According to the latest news, U.S. inflation as measured by the Consumer Price Index (CPI) remained unchanged at 3.7% on a year-over-year basis. The US Bureau of Labor Statistics (BLS) reported the August figure on Thursday, which was slightly higher than the expected 3.6%.

Is an Unchanged CPI Good for XAUUSD Bulls?

The XAUUSD came under selling pressure immediately following the release of the September inflation report. The monthly core report, which excludes oil and food prices, came in 0.3% higher, while the annual data was cut to 4.1%. The main reason for the jump in the headline number was the rebound in oil, gasoline, and food prices.

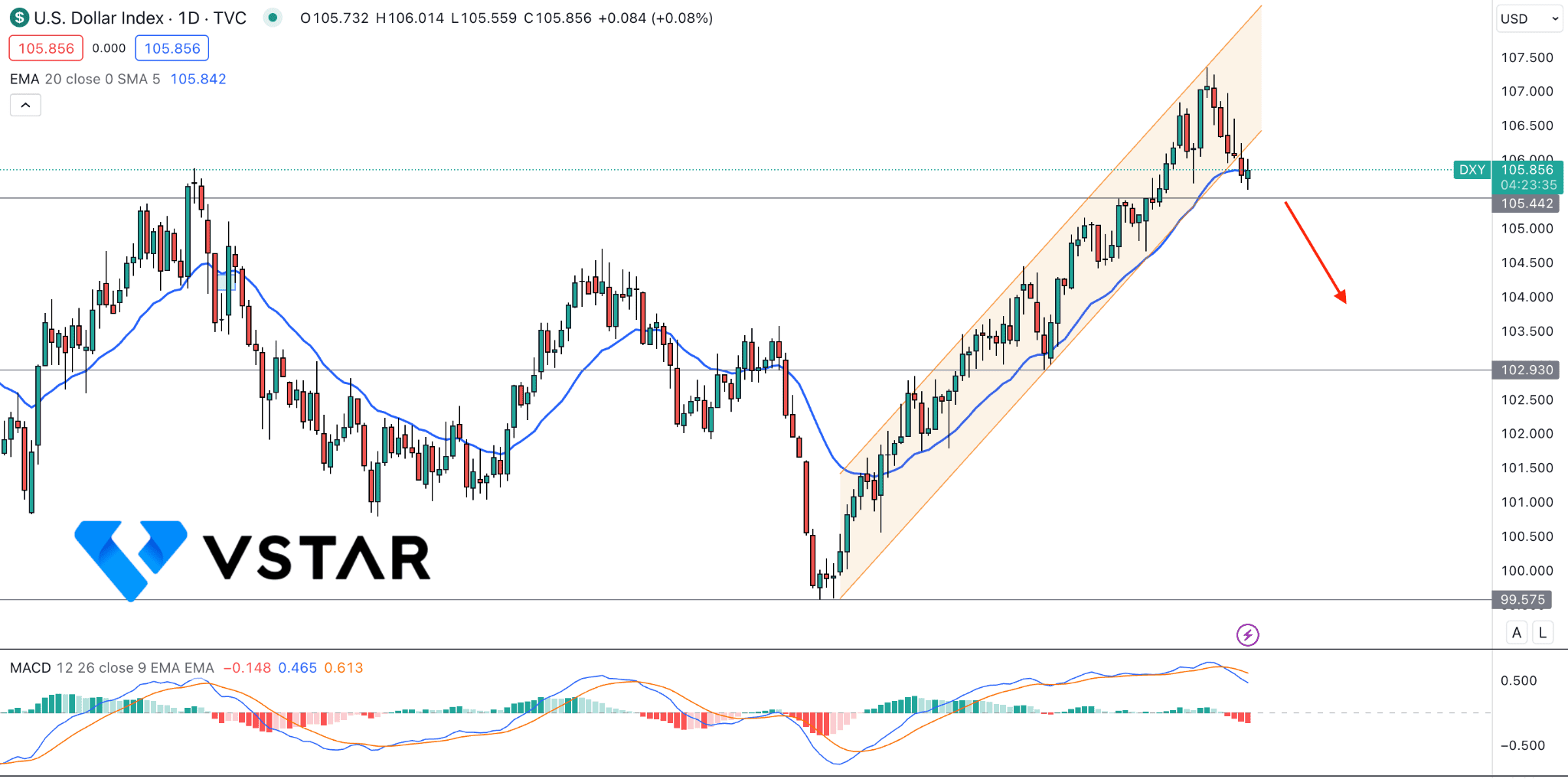

The US Dollar Index (DXY) rallied sharply after the release of the data and maintained the momentum into the New York close. The unchanged CPI report indicates no progress in inflationary pressures, which could push the central bank to raise interest rates in November.

