I. Introduction

A. Overview of the NZD/CHF currency pair

The NZD/CHF currency pair represents the exchange rate between the New Zealand Dollar (NZD) and the Swiss Franc (CHF). In the forex market, currency pairs such as the NZD/CHF are actively traded because they reflect the relative strength or weakness of the two countries' economies and their respective monetary policies. Traders and investors analyze this currency pair in order to make informed decisions and take advantage of potential profit opportunities.

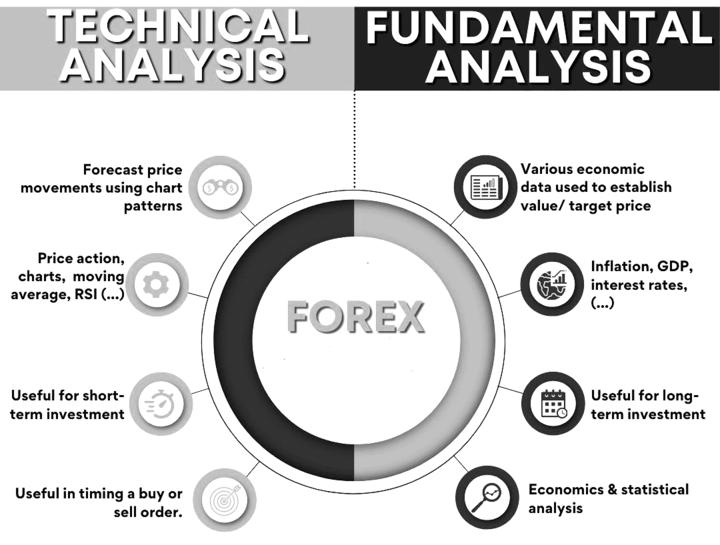

B. Importance of Fundamental Analysis

Fundamental analysis is a critical approach to understanding the forces that drive currency values. It involves the evaluation of economic, financial and political factors that affect a country's economy and, consequently, its currency. This analysis is in contrast to technical analysis, which focuses on historical price movements and chart patterns. Fundamental analysis allows traders to make informed predictions about currency movements and identify long-term trends.

Source: Forex League

C. A brief explanation of the New Zealand Dollar and the Swiss Franc

The NZD is the official currency of New Zealand and is issued and regulated by the Reserve Bank of New Zealand (RBNZ). New Zealand's economy is heavily dependent on agricultural exports such as dairy, meat and wool. In addition, tourism plays a significant role in the country's revenue. As a result, the value of the NZD is closely tied to global demand for commodities and the health of the tourism industry.

The Swiss Franc is the official currency of Switzerland, issued and controlled by the Swiss National Bank (SNB). Switzerland is known for its stable economy, low inflation rate and strong financial sector. The CHF is often considered a safe haven currency, attracting investors during times of global economic uncertainty or geopolitical tension.

Source: ironfx.com

II. Macroeconomic Overview: New Zealand

A. Economic Indicators Review

1. GDP and Unemployment Rate

Gross Domestic Product (GDP) is a key indicator of a country's economic performance, measuring the total value of all goods and services produced within its borders. In recent years, New Zealand has experienced steady GDP growth, supported by strong performances in the agriculture and tourism sectors. In 2023, for example, New Zealand's GDP grew by 2.9% despite macroeconomic challenges. Such growth signals a resilient economy and can be positive for the value of the New Zealand Dollar (NZD) against other currencies, including the Swiss Franc (CHF).

Source: stats.govt.nz

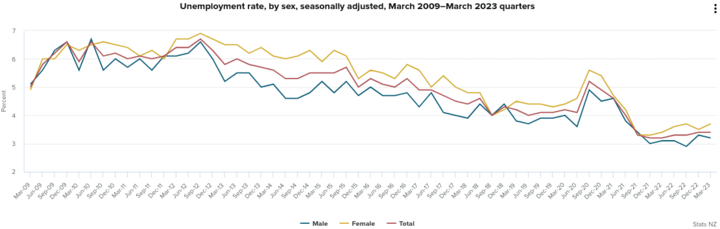

Another key indicator is the unemployment rate, which reflects the percentage of the labor force that is unemployed and actively looking for work. Low unemployment rates indicate a healthy labor market and economic growth. As of the March 2023 quarter, New Zealand has maintained a relatively low unemployment rate, hovering around 3.4%. As employment numbers improve, consumer spending typically increases, further boosting economic activity and potentially strengthening the NZD.

