I. Recent Alibaba Stock Performance

Recent BABA stock price performance and changes

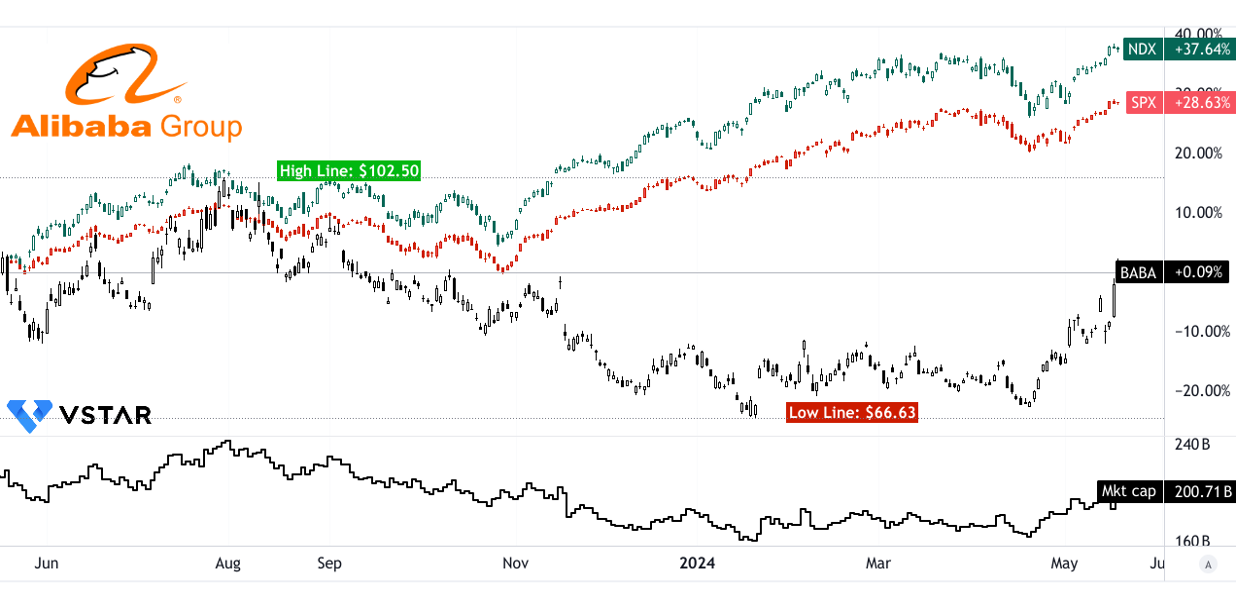

Over the past 12 months, Alibaba (NYSE:BABA) has faced a challenging stock performance. As of the latest data, Alibaba's market capitalization stands at $201 billion. The stock's 52-week high reached $102.50, while its 52-week low fell to $66.63, indicating significant volatility and uncertainty.

Alibaba's stock price return over the past year has been relatively flat, with a meager 0.1% increase. This performance starkly contrasts with broader market indices, where the S&P 500 achieved a robust 29% return, and the tech-heavy Nasdaq-100 surged by 38%. Several factors contribute to this underperformance. Regulatory pressures from Chinese authorities, including antitrust investigations and new data privacy laws, have dampened investor confidence. Additionally, macroeconomic concerns such as a slowing Chinese economy and trade tensions have further weighed on the stock.

Source: tradingview.com

Main influencing factors

Revenue Growth and Profitability:

Alibaba reported a 7% year-over-year revenue increase for Q4 fiscal 2024, reaching RMB221.87 billion (US$30.73 billion). For the full fiscal year, revenue grew by 8% to RMB941.17 billion (US$130.35 billion). However, the income from operations saw mixed results, with a 3% decline in the March quarter and a 13% increase over the fiscal year, suggesting volatility in operational efficiency and profitability.

Investments in Strategic Priorities:

The company's focus on strategic business priorities such as AI, cloud computing, and international commerce has driven substantial investment. For instance, increased capital expenditures primarily directed towards Alibaba Cloud infrastructure resulted in a significant drop in free cash flow by 52% year-over-year for the quarter. These investments, while crucial for long-term growth, have impacted short-term profitability.

Market Challenges and Competition:

The decline in net income by 96% for the quarter was primarily due to mark-to-market losses from investments in publicly traded companies. This substantial drop, alongside a 5% decrease in adjusted EBITA, indicates the financial strain from both external market conditions and internal investment decisions.

Source: seekingalpha.com

AI and Cloud Computing Growth:

The accelerated growth in cloud computing revenues, driven by AI products, highlights a critical growth area. The triple-digit growth in AI-related revenue underscores Alibaba's strategic pivot towards emerging technologies, which is expected to be a significant driver of future revenue.

Regulatory and Market Dynamics:

Alibaba continues to navigate complex regulatory landscapes in China, impacting its operational and financial strategies. Additionally, global market dynamics, including competitive pressures in international e-commerce, further influence its stock performance.

