I. Recent Nextera Energy Stock Performance

Recent NEE stock price performance

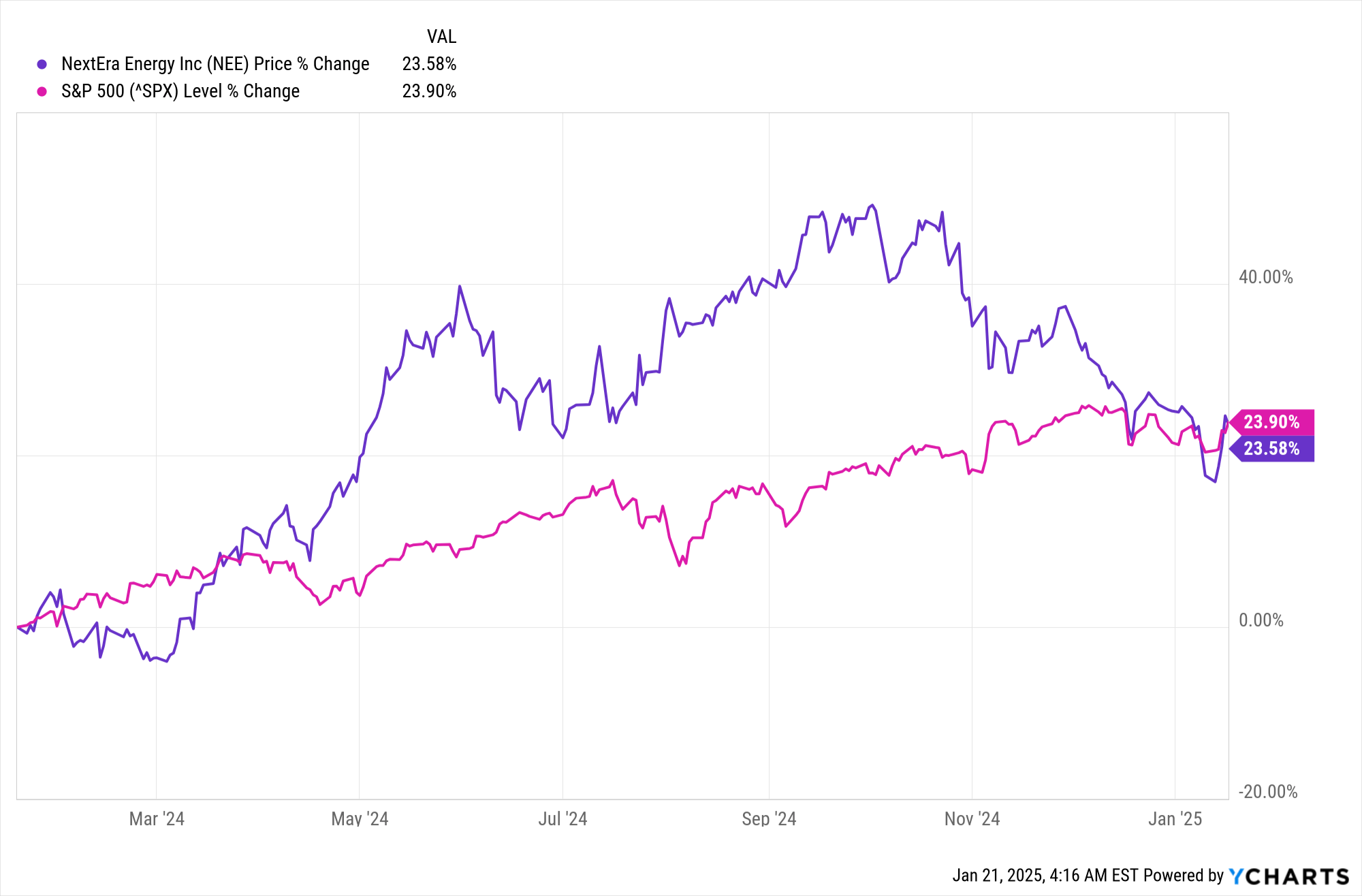

NextEra Energy (NEE) stock has demonstrated mixed performance over recent periods, reflecting both resilience and challenges in the broader market. Over the past week, NEE's price return was 5.02%, outperforming the S&P 500's 2.91%, indicating a strong short-term rebound. However, over one month, NEE declined by 2.09%, underperforming the S&P 500's slight dip of 0.89%. Longer-term performance shows a more nuanced picture: NEE's six-month price return is -0.20%, lagging behind the S&P 500's 7.31%, while its year-to-date return of -1.30% contrasts with the S&P 500's 1.96% gain. Over one year, NEE delivered a solid 23.58% return, though it hit head to head with the S&P 500's 23.90%. Over three years, NEE's -14.95% return significantly underperformed the S&P 500's 28.61%, but its five- and ten-year returns of 11.70% and 161.54%, respectively, highlight its long-term growth potential, albeit still below the S&P 500's 80.10% and 196.95% over the same periods.

