I. Recent PayPal Stock Performance

PayPal's Movement To Crypto

PayPal's strategic involvement in cryptocurrency has solidified its position as a significant player in the digital currency space. By enabling merchants to accept crypto payments and allowing customers to buy, hold, and sell cryptocurrencies directly from their PayPal accounts, the company simplifies access to digital currencies. The integration extends to Venmo, where users can manage their crypto assets within the app, appealing to a younger, tech-savvy audience.

The innovative Checkout with Crypto feature converts cryptocurrency holdings into fiat currency at the point of sale, ensuring smooth and effortless transactions. Furthermore, PayPal's recent launch of its stablecoin, PayPal USD (PYUSD), on the Solana blockchain exemplifies its commitment to enhancing transaction efficiency. By leveraging Solana's high speed and low fees, PayPal makes digital currencies more accessible and practical for everyday use, driving broader adoption and integration into mainstream finance.

PayPal's Collaboration with Large-Cap Companies

PayPal's strategic initiatives and robust portfolio signal a promising long-term opportunity. For large enterprises, PayPal is enhancing its core branded checkout experiences. Early testing of Fast Lane by PayPal has shown a low-double-digit increase in guest checkout conversions for participating merchants, indicating strong demand. The company plans to make Fast Lane widely available in the United States in the latter half of the year, reflecting its commitment to optimizing the checkout process.

PayPal's collaboration with Apple and Alphabet to integrate the Venmo debit card with Google Pay and Apple Pay is a significant advantage. This feature, anticipated to launch in the coming months, will enhance customer momentum. The growing popularity of PayPal's Tap to Pay on Android and iPhone also highlights the company's commitment to providing seamless and convenient payment solutions for its users. Through these initiatives, PayPal is well-positioned to capitalize on the evolving digital payment landscape and drive sustained growth.

PayPal is also moving towards password-less authentication processes, such as biometrics, and plans to launch a redesigned mobile checkout experience to boost conversion rates. For small and medium-sized businesses (SMBs), the PayPal Complete Payments platform is gaining significant traction. The platform's geographic reach extends to over 34 countries, with new features introduced in Australia, Germany, and the United States. These efforts will strengthen PayPal's relationships with SMBs and reduce customer churn.

Key Financial Metrics Beat

In Q1, PayPal's total payment volume from merchant customers soared 14% to $403.9 billion, surpassing analysts' expectations of $393.64 billion. Active accounts increased by 1 million to 427 million, marking the first sequential growth since late 2022. "PayPal's Q1 featured a bigger beat than anticipated on key metrics," remarked Bank of America analyst Jason Kupferberg, highlighting a 4% growth in transaction profit revenue against expectations of zero growth.

Furthermore, PayPal repurchased $1.5 billion of its shares in Q1, with plans for at least $5 billion in buybacks throughout 2024. The year's guidance includes Q1 restructuring charges of $175 million and an estimated $90 million from $70 million in Q2.

Last year, PayPal appointed Jamie Miller, formerly CFO at consultancy EY, as its new chief financial officer. This leadership change aligns with PayPal's evolution from an online checkout site to a comprehensive mobile shopping and person-to-person payments platform.

Amid intensifying competition with Apple, Block (formerly Square), and other fintech firms, PayPal's strong performance and strategic initiatives highlight its resilience and growth potential in the digital payments sector.

Expert Insights on PayPal Stock Forecast for 2024, 2025, 2030 and Beyond

Paypal stock price rapidly fell from Q3 2021 to Q2 2022. Since then, the price has been moving sideways, making a low near $50. Before checking on details on the Paypal stock price Forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about PYPL stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$66.72 |

