I. Recent Arm Holdings Stock Performance

Arm Stock Price Performance And Changes

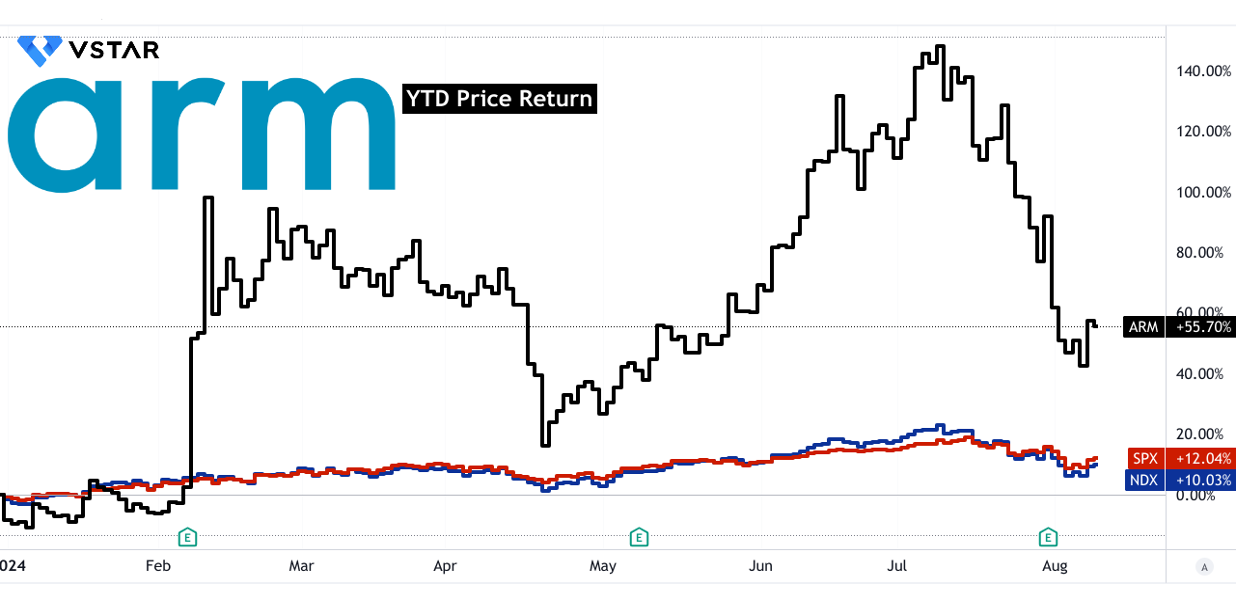

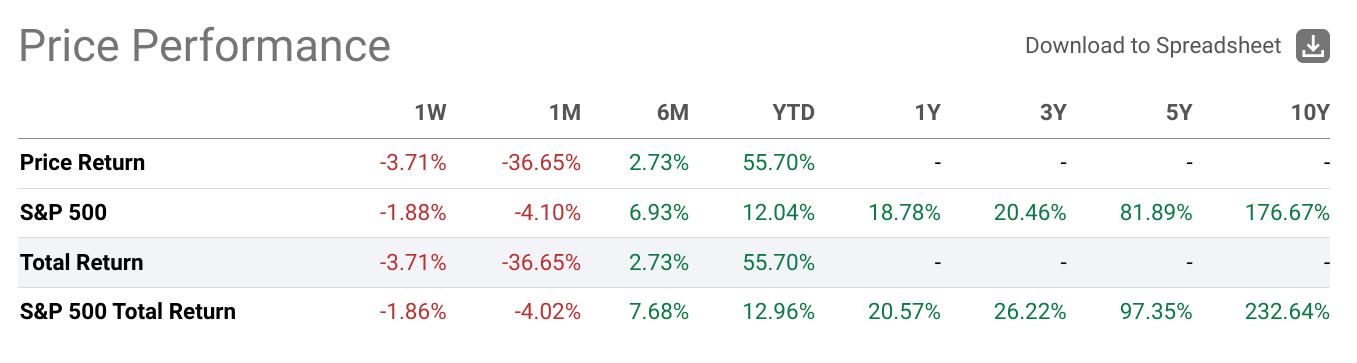

Arm Holdings (NASDAQ:ARM) stock has experienced volatile performance in recent periods. Year-to-date, Arm has seen a robust increase of 55.70%, substantially outperforming the S&P 500's 12.04% gain. This strong performance may be driven by positive investor sentiment around the company's long-term prospects, particularly in AI and other advanced technologies.

Source: tradingview.com

Over the past month, Arm stock plummeted by 36.65%, a significant drop compared to the S&P 500's 4.10% decline. This sharp decline likely indicates investor concerns regarding the company's valuation or potential challenges in the semiconductor industry.

However, Arm's six-month performance shows a modest gain of 2.73%, which, while positive, lags behind the S&P 500's 6.93% increase. This suggests that while the company has faced recent setbacks, it has managed to maintain some growth momentum.

Source:seekingalpha.com

Main influencing factors

Arm Holdings (NASDAQ: ARM) has demonstrated impressive performance recently, underscoring its strong market positioning and growth trajectory. In the latest quarter, the company achieved record revenues of $939 million, marking a 39% year-over-year increase. This growth was driven by robust license and royalty revenues, with licenses surging 72% and royalties up 17%. These results reflect continued high demand for Arm's technology, particularly in AI and advanced compute applications.

Key factors influencing Arm's performance include its leadership in AI and compute efficiency. The company's technology, particularly Armv9, has seen widespread adoption, which has significantly boosted royalty revenues. The introduction of advanced products such as Google's Axion Processor and AWS's Graviton4 highlights Arm's pivotal role in the AI and cloud sectors. These developments are contributing to increased demand for Arm's high-performance, power-efficient chips.

Moreover, Arm's success is supported by its expansive ecosystem and strategic investments. The company's focus on compute subsystems and its growing partnerships across mobile, cloud, and automotive sectors are enhancing its market presence. For example, the launch of Arm Ethos-U85 for edge AI and the expansion of CSS offerings are critical in accelerating customer time-to-market and boosting overall revenue per chip. Despite these successes, Arm faces some challenges. The ongoing weakness in IoT and networking markets due to inventory corrections poses a risk. Additionally, the stock's performance might be impacted by potential fluctuations in licensing revenue, which can be variable.

Expert Insights on ARM Stock Forecast for 2024, 2025, 2030 and Beyond

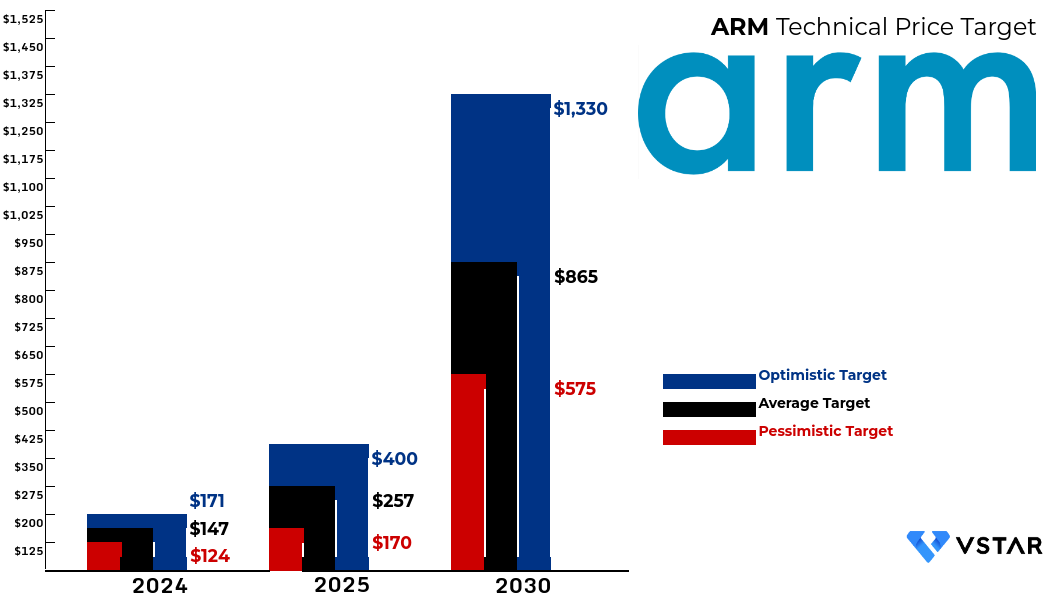

Arm Holdings (NASDAQ: ARM) has shown volatile stock performance, driven by high expectations post-IPO. Expert forecasts for ARM vary significantly, reflecting market uncertainty. For 2024, targets range from $124 to $171. By 2025, predictions extend from $170 to $400, and by 2030, estimates range from $575 to $1,330. These projections underscore the potential for substantial growth but also highlight significant risks tied to market and technological shifts.

