I. Recent Costco Stock Performance

Costco Business Expansion In 2025

As per the latest management data, Costco is likely to open new warehouses in 2025, bolstering sales.

Let's see the list of new possible stores that are likely to open in 2025:

- Brentwood, California

- Genesee County, Michigan

- Highland, California

- Prosper, Texas (March 14)

- Sharon, Mass. (March 1)

- Weatherford, Texas (March 15)

Moreover, the growing e-commerce operations could be another optimistic outlook for this stock. In particular, the conversion rate, ecommerce traffic, and other values signal a positive sales outlook.

Moreover, Costco's logistic operations are positive for e-commerce sections. In fiscal Q1, the company has already delivered nearly 1 million items through its logistic segment. The ongoing sales, global expansion, higher membership fees, and e-commerce growth could be a positive sign for this stock in 2025.

Growth Perspectives of Costco and Its Services At a Glance

Costco Wholesale Corporation is one of the leading membership warehouse chains that serve over 1.28 million cardholders across nine countries and provides access to over 870 locations. The company is popular for its significant discount offerings, and the retailer offers a broader range of goods and services to its customers, including groceries, electronics, clothing, and home essentials, alongside services like optical care, tire rotations, and travel bookings.

Costco membership is essential for in-store shopping, costing $65 for a Business and Gold Star membership. In contrast, the Exclusive Membership costs $130 with enhanced offerings such as 2% annual cashback for qualified purchases. Membership with Costco also enables members to enjoy extended warranties on appliances, discount prices on home and auto insurance, gasoline, and a competitive price in the pharmacy program. Costco Anywhere Visa card provides members with savings on cash back on dining, gas, and Costco purchases.

Costco's travel services allow customers to book vacation packages, car rentals, and cruises, whereas its auto program offers discounts on vehicles and related services such as tire installation. Costco's membership cost is somehow higher than that of BJ's and Sam's Club, while it compensates by offering broader enhanced services and attractive benefits to its consumers.

Costco Wholesale Corporation's growth chart reveals historically gradual progress and attractive performances, drawing investors' attention.

Expert Insights on Costco Stock Forecast for 2025, 2030, and Beyond

The data shows Costco's stock price gradually increasing and reaching the $1000 mark in December 2024. This makes investors cautious of trend indications as the price retraces and consolidates due to distribution and seeking accumulation to a successful breakout. The price is currently moving just below the ATH, and fundamental issues in the United States are being faced as the recent election occurred.

Before proceeding further, let's check on expert opinions on Costco's Stock price for 2025, 2030, and beyond.

|

Provider |

2025 |

2030 and Beyond |

|

Coin Codex |

$ 1,102.20 |

$ 3,175.98 |

|

Coinpriceforecast |

$1,064 |

$1,977 |

|

Tradersunion |

$1,276.33 |

$1,368.78 |

|

Stockscan |

$1,099.92 |

$1,559.73 |

II. Costco Stock Price Prediction 2025

Costco's stock price hit ATH recently near 1,007.80 and declined after reaching that level. As many analysts anticipate, the asset price is increasing gradually over the whole year and might hit a new ATH near 1200 by the end of 2025.

