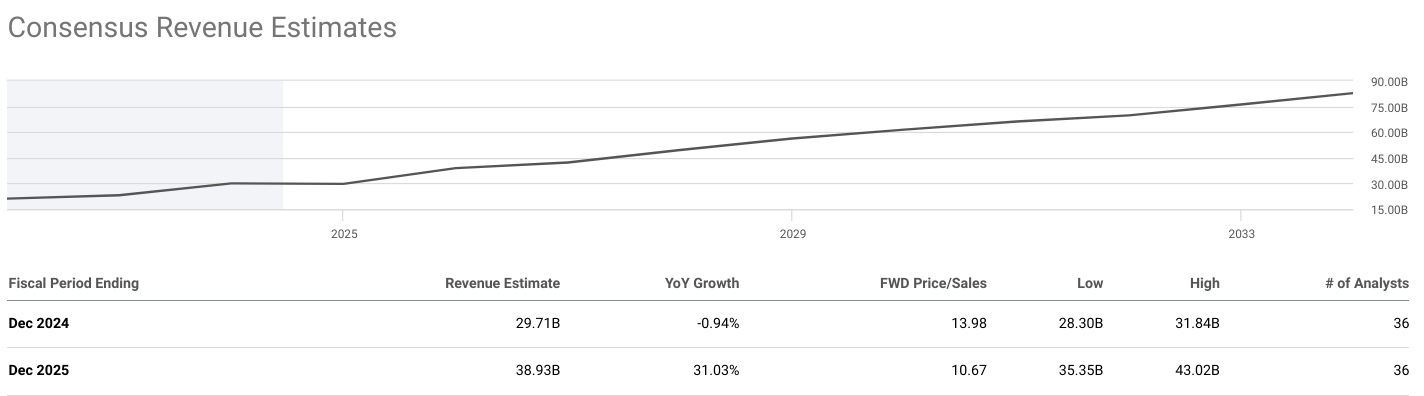

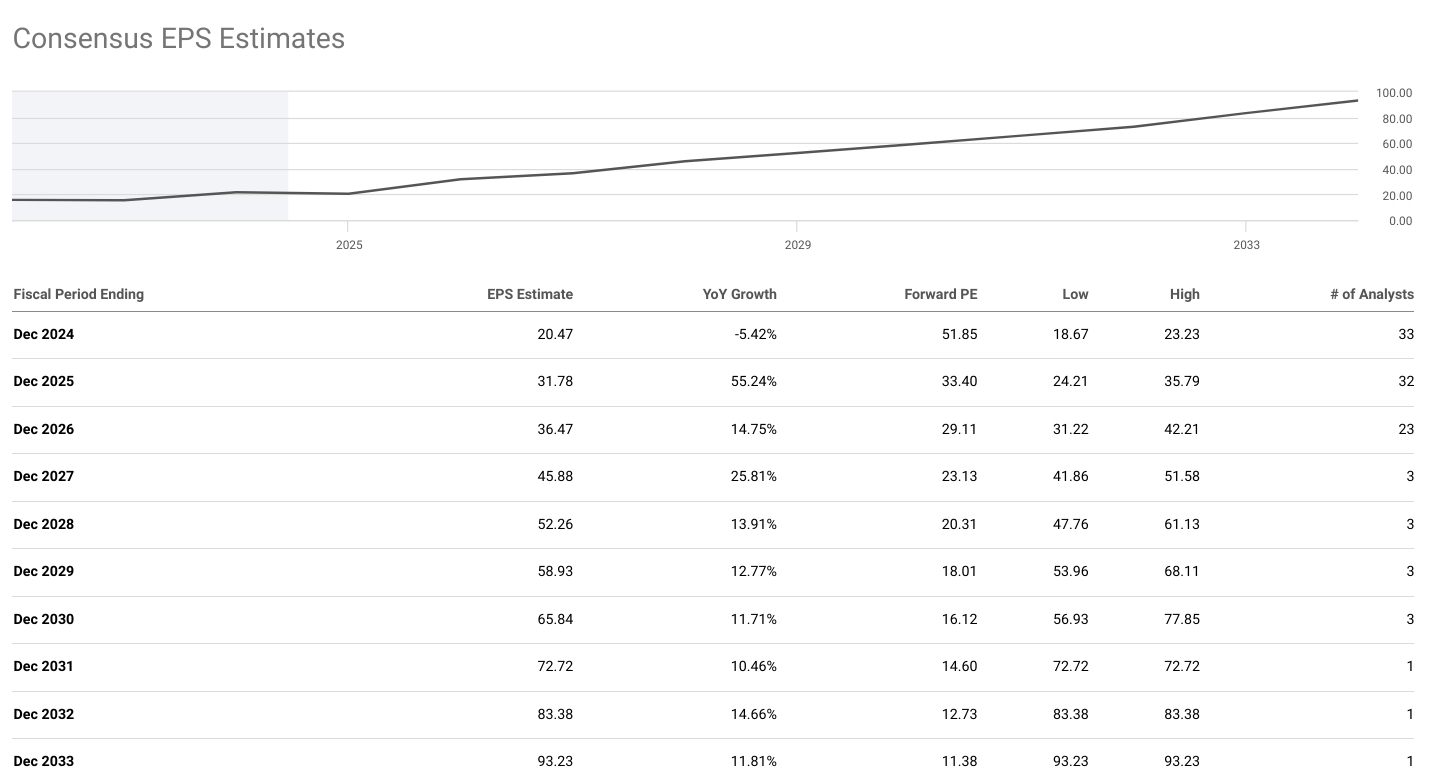

Financial Forecast 2030: ASML Holding's financial forecast reveals a robust growth trajectory through 2030. EPS estimates indicate a steady increase, reaching $65.84 in 2030 from $20.47 in 2024. Revenue is expected to grow correspondingly, reaching $66.16 billion by 2030 from $29.71 billion in 2024. This consistent growth in EPS and revenue demonstrates ASML's strong market position and effective operational strategies.

Source:seekingalpha.com

ASML Stock Forecast 2030 and Beyond - Bearish Factors

Cyclicality and Market Dependency: ASML's business is cyclical, heavily dependent on semiconductor industry cycles. Economic downturns or slowdowns in semiconductor demand could adversely impact revenue and profitability.

Regulatory and Environmental Factors: Regulatory changes impacting semiconductor manufacturing or environmental regulations affecting ASML's operations could lead to increased costs or operational challenges.

V. Conclusion

A. ASML Stock Outlook: Is ASML stock a buy?

The outlook for ASML stock is promising, with significant price forecasts for the coming years. By the end of 2024, the stock is projected to reach an average price target of $1,300, potentially climbing to $1,575 in an optimistic scenario or falling to $892 in a pessimistic scenario. Moving forward to 2025, predictions range from a low of $1,133 to a high of $2,015, with an average target of $1,575. Looking even further ahead to 2030, ASML is expected to achieve an average price of $2,590, with the