Source: Analyst's compilation

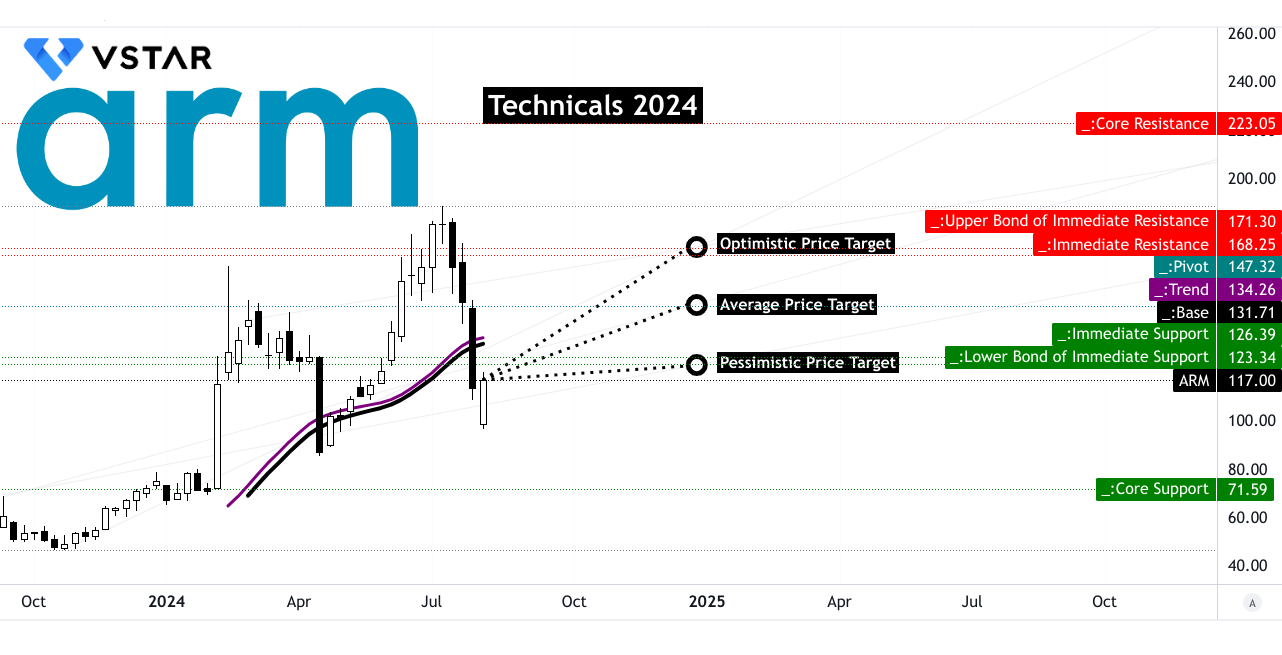

II. ARM Stock Forecast 2024

For 2024, ARM Holdings (NASDAQ: ARM) presents a mixed forecast. The average ARM price target is projected to be $147, reflecting a moderate upward trend. An optimistic scenario suggests a peak price of $171, indicating strong upward momentum. Conversely, a pessimistic outlook sets a low of $124, indicating potential downside risks.

Source:tradingview.com

The stock's current price stands at $117, below the trendline at $134.26 and the baseline at $131.71, which suggests a prevailing downward direction. Resistance levels are key to understanding ARM's potential movement. The primary resistance is identified at $126.39, with a significant pivot point at $147.32. In cases of heightened volatility, the resistance could extend up to $168.25, suggesting substantial potential for upward movement. The core support level is considerably lower at $71.59, providing a strong safety net in extreme scenarios.

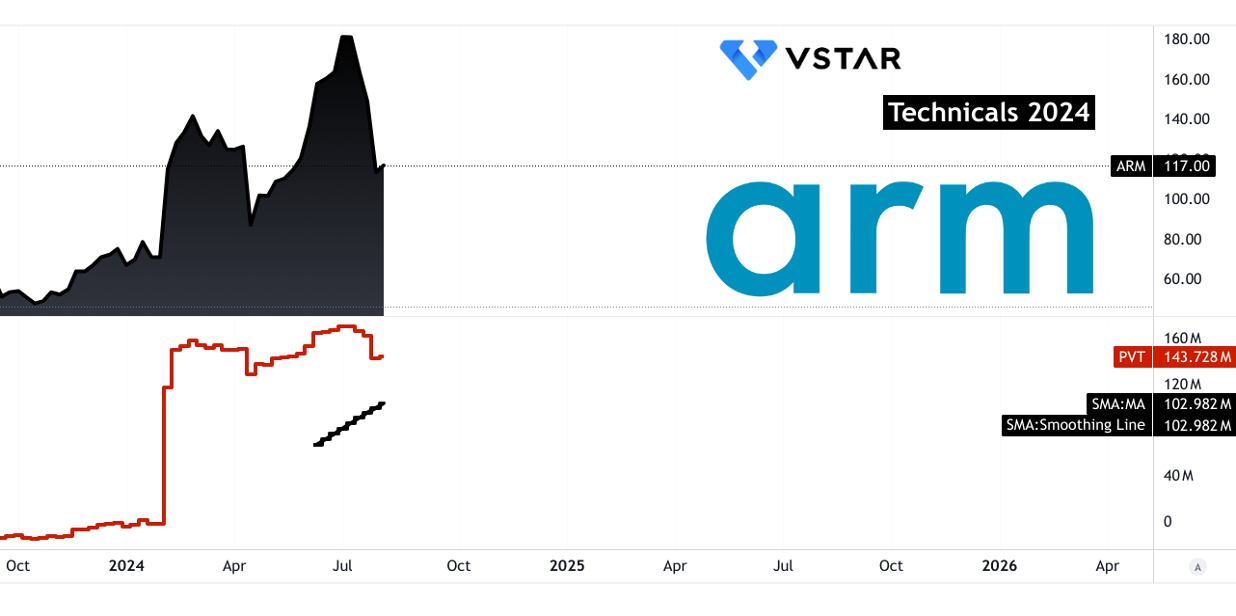

However, the price volume trend (PVT) reveals a bullish sentiment with the PVT line at 143.728 million, above its moving average of 102.982 million.

