In the foreign exchange market, a cross-currency pair representing the New Zealand dollar and the Japanese yen is known as NZD/JPY. It consists of a base and quote currency, just like other currency pairs. The New Zealand dollar (NZD) is the base currency, and the Japanese yen (JPY) is the quote currency in the NZD/JPY exchange rate.

The amount of JPY needed to purchase one NZD is the market value of the currency pair. For instance, if the NZD/JPY market rate is 76.50, one NZD may be converted into 76.50 JPY.

Due to the close economic ties between New Zealand and Japan, trading in the NZD/JPY pair is most active during the Tokyo session, which runs from 12 am to 8 am GMT.

The importance of fundamental analysis

A method of market analysis known as fundamental analysis considers different economic, social, and political elements that can affect the supply and demand for a currency. It is a crucial instrument in the currency markets because it enables investors and traders to comprehend the underlying economic factors that influence the value of a country's currency.

The ability of traders and investors to better comprehend the factors that influence currency values is one of the main advantages of applying fundamental analysis to the currency markets. Traders can make better choices about when to purchase or sell a certain currency by considering elements like economic growth, interest rates, inflation, and geopolitical developments. This strategy might be especially helpful for those who look at the market from a long-term view.

Trading possibilities that may not be obvious from solely technical research can also be found through fundamental analysis, which can assist traders. For instance, a trader analyzing the US dollar may look at variables like shifts in consumer spending, changes in GDP growth rates, and changes in the Federal Reserve's interest rate policies. Traders can gain a deeper understanding of the currency markets and spot winning trades by fusing these insights with technical analysis.

Macroeconomic View – New Zealand

The tiny, open economy of New Zealand is primarily reliant on exports, especially those from the agricultural industry. Here is a quick rundown of some of the most important macroeconomic data, monetary policy, and political environment in New Zealand.

Review of Economic Indicators

GDP and Unemployment Rate: In 2021, New Zealand's GDP increased by 4.5%, and in 2022, it is anticipated to increase by 2.5%. However, it has been declining since the opening of the economy after the pandemic “burst of demand” after the reopening. The unemployment rate was 4.0% in the fourth quarter of 2022, continuously declining. As the economy stabilizes.

Inflation rates: In the fourth quarter of 2021, New Zealand's inflation rate was 3.3%, exceeding the Reserve Bank of New Zealand's (RBNZ) target range of 1-3%.

Consumer and Business Confidence: Since the beginning of 2022, business confidence has steadily risen and is currently at a record high. Like many advanced economies, consumer and business confidence is often considered a leading indicator of economic growth.

Monetary Policy: The Reserve Bank of New Zealand's (RBNZ) monetary policy is flexible and keeps inflation within the desired 1-3% range. The RBNZ has launched several monetary policy measures in response to the COVID-19 epidemic, including a large-scale asset purchase program and a funding-for-lending scheme.

Interest Rate Expectations: A lot of emphases has been placed on the interest expectation of the Royal Bank of New Zealand, as it tends to offer larger interest rates than many other countries. As a result, the New Zealand dollar often is a “risk on” currency.

Political Environment

2023 general election: A general election is slated for 2023 in New Zealand. The election results might affect the nation's economic policies and course.

Economic policies of the government: Government economic measures include a program to subsidize wages and infrastructure spending to aid in the rehabilitation of the economy following the COVID-19 epidemic. In addition, the government has implemented measures to deal with societal problems like housing affordability and climate change, which could impact businesses and the overall economy.

The economy of New Zealand has been doing well, with consistent GDP growth and a declining unemployment rate. The fact that inflation is currently higher than the RBNZ's goal range, however, may result in a rate increase in the future. Although the political environment is stable, the general election results in 2023 could affect the nation's economic policies and course. To boost economic recovery and address social challenges, the government has implemented several policies that could impact businesses and the overall economy.

Macroeconomic View – Japan

Japan is the world's third-largest economy and a major player in global trade. Here is a brief overview of some key macroeconomic indicators, monetary policy, and the political climate in Japan:

Economic Indicators Review

GDP and Unemployment Rate: The GDP of Japan is expected to increase through 2023 and into the future. Having said that, Japan is typically slower than other economies regarding growth, but it has seen a lot of demand after the reopening beyond the Covid lockdowns. In February 2023, the unemployment rate was 2.9%.

