- Refinery inputs and production surged, indicating heightened activity and potential rise in demand for petroleum products.

- Crude oil imports rose significantly, signaling efforts to meet increasing demand.

- Motor gasoline and distillate fuel inventories tightened, potentially driving prices upward.

- Total products supplied decreased slightly, suggesting either lower consumption or efficiency improvements in petroleum product usage.

The analysis delves deep into the weekly EIA numbers, dissecting the trends and teasing out the implications for CFD prices. From the surge in refinery inputs to the subtle shifts in consumption patterns, the analysis focuses on the direction of crude oil prices.

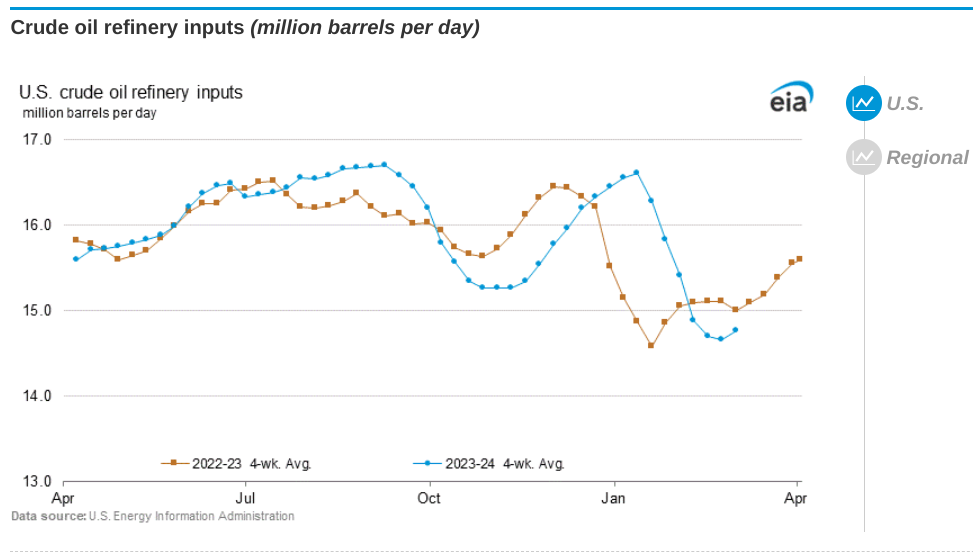

Refinery Inputs and Production

The EIA data indicates an increase in refinery inputs, with U.S. crude oil refinery inputs averaging 15.3 million barrels per day during the week ending March 1, 2024. This represents a 595 thousand barrels per day increase from the previous week's average. The increase in refinery inputs suggests heightened activity in the refining sector. Gasoline production also saw an increase, averaging 9.6 million barrels per day, along with distillate fuel production, which averaged 4.3 million barrels per day. These increments in production point towards a potential rise in demand for petroleum products, including gasoline and distillate fuels.

Source: eia.gov

Crude Oil Imports

U.S. crude oil imports averaged 7.2 million barrels per day last week, marking an increase of 837 thousand barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.7 million barrels per day, reflecting a 6.8% increase compared to the same period last year. The surge in crude oil imports suggests an attempt to meet the rising demand for crude oil products. Higher imports often signal a need to supplement domestic production to maintain adequate supply levels.

