GBP/AUD Currency Pair Overview

The exchange rate between the British pound and the Australian dollar is represented as the GBP/AUD currency pair, also called the pound sterling and Australian dollar pairing. It is a common trading instrument on the world foreign exchange market and reflects the value of one currency in relation to another.

Importance of Fundamental Analysis

Understanding and predicting the movements of currency pairs like GBP/AUD depends heavily on fundamental analysis. It entails examining the economic, political, and social aspects that affect how much different currencies are worth. By evaluating these key variables, trading professionals can design strategies and make educated selections.

Fundamental analysis sheds light on a nation's underlying economic circumstances. It entails monitoring metrics, including GDP expansion, inflation rates, employment statistics, central bank actions, and geopolitical developments. These elements affect a country's currency and influence changes in the exchange rate.

Trading decisions can be well-informed by examining fundamental indicators, which traders can use to forecast market movements. For instance, if a nation's economic statistics show strong growth, it can entice overseas investors, increasing the value of its currency. On the other hand, dismal economic news or unrest in the political system can weaken a currency.

A Short Description of the British Pound and the Australian Dollar

The United Kingdom uses the British pound, abbreviated as GBP. The Bank of England backs the pound sterling, which has a long history spanning several centuries. It is recognized for its consistency and widespread acclaim.

The official currency of Australia is the Australian dollar, represented by its symbol AUD. The Reserve Bank of Australia controls it, also called the Aussie dollar. Commodity prices, interest rates, and trade ties are just a few variables that impact the Australian dollar. Because Australia exports many commodities like iron ore and coal, changes in the price of those commodities might significantly impact the Aussie dollar.

Macroeconomic Overview - United Kingdom

Economic Indicators Review

The macroeconomic overview of the United Kingdom, which includes important indicators like the GDP, unemployment rate, inflation rates, and business and consumer confidence, offers insightful information about the nation’s economic performance.

A country's Gross Domestic Product (GDP), which represents the total value of the products and services generated there, is the main indicator of economic activity. The economy of the UK is strong and diverse, with a strong emphasis on services, manufacturing, and finance. The UK's GDP is currently 0.2%, demonstrating consistent growth, albeit slow.

The unemployment rate is a key metric for assessing the state of the labor market. It displays the proportion of the labor force that is unemployed and actively looking for work. Lower unemployment rates suggest more job opportunities and a healthy economy. The most recent unemployment rate in the UK is 3.9%, which shows a stable job market and favorable trends in employment possibilities.

As the nation's central bank, the Bank of England seeks to maintain an inflation target of 2%. Interest rates, consumer spending, and investment choices are just a few of the economic factors that inflation impacts. The UK's most recent inflation rate is 2%, which reflects the nation’s price stability level.

Business and consumer confidence are important indicators that shed light on the thoughts and expectations of industry players. Business optimism represents the hopes and expectations of businesses for future economic situations. A higher level of company confidence frequently results in more investment, growth, and job creation. Contrarily, consumer confidence shows people's attitudes and readiness to spend money and make significant purchases. Consumer and business confidence are key factors in economic growth.

Monetary Policy

Bank of England's Monetary Policy

The Bank of England (BoE) determines the UK's monetary policy. Its duties as the nation's central bank include preserving price stability, fostering economic expansion, and protecting the financial system. The BoE's monetary policy decisions greatly impact numerous elements of the economy.

Setting interest rates is the BoE's main instrument for influencing the economy. The BoE chooses the right level of interest rates to meet its goals through its Monetary Policy Committee (MPC). The BoE seeks to control inflation, promote economic growth, and maintain financial stability through changing interest rates.

Interest Rate Expectations

Expectations regarding interest rates significantly impact the economy and financial markets. They impact interest rates on loans, savings, investment choices, and exchange rates. Market participants closely follow the BoE's pronouncements and actions about interest rates to predict future policy changes.

Interest rate changes have the power to either accelerate or slow economic growth. Interest rate reductions promote both investment and consumption by encouraging borrowing and spending. On the other hand, increasing interest rates can reduce inflationary pressures, cool down a hot economy, and promote saving.

Various factors influence interest rate expectations, including economic data, inflation trends, employment figures, and global economic conditions. It is important to note that interest rate decisions are based on careful analysis and considerations of economic indicators and projections.

Political Climate

Economic policies of the government

Through the implementation of government economic policies, the political environment in the United Kingdom substantially impacts the economic environment. These measures aim to support stability, tackle societal issues, and encourage economic progress.

The UK government develops and puts economic policies into effect through various actions, including fiscal policy, regulatory reforms, and strategic investments. Budgetary allocations, taxation, and spending decisions are all part of fiscal policy. The government attempts to affect economic activity, promote growth, and manage public finances by changing tax rates and spending levels.