Inflation rates: In February 2023, Japan's inflation rate was 3.3%, significantly higher than the Bank of Japan's (BOJ) target inflation rate of 2%. However, cost-push factors like the price of food and energy are largely to blame for the recent spike in inflation. Furthermore, the Bank of Japan has stayed steadfast in its yield curve control program, buying Japanese Government Bonds to keep rates lower in the bond market.

Business and Consumer confidence: Consumer and business confidence is rising in Japan, even though it is still below pre-pandemic levels. Although progress has been slow, consumer confidence has also been increasing.

Monetary Policy

Bank of Japan's Monetary Policy: With short-term interest rates at 0.5% and the target yield on 10-year government bonds at roughly 0.5%, the BOJ has maintained its accommodating monetary policy stance. The BOJ has also kept up its massive asset acquisition program to stimulate economic development and hit its inflation target.

Interest rate expectations: In the foreseeable future, the BOJ is expected to retain its current monetary policy stance. But there are some rumors that the BOJ might think about changing its stance on policy in response to rising inflation. During 2023, it has allowed the 10-year interest rate to rise to 0.50%.

Political Climate

Global trade issues: Japan's economy is highly dependent on exports. Therefore, trade conflicts around the world could have a detrimental effect. With supply chain disruptions, Japan's exports have been impacted by the COVID-19 epidemic. It also can be disrupted by global slowdowns as well.

Government economic policies: The present administration has implemented several measures to aid in the economy's recovery following the COVID-19 pandemic, including a sizable stimulus package and assistance for small and medium-sized businesses. In addition, the government has put laws in place to deal with social problems, including climate change and gender inequality.

Japan's economy is recovering, with consistent GDP growth and a low unemployment rate. Since inflation is currently above the BOJ's target range, future policy changes might be necessary. Although there is political stability, supply chain disruptions and trade conflicts worldwide could hurt the nation's economy. The government has put various policies to support economic growth and deal with social issues.

Analysis of the NZD/JPY Currency Pair

Given the interest rate differences between the two countries, the NZD/JPY currency pair is a popular choice for traders and investors. However, several economic indicators are relevant for assessing the outlook of this currency pair.

Relevant economic indicators

It is crucial to consider how the economies of Japan and New Zealand are related. China and Australia are New Zealand's two main trading partners, and the country heavily depends on international trade. The US and China are Japan's two biggest trading partners, but the country's economy is strongly dependent on exports. Any modifications to the trade agreements between these nations may greatly affect the currency pair.

Impact of GDP growth, inflation rates, and interest rates on the currency pair

Important indicators include GDP growth, inflation rates, and interest rates. Investors prefer the NZD because of New Zealand's recent increases in interest rates, whilst the yen is less appealing due to Japan's lower interest rate of 0.50%. The currency pair has also been affected by inflation rates, which are above the goal in Japan due to high food and energy costs.

Factors Supporting a Long Bias

This pair typically has a long bias, as the interest rate differential has favored New Zealand for decades.

Expected economic growth in New Zealand

Expected economic growth in New Zealand, stable central bank policies in both nations, and the potential for a weaker Japanese yen due to risk-on emotions are all factors that support a long bias in the NZD/JPY currency pair. However, there are also possible risks associated with this long bias, including alterations in international trade regulations, political unpredictability in both countries, and sudden changes in interest.

Potential for a weaker Japanese yen due to risk-on sentiment

In general, as long as there are no longer-term concerns in the global markets, the longer-term bias is for the yen to lose value, as the Bank of Japan has been very loose with its monetary policy since the 1980s.

Potential Risks to the Long Bias

There are some risks to a long bias in the NZD/JPY pair, as a lot of uncertainty can come into the markets occasionally. The global economy is slowing down, and geopolitical issues remain a major problem.

Any unexpected change to interest rate expectations will also significantly influence where the pair goes. One example is when the Bank of Japan shocked the market by changing its limit from 0.25% on the 10-bond to 0.50% basis points. This surprise had the Japanese yen skyrocket in value early in 2023.

