Exxon Mobil (XOM) Earnings Analysis

Exxon Mobil (XOM) recently reported the performance of Q3 2023 with earnings of $9.1 billion, reflecting a $1.2 billion increase compared to the previous quarter. The progress was attributed to both market conditions and the company's ongoing efforts to improve operational performance. Exxon Mobil emphasized its focus on delivering industry-leading performance in any price environment.

One notable aspect of Exxon Mobil's strategy is its consistent approach to capital allocation. The company announced a 4% increase in the quarterly dividend to $0.95 per share, marking its 41st consecutive year of annual dividend increases. This orientation towards returning value to shareholders has been a cornerstone of Exxon Mobil's financial strategy.

Additionally, the company is actively strengthening its business portfolio by divesting non-strategic assets and investing in high-return opportunities. Notably, Exxon Mobil has closed several refinery sales, generating over $3 billion in cash proceeds year-to-date. Furthermore, recent acquisitions, such as Denbury, are geared towards reducing emissions in hard-to-decarbonize industries. Exxon Mobil sees the potential to cut 100 million tons of carbon emissions annually through this acquisition, complementing its existing efforts to reduce emissions.

The pending acquisition of Pioneer Natural Resources is also a strategic move to strengthen Exxon Mobil's upstream portfolio. This deal is expected to yield synergies of approximately $1 billion annually, starting in the second year post-closing. It will enable Exxon Mobil to accelerate Pioneer's net-zero ambitions by 15 years and further enhance water recycling efforts. The transaction is seen as beneficial for shareholders, the environment, the economy, and U.S. energy security.

Exxon Mobil's organic growth is exemplified by record refinery throughput in the energy products segment, driven by the Beaumont refinery expansion. The Baytown chemical expansion project, providing new performance chemical capacity, including linear alpha olefins, demonstrates the company's focus on profitable organic growth.

Financially, Exxon Mobil has reported robust performance, with earnings of $9.1 billion and cash flow from operations of $16 billion. These results are attributed to structural earnings improvements over recent years, including a $9 billion reduction in structural costs since 2019.

The company maintains a focus on refining its base operations, optimizing processes, strengthening digital capabilities, and enhancing the supply chain. Year-to-date production is on track with full-year guidance, and capital expenditures (capex) are aligned with the plan, with expectations of finishing 2023 capex at the upper end of the guidance range.

In terms of shareholder returns, Exxon Mobil distributed $8.1 billion to shareholders in the third quarter, comprising $3.7 billion in dividends and $4.4 billion in share repurchases.

Lastly, the acquisition of Pioneer Natural Resources is a pivotal move to unlock synergies, increase production, and enhance value. The combined entity expects to reach two million oil-equivalent barrels per day by the end of 2027. This goal is tied to value creation, operational efficiency, and the utilization of existing capital spending. It underlines Exxon Mobil's leads in achieving results that benefit shareholders and the environment.

Specific Downsides

- Exxon Mobil's financial performance is heavily influenced by fluctuations in oil and gas prices. A sustained drop in prices can significantly impact revenues and profitability.

- As the world shifts towards cleaner energy sources, Exxon Mobil faces the risk of stranded assets and declining demand for fossil fuels.