The majority of Fed policymakers have indicated a rate hike at the November meeting, which is supported by rising long-term Treasury yields. For gold, the unchanged CPI is a bearish factor, while the tensions of the Israeli-Palestinian war could indicate a safe-haven nature for the yellow metal.

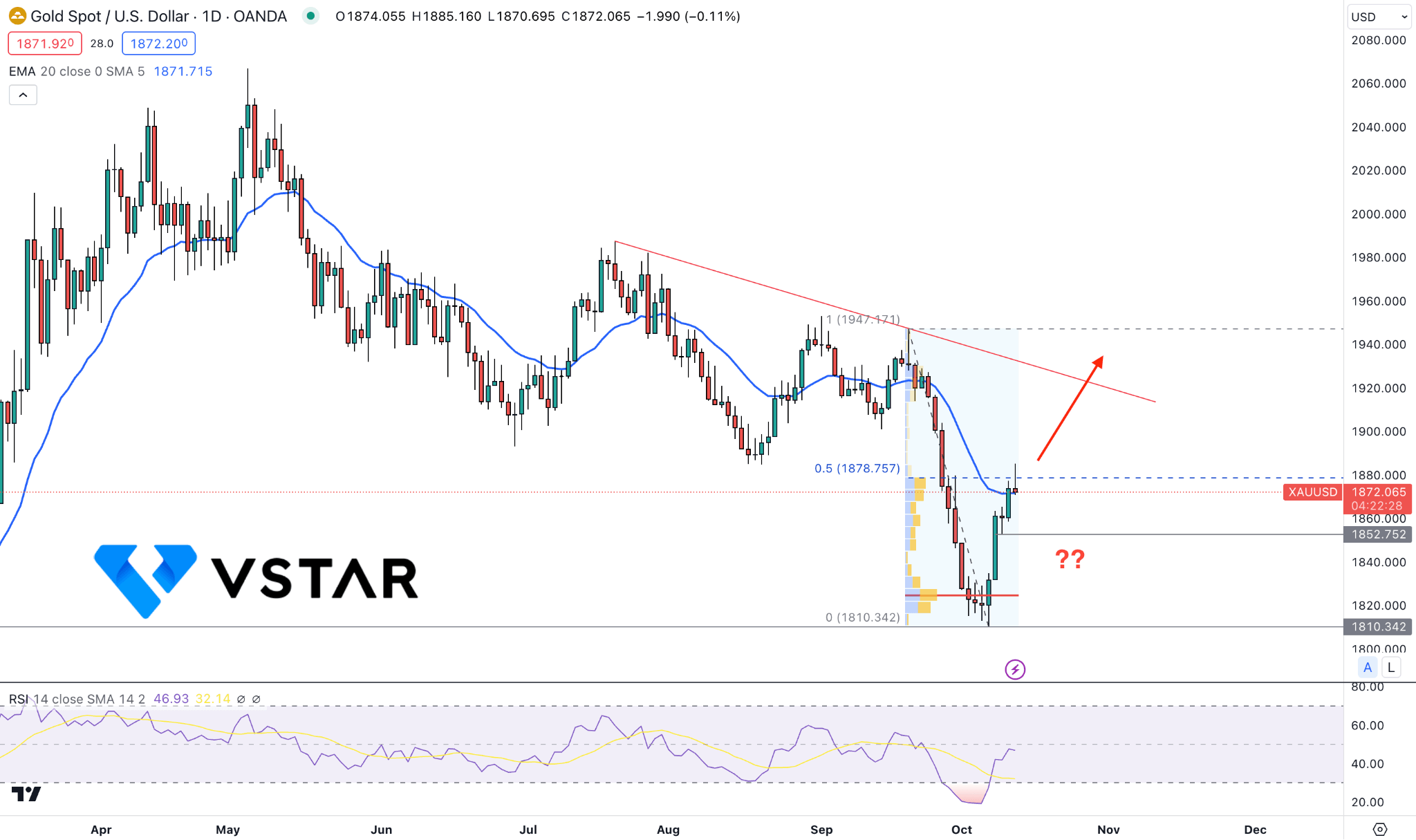

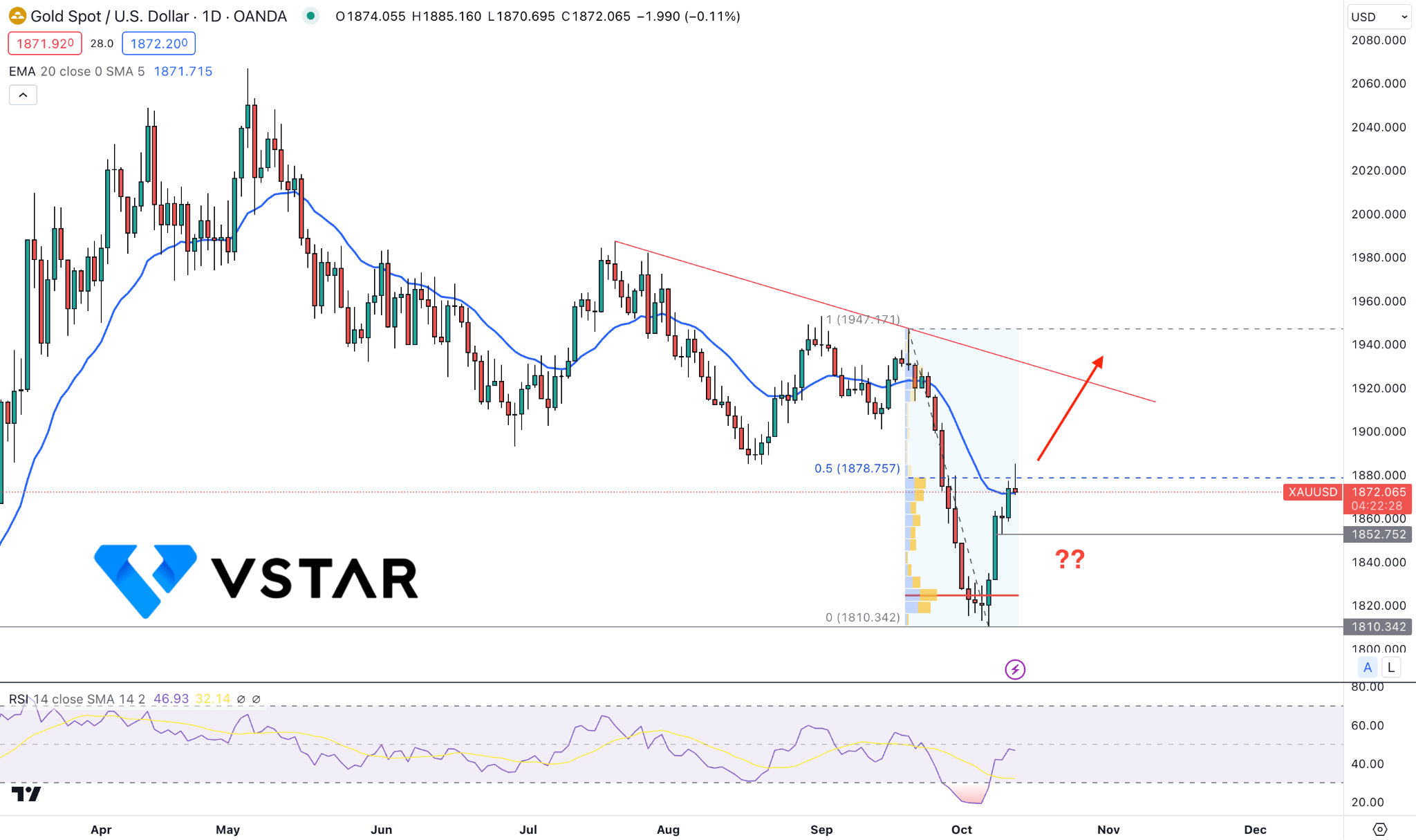

Gold (XAUUSD) Technical Analysis

The daily chart of the XAUUSD shows an extensive bearish pressure where an impulsive bearish pressure found a bottom at the 1810.34 support level. However, there was a V-shaped bounce from the bottom, which is not enough to consider a bullish reversal.

Despite the bullish pressure in the USDX following the CPI report, the XAUUSD failed to hold the downward pressure and closed the day at the 20-day EMA level. However, the price encountered resistance at the 50% retracement level from the high of 1947.17 to the low of 1810.34, which could be a premium zone for the yellow metal.

On the upside, a trendline resistance indicates the presence of buying liquidity, which needs to clear the 1920.00 level before filling it. Also, the bullish daily candle above the 1920.00 level could be a strong long signal as it will erase all losses below the 1884.91 swing low.

In this regard, the short-term bullish opportunity on this pair is valid as long as the price remains above the 20 EMA. On the bearish side, there is a strong short-term support level at the 1852.75 level that needs to be breached before the pair falls towards the high volume 1824.70 level.