Source:tradingview.com

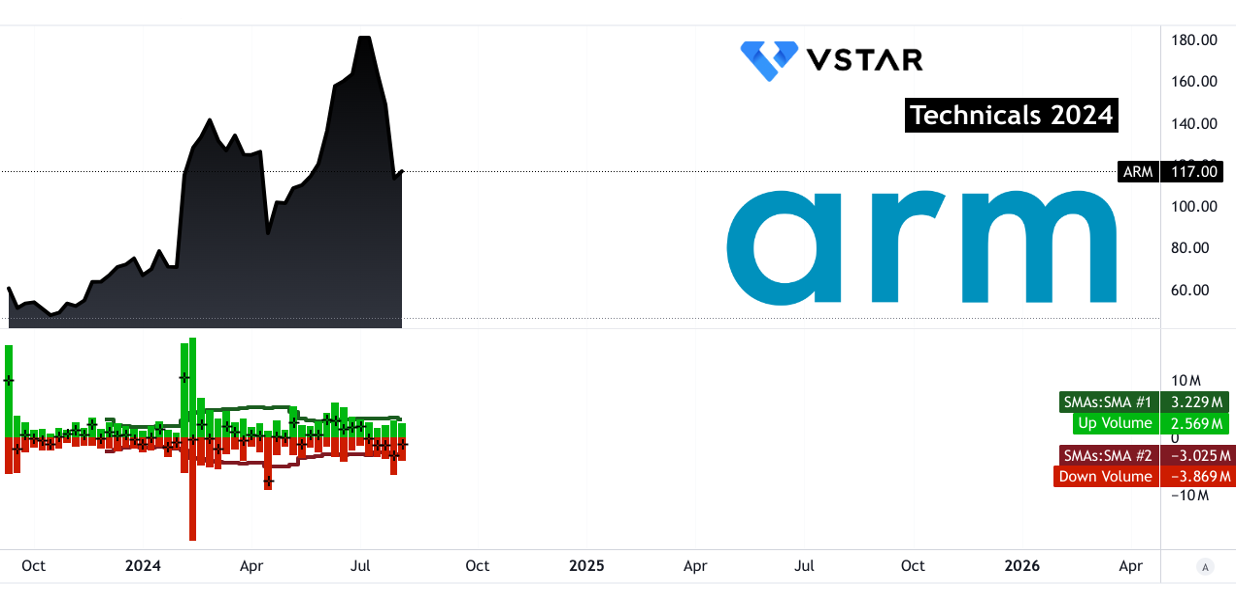

This bullish momentum is contradicted by the up volume average of 3.229 million is below the down volume average of -3.869 million, highlighting stronger selling pressure.

Source:tradingview.com

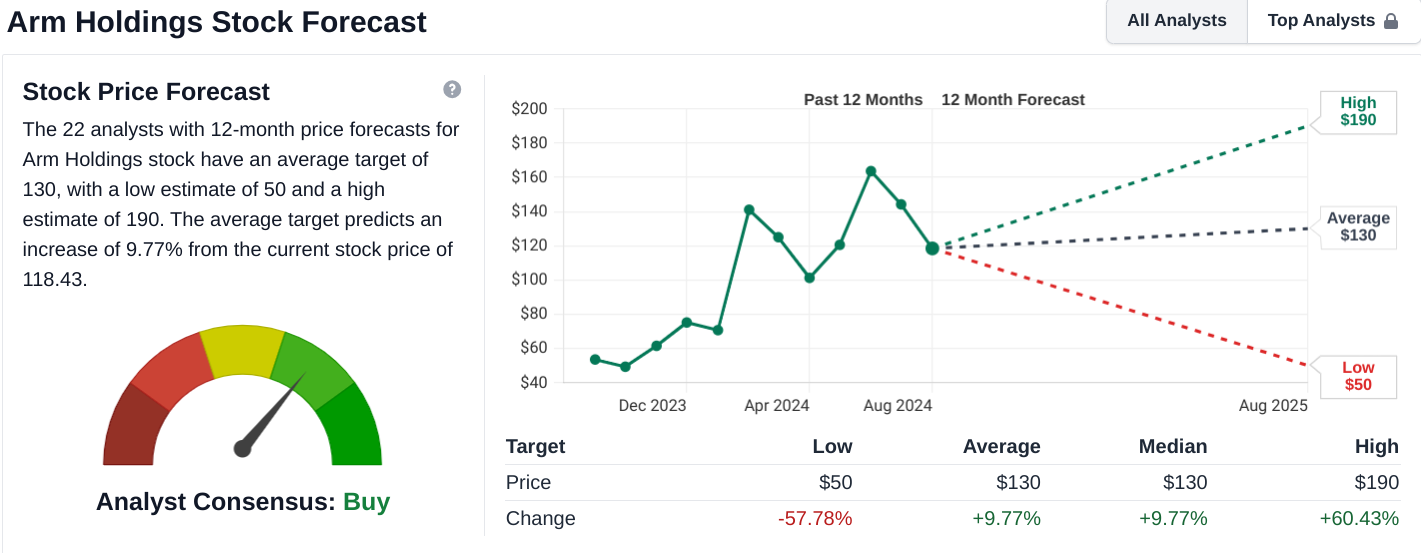

As of mid-2024, Arm Holdings (NASDAQ: ARM) stock forecasts present a mixed yet optimistic outlook. According to TipRanks, 19 Wall Street analysts have set an average 12-month price target of $139.31, suggesting a potential increase of 17.63% from the current price of $118.43. The forecasts range from a high of $180.00 to a low of $82.00, indicating considerable variability in expectations.

StockAnalysis.com provides a slightly lower average target of $130, which translates to a 9.77% potential increase from the current price. This forecast also spans a broad range, from $50 to $190, reflecting differing views on Arm's future performance.

Source:stockanalysis.com

Investing.com offers an average target of $135.42, implying a 14.35% upside. Analysts on this platform generally have a positive outlook, with forecasts ranging from a low of $66.00 to a high of $200.00.

A. Other Arm Stock Price Forecast 2024 Insights

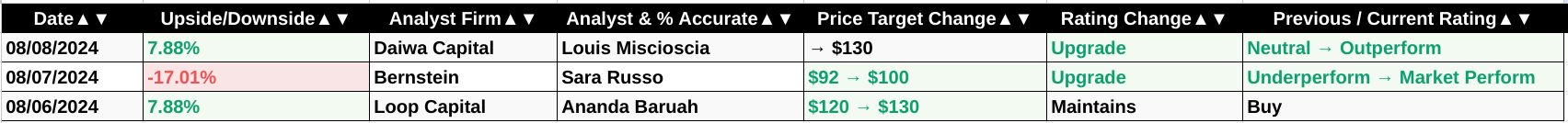

In 2024, ARM Holdings (NASDAQ: ARM) faces varying forecasts from prominent analysts.

- Daiwa Capital: On August 8, 2024, analyst Louis Miscioscia upgraded ARM from Neutral to Outperform with a price target of $130. This represents a 7.88% upside from its then-current price.

- Bernstein: Analyst Sara Russo revised ARM's target upwards from $92 to $100 on August 7, 2024. Despite the increase, Bernstein maintained its rating of Market Perform, indicating a -17.01% potential downside.

- Loop Capital: Ananda Baruah kept a Buy rating on ARM while raising the price target from $120 to $130 on August 6, 2024, reflecting a 7.88% upside potential.

Source: Benzinga.com

These data points highlight a mixed outlook for ARM in 2024. While Daiwa Capital and Loop Capital show optimism with upgraded ratings and higher price targets, Bernstein's cautious stance reflects concerns about potential downside despite its increased target. This divergence suggests uncertainty in ARM's stock performance, influenced by market conditions and company-specific factors.

B. Key Factors to Watch for Arm Stock Forecast 2024

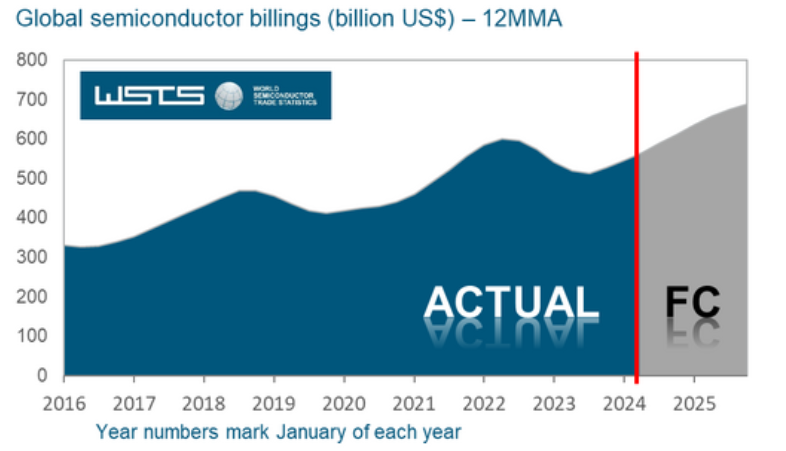

Arm Holdings (NASDAQ: ARM) has shown resilience and growth potential, reflecting broader industry trends. The global semiconductor market, which is expected to grow by 16% in 2024, significantly influences Arm's outlook. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached $46.4 billion in April 2024, up 15.8% year-over-year and 1.1% month-to-month, marking the first month-to-month increase of the year. This positive momentum is expected to continue, with the World Semiconductor Trade Statistics (WSTS) forecasting a record annual sales total of $611 billion for 2024.