Expert Insights on BABA Stock Forecast for 2024, 2025, 2030 and Beyond

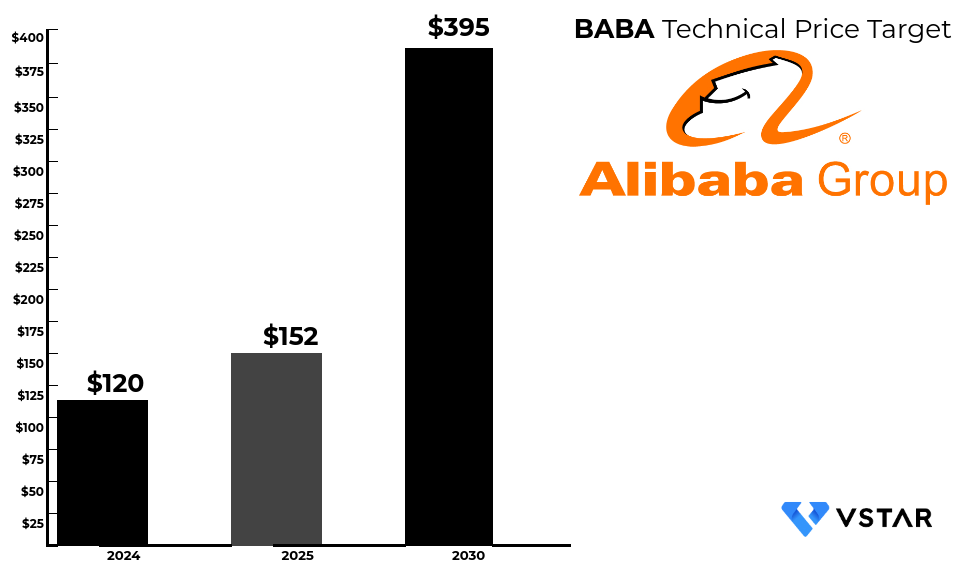

Alibaba's recent stock performance has been volatile due to regulatory scrutiny and economic factors. The forecasts project recovery and growth, with targets of $120 in 2024, $152 in 2025, and $395 by 2030. These projections rely on Alibaba's ability to navigate regulatory challenges, geopolitics, and capitalize on market leads, highlighting both the potential and uncertainty in its long-term outlook.

Source: Analyst's compilation

II. BABA Stock Forecast 2024

The average BABA price target by the end of 2024 is projected to be $120, supported by momentum analysis and Fibonacci retracement levels indicating a steady upward trend. The optimistic scenario predicts a high of $152, driven by robust upward price momentum and positive market sentiment. Conversely, the pessimistic scenario suggests a potential low of $57, considering possible downward pressure and volatility based on short- to mid-term swings.

The stock's trendline and baseline are both around $75.00, which is below the current price of $88.54, indicating the stock is trading above its recent averages. The primary support level is identified at $84.82, with core support at $57.04, providing a cushion against potential downward movements. The pivot point of the current horizontal price channel is at $78.81, with significant resistance at $100.57.

Source: tradingview.com

The Relative Strength Index (RSI) currently stands at 72.4, which is above the bullish level of 31.67 and significantly higher than the bearish level of 48.82. This suggests strong bullish momentum. The RSI line trend is upward, further confirming the bullish Alibaba stock outlook.

Additionally, the Moving Average Convergence/Divergence (MACD) indicator shows a MACD line at -0.059 against a signal line of -2.12, with a bullish histogram of 2.060. The increasing trend in the MACD histogram indicates strengthening bullish momentum, supporting the projected rise in BABA stock price.

Source: tradingview.com

The BABA forecast in 2024 suggests a cautiously optimistic outlook with moderate variations in analyst predictions. According to TipRanks, 15 Wall Street analysts offer a 12-month Alibaba price target average of $105.13, with forecasts ranging from $80.00 to $124.90. StockAnalysis provides analyst consensus of strong buy and a slightly higher average target of $110.26 from 17 analysts, with a broader range from $85 to $140. CoinPriceForecast anticipates a year-end price of $108.21, marking a 22% increase from current levels.

Source: stockanalysis.com

A. Other Alibaba Stock Forecast 2024 Insights: Is Alibaba a good stock to buy?

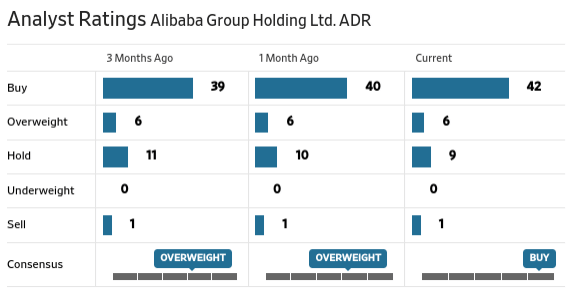

As of mid-May 2024, several prominent financial institutions and analysts have provided their price targets and ratings for Alibaba (BABA) stock. Barclays, through analyst Jiong Shao, has adjusted the BABA price target from $109 to $107 while maintaining an "Overweight" rating, suggesting a potential upside of 20.86%. Similarly, B of A Securities' analyst Eddie Leung has raised the Alibaba price target from $99 to $103, maintaining a "Buy" rating with a 16.34% upside.

Truist Securities, represented by Youssef Squali, has made two updates this month. On May 15th, the BABA target price was adjusted from $113 to $110, with a maintained "Buy" rating, reflecting a 24.25% upside. A second update on May 7 had slightly lowered the target from $114 to $113, still maintaining a "Buy" rating and suggesting a 27.64% upside. This indicates a generally positive outlook despite minor target adjustments.

Citigroup's analyst Alicia Yap has set a BABA price target of $122, slightly down from the previous $124, maintaining a "Buy" rating and suggesting a substantial upside of 37.81%. Benchmark's Fawne Jiang reiterated a "Buy" rating with a current Alibaba price target of $118, indicating a 33.29% upside, showing strong confidence in Alibaba's stock performance.

Mizuho's analyst James Lee has been more conservative, lowering the BABA price target from $95 to $92 while maintaining a "Buy" rating, which suggests a modest upside of 3.92%. Despite this, the overall sentiment from major financial analysts remains positive, with most maintaining their "Buy" or "Overweight" ratings. These insights reflect a generally optimistic view on Alibaba's growth prospects and market position, despite slight adjustments in price targets.