Source: stats.govt.nz

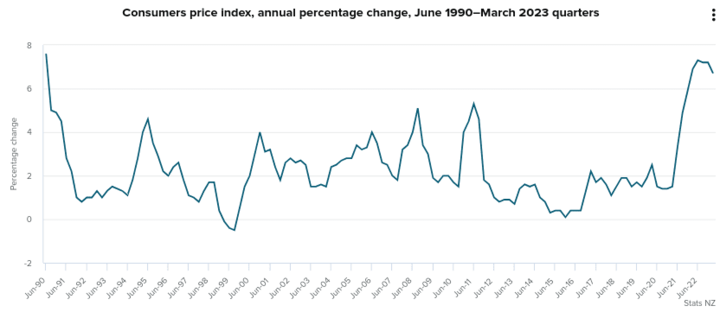

2. Inflation Rates

Inflation rates play a crucial role in a country's monetary policy and exchange rate movements. Moderate inflation is generally considered beneficial for economic growth, as it encourages spending and investment. In March 2023, New Zealand experienced high inflation, with consumer prices rising at an annual rate of approximately 6.7%. The Reserve Bank of New Zealand (RBNZ) closely monitors inflation data to adjust monetary policy and maintain price stability. If inflationary pressures increase significantly, the RBNZ may consider tightening monetary policy by raising interest rates, which could make the NZD more attractive to foreign investors.

Source: stats.govt.nz

3. Business and Consumer Confidence

Business and consumer confidence surveys provide valuable insights into the level of optimism in the economy. High levels of business and consumer confidence can stimulate economic activity and investment. In 2Q2023, business and consumer confidence in New Zealand was relatively high (83.1), indicating positive sentiment despite macroeconomic challenges. Increased confidence levels can support economic growth and positively influence the value of the NZD against the CHF.

Source: tradingeconomics.com

B. Monetary Policy

1. The Reserve Bank of New Zealand's Monetary Policy

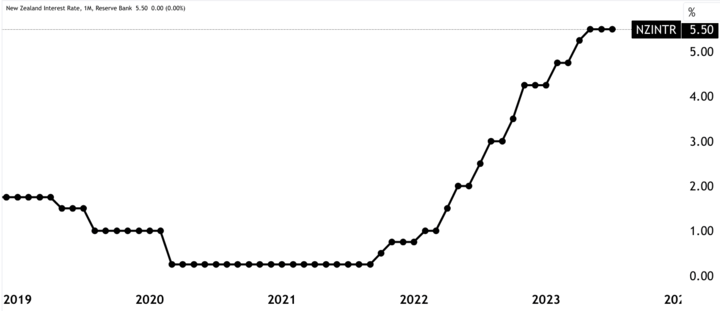

The RBNZ is responsible for the formulation and implementation of monetary policy in New Zealand. Its primary objective is to maintain price stability, with an inflation target of 1-3%. To achieve this, the RBNZ uses various policy tools, including setting the Official Cash Rate (OCR), which influences short-term interest rates and borrowing costs in the economy.

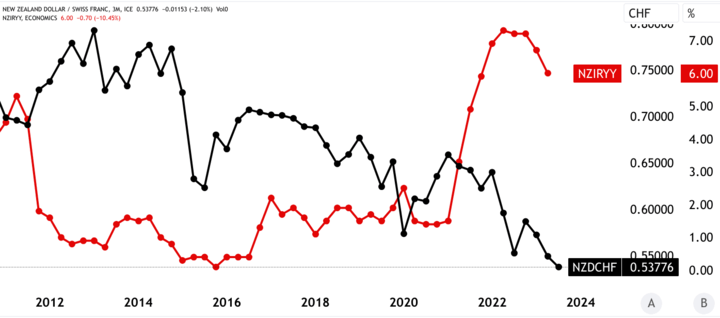

Source: tradingview.com

From July 2023, the RBNZ maintained a hawkish monetary policy stance, keeping the interest rate at a historically high level of 5.50%. The high interest rate environment was intended to contain high inflation. However, the central bank closely monitors economic indicators and adjusts its policy stance as needed, which can have a significant impact on the value of the NZD.