Source: wsts.org

Arm's recent developments align with this optimistic forecast. The company benefits from robust growth in the semiconductor sector, particularly in logic and memory integrated circuits. The Americas and Asia Pacific regions, which are projected to experience significant growth, are key markets for Arm. This regional expansion is expected to enhance Arm's market share and revenue.

ARM Stock Price Prediction 2024 - Bullish Factors

Several bullish factors support a positive outlook for Arm in 2024:

- Industry Growth: The semiconductor market's anticipated 16.0% growth is a strong indicator of increased demand for chips. This surge benefits Arm, as its designs are integral to the semiconductor supply chain.

- Regional Expansion: Arm stands to gain from the projected 25.1% growth in the Americas and 17.5% growth in Asia Pacific. These regions are crucial for Arm's business, offering ample opportunities for revenue growth.

- Sector Performance: The significant increase in demand for memory and logic chips aligns with Arm's product offerings. The company's innovative designs in these segments are likely to drive strong sales and profitability.

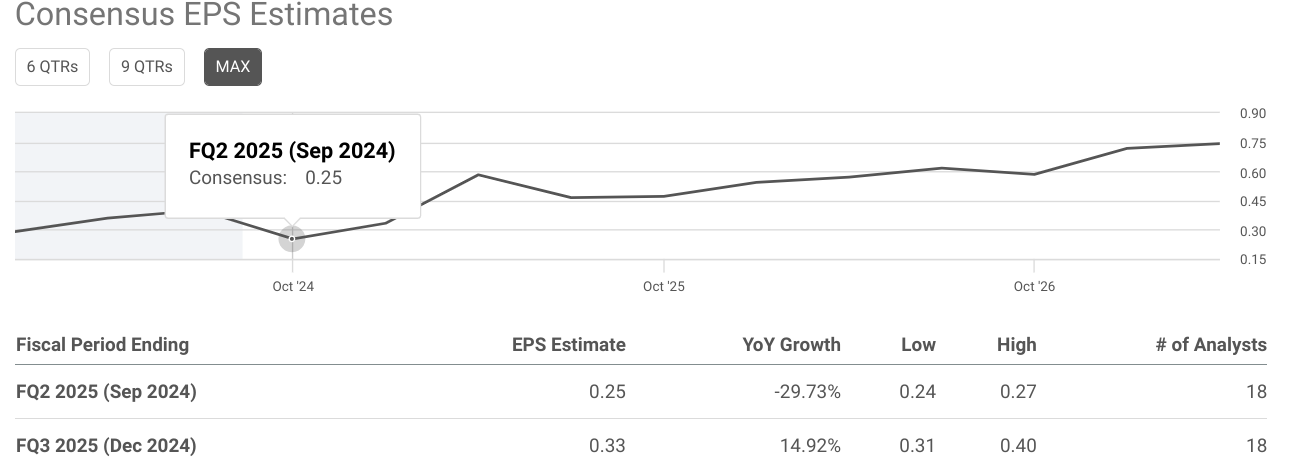

For fiscal Q2 2025, EPS estimates are $0.25, a significant decline of 29.73% year-over-year, with revenue estimated at $807.11M, marking a slight increase of 0.14%. In contrast, Q3 2025 forecasts a rebound with EPS at $0.33, up 14.92%, and revenue at $940.06M, representing a 14.08% increase. These estimates reflect the company's volatile performance and the broader market's uncertainty. Notable recent achievements include Google's Axion Processor and AWS's Graviton4, which highlight growing demand for Arm's technology in AI and cloud computing. Additionally, strong adoption of Armv9 and expansion into automotive and cloud services, coupled with a robust software ecosystem of over 20 million developers, positions Arm for future growth.

Arm Forecast 2024 - Bearish Factors

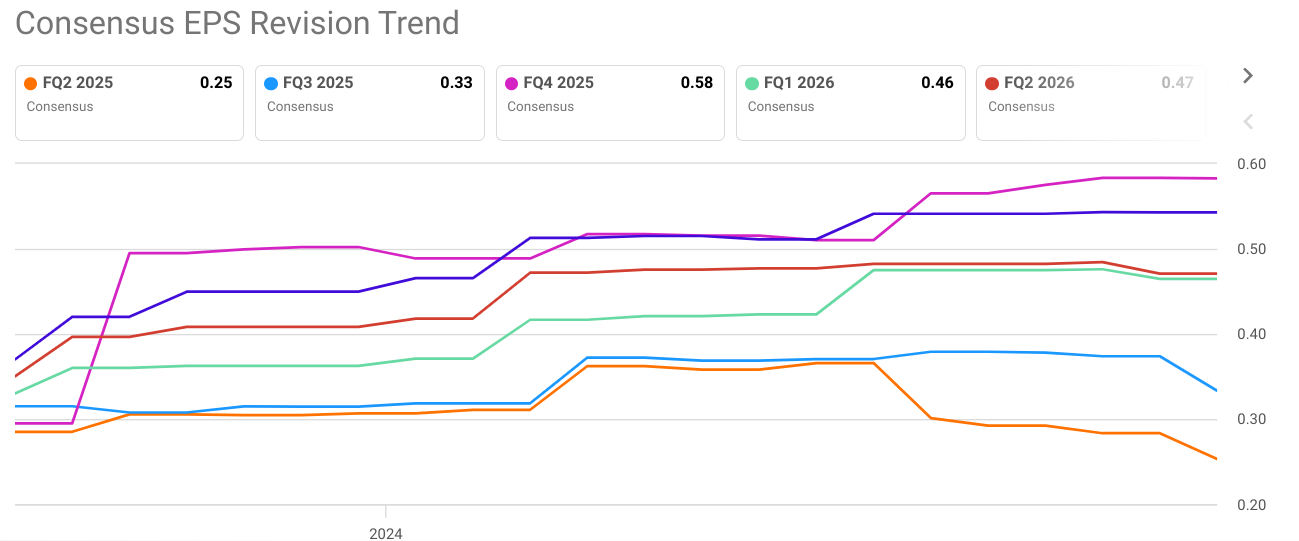

However, challenges remain. The company's EPS revision trends show a declining outlook, with recent estimates showing negative revisions across 1-month, 3-month, and 6-month periods. Revenue forecasts also reflect a decrease in the growth rate, particularly in the industrial IoT and networking sectors, due to persistent inventory issues. Additionally, despite strong performance in other segments, Arm faces potential headwinds from an ongoing inventory correction impacting broader industrial markets.