B. Key Factors to Watch for Alibaba Stock Price Prediction 2024

Alibaba stock forecast for 2024 is influenced by a myriad of factors, both bullish and bearish, stemming from the company's recent financial performance and strategic developments.

BABA Stock Prediction 2024 - Bullish Factors

Revenue Growth and Diversification:

Alibaba's revenue estimates for fiscal periods ending in 2025 demonstrate consistent growth, driven by double-digit increases in segments like Alibaba International Digital Commerce (AIDC), particularly its cross-border retail operations. The company's focus on expanding its international footprint and enhancing consumer experience, as highlighted by Jiang Fan, suggests sustained revenue growth.

Cloud Computing and AI Revenue:

Alibaba Cloud's revenue growth, fueled by increasing demand for cloud services and AI-related products, serves as a bullish indicator. The strategic investments in AI infrastructure and partnerships with leading companies position Alibaba as a frontrunner (with 4% market share) in the rapidly evolving cloud computing landscape.

Source: statista.com

Shareholder Returns and Capital Management:

Alibaba has made efforts to return value to shareholders through significant share repurchases (US$12.5 billion) and dividends (US$4.0 billion for fiscal 2024). This strategy aims to bolster shareholder confidence and stabilize stock performance despite the Alibaba earnings volatility.

Alibaba Stock Prediction 2024 - Bearish Factors

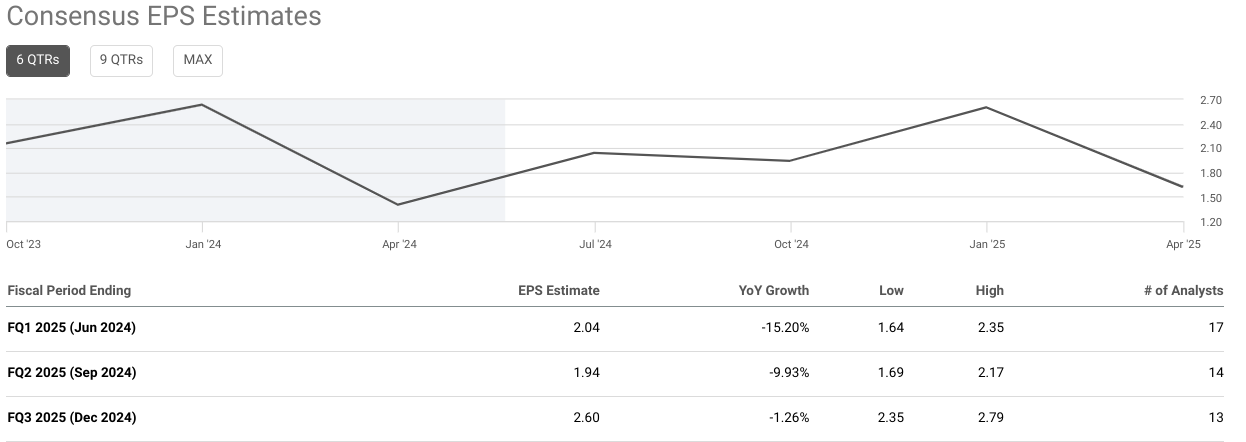

Negative EPS Growth (YoY):

Despite revenue growth, consensus EPS estimates show a downward trend for fiscal periods ending in 2025. This decline in EPS, coupled with negative YoY growth projections, raises concerns about profitability and operational efficiency, potentially dampening investor sentiment.

Source: seekingalpha.com

Increased Investment and Losses:

Alibaba's significant investments in various segments, including AIDC and Cainiao, have resulted in increased losses, as indicated by adjusted EBITDA figures. While these investments aim to drive future growth, sustained losses may weigh on short-term financial performance and investor confidence.

