- North America's LNG export capacity is set to grow over the next five years, driven by new projects in Mexico, Canada, and the United States, creating significant opportunities for CFD trading.

- The expansion of Mexico's LNG export capacity, Canada's ambitious LNG projects, and the United States' pioneering role in LNG exports highlight North America's emergence as a key player in the global LNG market.

- Canada is actively entering the LNG market, with two projects under construction in British Columbia, offering a combined export capacity of 2.1 Bcf/d.

- The United States is adding LNG export capacity through five projects, with Golden Pass and Plaquemines LNG expected to start exports in 2024.

Natural gas, as a vital component of the global energy mix, is subject to a complex web of factors that influence its production, demand, and pricing dynamics.

Expanding LNG Exports: A Game Changer

One of the most significant factors influencing the natural gas market is the substantial expansion of LNG exports in North America. Over the next five years, there is a significant surge in LNG export capacity expected, primarily driven by projects in Mexico, Canada, and the United States. This expansion is poised to have profound consequences on both regional and global energy markets, which, in turn, directly impact the price of CFDs on natural gas.

Mexico: Emerging as a Key Player

Mexico, a nation that has traditionally been a natural gas importer, is positioning itself as a major player in the LNG market. Currently, three projects are under construction in Mexico, with a collective LNG export capacity of 1.1 billion cubic feet per day (Bcf/d). These projects are Fast LNG Altamira, Fast LNG Lakach, and Energia Costa Azul.

Fast LNG Altamira is particularly noteworthy. It comprises three units, each with the capacity to liquefy up to 0.18 Bcf/d. The first unit is located offshore, while the other two units are onshore at the Altamira LNG regasification terminal. These units will be supplied with natural gas from the United States via the Sur de Texas-Tuxpan pipeline. The initial LNG exports from the offshore unit are anticipated to commence in December 2023, and LNG exports from the onshore units are projected to start in 2025.

Fast LNG Lakach, another Mexican project, with a capacity of 0.18 Bcf/d, is set to be installed offshore of Veracruz, Mexico, at the nearby Lakach natural gas field. First LNG exports from this project are anticipated in 2026.

The Energia Costa Azul LNG export terminal, situated in Baja California, western Mexico, is another significant project. It will have a LNG export capacity of 0.4 Bcf/d for Phase 1 (currently under construction) and an ambitious 1.6 Bcf/d for Phase 2 (proposed). The export terminal will be supplied with natural gas from the Permian Basin in the United States.

Furthermore, developers have proposed other LNG export projects for Mexico's west coast, including Saguaro Energia LNG, Salina Cruz FLNG, and Vista Pacifico LNG. These projects have a combined capacity of over 2.7 Bcf/d. They intend to leverage the relatively low-cost natural gas imported from the United States for LNG exports to Asian markets. However, it's crucial to note that none of these proposed projects has reached a final investment decision, signifying potential risks and uncertainties associated with their development.

Canada's Growing Presence in LNG Exports

Canada is making noteworthy strides in the LNG market, with two projects currently under construction in British Columbia, contributing a combined LNG export capacity of 2.1 Bcf/d. LNG Canada, boasting an export capacity of 1.8 Bcf/d, is scheduled to commence operations in 2025, while Woodfibre LNG, with a capacity of 0.3 Bcf/d, is expected to begin service in 2027. Moreover, Canada's National Energy Board has authorized an additional 18 LNG export projects with a substantial combined capacity of 29 Bcf/d.

This growth of the Canadian LNG industry signifies a positive trend, demonstrating the nation's intent to tap into the lucrative global LNG market, especially in Asia. However, these projects face competitive pressures and uncertainties related to global LNG prices and evolving market dynamics.

United States: The Pioneering LNG Exporter

The United States has been a trailblazer in the LNG export industry, currently possessing 11.4 Bcf/d of existing LNG capacity. At present, five LNG export projects are under construction, adding 9.7 Bcf/d of LNG export capacity. Among these projects are Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande, and Port Arthur. LNG exports from Golden Pass LNG and Plaquemines LNG are anticipated to start in 2024.

The expansion of the United States' LNG export capabilities is significant for its economy, promoting energy independence and creating new opportunities in the energy sector. Nevertheless, the U.S. LNG market is becoming increasingly competitive, with global players vying for market share. Furthermore, regulatory and environmental challenges could potentially impact the pace of LNG project development.

Market Highlights and Pricing Trends

Detailed analysis of market highlights is essential in understanding the current state of the natural gas market. Recent data indicates that prices are undergoing fluctuations, though mostly within a relatively narrow range.

The Henry Hub spot price, which serves as a benchmark for natural gas prices in the United States, has experienced a modest decline, primarily due to regional supply and demand dynamics. Importantly, prices on the West Coast have witnessed substantial changes, illustrating the influence of regional factors on pricing.

On the international front, LNG prices in East Asia have seen an increase, while natural gas futures prices for delivery at the Title Transfer Facility (TTF) in the Netherlands have decreased. These trends underscore the growing importance of Asian markets for LNG exports. The state of international LNG prices is crucial for North American LNG exporters, as it significantly impacts their revenue and market selection.