potential to reach as high as $3,825 or drop to $1,825 under less favorable conditions. These forecasts underscore ASML's robust growth trajectory, driven by its technological leadership in EUV lithography and strong market demand. ASML stock is a long-term buy.

B. Trade ASML Stock CFD with VSTAR

Trading ASML stock CFDs with VSTAR offers numerous benefits. VSTAR provides tight spreads, which reduce trading costs and enhance profit margins. Additionally, VSTAR's copy trading feature allows investors to mirror the strategies of successful traders, potentially increasing their own trading success. VSTAR also offers a user-friendly platform, comprehensive market analysis tools, and responsive customer support, making it an attractive choice for trading ASML stock CFDs. These features collectively provide a supportive trading environment, enabling both novice and experienced traders to capitalize on ASML's market opportunities effectively.

FAQs

1. Is ASML a good stock to buy?

ASML is generally considered a good buy by analysts, with a consensus rating of "Buy".

2. Where will ASML stock be in 5 years?

ASML stock price is expected to continue growing, potentially reaching around $1,780 to $2,880 by 2029.

3. What will ASML stock be worth in 2030?

By 2030, ASML share price could reach an average of $1,922.21, with high estimates around $2,330.72.

4. Is ASML a good dividend stock?

ASML has a dividend yield of approximately 0.68% and a sustainable payout ratio of around 32.53%. While it offers dividends, the yield is relatively low compared to other dividend stocks.