The analysis explores various factors influencing Bitcoin's price during the week . These factors encompass technical analysis, macroeconomic trends, regulatory developments, and global events that have the potential to sway Bitcoin's trajectory.

Technical Analysis

To set the stage for our analysis, let's begin with a technical perspective by examining key support and resistance levels for Bitcoin (BTC). These levels are instrumental in understanding the potential price movements and assessing market sentiment:

Weekly Resistance (in case of extreme volatility): $30,800

Weekly Resistance (in case of high volatility): $29,050

Weekly Resistance (in case of low volatility): $27,990

Weekly Support (in case of low volatility): $26,245

Weekly Support (in case of high volatility): $25,155

Weekly Support (in case of extreme volatility): $23,430

The above critical technical levels can be considered while initializing the long positions (near support level) and short positions (near resistance level). The continuous weekly technical developments can be observed on vstar.com.

Now, let's delve into the factors that have the potential to influence Bitcoin prices, both bullish and bearish.

Factor 1: The Ether-Bitcoin Ratio and ETFs

Bearish Implications

The Ether-Bitcoin (ETH/BTC) ratio has been on a steady decline, reaching a 15-month low. This drop has occurred despite the introduction of several Ether futures-based exchange-traded funds (ETFs) in the United States. The lackluster response to these ETFs suggests a lack of demand for Ethereum, which is concerning for those who hoped these products would uplift market sentiment.

One possible explanation for this decline is the ongoing bear market, which historically leads traders to flock to Bitcoin, the oldest and most established cryptocurrency, in times of market uncertainty. Additionally, Ethereum's spot trade volume has remained relatively flat over the past two months, with occasional spikes above $2 billion. This indicates a potential lack of interest in Ethereum compared to Bitcoin, which has seen increased demand due to its status as a digital gold and a safe haven asset.

Furthermore, Bitcoin's dominance rate in the total crypto market has increased from 41% to 51% this year. This shift toward Bitcoin suggests a preference for the pioneer cryptocurrency during times of uncertainty. The bearish implications extend to the potential for continued underperformance of Ethereum compared to Bitcoin, especially in a higher interest rate environment.

Bullish Implications

The declining Ether-Bitcoin ratio may suggest an opportunity for those looking to invest in Ethereum, as it may be undervalued relative to Bitcoin. Investors and traders might consider this dip in the ratio as a potential buying opportunity, particularly if they anticipate a reversal or a shift in market sentiment toward Ethereum.

Additionally, while the initial response to ETFs has been tepid, it is possible that these products will gain traction over time, leading to increased demand for both Bitcoin and Ethereum. The relatively low trading volumes of these ETFs in their first week may not accurately reflect their long-term potential.

Ultimately, the bearish and bullish implications of the Ether-Bitcoin ratio and ETFs suggest that market participants should closely monitor these dynamics, considering potential investment opportunities and risks in the cryptocurrency market.

Factor 2: The U.S. Treasury Market

Bearish Implications

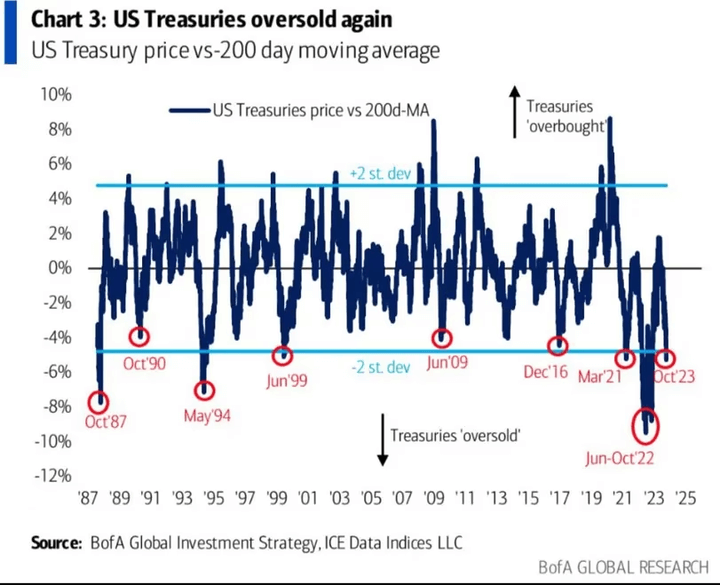

Bank of America's analysis of the U.S. Treasury market highlights potential bearish implications for Bitcoin. The analysis suggests that Treasury notes are currently oversold, with prices trading at a substantial discount to their 200-day simple moving average, while yields are at multi-year highs. Historically, oversold Treasury notes have preceded major volatility events in various financial markets, including cryptocurrencies. This pattern suggests that broader markets, including Bitcoin, could soon experience increased price turbulence.