Source: Ycharts.com

Main influencing factors

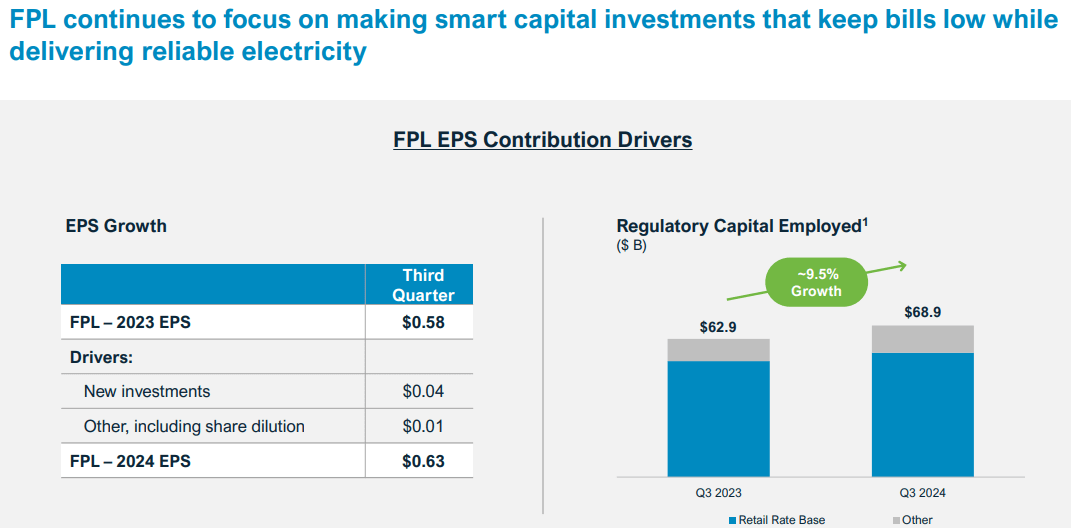

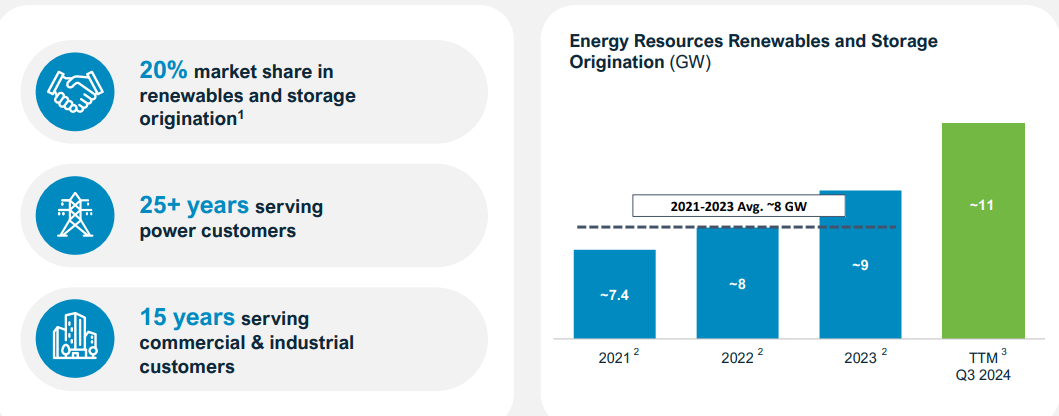

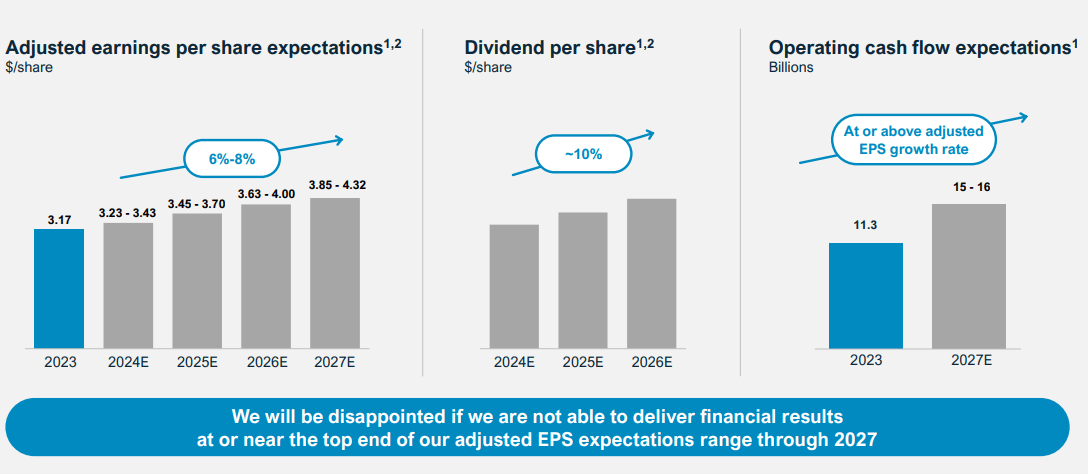

Several factors have influenced NEE's recent performance. The company reported strong third-quarter 2024 results, with adjusted earnings per share increasing by 10% year-over-year, driven by robust operational performance at Florida Power & Light (FPL) and Energy Resources. NEE added approximately 3 gigawatts to its renewables and storage backlog, bringing its four-quarter total to 11 gigawatts, reflecting strong demand for clean energy solutions. Additionally, NEE secured framework agreements with two Fortune 50 companies for up to 10.5 gigawatts of renewables and storage projects by 2030, further solidifying its market position. However, the company faced challenges from hurricanes Helene and Milton, which caused significant power outages in Florida. Despite these disruptions, FPL's investments in grid resilience and smart technology minimized outages, showcasing the company's ability to manage extreme weather events effectively.

