I. Recent American Airlines Stock Performance

American Airlines Management Projection

On July 25, American Airlines AAL announced its second-quarter earnings and revised its full-year financial estimate. The fair value estimate has dropped from $13.10 to $12.00 per share.

Because global distribution systems and travel management companies are still utilizing outdated digital protocols to miss out on the many complex offers that airlines make, the company's aggressive efforts in late 2023 to modernize how it sells and distributes its tickets digitally disrupted the distribution process. The company has thus lost its edge in the profitable business travel sector.

In June, American announced the departure of its chief commercial officer and reverted strategies meant to encourage the use of digital ticketing systems, such as deducting mileage rewards from travelers using antiquated systems. We estimate that the company's distribution will take until the following year to revert to its prior levels. The commercial error happened at a bad time: in early 2024, US airline capacity exceeded demand, which prompted aggressive ticket discounts that further undermined profitability.

Direct Booking Strategy Bites Back: American Airlines Profits Crash

Following a sharp drop in profits, American Airlines is currently dealing with the consequences of its current direct booking plan. The airline's goal of eliminating middlemen and encouraging direct booking through its systems hasn't worked out.

To cut expenses and improve ties with customers, the airline preferred direct reservations over those made through independent travel agencies. But this tactic has backfired miserably, resulting in a 46% decline in earnings. Reduced insight and fewer bookings due to the decreased dependence on travel agencies have negatively impacted the final result.

The repercussions of this strategy have been felt by the travel industry, especially by travel agents. Customers frequently depend on travel agents to help them access the intricacy of flight options and offers, so it is not surprising that numerous agents have noted a decrease in reservations for American Airlines flights. As a result of the decline in bookings, the airline and its affiliates have been impacted.

The financial outcomes for American Airlines' period present a clear picture. As the company attempts to handle the consequences of the strategy, revenue has decreased, and operating expenditures have gone up. Due to the notable decline in profits, analysts and investors in the industry are becoming increasingly concerned about the viability of the direct reservation method.

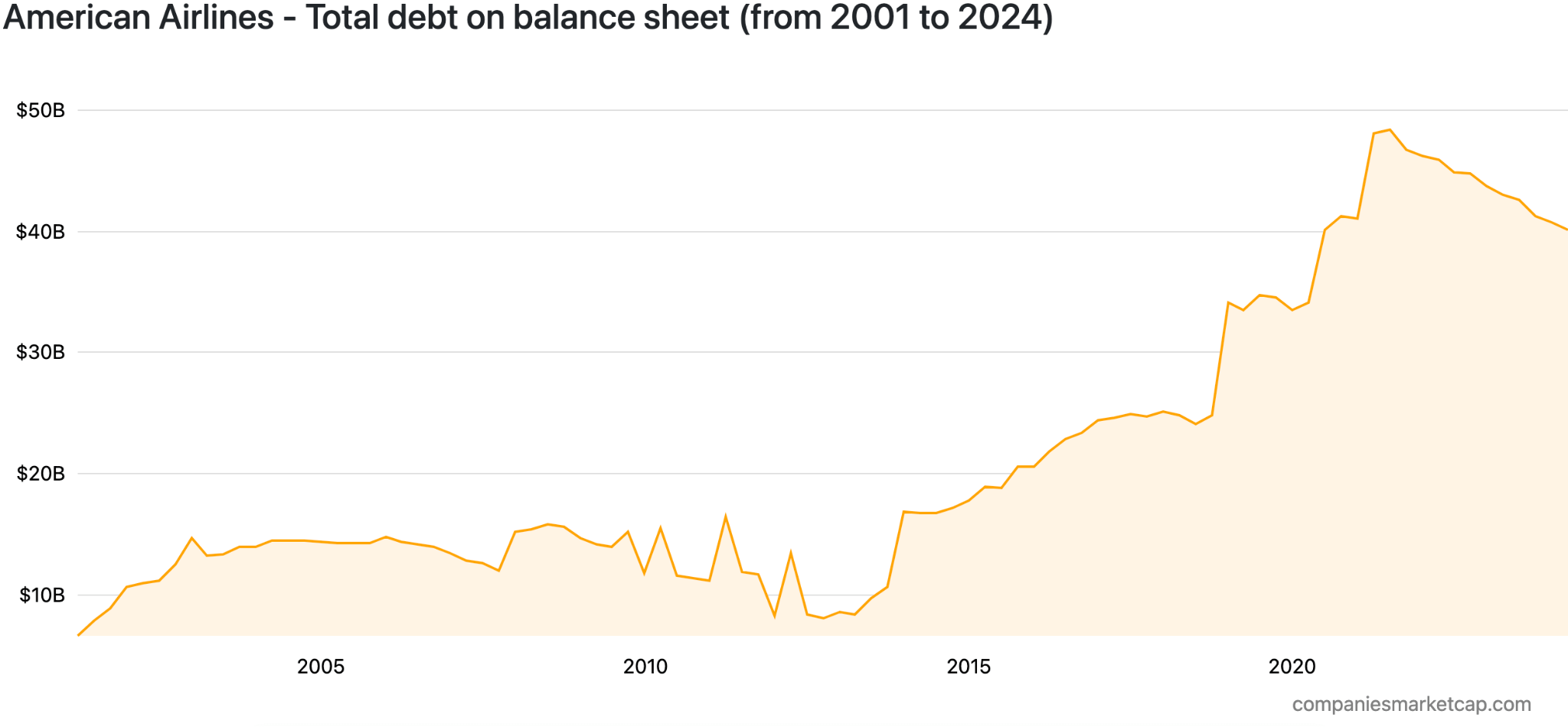

American Airlines Debt Burden: A Threat or Not

Source: companiesmarketcap.com

Operating-wise, American Airlines is heavily indebted, and its short-term liabilities are greater than its liquid assets. Analysts anticipate the company will profit this year despite these obstacles; it has turned a profit over the past 12 months. Additionally, InvestingPro Tips points out that despite being a major participant in the passenger airline sector, American Airlines does not distribute dividends to shareholders, which could impact investment choices.

For anyone considering investing in American Airlines, it's crucial to remember that the company's stock is trading close to its 52-week low and that its price has dropped dramatically over the previous three months. Although the current price offers a more affordable entry point, analysts' caution is also reflected.

Expert Insights on AAL Stock Forecast for 2024, 2025, 2030 and Beyond

AAL stock price is trading at a record low, signaling a long-term buying opportunity from the discounted price. Before proceeding further, let's see Expert Insights on AAL Stock Forecast for 2024, 2025, 2030, and Beyond:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$14.41 |