Source: seekingalpha.com

Source: seekingalpha.com

III. ARM Stock Forecast 2025

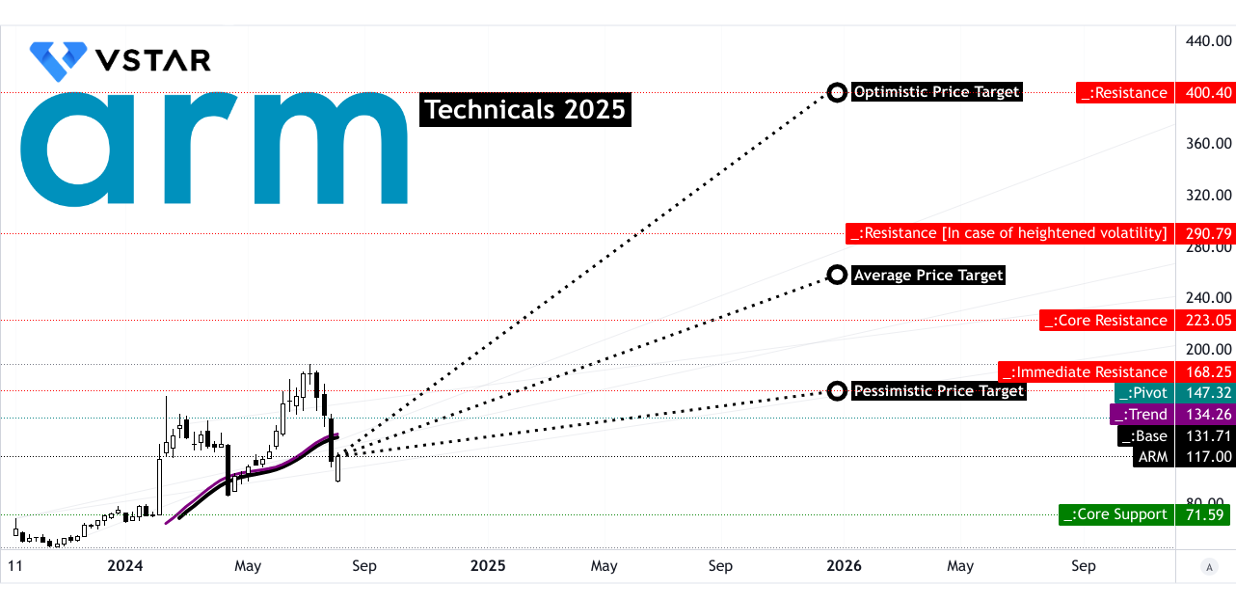

Arm Holdings (NASDAQ:ARM) presents a varied forecast for 2025. Based on current technical analysis, the average Arm stock price target by the end of 2025 is projected at $257. This estimate reflects a moderate expectation, built on the momentum of change-in-polarity observed over the mid-term and projected using Fibonacci extension levels. Optimistically, the stock could reach $400 if the upward price momentum persists, extending over Fibonacci levels. Conversely, a pessimistic view suggests a potential drop to $170, driven by current downward price momentum and Fibonacci retracement levels.

Moreover, resistance levels are crucial for understanding price movements. The primary resistance is at $168.00, with a core resistance at $223.00. In scenarios of heightened volatility, the resistance could extend to $291.00. The optimistic ARM target price of $400.00 faces significant resistance, indicating that reaching this target will require overcoming substantial market barriers.

Source:tradingview.com

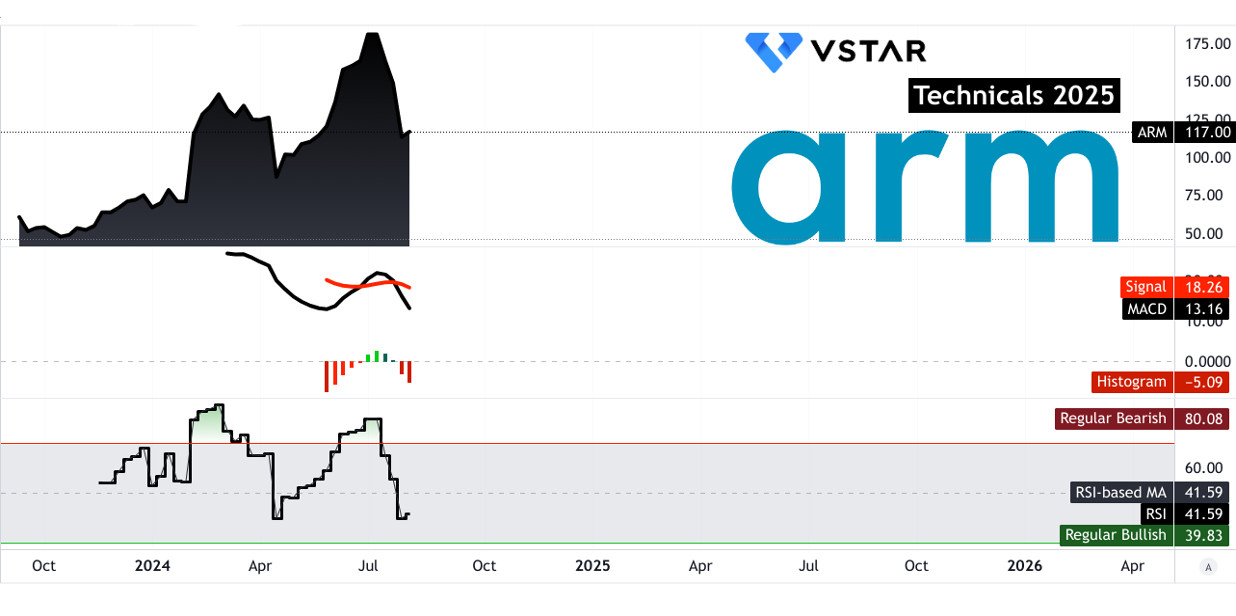

The current trendline indicates a downward direction, suggesting potential challenges for price increases. The Relative Strength Index (RSI) stands at 41.59, showing a regular bullish divergence but a bearish trend. This RSI value, below the typical bullish threshold of 39.83, indicates that the stock may experience further declines before a potential recovery.

The Moving Average Convergence/Divergence (MACD) analysis also reflects a bearish trend. With the MACD line at 13.16 and the Signal Line at 18.26, the histogram shows a negative value of -5.09. This bearish signal, along with an increasing strength of the trend, further supports the cautious outlook for ARM stock price.

Source:tradingview.com

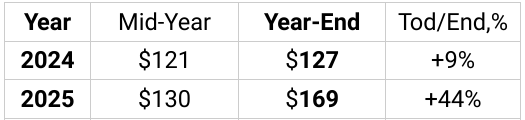

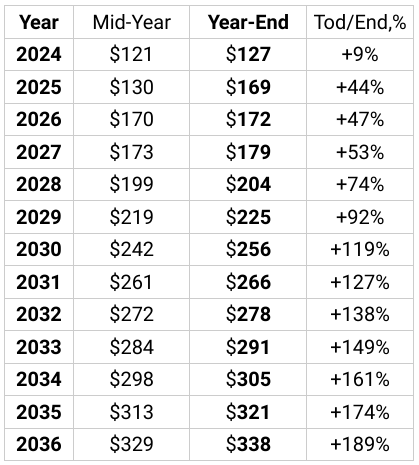

For 2025, ARM Holdings (NASDAQ: ARM) forecasts show varied predictions. According to coincodex.com, ARM's stock could rise to $131.44, reflecting a 10.98% increase based on a decade-long growth rate. Conversely, coinpriceforecast.com is more optimistic, projecting a mid-year price of $127 and a year-end target of $169, marking a potential 44% gain. The disparity highlights uncertainty and differing expectations in growth rates.