Reforms to regulations also have a significant impact on how the business environment is shaped. The government may pass laws that promote entrepreneurship, increase market competition, and simplify business conduct. These changes are intended to increase investment and productivity and assist industry expansion.

Brexit

Brexit, the UK's decision to leave the European Union, has significantly altered the political and economic climate. Due to the complexity and uncertainty of choosing to leave the EU, careful planning and navigation are now necessary.

Regulations, market access, and trade relations have all changed due to Brexit. The UK government has had to negotiate new trade deals, set up customs procedures, and create new regulations for specific industries. These changes have an impact on enterprises, commerce, and economic expansion.

Addressing potential obstacles and embracing opportunities are necessary to manage the effects of Brexit. The government has been implementing transitional plans, supporting impacted industries, and forming new trade alliances to lessen disruptions and ensure a seamless transition. The constantly changing nature of the Brexit negotiations and follow-up agreements necessitates constant observation and flexibility.

Macroeconomic Overview – Australia

Economic Indicators Review

GDP and Unemployment Rate

Both the GDP and unemployment rate show robust growth in the Australian economy. The value of all products and services generated in a nation is reflected in the GDP, which is a key indicator of economic activity. Australia has a well-diversified economy with considerable contributions from industries including mining, services, agriculture, and manufacturing.

Consistent economic growth has been observed in the nation thanks to strong export markets, domestic demand, and investments in important industries. This development helps to raise living standards and increase employment opportunities.

Australia has been successful in keeping its unemployment rate at comparatively low levels. The Australian government and policymakers continue to prioritize employment initiatives and skill development programs to assist additional job growth and lower unemployment.

Inflation Rates

Maintaining price stability and the purchasing power of the Australian dollar depends heavily on inflation rates. As the nation's central bank, the Reserve Bank of Australia (RBA) uses a variety of monetary policy instruments to control inflation within a goal range of 2-3%. To keep inflation under control, the RBA carefully monitors economic indicators and modifies interest rates as necessary.

Business and Consumer Confidence

Investor, consumer, and economic growth can all be significantly impacted by business and consumer confidence, a key indicator of economic sentiment.

Businesses' optimism and expectations for the economy’s future are reflected in their business confidence. It affects choices about investments, company growth, and employment. Consumer confidence, on the other hand, reflects the sentiment and willingness of individuals to spend and make major purchases. Higher consumer confidence leads to increased consumer spending, which stimulates economic activity.

Monitoring consumer and corporate confidence offers insights into the general economic picture and aids in the decision-making of businesses, decision-makers, and investors. The Australian economy may maintain growth and stability by establishing an atmosphere favorable to business and consumer mood.

Monetary Policy

Reserve Bank of Australia's Monetary Policy

In Australia, the Reserve Bank of Australia (RBA) is responsible for developing and carrying out monetary policy. As the nation's central bank, the RBA is essential to preserve price stability, promote economic growth, and guarantee the financial system’s stability.

The RBA's Board decides on changes to its monetary policy after evaluating the state of the economy and variables that affect inflation and economic growth. Setting the official cash rate, which impacts interest rates across the financial system, is the RBA's main weapon for influencing the economy.

The RBA evaluates economic data like GDP growth, employment statistics, wage growth, and inflation trends to determine whether the official cash rate needs to be adjusted.

The RBA controls the monetary environment by using open market operations, liquidity management, regulatory policies, and interest rate decisions. These initiatives guarantee the financial system's effectiveness and stability, which promotes long-term economic growth.

Interest Rate Expectations

Market participants, companies, and consumers actively monitor interest rate predictions because they impact borrowing costs, savings rates, and investment choices. The RBA's decisions about the official cash rate are greatly affected by interest rate expectations.

Changes in interest rates impact various economic sectors. Interest rates can increase investment, consumption, and economic activity by encouraging borrowing and spending. On the other hand, increasing interest rates can reduce inflationary pressures, promote saving, and rein in overborrowing.

Various variables, such as economic indicators, inflationary trends, job situations, and developments in the global economy, impact interest rate expectations. To forecast potential changes in interest rates, market participants actively examine RBA announcements, economic data releases, and other indications.

Remembering that the RBA bases its decisions on meticulous study, considering domestic and global issues is crucial. The RBA's strategy is to achieve resilient financial systems, stable prices, and sustained economic growth.

Political Climate

Economic policies of the government

The political environment influences Australia's government's economic policies to promote economic growth, stability, and social well-being. The government develops and puts into effect economic policies through several different strategies, including fiscal policy, regulatory reforms, and tactical investments.