Trading Strategies for NZD/JPY

The New Zealand dollar (NZD) and the Japanese yen (JPY) are two currencies that are popularly traded in the forex market. Trading the NZD/JPY currency pair requires the use of effective trading strategies to manage risk and optimize profits. Here are some trading strategies to consider when trading NZD/JPY.

Technical Analysis

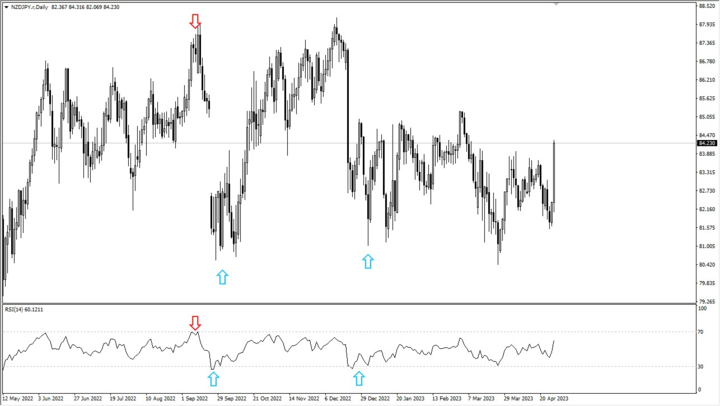

Technical analysis involves analyzing charts to identify trends and patterns that could indicate the direction of future price movements. When trading NZD/JPY, it is essential to use technical analysis to help identify potential entry and exit points.

One approach to technical analysis is the use of indicators such as moving averages and the Relative Strength Index (RSI). Moving averages are commonly used to determine the direction of a trend and potential support and resistance levels. The RSI is used to identify overbought and oversold conditions and potential trend reversals.

NZD/JPY Chart with RSI indicator

Risk Management

Managing risk is critical when trading any currency pair, including NZD/JPY. Setting stop-loss and take-profit levels is essential to minimize losses and maximize profits. Stop-loss orders close a trade when the price reaches a predetermined level, reducing the risk of significant losses.

Determining position size is also an important aspect of risk management. Position size should be based on the trader's risk tolerance and trading account size. A general rule of thumb is to risk no more than 2% of the trading account on a single trade.

News Trading

Trading based on news releases and economic events is another strategy to consider when trading NZD/JPY. News releases such as the Reserve Bank of New Zealand's interest rate decisions or Japanese economic data can significantly impact the currency pair's price.

Following economic events and news releases is essential for traders looking to capitalize on market reactions to the news. News trading requires a fast and accurate response to market movements, so traders must have access to up-to-date news and information.

Trading NZD/JPY requires a well-thought-out trading plan that includes technical analysis, risk management, and news trading. By using effective trading strategies, traders can minimize their risks and optimize their profits when trading this popular currency pair. However, traders should always remember that there is no guarantee of success in trading, and risk management is crucial to preserve capital.

Trade NZD/JPY at VSTAR

Trading the NZD/JPY pair is easy at VSTAR, as the world-class platform, VSTAR App gives a multitude of indicators that you can use for technical analysis. Furthermore, VSTAR offers education for traders to further their trading prowess.

VSTAR also offers significant educational materials and constantly works on its backend to improve customer service. VSTAR offers market access and is heavily regulated and licensed by CySec, the Cyprus Securities and Exchange Commission.

Conclusion

In conclusion, fundamental analysis is a crucial tool in assessing the outlook of the NZD/JPY currency pair. With close economic ties between New Zealand and Japan, economic indicators such as GDP growth, inflation, and interest rates play a significant role in the currency pair's movement. Investors should also consider potential risks such as alterations in international trade regulations, political instability, and unexpected changes in interest rate expectations. However, with expected economic growth in New Zealand, stable central bank policies in both nations and the potential for a weaker Japanese yen due to risk-on sentiment, this pair has a general long bias. Traders can easily trade the NZD/JPY pair on VSTAR, which offers a world-class trading platform and educational resources to enhance traders' skills.

Ultimately, the NZD/JPY pair is often used to express a “risk on” type of economic environment and often will move based on this. The almost semi-permanent low rates in Japan, with the higher rate in New Zealand, make this a common feature.