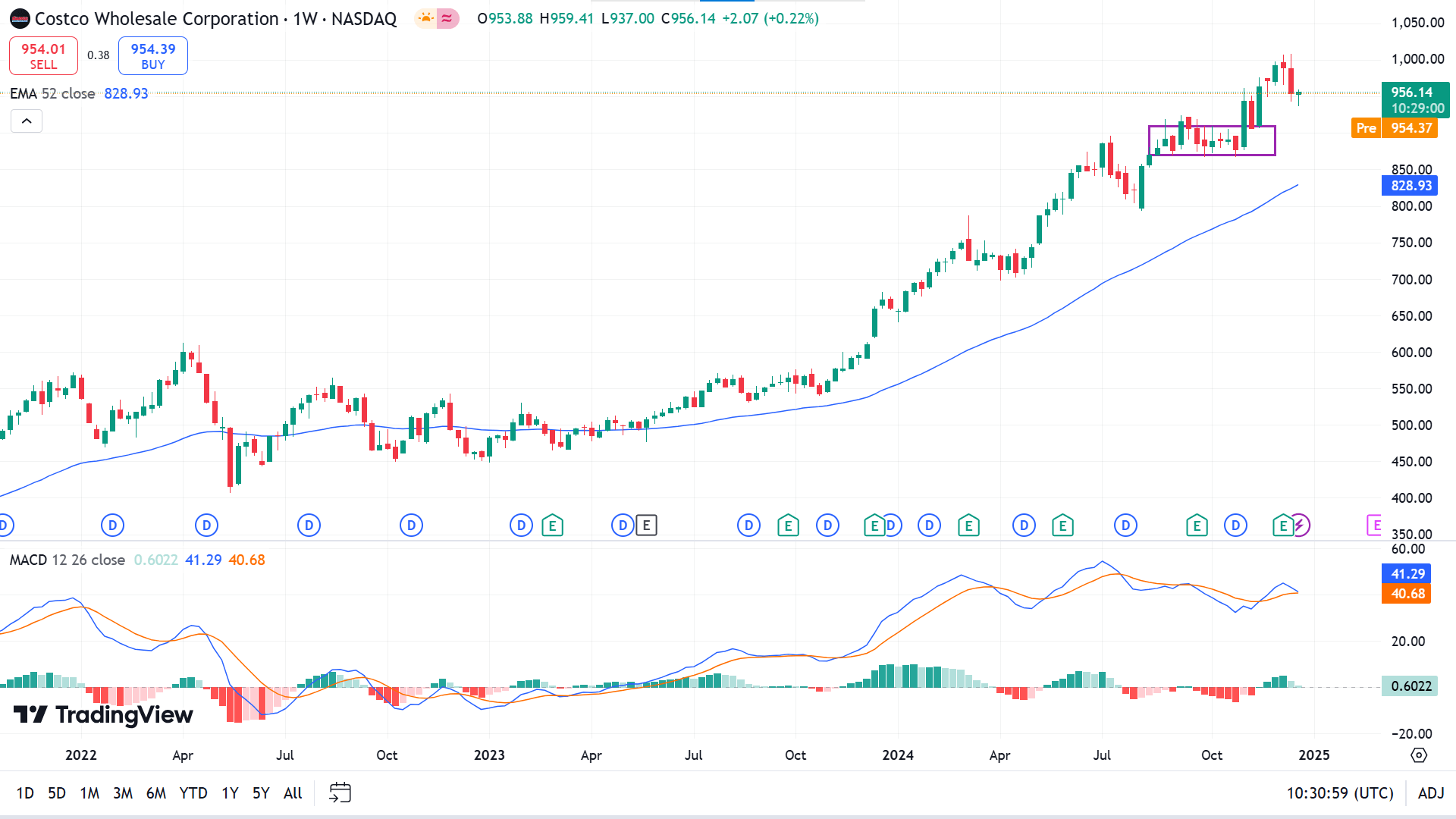

The weekly chart confirms that Costco remains bullish as the price floats above the EMA 52 line since Q2, signaling sustainable growth. The price had remained in a range between 922.63 and 871.29 from mid-August to October, and a successful breakout occurred that turned the price above the 1000 mark. The MACD reading is still bullish as the dynamic line creates a bullish crossover, and green histogram bars appear above the midline of the indicator window, suggesting sufficient bullish pressure.

The 1000 level is psychological, so the asset may face profit-taking or distribution, causing the price to have a retracement to gather bullish pressure to beat the ATH of 1007.80 and reach the primary resistance near 1,064.65. A breakout might trigger further upside near the 1200 level.

Meanwhile, on the downside, as the price remained on an uptrend for a longer period, a retracement is acceptable near the ATH of 1007.80. So, the primary support is near 910.94, following the next support near 828.93.