$16.81 |

$37.34 |

|

Stockscan |

$11.61 |

$4.35 |

$24.95 |

|

Coincodex |

$12.22 |

$ 10.28 |

$ 10.97 |

|

3rates |

$5.08 |

$8.35 |

n/a |

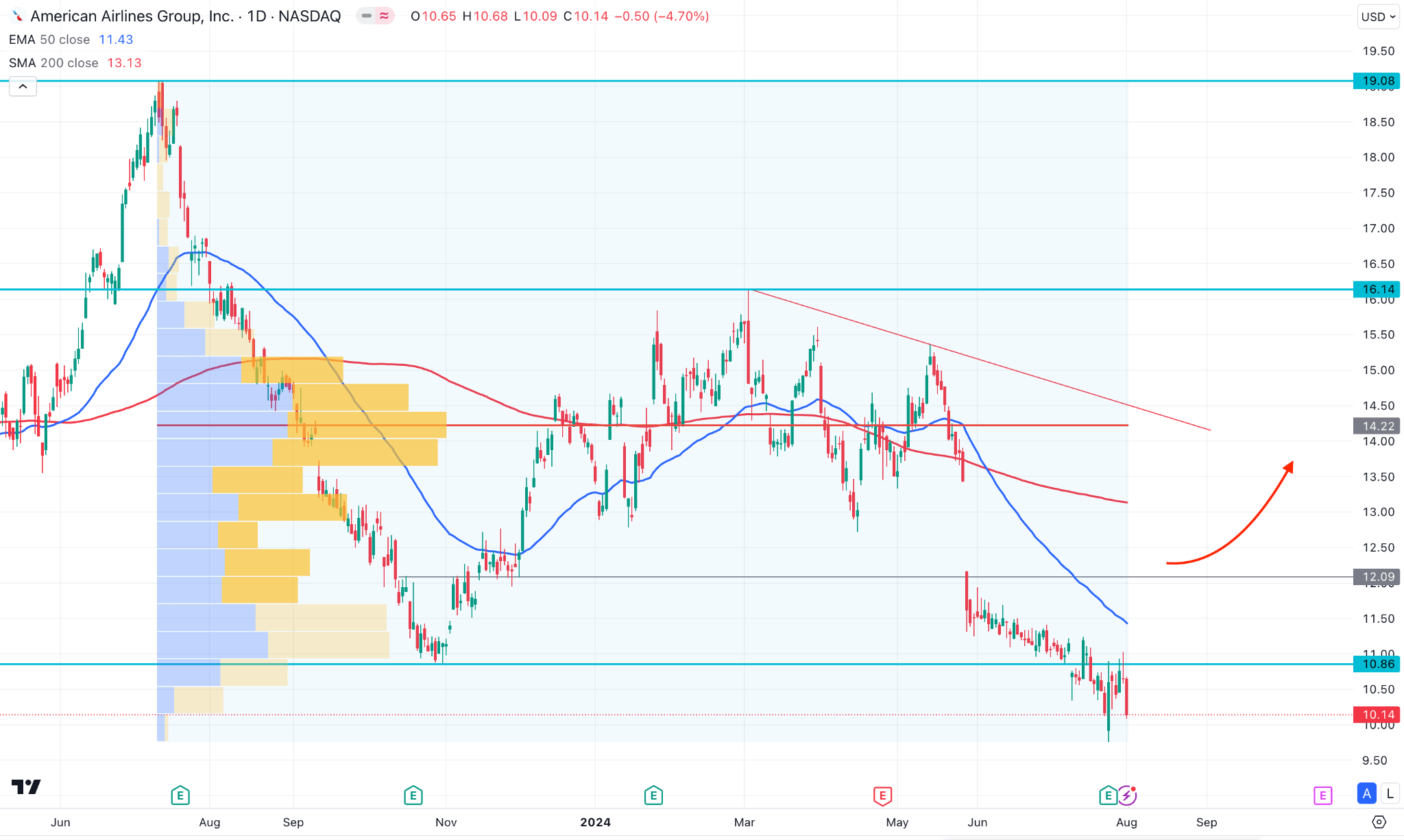

II. AAL Stock Forecast 2024

American Airlines Stock (AAL) is trading at a record level, from where a valid recovery could initiate a bullish signal. A stable market above the 12.03 level might initiate an upside pressure towards the 14.22 resistance level by the end of 2024.

In the daily chart of AAL, the most recent price is trading at the multi-year low, concerning the fundamental growth and a risk of insolvency. On the other hand, the recent price from the discounted zone could be a high probable long opportunity as a value investment.

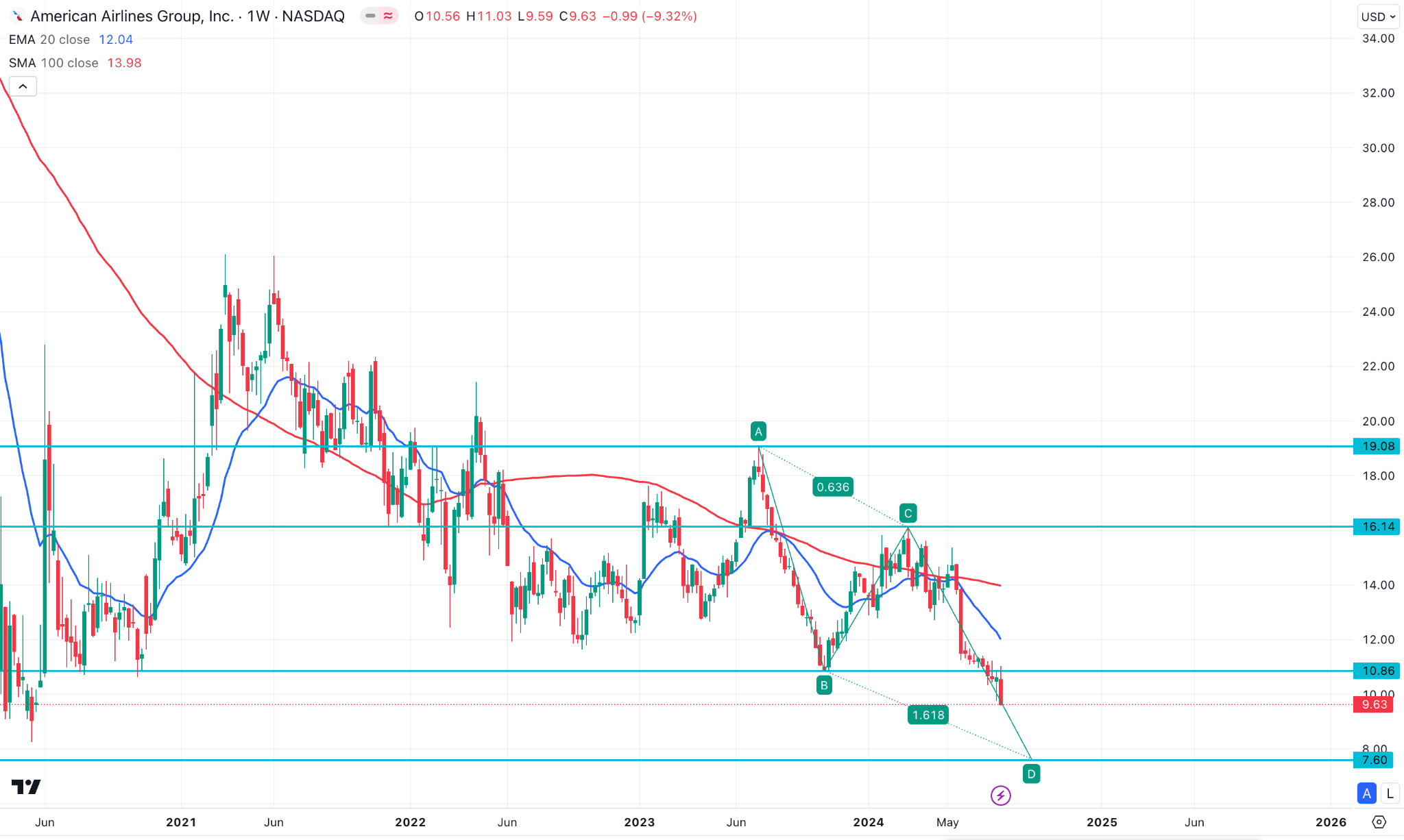

The selling pressure from June 2023 created support at the 10.86 level before approaching higher to the 16.14 level, from where the most existing downside pressure has come. As the current price is trading below the existing 10.86 low, we may consider the market pressure as bearish. In this context, finding a bullish trend might need a solid price action with fundamental support.

In the main chart, the 200-day Simple Moving Average is 29% above the current price, whereas the 50-day EMA is acting as an immediate resistance. Moreover, the volume shows a bullish possibility as no significant activity was seen since below the 14.00 level.

Based on the AAL Stock Forecast 2024, a valid bullish reversal with a daily candle above the 12.09 level might activate the bullish possibility, aiming for the 200-day SMA line. However, the ongoing market trend is still bearish, and a stable market above the 200-day SMA could increase the possibility of grabbing buy-side orders from the 16.14 swing high.

A. Other American Airlines Stock Forecast 2024 Insights

According to a report on investing.com, TD Cowen reevaluated American Airlines (NASDAQ: AAL), reducing its AAL price target to $10 from $16 and lowering the stock from Buy to H

old. Concerns about the airline's recent aggressive disregarding tactics and possible threats to its profits and revenue in the second half of 2024 have prompted the revision.

The company doubts American Airlines' capacity to produce free cash flow (FCF) over the next few years and hinted that there might be setbacks in strengthening the company's balance sheet.

The downgrade reflects a cautious assessment of the airline's cash flow and strategic positioning in the cutthroat aviation market. Its revised AAL target price of $10 indicates a reevaluation of expectations for the airline's valuation in light of its challenges.