Source: Q3 2024 Deck

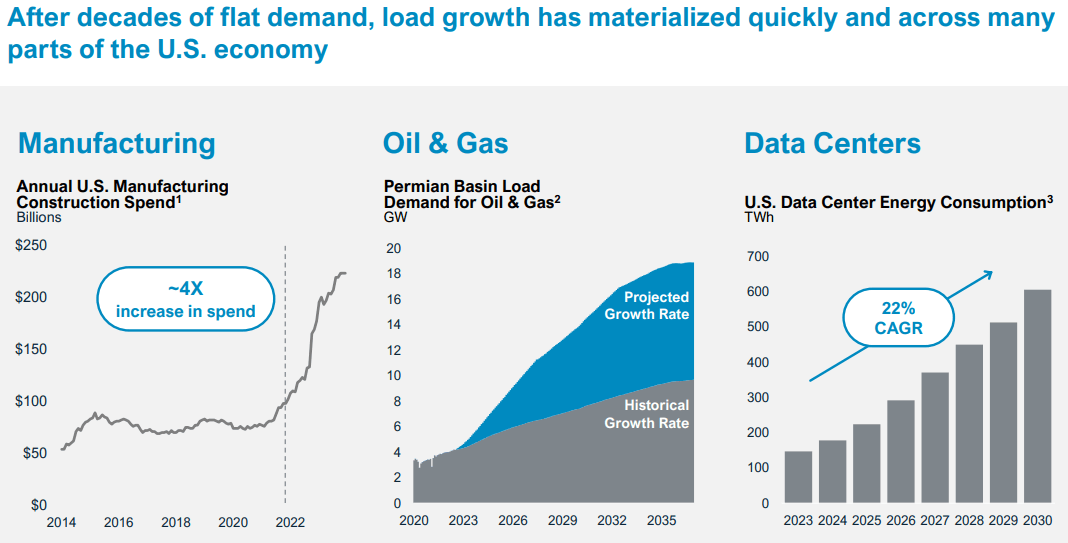

Looking ahead, NEE is well-positioned to capitalize on the growing demand for renewable energy, driven by data center expansion, industrial electrification, and reshoring of manufacturing. The company's low-cost solar and storage solutions, combined with its extensive backlog and strategic partnerships, provide a strong foundation for future growth. However, macroeconomic factors, regulatory challenges, and the pace of renewable energy adoption will remain key variables influencing NEE's stock performance.

