Navan, formerly TripActions, has rapidly grown market attention in the fintech industry, especially in the corporate travel and expense management sector. The company is robustly demonstrating its footprint in adaptability and innovation. In February 2023, Navan showed a significant transformation, rebranding from TripActions to Navan and integrating OpenAI technologies into its platforms. In this move, the company consolidated its services into one accessible application, streamlining business applications and advancing its position as a crucial player in the sector.

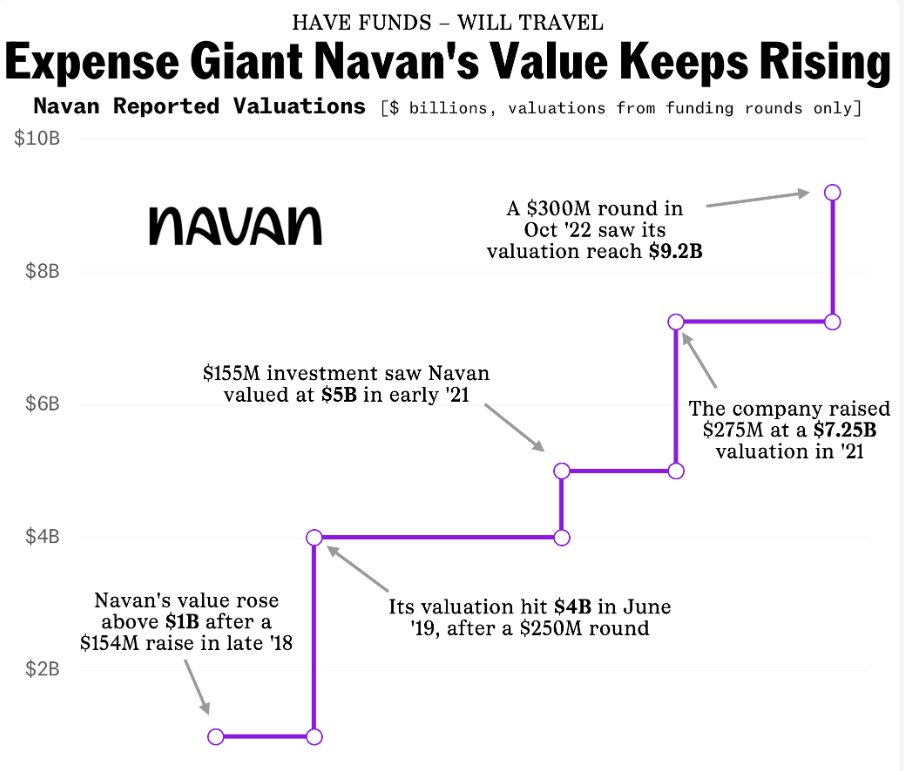

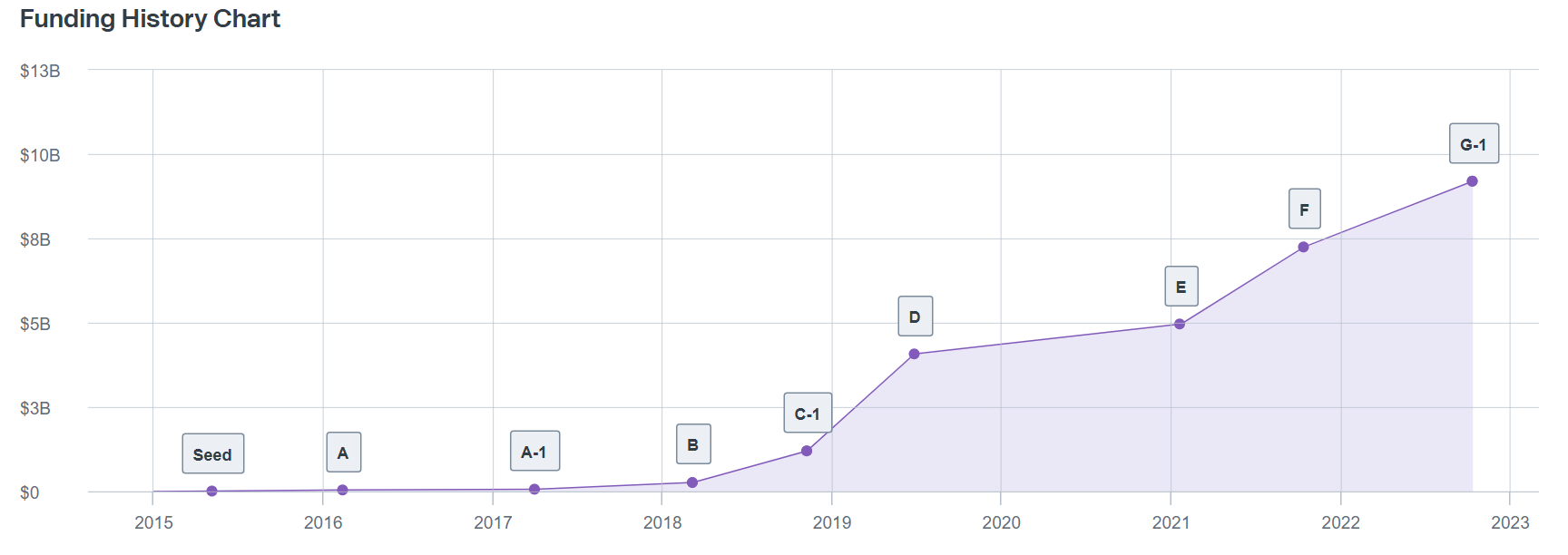

Navan's financial milestone underscores the company's increasing influence. The company secured $300M from the latest funding round in October 2022 from the G series funding round, reaching a valuation of $9.2B. However, the valuation declined to $5B by April 2024, declaring pre-IPO fluctuating dynamics. Despite these shifts, the company is preparing to go public or offer an IPO by April 2025, according to recent reports and suggestions.

Navan has already implemented some strategic initiatives by appointing a new Chief Financial Officer, Amy Butte, former NYSE executive, in June 2024 to strengthen its leadership team. It reflects the company's commitment to aligning market demand while going public and enhancing investors' confidence. Integrating data-driven and AI solutions helps the company achieve a competitive edge in the expanse and travel management industry. The potential IPO possibility and profitability drive the company to gain significant investors' attention, which groups with its market potential and innovative approach.