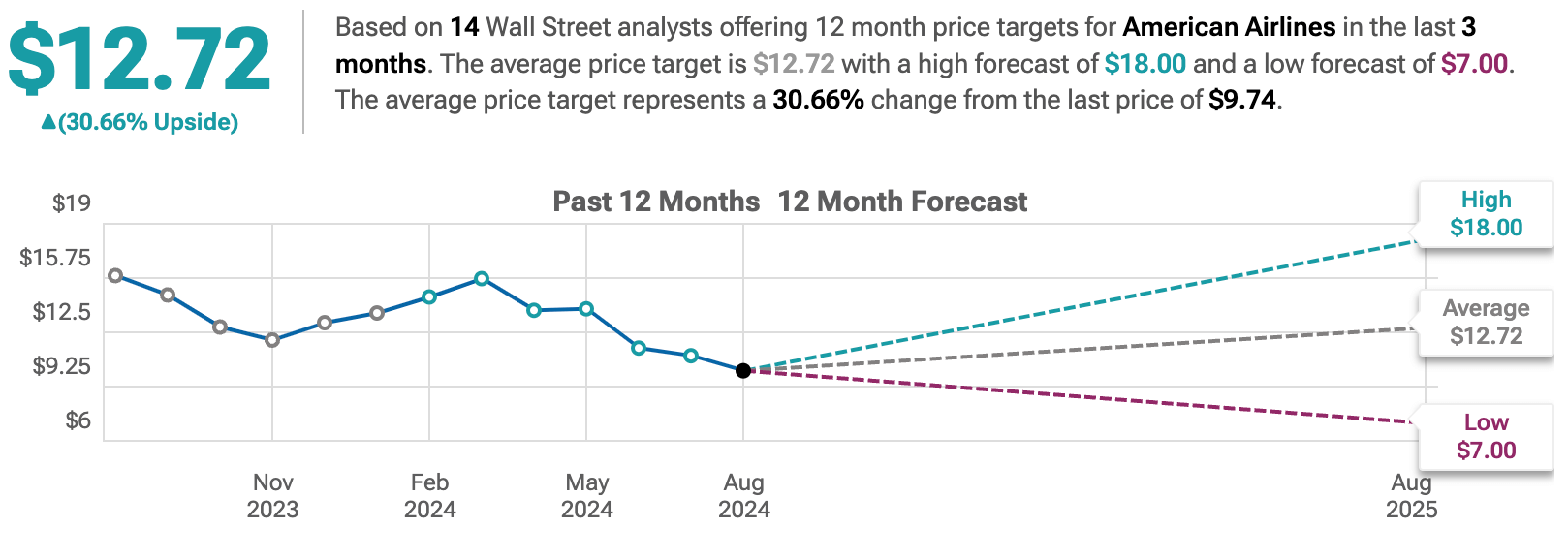

Another report from Tiprank suggests a similar outlook. The 12-month forecast of AAL is an average of $12.72, with the highest AAL price target of $18.00.

Also, the report poised a hold position on this stock, as 7 out of 14 analysts remain on hold, while five analysts suggest a bullish possibility.

B. Key Factors to Watch for American Airline Stock Forecast 2024

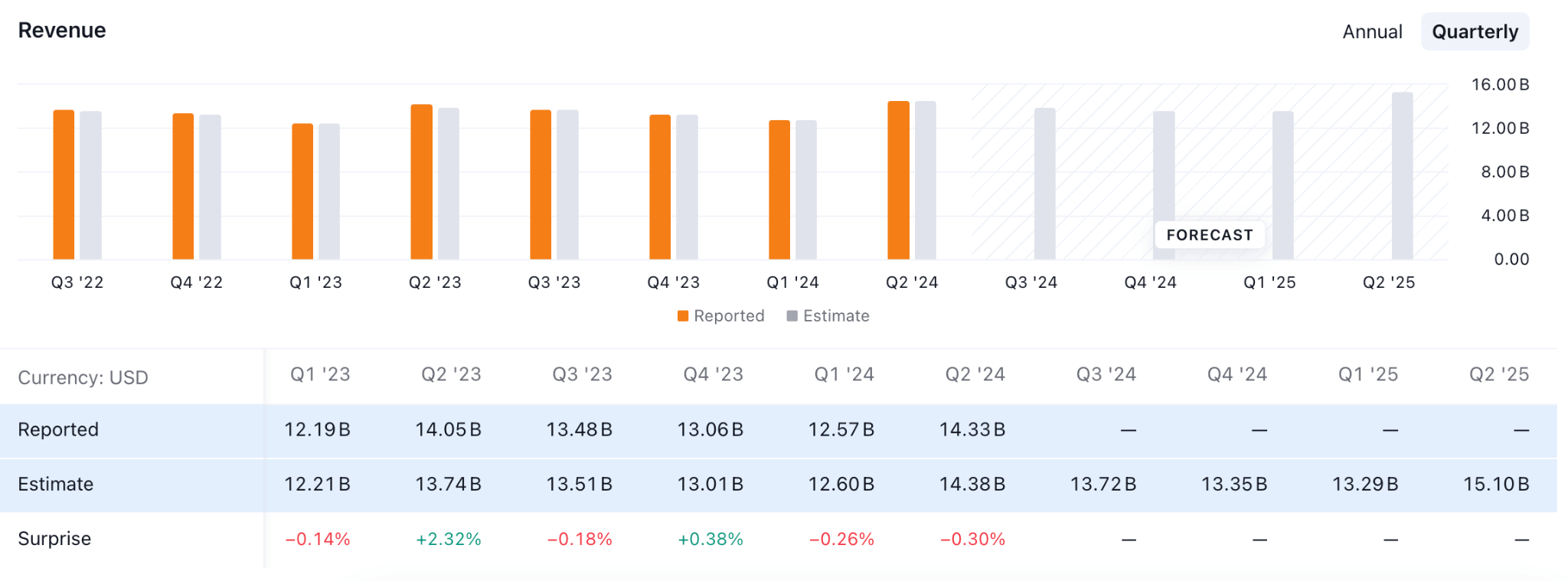

AAL Revenue Forecast 2024

In the American Airlines Stock Forecast 2024, the latest revenue for the second quarter of 2024 showed upbeat results from the previous quarter but below expectations. Also, there is no significant change expected in the coming quarters, which might come slightly below the actual Q2 revenue of $14.33 billion.

Considering the current forecast, a big change is needed before forming a buy signal in this stock. Until then, a corrective or sideways movement might continue throughout the year-end.

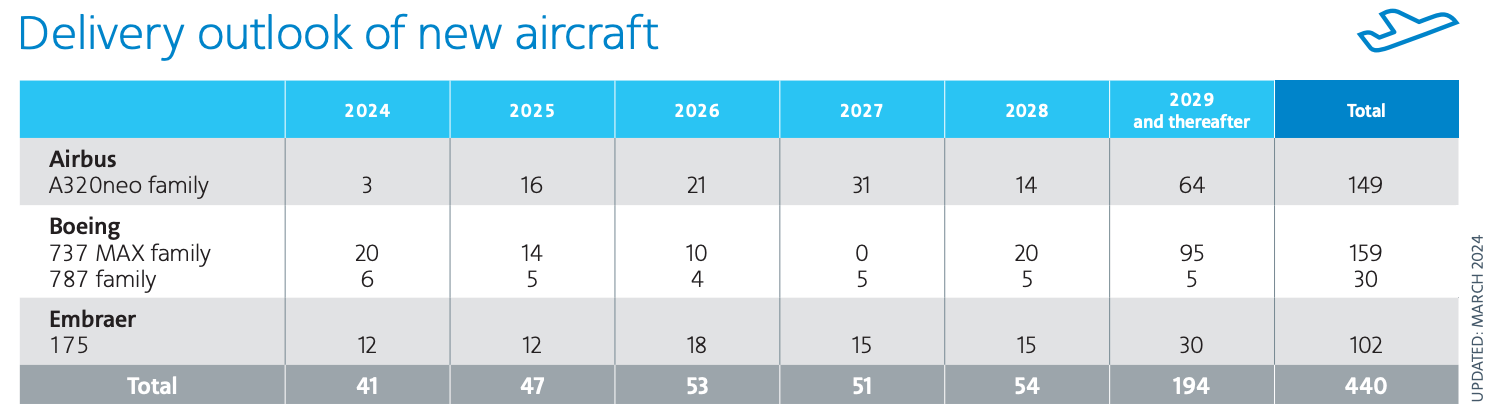

AAL Airbus Orders Outlook

Source: news.aa.com

American Airlines has made a major fleet-wide investment in cleaner technology by signing an initial contract to purchase 100 hydrogen-electric engines from ZeroAvia. The airline is following the industry's general trend of lowering aviation emissions by switching to environmentally friendly engines. Financial developments include the exchange of warrants in 11 major U.SH. airlines for $556.7 million to the U.S. Treasury Department, with $12.6 billion in government assistance going to American Airlines.