III. BABA Stock Forecast 2025

Source: tradingview.com

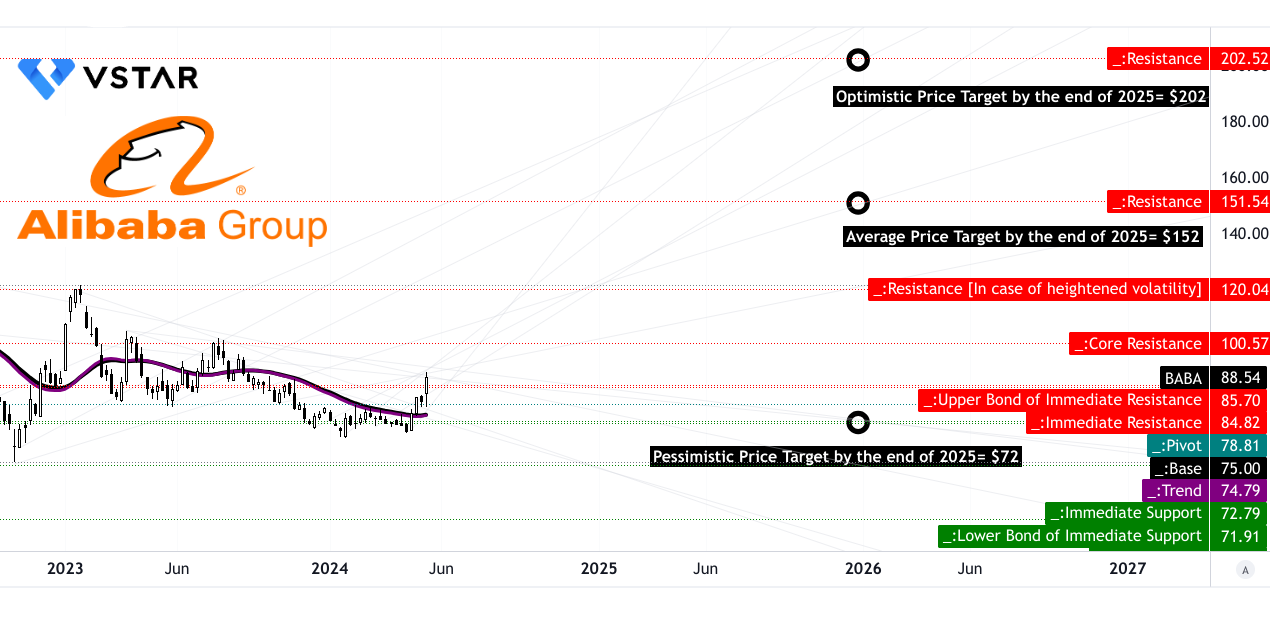

Based on technical analysis, Alibaba stock is projected to reach an average price of $152 by the end of 2025. This Alibaba forecast takes into account the momentum of change-in-polarity over the mid-term, projected over Fibonacci extension levels. The optimistic scenario predicts a BABA price target of $202, driven by the upward price momentum of the current swing, also projected over Fibonacci extension levels. Conversely, in a pessimistic scenario, the stock could drop to $72, based on downward price momentum projected over Fibonacci retracement levels.

To support this BABA forecast, an analysis of TradingView charts reveals several key technical aspects. The current price of BABA is $88.54, with a trendline and baseline both hovering around $74.79 to $75.00, indicating stability with a slight upward trajectory. The trendline, a modified exponential moving average, suggests a gradual increase in stock value. The direction of the stock price is currently upward, reinforcing the potential for a bullish trend.

The primary support level is identified at $85.70, indicating a strong foundation where buying interest is likely to prevent further declines. The pivot of the current horizontal price channel is at $78.81, serving as a central point around which the stock oscillates. Key resistance levels include $100.57 and $151.54, with a core resistance point at $100.57, indicating significant price barriers. In the event of heightened volatility, resistance could extend to $120, and support could fall to $71.91.

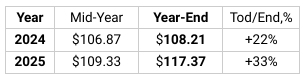

The 2025 stock forecast for Alibaba (BABA) varies between sources. Coincodex predicts a modest 4.90% increase, bringing the stock price to $92.83, reflecting its historical growth rate. Conversely, CoinPriceForecast is more optimistic, projecting the stock to reach $117.37 by year-end, marking a 33% rise. These divergent forecasts highlight the uncertainty and differing analyses regarding Alibaba's future performance, influenced by market conditions, regulatory impacts, and overall economic trends.

Source: coinpriceforecast.com

A. Other Alibaba Stock Price Prediction 2025 Insights: Is Alibaba a buy?

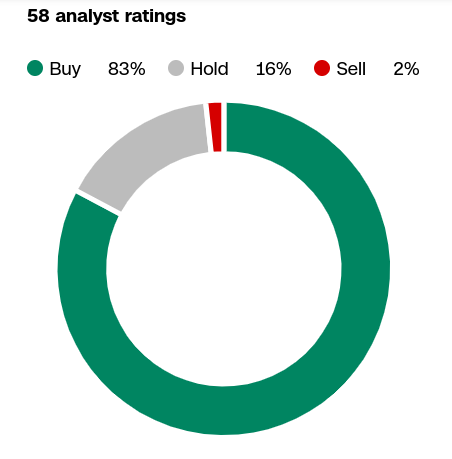

The forecast for Alibaba stock in 2025 reflects a blend of analyst opinions and institutional insights. According to CNN.com, out of 58 analysts, 83% suggest buying, 16% recommend holding, and 2% advice selling. Their median price forecast stands at $105.18, with a high estimate of $135.37 and a low of $75.98, indicating a wide range of expectations.

Source: CNN.com

Meanwhile, WSJ.com's data reveals a similar sentiment, with a majority of analysts leaning towards buy rating. Their price targets in yuan are notably higher, with a median of ¥763.26, suggesting optimism about Alibaba's growth potential in both domestic and international markets.

Source: WSJ.com

B. Key Factors to Watch for Alibaba Stock Forecast 2025

Financial Forecast 2025:

For fiscal 2025, Alibaba's consensus EPS estimate is $8.24, reflecting a slight decline of 4.19% year-over-year, with a forward P/E ratio of 10.74. Revenue is expected to grow by 8% to $140.52 billion. However, the EPS revision trend shows a downward trajectory over the past six months, indicating a cautious sentiment among analysts.

BABA stock price prediction 2025 - Company Strategy/Development Prospects

- E-commerce Expansion: The Taobao and Tmall Group (TTG) are enhancing their user-first strategy by improving product supply, competitive pricing, and service quality. This has led to double-digit growth in GMV and increased membership in the 88VIP program.

- Cloud Computing and AI: Alibaba Cloud is aligning its product strategy for the AI era, experiencing triple-digit growth in AI-related revenue. Investments in AI infrastructure aim to capture burgeoning demand.

- International Expansion: Alibaba International Digital Commerce (AIDC) reported 45% revenue growth and a 20% increase in order volume, driven by AliExpress's shift to a supply chain efficiency-driven model and strategic expansions in key markets.

- Logistics and Infrastructure: The synergy between Alibaba's logistics arm Cainiao and its e-commerce operations is pivotal, although Cainiao's IPO was withdrawn to enhance internal synergies.