$79.87 |

$130.81 |

|

Tradersunion |

$52.67 |

$89.29 |

$186.62 |

|

Stockscan |

$66.42 |

$176.87 |

$20.92 |

|

Coincodex |

$86.34 |

$70.83 |

$142.78 |

II. PayPal Stock Forecast 2024

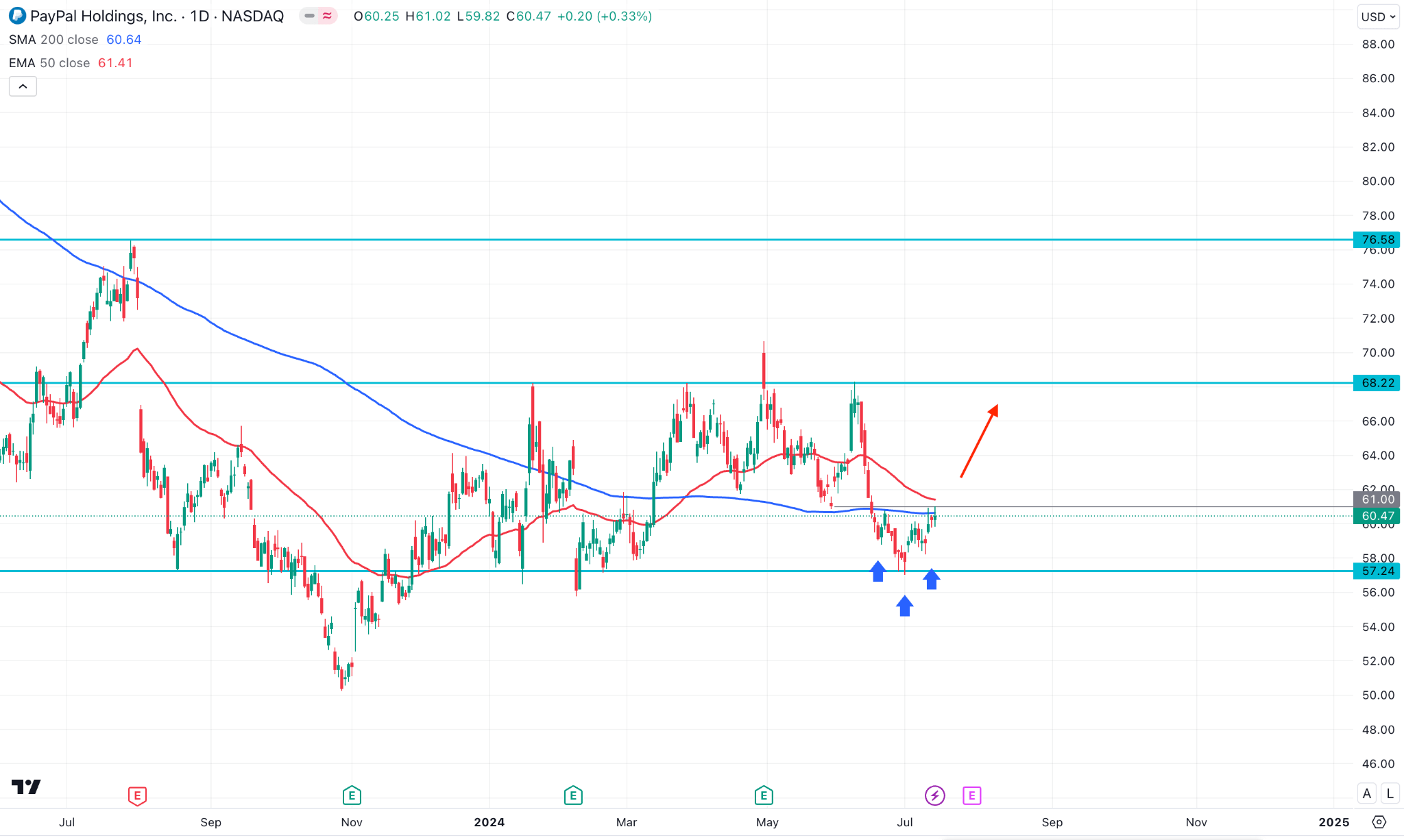

The price for PayPal Stock is 61.00 at the time of writing. It has been consolidating between 57.24 and 68.22 since November 2023. A breakout above 68.22 can trigger the price toward 76.58 by the end of this year.

On the daily chart, 57.24 shows an acceptable support level, and bullish pressure is validated as the price moves above the SMA 200 line. Moreover, the EMA 50 line crosses above the SMA 200, which is the“golden cross”that confirms the price may enter a long-term bullish trend and head toward the nearest resistance of 68.22. Any breakout can trigger the price toward the next resistance near 76.58.

Meanwhile, The price is still below the EMA 50 line, a valid head and shoulders pattern is visible near the resistance, and the price is still below the neckline, declaring seller activities that may continue and the price decline toward the primary support near $7.24, followed by the next support near 52.96.

Let's see the further aspect of PayPal Stock Price Forecast 2024 from the following indicators:

- Average Directional Index (ADX): The ADX indicator value is below 20, declaring a weaker current trend. Hence, the price can decline further, following a weak bullish trend and a bit of soaring sell pressure, to the support level of 57.24, followed by the next support near 52.96.

- MACD: The MACD indicator window shows fresh bullish pressure through signal lines edging upside and green histogram bars above the middle line, reflecting the possibility that the price may hit the nearest resistance of 68.22.

- The Relative Strength Index (RSI): The RSI indicator window supports bullish pressure as the dynamic signal line is above the midline, heading upside. Any breakout of the current resistance may trigger the price to the next possible resistance, which is near 76.58.

A. Other PYPL Stock Forecast 2024 Insights

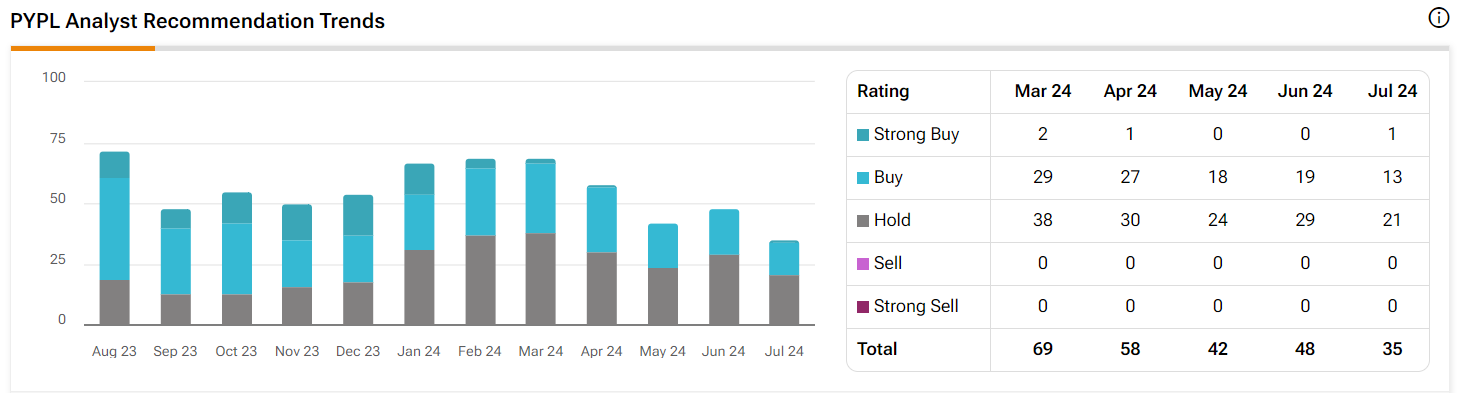

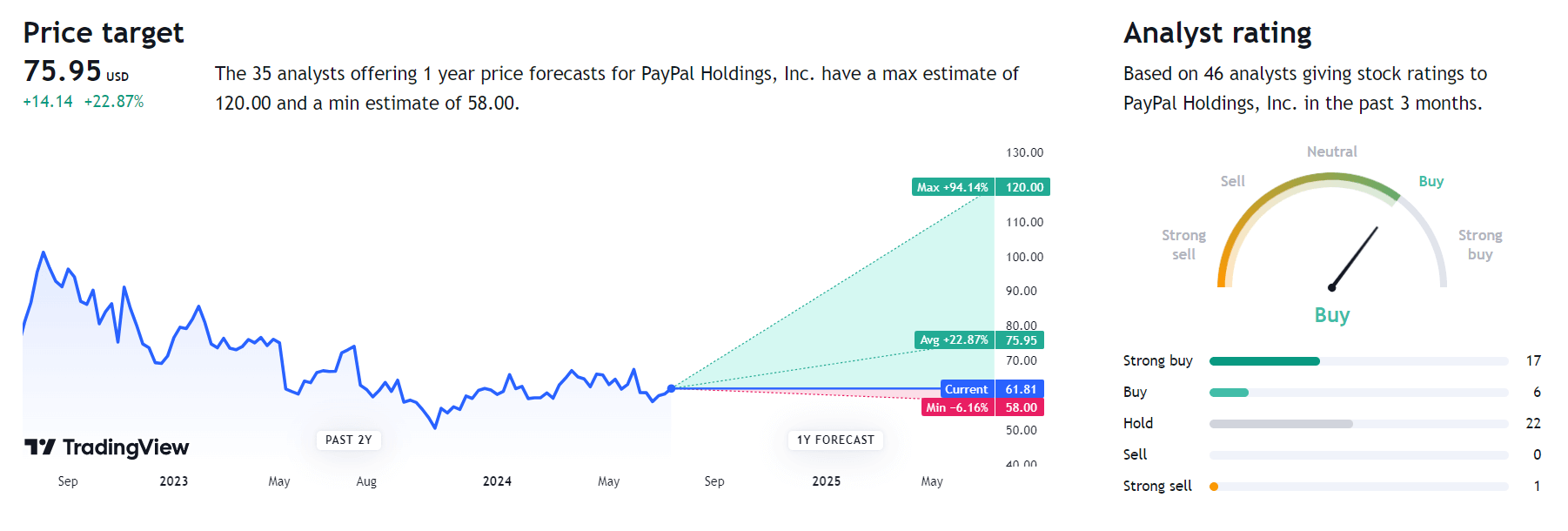

According to a recent report from Tipranks, most analyses suggest long in the stock; as of July 2024, among 35 studies, 14 suggest buy and 21 suggest hold. In the meantime, there are 0 sell suggestions, and the average PayPal price target for the past three months is $74.96.