Expert Insights on Nextera Energy Stock Forecast for 2025, 2030 and Beyond

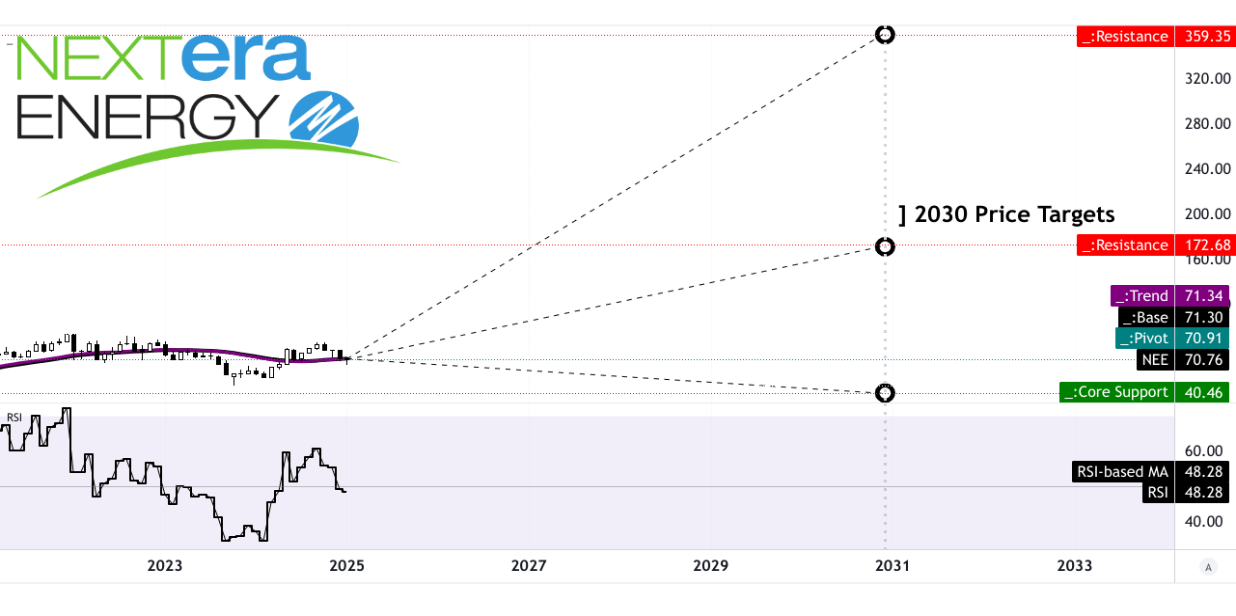

NextEra Energy's stock forecast shows significant growth potential, with the average NEE price target rising from $88.70 in 2025 to $172.68 by 2030, reflecting a 95% increase. The optimistic target surges from $112.60 in 2025 to $359.35 by 2030, driven by strong renewables growth and grid investments. However, the pessimistic target drops from $56.70 in 2025 to $40.46 by 2030, highlighting risks like regulatory hurdles and macroeconomic uncertainties. NEE's performance will hinge on executing its renewables strategy and navigating market challenges.

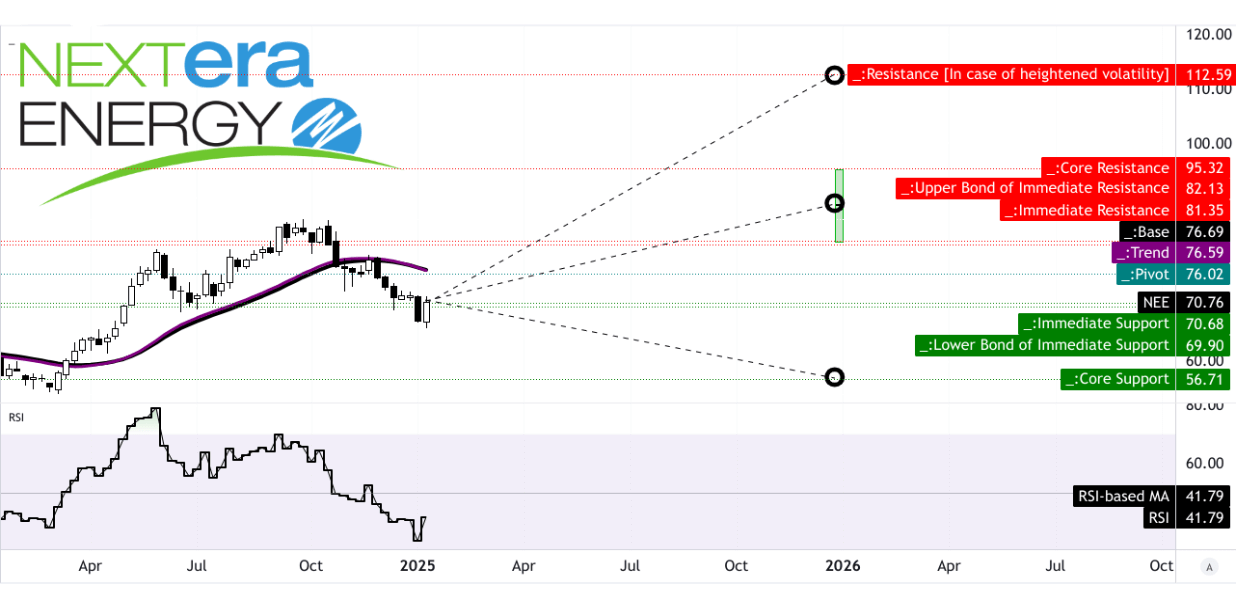

II. NEE Stock Forecast 2025

The NEE stock forecast for 2025, based on the technical analysis, reveals a range of predicted prices reflecting varying market scenarios. The current price of $70.76 is below the trendline and baseline, both at approximately $76.59 and $76.69, respectively, indicating a potential resistance level. The average NEE price target by the end of 2025 is projected at $88.70, derived from momentum analysis and Fibonacci retracement/extension levels, suggesting a 25.4% increase from the current price. This projection aligns with the broader bullish sentiment observed in analyst ratings, though it remains cautious given the stock's current position below key technical levels.

The optimistic NEE price target for 2025 is $112.60, representing a 59.1% upside, based on upward price momentum and Fibonacci extensions. This scenario assumes sustained bullish trends and positive market conditions. Conversely, the pessimistic NEE price target of $56.70, a 19.9% decline from the current price, reflects potential downward momentum and bearish market conditions, also projected using Fibonacci retracement levels. This wide range between the optimistic and pessimistic targets underscores the stock's volatility and sensitivity to market dynamics.

Source: tradingview.com

The pivot of the current horizontal price channel at $76.02 serves as a critical level for determining future price movements. A breakout above this level could signal a bullish trend, while failure to breach it may indicate continued consolidation or bearish pressure. The Relative Strength Index (RSI) value of 41.79, trending downward, suggests weakening momentum but no clear divergence, implying a neutral to slightly bearish short-term outlook. In summary, while the average and optimistic targets suggest growth potential, the pessimistic scenario and technical indicators highlight significant risks, making NEE a stock with high reward potential but equally high uncertainty.

