As traders anticipated the Bank of England's (BoE) announcement today, the GBPUSD surged beyond 1.2700 on a relatively calm Wednesday. Despite the recent UK economic data falling short of expectations, the BoE is expected to maintain the interest rate at 5.25%. However, the data is not sufficient to arouse concerns about a recession.

The UK Inflation Was Eased To 2% Target Level

On Wednesday, the Pound Sterling (GBP) surpassed the critical resistance level of 1.2700 due to the UK Office for National Statistics (ONS) releasing data that suggested a decrease in price pressures in May, as had been anticipated. For the first time in over three years, the UK's annual headline inflation decreased to the central bank's target of 2% from 2.3% in April. The core Consumer Price Index (CPI), which excludes volatile food and energy prices, decreased from 3.9% to 3.5% during the same period.

Headline inflation increased by 0.3% every month, which was slightly below the anticipated 0.4% increase. In addition, the report indicated that the annual Producer Price Index (PPI) for Core Output experienced a substantial increase of 1.0% in May, as opposed to a 0.3% increase in the previous month.

BoE Rate Decision Eyed

The US Dollar's counterparts made modest gains due to the market's low trading volumes, which were triggered by the closure of US markets for the Juneteenth holiday. The issuance of the US Initial Jobless Claims report for the week ending June 14 is anticipated to stimulate trading on Thursday. The forecast anticipates a modest decrease in new jobless claims to 235,000 from the previous 242,000 while still exceeding the four-week average of 227,000.

The BoE will update its Monetary Policy Report and announce its most recent rate decision prior to the release of US data during the London session. The market widely anticipates the BoE maintaining the interest rate at 5.25%. The Monetary Policy Committee (MPC) is anticipated to vote seven to two to maintain the rate, with seven members supporting the hold and two advocating for a rate reduction.

GBPUSD Forecast Technical Analysis

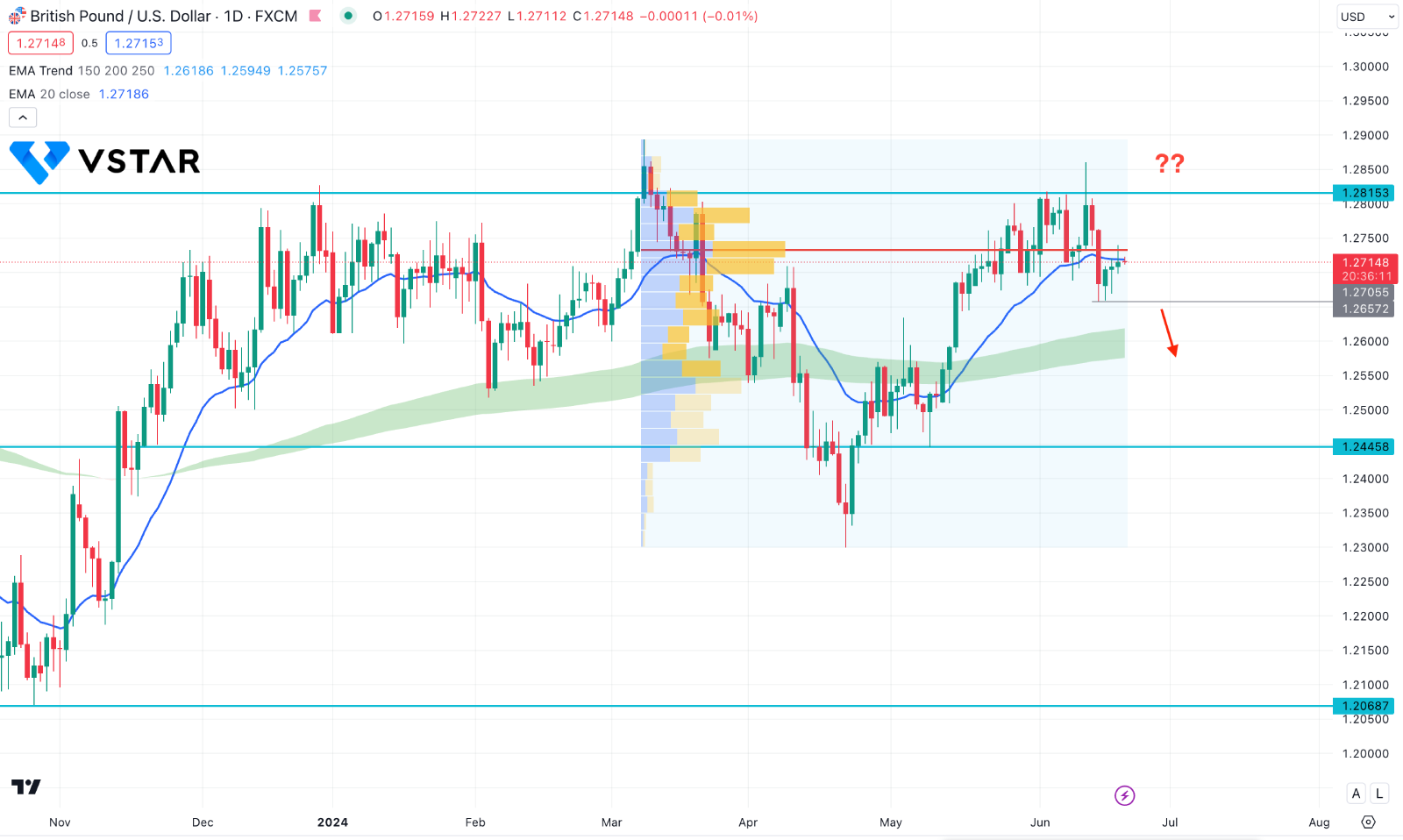

In the daily chart of GBPUSD, the recent price shows a consolidation after a bull run, from where a trend continuation might come after a valid bullish range breakout.

In the volume structure, the most significant level since March 2024 is just above the current price, working as immediate resistance with the dynamic 20-day EMA. Moreover, the moving average wave shows a long-term bullish trend, which is below the 1.2705 support level.

Based on the daily market outlook of GBPUSD, any bullish continuation with a daily candle above the high volume line could signal a high probability of trend continuation. In that case, the ultimate target for this pair is to test the 1.3000 psychological level.

On the other hand, a deeper discount is possible below the 1.2705 level, but a stable market below the MA wave could be a bearish signal, targeting the 1.2300 level.