AAL Price Prediction 2024 - Bullish Factors

- Demand for air travel is increasing as international travel restrictions loosen and vaccination rates increase. American Airlines' revenue growth may come from the revival of domestic and international travel.

- If American Airlines effectively controls and lowers its debt load, it can lower interest costs and strengthen its balance sheet, which will attract more investors.

- Implementing cutting-edge safety, operational efficiency, and customer service technologies can simplify operations and improve passenger experience.

AAL Forecast 2024 - Bearish Factors

- Fuel price fluctuations significantly impact the airline industry. If crude oil prices increase noticeably, American Airlines' operating expenses might increase, lowering the airline's profit margins.

- In addition to growing pay needs from pilots, flight attendants, and other employees, ongoing or prospective labor disputes may result in higher operating costs or service interruptions.

III. AAL Stock Forecast 2025

Although the recent price trades at a record low, AAL has a higher possibility of showing buying pressure from reliable price action. A valid complete of the corrective price pattern could increase the buy-side possibility towards the 16.14 level by the end of 2025.

In the weekly outlook of AAL, the broader market is extremely corrective as the price action since 2021 suggests several buy and sell pressures, indicating indecision. Moreover, the downside pressure from the June 2023 peak showed a bearish continuation from a valid recovery and moved to the record low.

Looking at the price action, we can clearly see a possible ABCD correction, where the main aim would be to test the 161.8% Fibonacci Extension at the bottom 7.60. A valid bullish price action from this level could be a potential long opportunity after validating the ABCD pattern.

Based on the AAL Stock Forecast 2025, immediate upward pressure with a stable market above the 20-week EMA might activate the long opportunity, invalidating the possible ABCD pattern. However, a bearish continuation is likely to happen, with the primary target being to test the 7.60 to 7.00 zone. A valid bullish recovery with a proper candlestick formation from this zone might provide a secondary long opportunity in 2025.

In both cases, the primary aim would be to test the 14.00 psychological level before moving beyond the 16.14 key resistance level.

A. Other AAL Stock Forecast 2025 Insights

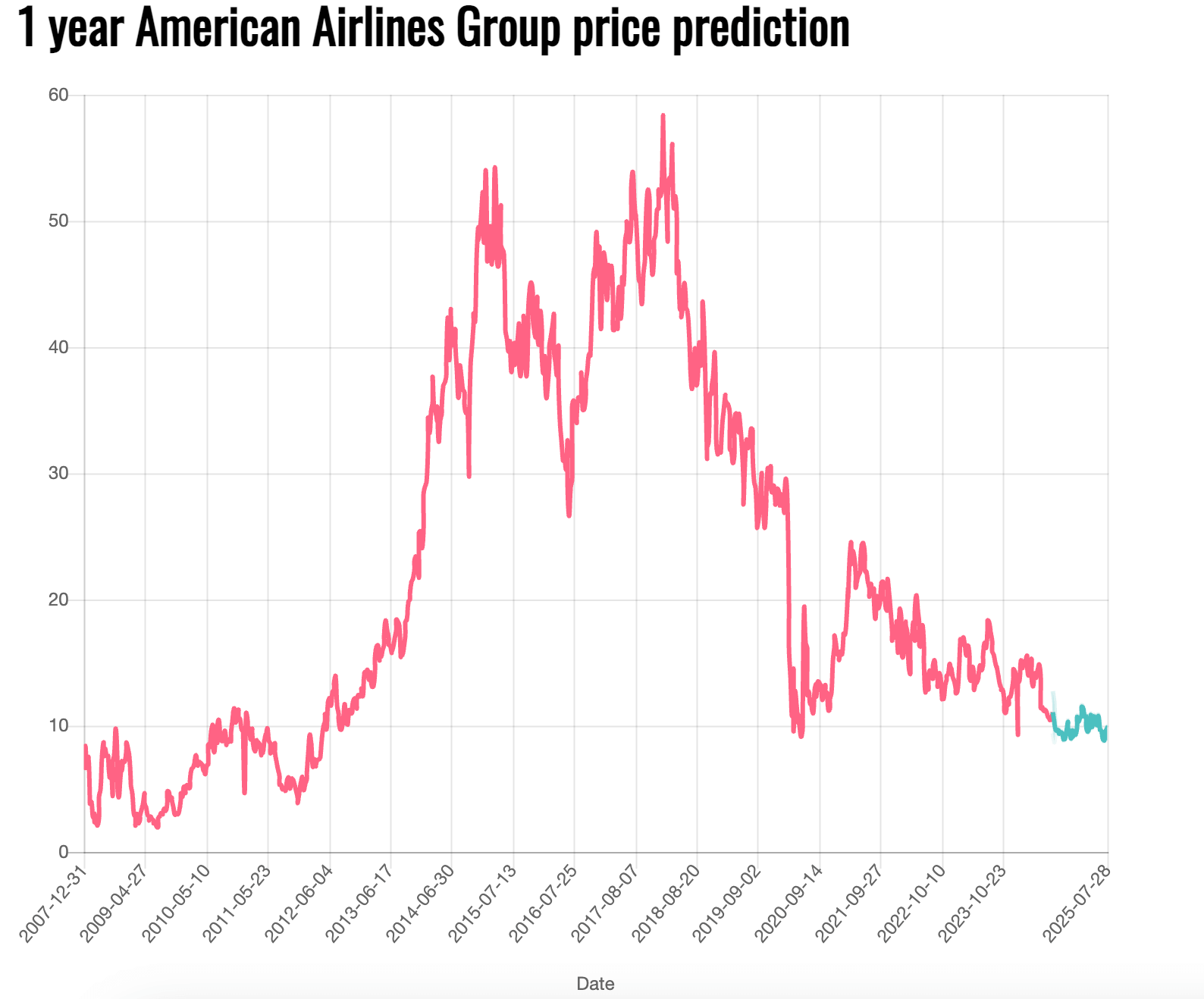

Source: gov.capital

A recent report from gov.capital showed an optimistic view about the AAL by the end of 2025. Based on the outlook, AAL is more likely to reach the $30.24 level in mid-2025, which signals an 181% price surge from the current price of $10.40.