2. Interest Rate Expectations

Interest rate expectations are an important factor in currency movements. Traders and investors closely follow central bank statements and forecasts to anticipate changes in interest rates. In July 2023, despite the RBNZ's high interest rate, there was speculation about possible further interest rate hikes in the near future, given the state of the economy and high inflationary pressures.

Market expectations of higher interest rates may attract foreign investors seeking better returns on their investments, increasing demand for the NZD. Conversely, a downward revision in interest rate expectations may weaken the NZD as investors seek higher-yielding currencies elsewhere.

C. Political Climate

1. Government Economic Policy

The economic policies pursued by the New Zealand government have a significant impact on the country's economic prospects and, consequently, on the value of the NZD. Fiscal policies, such as government spending and taxation, affect economic growth and public finances.

Political stability is also crucial to investor confidence. A stable political climate encourages foreign investment and business growth. Throughout the period under review, New Zealand has maintained a relatively stable political environment, which can have a positive effect on the NZD's standing in the forex market.

2. Impact of Commodity Prices on the New Zealand Economy

New Zealand's economy is heavily dependent on commodity exports, particularly dairy, meat, wool and forestry products. Therefore, changes in global commodity prices have a significant impact on the country's trade balance and economic performance.

For example, if global demand for New Zealand's agricultural exports is high, this can lead to an increase in export earnings, strengthening the NZD. Conversely, a decline in commodity prices can put pressure on the NZD as export revenues fall.

III. Macroeconomic Overview: Switzerland

A. Economic Indicators Review

1. GDP and Unemployment Rate

Switzerland has a highly developed and diverse economy, driven by strong manufacturing, financial services and pharmaceutical sectors. The country's Gross Domestic Product (GDP) has historically demonstrated stability and growth. For example, in 2022, despite macroeconomic uncertainties, the Swiss economy moved forward with a GDP growth rate of approximately 2.1%. This positive economic performance reflects Switzerland's resilience and ability to adapt to global economic conditions.

Source: data.worldbank.org

The unemployment rate in Switzerland is also relatively low compared to many other developed countries. In June 2014, the unemployment rate was around 1.9%. Low unemployment means a robust labor market and consumer spending, which supports economic growth and potentially strengthens the Swiss franc (CHF) against other currencies such as the New Zealand dollar (NZD).

Source: economy.com

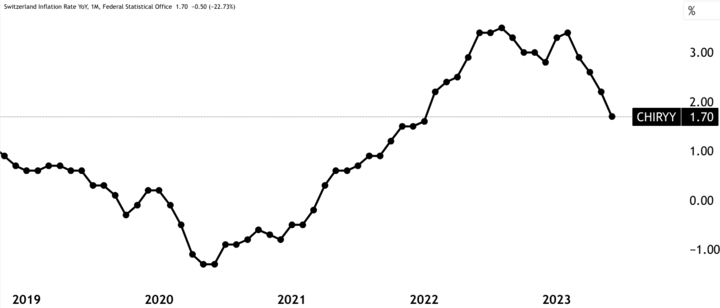

2. Inflation Rates

Price stability is a primary concern of the Swiss National Bank (SNB). Moderate inflation is generally targeted to support economic growth without eroding purchasing power. Switzerland has experienced relatively low inflation, with consumer prices rising at an annual rate of 1.7%. The SNB closely monitors inflation dynamics and adjusts its monetary policy to ensure price stability.

Source: tradingview.com

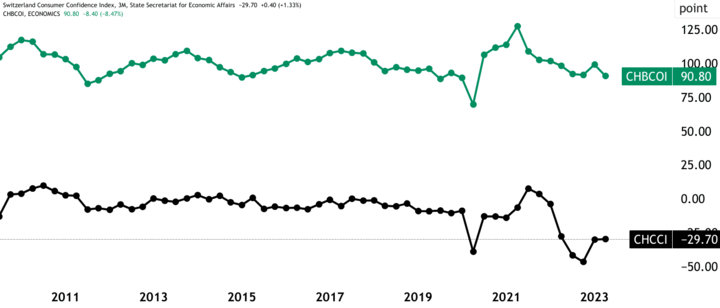

3. Business and Consumer confidence

Switzerland's economic outlook is significantly influenced by the level of business and consumer confidence. High levels of confidence drive investment and consumption, contributing to economic expansion. Throughout 2023, Switzerland will experience discouraging levels of business and consumer confidence, reflecting the lingering effects of ongoing macroeconomic adversities. Such negative sentiment could dampen economic activity and reduce the attractiveness of the CHF to foreign investors.

