As of August 31, 2023, nearly 60 public equity funds have announced their net profit figures for the first half of the year, and Efund continues to excel in this field. As of mid-2023, the total management scale of Efund has reached 1674.86 billion yuan. According to the data, the net profit of Efund in the first half of the year was 1.617 billion yuan, ranking first among public equity funds that have released data. And the interim report of Efatar Nikko Capital Management Nikkei 225 Traded Open-End Index Securities Investment Fund also delivered a good report card. The distributable profit at the end of the period was 58.87 million yuan, and the cumulative net asset value growth rate of the fund's shares was 27.26%, far exceeding the performance baseline.

The Japanese stock market has hit more than 30-year highs this year. On Friday, the Nikkei 225 rose 0.41% to a near-January high at the close in Tokyo, Japan. Nikkei Volatility, which measures the implied volatility of options on the Nikkei 225, fell 1.44% to 17.74, a near three-month low.

With Japanese stocks at record highs, can the bull market continue? Below are the macro dimensions that investors need to focus on when analyzing the Japanese stock market for their judgment.

Major Japanese Stock Markets

The Japanese stock market has several major stock indices, the most important of which are the Nikkei 225 (Nikkei 225) and the TOPIX.

The Nikkei 225 is Japan's best-known and most widely followed stock index, compiled by the Nihon Keizai Shimbun (NKES), and includes the stocks of 225 large companies traded on the Tokyo Stock Exchange (TSE). These companies tend to be major players in the Japanese economy and industry, so the index focuses more on the performance of large companies and is more representative of the blue chips in the Japanese stock market.

The TSE Index, which includes the stocks of all companies listed on the Tokyo Stock Exchange, is a broader market index that focuses not only on large companies, but also includes large, medium and small companies, as well as companies from different industries. As a result, the TOPIX is a more comprehensive reflection of the performance of the Japanese stock market as a whole.

Another difference between the two is the weighting methodology: the Nikkei 225 uses a price-weighted index calculation methodology, which means that changes in higher-priced stocks have a greater impact on the index. As a result, the index is more concentrated in high-value stocks. The TSE TOPIX, on the other hand, uses a market capitalization-weighted index calculation method, which means that stocks with higher company market capitalizations are weighted more heavily in the index. This methodology focuses more on companies with higher market capitalization and is not influenced by individual stock prices.

The macro influences on the Japanese stock market are discussed in four areas: the Bank of Japan's monetary policy, the Japanese government's fiscal policy, Japan's key economic indicators, and the Federal Reserve's monetary policy:

Monetary Policy of Bank of Japan

The Bank of Japan's monetary policy has a profound and direct impact on the Japanese stock market. The Bank of Japan began its quantitative easing policy on April 4, 2013, announcing a massive monetary easing policy to stimulate the Japanese economy, dubbed "Abenomics," as part of a series of economic policies proposed by then-Prime Minister Shinzo Abe. These policies included the following key measures

Increasing the money supply: The BOJ pledged to purchase large amounts of government bonds and other financial assets each year to increase the money supply, lower borrowing costs, and encourage businesses and individuals to invest and spend more.

Raising the inflation target: The BOJ raised the inflation target to 2% to break the deflationary spiral and encourage people to stop postponing their purchasing and investment decisions.

Active role in monetary policy: The BOJ stated that it would conduct a more active monetary policy to achieve the inflation target and would take further measures if necessary.

This policy led to lower interest rates on Japanese government bonds and also boosted the stock market. The Japanese stock market, particularly the Nikkei 225, has been on a clear upward trend since 2013, as low interest rates and investor confidence in the government's support for the economy have driven stock market performance.

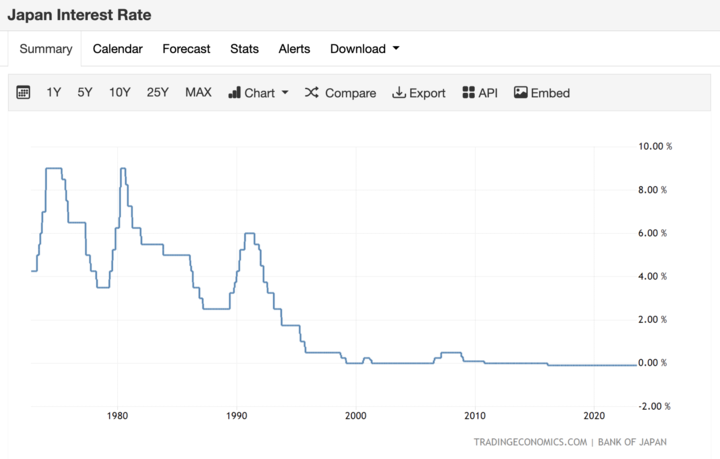

Chart: BOJ short-term interest rate path, currently at -0.1%

At its recent July meeting, the Bank of Japan unanimously decided to keep its key short-term interest rate unchanged at -0.1% and the 10-year bond yield at around 0%, but decided to increase the flexibility of its yield curve control policy in an effort to improve the sustainability of its stimulus policy. In addition, this policy has also helped exporters as it has led to a depreciation of the yen and improved export competitiveness, benefiting large Japanese exporters such as Toyota and Honda.