A. Other Costco Stock Price Forecast 2025 Insights

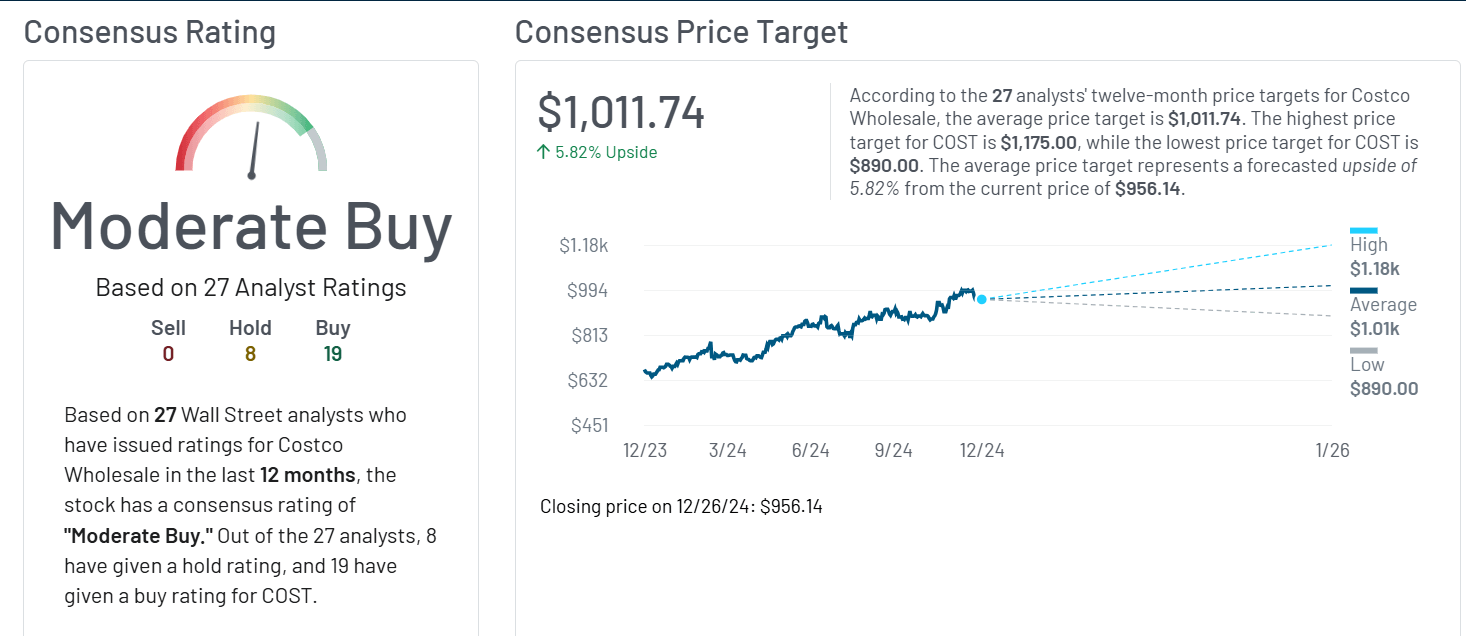

According to Tipranks, twenty-five Wall Street analysts provided price targets and ratings for Costco's stock price based on various key factors in the previous three-month period. Seventeen among them suggested the stock is a “buy” asset, eight of them maintain a “hold” rating, and none of them meant to “sell.” In the meantime, the anticipated maximum Costco price target for the next twelve months is 1,195, while the lowest they predict is 900, and the average price can be 1066.

Another popular platform, Marketbeat, published a report on Costco stock for the upcoming year, maintaining ratings and price targets. Twenty-seven analysts provided ratings on Costco's stock performance depending on various affecting factors. Nineteen of them maintain a “buy” rating, and eight of them reckon the stock as a “hold” asset, while there are no “sell” suggestions.