BABA Stock Forecast 2025 - Bullish Factors

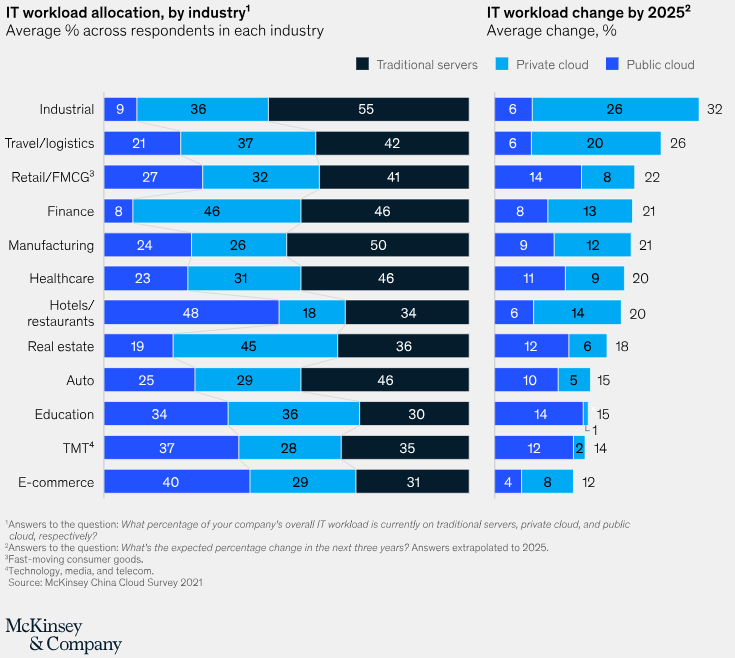

Cloud Computing Growth: Alibaba Cloud's strategic focus on high-quality revenue and AI products, with partnerships and proprietary models like Tongyi, positions it for continued double-digit growth in the latter half of 2025. Alibaba is poised to benefit from China's national policy guidance promoting digitization in the industrial and manufacturing sectors. The transformation of these sectors, contributing significantly to China's GDP, is expected to drive Alibaba's revenue, particularly through its cloud computing division. The 14th five-year plan projects significant increases in industrial internet-platform applications and IT workload migration to the cloud, which Alibaba Cloud is well-positioned to capitalize on.

Source: mckinsey.com

E-commerce Momentum: TTG's robust GMV growth, driven by user engagement and new monetization mechanisms, underscores Alibaba's dominant position in China's e-commerce sector. AIDC's success (International Market Penetration) in cross-border operations and market-specific enhancements, such as the AE Choice model, supports its aggressive international growth strategy. According to Statista, the global retail e-commerce market is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2028. The U.S. market, in particular, is projected to grow at a CAGR of 11.8%, with its current value at $843 billion. Emerging markets like India and Mexico are also expected to grow at CAGRs over 11%. This global growth trend presents substantial opportunities for Alibaba's international expansion and revenue diversification.

BABA Stock Forecast 2025 - Bearish Factors

Regulatory Risks: Alibaba continues to face scrutiny and regulatory challenges in China, which could impact its operational flexibility and profitability.

Economic Slowdown: China's economic conditions remain uncertain, and any slowdown could adversely affect consumer spending, impacting Alibaba's core e-commerce and cloud businesses.

Competitive Pressures: Intense competition from domestic and international players in e-commerce and cloud computing sectors could pressure Alibaba's margins and market share.

IV. Alibaba Stock Price Prediction 2030 and Beyond

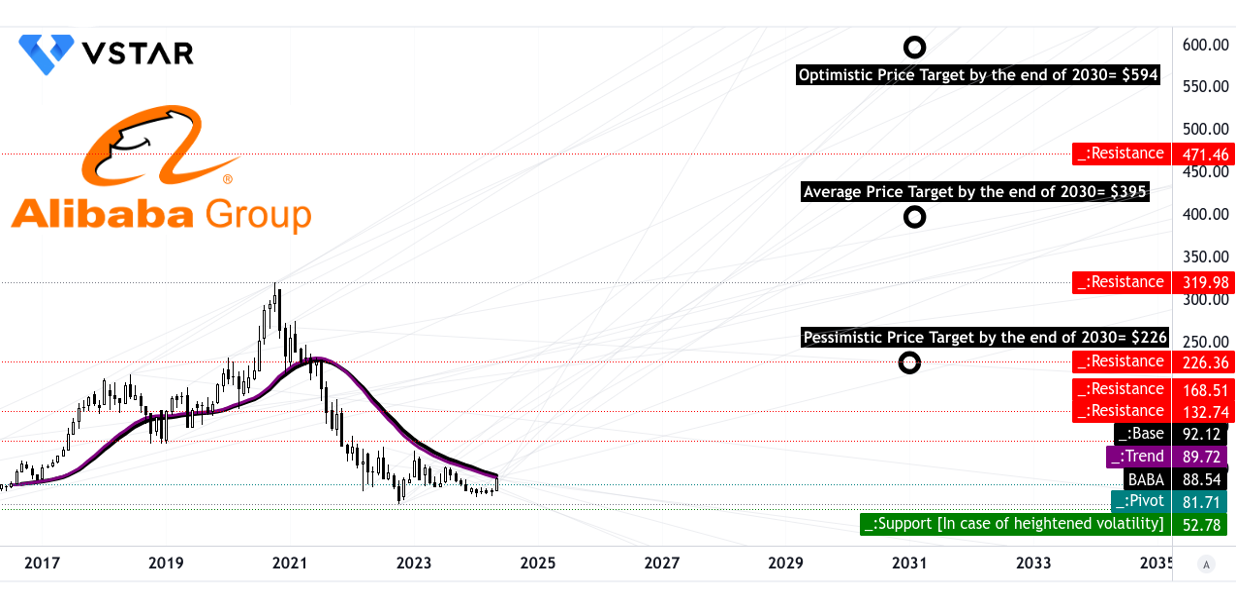

Technically, Alibaba stock (NYSE:BABA) is projected to reach an average price target of $395.00 by the end of 2030. Optimistic projections suggest a potential high of $594.00, while more conservative estimates place a pessimistic target at $226.00. These predictions are derived from the momentum of change-in-polarity over the long term, analyzed through Fibonacci extension levels for upward trends and Fibonacci retracement levels for downward trends.