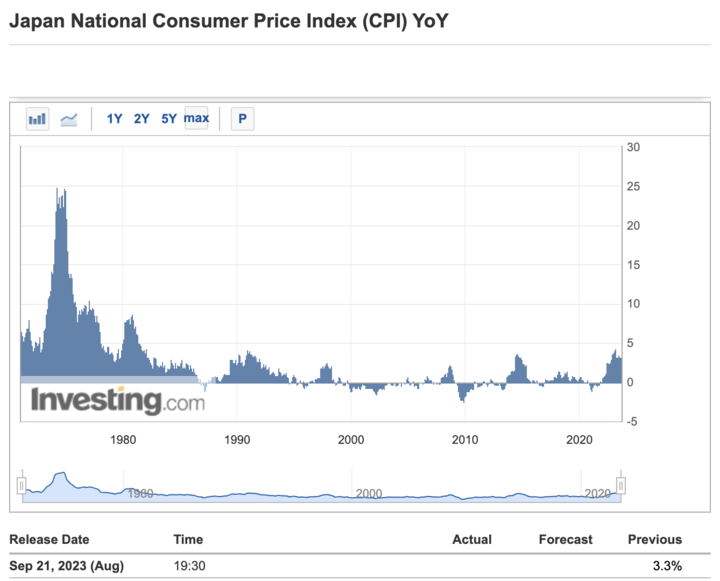

However, while quantitative easing has had a positive impact on Japan's stock market and economy, it has also raised concerns, including the risk that it could lead to asset bubbles, unstable financial markets, and long-term inflation. Currently, Japan's inflation rate has far exceeded the central bank's monetary policy target, reaching 3.1%. The Bank of Japan's monetary policy is one of the dynamics that investors need to pay attention to in terms of whether it is necessary to continue the low-interest rate model for a long time, which is a crucial factor for the development of Japanese stocks and Japanese companies.

Fiscal Policy of the Japanese Government

The Japanese government's approach to stimulating the stock market through fiscal policy may include the following:

- Increased fiscal spending: The government can increase public spending to create jobs and increase consumption by investing in areas such as infrastructure, education, and healthcare. This increase in spending can help boost domestic demand, which can have a positive impact on the economy and the stock market.

- Tax reduction policies: The government can reduce the tax burden, such as personal income tax, corporate tax, or consumption tax. This can increase the disposable income of individuals and businesses, encouraging more investment and consumption, and the impact on the stock market will depend on how investors use the funds from the tax cuts.

- Increase benefits and subsidies: The government can provide a variety of benefits and subsidies, such as family allowances and employment subsidies, to increase the financial flexibility of households and businesses and stimulate spending and investment.

- Support the financial system: The government can take measures to stabilize the financial market, such as injecting capital, buying non-performing assets, and providing guarantees, to ensure the stability of the financial system and encourage banks to lend more to support the real economy, which will help stabilize the stock market.

- Monetary policy link: The government can work with the central bank to take measures to link monetary and fiscal policies to provide more monetary liquidity, lower borrowing costs, and encourage investment and consumption.

These fiscal policy measures can help stimulate economic growth and stock market performance, but on the other hand, they can also lead to an increase in budget deficits, so the government must carefully balance the long-term sustainability of fiscal policy with the short-term needs of the economy. In addition, the specific form and effects of fiscal policy will be influenced by the macroeconomic environment and the government's policy goals.

Key Economic Indicators of Japan

GDP

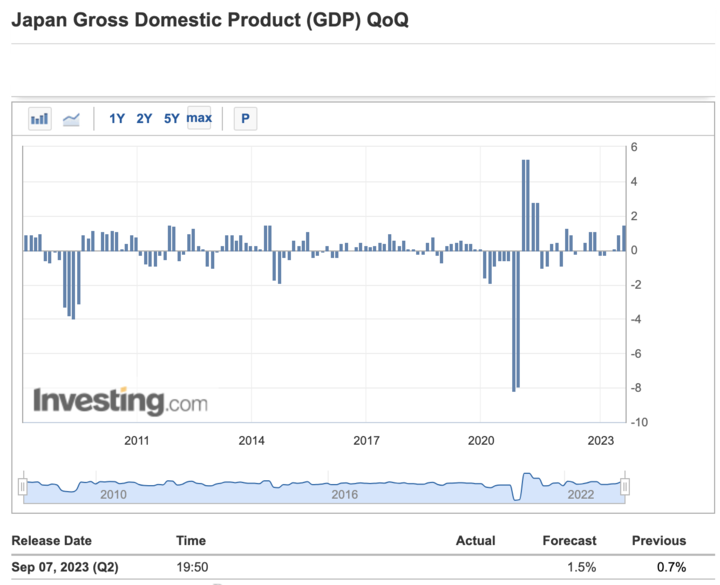

Typically, when Japan's GDP growth is strong, the stock market is likely to perform well because economic growth is usually accompanied by an increase in corporate earnings, which drives the stock market higher. Conversely, when there is a recession or weak growth, the stock market can come under pressure. In the first half of 2023, Japan's GDP growth surged, coinciding with the growth of the stock market.