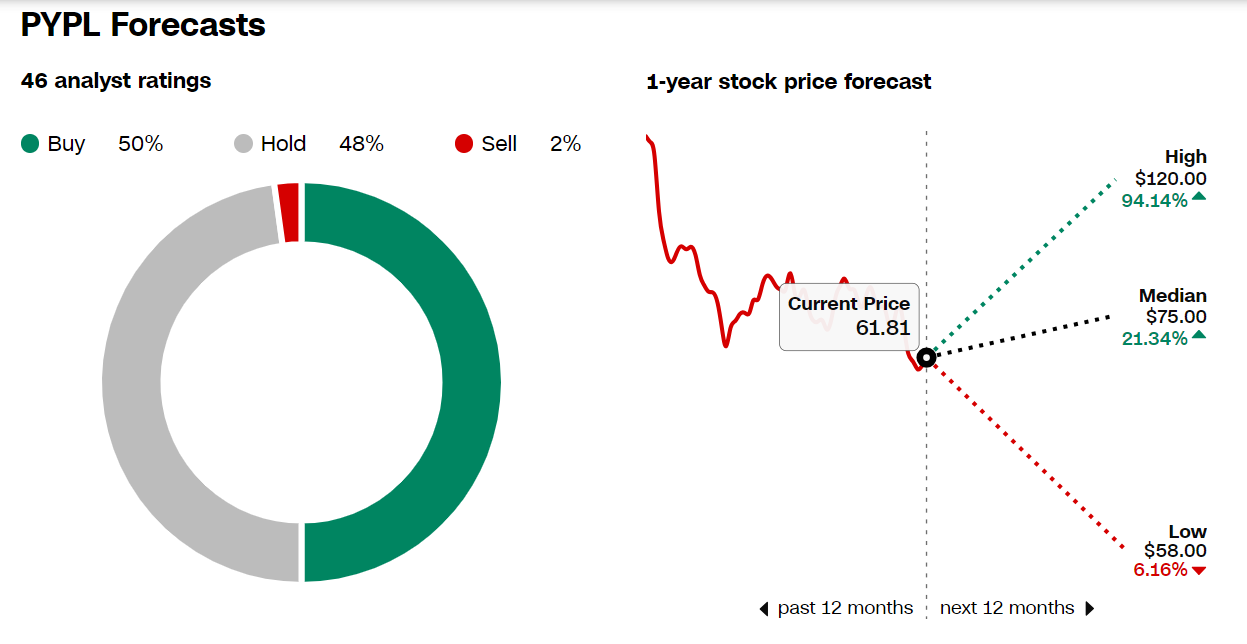

In another CNN report, 46 analysts have their forecast on the PayPal stock price, and 50% of them suggest long on the asset. Meanwhile, 48% suggest holding, and only 2% find the stock may be short in the upcoming days. They show their possible price target in the next 12 months. The lowest PYPL price target will be $58, the median price is $75, and the high PayPal stock price target they estimate is $120.