Source: tradingview.com

The current price of $88.54 shows a stock experiencing a sideways movement, which is reflected in the relative stability around the trendline ($89.72) and baseline ($92.12) values, both calculated using modified exponential moving averages. This sideways movement indicates a consolidation phase, suggesting potential for significant breakout in either direction in the long term.

The pivot of the current horizontal price channel is at $81.71, with primary support at $53.00, indicating a robust support level that could prevent substantial declines. Key resistance levels are set at $226.36 and $320.00, with heightened volatility possibly pushing resistance to $471.46. These resistance points highlight critical levels where significant price actions could occur, particularly around the core resistance at $320.00, which aligns with the long-term price targets.

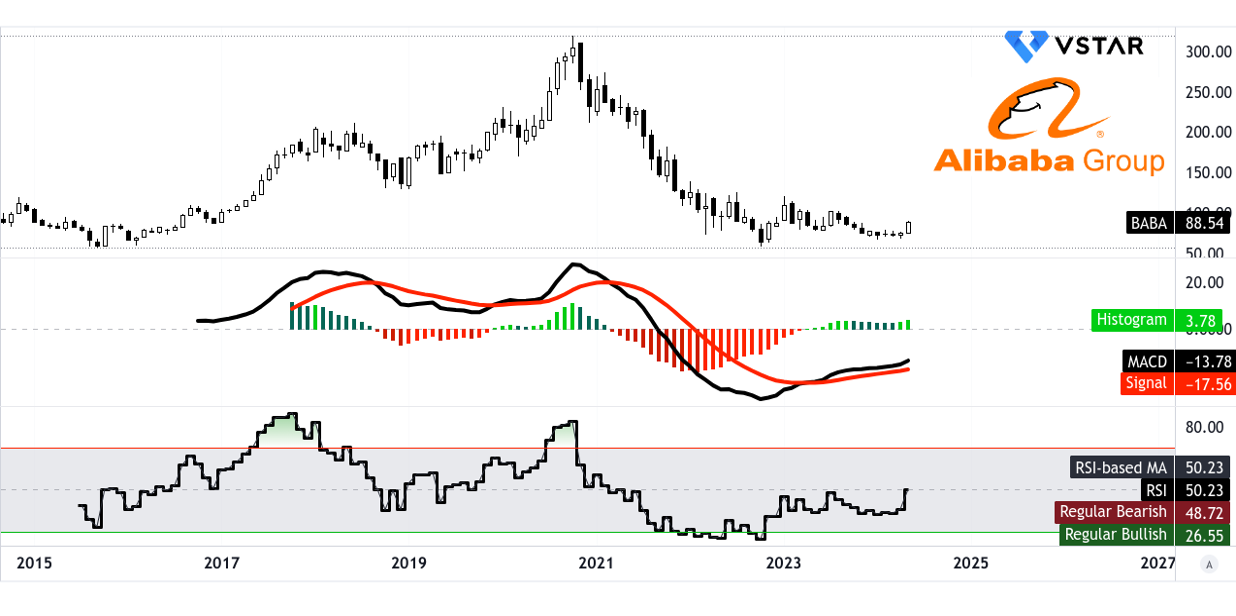

The RSI is currently at 50.23, indicating a neutral market sentiment with an upward trend, as there are no signs of bullish or bearish divergence. The MACD indicator further supports a bullish trend, with the MACD line at -13.78, the signal line at -17.56, and an increasing histogram of 3.78, signaling strengthening upward momentum.

Source: tradingview.com

The price targets for Alibaba (BABA) in 2030 show substantial variation between different forecasting sources. Coincodex.com predicts a relatively conservative target of $117.89, representing a 33.22% increase from current levels. On the other hand, Coinpriceforecast.com offers a much more bullish target of $216.77, indicating a 145% rise. This disparity underscores the challenges in long-term forecasting, reflecting different assumptions about Alibaba's growth prospects, market conditions, and potential regulatory impacts.