Source: tradingview.com

B. Monetary Policy

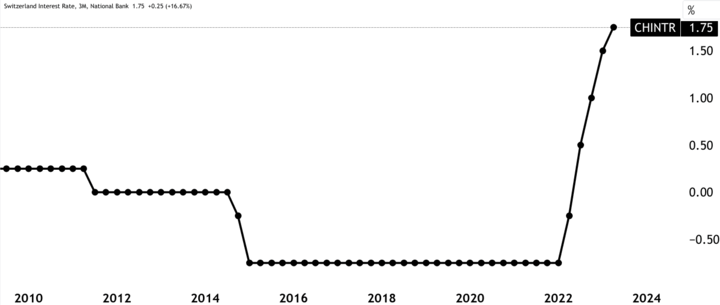

1. Monetary policy of the Swiss National Bank

The Swiss National Bank (SNB) is responsible for monetary policy in Switzerland. Its primary objective is to maintain price stability, taking into account economic conditions and financial stability. To achieve these objectives, the SNB uses various monetary policy instruments, including the setting of a target range for the three-month Swiss franc LIBOR rate.

In particular, the SNB's monetary policy remained accommodative in 2021, with the target range for the LIBOR rate maintained at -1.25% to -0.25%. The negative interest rate environment was intended to curb the appreciation of the CHF, as its safe-haven status often attracts capital inflows in times of global uncertainty. By keeping rates low, the SNB aimed to make Swiss assets less attractive to foreign investors seeking higher returns elsewhere.

2. Interest rate expectations

Expectations and speculation about future interest rate adjustments have a significant impact on currency movements. Traders closely follow central bank communications and economic data releases to gauge potential shifts in interest rate policy. Throughout 2023, the SNB has maintained its high interest rate stance, with further adjustments possible to address inflationary pressures and maintain CHF strength.

Source: tradingview.com

Rumors or hints of future interest rate hikes in Switzerland may strengthen the CHF as investors seek higher yields on their investments. Conversely, if the SNB indicates a continuation of an accommodative policy, this can lead to a weakening of the CHF as investors seek yield elsewhere.

3. Political Climate

- Government economic policy

The economic policies of the Swiss government play a role in shaping the country's economic performance. Switzerland's economic model emphasizes fiscal discipline, open markets, and strong financial institutions. The government's prudent fiscal policies have contributed to a favorable business environment and financial stability.

- Impact of Global Economic Uncertainty on Switzerland

Switzerland's position as a global financial center and its strong export-oriented economy expose it to global economic uncertainties. External factors such as geopolitical tensions, trade disputes and changes in global demand can affect Switzerland's economic outlook.

For example, during periods of global economic instability or uncertainty, the Swiss franc is often perceived as a safe-haven currency, attracting capital inflows from investors seeking refuge from market turmoil. This inflow of capital can drive up the value of the Swiss franc relative to other currencies, posing a challenge to Swiss exporters by making their products relatively more expensive in international markets.

IV. Analysis of the NZD/CHF Currency Pair

A. Relevant Economic Indicators

1. Correlation between the New Zealand and Swiss Economies

The correlation between the New Zealand and Swiss economies is relatively low as they have different economic structures and rely on different sectors for growth. New Zealand's economy is export-oriented and heavily dependent on agriculture and tourism. Switzerland, on the other hand, has a strong financial services sector, manufacturing and pharmaceutical exports. As a result, economic developments in these two countries may not always move in tandem, leading to divergent trends in the NZD/CHF currency pair.

However, it is important to note that both economies are affected by global economic conditions. Changes in international trade dynamics, geopolitical events and shifts in investor sentiment can affect both the NZD and the CHF. Therefore, while the direct correlation may be weak, global factors can create linkages between the two currencies.

2. Impact of GDP growth, inflation rates and interest rates on the currency pair

GDP growth, inflation rates and interest rates are important economic indicators that have a significant impact on the NZD/CHF currency pair.