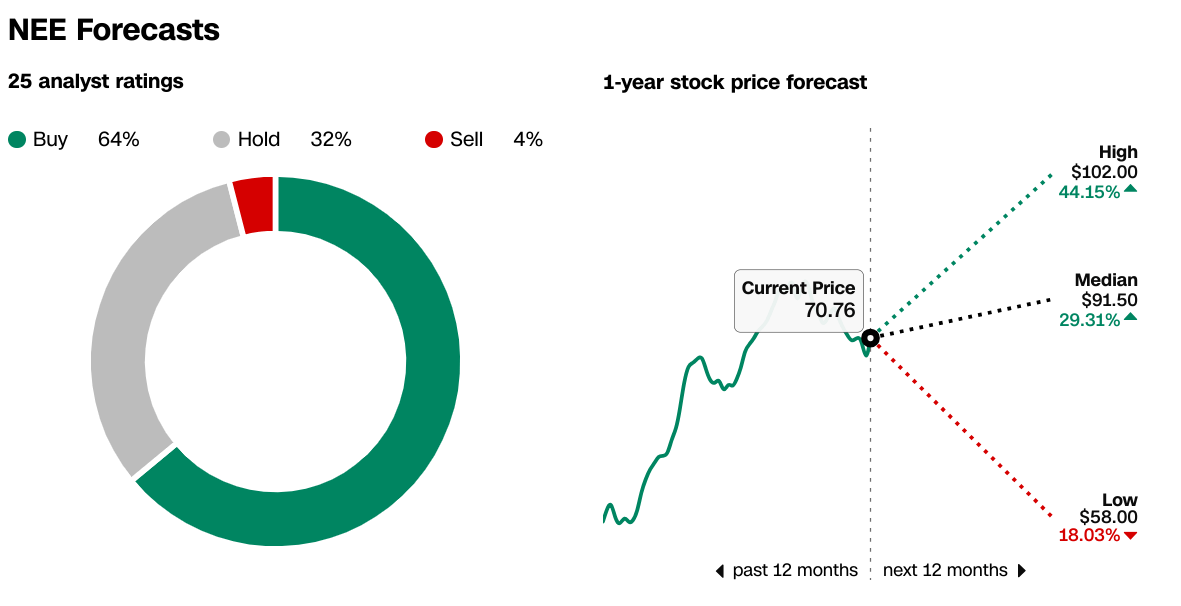

The NEE stock forecast for 2025 presents a mixed outlook based on data from multiple sources. According to TipRanks, the average 12-month price target for NextEra Energy is $85.38, reflecting a 20.66% increase from the current price of $70.76. The forecasts range widely, with a high of $102.00 (44.15% upside) and a low of $58.00 (18.03% downside), indicating significant volatility and uncertainty among analysts. CNN's data aligns closely, showing a median forecast of $91.50 (29.31% upside) and a high of $102.00, with 64% of analysts recommending a "buy," 32% suggesting "hold," and only 4% advising "sell." This suggests a generally bullish sentiment, though the wide range of predictions highlights potential risks.

Source: CNN.com

Coincodex's monthly forecasts for 2025 provide a more granular view, projecting a gradual price increase throughout the year. The average price starts at $69.46 in January 2025 and rises to $73.85 by December 2025, with potential ROI ranging from 0.18% in July to 10.27% in May. Notably, the minimum price predictions remain relatively stable, hovering around $60-$68, while the maximum prices peak at $74.77 in November. This indicates cautious optimism, with analysts expecting moderate growth but acknowledging potential fluctuations. Overall, while the data suggests a positive trajectory for NEE, the wide variance in forecasts underscores the need for careful consideration of market conditions and company performance.

A. Other Nextera Energy Stock Forecast 2025 Insights

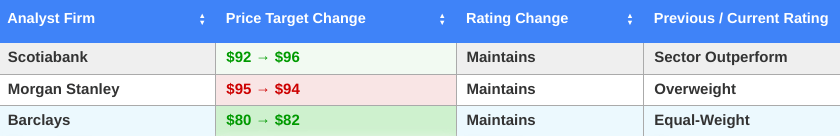

Several major institutions and analysts have provided specific price targets and ratings for NextEra Energy (NEE) stock, offering valuable insights into its 2025 forecast. Scotiabank maintains a "Sector Outperform" rating with a price target increase from $92 to $96, reflecting a 35.67% upside from the current price of $70.76. Similarly, Morgan Stanley reaffirms an "Overweight" rating, adjusting its target slightly from $95 to $94, representing a 32.84% upside. Barclays, however, maintains a more conservative stance with an "Equal-Weight" rating, raising its target from $80 to $82, which implies a 15.88% upside. These targets highlight a generally bullish sentiment among analysts, though with varying degrees of optimism. Scotiabank and Morgan Stanley's higher targets suggest strong confidence in NEE's growth potential, while Barclays' more modest increase indicates cautious optimism. Collectively, these forecasts underscore NEE's potential for growth in 2025, though the range of targets reflects differing views on the stock's trajectory and market conditions.