Source: coinpriceforecast.com

A. Other BABA Stock Forecast 2030 and Beyond Insights: Is BABA stock a buy?

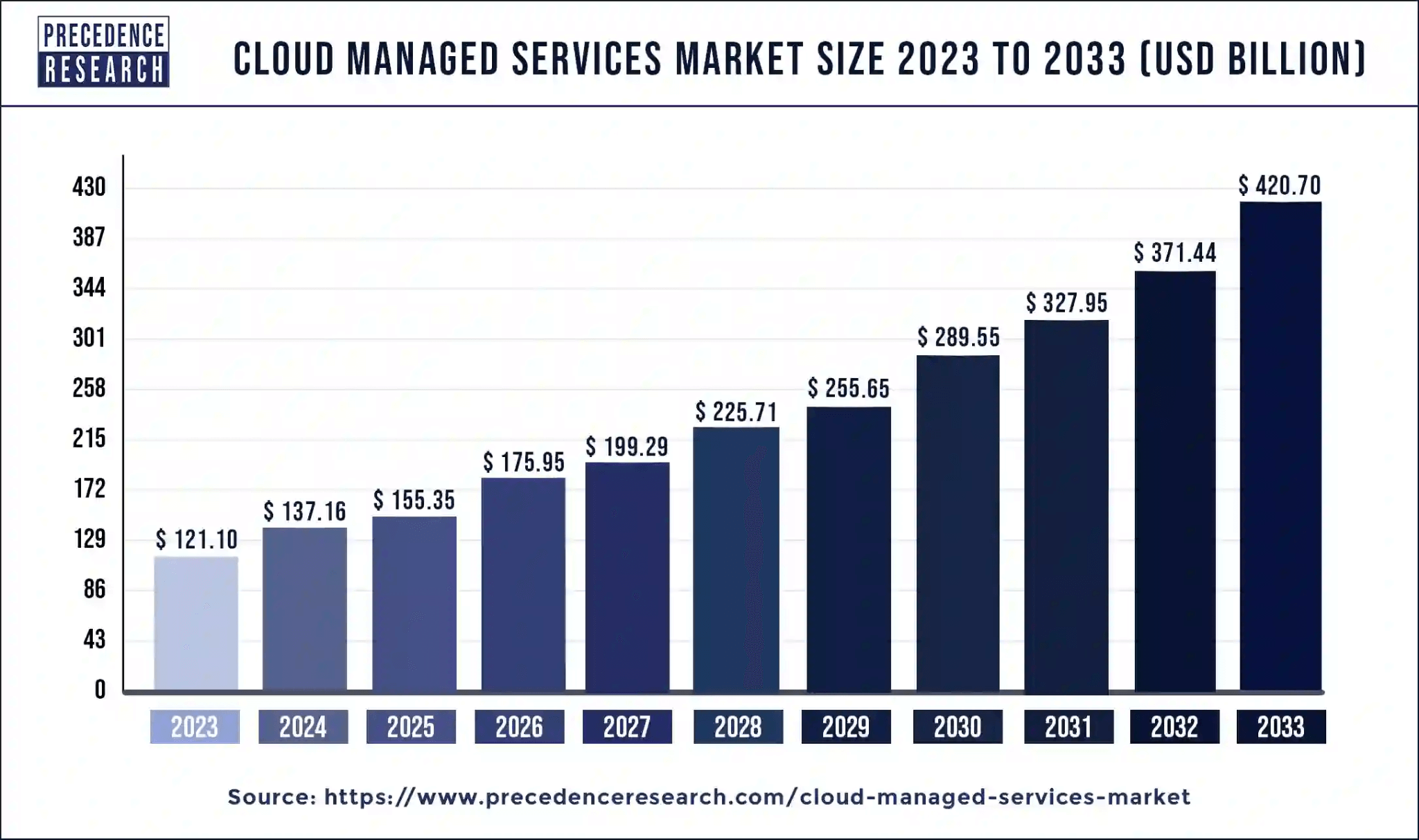

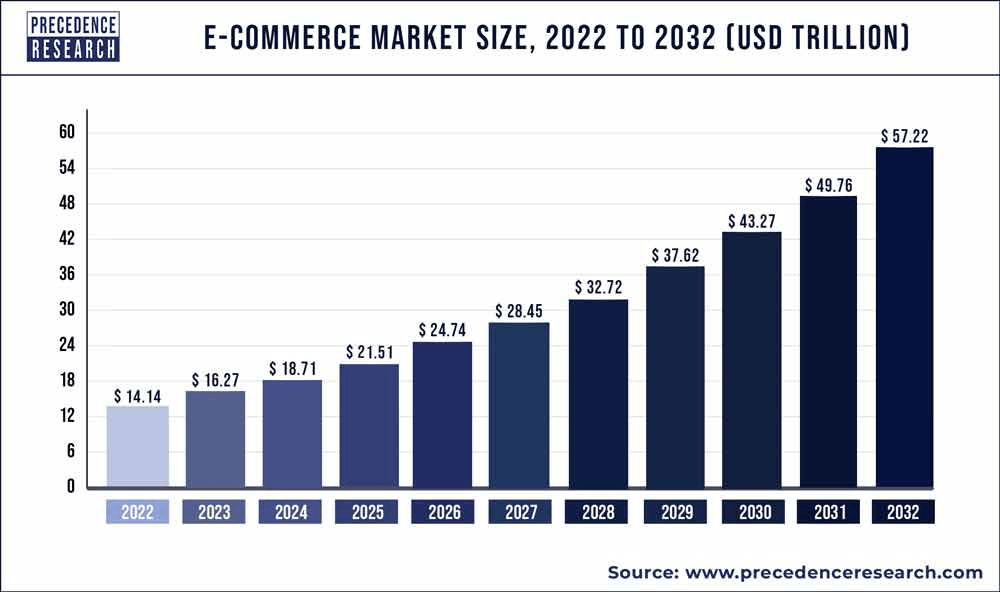

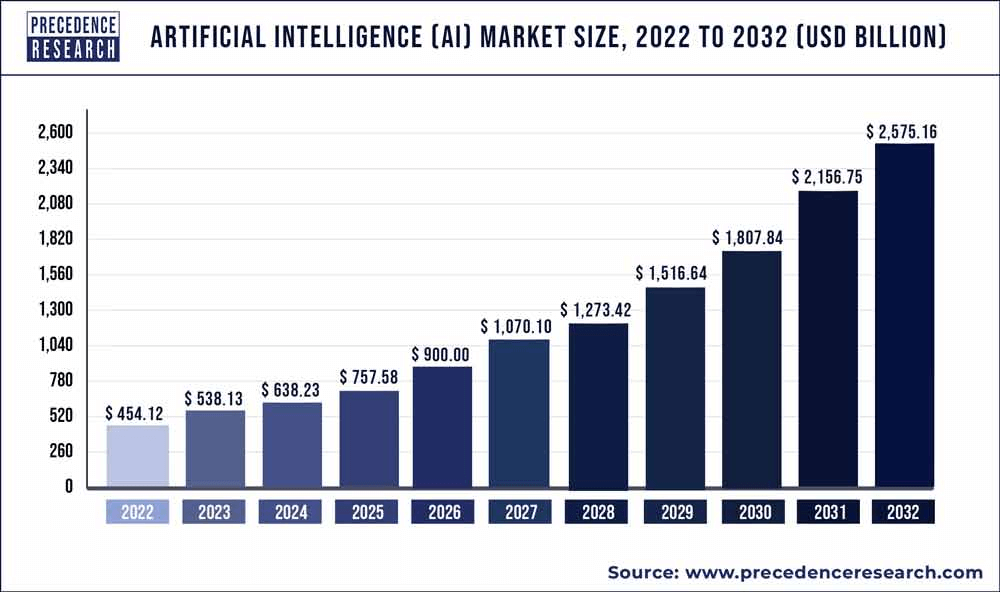

Alibaba stands to benefit significantly from the projected expansions in the global e-commerce, cloud managed services, and AI markets. As per precedenceresearch.com, the global e-commerce market is expected to grow to USD 57.22 trillion by 2032, with a CAGR of 15% from 2023 to 2032. The cloud managed services market is forecasted to reach USD 420.70 billion by 2033, growing at a CAGR of 13.26% from 2024 to 2033. Additionally, the artificial intelligence market, valued at USD 454.12 billion in 2022, is anticipated to hit USD 2,575.16 billion by 2032, with a CAGR of 19%.

Source: precedenceresearch.com

Source: precedenceresearch.com

B. Key Factors to Watch for Alibaba Stock Forecast 2030 and Beyond

BABA price prediction 2030 and beyond - Financial Forecast

Alibaba's projected financial performance for the next decade shows moderate but consistent growth. Consensus EPS estimates predict an increase from $8.24 in March 2025 to $10.33 by March 2027, with fluctuations indicating potential volatility. Revenue estimates show a steady increase from $140.52 billion in 2025 to $224.08 billion by 2034, reflecting Alibaba's broadening market reach and diversified business model. However, the year-over-year growth rate gradually declines, indicating a maturation phase.

Company Strategy and Development Prospects:

Alibaba's strategy focuses on AI integration, cloud computing, and international expansion. Their core public cloud offerings and AI-related revenues are anticipated to grow significantly, driven by investments in AI infrastructure and strategic partnerships with foundational model companies. The Taobao and Tmall Group's focus on a user-first strategy, competitive pricing, and enhanced user experience aims to drive growth in GMV and customer retention. Internationally, Alibaba's Digital Commerce Group is expanding cross-border retail operations and improving logistics through Cainiao.

Alibaba Stock Forecast 2030 and Beyond - Bullish Factors

AI and Cloud Growth: Alibaba Cloud's AI-driven strategy and robust growth in AI-related revenue signal strong future potential. The launch of Alibaba's proprietary AI model, Tongyi, and strategic partnerships with leading AI companies enhance its competitive edge.

Source: precedenceresearch.com

E-commerce Strength: The double-digit growth in GMV for Taobao and Tmall and the significant increase in Alibaba International Digital Commerce's revenue indicate strong consumer demand and effective market strategies.