I. What is Navan

Navan is an end-to-end travel management platform that provides solutions to travel, expense, and corporate card management services around the globe.

The company usually provides services to corporate clients, including booking trip reservations, managing costs, tracking travel itineraries, booking cars, etc. The foundation period was 2015, when it was TripActions, and it was recently rebranded as Navan. Ariel Cohen and Ilan Twig are the company's founders, and the company is headquartered in Alo Alto, California. The company has revolutionized corporate travel by offering more user-friendly and efficient services for managing and booking business travel.

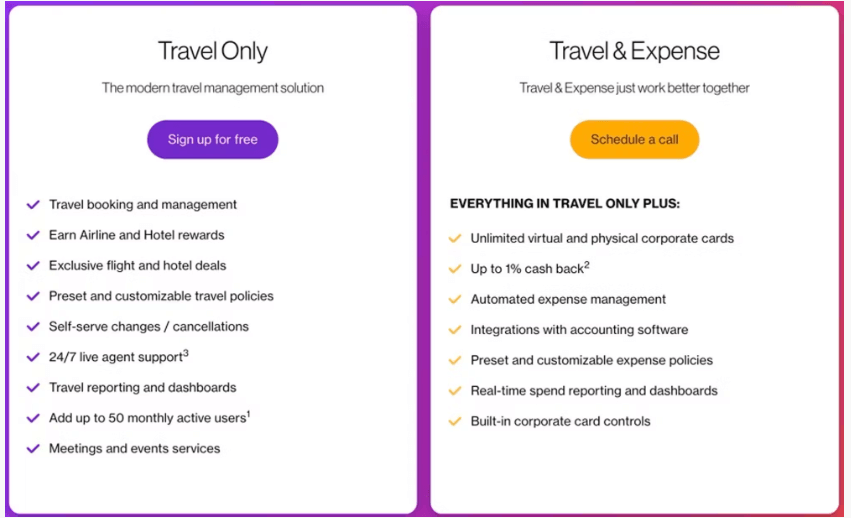

Navan offers a “Travel Only” package, which is free, and a “Travel and Expense” package, for which the fee is negotiable.

Navan leverages automation and artificial intelligence and has developed a highly efficient system to simplify business management for companies and their employees. The company offers services in two categories: expense management and travel. Note that the Navan Liquid corporate card and the Expanse management service drive the business to new heights. The company reported a 500% growth in 2021 regarding transaction value after launch. Navan followed an aggressive acquisition strategy to expand its operation in the international marketplace. The company acquired four travel management companies in India and Europe in a few years from 2021.