GDP Growth: Strong economic growth in New Zealand is generally bullish for the NZD. Robust GDP growth indicates a healthy economy, which may lead to increased foreign investment and demand for the NZD. Similarly, when Switzerland experiences strong GDP growth, it can boost the CHF due to positive market sentiment and increased demand for Swiss assets.

For example, if New Zealand's GDP growth comes in better than expected, traders may become bullish on the NZD/CHF, expecting the exchange rate to rise. Conversely, if Switzerland's GDP growth disappoints, traders may become bearish on the CHF, anticipating downward pressure on the currency pair.

Inflation Rates: Inflation affects the purchasing power of a currency. If New Zealand experiences higher inflation than Switzerland, the NZD may depreciate against the CHF. In response to rising inflation, the Reserve Bank of New Zealand (RBNZ) may consider tightening monetary policy by raising interest rates. This policy move may make New Zealand assets more attractive to investors, potentially supporting the NZD.

Source: tradingview.com

On the other hand, if Switzerland experiences higher inflation than New Zealand, this could lead to a stronger CHF. The Swiss National Bank (SNB) could respond by tightening monetary policy to control inflation, making Swiss assets more attractive to investors.

Interest rates: Interest rates are a key driver of capital flows and currency values. Higher interest rates in New Zealand attract foreign investors seeking better returns on their investments, increasing demand for the NZD. Conversely, higher interest rates in Switzerland may attract investors to the CHF.

B. Factors Supporting a Bullish or Bearish Position

1. Impact of the Reserve Bank of New Zealand's monetary policy on the currency pair

The RBNZ's monetary policy decisions have a significant impact on the NZD. If the RBNZ adopts a hawkish stance by signaling potential rate hikes due to strong economic indicators and inflationary pressures, it may support a bullish outlook for the NZD/CHF currency pair. Traders may expect the NZD to appreciate against the CHF, leading to higher exchange rates.

Conversely, if the RBNZ takes a dovish stance by suggesting an accommodative monetary policy to support economic growth, it may lead to a bearish outlook for the NZD and CHF. Traders may expect the NZD to weaken against the CHF.

2. Impact of the Swiss National Bank's Monetary Policy on the Currency Pair

Similarly, the SNB's monetary policy decisions can have a significant impact on the CHF. A hawkish stance by the SNB, indicating potential interest rate hikes, may lead to a bullish outlook for the CHF/CHF currency pair. Traders can expect the CHF to strengthen against the NZD.

Conversely, a dovish stance from the SNB, signaling an accommodative monetary policy to counter deflationary pressures or economic challenges, may support a bearish outlook for the CHF. Traders may expect the CHF to weaken against the NZD.

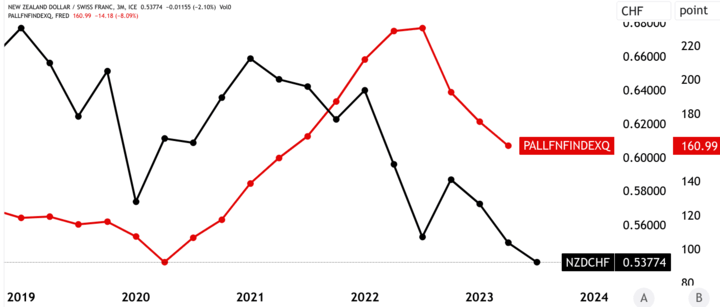

3. Impact of Global Commodity Prices on the New Zealand Economy

As a commodity-exporting nation, New Zealand's economy is sensitive to changes in global commodity prices. For example, an increase in global demand for dairy products can increase New Zealand's export earnings and strengthen the NZD. Conversely, a drop in commodity prices can negatively impact the NZD as export revenues decline.

Source: tradingview.com

C. Potential Risks for the Currency Pair

1. Sudden changes in global economic growth

Any unexpected changes in global economic growth can cause volatility in the NZD/CHF currency pair. A slowdown in global economic growth may reduce demand for New Zealand's exports, negatively impacting the NZD. Similarly, if global economic conditions deteriorate, investors may flock to the safe-haven CHF, causing it to appreciate against the NZD.

2. Unexpected changes in New Zealand or Swiss monetary policy

Central bank policy decisions are closely watched by traders and any unexpected changes in monetary policy can cause significant currency movements. Unexpected interest rate adjustments or shifts in policy statements by the RBNZ or SNB can cause the NZD/CHF exchange rate to fluctuate rapidly.