Source: markets.businessinsider.com

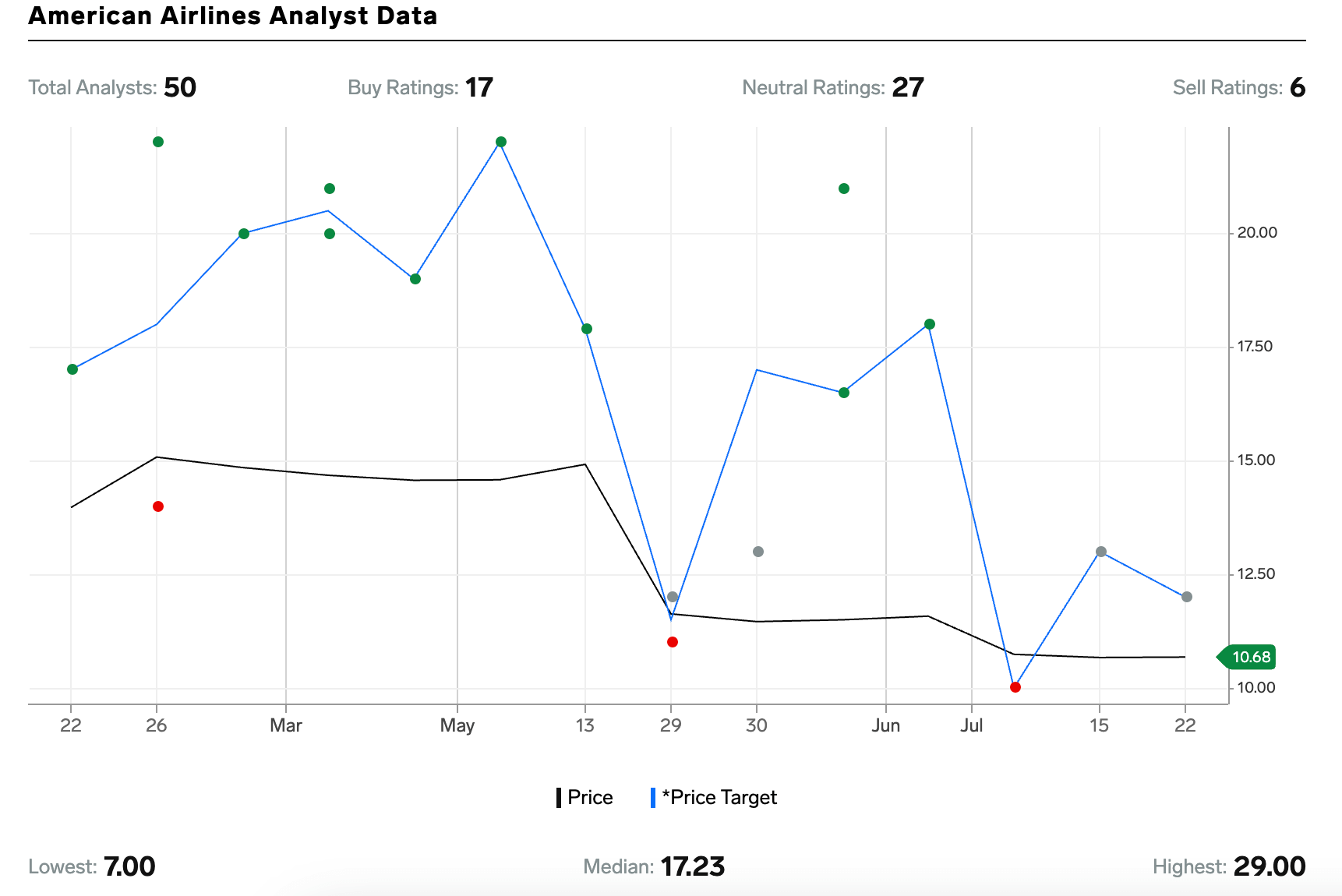

Another report from Business Insider showed a mixed sentiment among 50 analysts, from where 27 are on hold for this stock. On the other hand, 17 analysts showed a bullish possibility with the highest target level of $17.23.

B. Key Factors to Watch for American Airlines Stock Forecast 2025

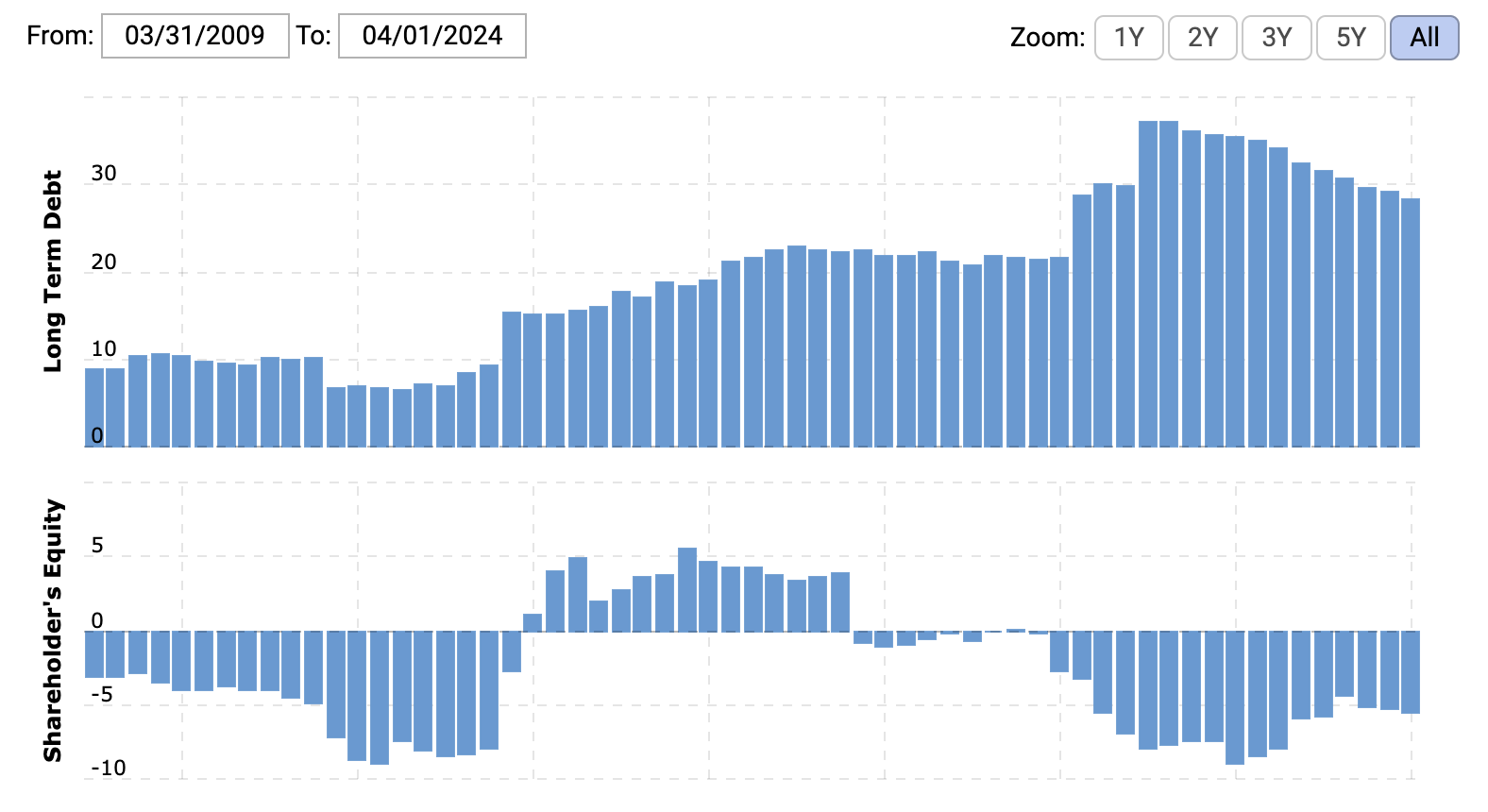

AAL Debt to Equity Ratio Analysis

Source: macrotrends.net

The debt-to-equity ratio is a crucial tool for gauging a stock's business sustainability. For AAL, the total debt in 2024 is reported at $28.23 billion against the equity of $5.53 billion. As the current debt is much higher than the equity finance, a risk of insolvency is potent in case the company fails to show positive earnings.