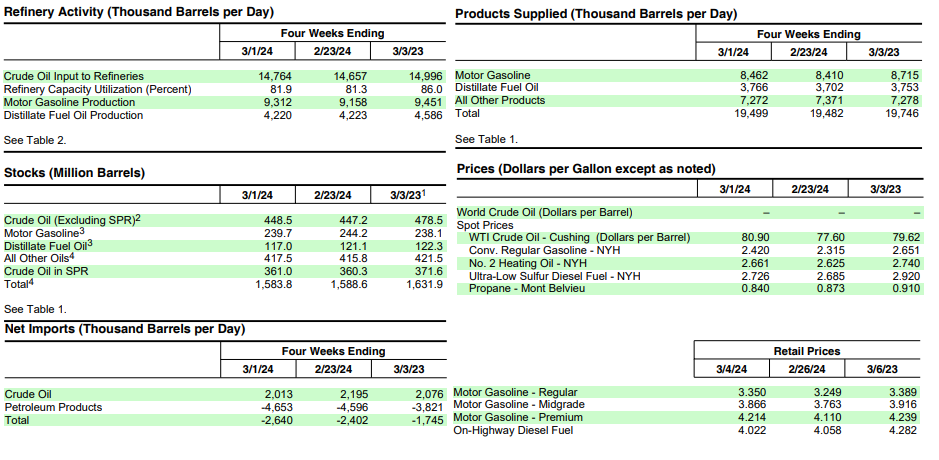

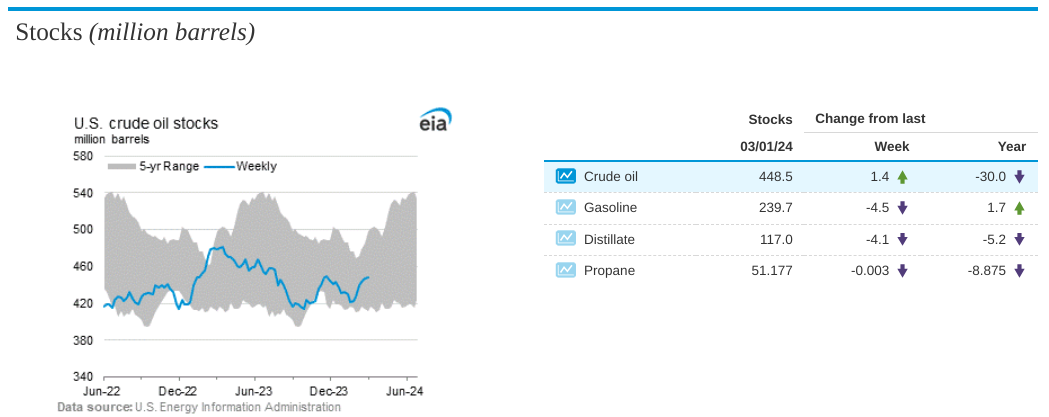

Commercial Crude Oil Inventories

Commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.4 million barrels from the previous week. However, at 448.5 million barrels, U.S. crude oil inventories are approximately 1% below the five-year average for this time of year. While the increase in inventories indicates a build-up in supply, the fact that they remain slightly below the five-year average suggests a balanced market situation.

Source: eia.gov

Motor Gasoline and Distillate Fuel Inventories

Total motor gasoline inventories decreased by 4.5 million barrels from last week, standing about 2% below the five-year average for this time of year. Both finished gasoline and blending components inventories increased last week. Distillate fuel inventories decreased by 4.1 million barrels last week and are approximately 10% below the five-year average for this time of year. These decreases in inventories for motor gasoline and distillate fuels suggest tightening supply conditions, potentially leading to upward pressure on prices for these products.

Total Products Supplied

Total products supplied over the last four-week period averaged 19.5 million barrels a day, down by 1.3% from the same period last year. Over the past four weeks, motor gasoline product supplied averaged 8.5 million barrels a day, reflecting a 2.9% decrease from the same period last year. Distillate fuel product supplied averaged 3.8 million barrels a day over the past four weeks, marking a 0.3% increase from the same period last year. Jet fuel product supplied was up 1.6% compared with the same four-week period last year. The slight decrease in total products supplied, particularly in motor gasoline, may indicate either a decline in consumption or efficiency improvements in the use of petroleum products.