B. Key Factors to Watch for PayPal Stock Prediction 2024

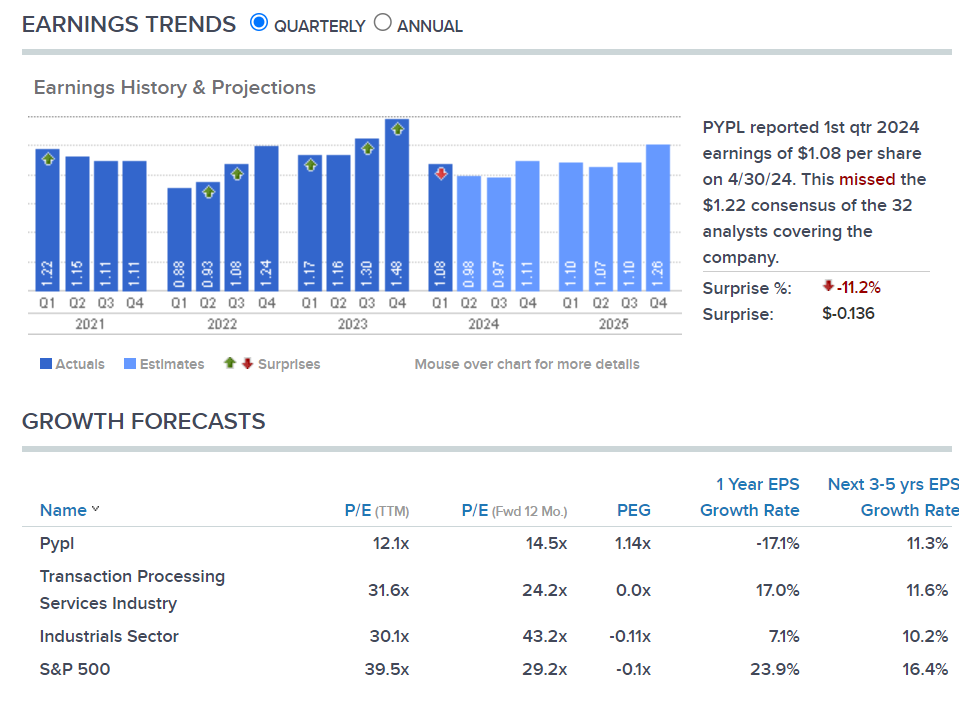

PayPal Earnings Forecast 2024

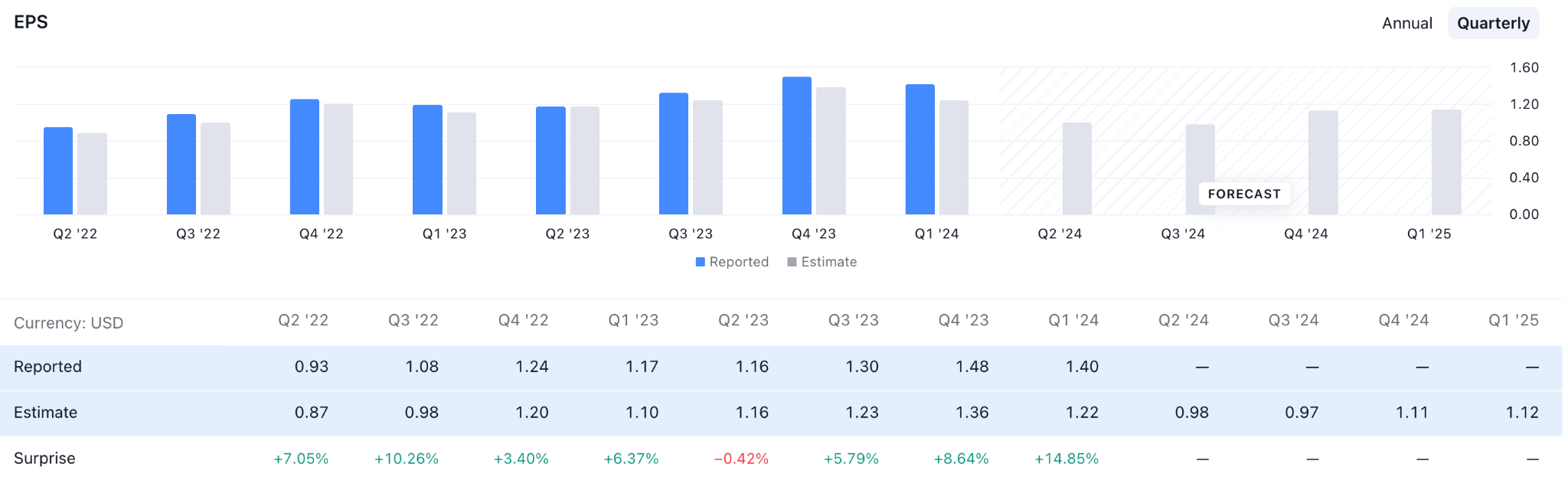

Based on the new reporting method, PayPal has updated its 2024 guidance, forecasting adjusted EPS growth of "mid to high single-digit percentage" from $3.83 in the prior year. Previously, PayPal had projected flat EPS growth for 2024. "Q1 has 2024 off to a good start," noted Susquehanna analyst James Friedman, highlighting the increased intensity and coherent strategy under PayPal's new management.

PYPL Management Forecast For 2024

New CEO Alex Chriss took the helm in late September and has been implementing significant changes. "We see substantial need for continued retooling of the company, how we work with our customers, and how we execute," Chriss stated during an earnings call with analysts. He acknowledged the progress made so far but emphasized the extensive work ahead. "This is a transition year where we are focused on execution and making critical choices that will set the business up for long-term success," Chriss remarked.

Chriss noted, "We have a plan that will return this company to where it needs to be and remain focused on execution to get there." These strategic updates underscore PayPal's commitment to transforming its business model and enhancing its competitive position in digital payments.

PYPL Forecast 2024 - Bullish Factors

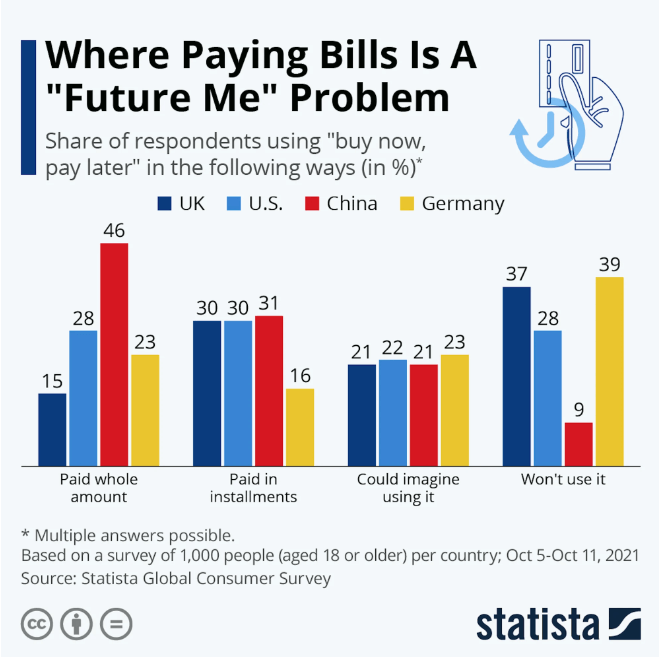

- PayPal's significant investment in its Buy Now, Pay Later (BNPL) offerings has led to considerable adoption. This expansion and partnerships with major retailers are poised to increase user engagement and transaction volume.

- The global shift towards digital payments, accelerated by the COVID-19 pandemic, is expected to persist. As consumers and businesses move away from traditional banking and cash, PayPal's broader range of digital payment solutions positions it well to capture this growing market.

- PayPal's venture into the cryptocurrency market, allowing users to buy, sell, and hold cryptocurrencies, has been well-received. Integrating cryptocurrencies into more of its payment solutions and expanding these services may boost transaction volumes and attract crypto enthusiasts.

PayPal Stock Analysis 2024 - Bearish Factors

- In the competitive digital payments landscape, challengers like Stripe, Square (Block, Inc.), and traditional financial institutions are bolstering their digital offerings, posing a threat to PayPal's market share and pricing power.

- Advancements in FinTech, central bank digital currencies (CBDCs), and the emergence of decentralized finance (DeFi) solutions may disrupt PayPal's business model, requiring agile adaptation to sustain its competitive edge.