Supply and Demand Dynamics

The supply and demand dynamics are fundamental drivers of natural gas prices and are closely monitored by traders in the CFD market. It's essential to provide precise information in this regard.

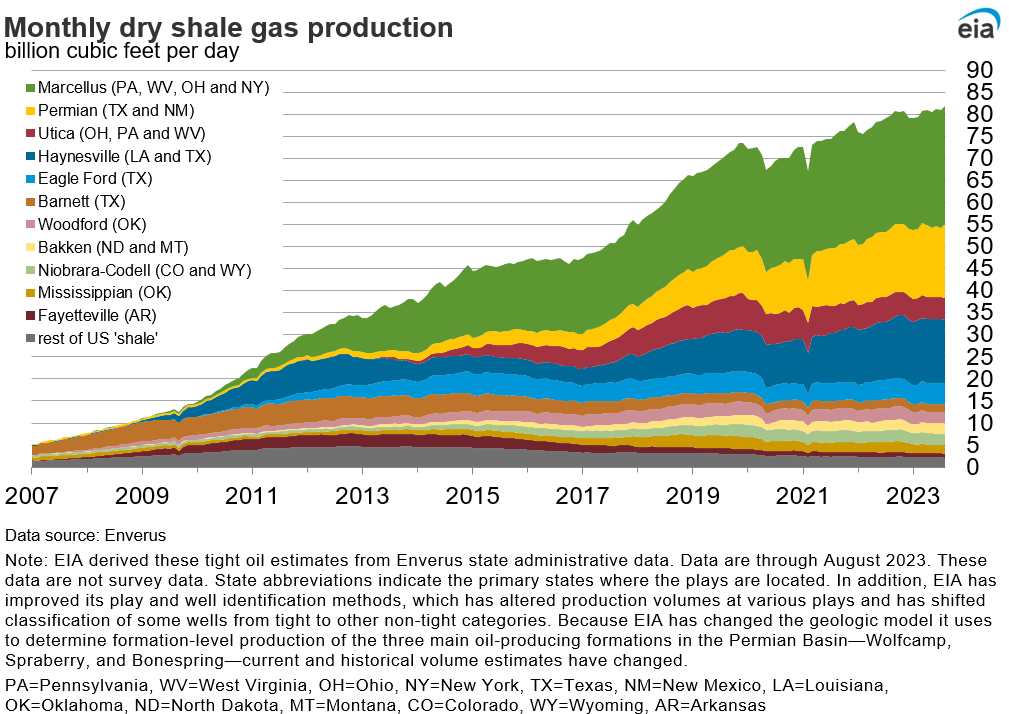

The average total supply of natural gas in the United States has exhibited a slight decrease of 0.1% (0.1 Bcf/d) in the recent period. Dry natural gas production, however, has grown by 0.1% (0.1 Bcf/d) to a weekly average of 102.6 Bcf/d. Average net imports from Canada have decreased by 3.8% (0.2 Bcf/d) from the previous week.

On the demand side, total U.S. consumption of natural gas has fallen by 1.6% (1.1 Bcf/d) in comparison to the preceding report week. This decline has been driven by reduced demand in the residential and commercial sectors, primarily due to milder temperatures, which led to decreased demand for space heating. In contrast, natural gas consumed for power generation has risen by 2.5% (0.8 Bcf/d) week over week. Industrial sector consumption has decreased by 1.1% (0.2 Bcf/d) during the same period.

It is crucial to provide precise information in terms of demand factors, as changes in demand can have an immediate impact on CFD prices.

Source: eia.gov

LNG and Export Trends

LNG exports play a pivotal role in shaping natural gas prices. Traders are keen to understand the trends in LNG exports, as these can influence trading strategies.

LNG exports from the United States have seen a slight reduction, attributed to fluctuating global demand and regional dynamics. The United States remains sensitive to these changes, emphasizing the need for flexibility in export strategies.

Moreover, tracking the number of LNG vessels departing U.S. ports is essential. These vessels are the lifelines of LNG exports. However, it's crucial to monitor any potential supply chain disruptions and their impact on the LNG market, as these disruptions can lead to price volatility in the CFD market.

Rig Count and Storage: Implications for Supply Security

Rig counts and storage levels have significant implications for the natural gas market. The number of rigs drilling for natural gas directly affects production levels and supply. Thus, changes in rig counts are closely monitored by traders.

According to data from Baker Hughes, the natural gas rig count increased by 1 to 118 rigs for the week ending October 17. Understanding the specific regions where these rigs are being added or removed is crucial for traders.

Storage levels also play a critical role in ensuring supply security. Precise data on the net injections into storage and current working natural gas stocks are essential for CFD traders to gauge future supply availability and potential price movements.

In conclusion, the North American natural gas market is undergoing a transformative phase with LNG exports at the forefront of change. While opportunities abound, traders in the CFD market must remain vigilant, adaptable, and well-informed to navigate the evolving dynamics of this critical industry.

Source: tradingview.com