- Tripura – India

- Reed & Mackay – Spain

- Contravo – Germany

- Fresia – Scandinavia

Openings and expansions in 2023 included:

- May: New Tel Aviv office and expanded London office

- August: New Austin and Bangalore offices

- September: Expanded Sydney office

- October: New Paris and Amsterdam offices

- November: New San Francisco office

- December: New New York City office

Navan uses volume discounts when sources from third-party services such as Priceline, Booking.com and Expedia to provide the best source options depending on budget and company type. The company has automated expense management and a reward system allowing employees to oversee all corporate travel elements in a single platform.

The company customers can use business cards in terms of credit or add existing MasterCard or credit cards to track expenses, earn reward points and control purchases. According to the company website, the company currently has 2000+ employees and has worked with over 9000+ companies, including Lyft, Netflix, Adobe, and Databricks.

II. Navan Financials

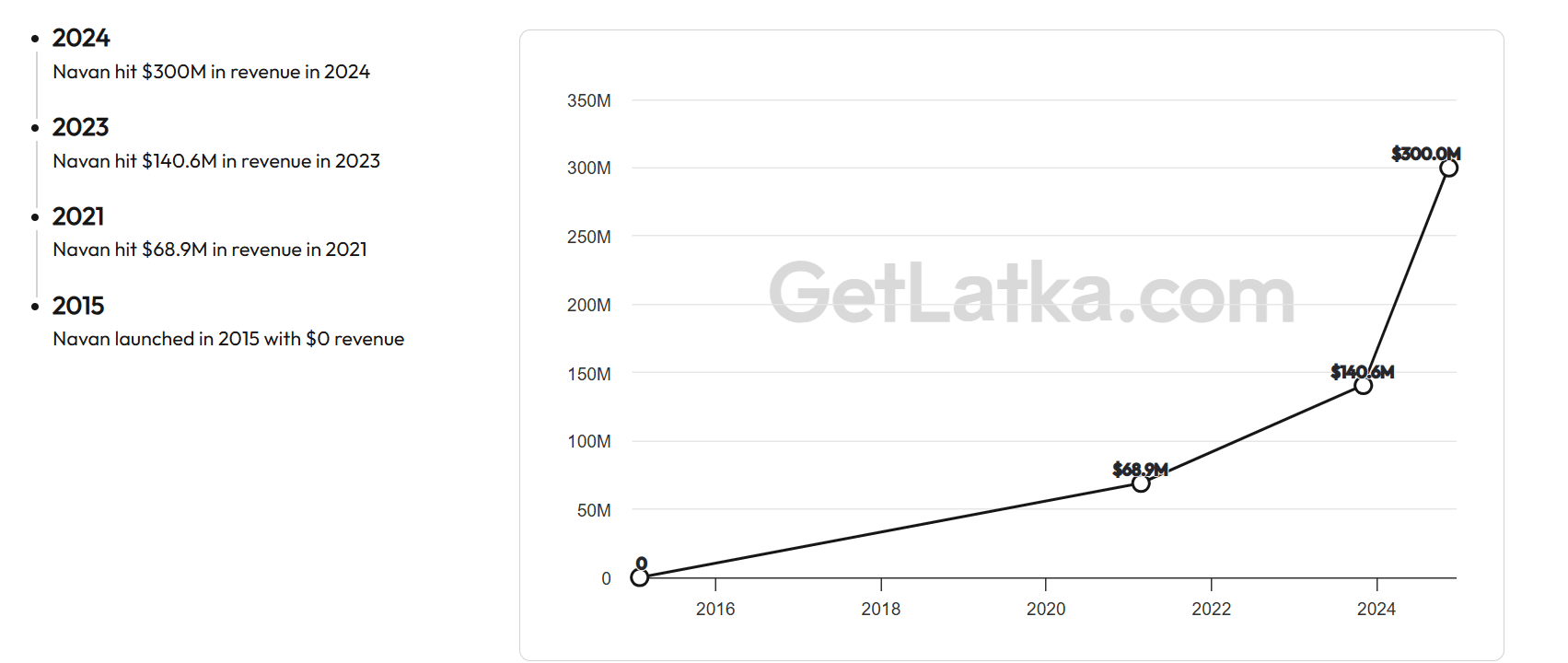

Navan Revenue Growth

Navan generates revenues from two main schemes: trip fees from travel booking and subscription licence fees for expense management software. The company generated $300m in revenue in 2024, more than twice the previous year 2023.

The revenue chart data confirms that the company is gradually improving, sparking investors' attention as the management body signals a potential IPO.

