- Nvidia's data center revenue skyrockets by 27% in Q4, reaching $18.4 billion.

- AI inference contributes significantly, driven by the adoption of the NVIDIA Hopper GPU computing platform.

- Gaming revenue surges by 56% in Q4, fueled by technological advancements and strategic expansions.

- Pro visualization revenue grows by 105% in Q4, reflecting increasing demand in industrial verticals.

Nvidia's Q4 fiscal 2024 earnings delivered a solid value growth signal. The article explores the earnings report in detail, with technical implications for the stock price.

Data Center Revenue Growth

In Q4, Nvidia's data center revenue reached $18.4 billion, up by 27% sequentially. The data center revenue saw a remarkable 409% increase compared to the previous year. For fiscal year 2024, the data center revenue was $47.5 billion, more than tripling from the prior year.

In detail, approximately 40% of data center revenue in the past year was attributed to AI inference. The growth was driven by the adoption of the NVIDIA Hopper GPU computing platform. Also, Networking revenue tripled from the previous year, indicating the significance of end-to-end networking solutions like InfiniBand.

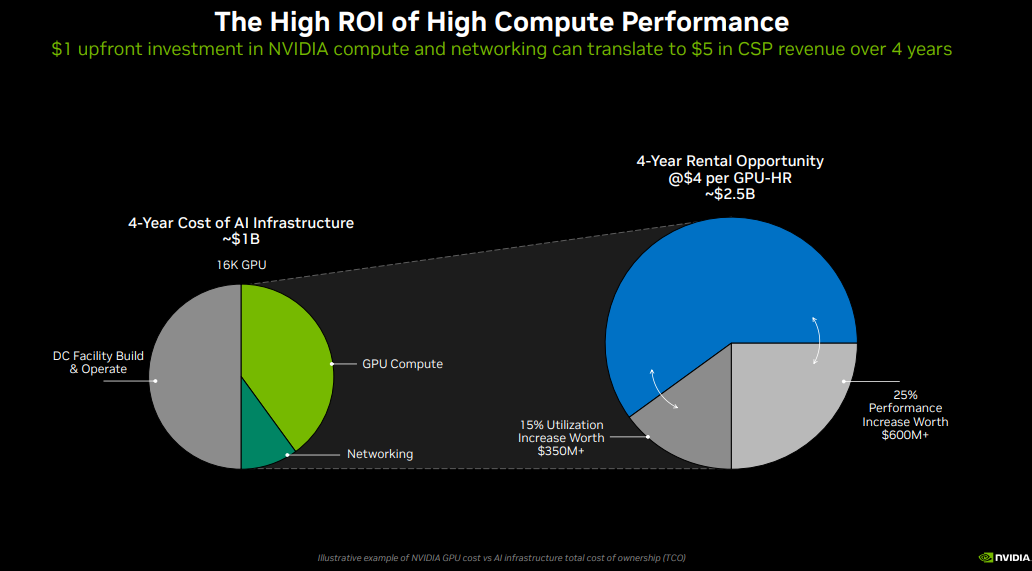

Fundamental, Nvidia's data center platform enables high ROI across various use cases, including AI training, inference, and data processing. Despite improvements in supply for Hopper architecture products, demand continues to exceed supply, leading to supply constraints.

Source: Company Presentation

Looking forward, Strong demand for next-generation products is expected to result in supply constraints in the future. Data center revenue growth was strong across all regions except China, where revenue declined significantly due to export control regulations. China represented a mid-single digit percentage of data center revenue in Q4, with expectations to stay in a similar range in the first quarter.

AI Adoption in Various Industries

Industry Verticals and Adoption Trends:

Consumer internet companies, including search, e-commerce, social media, and entertainment, are major adopters of AI, utilizing deep learning-based recommendation systems. Enterprise software companies are applying generative AI to boost productivity, with notable commercial success stories like ServiceNow driving significant net new annual contract value.

Notably, the field of LLMs is thriving, with leading companies making breakthroughs in generative AI. Startups are emerging to serve specific languages, cultures, and industries. Also, Nvidia's AI infrastructure is driving demand across various industries beyond traditional tech sectors, including biology, pharmaceuticals, automotive, healthcare, and financial services.

Finally, data center revenue contribution from the automotive vertical exceeded $1 billion last year, reflecting strong demand for Nvidia's DRIVE infrastructure solutions. Nvidia's AI infrastructure is deployed globally, catering to diverse market needs and tapping into the global demand for AI technologies.

Strong Performance in Gaming Segment

Gaming Revenue Trends:

Gaming revenue reached $2.87 billion in Q4, representing a 56% increase year-on-year. Fiscal year revenue in the gaming segment was $10.45 billion, up by 15%.

Product Offerings and Technological Advancements:

Nvidia's GeForce RTX GPUs, including the newly announced GeForce RTX 40 Super Series, offer both gaming performance and generative AI capabilities. AI Tensor cores and GPUs power AI for gaming, enhancing gaming performance and everyday productivity. Also, Technologies like DLSS and Tensor RT LLM improve ray tracing performance and inference speed, respectively, providing a better gaming experience for users.

Additionally, Nvidia's expansion into the AI-enabled laptop market with the RTX 40 Series AI laptops from major OEMs indicates a strategic move to reach a broader audience of gamers. Furthermore, Nvidia's comprehensive platform for building and deploying generative AI applications for RTX PCs and workstations aims to foster innovation and differentiation in the gaming industry.

Expansion in Pro Visualization and Automotive Segments

Pro Visualization Revenue Growth:

Pro visualization revenue reached $463 million in Q4, up by 105% year-on-year. Sequentially, revenue increased by 11%, reflecting a steady upward trend.

Automotive Revenue Trends:

Automotive revenue reached $281 million in Q4, marking an 8% sequential increase and crossing the $1 billion mark for fiscal year revenue. Automakers continue to adopt Nvidia's DRIVE platform for autonomous driving and other AI-related applications.

Lastly, collaboration with creative partners and developers, including leading automakers like LOTUS, aims to drive innovation and enhance the customer experience in the automotive sector. Also, demand in key industrial verticals like manufacturing, automotive, and robotics drives growth in the pro visualization segment, reflecting the adoption of RTX Ada architecture GPUs.

Nvidia (NVDA) Stock Technical Take

The Nvidia stock price has jumped over 16% since the Q4 fiscal 2024 earnings report. Technically, the NVDA stock price may hit $964 by the end of Q1 fiscal 2025 (April 2024).

Source: tradingview.com

On the upside, the core short-term resistance has emerged near $854 in the upcoming weeks, and the price may interact with this level (in the form of a minor correction). After that, the price may resume its ongoing upward trajectory (as observed from the trend line in purple) to hit the next major resistance at $964. On the downside, $696–$691 may serve as a critical support range. The pivot of the current price momentum is at $730, which will also serve as a solid support.

Finally, looking at the RSI standing at 72, although it signifies an overbought price level, their bearish divergence has not emerged yet, and the strength has resumed (quickly) from neutral momentum at the level of 50. Hitting the core support is very less likely, as it is way below $606.

In conclusion, Nvidia's Q4 demonstrated robust fundamentals, suggested by solid growth in data center revenue, gaming, and AI integration. As AI demand outpaces tech supply and tech advancements drive expansion, the stock's price direction indicates a bullish trend. Technical analysis suggests potential resistance levels, yet the overarching momentum remains firmly upward.