Source: benzinga.com

B. Key Factors to Watch for NEE Stock Forecast 2025

Financial Forecast and Company Strategy

NextEra Energy (NEE) has demonstrated strong financial performance, driven by robust operational performance at Florida Power & Light (FPL) and Energy Resources. The company added approximately 3 gigawatts (GW) to its backlog for the second consecutive quarter, bringing the four-quarter total to 11 GW. Additionally, NEE secured framework agreements with two Fortune 50 customers for up to 10.5 GW of renewables and storage projects by 2030, further solidifying its market position. These agreements, combined with the Entergy joint development agreement, total up to 15 GW of potential projects, highlighting NEE's ability to meet growing power demand.

Source: 2024_NEE_Investor_Presentation

NEE Stock Forecast 2025 - Bullish Factors

- Renewables and Storage Growth: NEE's renewables and storage portfolio is expected to grow significantly, with projections indicating a potential doubling from 38 GW in 2023 to 81 GW by 2027. This growth is supported by strong demand for low-cost, clean energy, particularly from data centers and industrial customers. The company's ability to deploy renewables and storage quickly, coupled with its extensive backlog, positions it well to capitalize on this demand.

- Cost Efficiency: NEE's low-cost solar and storage solutions are increasingly competitive, with new solar projects up to 40% cheaper than new gas generation when paired with battery storage. This cost advantage, combined with federal incentives, drives customer savings and strengthens NEE's market position.

Source: 2024_NEE_Investor_Presentation

NEE Stock Prediction 2025 - Bearish Factors

- Storm Recovery Costs: The company faces significant costs from hurricane recovery efforts, with preliminary estimates of $1.2 billion for Hurricanes Helene and Milton. These costs, while recoverable through surcharges, could impact short-term financial performance and customer bills.

- Market Volatility: Despite strong demand, NEE stock faces volatility due to macroeconomic factors, interest rate fluctuations, and regulatory risks. The wide range of price targets ($56.70 to $112.60) reflects uncertainty in market conditions.

III. NEE Stock Forecast 2030 and Beyond

The NEE stock forecast for 2030 and beyond presents a wide range of potential outcomes, reflecting both the company's growth opportunities and market uncertainties. Based on technical analysis, the average price target by the end of 2030 is $172.68, representing a 144% increase from the current price of $70.76. This projection is derived from momentum analysis and Fibonacci retracement/extension levels, assuming sustained growth in renewables and storage demand, as well as NEE's ability to execute its development pipeline effectively. The company's strong backlog of 24 GW and framework agreements for up to 15 GW of projects with Fortune 50 customers provide a solid foundation for this growth.

The optimistic price target for 2030 is $359.35, reflecting a 408% upside. This scenario assumes accelerated adoption of renewables, favorable regulatory policies, and successful execution of NEE's long-term strategy, including its potential nuclear recommissioning projects like Duane Arnold. However, the pessimistic price target of $40.46, a 43% decline, highlights significant risks, including regulatory hurdles, macroeconomic downturns, and challenges in scaling renewable energy infrastructure. This bearish scenario could materialize if NEE faces delays in project execution, cost overruns, or reduced demand for renewables.

Source: tradingview.com

The current technical indicators suggest a neutral to slightly bearish short-term outlook. The Relative Strength Index (RSI) is at 48.28, trending downward, indicating weakening momentum but no clear divergence. The pivot point of the horizontal price channel at $70.91 is a critical level to watch; a breakout above this level could signal a bullish trend, while failure to breach it may indicate continued consolidation or bearish pressure. In summary, while NEE's long-term growth potential is substantial, the wide range of price targets underscores the importance of monitoring market conditions and the company's execution capabilities.