Navan currently serves more than 8,800 customers worldwide and focuses on providing strong enterprise services with exclusive partnerships with organizations like Citi. The partner company enables access to over 25,000 worldwide commercial card programs that represent an annual charge volume of $42B in the United States. The extended volume processed through Navan has increased by 3X in Q1 2023 compared to 2022.

Profitability and Margins

The estimated annual revenue reached $491M per employee, which is $196,000, indicating significant growth potential. Although the company hasn't reached the profitability milestone yet, the recent adjustments reflect elegant resource utilization and scaling. Navan achieved a valuation of $9.2B in 2023, boosted by 2.2B funding, and positioned itself among top global cloud companies. The company has gained 10th position in the Forbes to 100 cloud list.

The company is already implementing strategies, such as employment reductions, to increase profitability. In December 2023, it announced that it would lay off some efforts to achieve profitability. According to a recent report from tech analysis, Navan expects to achieve an annual revenue of $1B in 2024. As the company plans to go public soon, Cohen, the CEO, plans to improve key financial metrics like gross margin before going public.

III. Navan IPO: Opportunities & Risks

According to a Business Insider report, In September 2022, Navan filed for an IPO confidently. In a following report, they published that Ariel Cohen, the Navan CEO, may seek to take the company public in late April 2024 with plans to improve key financial metrics such as gross margin before going public. Since filing, the company has made significant moves, such as boosting notable acquisitions and rebranding from the previous name, “TripActions.”

Meanwhile, the company significantly suffered from the coronavirus pandemic, when travelling became nearly impossible globally.

The IPO market has suffered in recent years due to unstable economic conditions. The optimism has come up in recent months from some successful IPO of startup and technology companies. It is a positive sign that the IPO market is warming up and the potential environment for Navan IPO.

A. Profitability Potential & Growth Prospects

Navan rebranded from TripActions in February 2023 after integrating Open AI tools to provide more efficient services. A notable AI tool is AVA, a personal assistant tool that processes approximately 150,000 monthly charts. An AI-powered recipient scanning tool enables users to scan, capture, and print digital receipts via smartphones. These integrations and aggressive expansion have enabled the company to achieve remarkable growth.

Navan, the travel management company, enables tracking expenses and managing travel plans. The company has significant customers, including Toast, Yelp, Lyft, Axios, and Pinterest. The company is already competing with established players like Rydoo, Expensify, SAP Concur, and TravelPerk. The company is currently focusing on providing a user-friendly interface and innovation that gives it a competitive edge over other players in the industry.

Navan has acquired several companies between 2021-2022, such as Reed & Mackay, Comtravo, and Resia, as a part of its expansion program. These all indicate positive forces on the company's growth.

Key Growth Potentials

- Total Addressable Market (TAM): The global travel market is anticipated to reach $1,657B by 2027 at a CAGR of 4.1% from 2022 to 2027. This reflects companies like Navan have the potential to capture the positive flow as it focuses on being a key player in the industry.

- Serviceable Available Market (SAM):In the entire business travel market, Navan targets the managed travel segment. The company poses around 35-40% of total business travel spend. In terms of TAM applying this percentage, SAM could hit an estimated $580-660B.

- Serviceable Obtainable Market (SOM): Navan is a fast-growing company in the competitive space currently small but is increasing gradually. Suppose the company can achieve 1-2% of SAM. Meanwhile, SOM could reach an estimated $5.8-13.2B. These estimations are based on the current market growth and traction.

B. Weaknesses & Risks

- Competitive Environment and Market Risks:Navan currency faces competitive pressure from competitors like SAP Concur and startups like Divvy and Ramp. Competitors can replicate Navan's offers or enable discounts to gain market traction and be obstacles to capturing market growth. Additionally, the travel business may tend to recover from the COVID pandemic, and remote work and cutting budget can negatively impact the industry growth.

- Financial and Regulatory Risks: Navan is expanding, so it requires subsequent cash-burning to provide seamless operation. The company has pressure to maintain a $7.25B valuation, which could overshadow profitability and put weight on sustainable growth. The company is opening a business in different regions around the globe, so regulatory risks on geopolitical issues can impact Navan's growth negatively.

- Operational Complexities: The company has to manage a robust infrastructure of operations. The company has the deal with operating in a robust structure, and a complex operational environment can put pressure on slowing the operation. A decreased service rate can negatively impact the company's growth.

IV. Navan IPO Details

A. Navan IPO Date

There is no exact official IPO date published yet for Navan IPO, but many sources confirm the company has plans to go public in April 2025. The managing body recently recruited Amy Butte, former CFO of the New York Stock Exchange, to obtain a stronger team for IPO success.