Price of Crude Oil and Petroleum Products

The price for West Texas Intermediate crude oil stood at $80.90 per barrel on March 1, 2024, marking a $3.30 increase from the previous week and $1.28 higher than a year ago. The New York Harbor spot price for conventional gasoline increased to $2.420 per gallon, representing a $0.105 increase from a week ago but $0.231 less than the year-ago price. The spot price for No. 2 heating oil at New York Harbor rose by $0.036 to $2.661 per gallon, $0.079 less than the price last year. The national average retail price for regular gasoline rose to $3.350 per gallon on March 4, 2024, marking a $0.101 increase from last week's price but $0.039 less than the year-ago price. The national average retail diesel fuel price declined by $0.036 to $4.022 per gallon, which is $0.260 lower than the price one year ago. These price fluctuations in crude oil and petroleum products reflect the interplay between supply, demand, and various market dynamics.

Implications on Price of CFDs on Crude Oil

Supply and Demand Dynamics:

The increase in refinery inputs, crude oil imports, and production of gasoline and distillate fuel suggests robust demand for petroleum products. This heightened demand could potentially lead to upward pressure on the price of CFDs on crude oil as investors anticipate increased demand for crude oil futures contracts.

Inventory Levels:

Although commercial crude oil inventories experienced a slight increase, they remain below the five-year average. This suggests a relatively balanced market, with potential upward pressure on crude oil prices due to supply constraints. Investors may interpret this as a bullish signal for CFDs on crude oil.

Product Inventories:

The decrease in inventories for motor gasoline and distillate fuels, along with the fact that they are below the five-year average, indicates tightening supply conditions for these products. This could contribute to higher prices for CFDs on crude oil as investors anticipate increased demand for crude oil to meet refining needs and replenish inventories.

Source: eia.gov

Consumption Trends:

The slight decrease in total products supplied, particularly in motor gasoline, may suggest either a decline in consumption or efficiency improvements in petroleum product usage. While this could potentially mitigate immediate price increases for CFDs on crude oil, sustained economic growth or recovery could offset this effect.

Price Volatility:

The mixed trends in spot prices for petroleum products, despite the increase in crude oil prices, suggest that other factors such as refining capacity, geopolitical events, or macroeconomic conditions may influence price movements. This could contribute to increased volatility in CFD prices, as investors weigh multiple factors in their trading decisions.

Macro Factors:

Various macroeconomic factors, including geopolitical tensions, OPEC decisions, and global economic growth rates, can significantly impact the price of crude oil and, consequently, CFDs on crude oil. Investors need to closely monitor these factors to anticipate price movements accurately and make informed trading decisions.

Technical Take: WTI Crude Oil

The price of CFD on WTI crude oil may hit $84.35 this week (or early next week). Currently, the price is at an immediate resistance zone of $78.65–$78.35. The reason behind this projection is that the price is also at a solid dynamic support created by the trendline (marked by the purple line). This led to a high compression of prices between the immediate resistance zone and the ascending support of the trend.

Source: tradingview.com

On the upside, $84.35 seems like a long jump. However, the above-mentioned price compression may lead to a significant price move in the form of a breakout above the immediate resistance. In short, a few aggressive upward price sessions can be observed this week.

Looking at the Relative Strength Index (RSI), there is significant upside potential as the indicator (at 53) is below its regular bullish level of 55. At the current level, RSI also suggests a neutral state of the price trend.

Therefore, there are relatively possibilities of downside price moves to test the pivot at $76 or the immediate support zone at $73.75–$73.40.

In conclusion, based on the analysis, the outlook for CFD trading on crude oil suggests a bullish sentiment. The increase in refinery inputs, crude oil imports, and production of petroleum products indicates robust demand, potentially leading to upward pressure on prices. Although crude oil inventories saw a slight increase, they remain below the five-year average, signaling supply constraints. Decreases in motor gasoline and distillate fuel inventories further tighten supply conditions, contributing to potential price hikes. While consumption trends suggest some moderation, macroeconomic factors and technical analysis support a bullish outlook, with a projected price target of $84.35 in the near term.