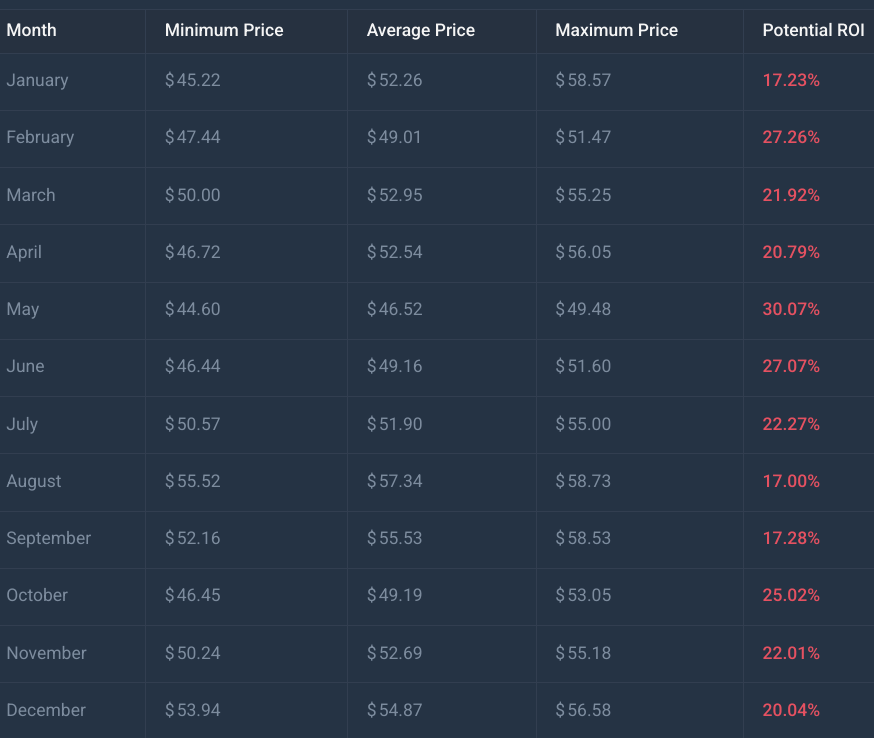

NextEra Energy's stock forecast for 2030, as per CoinCodex, shows a range of potential prices and returns. The minimum price fluctuates between $44.60 (May) and $55.52 (August), while the maximum price ranges from $49.48 (May) to $58.73 (August). The average price hovers around $49.19 (October) to $57.34 (August). The potential ROI varies monthly, peaking at 30.07% in May and dipping to 17.00% in August. These projections reflect market volatility and NEE's growth potential in renewables and storage, but also highlight risks such as regulatory challenges and macroeconomic uncertainties that could impact performance.

Source: coincodex.com

A. Other NEE Stock Forecast 2030 and Beyond Insights

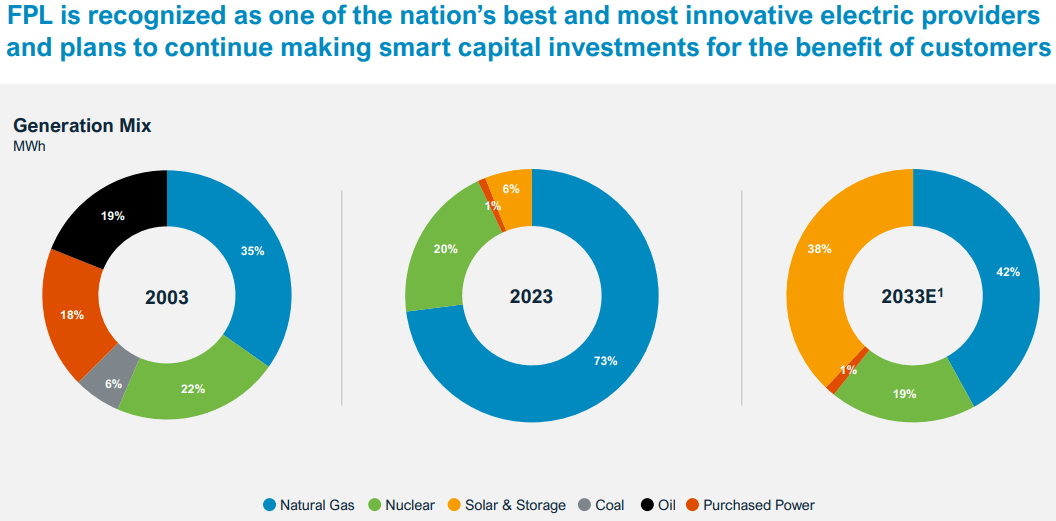

NextEra Energy (NEE) is well-positioned to benefit from the global surge in renewable energy, as highlighted by the IEA's Renewables 2024 report. The report forecasts a tripling of global renewable capacity by 2030, with solar PV leading the charge, accounting for 80% of growth. NEE's strategic focus on solar and storage aligns with this trend, as its renewables portfolio is set to expand from ~38 GW in 2023 to ~81 GW by 2027, with further growth expected by 2030. By 2033, NEE's energy mix is projected to shift significantly, with solar and storage rising to 38% of its portfolio, up from 6% in 2023, while natural gas declines from 73% to 42%.

Source: 2024_NEE_Investor_Presentation

The IEA report emphasizes that renewables, particularly solar, are now the cheapest option for new power generation globally, a trend NEE is capitalizing on through its low-cost solar and storage projects. However, challenges remain, including the need for grid modernization and storage capacity to integrate variable renewables effectively. NEE's investments in grid resilience and smart technologies position it to address these challenges, but regulatory uncertainties and high financing costs in emerging markets could slow global progress. Overall, NEE's growth trajectory aligns with global renewable trends, but its success will depend on navigating policy and infrastructure hurdles.

Source: iea.org

B. Key Factors to Watch for Nextera Energy Stock Forecast 2030 and Beyond

Financial Forecast and Company Strategy

NextEra Energy (NEE) is poised for significant growth through 2030, driven by its leadership in renewable energy and storage. The company plans to more than double its renewables and storage capacity from ~38 GW in 2023 to ~81 GW by 2027, with further expansion expected beyond that. This growth is supported by a robust backlog of 24 GW and framework agreements with Fortune 50 customers for up to 15 GW of projects by 2030. NEE's strategy focuses on low-cost solar and storage, which are up to 40% cheaper than new gas generation when paired with batteries, providing a competitive edge in meeting the projected 6x increase in U.S. power demand over the next 20 years.