As the government sets tax rates, spending priorities, and budgetary allocations, fiscal policy is crucial to governing the economy. The government's fiscal policy balances economic growth and prudent fiscal management while bolstering important industries, encouraging investment, and tackling societal issues.

Another component of economic policies is regulatory reform, which aims to improve the business climate, market competitiveness, and innovation. The government may enact reforms to simplify rules, lessen bureaucratic red tape, and encourage entrepreneurship.

Smart investments in infrastructure, R&D, and education also boost long-term economic growth and competitiveness. To boost economic activity and productivity, the government determines important sectors for investment and allots money to those areas.

Impact of global trade disputes on Australia

Due to its dependence on international trade, Australia's economy may be heavily impacted by global trade disputes. Trade disputes involving tariffs, trade restrictions, or modifications to trade agreements can disrupt supply chains, impact export markets, and give firms reason for concern.

Australia's economy is susceptible to changes in trade rules and worldwide demand because it is a significant exporter of commodities. Industries, including mining, agriculture, and manufacturing, which are important drivers of the Australian economy, can be impacted by disruptions in global trade.

Additionally, modifications in the dynamics of global commerce may impact consumer sentiment, foreign direct investment, and investor confidence. Trade dispute uncertainty might result in cautious investment choices and decreased economic activity.

The Australian government uses tactics like diversifying export markets, pursuing trade agreements with other nations, and engaging in diplomatic efforts to resolve disputes to mitigate the effects of international trade conflicts. These programs seek to preserve market access, advance ethical corporate conduct, and defend the interests of Australian firms and industries.

Analysis of the GBP/AUD Currency Pair

Correlation between the UK and Australian economies

When examining the GBP/AUD currency pair, it is essential to comprehend the relationship between the UK and Australian economies. The two nations' interdependence, commerce, and other economic linkages may affect the exchange rate. Assessing the prospective direction of the currency pair requires close monitoring of economic variables such as GDP growth, inflation rates, and interest rates in both nations.

Impact of GDP growth, inflation rates, and interest rates on the currency pair

An important metric for gauging a nation's economic health is GDP growth. A stronger currency might be attracted by increased GDP growth. On the other side, inflation rates affect a currency's purchasing power. A currency's value may be reduced by higher inflation, but a currency's strength may be increased by lower inflation. Interest rates have an impact on investment choices and capital flow, which affects currency valuations. Changes in GDP growth, inflation rates, and interest rates in the UK and Australia may impact the GBP/AUD currency pair.

Factors Supporting a Bullish or Bearish Stance

Brexit and its impact on the currency pair

The GBP/AUD currency pair is now subject to uncertainty due to the UK's exit from the European Union or Brexit. The direction of the Brexit talks, trade deals, and market perception of the UK's economic prospects can all impact the currency pair. (It should be noted that most issues are resolved at this point, but some remain.) Positive events may support an optimistic outlook, whereas a bearish outlook may result from uncertainties or unfavorable consequences.

Impact of Bank of England's interest rate policy on the currency pair

The interest rate decisions and policies of the Bank of England (BoE) can significantly influence the GBP/AUD currency pair. Higher interest rates in the UK relative to Australia can attract investors and strengthen the pound, leading to a bullish stance. Conversely, lower interest rates or unexpected BoE policy changes can weaken the pound, resulting in bearish sentiment.

Impact of the Reserve Bank of Australia's monetary policy on the currency pair

The GBP/AUD currency pair is significantly influenced by the Reserve Bank of Australia's (RBA) monetary policy actions. The Australian dollar is subject to the RBA's policy announcements, changes in interest rates, and economic forecasts. Higher interest rates or hawkish policy signals may support an optimistic prognosis, while lower interest rates or dovish signals may spark a negative outlook.

Potential Risks to the Currency Pair

Sudden changes in global trade policies

Tariffs, trade disputes, and protectionist policies can increase volatility and risk for the GBP/AUD currency pair. Supply chains can be damaged, export-import dynamics might be impacted, and investor confidence can be affected by abrupt changes in trade policies. When evaluating the risks associated with the currency pair, keeping track of global trade developments and any potential ramifications is crucial.

Unexpected changes in UK or Australian monetary policies

Unexpected monetary policy movements, such as interest rates or policy decisions, can greatly affect the GBP/AUD currency pair. Currency volatility can be brought on by monetary policy changes inconsistent with market expectations. Keeping up with central bank announcements, publishing economic data, and policy changes is essential for evaluating the currency pair's risks.

