Amid muted US Dollar (USD) price action, the Japanese yen (JPY) continues its steady day-to-day rise and pulls the USD/JPY exchange rate to a three-week decrease. The growing Russia-Ukraine conflict and the United States President-elect Donald Trump's tariff risks are the main causes of the moves toward the safe-haven JPY.

Why JPY Is Getting Strength

Nevertheless, the JPY may face pressure from the uncertainty surrounding the Bank of Japan's capacity to raise interest rates and heightened political unpredictability at home. Demand for the lower-yielding Japanese yen may be restrained ahead of the important US macro data due to the optimism surrounding a ceasefire agreement between Israel and Hezbollah and an increase in the yields on United States Treasury bonds.

Amid concerns about a trade conflict, interest in purchasing Japanese yen has not decreased. Several haven flows toward the Japanese yen are still being driven by worries that

The Bank of Japan may raise interest rates again at its following policy conference in December, according to data published Tuesday that showed Japan's service-sector prices were expanding. At the yearly "Shuntō" talks next spring, Japanese Prime Minister Shigeru Ishiba stated on Tuesday that he would request that businesses enact large wage increases.

Trade War & Its Effect On The USDJPY

President-elect Donald Trump's tariffs would start trade wars and affect the world economy. In addition to relieving US bond investors, Scott Bessent's candidature as US Treasury secretary caused the leading 10-year US Treasury yield to drop to a two-week low on Monday.

According to the November FOMC conference minutes, if inflation continues to be high, the Committee may decide to halt its policy rate alleviation and maintain it at a limiting level.

Officials said they are confident that the job market is doing well and that inflation is slowing down. This should enable the Fed to lower interest rates even more, albeit gradually.

Based on the CME Group's FedWatch Tool, the Fed is currently valuing a 63% chance that it will cut borrowing expenses by 25 basis points in December.

What Are Events To Look At?

Israel introduced airstrikes on the southern suburbs of Beirut on Tuesday night, while the militant Hezbollah group based in Lebanon claimed to have launched drones in Israel's direction.

US President Joe Biden said moments later that Israel and Lebanon approved the ceasefire agreement, which goes into effect at 2:00 GMT this Wednesday.

For a significant boost, traders now await the United States Personal Consumption Expenditure Price Index and the first modification of the US Q3 GDP print.

After that, the market will focus on various Japanese macro data, such as the Tokyo Core CPI paper, which is scheduled to be released on Friday.

USDJPY Forecast Technical Analysis

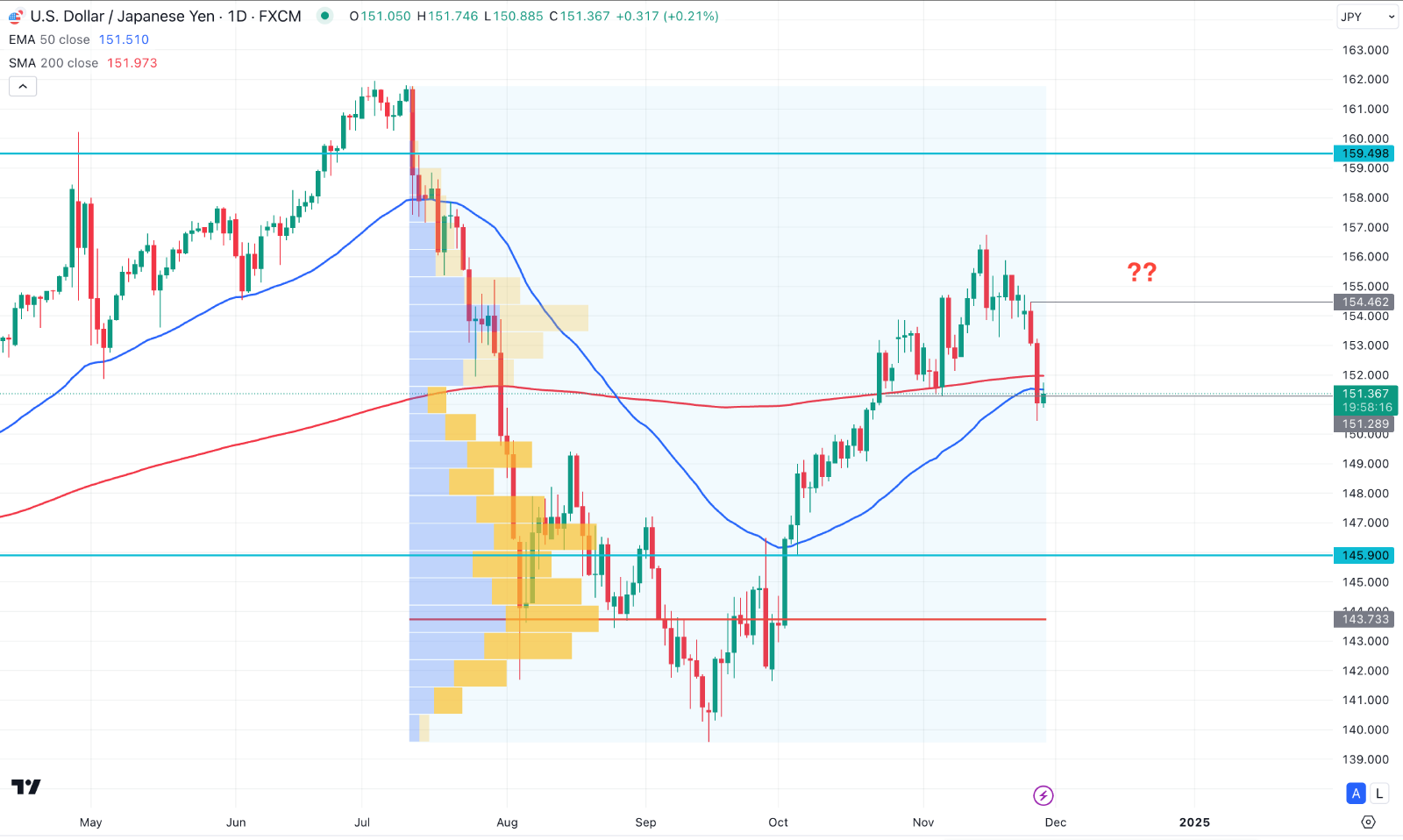

In the daily chart of USDJPY, the recent movement showed strong bearish pressure, taking the price below the 200-day Simple Moving Average. As both dynamic lines are above the current price, investors might extend lower after completing a considerable correction.

In this structure, 156.77 is a solid top from where selling pressure is present, with a bearish CHoCH formation. Primarily, the pair is more likely to continue lower as long as the ceiling is protected.

Based on this structure, the price might extend lower after forming a minor bullish correction. An immediate selling pressure below the Wednesday low could lower the price towards the 147.00 level. However, an extensive bullish reversal with a daily candle above the 154.46 level could eliminate the bearish signal, opening an opportunity to reach the 157.00 area.