Source: coinpriceforecast.com

A. Other Arm Stock Price Prediction 2025 Insights

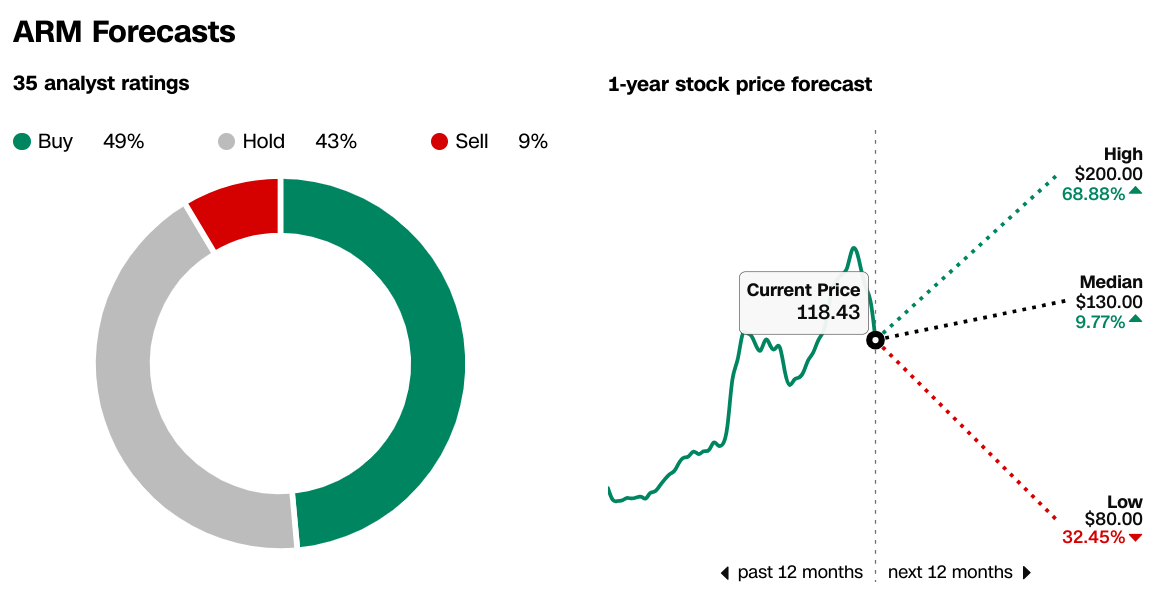

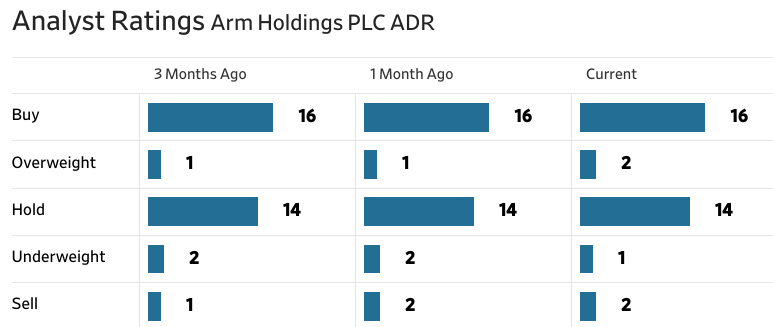

According to CNN.com, ARM's 1-year stock price targets range widely: the high estimate is $200, suggesting an 68.88% upside from the current price, the median forecast is $130, indicating a 9.77% potential increase, and the low estimate is $80, representing a 32.45% downside risk. Analysts' sentiment is largely positive with 49% rating it a buy, 43% holding, and 9% selling.

Source:CNN.com

The Wall Street Journal (WSJ.com) shows a slightly more conservative outlook. The median target aligns with CNN's forecast at $130, while the high is again projected at $200, and the low at $80. Notably, the average target across analysts is $139.65. The recent distribution of ratings reveals 16 buy ratings, 2 overweight, 14 hold, 2 underweight, and 2 sell, reflecting a strong inclination toward holding or buying ARM stock with a moderate overall sentiment.

Source:WSJ.com

B. Key Factors to Watch for ARM Stock Price Forecast 2025

ARM Stock Prediction 2025 - Bullish Factors

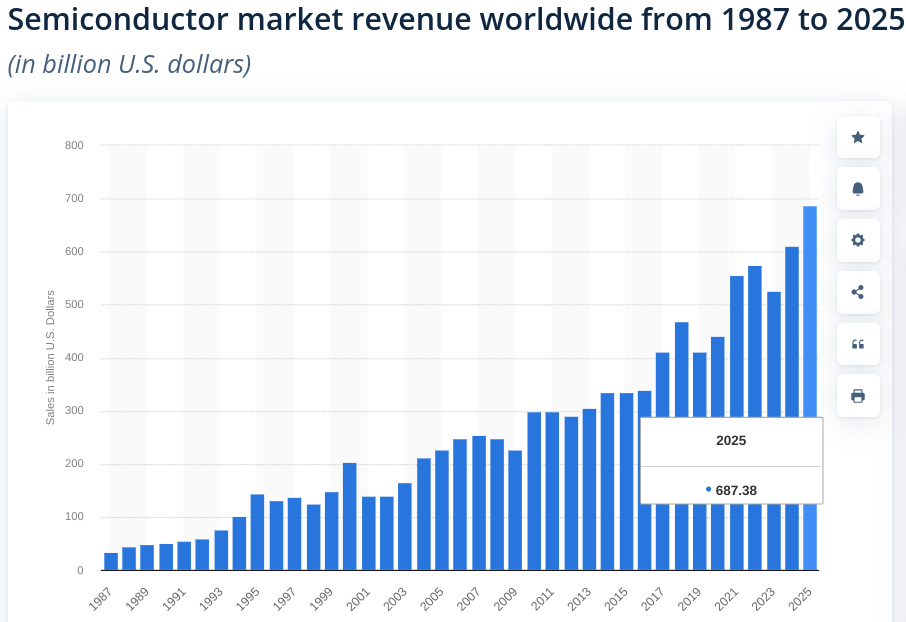

ARM Holdings (NASDAQ: ARM) is well-positioned for growth through 2025, benefiting from the global semiconductor market's expansion. The semiconductor industry is projected to reach $128 billion in manufacturing equipment sales by 2025, marking a 17% increase from 2024. This growth is driven by advancements in semiconductor technology and rising demand for high-performance chips, particularly in AI applications. As per statista.com, semiconductor market revenue may hit $687 billion by 2025.

Source: statista.com

ARM's strategy to capitalize on this trend includes expanding its portfolio of high-performance processor designs. The company's focus on developing ARMv9 architecture, which enhances AI and machine learning capabilities, aligns with the growing emphasis on AI processing in the semiconductor sector. ARM's push into automotive and edge computing markets also reflects its strategy to tap into emerging areas of high demand.

- AI and Semiconductor Demand: The rapid proliferation of AI technologies is a significant bullish factor. ARM's designs are crucial for next-generation AI chips, which are essential for data centers and edge devices. The expected 17% growth in leading-edge chip capacity by 2025, driven by advancements such as 2nm Gate-All-Around (GAA) chips, highlights a robust demand for ARM's technology.

- Capacity Expansion: The global semiconductor manufacturing capacity is set to grow by 7% in 2025. This expansion is vital for meeting the increasing demand for high-performance chips. ARM's strategic partnerships and licensing agreements with major semiconductor manufacturers position it well to benefit from this growth.

- Automotive Sector: The automotive semiconductor industry is forecasted to see a long-term positive outlook, with revenues expected to exceed $130 billion by 2029. ARM's focus on automotive applications, including high-performance chips for autonomous driving and advanced driver-assistance systems (ADAS), positions it advantageously in this sector.

Arm Holdings stock forecast for 2025 is shaped by several critical factors, including its financial projections and strategic developments. Analysts estimate a 23.02% YoY growth in EPS, reaching $1.56 in March 2025, with revenue expected to rise by 22.89% to $3.97 billion. These forecasts suggest strong financial performance driven by continued demand for Arm's technology in AI, mobile, and cloud computing sectors. Strategically, Arm is focused on expanding its market share in cloud computing, automotive, and mobile, supported by key partnerships with tech giants like Google and AWS. The launch of new products such as the Arm Ethos-U85 for Edge AI and the CSS for client computing are expected to drive future growth.

The bullish outlook for Arm in 2025 is underpinned by several factors. First, the growing adoption of AI across industries significantly boosts demand for Arm's high-performance, power-efficient CPUs, as seen with the 39% YoY revenue growth reported recently. Arm's strong position in the smartphone market, with a 50% YoY increase in royalty revenue, and its expanding presence in cloud services and automotive sectors, are key drivers of growth. Additionally, the ongoing adoption of the Armv9 architecture and the integration of Arm technology in AI-driven cloud solutions by major players like Google and AWS bolster the company's prospects.