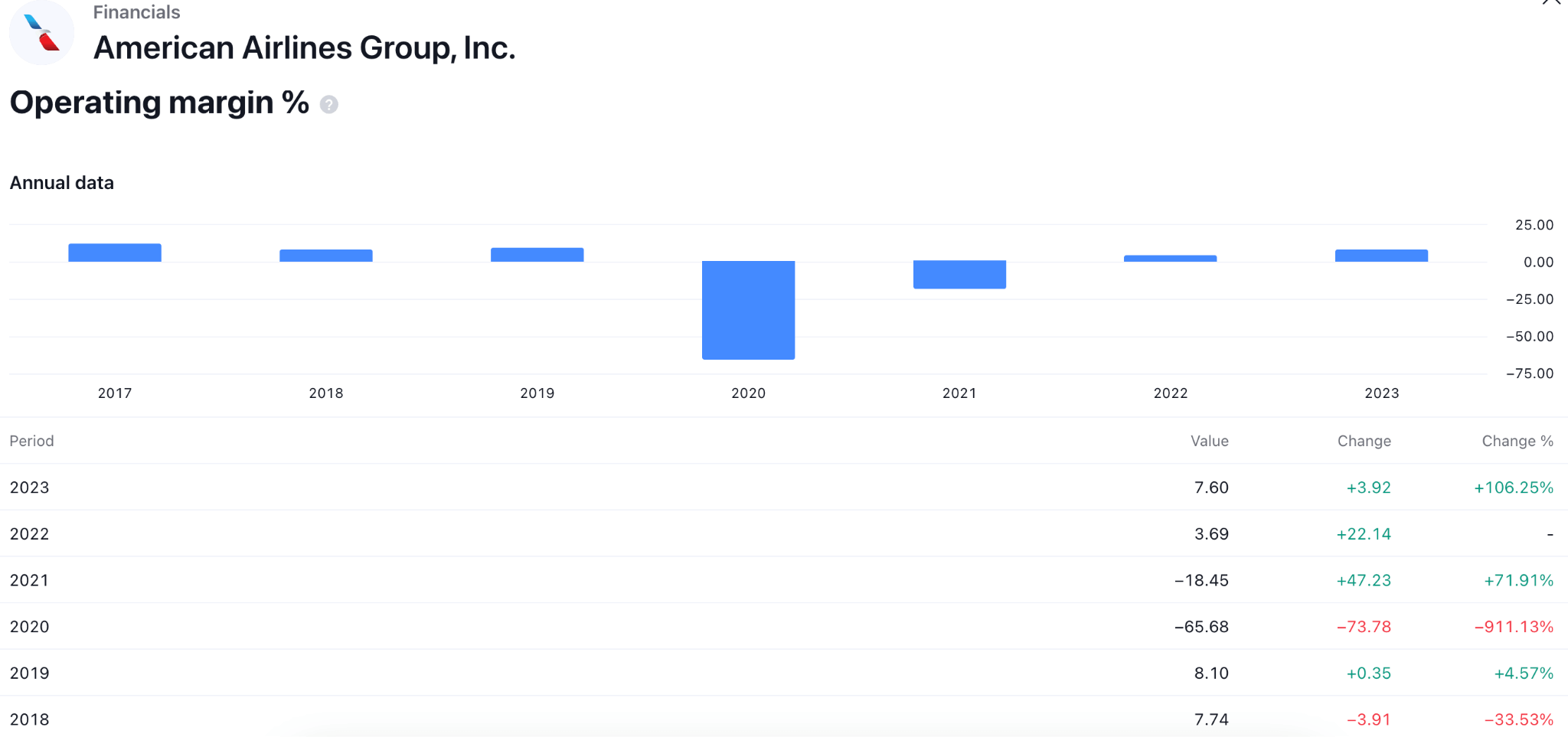

AAL Stock Operating Margin Analysis

In the yearly operating margin curve, the recent number suggests a valid recovery since 2020. Due to the pandemic, the earnings came lower at 911% down from the previous year. However, the number has kept rising since then, reaching a peak of 106% growth in 2023.

Depending on the price action, if the company keeps maintaining its growth, we may expect a positive outlook for the stock in 2025.

American Airlines Stock Prediction 2025 - Bullish Factors

- The ongoing recovery in the air travel sector could be a bullish factor for American Airlines Stock (AAL). Air travel demand increased 7.7% year over year in 2023, which might be a positive sentiment for AAL.

- American Airlines is looking to add widened routes. Some signs are found from the purchase of up to 20 Overture planes and 40 more high-speed jets.

- The AAL management aims to lower the debt by $15 billion by the end of 2025. As the current gearing is high, the activity to control the higher debt could signal a buy signal for the AAL. The company has already paid the debt of $3.2 billion in 2023 and is aiming to pay more than 80% by the end of 2025.

AAL Stock Prediction 2025 - Bearish Factors

- The higher fuel cost could be a challenging factor for AAL. Also, the ongoing geopolitical uncertainty could make the oil market more volatile, creating an uncertain situation for the global travel business.

- Higher non-fuel expenses are putting pressure on AAL. According to a recent report, salaries, wages, and other benefits keep moving, putting pressure on AAL.

IV. AAL Stock Forecast 2030 and Beyond

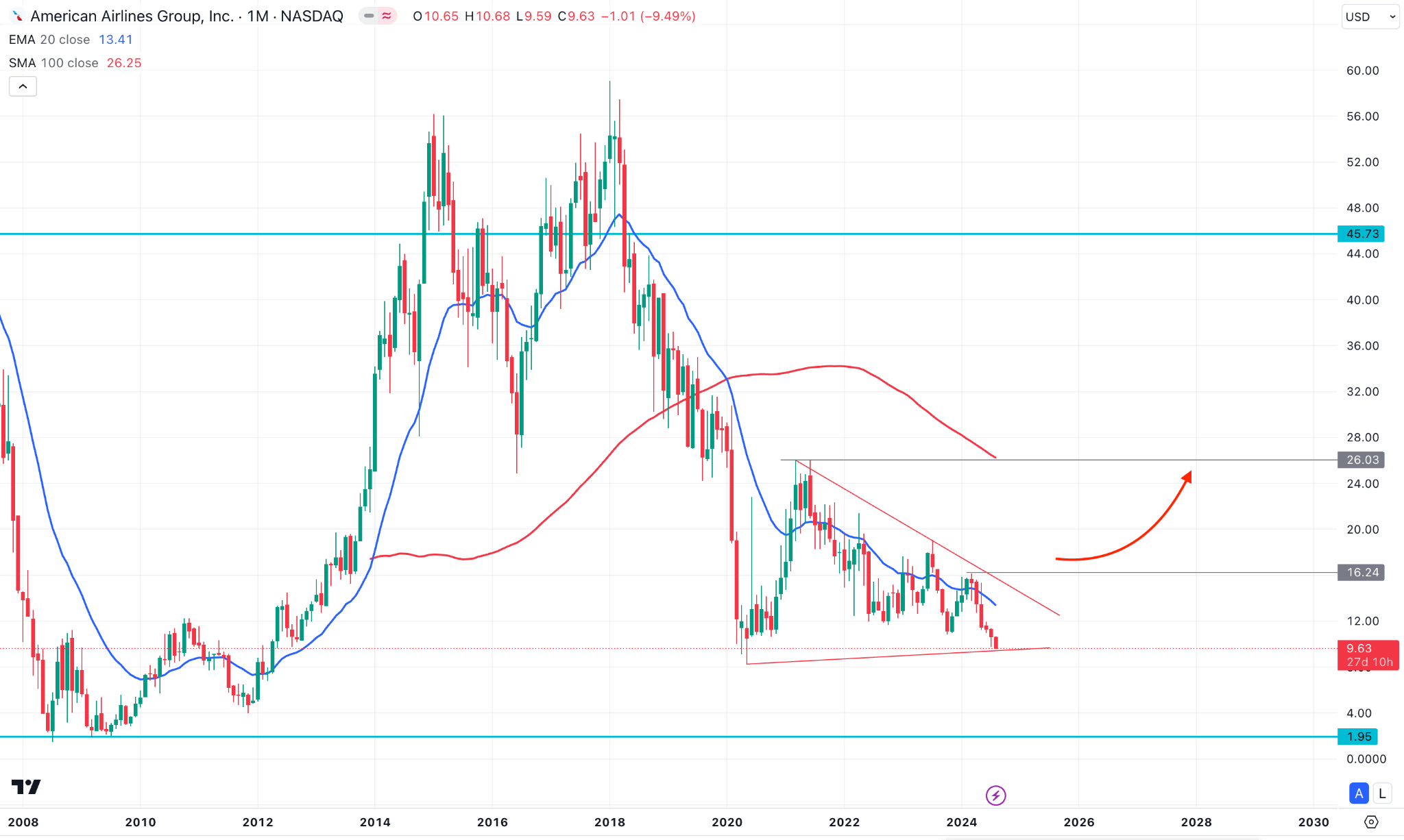

AAL is under pressure from the recent selling pressure at the multi-year low. However, a recovery from the wedge support with a valid bullish break could open a long opportunity, aiming for the 45.73 level by the end of 2030.

In the monthly time frame, American Airlines stock has ongoing selling pressure from the 2018 peak. The price showed a strong buy-side liquidity sweep from the 2024 high and immediate bearish counter-impulsive pressure. However, the selling pressure from the 2018 peak has become corrective after making a bottom during the COVID-19 pandemic.

In the most recent months, the bullish peak was at 26.03 level initiating a broader correction as a falling wedge formation, where the current price is hovering at the channel support.

