Data Center GPU Business Performance is Striking, and the Future of AI Infrastructure is Promising

Last week, NVIDIA released its Q2 earnings results, and the data significantly exceeded expectations: revenue was $13.5 billion, up 101% year-over-year, far exceeding the company's expectations and the market's expectations; net profit margin reached 49.9%, a new record high; the data center business is growing strongly, with revenue up 171% year-over-year to $10.3 billion, becoming the main driver of earnings growth this quarter.

Growth in the data center business was fueled by increasing demand for artificial intelligence from large cloud computing companies and consumer Internet companies. Strong demand for NVIDIA's data center GPUs is expected to continue, particularly in the U.S. market, as data centers around the world transition from general-purpose computing to AI-accelerated computing.

NVIDIA's gaming business also returned to growth, growing 11% sequentially. It benefited primarily from the recovery in the PC market and increased demand for GeForce RTX 40-series GPUs. However, growth in the automotive business slowed to 15% due to the impact of lower overall automotive demand.

NVIDIA's third-quarter revenue guidance continues to exceed expectations, with year-over-year growth of approximately 170% to $16 billion, well ahead of market expectations. Tensions in the supply chain are expected to ease as TSMC expands production.

Overall, NVIDIA's performance was strong, with expected growth driven primarily by the opportunities presented by the transformation of data centers to AI-accelerated computing. The demand for AI is expected to continue, and NVIDIA is expected to benefit.

NVDA's EPS Soars on Buybacks

NVIDIA stock has soared 220% since 2023, and as of last Wednesday, NVIDIA stock was trading at 45 times 12-month forward earnings estimates, compared with 19 times for the S&P 500, according to Refinitiv Datastream.

With a stellar earnings performance and a bright stock price, NVIDIA has a lot of cash on hand and announced a $25 billion share buyback after this quarter, making it the fifth-largest buyback among U.S. companies this year. Several other giant tech and growth companies have also announced larger buybacks this year: $90 billion from Apple, $70 billion from Google parent Alphabet, and $40 billion from Meta.

Stock buybacks are a practice in which a company uses its own funds to purchase shares it has already issued. By repurchasing shares, a company can reduce the number of its outstanding shares, resulting in a more concentrated distribution of ownership per share. Repurchasing stock reduces the number of shares outstanding, which means that the company's future earnings will be distributed to fewer shareholders. If the company's profits remain the same or increase, the profits distributed to fewer shareholders will result in higher earnings per share (EPS).