3. Geopolitical risks, such as trade tensions between the US and China.

Geopolitical events, such as trade tensions between major economies like the US and China, can create uncertainty in global markets. This uncertainty can lead to risk aversion among investors, causing them to seek safe-haven currencies such as the CHF. Such geopolitical risks can cause sudden and sharp movements in the NZD/CHF currency pair.

V. Trading Strategies for the NZD/CHF Cross

Trading the NZD/CHF currency pair requires a comprehensive approach that combines technical analysis, risk management and news trading strategies. By integrating these methods, traders can improve their decision-making process and navigate the dynamic forex market more effectively.

A. Technical Analysis

1. Identifying Trends and Patterns

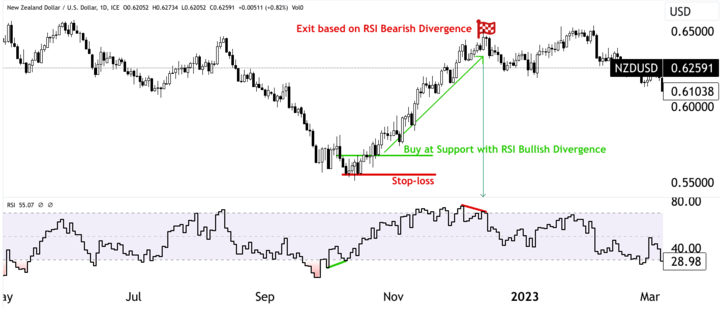

Technical analysis involves studying historical price data and identifying patterns or trends that can help predict future price movements. Traders often use chart patterns such as head and shoulders, double tops and bottoms, and ascending and descending triangles to identify potential trend reversals or continuation patterns.

Source: tradingview.com

For example, if a trader observes a resistance level (red line) forming on the daily chart of the NZD/CHF with an RSI above 70 (overbought levels), this indicates a potential bearish trend. In this scenario, the trader may consider going short when the price breaks below a support level (green line), with a lower price level (blue line) as a profit target.

2. Using Indicators such as Moving Averages and Fibonacci Retracements

Moving averages are popular technical indicators used to smooth price data and identify trends. The 50-day and 200-day moving averages are commonly used by traders to determine the overall trend direction. When the 50-day moving average crosses above the 200-day moving average, it creates a golden cross signal, indicating a potential bullish trend. Conversely, a death cross occurs when the 50-day moving average crosses below the 200-day moving average, signaling a possible bearish trend.

Fibonacci retracements are another valuable technical analysis tool that helps identify potential support and resistance levels. Traders use Fibonacci levels such as 38.2%, 50% and 61.8% to identify potential areas where the price may reverse or consolidate before resuming its trend.

B. Risk Management

1. Setting Stop Loss and Take Profit Levels

Risk management is crucial in Forex trading in order to protect capital and minimize potential losses. Traders should always set Stop Loss and Take Profit levels when entering a trade. A stop-loss order is placed at a predetermined level below the entry price to limit potential losses should the trade move against the trader's position. A take-profit order, on the other hand, is placed at a target price at which the trader aims to exit the trade and lock in profits.

For example, if a trader enters a long position on the NZD/CHF at 0.6500, he can set a stop loss at 0.6450 to limit potential losses. In addition, they can set a Take Profit at 0.6600 to lock in profits if the price reaches the desired target.

2. Determine Position Size Based on Risk Tolerance

Position size is an important aspect of risk management. Traders should calculate their position size based on their risk tolerance and the distance between the entry price and the stop-loss level. A common rule of thumb is to risk only a small percentage of the trading account balance on any single trade, typically in the range of 1% to 2%.

For example, if a trader has a trading account balance of $10,000 and is willing to risk 1% of their account on a NZD/CHF trade with a 50 pip stop loss, they would calculate their position size as follows:

Position Size = (Account Balance × Risk Percentage) / Stop Loss in Pips

Position size = ($10,000 × 0.01) / 50 = $2 per pip

C. News Trading

1. Tracking economic events and data releases

News trading involves analyzing economic events and data releases that may have a significant impact on the NZD/CHF exchange rate. Traders should keep an economic calendar handy to be aware of scheduled announcements such as GDP growth figures, inflation rates and central bank interest rate decisions for both New Zealand and Switzerland.