Based on the AAL Stock Forecast 2030 and Beyond, bearish exhaustion at the wedge support could be a primary sign of a recovery. However, a conservative approach is to find a bullish monthly candle above the 16.28 static resistance level before opening a long position.

On the bullish side, the ultimate target of the buying pressure could be the 45.73 level. However, the 26.06 resistance level could be challenging to break as valid selling pressure from this level might resume the existing trend.

A. Other AAL Stock Forecast 2030 and Beyond Insights

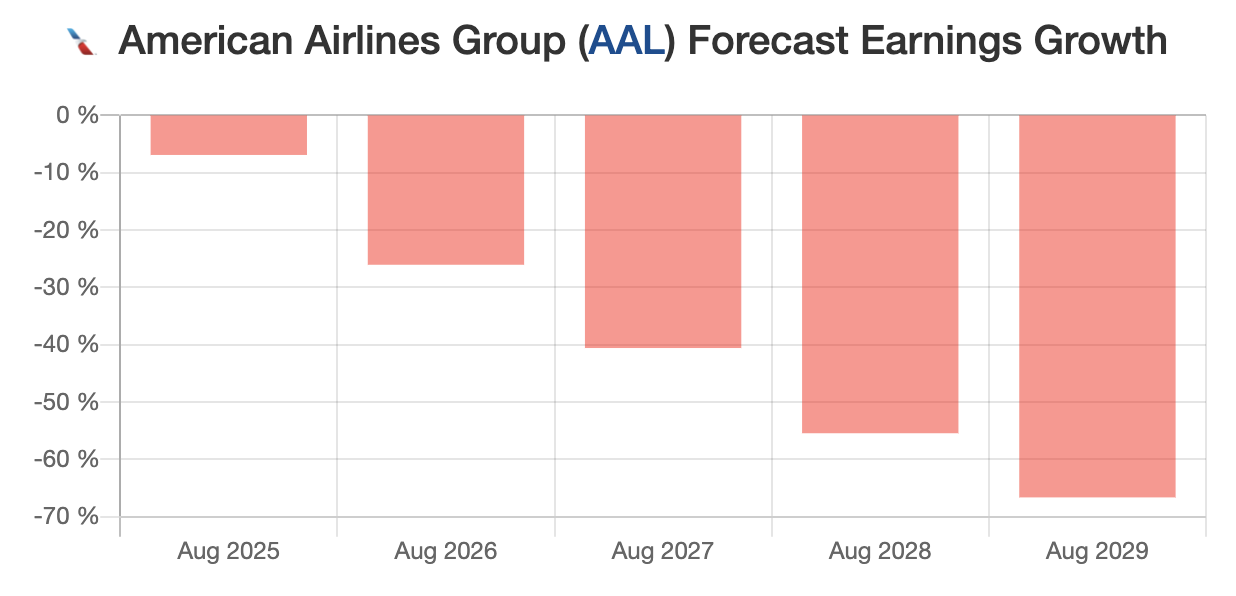

A report from Walletinvestor showed forecasted earnings for AAL, with yearly earnings for 2029 potentially 70% lower than the latest actual revenue.

The downbeat earnings clearly define a challenge for the stock, which currently has a forecasted price of $3.31 for 2029.

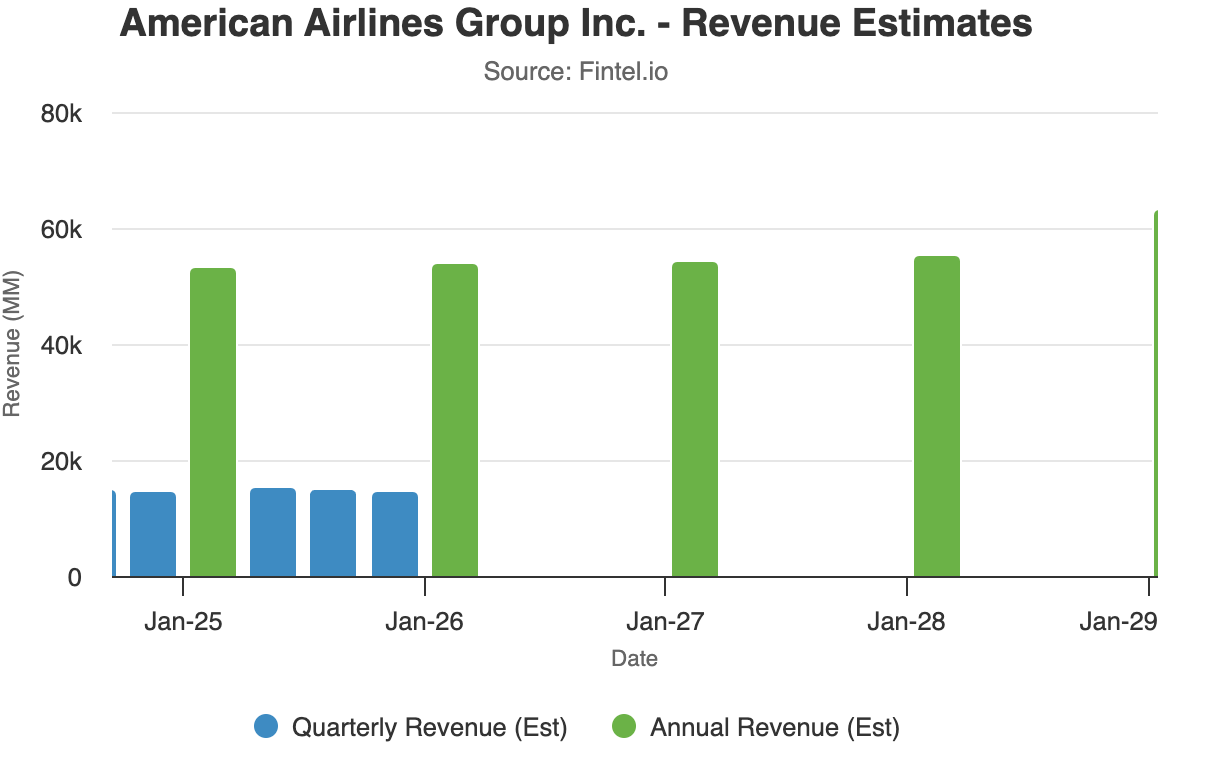

Source: fintel.io

Another report from fintel.io shows a positive outlook for AAL, showing the forecasted revenue for 2028 at $55.4 billion, up from $55.3 billion in 2027. If the company can maintain the growth, we may expect the stock price to surge but no specific AAL stock price target was sent from this analysis.

B. Key Factors to Watch for American Airlines Stock Forecast 2030 and Beyond

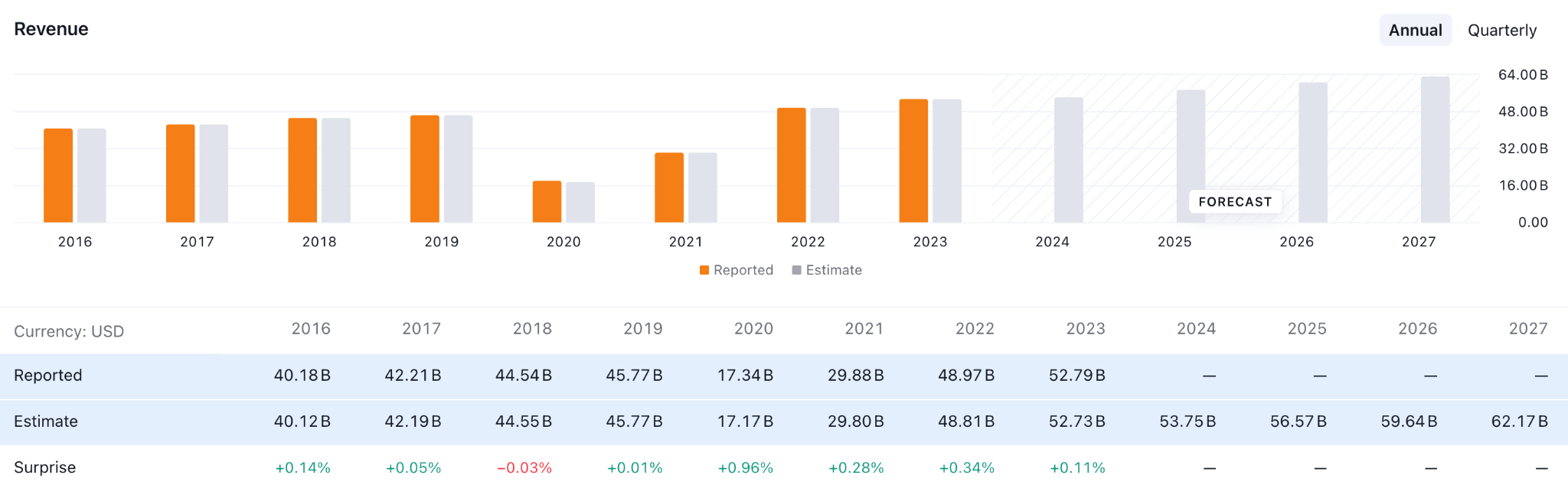

AAL Revenue Forecast

The above image shows that AAL's actual revenue rebounded from 2020 and reached an 8-year high in 2023. Moreover, the forecasted revenue might have an upbeat result in 2025 at $56.57 billion. Also, growth could continue and move to a record high of $62.17 billion in 2027.