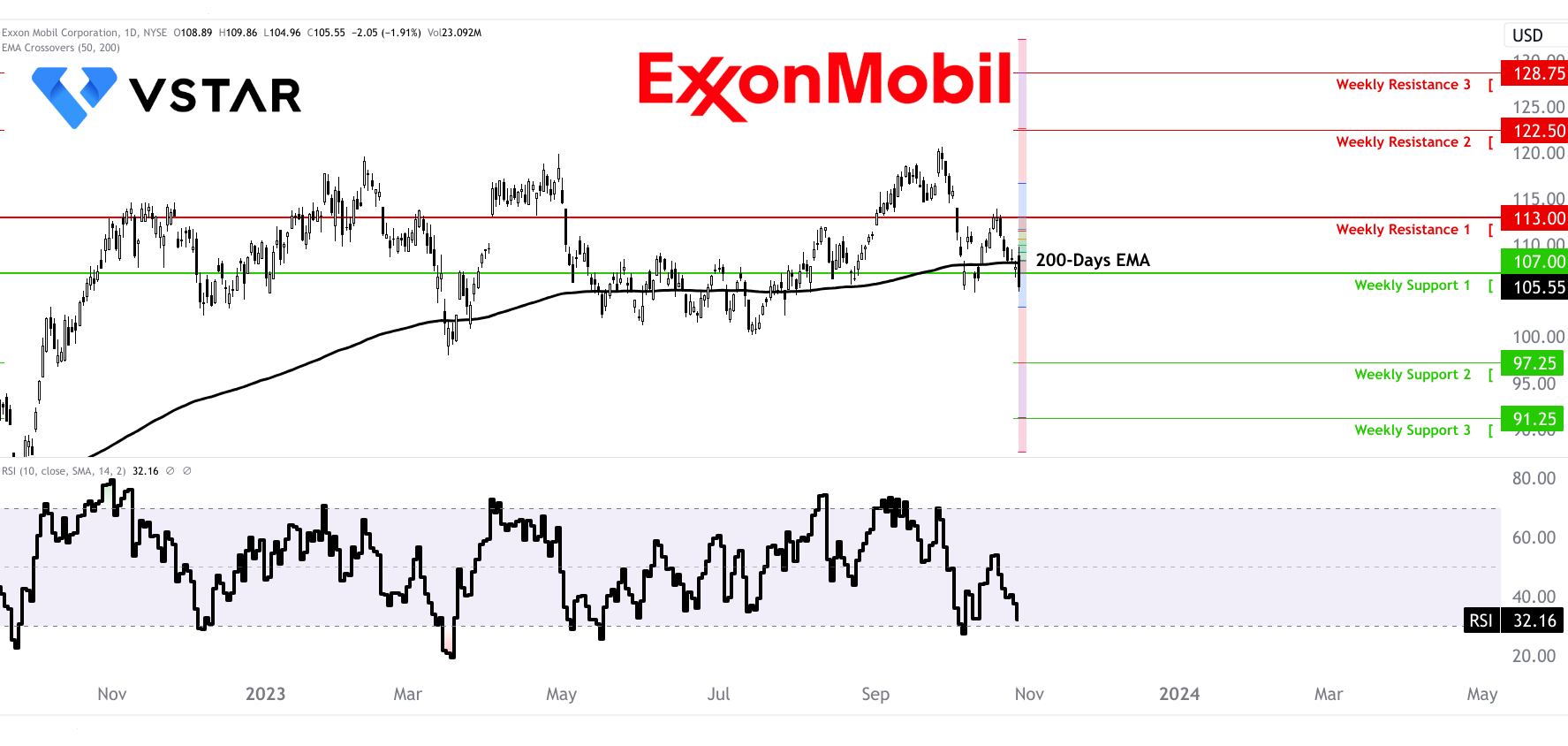

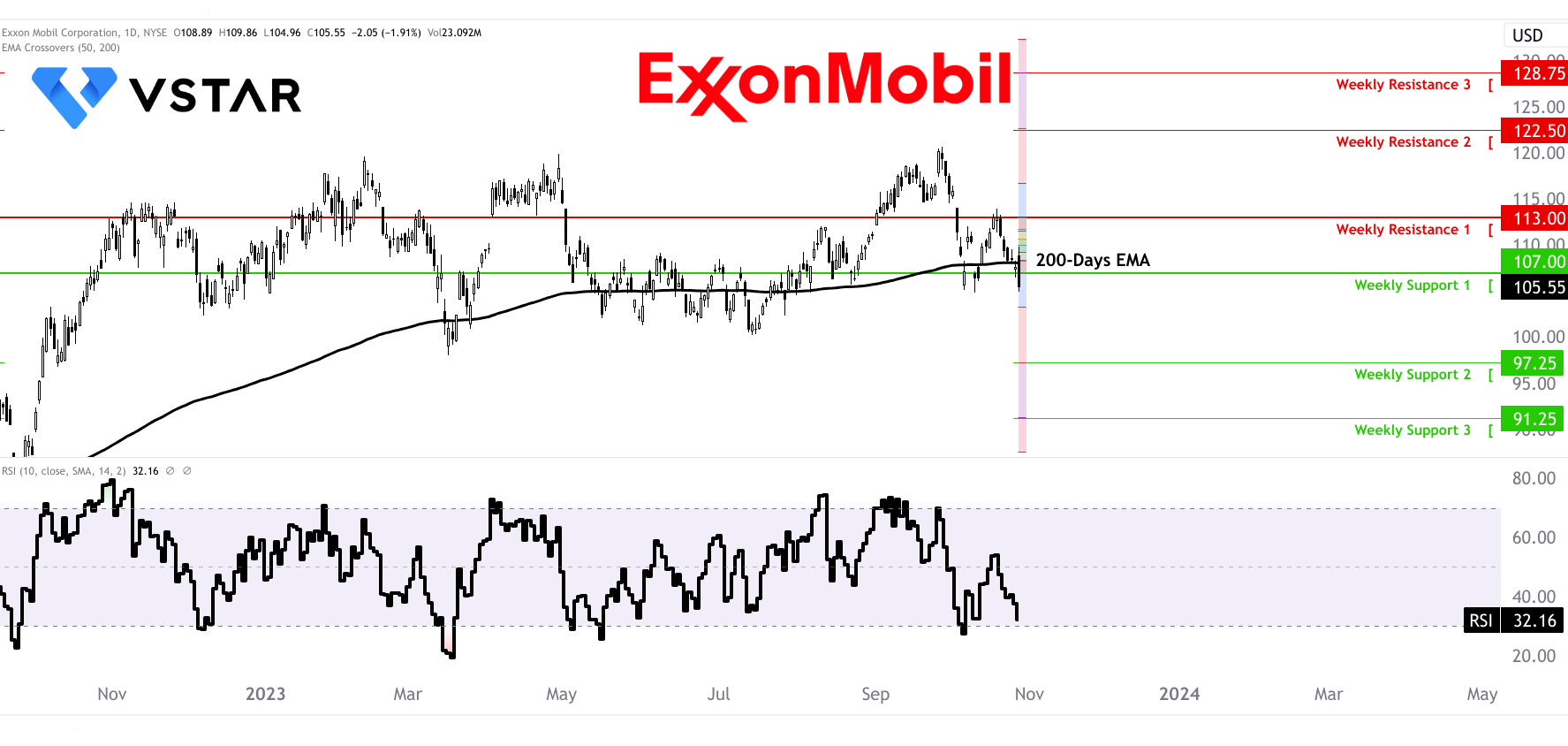

XOM Stock Technical Snapshot

Source:tradingview.com

In conclusion, Exxon Mobil's recent financial and operational performance is strong, underpinned by a strategy of improving efficiency, expanding high-return opportunities, and reducing emissions. The pending acquisitions and ongoing capital allocation strategy demonstrate the company's focus on long-term value creation and sustainability. However, investors should closely monitor the execution of these strategic moves, given their significant implications for the company's future performance and market valuations.