The S&P 500 Index is a barometer of the US stock market's health and, by extension, the broader economic landscape. To formulate a forward-looking fundamental analysis of the S&P 500 Index, we must delve into the most recent US Consumer Price Index (CPI) data for September 2023. In doing so, we'll assess the current economic conditions, dissect potential future scenarios, and, most crucially, evaluate their implications for the S&P 500 Index.

Current Economic Snapshot

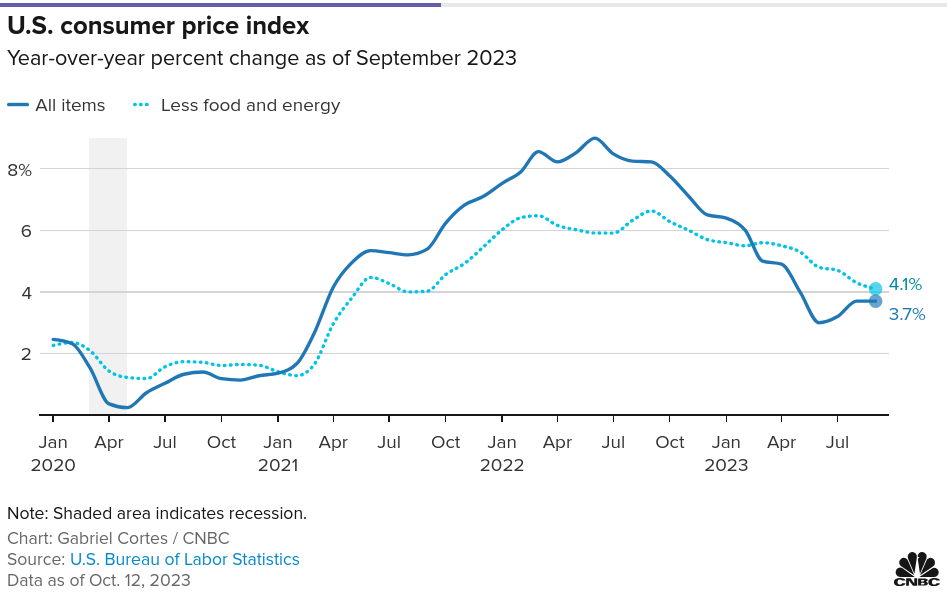

The latest CPI report for September 2023 reveals some noteworthy trends. Consumer prices rose by 0.4% on a monthly basis, slightly surpassing the consensus forecast of 0.3%. On a year-over-year basis, the CPI increased by 3.7%, exceeding the expected 3.6%. However, it is essential to scrutinize the core CPI, which excludes the volatile food and energy components. The core CPI increased by 0.3% on the month, perfectly aligning with expectations, but it surged by 4.1% on a 12-month basis. These numbers underscore the persistence of inflationary pressures across the broader economy.

Source: CNBC

Factors Driving CPI

Shelter Costs: The primary driver behind the recent inflation increase was shelter costs. They accounted for over 50% of the CPI's overall rise. Notably, both rent and owners' equivalent rent saw substantial increases. This is a reflection of the ongoing housing market dynamics, driven in part by increased demand and supply-side constraints, like construction material shortages.

Energy Prices: While major energy components displayed mixed dynamics in September, the energy index, as a whole, increased by 1.5% during the month. Gasoline prices saw a noteworthy rise of 2.1% in September, following a substantial 10.6% surge the prior month. This volatility hints at the sensitivity of energy prices to geopolitical events and supply-demand imbalances, which can create inflationary pressures.

Food Costs: The food index also experienced a modest increase of 0.2% in September. Interestingly, the food at home index rose by only 0.1%, indicating that consumers are paying more for food away from home, potentially due to increased restaurant prices. Nevertheless, this modest increase in food prices is a relief compared to the more substantial rises observed in shelter and energy costs.

The Federal Reserve's Dilemma

The Federal Reserve finds itself at a critical juncture, as evidenced by the minutes of its September meeting. Despite concerns about inflation and lingering upside risks, the committee opted not to raise interest rates. This divergence in the Fed's stance and market expectations is critical for understanding potential market volatility. It is essential to consider that, since the release of the minutes, Treasury yields have surged, at one point reaching 16-year highs.

Interest Rates and Market Expectations

Several Federal Reserve officials have indicated that these yield increases could potentially obviate the need for further policy tightening. Market pricing now implies only a small probability that the central bank will raise rates before the end of the year. Moreover, market expectations are leaning toward a scenario where the Fed might reduce its key borrowing rate by approximately 0.75 percentage points before the end of 2024. This significant divergence between the Fed's historical policy stance and current market sentiment can have substantial consequences for the stock market.

Key Implications for the S&P 500 Index

Interest Rates: The performance of the S&P 500 Index is significantly influenced by the interest rate environment. A scenario where the Fed raises interest rates sooner and more aggressively than currently expected could result in a market correction. Higher interest rates typically lead to lower stock valuations as they increase the cost of borrowing and reduce the present value of future cash flows.

Earnings Reports: Upcoming corporate earnings reports will be of paramount importance. They will provide insights into how companies are managing the cost pressures stemming from rising inflation. If corporations can pass on price increases to consumers without sacrificing profitability, this may mitigate concerns about future earnings and support stock prices.

Investor Sentiment: The reactions of investors to data releases and the Fed's policy decisions are vital to monitor. Investor sentiment can create short-term market volatility, and it is crucial to gauge the market's interpretation of economic and policy news.