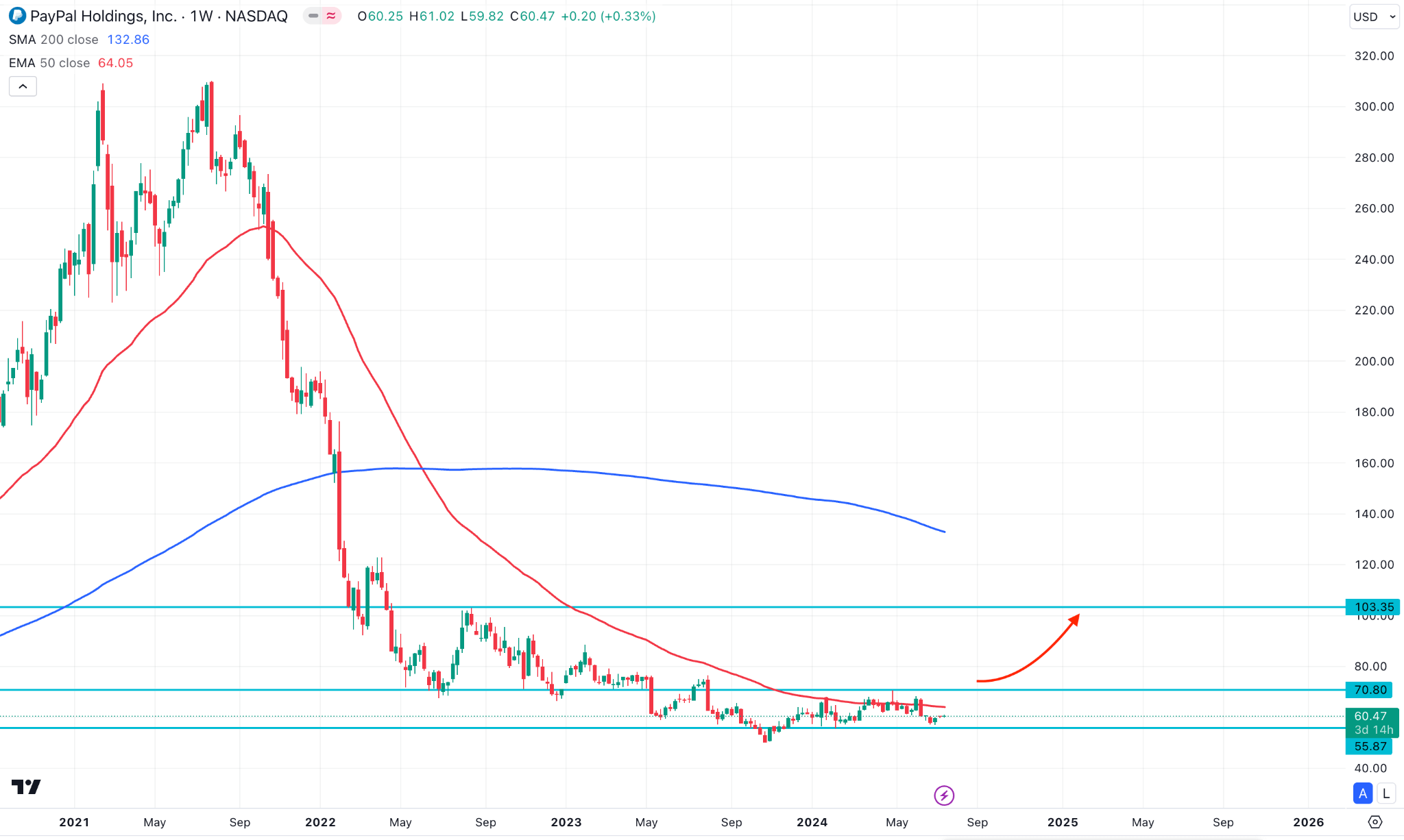

III. PayPal Stock Forecast 2025

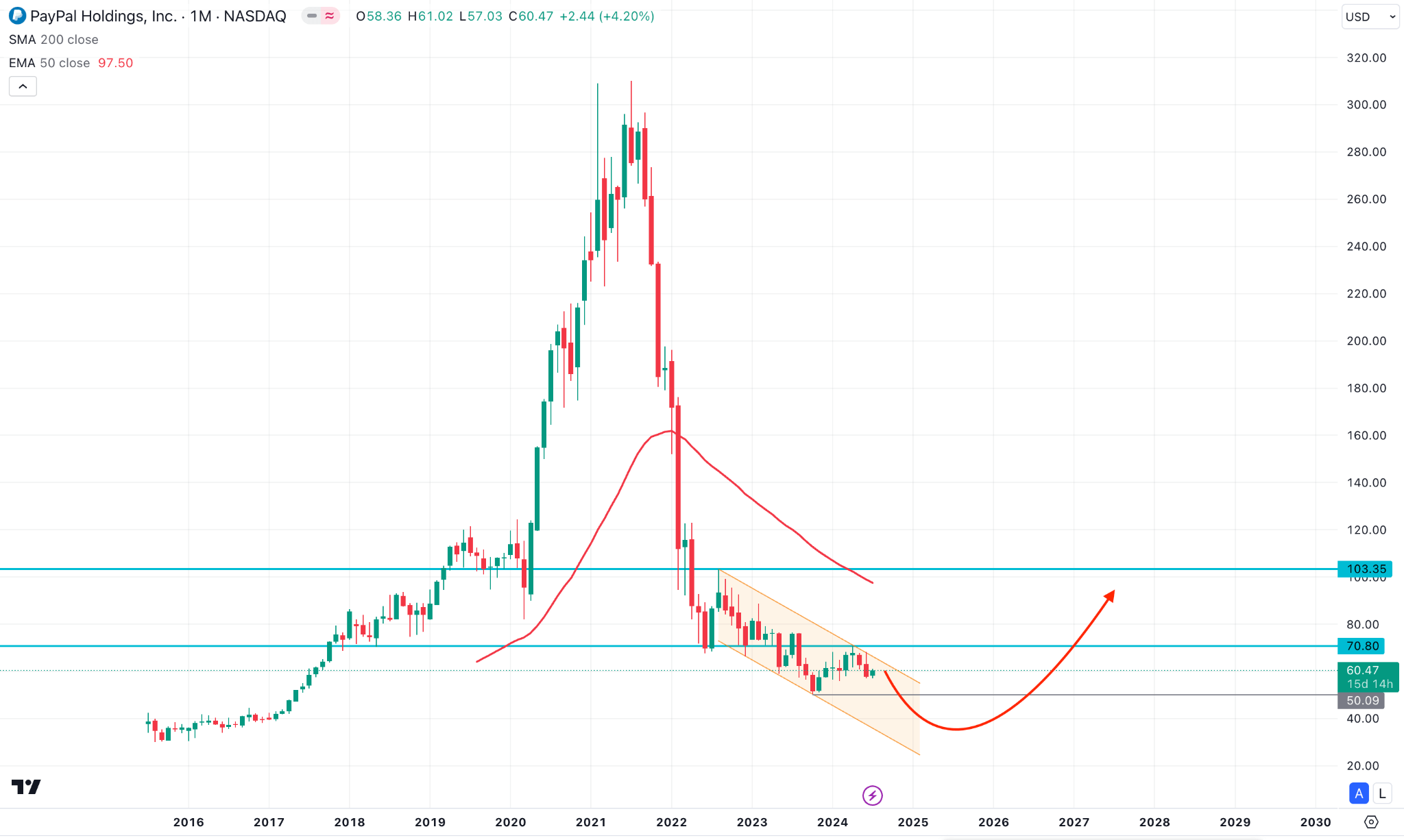

Any breaking above the current resistance of 70.80 can trigger the price toward 103.35 by the end of 2025.

The price reached its ATH near 310.16 in July 2021 but declined sharply and reached a low of 50.25 in October 2023. Then, it climbed above the 55.87 support level and remained sideways, making a primary resistance near 70.80.

The price still floats below the 50-week EMA line, reflecting the possibility that it will decline again to the support of 55.87 or beyond 50.25. Meanwhile, if the price exceeds EMA 50, it may hit the dynamic resistance near 132.86, as the SMA 200 line suggests.

However, the RSI indicator reading on the weekly chart is just at the midline, which indicates that the price is on an uptrend currently as the signal line edges upwards and may head to hit the resistance with consecutive buy pressure.