Arm Holdings Stock Forecast 2025 - Bearish Factors

Despite these positive developments, potential risks could weigh on Arm stock. One key concern is the ongoing inventory issues in the industrial IoT and networking segments, which may dampen overall revenue growth. Additionally, while Arm is expanding into new markets, competition from other semiconductor companies could challenge its market share and pricing power. Finally, the high forward P/E ratio of 75.80 suggests that the stock is priced for perfection, leaving little room for error in execution, which could lead to volatility if growth expectations are not met.

IV. ARM Stock Forecast 2030 and Beyond

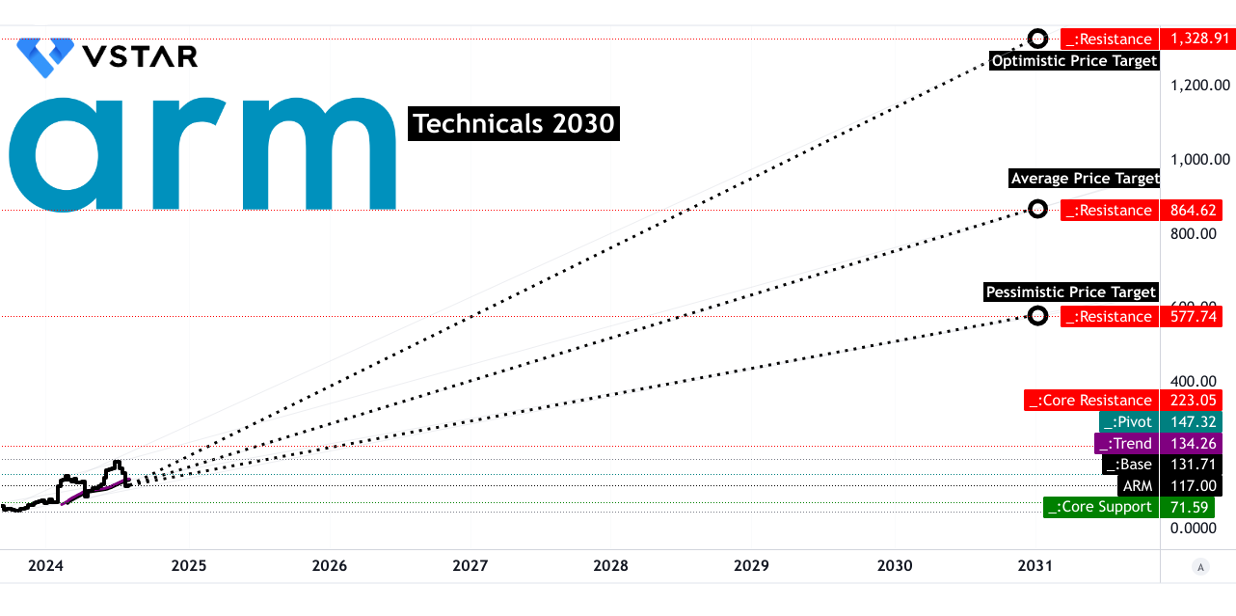

ARM Holdings stock price is projected to reach an average of $865 by the end of 2030. The optimistic target is $1,330, while the pessimistic estimate is $575. These predictions are derived from analyzing long-term trends, momentum, and Fibonacci extension and retracement levels.

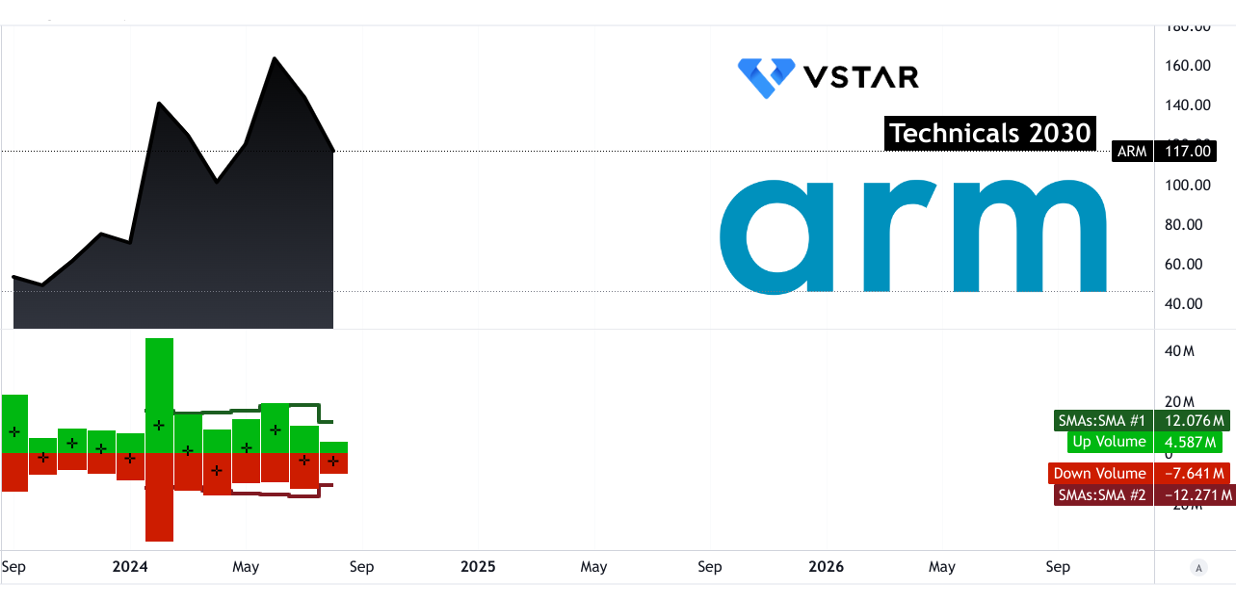

Source:tradingview.com

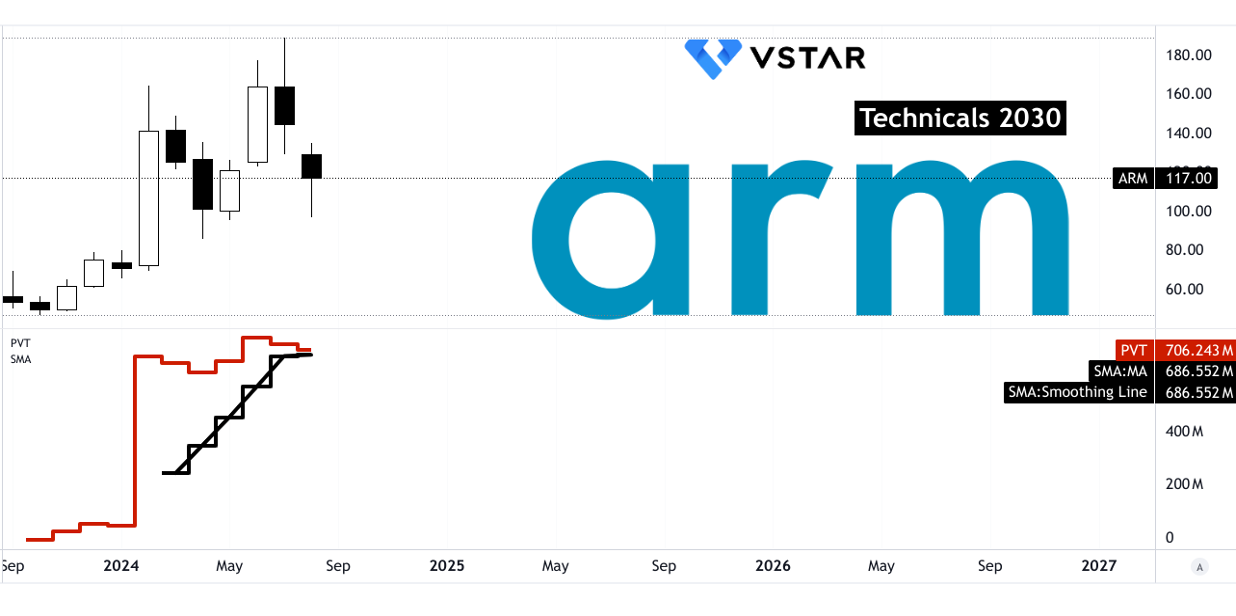

Current technical indicators reveal a downward trend in ARM's stock price, despite its bullish price volume trend (PVT) of 706.243 million compared to the moving average of 686.552 million. The primary resistance level is set at $578, with a core resistance at $223. The support level stands at $72. The average price target reflects a momentum shift, projecting significant growth based on long-term trends and Fibonacci analysis. The optimistic target considers strong upward momentum, while the pessimistic target accounts for potential downtrends.