Inflation Expectations: High inflation has persisted in core CPI, which excludes food and energy prices. The stability of core inflation at 4.1% over the past year raises questions about whether these pressures are indeed transitory, as the Fed has previously indicated, or if they have more enduring implications.

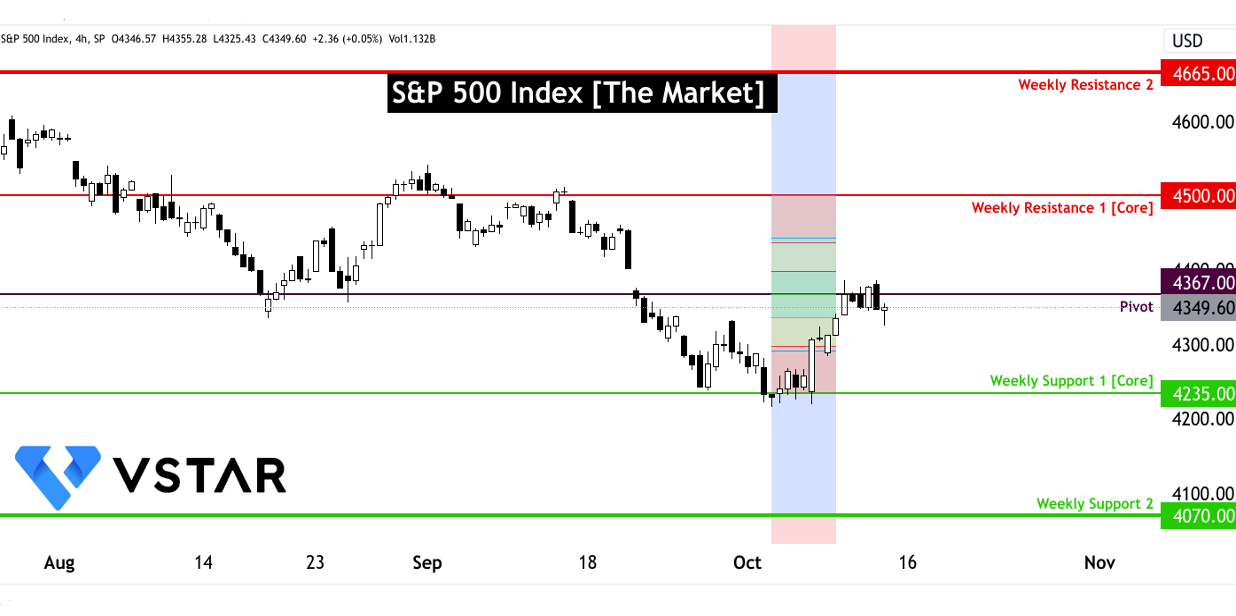

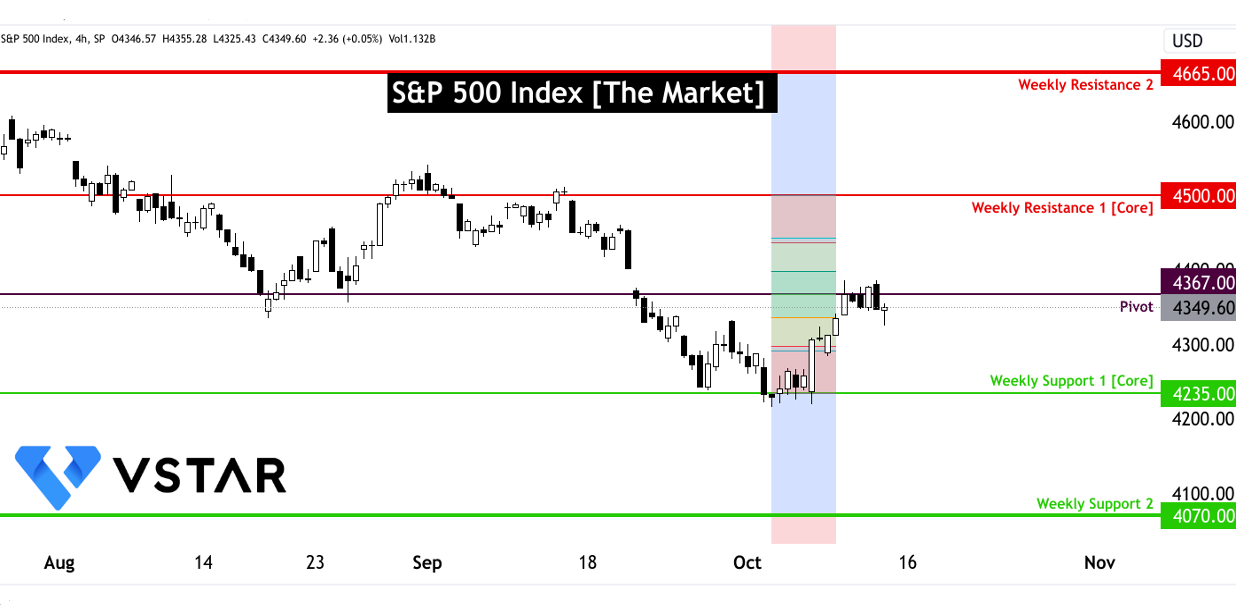

The technical perspective on the short-term moves of S&P 500 Index can be comprehended as follows:

Source: tradingview.com

In conclusion, the CPI data for September 2023 paints a vivid picture of current economic conditions and the challenges that lie ahead. The S&P 500 Index's future trajectory is contingent on a complex interplay of factors. The Fed's policies, corporate earnings, investor sentiment, and unforeseen events are all integral to shaping the index's path.