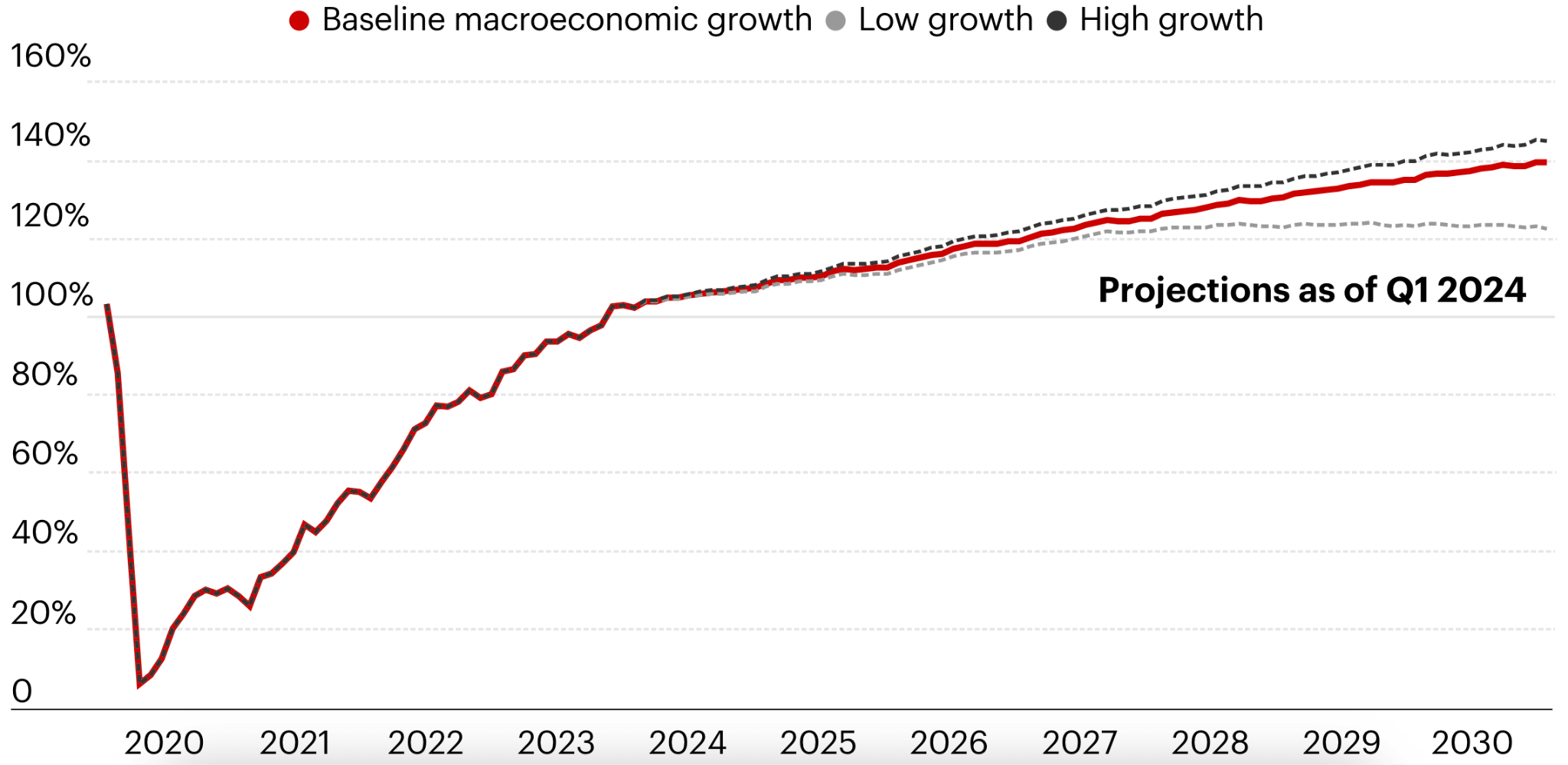

Global Air Travel Business Forecast for 2030

Source: bain.com

The global air travel business showed massive growth in 2019, moving 100% higher in 2034. Moreover, the forecasted growth remains positive for the coming days but not as much as before.

However, if the industry can maintain the baseline growth, we may expect a positive outcome from the AAL stock.

AAL Stock Price Forecast 2030 and Beyond - Bullish Factors

- AAL could benefit from the new aircraft, which can use a lower cost and bring benefits with a higher profit margin. For example, older planes can be replaced with models like the Boeing 787 Dreamliner.

- If the company maintains its presence in the online platforms' customer service and ticket sales sections, it can bring operation efficiency to the highest level.

- Expanding codeshare agreements with other airlines can increase AAL's market reach and provide more travel options for customers, potentially driving up ticket sales.

AAL Stock Price Prediction 2030 and Beyond - Bearish Factors

- AAL's high debt is a challenging factor that might limit its investment in new technologies and opportunities.

- Geopolitical tensions, such as trade wars or conflicts, can affect international travel demand and disrupt AAL's global operations.

V. Conclusion

A. American Airlines Stock Outlook

American Airlines (AAL) faces tremendous issues, as indicated by its recent earnings and market performance. However, the long-term outlook includes both recovery chances and threats.

Despite the bearish trend, a bullish reversal is possible if the price stabilizes above the 12.09 mark. Achieving this might bring the stock closer to the 200-day Simple Moving Average (SMA) and the 14.22 resistance level by the end of 2024.

The forecast for 2025 is uncertain, with the possibility of recovery and additional reductions. In 2030, estimates suggest a big comeback if crucial bullish variables emerge.

B. Trade AAL Stock CFD with VSTAR

Investors can easily benefit from bullish and bearish movements in AAL through the contract for difference (CFDs) in VSTAR. Other benefits include:

- Lower Trading Cost: In VSTAR CFDs trading, investors can easily buy and sell stocks without paying commissions or stamp duties.

- Portfolio Diversification: It is easy for trades to expand their presence in forex, stocks, commodities, indices, and cryptocurrencies from one place.

- No Ownership of Underlying Asset: When trading CFDs, you do not own the actual stock, which means there are no concerns about physical ownership, dividend collection, or corporate actions. Investors can open a long position for a bullish market and a short position for a bearish market.

- Advanced Trading Tools: VSTAR offers a range of advanced trading tools and resources, such as technical analysis charts, risk management features, and educational materials to help traders make informed decisions.

- Mobile Portability: VSTAR is designed with a user-friendly interface in its mobile app so that people from anywhere can manage their trading portfolio.

These advantages make AAL stock trading attractive, as investors can benefit from the market even if there is selling pressure. Also, value investors can take a part in it by buying and HODLing from a discounted price.

FAQs

1. Is AAL a good stock to buy now?

Some analysts recommend a "hold," while others see potential due to solid demand for air travel.

2. What is the 12 month price forecast for AAL?

The average 12-month price forecast for AAL is around $13.73, with estimates ranging from $7.00 to $23.00.

3. What is the fair value of AAL?

The fair value of AAL is estimated to be around $12.00.

4. Who owns the most shares of AAL?

The largest institutional shareholders are Vanguard Group Inc. and BlackRock Inc., with Vanguard owning approximately 75 million shares.