B. Key Factors to Watch for Costco Stock Forecast 2025

Earnings And Revenue Growth Perspective

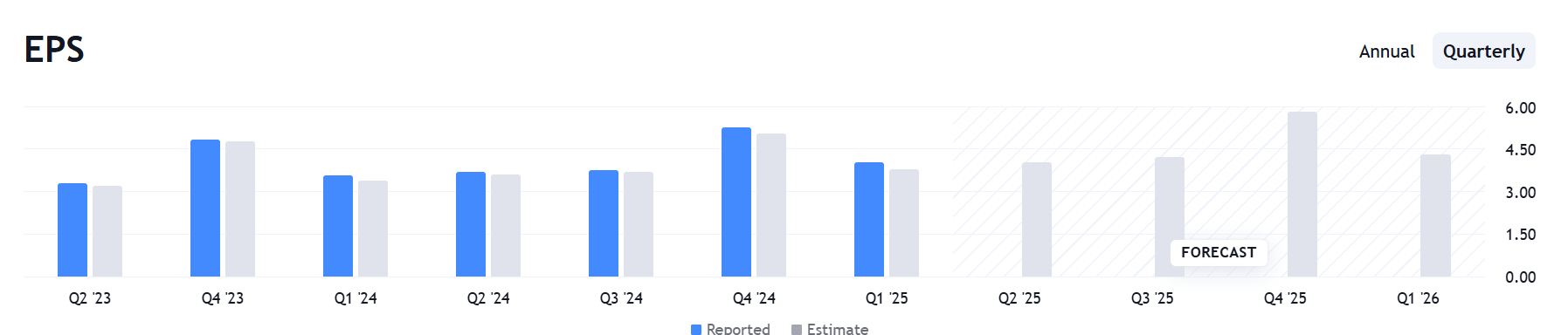

Recent earnings and revenue data show that the company is progressing gradually and may maintain progress in the upcoming years. In November 2024, revenue came to $258.80 B, while earnings came to $7.57B, which is attractive compared to November 2023, when the figure was $245.65B and $6.51B, respectively. These data reflect a significant growth over one year.

According to analysts' projections, earnings per share (EPS) for Costco might come at $17.75 for the fiscal year 2025, which is approx. 10.2% higher than the previous year.