Source:tradingview.com

The charts show that despite the current bearish volume momentum (down-volume average is exceeding up-volume average), the long-term trend points towards a potential price increase. The modified exponential moving average, indicating a downward price direction, contrasts with the bullish PVT, suggesting a complex market dynamic. Resistance levels, particularly at $578 and $864, indicate key price points that could influence future movements.

Source:tradingview.com

Arm Holdings (NASDAQ: ARM) shows strong growth potential, with forecasts indicating significant stock appreciation by 2030. According to Coincodex, ARM's stock could rise to $218.70 by 2030, representing an 86.87% increase. CoinPriceForecast predicts an even higher valuation, projecting the stock at $256 by 2030, a 119% increase. These forecasts suggest sustained growth, driven by ARM's leadership in semiconductor design and expanding market presence.

Source:coinpriceforecast.com

A. Other Arm Stock Price Prediction 2030 and Beyond Insights

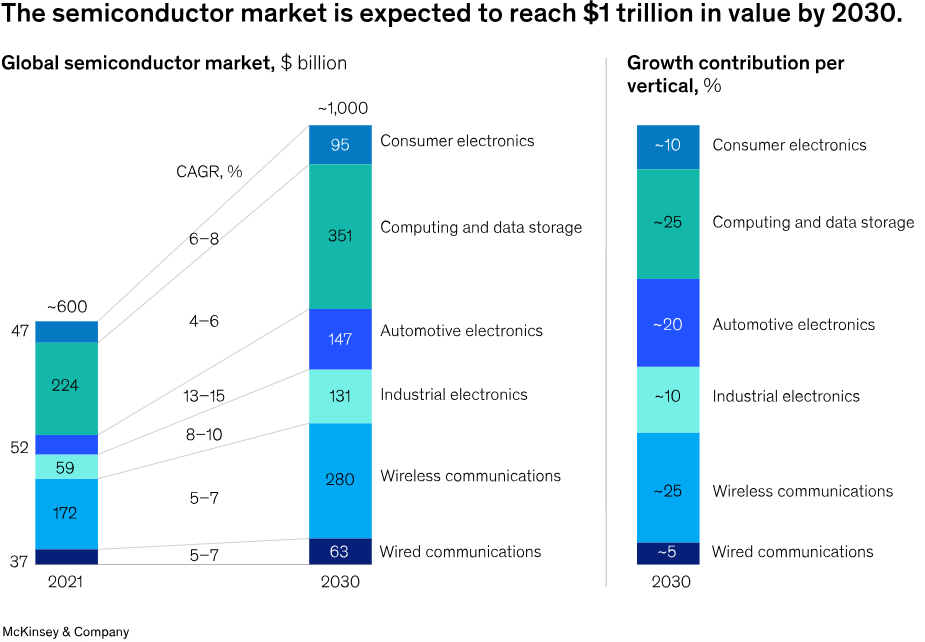

Arm Holdings (NASDAQ: ARM) is strategically positioned to benefit from several critical factors driving its stock forecast through 2030. Firstly, as per Mckinsey, the global semiconductor market is projected to surpass $1 trillion by 2030. As per Market.us Scoop, the market is growing at a CAGR of 8.8% from $547.2 billion in 2023. This growth is largely driven by advancements in AI, vehicle electrification, and autonomous driving. The semiconductor industry is experiencing substantial investments, with approximately $1 trillion expected to be invested in fabs globally through 2030. ARM's involvement in designing chips for emerging technologies, such as AI and 5G, aligns well with these trends.

Source: mckinsey.com

Arm's expansion into new regions also highlights its strategic development prospects. The shift towards sustainability, supply chain security, and government subsidies are becoming pivotal in site selection for semiconductor fabs. ARM's focus on these areas ensures it remains competitive and adapts to evolving market demands.

The bullish outlook for ARM stock can be attributed to several factors. The booming AI market, with a projected annual growth rate of 28.46% and a market volume of $826.70 billion by 2030 (as per statista.com), represents a significant growth opportunity for ARM. The company's role in designing chips for AI applications positions it favorably within this expanding sector. Additionally, ARM's integration into advanced semiconductor technologies, such as chiplets and co-packaged optics, aligns with industry trends aiming to overcome the limitations of Moore's Law.

Moreover, strategic acquisitions and partnerships in the semiconductor sector underscore a robust industry landscape. For example, Intel's acquisition of Tower Semiconductor and Analog Devices' merger with Maxim Integrated highlight the increasing consolidation and innovation in the industry. ARM's ability to leverage these developments further supports its positive stock forecast.

B. Key Factors to Watch for ARM Stock Forecast 2030 and Beyond

Arm Stock Price Forecast 2030 and Beyond - Bullish Factors

Arm Holdings' financial forecast for 2030 is anchored by a robust growth trajectory in both revenue and earnings. Analysts predict a significant rise in EPS from $1.56 in 2025 to $6.31 by 2034, reflecting consistent annual growth, with a forward P/E ratio decreasing from 75.80 in 2025 to 18.77 by 2034. Revenue is also expected to surge, growing from $3.97 billion in 2025 to $29.17 billion by 2034. The company's strategy focuses on expanding its influence in AI, cloud computing, and mobile, highlighted by partnerships with tech giants like Google and AWS. Arm's focus on its Compute Subsystems (CSS) is likely to drive further growth, especially in automotive and cloud markets.

Source: seekingalpha.com

Moreover, Arm's revenue forecast showcases its robust growth potential, with revenue expected to almost double every five years, driven by AI and cloud computing demands. The company's strong presence in mobile devices, evidenced by a 50% YoY growth in smartphone royalties, positions it well to capitalize on the ongoing global smartphone proliferation. Furthermore, the expansion of Arm's ecosystem, particularly in AI and automotive sectors, coupled with strategic partnerships, such as with Google and AWS, bolsters its growth prospects. The potential to dominate emerging markets like Edge AI and AI PCs with products like the Arm Ethos-U85 further cements its bullish outlook.

ARM Stock Forecast 2030 and Beyond - Bearish Factors

Despite the optimistic growth forecasts, Arm faces significant risks. The high forward P/E ratio, even with decreasing multiples, indicates that the stock is priced for perfection, leaving little room for error. Market saturation in the smartphone industry, coupled with persistent inventory issues in IoT and networking sectors, could dampen royalty revenue growth. Additionally, the company's heavy reliance on a few key markets could expose it to cyclical downturns. Any delays in the adoption of new technologies or failure to maintain its competitive edge in AI and cloud computing could significantly impact Arm's long-term growth prospects.

V. Conclusion

A. Arm Stock Outlook

Arm Holdings (NASDAQ: ARM) presents a mixed outlook with varied price forecasts for 2024, 2025, and 2030. For 2024, targets range from $124 to $171, reflecting moderate optimism. By 2025, expectations are more diverse, with projections from $170 to $400, influenced by Arm's role in AI and cloud sectors. Looking towards 2030, estimates vary significantly, ranging from $575 to $1,330, underscoring potential for substantial growth amid technological advancements. Investors should weigh these forecasts alongside Arm's market positioning and broader semiconductor industry trends.

B. Trade ARM Stock CFD with VSTAR

Trading ARM stock CFDs with VSTAR offers benefits such as tight spreads, which minimize trading costs and enhance profit potential. Additionally, VSTAR provides leverage, allowing investors to amplify their exposure to Arm's price movements. The platform's user-friendly interface and advanced trading tools further enhance the trading experience, making it an attractive option for those looking to capitalize on Arm's stock volatility.