The IPO market has experienced a slowdown and fluctuations, but several influencing factors suggest that the IPO can take place as soon as April 2025.

B. Navan Valuation

Navan has raised $2.2 as of April 2023. The company valuation reached $9.2B in October 2022, after round G funding accumulated $300M.

The company is progressing rapidly as the valuation follows Navan was valued at $1B in 2018, $4B in 2019, and $7.3B by December 2021. This reflects notable growth and the potentiality that the company may progress further.

Major Funding Rounds & Total Funding

According to Business Insider, the recent valuation of Navan is nearly $12B, and Crunchbase data reports the raise of $1B in equity funding and $1.2 billion in debt financing from seven rounds of funding.

|

Date |

Funding Series |

Funding Amount |

Investors |

|

10/12/2022 |

Series G-1 |

$77MM |

Addition Ventures, Andreessen Horowitz, Base Partners, Elad Gil, Greenoaks Capital, Lightspeed Venture Partners, Premji Invest, Zeev Ventures |

|

10/12/2022 |

Series G |

$77MM |

Addition Ventures, Andreessen Horowitz, Base Partners, Elad Gil, Greenoaks Capital, Lightspeed Venture Partners, Premji Invest, Zeev Ventures |

|

10/13/2021 |

Series F |

$275MM |

Andreessen Horowitz, Base Partners, Elad Gil, Greenoaks Cap |

|

01/21/2021 |

Series E |

$362MM |

Addition, Andreessen Horowitz, Greenoaks Capital, Lightspeed |

|

06/27/2019 |

Series D |

$279.92MM |

Andreessen Horowitz, Lightspeed Venture Partners, Sgvc, Zeev Ventures |

|

11/08/2018 |

Series C-1 |

$10MM |

Andreessen Horowitz, Lightspeed Venture Partners, Sgvc, Zeev Ventures |

|

11/08/2018 |

Series C |

$152.45MM |

Andreessen Horowitz, Lightspeed Venture Partners, Sgvc, Zeev Ventures |

|

03/07/2018 |

Series B |

$51.3MM |

Lightspeed Venture Partners, Zeev Ventures |

|

04/01/2017 |

Series A-1 |

$12.5MM |

Lightspeed Venture Partners, Sgvc, Zeev Ventures |

|

02/12/2016 |

Series A |

$10.12MM |

Lightspeed Venture Partners, Sgvc |

|

05/07/2015 |

Series Seed |

$4.18MM |

Lightspeed Venture Partners, Sgvc, Zeev Ventures |

C. Share Structure & Analyst Opinions

The exact estimated share price or structure hasn't been officially published yet. Note that the share price and amount should be equivalent to the valuation of the IPO period, which currently stands at $12B.

Successful funding rounds and key financial metrics like revenue growth, profitability, innovation, and rapid expansion suggest Navan may post a successful IPO very soon.

V. How to Invest in Navan IPO & Navan Stock

Where to Buy Navan IPO Shares

To invest in Navan IPO, investors should stay updated on official announcements regarding preferred platforms. Speculation suggests that Goldman Sachs may collaborate with Navan to facilitate its IPO process. Once the declaration is made, investors need to open an account on the supported platform, likely a broker, bank, or financial institution. After signing up, account validation with personal information is required to access all features. Following this, investors can deposit funds to purchase shares and invest in Navan IPO.

Navan IPO Trading Strategies

Once Navan goes public, investors can consider strategies to optimize returns:

- Momentum Trading: Take advantage of early market enthusiasm surrounding Navan's leadership in the corporate travel and expense space by monitoring initial price movements for short-term profit opportunities.

- Short-Term Trading: Day traders or swing traders can exploit price fluctuations during the initial trading days, capitalizing on volatility before the stock stabilizes.

- Long-Term Investment: Navan's strong market position, innovative platform, and potential for global expansion make it an attractive long-term investment, especially as the demand for streamlined travel and expense solutions continues to grow.

Alternative Ways to Trade Navan Stock

- ETFs: Invest in ETFs focusing on fintech or travel technology for diversified exposure to Navan's sector.

- Options Trading: Use options to manage volatility or secure strategic entry points post-IPO.

- CFD Trading: Trade Navan stock price without ownership through CFDs on platforms like VSTAR, offering flexible market positioning.

Align strategies with financial goals and stay informed on Navan's progress and industry trends for optimal decision-making.