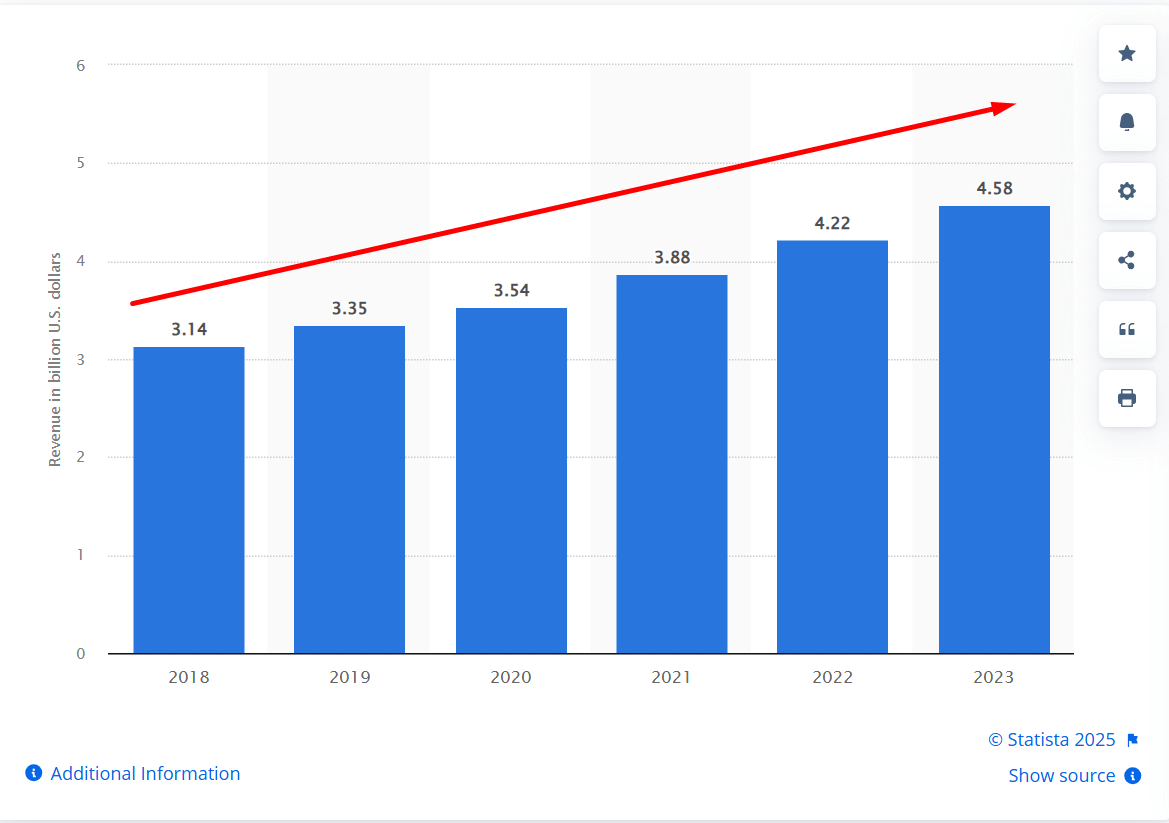

COST Sales Data Shows A Solid Growth

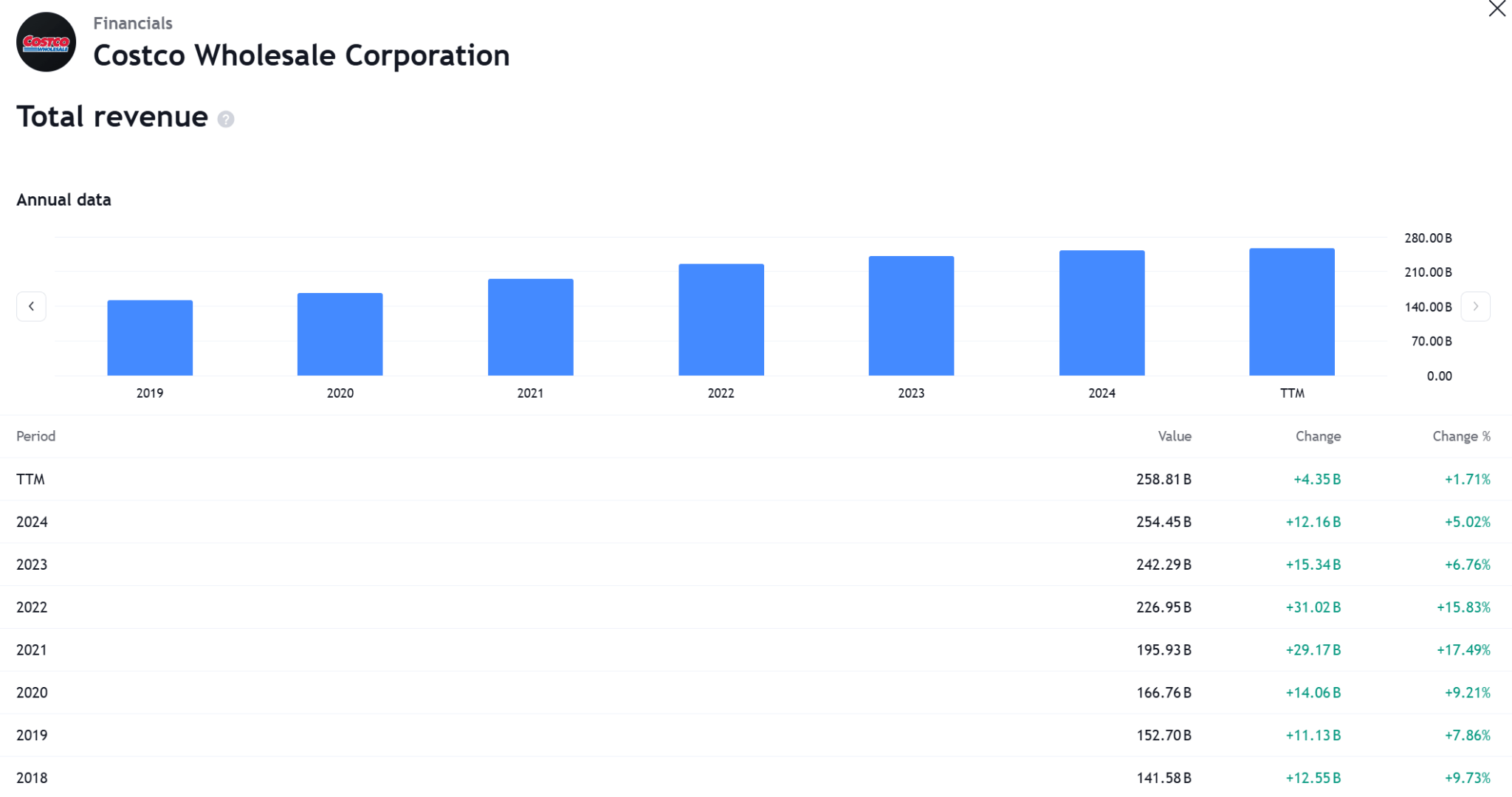

Another key indicator for warehouse retail sales companies is observing sales data. Since 2010, the company has maintained a growth in revenue, signaling a stable business.

The average revenue growth for the last 5 years is 9.34%, which signals a stable yearly growth. Following the stability and ongoing store expansion around the world could be a potential investment opportunity in 2025.

COST Stock Forecast 2025 - Bullish Factors

- Consistent revenue and earnings growth: Recent revenue and earning growth data reflect a robust growth perspective for Costco. Consistent growth indicates sustainable long-term growth for the company.

- Innovative service and product offerings: Costco has innovative services and strategic partnerships such as Bike+ offerings and collaboration with Peloton give booster to providing elegant services to customers.