Natural disasters and other geopolitical risks

Political unpredictability, geopolitical unrest, and natural disasters can all harm the GBP/AUD currency pair. These events may impact economic stability, investor confidence, and trade relations. It is crucial to keep track of geopolitical changes and determine how they might affect the impacted economies and currencies.

Trading Strategies for GBP/AUD

Technical Analysis

Identifying trends and patterns

Using technical analysis, you may see trends and patterns in the GBP/AUD currency pair by looking at historical price data. Traders evaluate price movements using tools including trendlines, support and resistance levels, and chart patterns. Trading professionals can make educated decisions about purchasing or selling a currency pair by seeing and following trends.

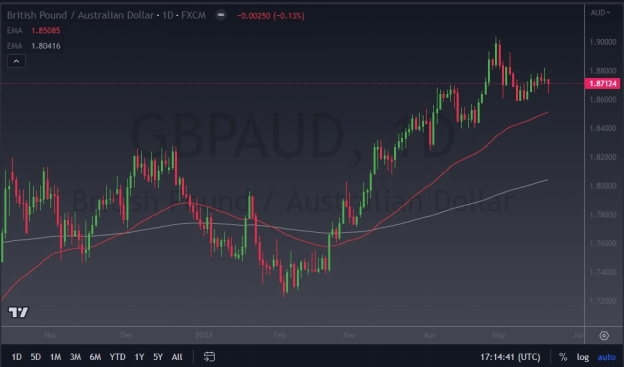

Use of indicators such as moving averages and Bollinger Bands

Moving Averages on a GBP/AUD chart

Traders frequently use technical indicators to gain further insights into the state of the market. For instance, moving averages can identify probable support or resistance levels and smooth out price swings. Bollinger Bands offer data on probable overbought or oversold circumstances and volatility. These indicators can help traders decide when to enter and leave a position based on price changes and market conditions.

Risk Management

Setting stop-loss and take-profit levels

When trading GBP/AUD, it is essential to put risk management measures into practice. To reduce potential losses and ensure profits, traders should choose proper stop-loss and take-profit levels. Take-profit orders capture profits when the market goes in the right direction, while stop-loss orders prevent substantial losses if the market swings negatively.

Determining position size based on risk tolerance

A trader’s position size should depend on their risk appetite and account size. The risk may be managed by determining the proper position size and keeping prospective losses within reasonable bounds. Trading professionals can help traders choose the ideal position size for each trade using risk management approaches like the percentage risk rule.

News Trading

Following economic events and data releases

Monitoring and responding to data releases and economic events impacting the GBP/AUD currency pair constitute news trading. Key economic data, including GDP growth, inflation rates, and employment statistics from the UK and Australia, should be monitored by traders. By monitoring these events, traders can forecast prospective market changes and modify their trading strategy.

Trading based on market reactions to news

Market reactions to important economic news releases can cause volatility and present trading opportunities. Traders can profit from these fluctuations by initiating positions depending on how they understand the news and how it affects the GBP/AUD currency pair. It is crucial to remember that news trading has inherent risks because market responses might be unanticipated.

Trade GBP/AUD at VSTAR

Trading the GBP/AUD pair offers many opportunities when approached with strategy and professionalism. It would be best to deal with a trusted broker to continue benefiting from this pair. VSTAR offers regulation and licensing in the EU, falling under the protection of CySEC. By offering vast liquidity and balance protection, traders can feel secure in their investments in this pair and all our markets.

Conclusion

In conclusion, several variables that need careful consideration and evaluation affect the GBP/AUD currency pair. Understanding the underlying economic conditions in Australia and the UK, including GDP growth, inflation rates, interest rates, and political variables, is vital. These elements impact the currency rate and shed light on anticipated market moves.

The monetary policies of the Bank of England (BoE) and the Reserve Bank of Australia (RBA) also significantly impact the GBP/AUD exchange rate. Both central banks ' interest rate decisions and policy changes can influence investor sentiment and the strength of the respective currencies.

Risks to the currency pair include sudden changes in global trade policies, unexpected shifts in monetary policies, and geopolitical events. Natural disasters and political instability can also affect the exchange rate.

Traders can employ various strategies when trading the GBP/AUD pair, including technical analysis, risk management techniques, and news trading based on economic events and data releases. Proper risk management, setting stop-loss and take-profit levels, and determining position sizes based on risk tolerance are essential aspects of trading this currency pair.

When engaging in GBP/AUD trading, it is advisable to choose a reputable broker like VSTAR that offers regulation, licensing, liquidity, and balance protection to ensure a secure trading experience.

Overall, a comprehensive understanding of fundamental factors, careful analysis, and the adoption of appropriate trading strategies can assist traders in making informed decisions when trading the GBP/AUD currency pair.