Source: 2024_NEE_Investor_Presentation

NEE Stock Forecast 2030 and Beyond - Bullish Factors

- Renewables and Storage Expansion: NEE's renewables and storage portfolio is expected to grow significantly, with forecasts indicating a tripling of renewables growth over the next seven years compared to the prior seven. The company's ability to deploy these technologies quickly and cost-effectively positions it to capitalize on the growing demand for clean energy, particularly from data centers and industrial customers.

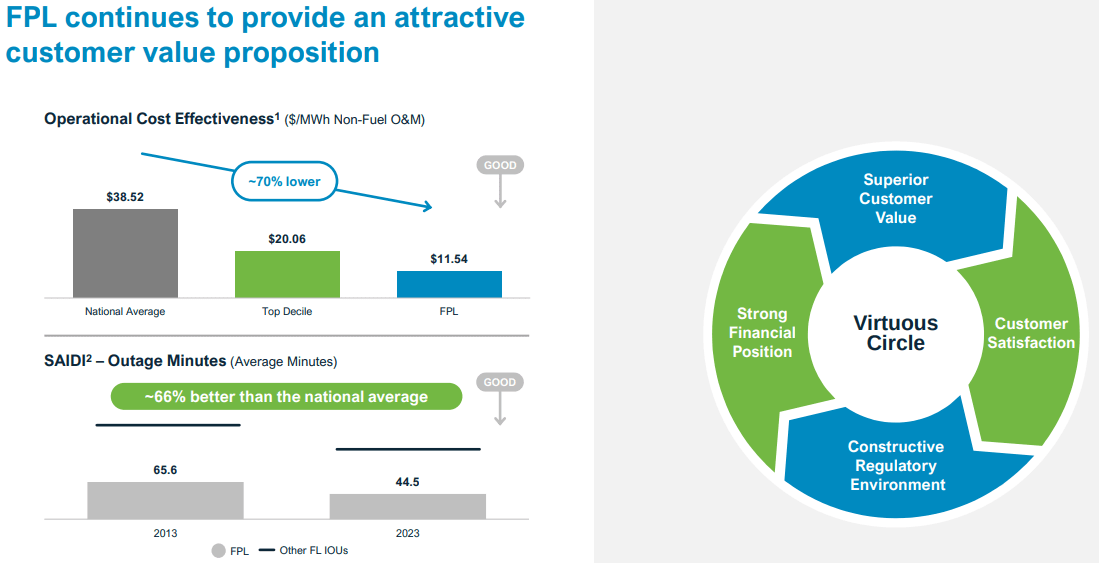

- Grid Resilience and Reliability: NEE's investments in grid hardening, undergrounding, and smart grid technology have proven effective during extreme weather events, reducing outages and improving reliability. These investments enhance customer value and support long-term growth.

- Cost Efficiency and Customer Savings: NEE's low-cost solar and storage solutions, combined with federal incentives, drive significant customer savings. The company's non-fuel O&M costs are 70% better than the national average, saving customers $3 billion annually. These efficiencies strengthen NEE's market position and support sustained bottom-line growth.

Source: 2024_NEE_Investor_Presentation

NEE Stock Forecast 2030 and Beyond - Bearish Factors

- Regulatory and Macroeconomic Risks: NEE faces potential regulatory hurdles and macroeconomic uncertainties, including interest rate fluctuations and inflation, which could impact project financing and profitability. The company's ability to navigate these risks will be critical to its long-term success.

- Nuclear and Gas Challenges: While NEE is exploring nuclear recommissioning (e.g., Duane Arnold), the high costs and regulatory complexities associated with nuclear energy pose risks. Similarly, gas generation, while necessary for capacity, faces competition from cheaper renewables and storage.

IV. Conclusion

A. NEE Stock Outlook

NextEra Energy (NEE) shows strong growth potential, with price forecasts indicating significant upside. For 2025, the average price target is $88.70 (25.4% increase from $70.76), with optimistic targets reaching $112.60 (59.1% upside) and pessimistic targets at $56.70 (19.9% downside). By 2030, the average target rises to $172.68 (144% increase), with optimistic projections at $359.35 (408% upside) and pessimistic scenarios dropping to $40.46 (43% decline). These forecasts reflect NEE's leadership in renewables and storage, but also highlight risks like regulatory hurdles and market volatility. Investors should consider NEE's long-term potential but remain cautious of short-term uncertainties.

B. Trade NEE Stock CFD with VSTAR

Trading NEE Stock CFDs with VSTAR offers several advantages, including tight spreads and low trading fees, enabling cost-effective trading. VSTAR provides deep liquidity for reliable and fast order execution, ensuring minimal slippage. The platform is globally regulated by ASIC (526187) and offers negative balance protection, safeguarding traders from excessive losses. With a user-friendly app, a $50 minimum deposit, and access to 1,000+ markets, VSTAR is ideal for both beginners and experienced traders. Explore NEE's price movements with VSTAR's risk-free demo account and capitalize on market opportunities efficiently.