- Expansion plan: Costco has notable expansion plans, including opening twenty-nine warehouses across the globe in 2025, reflecting broader geographic reach and consumer acceptance.

Costco Stock Price Prediction 2025 - Bearish Factors

- Increasing competition: Despite a remarkable market presence, the company faces competition with several established retail giants like Walmart and Amazon. Increasing the market share of competitors in the retail and e-commerce sectors may negatively impact Costco's future growth and market share.

- Valuation concern and economic uncertainty: The stock price is already 53 times higher than the estimated earnings, which is remarkably upward than both industry peers and historical averages. These may drive mid-term price correction. Meanwhile, another challenging factor for the company is sustaining its growth in economic uncertainty, such as prolonged inflation, rate hikes, etc.

III. Costco Stock Price Prediction 2030 and Beyond

Observing the price performance and many other technical factors, experts anticipate that the price might hit an average of $2000 by the end of 2030.

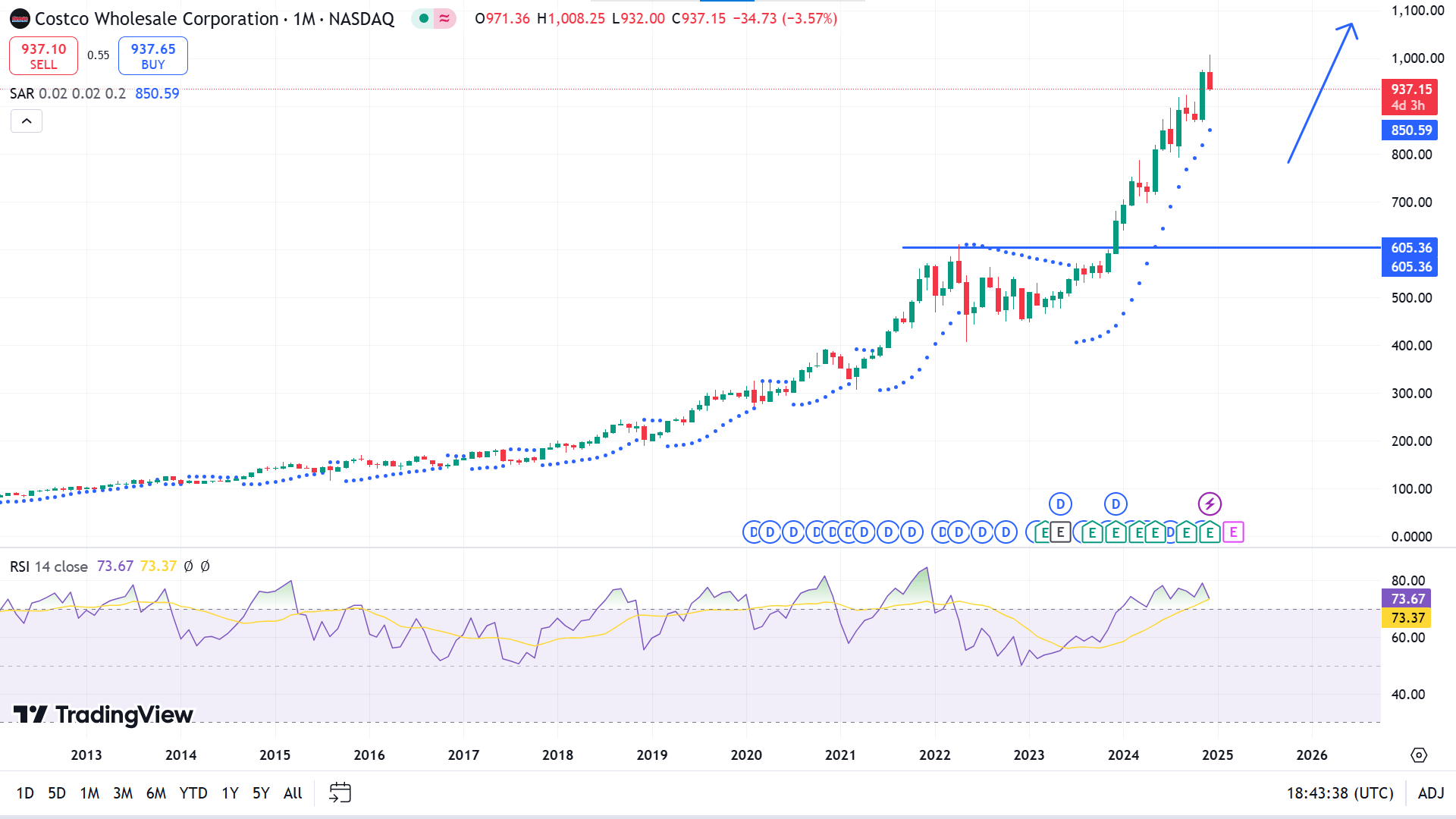