The increased volatility in the broader financial markets can lead to risk-averse behavior, with investors seeking safer assets, such as traditional safe-haven assets like gold, or even cash, rather than cryptocurrencies. If the oversold Treasury notes coincide with a broader market correction or economic downturn, Bitcoin may face downward pressure due to investors' flight to safety.

Bullish Implications

While the oversold condition of Treasury notes may precede major market events and increased price turbulence, Bitcoin has historically reacted positively to such conditions. For example, in early 2021, when Treasury notes were oversold, Bitcoin's price reached new record highs, surpassing $60,000. This suggests that Bitcoin could benefit from the increased price volatility in the broader markets, leading to potential price surges.

Bitcoin is often considered a "digital gold" and a hedge against economic uncertainties. When traditional safe-haven assets like gold and U.S. Treasuries face oversold conditions, some investors turn to Bitcoin as an alternative store of value. If the oversold Treasury notes trigger a market correction, Bitcoin could experience increased demand from investors seeking to preserve their wealth in a non-traditional asset.

Therefore, it is essential for investors to closely monitor the dynamics of the U.S. Treasury market and assess its potential impact on Bitcoin, considering both bearish and bullish scenarios.

Source: coindesk

Factor 3: Cryptocurrency Use by Militant Groups

Bearish Implications

Recent reports have highlighted the use of cryptocurrencies by Palestinian militant groups for financing their operations. These groups received substantial sums of cryptocurrency funds over the past year. These transactions raise concerns about the potential misuse of cryptocurrencies for illegal and illicit purposes, such as funding terrorist activities.

The involvement of cryptocurrency in funding such groups not only poses regulatory challenges but also has reputational risks for the broader cryptocurrency market. Regulatory authorities may tighten oversight and impose stricter regulations on the cryptocurrency industry to prevent illicit activities, potentially affecting the overall market.

Moreover, the exposure of cryptocurrencies being used for illegal purposes may lead to negative sentiment among investors and the general public, potentially undermining trust in the technology and its adoption.

Bullish Implications

While the use of cryptocurrencies by militant groups is concerning, it also highlights the transparency and traceability of blockchain technology. Cryptocurrency transactions are recorded on public ledgers, making it possible for authorities to trace and seize illicit funds. This transparency offers a potential solution for combating financial crimes and enhancing anti-money laundering efforts.

The use of cryptocurrencies by such groups underscores the need for better regulation and compliance in the cryptocurrency industry. Regulatory measures can help prevent misuse of digital currencies and promote a safer and more transparent ecosystem.

Additionally, the fact that these groups use cryptocurrencies to move funds within their organizations suggests that digital currencies are becoming mainstream financial tools, which may increase their adoption worldwide.

Conclusion

In conclusion, Bitcoin's price is influenced by a multitude of factors, ranging from technical analysis to macroeconomic trends, regulatory developments, and global events. In this analysis, we've explored the bearish and bullish implications of various factors that may influence Bitcoin price.

From a technical perspective, understanding support and resistance levels is crucial for assessing potential price movements and market sentiment. Technical analysis provides valuable insights for traders and investors.

The Ether-Bitcoin ratio and the introduction of ETFs present a complex landscape for the cryptocurrency market. The bearish implications suggest challenges for Ethereum in a bear market and a higher interest rate environment. The bullish implications highlight potential investment opportunities and the evolving nature of the cryptocurrency market.

The U.S. Treasury market's oversold condition can lead to both bearish and bullish scenarios for Bitcoin. It is essential to monitor these dynamics and their potential impact on Bitcoin's price.

The involvement of cryptocurrencies in financing militant groups is a complex issue. While it raises bearish concerns regarding regulations and reputational risks, it also highlights the potential for blockchain technology to enhance transparency and traceability in financial transactions.

In this dynamic and evolving cryptocurrency market, staying informed and conducting thorough research is critical for making informed investment decisions. Bitcoin's price is subject to numerous influences, and it is crucial for market participants to adapt to changing circumstances and seize opportunities while managing risks.

Source: tradingview.com