Alibaba Stock Price Prediction 2030 and Beyond - Bearish Factors

Market Saturation: The slowdown in year-over-year revenue growth rates indicates market saturation, particularly in core e-commerce and cloud services. This could limit Alibaba's future expansion opportunities.

Geopolitical Tensions: Ongoing US-China trade tensions and potential sanctions on Chinese tech companies could disrupt Alibaba's international operations and supply chains, affecting its growth and profitability.

V. Conclusion

A. BABA Stock Outlook: Alibaba buy or sell?

The outlook for Alibaba stock (NYSE:BABA) shows a blend of cautious optimism and significant uncertainty. Analysts project that Alibaba stock could reach approximately $120 by the end of 2024, $152 by 2025, and potentially $395 by 2030, assuming favorable market conditions and successful navigation of regulatory challenges.

Alibaba stock is a buy. Given the forecasted growth and the company's strategic investments, Alibaba stock remains a good investment option with short-term volatility.

B. Trade Alibaba Stock CFD with VSTAR

Trading BABA stock CFDs with VSTAR offers several advantages, particularly for both novice and experienced traders. VSTAR provides access to a user-friendly platform with features like copy trading, allowing users to mirror the strategies of successful traders. This can be especially beneficial for beginners looking to learn and profit from experienced market participants. VSTAR also boasts low trading fees, deep liquidity, and reliable order execution, ensuring that trades are executed swiftly and efficiently.

Additionally, VSTAR is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing a secure trading environment. The platform supports various payment methods and offers negative balance protection, ensuring that users cannot lose more than their initial investment. With a minimum deposit requirement as low as $50, VSTAR makes trading accessible to a wide range of investors.

FAQs

1. Is BABA a good stock to buy now?

Some analysts suggest Alibaba stock holds near highs after a post-earnings surge, while others recommend caution due to near-term challenges and regulatory headwinds.

2. What is the price prediction for BABA stock in 2024?

The average BABA stock price target by the end of 2024 is estimated to be around $109.96, with a high forecast of $135.00 and a low forecast of $85.00.

3. What is the BABA stock forecast for 1 year?

The average 1-year BABA price target is $110.26, with a range from $85.00 to $140.00.

4. What will Alibaba stock be worth in 2025?

Predictions suggest BABA stock could be worth between $201.02 and $224.60 in 2025.