On the monthly chart, the price has remained on a solid uptrend after consolidating below $605.36, as the Parabolic SAR continues creating dots below price candles. Costco's stock price has gradually increased over decades, which faced sideways in the monthly chart from Q4 2021 to Q4 2023, then reached ATH of $1,007.80 in December 2024.

Meanwhile, the RSI dynamic line above the indicator window's upper line reflects that the asset price remains overbought. So, a retracement is anticipated as the RSI dynamic line edges down above the upper line, declaring sellers may gain weight on the asset price.

According to the broader market contexts, primary support is near $900, which can be an adequate buy zone toward the ATH or beyond toward the anticipated $2000.

Meanwhile, on the negative side, a breakout below $900 with a consolidation could drive the price toward the next support near $605.36.

A. Other Costco Stock Forecast 2030 and Beyond Insights

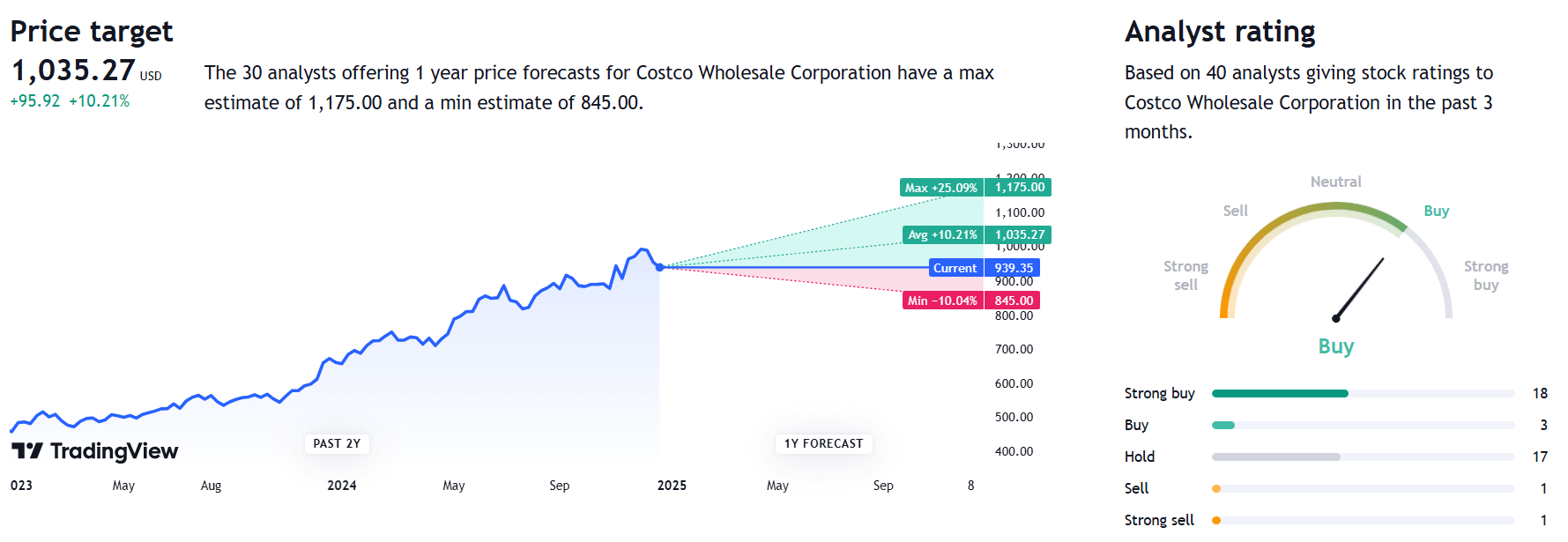

A group of analysts gave their ratings and price predictions for Costco's stock for the upcoming year in Tradingview. Forty analysts gave their ratings, eighteen of which gave “strong buy ratings,” three of which suggested “buy,” and seventeen of which maintained “hold” ratings. In contrast, one suggested “sell,” and another maintained “strong sell” ratings.