Chart: Japan's GDP Growth Annualized Quarterly Rate

GDP sub-items

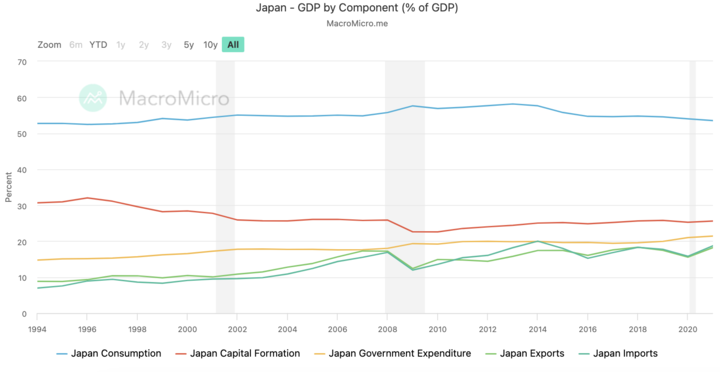

In addition to assessing the macro trend of the Japanese economy based on Japan's GDP, it is also possible to forecast Japan's economic growth based on the GDP subcomponents. Like the U.S., Japan's GDP statistics are calculated using the expenditure method, which is divided into: personal consumption, private investment, government spending, and net exports of goods and services.

Chart: Change in the breakdown of Japan's GDP (2021)

In the early 1990s, Japan's net exports (exports minus imports) had a significant impact on GDP growth as Japan's exports continued to grow. Over time, however, other factors began to take on greater importance, and Japan's domestic demand factors, including personal consumption, business investment, and government spending, gradually increased their contribution to GDP growth. The government adopted various policies to stimulate domestic demand, such as infrastructure investment and tax cuts. Japan's trade surplus is gradually declining, but Japan's manufacturing sector still holds an important position in terms of GDP contribution. Japan's manufacturing sector is not only Japan's export leader, but also holds an important position in the global manufacturing industry. The U.S. manufacturing PMI, published by the Institute for Supply Chain Management (ISM), tends to lead Japanese export growth by about six months on a year-on-year basis, and can be considered a leading indicator of Japan's manufacturing development.

Inflation

Since the bursting of the real estate bubble in the 1990s, the Japanese economy has been mired in low growth and deflation. Low inflation has been cited as the cause of Japan's prolonged economic stagnation, and it is only in recent years that inflation has begun to pick up with rounds and rounds of quantitative easing. But while some inflation can push up the prices of companies' products and services, corporate profits could be squeezed if costs rise faster than prices. Rising inflation can affect corporate earnings and stock market valuations, with different effects on companies with different cost and revenue structures, which must be analyzed on a case-by-case basis.

Employment and Demographics

As Japan's private consumption becomes a more prominent driver of GDP, the state of the labor market becomes increasingly important. This is because the labor market and wages are critical to consumption levels. When employment is high and unemployment is low, people are more able to spend and purchase products and services, which helps stimulate corporate earnings and thus the stock market. Conversely, high unemployment and an unstable labor market can lead to a decline in consumption, which can have a negative impact on the stock market. Japan faces the challenge of an aging population and a declining birth rate, which could affect the stock market in a number of ways. Older people may prefer solid investments such as bonds and fixed-income products to the stock market. In addition, aging may lead to a tight labor market, limiting the growth potential of companies. The employment situation and investment behavior of young people also affect the stock market. If employment opportunities for young people are limited, it may be more difficult for them to accumulate investment capital, and the investor base may be affected. In addition, the consumption and savings behavior of young people can also affect the stock market. Therefore, it is also important to keep an eye on Japan's labor market data.

Monetary Policy of the Federal Reserve

The Fed's monetary policy decisions tend to cause volatility in global market sentiment, including the stock market. Currently, the Fed is pursuing a tightening policy, which has raised market concerns and is likely to lead to a decline in global stock markets, including those in Japan. While the Fed's rate hike cycle has had an impact on the foreign exchange market, the depreciation of the yen will be beneficial for Japanese exporters as it will increase the price competitiveness of their products in the international market. This could have a positive impact on export-related companies in the Japanese stock market. According to an estimate by Japan's Daiwa Securities, a one-unit daily depreciation of the yen against the U.S. dollar would increase the total profits of all listed companies in the Tokyo stock market by about 198 billion yen. As a result, employees of multinational companies will be able to receive higher bonuses and shareholders will be able to distribute more dividends, thus enjoying the benefits of the yen's depreciation. Therefore, it is also important to pay attention to the impact of the Fed's monetary policy on the Yen exchange rate.

There is a cycle to every type of investment sentiment of the underlying investment. Macroeconomic cycles move less than financial cycles, which in turn move less than sentiment cycles, making it more important for short-term traders to pay attention to investor market sentiment. Continuous attention to investment market information to get more value out of volatility.