Based on the PayPal Stock Price Forecast 2025, a bullish break with a valid weekly candle above the 70.80 level would increase the possibility of an upward correction as a mean reversion.

The scenario will be the opposite if the signal line starts sloping downward. In that case, a bearish continuation might extend if a weekly candle appears below the 55.87 support line.

A. Other PYPL Stock Forecast 2025 Insights

Looking at the price prediction on Tradingview, 46 analysts gave their ratings on the PayPal stock. Seventeen gave strong buy suggestions, 6 suggested buying, and 22 suggested holding the asset. Only one suggested selling the asset; the highest possible level is $120 by the end of 2025. At the same time, the potential downside is $58.

Another report from Nasdaq.com suggests that there are some core facts that investors should focus on. Primarily, PYPL has more than 400 million accounts, which might be a crucial factor in boosting earnings.

In recent quarters, the upbeat earnings report with a lower valuation could work as additional buying factors. Considering the momentum, the stock is likely to double by the end of 2025.

B. Key Factors to Watch for PayPal Stock Prediction 2025

PYPL Revenue Forecast 2025

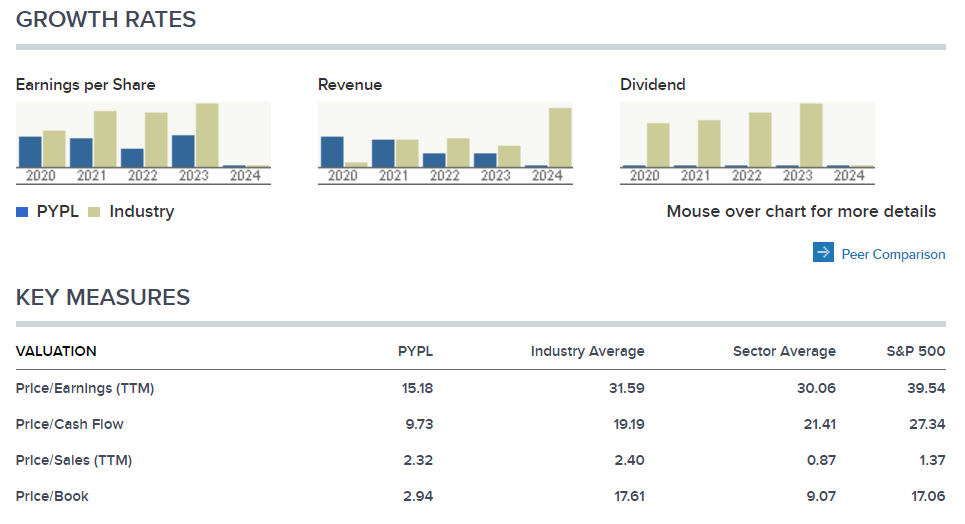

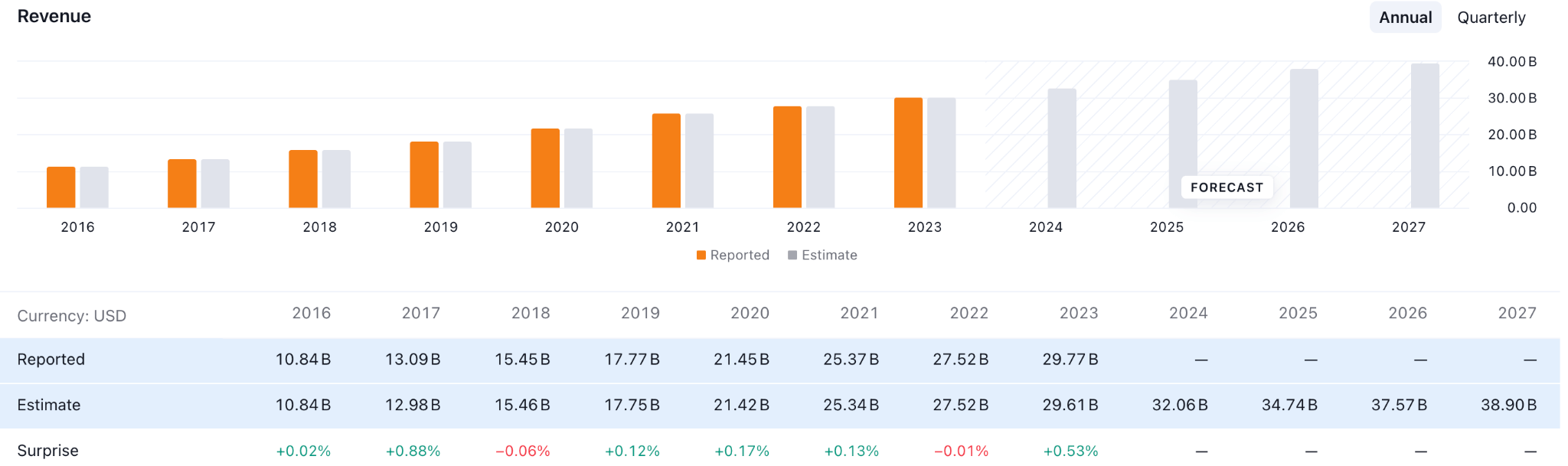

PayPal has maintained revenue growth since 2016, as shown in the image above. Its yearly revenue was $10.14 billion in 2016, which increased to $29.77 billion in 2023.

Moreover, the company has positive forecasts from analysts, where the current forecast for 2025 full-year revenue is $34.74 billion, which is higher than 2024's forecast of $32.06 billion.