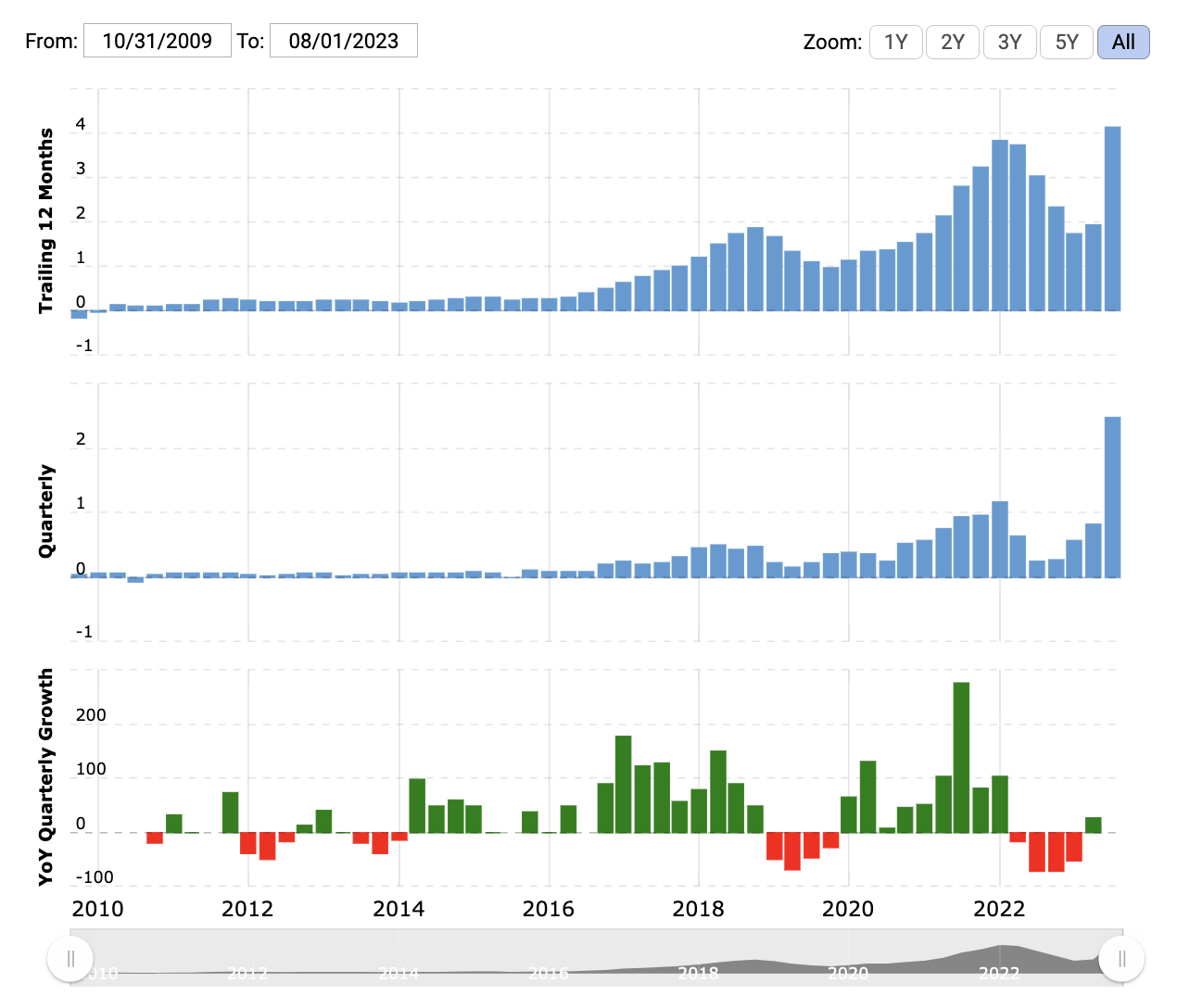

Chart: nvidia earnings per share (EPS) Performance

Source: macrotrends

For the quarter ended July 31, 2023, NVIDIA reported earnings per share of $2.48, up 853.85% year-over-year. For the 12 months ended July 31, 2023, NVIDIA's EPS was $4.14, up 35.74% year-over-year. Nvidia's EPS for 2022 was $3.85, up 122.54% from 2021. Nvidia's EPS for 2021 was $1.73, up 53.1% from 2020. The buyback represents just 2.1% of NVIDIA's $1.2 trillion market cap, well below the broader market's historical buyback yield of 2.58%, but as a hot growth tech company, cash buybacks in lieu of dividends are the only way to get more money to invest in growth.

Whether or not buybacks actually boost earnings per share, however, depends on other factors:

- Changes in earnings: If a company's profits decline, earnings per share may not increase even if the number of shares decreases.

- Changes in share price: Share repurchases can affect a company's share price. If a share buyback results in an increase in the share price, shareholders holding the shares may benefit from capital gains, but this will not directly affect earnings per share.

- Debt impact: If a company increases its debt to repurchase shares, the interest expense may reduce the company's net income, which could affect earnings per share.

- Equity Dilution: If a company finances a buyback by issuing new shares, the newly issued shares may dilute the equity of existing shareholders, negatively impacting earnings per share.

In summary, share repurchases can be accretive to earnings per share, but this depends on many factors, including the company's earnings performance, share price movements, debt levels, and the exact manner in which the shares are repurchased.

If the performance of the financial markets is difficult to understand, we can break down and analyze NVIDIA's vision to find out exactly where its industry ceiling is.

Unveils several innovative technologies to rewrite the industry ceiling

At SIGGRAPH 2023, NVIDIA announced several new graphics technologies and products. These innovations will revolutionize the metaverse, self-driving cars, robotics, and more.

First up was the next-generation GH200 AI chip, which uses innovative packaging technology to connect multiple GPUs to deliver 8 petaflops of peak performance based on a dual-core configuration. Equipped with a new-generation HBM3e memory with a 50% increase in bandwidth, it can dramatically accelerate training to handle complex, large-scale generative AI models. It can be seen that the chip has a strong advantage in computing power, which is significant for promoting the development of AI technology. In addition, NVIDIA also released a number of new GPU graphics card products with strong performance, including the flagship RTX 6000, which has a high number of CUDA cores of up to 18,176 and a memory bandwidth of 960GB/s. These new cards are expected to significantly improve the efficiency of digital content creation. In particular, the demand for 800G and even 1.6T optical modules will explode.

NVIDIA also released new development tools and platforms such as AI Workbench, which simplifies the process of developing and deploying AI systems by connecting to various cloud computing resources. Developers can easily access powerful computing resources such as GPU server clusters and quickly train various types of deep learning models using tools such as Jupyter Notebook. At the same time, NVIDIA has also introduced products such as AI Enterprise 4.0, which provides comprehensive support for enterprise-level users from data preparation and model development to large-scale deployment. Visible NVIDIA in the construction of software platforms also carried out a comprehensive layout.Workbench is significant, NVIDIA jumped out of the market to do their own AIGC cloud computing, and own customers to form a competitive relationship can only mean that the market for AIGC cloud services is really too big.

In terms of virtualization technology, NVIDIA's 3D collaboration platform, Omniverse, has undergone a major upgrade, adding OpenUSD support to enable seamless connectivity and interoperability of different 3D content creation software. Based on advanced language modeling technologies such as GPT, Omniverse also automatically generates code for virtual scenes, dramatically simplifying the construction of digital environments. In addition, NVIDIA has released new cloud APIs and other features that further enhance the development efficiency of virtual spaces. It can be seen that these upgrades will significantly reduce the threshold of meta-universe environment development. the significance of OpenUSD is expected to unify the meta-universe tools and software of the warring countries, in modeling, animation, materials, binding, rendering, and other aspects of the unified format to improve the ability to collaborate, and to provide a basis for the creation of meta-universes for ChatUSD (AIGC generates OpenUSD files).

This update of NVIDIA's series of products is proof of its strong strength and strong accumulation in artificial intelligence and digital world technology. Such a multifaceted technological output will certainly vigorously promote the rapid development of AI and the meta-universe. Here, NVIDIA plays the role of helmsman and leader, and its advanced independent research and development capability guarantees the leadership of its products. It is foreseeable that under the leadership of NVIDIA, AI and digital world technology will certainly make new breakthroughs and progress.

In summary, this NVIDIA SIGGRAPH conference can be said to be a multi-pronged approach to hardware, software, and platform, realizing a full range of technology upgrades. This fully demonstrates NVIDIA's strength and ability to integrate resources in the field of artificial intelligence computing and other cutting-edge technologies. At the dawn of the metaverse era, NVIDIA is preparing for the future with various innovations. Its leadership position in AI is already as strong as ever, and we have every reason to believe that NVIDIA will continue to lead the industry in a higher direction.