Thirty professionals set price targets for Costco stock for the upcoming years. They anticipate the price might hit a maximum of $1,175.00, an average of $1,035.27, and the lowest the asset can hit is $845.00.

Another popular platform, Coincodex, published an analysis report on Costco's Stock price. Experts anticipate the price can hit a maximum of $3,235.97 by the end of 2030, when the average and minimum prices would be $3,025.11 and $2,806.83, respectively.

B. Key Factors to Watch for Costco Stock Price Forecast 2030 and Beyond

International Market Expansion and Membership Growth

Costco's strategic growth and expansion in the international marketplace define potential robust future performance and generate notable revenue. The company has plans to open outlets in countries like Japan and aims to double its outlets to sixty by 2030, besides China and Europe.

This significant expansion may drive the company to achieve sustainable revenue growth and boost sales in various locations around the globe. Meanwhile, Costco depends on membership fees to generate revenue growth. The company expects to have around 170-200 million members by 2030, which will impact the company's revenue positively, besides reflecting consumer loyalty and notable adoption.

Therefore, investors should watch the expansion and membership growth closely as it can be a key driver to achieving the projected $1 trillion revenue by the end of 2030.

E-commerce Growth and Cash Flow Analysis

Costco has focused on increasing e-commerce growth besides opening physical stores. Recently, the company reported a sales increase of 19.3% YoY in digital commerce between Jan 2022 and Oct 2024, reflecting notable investments in e-commerce to provide services from remote locations.

Costco's free cash flow came to $5.01B when earnings reached $7.58B, indicating significant growth compared to similar companies.

Costco Stock Price Prediction 2030 and Beyond - Bullish Factors

- Rapid Market Expansion: The aggressive expansion of Costco in markets like India and China could boost significant revenue growth by the end of 2030. In the meantime, international sales can generate 30-35% of the total revenue, reduce dependency on the domestic market and diversify the portfolio.

- Private Level Growth: The increasing popularity of Kirkland Signature drives Costo to have a competitive edge and higher margins. Private-level sales can generate 35–40% of total revenue by 2030, enlightening customer loyalty and protecting the company from price pressure from competitors.

- Enhancing E-commerce Platform: The company has made a notable investment in e-commerce, providing faster delivery and a user-friendly platform to capture significant digital sales market share. Costco expects digital commerce to contribute 15–20% of its revenue by the end of 2030.

Costco Stock Predictions 2030 and Beyond - Bearish Factors

- Membership Fee Dependency: Costco relies significantly on membership fees to generate significant revenue. Although membership fees are a sustainable income source, highly depending on the sector, they may pose risks in future growth cause the renewal rate can decrease due to several factors like competitors' challenges or changing customer habits, which can negatively impact the company's future development.

- Slow Technological Innovation and Regulatory Challenge: The company is still in the process of providing notable digital services compared to tech-savvy giants in the sector. So, Costo must overcome the slow innovation to match the market demand or get a competitive edge. Meanwhile, the regulatory challenge is another factor that could negatively impact Costco's future growth.

IV. Conclusion

A. COST Stock Outlook

Costco Wholesale Corporation (COST) has posted significant gains for decades, and the stock price has reached a record peak. Several factors, such as notable business models and consistent financial performance, influenced this massive upward movement.

The earning growth analysis for the previous five years shows the company achieved 14.2% growth, similar to the industry growth. The company posted 16.3% growth in the last year, outperforming the industry growth of 10.5%.

The stock price has already hit $1000, which is anticipated to hit nearly $2000 by 2030, a 100% growth over six years. The company has strategic initiatives such as enhanced e-commerce and aggressive expansion. However, investors should closely observe and continue research as competitive dynamics and market conditions can influence future performance.

B. Trade COST Stock CFD with VSTAR

Trading CFDs unlocks the potential to profit from rising and falling markets, making it an attractive option for those exploring Costco stock. A trusted platform like VSTAR elevates this experience, offering reliability and advanced features.

With robust multi-tiered regulatory safeguards, VSTAR ensures maximum fund security while delivering exceptional trading conditions. The platform's seamless mobile accessibility, lightning-fast execution speeds, dedicated customer support, and diverse asset offerings create an ideal environment for investing in Costco. With Costco's consistent market performance, VSTAR provides a sophisticated solution for dynamic trading and long-term investment opportunities.