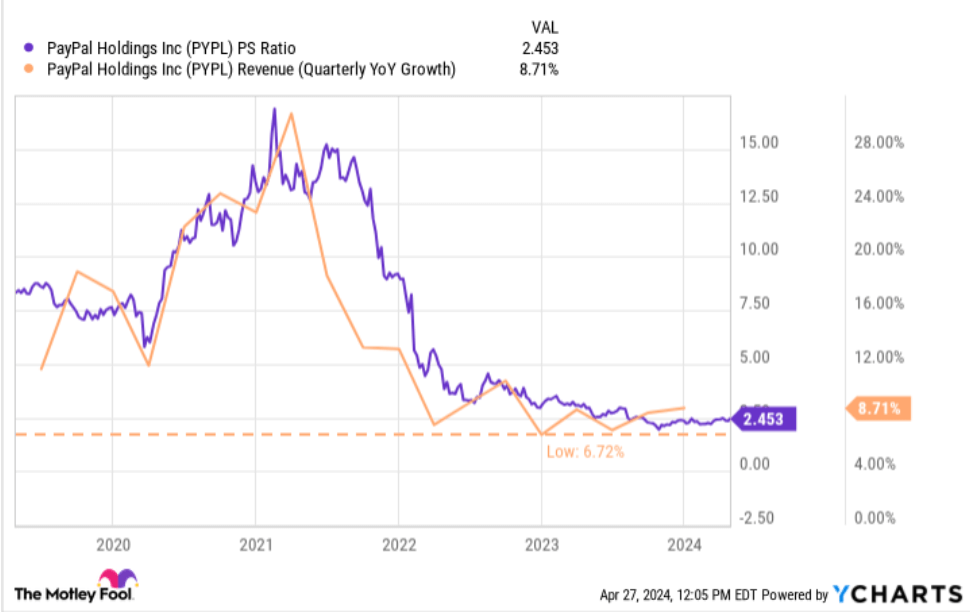

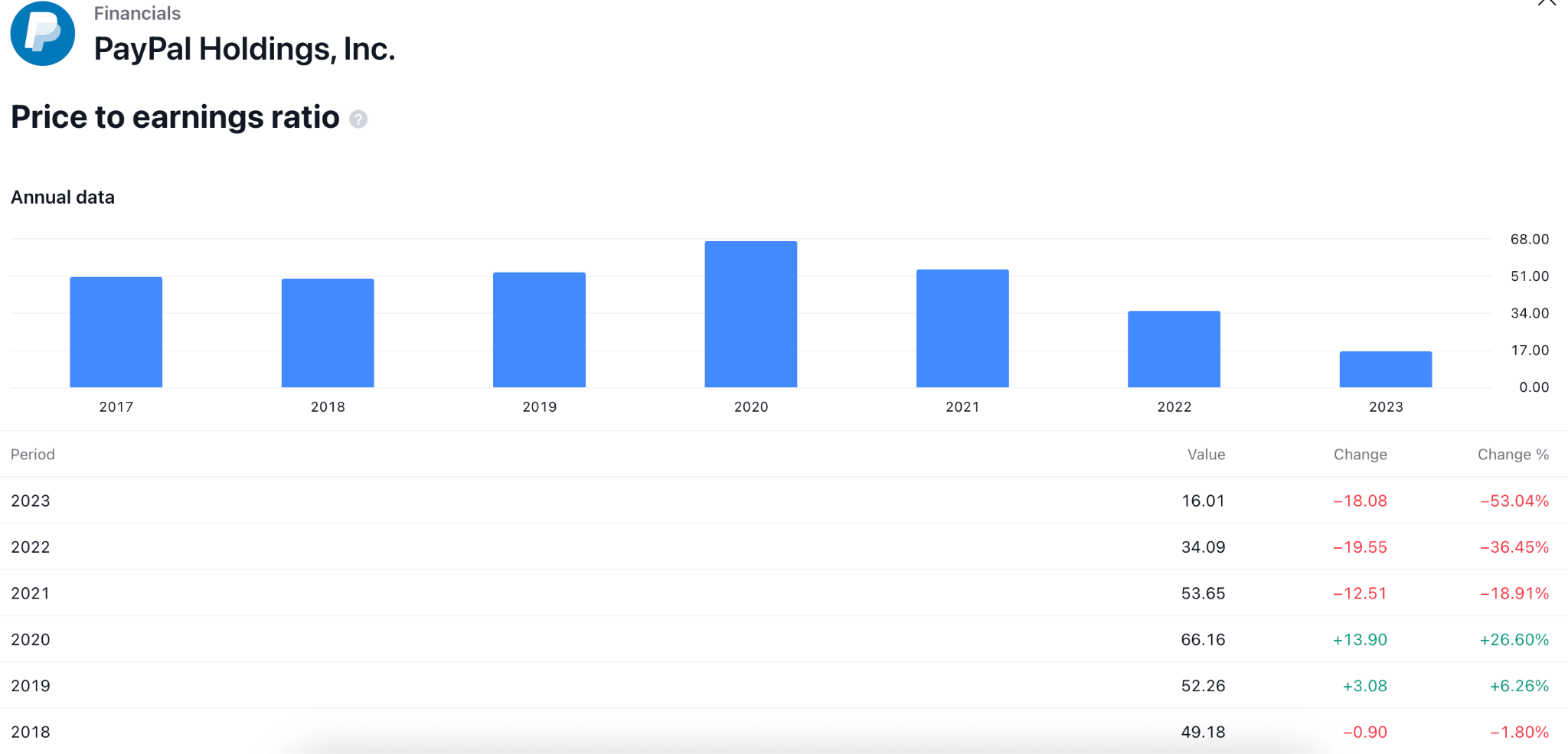

PayPal PS Ratio Analysis

PayPal maintains an average revenue growth of 8.71%, which is higher than the lowest level of 2023's 6.72%. On the other hand, the company's current PS ratio is 2.45, which is at the lowest level in the last four years.

Meanwhile, PayPal revenue holdings exceed the PS Ratio, which means PayPal's stock price may soar in the upcoming year.

PayPal Forecast 2025 - Bullish Factors

- PayPal is set to capitalize on the growing demand for flexible payment options with its expanding Buy Now, Pay Later (BNPL) services and strategic partnerships with major retailers, aiming to drive higher transaction volumes and deepen user engagement.

- PayPal's super app development, integrating necessary financial services such as payments, investing, savings, and shopping, presents a transformative opportunity to enhance user interaction. By offering a comprehensive solution for diverse financial needs, PayPal aims to increase per-user revenue and strengthen customer loyalty.

- With the increasing global adoption of digital wallets, driven by their security benefits and convenience, PayPal is well-positioned to leverage its strong brand recognition and extensive user base. This positions PayPal to capture a larger share of the growing digital wallet market as more consumers shift towards digital payment solutions for everyday transactions.

PayPal Price Prediction 2025 - Bearish Factors

- Maintaining or growing its user base poses challenges for PayPal, potentially impacting revenue growth and transaction volumes. Market saturation in developed regions and competition in emerging markets may limit user expansion.

- Integrating recent successful acquisitions, such as Paidy and Honey, is critical for PayPal's financial performance. Challenges in achieving expected synergies could lead to operational inefficiencies and increased costs.

IV. PayPal Stock Forecast 2030 and Beyond

The monthly chart for PayPal stock shows the price might find a reliable bullish reversal after overcoming the 103.30 resistance level, which might extend the gain above the 200.00 psychological line by the end of 2030.

In the broader context, the current market is facing extreme selling pressure as a counter-impulsive bearish momentum is visible from the all-time high. Moreover, the price went sideways after moving below the 2020 low with no sign of a recovery.

The 20-month EMA remains above the price with a steady bearish slope, which might be an additional bearish factor.

Based on the PayPal Stock Forecast 2030 and Beyond, the price might seek to break above the channel resistance and regain the dynamic resistance levels. In that case, a valid bullish monthly candle above the 70.80 area could be a potential long signal, increasing the possibility of reaching the 200.00 level.

On the other hand, investors should closely monitor how the price reacts at the channel resistance. As the ongoing market trend is bearish, any bearish reversal could be a potential bearish continuation, targeting the 30.00 area.