![]()

Source: vstar.com

2. Trading on the market's reaction to news

When important economic data is released, it can lead to increased volatility and sharp price movements in the forex market. Traders can take advantage of these opportunities by carefully analyzing the news and its potential impact on the NZD and CHF. If the actual data differs significantly from the market's expectations, traders can initiate trades in the direction of the market's reaction.

For example, if the RBNZ announces a surprise rate hike, indicating a hawkish monetary policy stance, traders may expect the NZD to strengthen against the CHF. In this case, they may consider going long on the NZD/CHF in anticipation of further gains.

Trading the NZD/CHF with VSTAR

VSTAR offers a compelling way to trade the NZD/CHF currency pair, with competitive leverage of up to 1:200, allowing traders to participate in more opportunities with less capital. The platform offers premium liquidity, allowing for quick entry and exit of trades at any time.

With spreads starting at 0 pips, VSTAR ensures that traders receive the most competitive pricing on key products. Their commitment to best execution ensures that orders are filled at the best market prices and executed quickly within milliseconds.

VSTAR's CFD trading experience covers a wide range of products, including stocks, indices, currency pairs, commodities and cryptocurrencies, providing traders with diverse opportunities. The platform's market depth, efficient order execution and flexible leverage options enhance the trading experience and allow traders to take advantage of every market opportunity.

Transparency is a key aspect of VSTAR's offering, with transparent fees and extremely low transaction costs giving traders a clear view of their trading costs. The platform's powerful technical infrastructure ensures stability and security, making investments safer and trading smoother for users.

In addition, VSTAR's strict regulatory compliance ensures a transparent and fair trading environment, giving traders added peace of mind in their transactions.

The platform's multi-lingual customer service team provides 24/7 support, ensuring that traders can receive assistance in their preferred language at any time.

VSTAR provides traders with comprehensive tools, chart analyzers, technical indicators, news, education, podcasts and tutorials to enhance their trading skills and help them make informed decisions.

VSTAR's trading app is designed to provide a seamless experience for traders of all types, with enhanced mobile trading capabilities, enabling them to trade efficiently on the go.

VI. Conclusion

A. Recap of the Fundamental Analysis of the NZD/CHF Cross

Economic Indicators: We have discussed key economic indicators such as GDP growth, unemployment rate, inflation rates, and business and consumer confidence. Strong economic performance in both countries can lead to currency appreciation, while weak economic data can lead to currency depreciation.

Monetary Policy: The monetary policies of the Reserve Bank of New Zealand (RBNZ) and the Swiss National Bank (SNB) play a significant role in determining the NZD/CHF exchange rate. Interest rate decisions and policy statements from these central banks can cause significant movement in the currency pair.

Political Climate: The economic policies of the governments of New Zealand and Switzerland, as well as geopolitical risks, can have an effect on the currencies of these countries and therefore on the NZD/CHF exchange rate.

B. Overview of bullish or bearish stance based on analysis

Based on the fundamental analysis, a bullish stance on the NZD/CHF may be supported by strong economic growth in New Zealand, favorable interest rate differentials compared to Switzerland, and positive market sentiment towards the NZD.

On the other hand, a bearish stance may be warranted if New Zealand's economic indicators fall short of expectations, the RBNZ adopts a dovish monetary policy stance, or global economic uncertainty drives investors to safe-haven currencies such as the Swiss franc.

C. Final Thoughts on Trading the NZD/CHF Cross Based on Fundamental Analysis and Trading Strategies

Trading the NZD/CHF cross requires a well-rounded approach that combines fundamental and technical analysis with sound risk management strategies. Traders need to stay abreast of economic data releases and central bank announcements from both countries in order to make informed decisions.

Source: tradingview.com

Technical analysis tools such as trend lines, moving averages and Fibonacci retracements can complement fundamental analysis by providing additional insight into potential entry and exit points.

In addition, implementing proper risk management techniques, such as setting stop-loss and take-profit levels and determining appropriate position sizes, is critical to protecting capital and managing potential losses.

Given the risks associated with trading, it is important to trade with a regulated and reputable broker, such as VSTAR, that offers competitive leverage, deep liquidity, and an easy-to-use trading platform with advanced tools and resources.