Forex trading, also known as foreign exchange trading, is the buying and selling of different currencies in the global market. It is the largest financial market in the world, with an estimated daily trading volume of over $5 trillion. Forex trading offers many opportunities for investors to make profits, but it also involves risks.

In order to be successful in forex trading, it is essential to understand the mechanics of the market, including currency pairs, leverage, bid-ask spread, order types, trading platforms, charting tools, fundamental analysis, and sentiment analysis.

Forex trading involves buying and selling currencies, which are traded in pairs. For example, the EUR/USD pair represents the euro and the US dollar. Understanding the key concepts of forex trading, such as leverage, bid-ask spread in forex, forex order types, forex trading platforms, and analysis tools, is essential to becoming a successful trader.

In this article, we'll delve deeper into forex charting tools, fundamental analysis, and sentiment analysis, three essential concepts in Forex trading. Additionally, we'll introduce you to VSTAR, a regulated trading platform that offers low institutional trading costs, making it an excellent choice for both beginners and experienced traders alike.

Currency pairs

In forex trading, currency pairs are the most important aspect. A currency pair is the exchange rate between two currencies. The first currency is the base currency, while the second is the quote currency.

When you buy a currency pair, you are essentially buying the base currency and selling the quote currency. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

Many different currency pairs are commonly traded in the forex market. Some of the most popular pairs include:

➢ EUR/USD

➢ USD/JPY

➢ GBP/USD

➢ USD/CHF

➢ AUD/USD

➢ USD/CAD

When trading currency pairs, consider the relationship between the two currencies. Understanding the factors that affect the currencies in the pair is essential for successful trading.

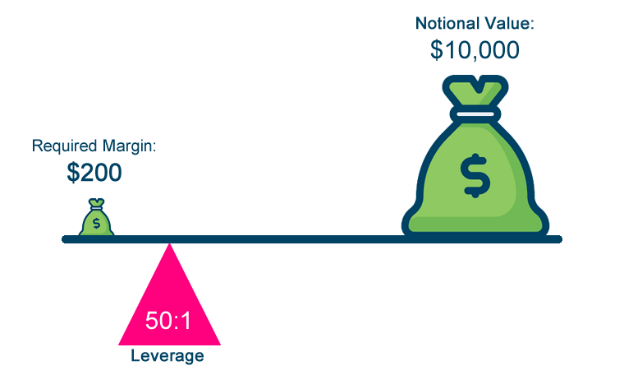

Leverage

Leverage in forex trading is a powerful tool that allows investors to trade with more money than they actually have. It allows traders to increase their potential profits, but it also increases their potential losses. Leverage is expressed as a ratio, such as 50:1 or 100:1.

For example, if a trader has a leverage of 1:100 and a trading account balance of $1,000, they can trade with a position size of $100,000. This means they control 100 times more money than they actually have in their account.

While leverage can be a useful tool for experienced traders, it can also be risky for beginners. It is important to use leverage wisely and to understand the risks and benefits of using it in forex trading.

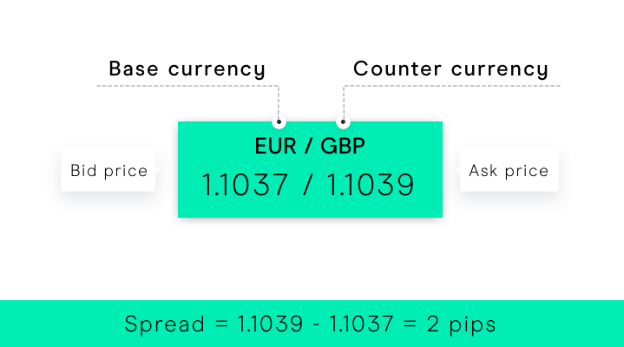

Bid-Ask Spread

The bid-ask spread is the difference between a currency pair's buying price (bid) and selling price (ask). It is the cost of trading and is expressed in pips, the smallest unit of price movement in forex trading.

Bid-ask spread in forex is important because it affects the profits and losses of traders. The wider the spread, the more it will cost to enter and exit a trade. Therefore, choosing a broker with a tight bid-ask spread is important.

Order types

In forex trading, several orders can be used to enter and exit trades. These include:

➢ Market orders: a buy or sell order at the current market price.

➢ Limit orders: a buy or sell order at a specific price.

➢ Stop orders: a buy or sell order triggered when the price reaches a specific level.

Understanding different Forex order types and how they can be used to manage risk and maximize profits in forex trading is important.