A. Other PYPL Stock Forecast 2030 and Beyond Insights

As per the report from Tradersunion, expert analysts suggest that considering various fundamental factors, the PayPal target price might hit $187.28 by the end of 2030.

However, Wallertinvestor analysts anticipate that revenue growth may turn negative in the upcoming years, causing the price to decline and reach a maximum of $12.22 by the end of 2029.

B. Key Factors to Watch for PayPal Stock Prediction 2030 and Beyond

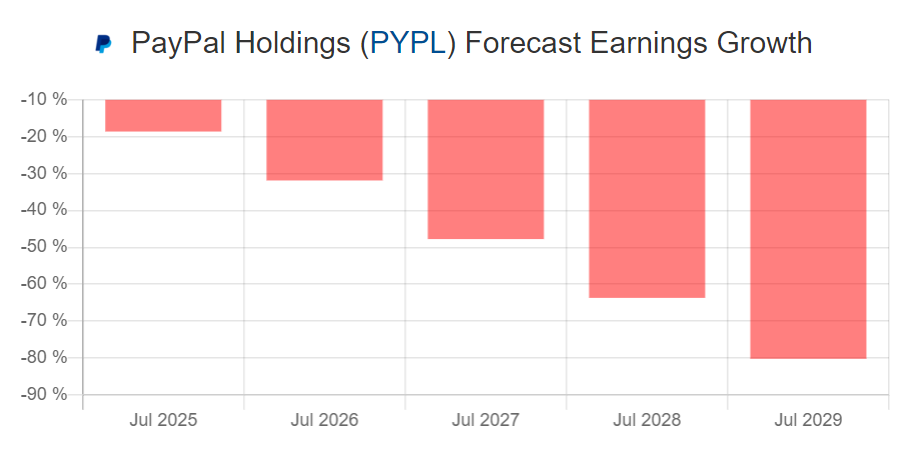

PYPL Growth Estimate

Analysts have shown an upbeat forecast for the next five years, which may influence the price to surge. It will be crucial for PayPal to successfully integrate cryptocurrencies into its payment ecosystem and effectively manage competitive pressures from fintech rivals and traditional financial institutions.

PayPal's Buy Now Pay Later Integration

Source: fool.com

The Buy Now, Pay Later (BNPL) services and financial technology innovation are widely accepted worldwide, which can boost the company's expansion in the upcoming six years.

Additionally, navigating regulatory landscapes worldwide to maintain operational flexibility and compliance will significantly shape PayPal's long-term growth trajectory and investor confidence.

PYPL Investment For Stellar Returns

PayPal's long-term investment returns will hinge on the success of its new ventures. The good news is that the stock is undervalued, and its core business is poised for growth, ensuring solid returns even without new initiatives.

Currently trading at a forward price-to-earnings (P/E) ratio of just 16.01, PayPal presents an attractive opportunity. With an anticipated 16% annualized growth rate, the price/earnings-to-growth (PEG) ratio of 1.0 highlights its promising growth potential.

Long-term investing involves navigating market fluctuations, and stocks sometimes need improvement before yielding significant returns. Investors should diversify, adhere to fundamentals, and exercise patience, understanding that substantial returns can materialize swiftly after periods of little activity. PayPal's strategic initiatives and strong core business lay a solid foundation for potential long-term gains.

PayPal Stock Price Prediction 2030 and Beyond - Bullish Factors

- The global shift towards digital payments, driven by growing smartphone usage, internet penetration, and a preference for cashless transactions, is expected to continue. PayPal's comprehensive digital payment solutions position it well to capitalize on this trend.

- PayPal's innovation efforts may lead to new financial products and services, such as high-yield savings accounts, investment platforms, and personalized financial management tools, which attract new users and generate additional revenue.

- Leadership in social, environmental, and governance (ESG) practices can enhance PayPal's reputation, attracting socially conscious investors and customers. A solid commitment to sustainability and corporate responsibility can drive long-term value creation.

PayPal Stock Forecast 2030 and Beyond - Bearish Factors

- Increasing competition from digital payment providers and traditional financial institutions could erode PayPal's market share and pressure pricing power, affecting revenue growth.

- The ongoing surge in fintech startups offering similar or better services at a lower price could potentially threaten PayPal's market share. Already, tech giants like Google, Apple, and Amazon are focusing on financial services, increasing the threat to PYPL.

V. Conclusion

A. PayPal Stock Outlook

PayPal's future growth closely depends on the digital payment landscape and cryptocurrency expansion. The stock price has remained sideways since the beginning of 2024, where a potential bullish breakout could be the primary signal of a trend reversal.

Key technical indicators like 200 SMA and MACD signal an ongoing selling pressure, from where a solid bottom is needed. Overcoming the 61.00 level would be a breakthrough for this stock as it might open the continuation signal for 2025 and beyond. Looking further ahead to 2030 and beyond, the monthly chart suggests a potential break above the 70.80 resistance, targeting the 200.00 level.

Investors must consider key features like Buy Now Pay Later (BNPL) services and cryptocurrency integration to position the company's outlook. However, intense competition, technological advancements, and regulatory challenges could impact its market share and growth trajectory.

In light of these factors, investors might find Contract for Differences (CFD) trading a viable strategy to navigate market volatility and leverage potential price movements. Investors can make informed decisions about their investment in PayPal stock, balancing potential risks with opportunities for long-term gains.

B. Trade PYPL Stock CFD with VSTAR

Trading PYPL stock CFDs with VSTAR offers several advantages-

- Flexibility and Leverage: VSTAR enables traders to utilize leverage, allowing for greater exposure with smaller capital investments. This flexibility allows for trading in both rising and falling markets.

- Fund Safety Measurement: VSTAR utilizes segregation of funds, which means clients' funds remain separate from brokers' own funds.

- Advanced Trading Tools: VSTAR provides a comprehensive suite of trading tools, including real-time data, technical analysis indicators, and risk management features, enhancing your trading experience and decision-making capabilities.

- Low Fees and Competitive Spreads: VSTAR offers competitive spreads and low transaction fees, helping to maximize your trading profitability.

Overall, PayPal stock (PYPL) needs to form a valid bottom before initiating a bull run. However, the price is trading at a record low, from where any immediate rebound could signal a market reversal.

FAQs

1. Is PayPal a Buy, Sell or Hold?

The consensus analyst rating for PayPal is a Moderate Buy.

2. What is the prediction for PayPal stock?

The average 12-month price forecast for PayPal is around $75.56.

3. What is the price target for PayPal in 2024?

The price target for PayPal in 2024 is estimated to be between $60.00 and $90.00.

4. What will PayPal stock be in 2025?

By 2025, PayPal stock is expected to reach an average price of $108.94, with a high estimate of $176.87 and a low estimate of $41.01.