Trading platforms

A trading platform is software used to execute trades in the forex market. There are several different types of forex trading platforms, including:

➢ PC platforms: software that is downloaded and installed on a computer.

➢ Web platforms: software that is accessed through a web browser.

➢ App platforms: software that is accessed through a mobile device.

When choosing a trading platform, it is important to consider factors such as ease of use, functionality, and security.

Speaking of the trading platform, VSTAR’s names come to mind; that offers globally regulated and secure trading for beginners. They provide $100,000 risk-free demo accounts in just 10 seconds and support multiple payment methods, including VISA MASTERCARD, international bank wire, Tether, Skrill, Netteller, SticPay, and Perfect Money, making it very convenient for both master and novice traders ensuring deposit and withdraw funds with ease.

VSTAR is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), No 409/22, and is a Cyprus Investor Compensation Fund member. Additionally, VSTAR operates under the European Regulatory Framework of MiFID II, ensuring you have a secure trading experience.

VSTAR's user-friendly interface is designed for both experienced traders and beginners alike. The app has a minimum deposit of only $50, offering you the lowest trading cost possible with negative balance protection. Explore popular markets in real-time and catch trading opportunities with just a few clicks. Additionally, VSTAR offers a $100,000 risk-free demo account to help you explore the platform within 10 seconds.

Charting Tools

Technical analysis is a method of analyzing the market by examining Forex trading charts and other indicators to identify patterns that can help predict future market movements. Charting tools are a critical component of technical analysis. Different charting tools include line charts, bar charts, candlestick charts, and point-and-figure charts.

➢ Line charts are the simplest type of charting tool and show the closing prices for a given currency pair.

➢ Bar charts display each trading period's opening, high, low, and closing prices.

➢ Candlestick charts are similar to bar charts but provide more detail on the trading range and are widely used by traders to identify patterns.

➢ Point-and-figure charts are used to track price movements over time and help traders identify important levels of support and resistance.

VSTAR provides users with various charting tools to aid technical analysis, including multiple chart types, timeframes, and drawing tools. VSTAR's charting tools are easy to use and offer customization options for traders to tailor their analysis to their forex trading strategies.

Fundamental Analysis

Fundamental analysis in forex is the process of analyzing economic and financial data to determine the intrinsic value of a currency. It involves examining economic forex indicators such as GDP, inflation, employment rates, and interest rates, as well as geopolitical events and central bank policy decisions.

Traders who use fundamental analysis often look for long-term trends in currency prices and consider economic news releases as potential trading opportunities. VSTAR offers a range of economic calendars and news feeds to keep traders up-to-date on the latest economic and political developments that may impact the market.

Sentiment Analysis

Sentiment analysis in forex is the process of analyzing the market's mood or sentiment toward a particular currency. It involves looking at factors such as news headlines, social media, and trading volumes to gauge market sentiment.

Traders who use sentiment analysis often look for shifts in market sentiment as potential trading opportunities. For example, if there is a lot of negative news about a currency, it may be a good time to sell it.

Master Forex Trading with VSTAR

VSTAR is a regulated trading platform that offers low institutional trading costs, making it an excellent choice for both beginners and experienced traders. With VSTAR, traders can trade a range of currency pairs with leverage, maximizing their potential profits.

VSTAR also offers a range of trading tools, including various order types, forex margin trading, forex, risk management tools, forex trading signals, and advanced charting tools. They help traders to become a master trader in over 1000 markets with VSTAR as they offer to trade a wide range of financial instruments with VSTAR, including Forex currency pairs such as USD, EUR, CAD, AUD, GBP, and JPY.

Additionally, trade CFD Indices like S&P500, NAS100, HK50, CHN50, and CFD US Shares, including Tesla, Google, Apple, Meta, and Microsoft. Trade CFD HK Stocks such as Alibaba and Tencent and commodities like Gold, Silver, WTI, Gas, and Coffee.

Additionally, VSTAR provides users with access to a comprehensive forex trading tutorial that covers all the basics of Forex trading, from understanding currency pairs to developing a trading strategy. The novice traders may encounter institutional-level trading with VSTAR with their low trading fees with 0 commission and super-tight spreads that maximize your profits and, last but not least, deep liquidity for reliable and lightning-fast order execution.

Conclusion

Mastering the mechanics of Forex trading requires an understanding of key concepts such as currency pairs, leverage, bid-ask spread, order types, forex trading platforms, and analysis tools. Charting tools, fundamental analysis, and sentiment analysis are essential tools for traders looking to develop effectively.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.